A framework for risk analysis of the shellfish aquaculture: The case of the Mediterranean mussel farming in Greece

2023-10-19JohnTheodorouIoannisTzovenis

John A.Theodorou, Ioannis Tzovenis

a Department of Animal Production, Fisheries & Aquaculture, University of Patras, Mesolonghi, 30200, Greece

b Laboratory of Ecology & Systematics, Biology Dept., University of Athens, Panepistimioupolis, Zografou, 15784, Greece

Keywords:ISO 31000 Risk analysis Mediterranean mussel farming Aquaculture insurance

ABSTRACT Mediterranean mussel farming in Greece developed considerably during the last 40 years reaching a gross commodity product up to the limits of the country’s production capacity (35–40,000 tonnes/year).Despite the achievements in the sector’s growth, little or no effort has been attributed yet to risk assessment and moreover to risk management of the activity.The present effort aims at developing a working framework for the shellfish aquaculture of Greece to be used as a tool by the sector’s decision makers to advance strategies for risk elimination or avoidance.The work was based on a generic risk management standard tool, the Joint Australian and New Zealand Risk Management Standard AS/NZS ISO 31000:2009 that has been adapted to the specific national characteristics of all levels of the mussel farming business -activities and the industry function.The framework supported by data sets regarding development, production, profits and losses, retrieved by surveys through distributed questionnaires or interviews during site-visits, as well as by collecting data from national and international authorities.Data input covered technology, farm size, farmer risk-attitude, risk-management strategies, risk-perceptions and socioeconomic profiles.Major risks and risk management options were identified providing aid for remediation risk policies to the stakeholders.

1.Introduction

Ever since the early 70s, aquaculture is the most rapidly growing sector of the animal food production in the world (Aerni, 2004; Tacon,2020) offering more than half of the world’s fish supply for human consumption (FAO, 2020).Mollusc production represented by 65 bivalve species, growing at an average annual rate of 3.46% per year since 2000, contributes on the 25% of the global animal aquaculture (17,4 million tons) of a total value of 30.4 billion USD in 2017.Mussels as a part of this production volume (24%), reached about 2185 million tons(2017) of a value approximately 3.4€ billion (2016) (Avdelas et al.,2021; FAO, 2020; Tacon, 2020).

The cultivation approach is based on the principles of the capturebased aquaculture (Ottolenghi, Silvestri, Giordano, Lovatelli, & New,2004), where the “raw” material, or seed, is collected from natural stocks in the wild.The on-growing phase takes place extensively in suitable farming areas of adequate eutrophication to support the bivalve production (Costa-Pierce, 2002).

Mussel farming hence, depends on the local environmental factors(temperatures, salinity, currents, parasites,etc) including natural primary productivity, and faces risks similar to those of the agriculture sector (Avdelas et al., 2021).Consequently, the theoretical risk research experience and the corresponding management from terrestrial agri-business (agriculture, livestock, forestry, conservation) (Flåten,Lien, Koesling, Valle, & Ebbesvik, 2005; Hardaker, Lien, Anderson, &Huirne, 2015, p.276; Harwood, 2000; Huirne, Meuwissen, Hardaker, &Anderson, 2000; Lien et al., 2006), has to be applied to the capture-based aquaculture.

Because the existing risk methodology background comes from the land-based agri-farming (van Winsen et al., 2016), there is limited knowledge about the risk sources or risk management strategies used to support the financial sustainability of the bivalve shellfish sector (Le Grel & Le Bihan, 2009; Ahsan & Roth, 2010; Le Bihan, Pardo, & Guillotreau, 2013; O’Mahony, 2018; Avdelas et al., 2021).

Modern (intensive) aquaculture has approximately 4 decades development in contrast with the agri-farming and livestock production that there is cumulative experience of several thousand years.The biological life cycle of domesticated terrestrial animals such as chickens,pigs, and rouminants (cattles, goats and sheeps) are well known comparing with even the well-established main stream aquatic species such as: i) clams, oysters and shrimps (shellfish) and ii) salmon, trout,seabass and seabream (finfish).Furthermore, new potential species are introduced for mass production while continuous technical innovations change the way of producing, generating together with the new opportunities also risks such as diseases or environmental biosafety issues(Secretan, 2003, p.73; Erondu & Anyanwu, 2005; Kapuscinski, 2005;Kapuscinski, Li, Hayes, & Dana., 2007; O’Mahony, 2018; Le Bihan,Catalo, & Le Bihan, 2020; Lupo et al., 2021).While for the terrestrial animal health there is well developed health control tests (De Vos,Saatkamp, Huirne, & Dijkhuizen, 2003) and veterinary medicaments,for the aquaculture the testing techniques are still under developing as new knowledge coming through the recent experience.In addition, in the terrestrial animals it is possible to control the health of each animal(goat, pig, cow, etc) in the farm separately, in the aquatic farming this is happening based on indicative samples that may not always guarantee the absence of the effective threats (pathogens agents).As a consequence, insurance is not always available for certain type of risks in aquaculture (Beach & Viator, 2008; Nguyen & Jolly, 2019; Yu & Yu,2020) or available in high rates or high self-insurances (Secretan, 2003,p.73; van Anrooy, Secretan, Lou, Roberts, & Upare, 2006).

The main objectives of this study is to demonstrate a methodology suitable to identify the major risk sources for mussel farming in Greece(as a case study) and to highlight the industry’s risk management priorities.Several “acts of God” in the past (ie acute unpredicted phenomena due to environmental changes) have shown that the sector is vulnerable to disaster due to the absence of recovery from losses plans(Guillotreau et al., 2017; Rodrigues et al., 2015; Vlachopoulou & Mizuta, 2018; Lupo et al., 2021).

In the early stages of Greek mariculture, especially in the seabass/bream sector (Theodorou, 2002; Τheodorou & Τzovenis, 2004), most risk assessment depended on information extrapolated from individual case studies, usually from other countries with more experience (Norway, Scotland) (Stead & Laird, 2001, p.502; Tveteras, 1999) or from studies of other species such as salmon (salmon) (Bergfjord, 2009),catfish (Le & Cheong, 2010), and shrimps (Ahsan, 2011; Joffre,Poortvliet, & Klerkx, 2018; Lien, de Mey, Bush, & Meuwissen, 2021).Unfortunately, aquaculture can be quite location-or production-system-specific and thus widespread generalization usually does not work(Τheodorou & Τzovenis, 2004; Le Bihan et al., 2020).

Furthermore, insurance claims data (ie hazards and cost of losses) for bivalve farming, which would reveal activity risks in order to be used for risk management (compensation) planning in Greece, is lacking (Secretan, 2003, p.73; Theodorou, Perdikaris, & Filippopoulos, 2015).

As a result, an alternative analytical tool for Greek mussel farming had to be investigated and tested.Benchmarking other industries on how to approach similar problems where limited data is available(Crawford, 2003; Cooper, Grey, Raymond, & Walker, 2005; Bondad-Reantaso, Arthur, & Subasinghe, 2008; Doubleday et al., 2013; Le Bihan et al., 2013; Guillotreau, Le Bihan, Morineau, & Pardo, 2021)indicated that a generic risk analysis model may be the suitable tool in this case.For this reason, evaluation though application of a generalised framework that can be used for multiple purposes, such as identify knowledge gaps and milestone information; link technical and socioeconomic issues at different levels; give a structure to answer, update and revise key questions; and provide a plan for the relations and responsibilities of the contributed stakeholders is necessary.The generalised framework can be used as a flexible working mind-map that supports the methodological steps required for effective decision making(Crawford, 2003; Fletcher, Chesson, Sainsbury, Hundloe, & Fisher,2005).

2.Materials & methods

The Joint Australian and New Zealand Standard AS/NZS ISO 31000:2009 Risk Management Standard was selected to be tested as an advanced methodological tool for the present study.

For this purpose several criteria (Purdy, 2010) examined the risk management efficiency of the Standard:

i) Accountable risk performance must be measured at each stage of the examined industry process, giving the levels of acceptance and providing a range of management treatments.

ii) Risk limits must be clearly defined and comprehensive, and provide targets for the relevant treatment strategies to reach.

iii) Each task must focus on a certain source of risk, and its possible risk management must be applied up to a certain level.

iv) The risk management process must be considered as the heart of the risk analysis study.

v) Every step must be developed through continuous risk communication between stakeholders (producers, governmental administrators, scientists, etc.).

In this context, the present work aims to evaluate through application a risk analysis framework that considers technical and socioeconomic factors at different levels of Mediterranean mussel farming of Greece, to be used as a tool by the sector’s decision makers to systematically identify and evaluate critical areas for the risk management of the industry.In addition, the study illustrates how this framework will allow mussel farmers and stakeholders to focus on the most important sources of risks and the most effective risk-sharing management strategies.

2.1. Theoretical background

As there are several definitions about risk analysis and risk assessment by different stakeholders (Lane & Stephenson, 1998; Vose et al.,2001; Stephen, 2001a, 2001b; MacDiarmid & Pharo, 2003;; Goldstein &Carruth, 2004; OIE, 2004; FAO/WHO, 2004, pp.45–47; Moreau &Jordan, 2005; Bartholomew, Kerans, Hedrick, MacDiarmid, & Winton,2005; Aven & Renn, 2009; Muller-Graf, Berthe, Grudnik, Peeler, &Afonso, 2012; Hardaker et al., 2015, p.276), in practice the definition terms are related to the suitability of the tools in certain fields (Anonymous, 2005, 2009).In this effort, the term ‘risk’ follows the term ‘risk analysis’ as used in its broadest sense, including a) risk assessment; b)risk management; and c) risk communication as proposed by Cooper et al.(2005) for the effective use of the AS/NZS 4360:2004 that is totally incorporated into the new Joint Australian and New Zealand Standard AS/NZS ISO 31000:2009 (making AS/NZS 4360 redundant) to manage risk in large projects and complex procurements (see Fig.1).Risk analysis integrates risk assessment (a) and risk communication (c) and is structured to support risk management (b) effectively (see Fig.1).In addition, the way the assessment process can be linked to risk management (GESAMP, 2008) is also demonstrated.

2.2. Risk analysis

Risk Analysis is a methodological tool, commonly defined by its adopted processes, used in several sectors more or less to answer the same questions:What can go wrong?;How likely is that to happen?;How severe would be the consequences if it did?;What actions should be taken to reduce the likelihood of it happening,or to reduce the consequences? (Mac-Diarmid & Pharo, 2003).

Answers are usually provided by application of a common set of general principles:

a.hazard identification(to identify issues that under certain conditions might cause damage or loss);

b.risk assessment(a process to evaluate the likelihood of a hazard occurring and calculating the consequences);

c.risk management(a process to prevent damages or limit them to acceptable levels); and

Fig.1.A working framework used to analyse the risks of the Greek mussel farming industry based on the AS/NZS ISO 31000 Model Process and the risk management guidelines by Cooper et al.(2005), for large projects and complex procurements.

d.risk communication(improvement of risk assessment and management through exchange of knowledge and experience between stakeholders) (Arthur, 2008).There are various adoptions of the above generic principles aimed at dealing with environmental (Nash,Burbridge, & Volkman, 2005, 2008; Doubleday et al., 2013; Lebel,Lebel, & Lebel, 2016), financial (Engle & Neira, 2005; Valderrama &Engle, 2001), technological (Ayyub, 2003, p.571; Joffre, Klerkx, &Khoa, 2018; Lebel et al., 2021), and health & safety (Peeler et al.,2007; Stephen, 2001a, 2001b; Vose et al., 2001; Zagmutt, Sempier, &Hanson, 2013) risks.Modifications have to do with scale or approach(Stensland, 2013) using qualitative, semi-quantitative and/or quantitative analysis tools (Ayyub, 2003, p.571; (Muller-Graf et al.,2012); Theodorou, Moutopoulos, & Tzovenis, 2020).

In order to assess the risks in all activities of the Greek mussel farming industry, i.e.in a holistic manner, working at different levels(farm units, associations, sector) and different sections (financial,technical, socio-economical, environmental) involving all interested parties, a flexible tool capable of multi-layered analysis was needed.

As such the Joint Australian and New Zealand Standard AS/NZS ISO 31000:2009 Risk management—Principles and Guidelines (Standards Australia and New Zealand, 2009) was selected (Fig.1).This is a managerial tool where risk strategy effectively manages the uncertain outcomes of the objectives (risk) by adding measurable principles to the risk management process at all levels of the decision making (Lalonde &Boiral, 2012; Purdy, 2010).The Joint AS/NZS ISO 31000:2009 is the upgraded international ISO (International Standard Organization)version of the earlier Australian and New Zealand Standard AS/NZS 4360:2004 on Risk Management (Standards Australia and New Zealand,2004).The last version AS/NZS ISO 31000:2018 of this standard recently released, aiming to simplify the process and to further improve its efficiency, without cease the basic principles of the earlier standard version that is used in the present effort.

The Joint AS/NZS ISO 31000:2009 incorporates the existing structure of the AS/NZS 4360:2004 (making the AS/NZS 4360 redundant)and enhances its effectiveness by improving risk management methodology through:i.adding new definition on risk (see below);ii.adding 11 new criteria to measure its effectiveness;iii.making risk strategies the mandatory outcomes of every level of management, enhancing the process by adding five more attributes; andiv.recommending the development of a wide risk framework.

This standard was used in this study, as its previous version (AS/NZS 4360, 1999; 2004) had worked effectively as a methodology to prioritise risk issues for aquaculture and fisheries management (Fletcher, 2005;Fletcher, Chesson, Fisher, Sainsbury, & Hundloe, 2004, p.88; Fletcher et al., 2005).Crawford (2003) also used it with success to qualify the impact of shellfish farming on the environment in Tasmania, Australia.In addition, its generic form was suitable for managing the risks of large projects and complex procurements (Cooper et al., 2005).

2.3. Definitions

2.3.1.Uncertainty

Renn et al.(2003) defined uncertainty as “the state of knowledge under which the possible outcomes are well defined but there is insufficient information to assign the likelihood to these outcomes”.Uncertainty can be expressed in various types and forms, which has to be taken into account, including: a) uncertainty of knowledge (incomplete data, sample limitation, measurement error), b) variability of the results (deviation of the outcomes), c) descriptive difficulties (linguistic uncertainty,expression, poor definition) (Scheer et al., 2014), and d) cognitive difficulties (bias, sensory and perception uncertainty as a result of the mental process).Uncertainty is an integral part of the risk analysis process and its components (Anonymous, 2009).

2.3.2.Risk

The concept of risk can be linked to “an event where the outcome is uncertain” (Aven & Renn, 2009) and referred to as “the results of the uncertainty upon the objectives” (Standards Australia & New Zealand,2009).It can be defined as “the potential of losses and rewards resulting from an exposure to a hazard(the potential to harm a target)or as a result of a risk event(encompasses the probability of exposure and the extent of damage)” (Scheer et al., 2014).Consequently, risk can be expressed as the combination of the probability of an event and its consequences(ISO, 2002).It has certain characteristics that should be used in the risk assessment process.As it is an outcome of an uncertain future, it cannot be defined neither in the past nor in the present.Risk becomes non-existent when the uncertainties are resolved (Ayyub, 2003, p.571).

2.3.3.Risk analysis

As there are several definitions of risk analysis and risk assessment by different authors and stakeholders (Lane & Stephenson, 1998; Vose et al., 2001; Stephen, 2001a, 2001b; MacDiarmid & Pharo, 2003;Goldstein & Carruth, 2004; OIE, 2004; FAO/WHO, 2004, pp.45–47;Moreau & Jordan, 2005; Bartholomew et al., 2005; Muller-Graf et al.,2012; Hardaker et al., 2015, p.276), in practice the definition terms are related with the suitability of the tools in certain fields (Anonymous,2005, 2009).In this study, ‘risk’ is taken from the term ‘risk analysis’used in its broadest sense, including a) “risk assessment”, b) “risk management”, and c) “risk communication” as proposed by Cooper et al.(2005) for the effective use of the Australian and New Zealand Standard 4360:2004 on Risk Management (AS/NZS 4360:2004) (part of the Joint AS/NZS ISO 31000:2009).Risk analysis integrates risk assessment and risk communication, and is structured to effectively support risk management.In addition, it demonstrates the way the assessment process can be linked to risk management (GESAMP, 2008).

2.3.4.Risk assessment

Risk assessment is a technical and scientific process by which the risks of a given situation for a system are modelled and quantified.It determines the likelihood and the consequences of the exposure to a hazard (adverse event).Risk assessment can require and/or provide qualitative, semi-quantitative and quantitative data to the stakeholders for use in risk management (Ayyub, 2003, p.571; Muller-Graf, Berthe,Grudnik, Peeler, & Afonso, 2012).

2.3.5.Risk management

Risk management is a process based on the results of the risk assessment of setting up actions and plans to control and eliminate the outcomes of the identified risks to acceptable levels (Cooper et al.,2005).

2.3.6.Risk communication

Risk communication is an interactive process between the stakeholders to inform and evaluate the outcomes of risk assessment and risk management.It aims at the improvement of effectiveness of the overall risk analysis plan by a continuous upgrade and implementation of the process (Anonymous, 2009; Cooper et al., 2005; Hill, 2009).

2.4. Methodological steps

The generic form of the Joint AS/NZS ISO 31000:2009 was adapted to the specific Greek characteristics of all levels of the Mediterranean mussel farming business activities and industry function.

The working steps were as follows:

(1) Establish the context;

This refers to “the structuring of the objectives and the scope of the risk assessment by using the combination of various elements at a range of different levels that act together for a certain reason” (Cooper et al., 2005).In the case of the Mediterranean mussel farming industry profile in Greece (Fig.1), the context inputs include data facts and figures related to the Greek mussel farming sector’s growth and development.Data on bivalve shellfish landings and production harvests at a national level are insufficient.As samples used the official published issues and was tried to identify what exactly officially reported.In addition, it was tried to“clear the data” based on biological and empirical estimations about the capacities and the reporting volumes of each site.For this purpose,supplementary data were obtained from literature (including grey),public administration and personal interviews-questionnaires.Grey literature referred to industry associations’ reports, fisheries authorities’documentations, public communications of aquaculture scientists and industry consultants.Seasonal reported reductions of production volumes due to disease, or other aetiologies were taken into account.Then was realized that the data has to be cleared even from the official sources as FAO, NSSG (Theodorou et al., 2011, 2015).In order to cover the gaps of the official statistics we had to ask farmers, local administrators and other stakeholders for estimations of production volumes in their area,what do they reported as production, etc.

Discrepancy between different data sets weakens national and international data monitoring (Moutopoulos & Koutsikopoulos, 2014).Inefficient statistical collecting systems are not a Greek phenomenon concerning fishery statistics in the European Union (EU) (The Economist, 2008).Discrepancies resulting from measuring systems (e.g.,mussel shocks (pergolaris) vs.packed volumes, license capacity vs.actual production volume, export vs.ex-farm price, number of licensed vs.actively working and producing farms) constitute a major difficulty in the effort to produce reliable statistics objectively.

The context, based on a review of the existing status of the industry(Theodorou et al., 2011, 2015; Theodorou & Tzovenis 2017), gives details about the natural and business environment of mussel farming in Greece as well as the production and marketing structure.The conclusion points out the major “sensitive” risk areas that have to be focused on in the next step of the assessment.

(2) identify the risks;

Risk identification, as has been demonstrated in several empirical studies (Joffre, Poortvliet, & Klerkx, 2019; Kahneman & Tversky, 1979;Lien et al., 2021; MacCrimmon & Wehrung, 1986; Rabin & Thaler,2001), must focus on the individual’s risk perception estimation rather than on classical decision-making theory, as this seems inadequate to explain the risk choices individuals must make.They personalize risk decisions, and this makes risk behavior subjective.Mussel farmers are exposed to a wide range of risks, including those that are production dependent (zoosanitary and zootechnical aspects), and production independent (pollution, aquatic animal attacks, weather impacts), as well as market risk (seasonal availability of the product and the quality) and third party (mussel farm environmental impact, consumer and public health).Farmers’ risk attitude is also strongly influenced by their past experience, their socio-demographic background, and the history of farm losses (past events).

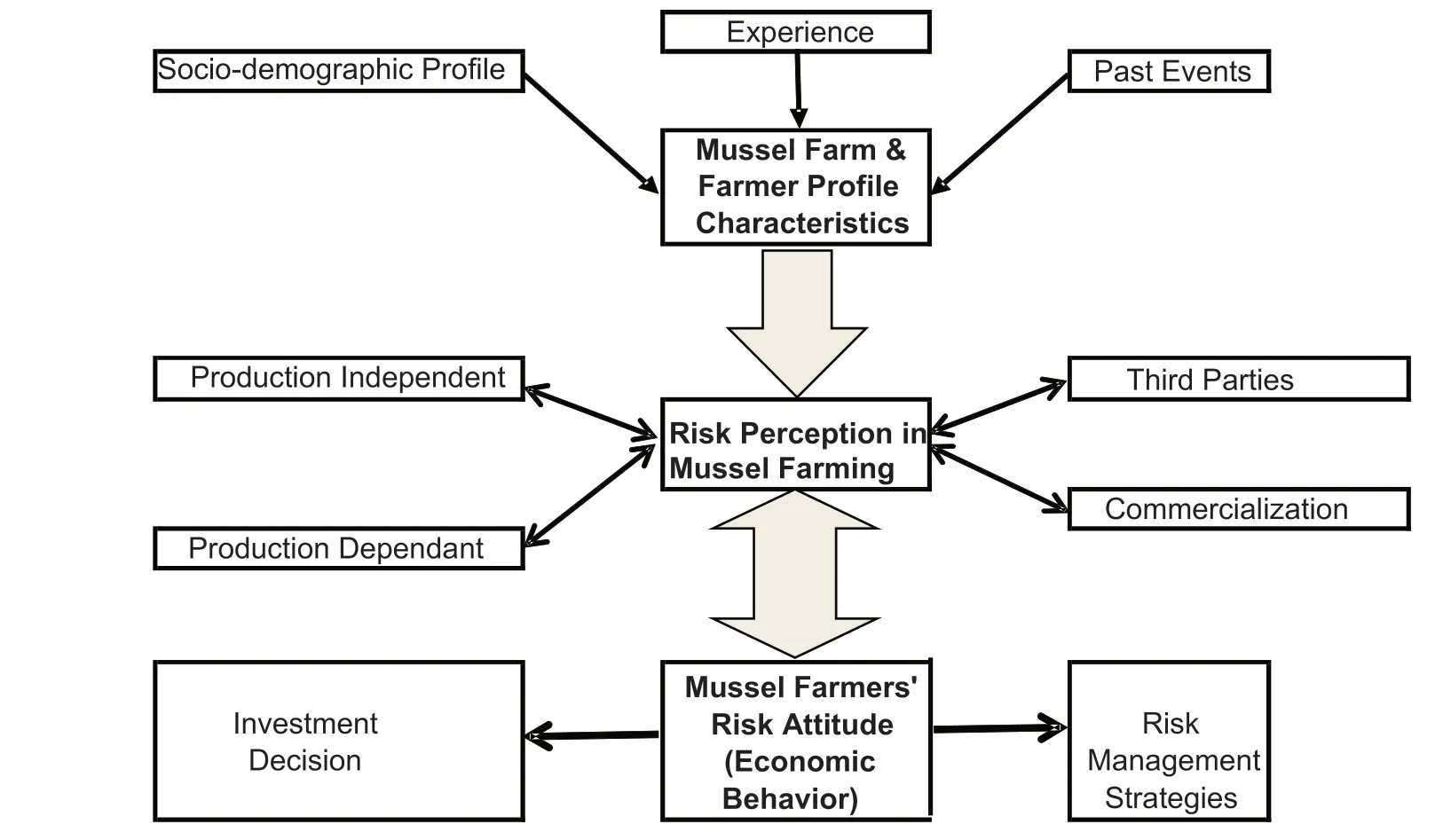

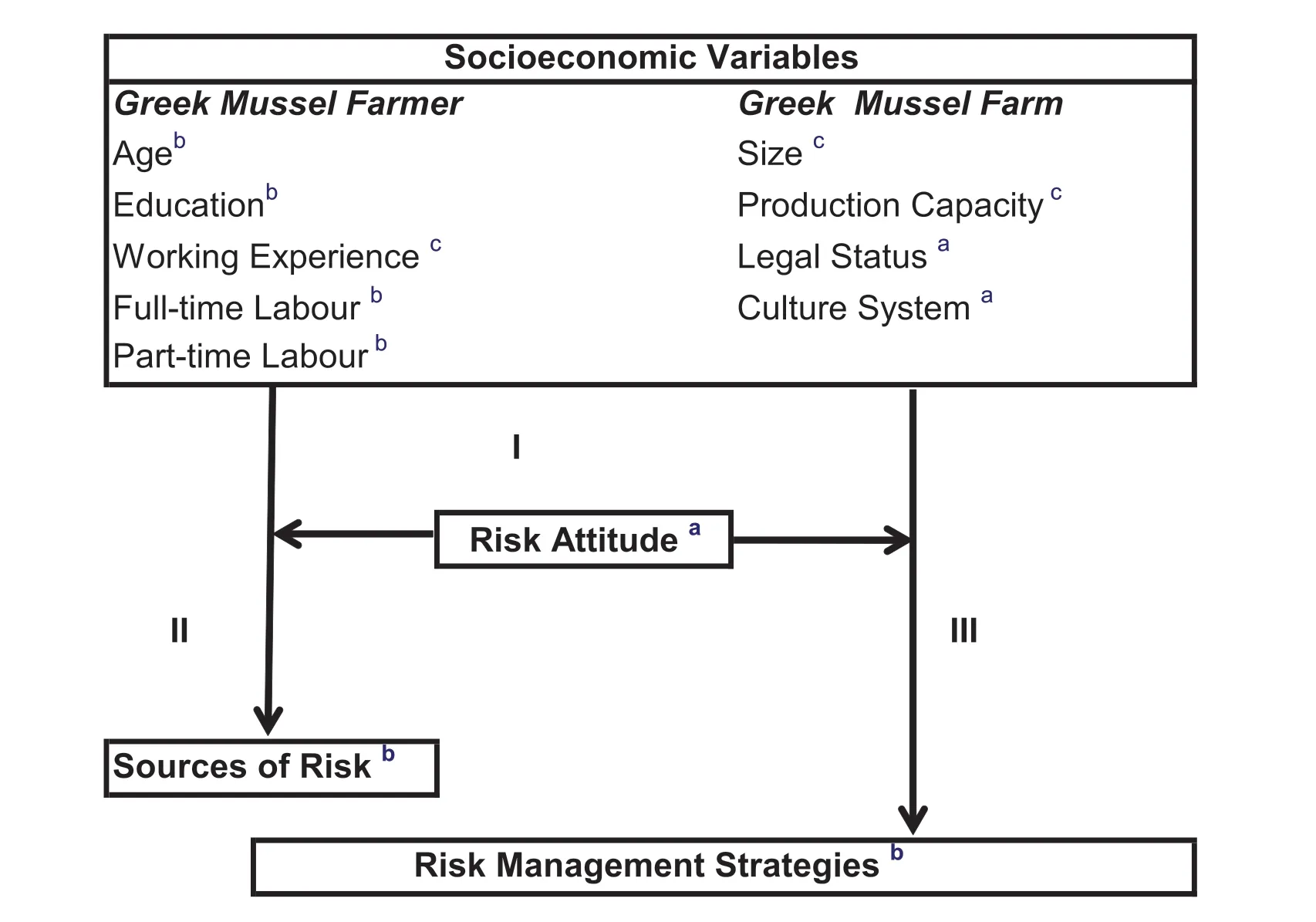

Determine what could happen that would affect mussel farming,based on the research framework of the van Raaij’s (1981) descriptive model, modified and especially adapted to examine the risk behaviour of the Greek mussel farmers (Fig.2).Information used in the risk characterisation and identification process includes analysis of empirical data based on the mussel farmers’ experience (Τheodorou & Τzovenis, 2004).Since mussel farming has more or less the characteristics of agri-farming, the mussel farmers’ risk attitude, risk perceptions and socioeconomic profiles also were taken into account (Fig.3), as demonstrated in similar studies for the primary sector (Ahsan & Roth,2010; Bergfjord, 2009; Le & Cheong, 2010; Le Grel & Le Bihan, 2009;Lien et al., 2021; Meuwissen, Huirne, & Hardaker, 1999; Meuwissen,Huirne, & Hardaker, 2001).

(3) analyse the risks;

The risks were defined by using a range of analytical tools,depending on the data availability.Usually the first stage is to identify the risks qualitatively (using nominal or descriptive scales for describing the likelihoods and consequences of the risks), followed by a semiquantitative (allocating numerical values to the descriptive scales,which are then used to derive quantitative factors) and/or quantitative(use numerical ratio scales for likelihoods and consequences) approach(Cooper et al., 2005).

Fig.2.A framework for the economic/risk behaviour of the Greek Mussel farmers based on the risk categorization of Τheodorou and Τzovenis (2004) and the modifications of the Van Raaij’s descriptive model (1981) for shrimp farming by Ahsan (2011).

Fig.3.Risk analysis plan based on the socioeconomic variables of the Greek mussel farmers and their risk attitude to identify risk sources and elect the suitable management strategies: (I) Attitudes towards risk; (II) Perceptions of sources of risk; (III) Perceptions of risk management strategies.(a) Non-metric variable/nominal scale; (b) Non-metric variable/ordinal scale; (c) Metric variable (adapted from Meuwissen et al., 1999).

In order to accomplish the above tasks, mussel farmers were asked to complete a questionnaire, and an interview survey was carried out on mussel farm sites all around the country.The developed material was then extensively examined by industrial and scientific experts in order to ensure that the taxonomy and the terminology of the risk analysis was clear and understandable during the communication among the stakeholders (MacDiarmid & Pharo, 2003; Theodorou et al., 2020).The possible sources of risk were given on a Likert-type questionnaire, where mussel farmers were asked to evaluate the possible risks on a scale 1–5(minimum-maximum) (Malhotra, 2004, p.887; Meuwissen et al., 2001).

Financial data from commercial companies and suppliers’ data regarding mussel farm economics were also used, and were crosschecked with the mussel farmers’ opinions on the questionnaire and during the interviews.Enterprise budgets of different farm sizes, culture schemes, and management options were assessed for financial viability.Sensitivity analysis, as described by Kam and Leung (2008), followed the budgeting processing in order to examine how the changes in the key production and management variables affect financial performance (e.g.profitability).

The effects of harmful algal blooms (HABs) on the industry were identified, given the critical season and duration that the problem is a risk for the industry, by using the principles of the AS/NZS 4360:1999 standard as modified by Fletcher et al.(2004, p.88) for an Ecologically Sustainable Development (ESD) of aquaculture.Similar applications by the same researchers have been used successfully in fisheries (Fletcher,2005; Fletcher et al., 2005).

An estimation of the financial risks of different mussel farm sizes in relation to the major sources of risks and suitable risk mitigation strategies could provide a tool for a continuous review and improvement of risk management, as the basic framework has already been developed and could be easily updated by future parameter changes.

(4) evaluate the risks;

This stage of the risk analysis process generates a prioritised list of risks and a detailed understanding of their impacts on the activity.The results from a typical Likert-type questionnaire identifying risk sources and the corresponding risk attitude of the Greek mussel farmers were analysed and the risks were prioritised by using descriptive statistics and Principal Component Analysis-PCA (Malhotra, 2004, p.887; Meuwissen, 2000, p.117).Step-wise multi-regression models were also developed, linking the risk sources and risk management with the social-economic background and the relative risk attitude of the Greek mussel farmers (Theodorou, Tzovenis, & Katselis, 2021).

In addition, the financial risks of different mussel farm size were evaluated by using What-if Analysis.A scenario–based analysis was developed for studying farms of different sizes and production levels,focusing on possible changes in the fixed costs and variable costs, according to Kam and Leung (2008).The seasons that the mussel harvesting bans were catastrophic for the sector were highlighted semi-quantitatively by using a risk matrix analysis (Theodorou et al.,2020).Also, the risk-ranking effects on mussel farming operational costs has been evaluated by a similar approach.

(5) treat the risks;

The treatment of risk involves the identification of the most appropriate strategies for dealing with its occurrence (Joint AS/NZS ISO 31000:2009).It refers to the actions that have to be taken in order to eliminate exposure to the risk outcomes.Methodologically, this working step requires input from the outcomes of the previous risk evaluation (4)effort.

The strategies for dealing with the risks were summarised by Baccarini, Salm, & Love, (2004):

(i)Avoidance– avoid actions that could cause risk to rise.

(ii)Reduction– take actions that mitigate or reduce the probability of a hazardous event to occur.

(iii)Transfer– partial or whole risk transfer to a third party.

(iv)Retention– accept risk and its consequences.

Risk-management strategies were identified using a methodology similar to that used with sources of risk, i.e.using Likert-type questionnaire plus additional open-ended questions during interviews in order to cross-check the responses.Again, descriptive statistics and the Principal Component Analysis were used to prioritise the riskmanagement strategies (Le Grel & Le Bihan, 2009; Malhotra, 2004, p.887).In addition, multi-regression models were developed to link risk management with the social-economic and the relative risk attitude of the Greek mussel farmers.

(6) monitor and review the whole process;

During the risk analysis study, a continuous monitoring and review of the whole process takes place as the implementation of the initial framework working plans might raise new questions and issues to be addressed.A supporting process in this context, based on the same protocol, could provide further details about the system and boost the initial effort.

In this study a new need came to surface during risk analysis; i.e.to survey supplementary targets–risks in order to manage the primary risks identified effectively.The effect of a farm’s size on its financial sustainability was investigated by using the principles of financial analysis,following the same risk-analysis supporting process (Theodorou, Tzovenis, Adams, Sorgeloos, & Viaene, 2014).

The role of the harvesting bans due to incidents of HABs was examined using semi-quantitative tools and the same working protocol(Theodorou et al., 2020).

Supplementary support to evaluate the primary process was given by the mussel farmers’ socioeconomic survey.The supporting processes(detailed analysis and models) presented here could be further investigated if there is a special need or question to answer.Finally, their range could be expanded if another risk is identified and needs further analysis in the future.

(7) communicate and consult on the outcomes.

Risk communication is an interactive process between risk assessors,risk managers and the rest of stakeholders (mussel farmers, producers’cooperatives, academia, public administration, other authorities) that targets the clear understanding of the results of the risk analysis.It is a transparency and continuous improvement tool, necessary to eliminate uncertainties that normally exist in the whole risk analysis working plan.The present study constitutes the communication outcome, prepared as a consultation tool, an integral part of the processes of the conceptual framework according to the Joint AS/NZS ISO 31000:2009 Management Standard.

3.Results & discussion

3.1. Framework outcomes

The framework tool for Mediterranean mussel farming risk analysis consists of a primary process giving the generic points of the management process, the option definitions of a quantitative analysis of the risks and the management options, followed by an audit process.

The context of this effort has been established by Theodorou et al.(2011), giving the profile of the industry which is concentrated in northern Greece, covering 375.5 ha of sea surface and consisting of about 523 mussel farms (registered and unregistered), most of them up to 3 ha in size.The farming production capacity is approximately 100 t/ha.The total annual production (gross pergolari-socks weight) has increased to 36,000–40,000 t, most of which is exported, at an annual value of over 10 million euros.

3.2. Primary process

The primary process of the risk analysis was carried out by evaluating 33 identified risk sources proposed through a Likert-type questionnaire by the producers (Theodorou, Tzovenis, Sorgeloos, & Viaene,2010).Highly ranked sources of risk were ex-farm prices, disability and the health of the farmer and farmer’s family, vessel availability, and harvesting bans due to HABs.The most preferred risk-management strategies were the development of financial and credit reserves, followed by off-farm employment (in agribusiness, commerce and other services providing an income certainty), producing the least possible costs, and the horizontal collaboration between farmers (i.e.by sharing equipment, supplies, labour, etc.).Moreover, mussel farmers prefer to take risks in areas that are familiar to them, such as production(Theodorou, Leech, Perdikaris, Hellio, & Katselis, 2019), and they try to avoid areas in which they have less knowledge and experience, such as finance.However, it seems that the risks are remediated with a high education level and experience, and dependent on the legal status of the company.

Most of them agree that a public policy must be established for compensating for disasters, mainly harvesting bans due to harmful algal blooms, predator attacks, extreme weather events, illegal actions and diseases (Theodorou et al., 2021).

The above results of the primary process of the risk assessment can be further boosted by a secondary process.The same methodological procedures were used to answer questions that come from risk communication of the primary results, such as: which factors affect the profitability of the farms; why ex-farm prices perceived as the major source of risk.The answers to these questions were re-input to the primary process (Fig.1).

3.3. Secondary process

What-if scenarios and sensitivity analysis regarding the profitability of different farm sizes showed that mussel farms using the widely accepted long-line technique for less than 3 ha (most of the Greek farms)were not viable economically.Cooperation to achieve benefits of scale and restructuring to larger schemes is recommended to achieve business sustainability (Theodorou et al., 2014).The risk matrix used to estimate semi-quantitatively the risk of the harvesting bans due to HABs at the farm level demonstrated that the phenomenon is catastrophic only under certain conditions (closures >6weeks) during the market season(Theodorou et al., 2020).This methodological approach promoted by Fletcher et al.(2004; 2005), is further originated from the AS/NZ 4360 Risk Management Standard (1999; 2004).

3.4. Framework evaluation & perspectives

The effectiveness of conceptual frameworks as a tool has been demonstrated by several researchers of different backgrounds (Baccarini, Salm, & Love, 2004; Chilonda & Van Huylenbroeck, 2001; De Vos et al., 2003; Fletcher et al., 2005; McDermott, Coleman, & Randolph,2000).This study was an attempt to define a working framework with which to assess and manage the major risks affecting Mediterranean mussel farming in Greece.The principles of the Joint Australian and New Zealand AS/NZS ISO 31000:2009 Risk Management Standard was useful as a framework -road map to approach the problem.The advantage of this model was the generic and flexible formulas that provides you with the opportunity to use part of its guided recommendations to meet your target.The criteria were set forth in order to evaluate the steps taken towards risk assessment’s successful completion and were used as such to verify this approach.The proposed framework was used as an interactive risk management tool of the sector rather than a risk report.It described the mission statement of this effort, how to approach it (methodologies), how to evaluate the results and provide adequate answers, and what to do in the case new questions come to surface during the process (i.e.profitability, harvesting bans).The communication and consultation between stakeholders that carried out during the whole process of the risk analysis by the sharing of the outcomes through conference presentation and scientific publications, was a driver for continuous implementation and upgrade of the existing results.

In this effort the principles of the Joint Australian and New Zealand Risk Management Standard AS/NZS ISO 31000:2009 were adapted to the industry profile.Despite modern shellfish aquaculture being a relatively new activity in the primary sector, the mussel farming profile is more or less similar with land-based agribusiness.For this reason, the economic/risk behaviour of the mussel farmer was taken into account in the primary process of risk assessment (Cooper et al., 2005), by investigating risk perceptions and risk attitudes through structured questionnaires and interviews, all based on the principles suggested by Van Raaij’s descriptive model (1981).

The risk model was developed using the best data on mussel farming in Greece (Theodorou et al., 2011) available at the time.During the work process, information gaps were identified as well as discrepancies between different data sets as various measuring systems were used,constituting a major difficulty in the effort to produce unbiased and reliable statistics.As data quality is an important component of risk assessment (Bartholomew et al., 2005), the precision and sensitivity of the methods used to collect data were checked, allowing the estimation,and consequently, the elimination of the uncertainties in the process.The problem stems from the inefficient systems commonly used to collect fisheries statistics in the European Union (EU) (The Economist,2008; Theodorou, 1995).Production data, including import and exports values, were collected from the Greek National Statistic Service (NSS)and FAO, and cross-checked with data from structured questionnaires and guided interviews with industry stakeholders such as mussel farmers, cooperative members, mussel processors and administrators.At this stage during the communication process, special attention was given to a clear understanding of the classification and terminology of risk assessment by the stakeholders (MacDiarmid & Pharo, 2003).For this purpose, preliminary in-depth interviews with several experienced industry and academic experts were carried out in order to draft a tailor-made risk assessment questionnaire with specification needs that could be easily understood by the respondents.In addition, a lot of emphasis was given to the extensive pre-testing of the questionnaire before commencing the survey, targeting the elimination of any misunderstandings during communication (Theodorou et al., 2021).As the actual study progressed and answers were given to the questions, the quality of the risk assessment improved and, as a result of improved analysis, the conclusions were supported and modified (as in Bartholomew et al., 2005).

Principal Component Analysis (PCA) was used successfully in several other trials (Ahsan, 2011; Ahsan & Roth, 2010; Le & Cheong, 2010; Le Grel & Le Bihan, 2009) to identify risks and rank their severity according to the risk perceptions and attitudes of the farmers.It was also a suitable technique to sum up risk-management priorities despite the sample size in these studies being relatively small.The examined industries were structured with small numbers-members of companies (Ahsan & Roth,2010; Le Bihan et al., 2013), compared to the usual application of the techniques in larger groups; e.g.consumer marketing research (Malhotra, 2004, p.887).

The socioeconomic profile and the structure of the farm play a critical role in determining how farmers perceive and manages the risk.Mussel farmers seem to take risks in sectors familiar to them, such as in production and marketing rather than on financial issues where they have less experience.A consequence of this preservative economic behaviour, is that mussel farming sector during the present economic crisis period, is less exposed to financial debt than the rest of aquaculture in Greece (Theodorou & Tzovenis 2017).

As the primary process was carried out by a continuous monitoring and review, several new research questions came up, the answers to which were necessary to boost the analysis of the primary process.New areas where more knowledge was needed were identified, and the relevant gaps had to be filled in order to eliminate and control the risks.

For this purpose, a secondary supporting process was carried out based on the same general principles of the Joint Australian and New Zealand Risk Management Standard AS/NZS ISO 31000:2009, but the analytical tools were adapted to effectively answer the questions.The selection of analytical techniques was based on data availability and the best-suited system process.The principles of basic economic theory were used to analyse the risk factors affecting the profitability of the mussel farms, and it was concluded that the small scale of the activity in Greece affects the financial profitability of mussel farming.Furthermore, as farm size is dictated by the licensing system, the related public policy acts as an institutional risk.These findings were in accordance with Ahsan and Roth (2010), who, from an empirical point of view, showed that larger mussel production and larger farms improve economic sustainability and decrease the risk of loss.In addition, they suggested that this implies a public administration failure to supply licences of a suitable size, in agreement with economic rationale, due to several reasons not fully understood scientifically.

The synthesis of both primary (overall analysis and models) and secondary supporting processes (detailed analyses and models) gave an ample overview and finalised the risk analysis of the mussel farming sector in Greece.

This conceptual framework is very important as a mind-map for a continuous update in the future, as risk assessment and management is not a static process and potential new risks may have to be taken into account.As it was based on generic principles, with its platform modified and specially adapted to the current risk analysis needs of the Mediterranean mussel farming industry, it could easily be updated to give answers and competent risk-management solutions in the future.

The proposed working framework applied for the Greek mussel farming sector complies with the 11 effectiveness principles of the Joint AS/NZS ISO 31000 Standard as:

1.It creates value with the identification and evaluation of the major risk sources of the Greek mussel industry and concludes with risk management strategies and insurance policies that eliminate losses;

2.Its multi-layer approach makes it an integral part of the organisational sector process;

3.It was developed as an interactive tool to support the industry decision making; flexible structure to answer requested questions

4.It can detect the uncertainties that lead to losses; i.e.profitability and harvesting bans due to HABs;

5.It was structured following the basic principles of the standard,giving a systematic function to the risk management of the mussel farming sector;

6.It used the best available information (Theodorou et al., 2011),with cross-checking of various sources in combination (Theodorou et al., 2014) with mussel farmers’ questionnaire survey(Theodorou et al., 2021);

7.The framework was tailor-made for use in Mediterranean mussel aquaculture, incorporating different methodological methods to answer each individual research question separately, concluding at the end on a synthesis of the required risk management priorities;

8.It takes into account all the socioeconomic factors, including the risk perceptions and risk attitudes of the Greek mussel farmers(Theodorou et al., 2021);

9.The transparency of the process was secured by the publishing of the research outcomes (Theodorou et al., 2011, 2014, 2020,2021)

10.It is a dynamic system that could be repeatedly used with new data inputs (i.e.by adding new risks, and partial or in-depth analysis of the existing ones by a secondary supplementary process);

11.It can be used for a continuous improvement of the industry by providing policies for effective risk management especially under the recent financial Greek crisis environment.

The proposed conceptual framework for the risk assessment of the Greek bivalve aquaculture also meets the main characteristics for advanced risk management (Purdy, 2010), following the annex of AS/NZS ISO 31000; that is:

i) It sets up accountable values (measurements) and industry performance goals for each level of the activity such as on the primary (Theodorou, Tzovenis, & Katselis, 2021) and secondary models, giving the opportunity for a continuous upgrade and improvement on each level of decision making (Theodorou et al.,2020; Theodorou et al., 2014).

ii) It is comprehensive, and the risks are clearly defined and measured at each level of the process, giving accountable ranges of acceptability and treatment (Theodorou et al., 2020; Theodorou et al., 2021).

iii) Management strategies for risk mitigation are involved in all levels of the multi-layer decision making within the industry structure (Theodorou et al., 2011).

iv) It is focused on the continuous boosting of the risk-management process of mussel farming in Greece, giving emphasis on its development as a major risk-management tool for the industry stakeholders and the policy makers.This is given as a secondary process in order to provide answers on the new questions about the profitability (Theodorou et al., 2014) and HABs losses that came up to the surface in Theodorou et al.(2020).

v) In practice, all the above-mentioned characteristics were achieved through able and continuous communication between internal (producers, fisheries administrators, etc) and external(scientists, legislators, actuaries, consumers, etc.) stakeholders.

4.Conclusions

The principles for risk management of the Joint Australian New Zealand International Standard AS/NZS ISO 31000:2009 were successfully used to identify and analyse the risks associated with the sustainability of the Mediterranean mussel farming in Greece.As the process has a generic function it was easily modified to meet the specific needs of the local industry.Socioeconomic models were successfully adapted and linked with the standard to answer research questions and to fill in the knowledge gap about the associated risks and their management.

CRediT authorship contribution statement

John A.Theodorou:Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Writing – original draft.Ioannis Tzovenis:Validation, Visualization, Writing – review & editing.

Declaration of competing interest

There is not any conflict of interests for the present work.

杂志排行

Aquaculture and Fisheries的其它文章

- Slurry ice as an alternative cooling medium for fish harvesting and transportation: Study of the effect on seabass flesh quality and shelf life

- Application of hurdle technology for the shelf life extension of European eel(Anguilla anguilla) fillets

- Physicochemical properties of silver carp (Hypophthalmichthys molitrix)mince sausages as influenced by washing and frozen storage

- Bacterial community in response to packaging conditions in farmed gilthead seabream

- Effective algorithmic operational framework for fish texture evaluation in industry: Achieving maturity

- Seasonal variation in the biochemical composition, condition index, and meat yield of the non-indigenous pearl oyster Pinctada imbricata radiata(Leach, 1814) from the West of the Aegean Sea, Greece