A Mathematical Model Based on Supply Chain Optimization for International Petrochemical Engineering Projects

2015-06-22GaoNingSunWei

Gao Ning; Sun Wei

(1. College of Chemical Engineering, Beijing University of Chemical Technology, Beijing 100029; 2. SINOPEC Great Wall Energy and Chemical Co., Ltd., Beijing 100120)

A Mathematical Model Based on Supply Chain Optimization for International Petrochemical Engineering Projects

Gao Ning1,2; Sun Wei1

(1. College of Chemical Engineering, Beijing University of Chemical Technology, Beijing 100029; 2. SINOPEC Great Wall Energy and Chemical Co., Ltd., Beijing 100120)

Based on the study of supply chain (SC) and SC optimization in engineering projects, a mixed integer nonlinear programming (MINLP) optimization model is developed to minimize the total SC cost for international petrochemical engineering projects. A steam cracking project is selected and analyzed, from which typical SC characteristics in international engineering projects in the area of petrochemical industry are summarized. The MINLP model is therefore developed and applied to projects with detailed data. The optimization results are analyzed and compared by the MINLP model, indicating that they are appropriate to SC management practice in engineering projects, and are consistent with the optimal priceeffective strategy in procurement. As a result, the model could provide useful guidance to SC optimization of international engineering projects in petrochemical industry, and improve SC management by selecting more reliable and qualified partner enterprises in SC for the project.

supply chain, optimization, model, engineering project, MINLP

1 Introduction

Supply chain (SC) is defined as a multifaceted structure focusing on the integration of all factors involved in the overall process of procurement, production and distribution of end products to the customers. SC is usually characterized by the forward flow of materials/goods and the bi-directional flow of information[1-3].

The concept of supply chain management (SCM), is a set of approaches utilized to minimize the system-wide costs while satisfying the service requirements by integrating SC[4-5]. In order to optimize the performance of SC, attention was mainly paid to the development of supply chain modeling. SC can be described by using a mathematical programming model or a simulation-based model[6-9]. Usually, mathematical programming models can be applied at different levels, from operational to top decision level, while the simulation-based method is more focused on operational details.

In SCM research on petrochemical industry, Sear[10]developed a linear programming (LP) model for planning material flow in an oil company. Escudero introduced uncertainties in supply costs, demands and product prices through a nonlinear programming (NP) model to optimize the supply, transformation and distribution of an oil company[11]. Later studies show that the situation of real world problem can be better described by mixed-integer nonlinear programming (MINLP) models, in which integer variables are introduced to represent choices of different nodes and nonlinear constraints or objective functions are employed to represent nonlinear realities in the SC[12-15]. Few studies threw light on SC optimization for petrochemical engineering projects. However, researches on engineering projects in similar industries may provide meaningful points forReference[16-17]. Large capital investments are invested in engineering projects, in which a large proportion is tied up by procurement. Production safety would be impacted directly by the quality of procured equipment, which is also the top concern in petrochemical industry. Procurement has to be guaranteed from an integrated view, and suppliers become a key factor in SC of engineering projects. Besides, major equipment/ materials in petrochemical engineering projects had to bedesigned and manufactured specifically. Furthermore, to achieve a better performance of SC there could be different sourcing options with varied supplier selection, which would make SC structures more complicated. To make the SC optimization of such case, mathematical programming models are applicable. The aim of SC optimization is to achieve certain project performance, usually a cost related objective, by considering all possible combination of supplier selections, their inter-dependence and within all constraints[18].

2 Model Development

2.1 Typical project and SC characteristics

A steam cracking project M, as the typical engineering project in petrochemical industry, was selected as the research object for developing the MINLP optimization model. A top Chinese petrochemical company worked as the main contractor in Project M. SCM was one of the key issues to assure project success[19].

The SC of Project M could be described as follows. Firstly, it is a typical aggregate structure without the Sales Section. The main contractor leads the project on EPCM (engineering, procurement and construction management) basis. Secondly, more than 230 equipment and materials (collectively called items) need to be purchased from various suppliers in different countries. The procurement cost of items constitutes 70% of EPCM contract price, which means that procurement has a critical importance in the SC of project M. The SC cost is affected by many factors, including the procurement cost, the supervision cost, the transportation cost, the tax refund and other expenses. Thirdly, all items should be purchased in compliance with proper technical standards from qualified suppliers in global resources. To guarantee the quality and schedule of project, the optimal price-effective orientation is taken as the procurement strategy in Project M. Due to the inter-dependence relationship among items in Project M, different procurement options are available. These options will lead to different supplier selections and have influence on the final cost and structure of the supply chain. The SC characteristics of international petrochemical engineering projects can be summarized in accordance with the above characteristics of Project M.

(1) Procurement management is the key of SC optimization in international petrochemical engineering projects due to procurement’s big impact on the overall cost and schedule of project.

(2) The SC is a typical aggregate structure of core enterprise and partner enterprises. In the procurement of projects, the interaction by main contractor acting as the core enterprise with suppliers acting as partner enterprises constitutes the main content of SC activities, and makes the SC an aggregate structure, which means that more efforts should be focused on the relationship between the core enterprise and the partner enterprises.

(3) Procurement on a global basis increases the complexity of SC cost. There are many factors affecting SC cost, and make it more complex to minimize SC cost in international engineering projects.

(4) The selection of suppliers should be based on a comprehensive view to improve SC efficiency and decrease SC cost. Specially designed strategy is needed for supplier selection, and the different impact of different items on project should also be considered. A comprehensive view should be taken into account for the evaluation and selection of suppliers as partner enterprises in SC.

In brief, for a better SC optimization modeling of petrochemical engineering projects, it is important to focus on the procurement management in SC, optimize the relationship between the core enterprise and the partner enterprises, take all related factors into consideration and make the optimization arising out of a comprehensive view.

2.2 Assumptions for modeling

Based on the complexity of SC in petrochemical engineering projects, some assumptions are made for modeling to address key issues.

(1) The relationship of the project contractor and suppliers is more emphasized in model developing, and the selection of suppliers and their interaction with contractor is the key issue for research in this paper.

(2) Twelve typical items are selected and analyzed to simplify problems and to be easy of expression. They are separated into three groups, i.e.: the furnace components group (4 items), the auxiliary equipment group (6 items), and the basic materials group (2 items). The items, groups and possible supplier sourcing countries are shown in Figure 1.

Figure 1 Typical item selection in steam cracking project for SC optimization

(3) The Business Credit Factor is used as the quantitative factor to evaluate each supplier’s performance in the project. Suppliers with higher Business Credit Factors are deemed to be more reliable in SC practice. The factors are collected upon years of statistics about millions of data. At the same time, the Importance Level is used to evaluate the importance of each item in the project. Items with higher Importance Level are deemed to be more important in SC practice. According to the consequence of quality failure or late delivery of an item in the project, all items are separated into A, B and C levels based on their quality importance, and are separated into 1, 2, 3, and 4 levels based on their delivery importance[20].

(4) In petrochemical engineering projects, the number of suppliers for each item should be minimized after evaluation, which is helpful for a better efficiency of procurement management, after-sales service, spare parts supply and training/operation of personnel at site. 0-1 variables are introduced as constraints to reflect this fact. Suppliers are from different countries. The main contractor will buy Chinese products in RMB when necessary and get tax refund from itself. All necessary custom taxes of the items collected in the project country should be borne by the project owner.

(5) Some other assumptions related to SC cost are made. The supervision cost is proportional to the procurement cost of an item. The supervision cost for a foreign supplier is assumed to be 1.5 times higher than a domestic one. All items are transported in bulk-cargo or containers, which means transportation cost is mainly the ocean transportation fee. The insurance fee or transportation fee within one country is ignored. The schedule of four activities in SC is indicated as milestones of the project, including engineering, procurement, transportation and construction. Time constraints should be applied accordingly.

3 Model Formulations

Based on the above-mentioned assumptions, a new MINLP model is developed for SC optimization. Supplier selection in the model should be described by integer variables. The inter-dependence between suppliers in SC would be described as one set of constraints. The final SC structure, i.e., optimal supplier selection and their interdependence retionship will be determined by the model developed thereby.

Among all the related costs, five major costs affecting total SC cost are considered in SC optimization. Therefore the developed MINLP model could be described as follows.The objective function of the model, the minimum total SC cost, is defined by Formula (1):

where TPC, TSC, TIC, TTC, TER and TEC stand for the total procurement cost, the total supervision cost, the total inventory cost, the total transportation cost, the total export refund and the total evaluation cost, respectively.

3.1 Model formulations

3.1.1 Determination of TPC

The total procurement cost, TPC, is the total sum of all purchasing costs for items provided by the suppliers. TPC is determined by Formula (2)

TPC is obtained by the unit item cost, PCgji, multiplied by the purchased quantity, quantitygji.

In the formulation shown above, g is the index for each item group ranging from 1 to 3, i.e.: group 1 covers the furnace components, group 2 covers the auxiliary equipment, and group 3 covers basic materials. Then j is the index for each item in group g, andiis the index for each supplier of item j in group g. Zgjiis a binary integer variable, indicating whether the supplieriis selected for item j in item group g.is the exchange rate of foreign currency to RMB in procurement activity.

PCgjiis the procurement cost for item j from supplieriin group g, and it can be obtained from Formula (3)

BIDPCgjiis the quotation price from supplierifor item j in item group g. Here αgjiis the discount and Ugjiis a binary integer variable, indicating whether the discount is available to the procurement of item j. When two items could be manufactured and purchased by a package procurement, a discount αgjiwill be provided by the supplier.

3.1.2 Determination of TSC

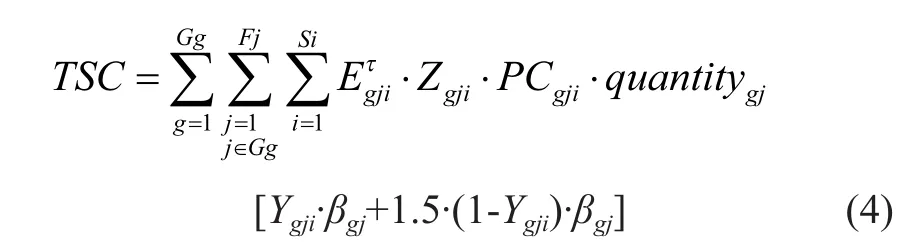

The total supervision cost, TSC, is the fee paid to supervision companies to ensure manufacturing quality of major items. TSC is calculated by Formula (4)

TSC is related to the purchase cost and the location of the supplier. When item j in Group g is purchased from China, the value of Ygjibinary integer variable is 1. As in the assumption, TSC will be 1.5 times greater in a foreign supplier.

βgjis the proportion of supervision cost to PCgji. The value of βgjis determined by Formula (5) originated from the practice in petrochemical engineering projects. It can be seen that βgjis related to QKgj, the Imporeance Level of item.

QKgjreflects its influence of that related item on the quality and schedule of a project, whose value ranges from 1.5 to 5.

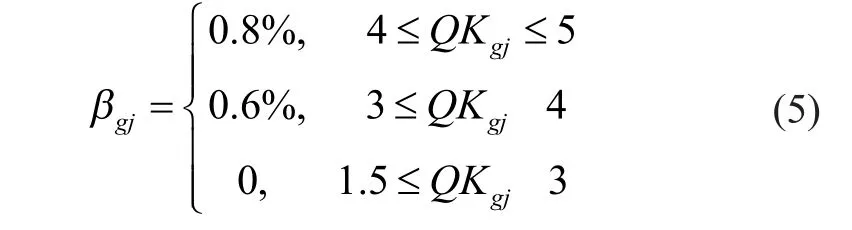

3.1.3 Determination of TTC

The total transportation cost, TTC, is calculated on the basis of ocean transportation, either in container or bulk cargo. TTC is defined by Formula (6)

TTC is described as the unit freight rate TCngji(in containers) or TCgji(in bulk careo) multiplied by WEIgji. The unit freight rates are collected from logistics enterprises. Ngjiis an integer variable indicating whether the items are transported in containers or in buil careo.

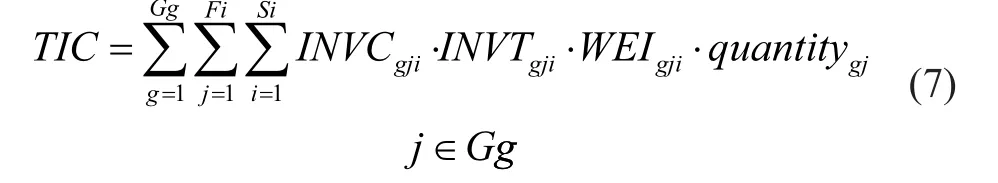

3.1.4 Determination of TIC

The total inventory cost, TIC, generally accounts for a small portion of total SC cost of international petrochemical engineering projects. TIC is given by Formula (7)

INVCgjiis the unit inventory cost. INVTgjiis the inventory time of item j in group g. WEIgjiis the weight of item j in group g.

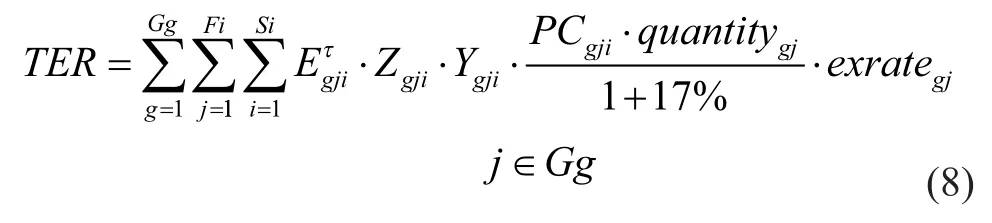

3.1.5 Determination of TER

The total export refund, TER, is only available to Chinese items, which are purchased in RMB by the contractor. TER is determined by Formula (8)

TER is a function of PCgjiand the rate of export refund exrategj. The category of items and their rates of export refund are determined by the relevant regulations of Chinese authorities, and are acquired from published resources.

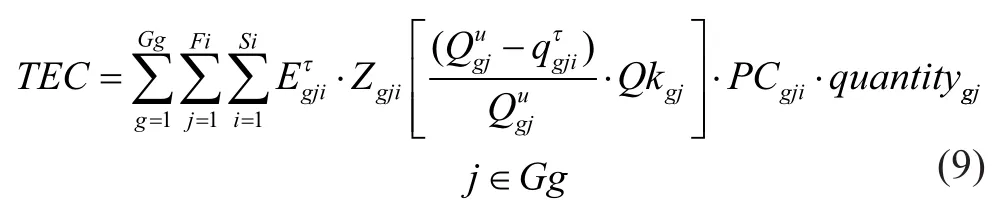

3.1.6 Determination of TEC

The total evaluation cost, TEC, is a virtual cost to make correction of suppliers’ procurement cost on overall view, in which the performance of different suppliers and the importance of different items in the project should be taken into consideration. When supplying the same items, outstanding suppliers, viz. suppliers with better Business Credit Factor above average, will get a negative correction of their procurement cost in evaluation to increase their competitiveness thereupon. For those suppliers below the average, the evaluation effect is on the contrary. With the introduction of TEC, the opportunity of outstanding suppliers is enhanced to be able to supply high quality products when providing important items. It follows the strategy of optimal price-effective scenario in procurement, which is clearly different from traditional procurement evaluation. The latter mainly focuses on direct purchasing cost, and always selects suppliers that can offer lowest prices. TEC is determined by Formula (9)

3.2 Constraints in the model

Decision variables, which characterize the partner enterprise selection in the SC, including those binary integer variables Zgji, Ugji, Ngji, Ygji, shall follow the formulas as shown below:

The constraint on supplier selection is defined b Formula (11),

Only one supplier for item j in group g can be selected. Whether the discount available for procurement is constrained by Formula (12),

Whether the transportation for item j from supplieriin group g is in bulk cargo or containers should be selected and only one choice is available by Formula (13),

TSC and TER can be affected by whether the supplierifor item j in group g is from China or not, which can be speculated by the exchange rate as expressed by Formula (14),

Ygjiis an integer variable.

All these binary integer variables can be constrained as

Different procurement options will lead to different supplier selection. Constraints representing the inter-dependence between suppliers are listed as follows:

When two items could be manufactured and procured from a same supplier, a discount αgjiwill be provided by the supplier.

A threshold of Business Credit Factoris set for some key items. It will be determined by the contractor in dif-ferent projects. The Business Credit Factorof supplierifor item j in group g should not be lower than the threshold value, otherwise the supplier will be excluded due to its violation of the requirements of the project.

Time nodes of activities in SC are defined as Xgjim, m is the index for the activities ranging from 1 to 4, including the beginning of procurement, the beginning of transportation, the end of transportation, and finally the completion of project.

Tgmis the time limit for Xgjimat each stage.

Completion of the whole stage of a petrochemical engineering project is described as DEL and can be limited by the following constraint.

4 Results and Discussion

4.1 Data of projects

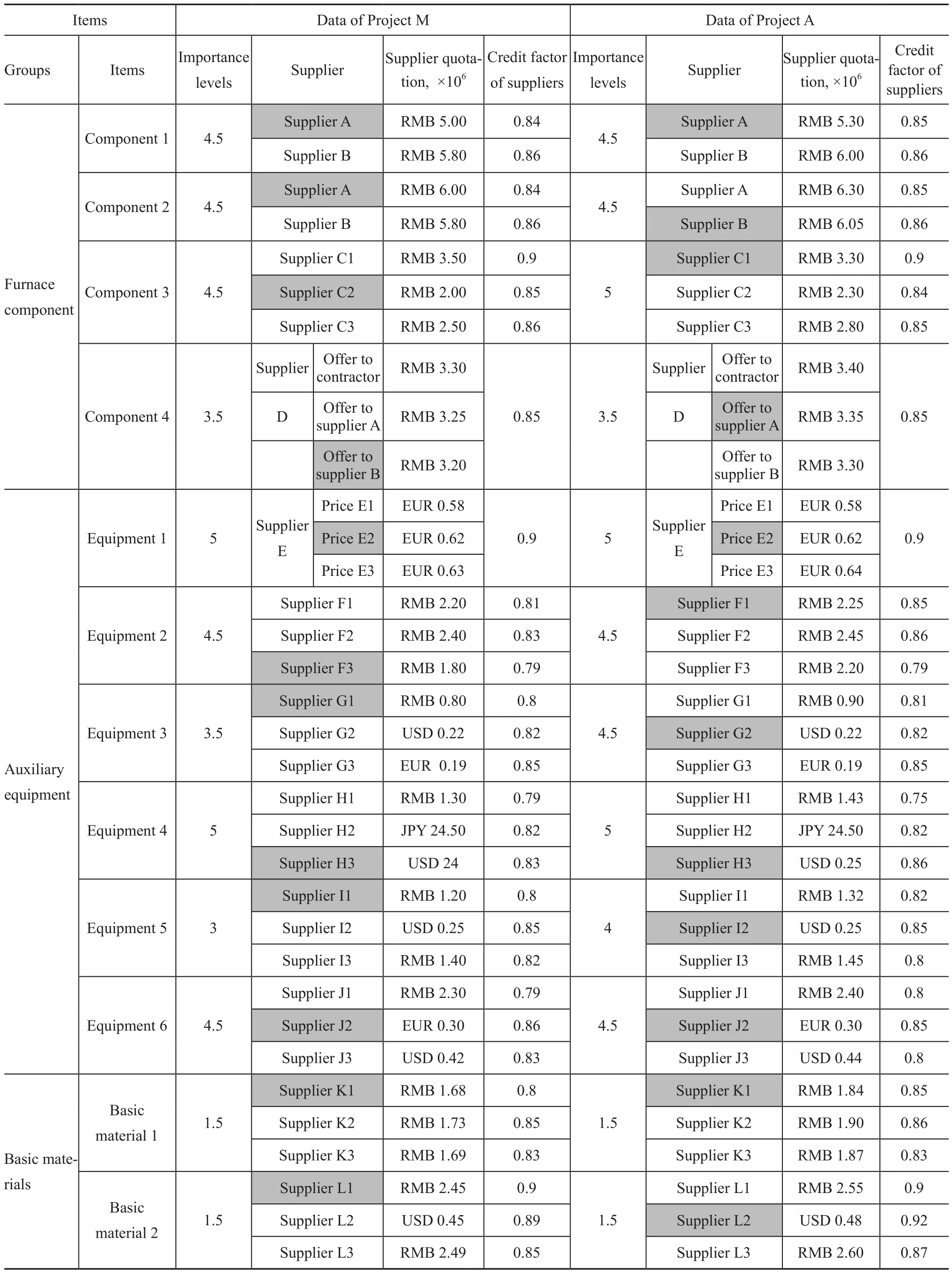

The developed MINLP model is applied to two projects, Project M and Project A. Project A is a steam cracking project scheduled to be built by the contractor in a developed country. The two projects have similar technology processes as well as similar items and relevant suppliers. However, as they are in different locations and at different time durations, the exchange rate of currency and some other factors are different. The most important difference is that there are more stringent requirements for suppliers in Project A. As it is in a developed country, more concerns are paid to the project procurement conditions like the quality, the energy consumption, the environmental protection regulations and other non-price-related issues. Therefore more reliable suppliers are tended to be selected with the unqualified suppliers being knocked out. The engineering data of the two projects are shown in Table 1. The Linear Interactive and General Optimizer (LINGO) is selected as the tool to solve the proposed MINLP problem. During the SC optimization, all possible combination of suppliers and inter-dependence among them are considered. The optimal supplier selection as partner enterprises in SC and their relationship with core enterprises are obtained by the model.

4.2 Optimization results of Project M

After optimization, the objective of model, viz.: the total SC cost of Project M, is RMB 34.46 million. TPC, TSC, TTC, TIC, TER and TEC are RMB 33.95, 0.27, 2.07, 0.03, -2.35 and 0.48 million, respectively. The optimal supplier selection in SC obtained is shown in shadows in Table 1. To express more clearly, the optimized supplier selection in SC of Project M by the MINLP model is shown in Figure 2. The solid line indicates that a certain supplier is included in the optimized SC, while the dash line indicates a certain supplier is excluded in the optimized SC.

It could be seen that suppliers for twelve items are all successfully determined by the model. They are from three countries, including 9 suppliers from China, 2 suppliers from Germany and 1 supplier from America. Three items, i.e. Equipment 1, 4, and 6 are determined to be sourced from the developed countries. At the same time, three of them are with high Importance Levels, denoting that they are critical items in Project M, and should be purchased from more reliable suppliers with more reliable performance. The model result is in line with the procurement reality in petrochemical engineering projects.

Optimized selection does not necessarily mean selection of suppliers which can offer the lowest prices. It could be found that four items in the optimized SC are not to be procured at their lowest price, including the Component 2, and the Equipment 1, 4 and 6. A comprehensive evaluation is made by the MINLP model on the procurement cost, the exchange rate, the transportation cost, the export refund, the Business Credit Factor and other factors, and therefore the result is determined based on the comprehensive assessment. For example, Equipment 4 is a key item with high Importance Level and a threshold for Business Credit Factor. The American supplier H3 is chosen, while H1 is excluded by the model because this supplier does not qualify for the Business Credit Factor. The model results show that the lowest procurement cost is not the selection standard, because it should comply with the comprehensive view. It means that the model is appropriate to the optimal price-effective procurement strategy, and could improve SC management by selectingSC partners who are more reliable and qualified for the project.

Table 1 Data of Project M and Project

Figure 2 Optimized supplier selections in SC of Project M by the MINLP model

4.3 Optimization results of Project A

After optimization, the total SC cost of Project A is RMB 35.70 million. TPC, TSC, TTC, TIC, TER and TEC are RMB 36.88 million, 0.30 million, 2.89 million, 0.03 million, -2.37 million and -2.03 million, respectively. The value of TEC is negative, indicating that the optimal suppliers selected by the model are characteristic of higher Business Credit Factor, which demonstrates that outstanding suppliers are more competitive in Project A.

The optimization results of supplier selection by the MINLP model are shown in shadow in Table 1. It can be seen that suppliers as partner enterprises in SC are successfully determined by the model. Twelve suppliers are obtained, including 6 suppliers selected from the developed countries to supply Equipment 1, 3, 4, 5, 6 and Basic material 1. The model result is in line with the procurement practice of those petrochemical engineering projects in the developed countries.

Upon comparing with the souring option in regard to price, it could be found that 9 items in the optimized SC of Project A are not at the lowest price. As mentioned above, more stringent requirements for suppliers are put forward to petrochemical engineering projects of the developed country, and suppliers with higher Business Credit Factor are likely to be selected. For example, as to Component 3, the supplier C2 can offer a lowest price. But its Business Credit Factor is less than the threshold value set in Project A. Thus the supplier C2 is excluded in the optimized SC. Although the price of the supplier C1 is the highest, its Business Credit Factor is highest too, indicating that the supplier C1 is relatively better in performance and more reliable for implementing the project SC. Finally the supplier C1 is selected as the optimal one for Component 3 by the MINLP model. It is again verified that the model results are in line with the SC management practice in different countries, and can embody the optimal price-effective strategy in procurement practice of projects.

4.4 Comparison of optimized results

The established MINLP model is successfully applied to both Project M and Project A. By carrying out the optimal supplier selection determined by the model, it can be found out that there are 7 different supplier selection suitable for the Projects M and A, including the component 1,3, and 4, the equipment 2, 3, and 5, and the basic material 2. In the Project M, more Chinese suppliers are proposed by the model. While in Project A there are more suppliers from the developed countries, and fewer suppliers from China. At the same time, 8 suppliers that can offer the lowest price are selected in SC optimization of Project M, while only 3 suppliers in Project A. These facts show that there are different conditions existing in different projects, and the model is confirmed to be applicable to SC optimization in different projects.

Figure 3 SC structure of Project A optimized by the MINLP model

There are other differences between the model results in Projects M and A. In the model results of Project A, Component 1 is from the supplier A, and Component 2 is from the supplier B separately. However, Components 1 and 2 are selected to be supplied by the supplier A as a package in the model results of Project M, which makes different SC structures of the two projects. The SC structure of Project A optimized by the MINLP model is shown in Figure 3

Figure 3 shows that the main contractor acts as the core enterprise, and the suppliers act as partner enterprises in SC. The core enterprise of SC has a direct relationship with 11 suppliers after SC optimization by the MINLP model. Three suppliers, i.e., the suppliers A, B and C, are selected to supply components. Component 4 is optimized to be supplied by the supplier A, which means the supplier D becomes a sub-supplier of the supplier A.

It can be found that Project M has a different SC structure. The core enterprise would have direct relationship with 10 suppliers, and the supplier A is selected to supply both Components 1 and 2. It means that the SC structure determined by the MINLP model could change to adapt for better performance of SC in different projects.

5 Conclusions

In this paper, a MINLP model is developed to minimize the total SC cost of international engineering projects in petrochemical industry. Through studies on steam cracking project, four typical characteristics of international petrochemical engineering projects are summarized. The model focuses a special attention on the procurement management and the relationship between the core enterprise and the partner enterprises, trying to make the optimization on a comprehensive view while taking all related factors into consideration.

The developed MINLP model is proved to be successful in the two typical engineering projects of petrochemical industry. The SC optimization results solved by the MINLP model aim at achieving the minimum total SC cost on a comprehensive view, and are not in pursuit of the lowest price. The model results are found to be in accordance with the different procurement strategies and practice in these countries. Besides the determination of the supplier selection as partner enterprises and their inter-dependence relationship in SC, the MINLP model can also determine SC structures which can be adapted to achieve better performance of SC. As a conclusion, the model is capable of providing useful guidance for SC optimization in petrochemical engineering project, and can improve SC management by selecting SC partners who are more reliable and qualified for the project.

This is an exploratory paper and more research needs to be conducted in this area. In the future research, morepetrochemical projects with sufficient actual data should be studied by the MINLP model. It is suggested that although the MINLP model is developed based on international engineering projects in petrochemical industry, the idea and method are also applicable to other engineering project in process industry for SC optimization.

[1] Min H, Zhou G. Supply chain modeling: Past, present and future[J]. Computers & Industrial Engineering, 2002, 43(1): 231-249

[2] Beamon B M. Supply chain design and analysis: Models and methods[J]. International Journal of Production Economics, 1998, 55(3): 281-294

[3] Sabbaghi A, Sabbaghi N. Global supply-chain strategy and global competitiveness[J]. International Business & Economics Research Journal, 2001, 3(7): 63-76

[4] Stadtler H. Supply chain management and advanced planning--basics, overview and challenges[J]. European Journal of Operational Research, 2005, 163(3): 575-588

[5] Shapiro J F. Challenges of strategic supply chain planning and modeling[J]. Computers & Chemical Engineering, 2004, 28(6): 855-861

[6] PapageorgioulG, Supply chain optimization for the process industries, advances and opportunities[J]. Computers & Chemical Engineering, 2009, 33(12): 1931-1938

[7] Grossmann I. Enterprise-wide optimization: A new frontier in process systems engineering[J]. AIChE Journal, 2005, 51(7): 1846-1857

[8] Longo F, Mirabelli G. An advanced supply chain management tool based on modeling and simulation[J]. Computers & Industrial Engineering, 2008, 54(3): 570-588

[9] Van der Zee D J, Van der Vorst J G, A modeling framework for supply chain simulation: Opportunities for improved decision making[J]. Decision Sciences, 2005, 36(1): 65-95

[10] Sear T N. Logistics planning in the downstream oil industry[J]. Journal of the Operational Research Society, 1993, 44 (1): 9-17

[11] EscuderolF, Quintana F J, Salmerón J. CORO, a modeling and an algorithmic framework for oil supply, transformation and distribution optimization under uncertainty[J]. European Journal of Operational Research, 1999, 114(3): 638-656

[12] Lasschuit W, Thijssen N. Supporting supply chain planning and scheduling decisions in the oil and chemical industry[J]. Computers and Chemical Engineering, 2004, 28(6): 863-870

[13] Ross A D. Performance-based strategic resource allocation in supply networks[J]. International Journal of Production Economics, 2000, 63(3): 255-266

[14] You F, GrossmanniE. Integrated multiechelon supply chain design with inventories under uncertainty: MINLP models[J]. AIChE Journal, 2010, 56(2): 419-440

[15] Liu S, PapageorgioulG. Multi objective optimization of production, distribution and capacity planning of global supply chains in the process industry[J]. Omega, 2013, 41(2): 369-382

[16] Yeo K T, Ning J H. Integrating supply chain and critical chain concepts in engineering procurement construction (EPC) projects[J]. International Journal of Project Management, 2002, 20: 253-262

[17] Azambuja M M, O’Brien W J. Rapid assessment and selection of engineered equipment suppliers[J]. Automation in Construction, 2012, 22: 587-596

[18] Lababidi H M S, Ahmed M, AlatiqiiM. Optimizing the supply chain of a petrochemical company under uncertain operating and economic conditions[J]. Ind Eng Chem Res, 2004, 43(1): 63-73

[19] Gao N. The practice and enlightenment of material supply in oversea ethylene projects[J]. China Petroleum and Chemical Economy Analysis, 2013(6): 57-61 (in Chinese)

[20] Wang Y. Petrochemical Procurement Management[M], Beijing: China Petrochemical Press, 2010: 158-168 (in Chinese)

date: 2015-01-23; Accepted date: 2015-04-01.

Dr. Gao Ning, Telephone: +86- 10-51586427; E-mail: gaoning.ccnh@sinopec.com.

杂志排行

中国炼油与石油化工的其它文章

- Pyrolysis Characteristics and Kinetics of Methyl Oleate Based on TG-FTIR Method

- Synthesis of Waterborne Polyurethane Modified by Nano-SiO2Silicone and Properties of the WPU Coated RDX

- A Highly Efficient and Selective Water-Soluble Bimetallic Catalyst for Hydrogenation of Chloronitrobenzene to Chloroaniline

- Curing Mechanism of Condensed Polynuclear Aromatic Resin and Thermal Stability of Cured Resin

- A Novel Thermally Coupled Reactive Distillation Column for the Hydrolysis of Methyl Acetate

- Effects of Fe2+, Co2+and Ni2+Ions on Biological Methane Production from Residual Heavy Oil