Primary logistics planning of oil products under the imbalance of supply and demand

2022-09-23RuiQiuYongTuLingQiLioYingQiJioBoHongWngYiGuoHoRnZhng

Rui Qiu , Yong-Tu Ling ,**, Qi Lio ,*, Ying-Qi Jio , Bo-Hong Wng , Yi Guo ,Ho-Rn Zhng

a National Engineering Laboratory for Pipeline Safety/Beijing Key Laboratory of Urban Oil and Gas Distribution Technology,China University of Petroleum-Beijing, Fuxue Road No.18, Changping District, Beijing,102249, PR China

b School of Petrochemical Engineering and Environment, Zhejiang Ocean University, Zhoushan, 316022, China

c Sustainable Process Integration Laboratory - SPIL, NETME Centre, Faculty of Mechanical Engineering, Brno University of Technology - VUT Brno,

Technick′a 2896/2, 616 69, Brno, Czech Republic

d Oil & Gas Pipeline Control Center, PipeChina, Dongtucheng Road No.5, Chaoyang District, Beijing,100013, PR China

e Center for Spatial Information Science, The University of Tokyo, 5-1-5 Kashiwanoha, Kashiwa-shi, Chiba, 277-8568, Japan

Keywords:Oil product logistics ∙Supply and demand imbalance ∙Petroleum enterprise ∙Resource adjustment ∙Mathematical Programming model

ABSTRACT This paper intends to complete the primary logistics planning of oil products under the imbalance of supply and demand. An integrated mathematical programming model is developed to simultaneously find the balance between supply and demand, and optimize the logistics scheme. The model takes minimum logistics cost and resource adjustment cost as the objective function, and takes supply and demand capacity, transportation capacity, mass balance, and resource adjustment rules as constraints.Three adjustment rules are considered in the model,including resource adjustment within oil suppliers,within oil consumers,and between oil consumers. The model is tested on a large-scale primary logistics of a state-owned petroleum enterprise, involving 37 affiliated refineries, 31 procurement departments,286 market depots and dedicated consumers. After the unified optimization, the supply and demand imbalance is eased by 97% and the total cost is saved by 7%, which proves the effectiveness and applicability of the proposed model.

1. Introduction

Affected by the COVID-19 epidemic and the deployment of clean energy, the growth rate of oil consumption has slowed down(Shang et al., 2021; Qiu et al., 2021). In the year 2020, global oil consumption has fallen by 9.1 million b/d,which is the first decline in 11 years.China is one of the few countries where oil consumption has increased,with an increase of 0.22 million b/d.As part of supply chain management, logistics planning of oil products is an important way for petroleum enterprises to seek more substantial profits,apart from relying on bid-ask spreads(Lima et al.,2021;Wang et al.,2021; Zhou et al., 2019b). Generally, oil product logistics can be divided into primary logistics and secondary logistics.The former is the research object of this paper.The primary logistics handles the bulk delivery of oil products from upstream refineries to downstream market depots through long-distance transportation modes such as pipelines, railways, and waterways (Lima et al., 2016). To satisfy market demand and save logistics costs,dispatchers should formulate an efficient logistics scheme in advance. On the one hand, dispatchers are responsible for coordinating cross-regional resource allocation based on upstream production plans, procurement plans, and downstream market demand plans. On the other hand,dispatchers should optimize the multi-mode and multi-stage transportation scheme by considering the transportation route,transportation capacity, inventory level, and so on. At present, the management technology of primary logistics of oil products is relatively mature. The first step is to collect logistics boundary information, including supply plans, demand plans, and transportation conditions. The next step is to establish a mathematical optimization model based on the logistics business process.Finally,the most economical resource allocation and transportation schemes can be obtained by model calculation.

Nomenclature Sets and indices i∊I = {1'…'im} Set of oil suppliers j∊J = {1'…'jm} Set of oil consumers k∊K = {1'…'km} Set of oil products z∊Z = {1'…'zm} Set of transportation modes o∊O = {1'…'om} Set of oil product types Parameters bOILk,o A binary parameter:If oil product k belongs to type o,it is 1; otherwise, it is 0 bTRAi,j,k,z A binary parameter:If oil product k can be delivered from supplier i to consumer j by transportation mode z, it is 1; otherwise, it is 0 bCDDj,j’,k A binary parameter: If oil product k can be redelivered from consumer j to consumer j', it is 1;otherwise, it is 0 bCREi,k A binary parameter: If supplier i has a backlog of oil product k, it is 1; otherwise, it is 0 bCDEj,k A binary parameter: If consumer j has a stockout of oil product k, it is 1; otherwise, it is 0 cTRAi,j,k,z The unit freight cost of oil product k which is delivered from supplier i to consumer j by transportation mode z, CNY/t cSREi,k Unit backlog cost of oil product k of supplier i,CNY/t cSDEj,k Unit stockout cost of oil product k of consumer j,CNY/t cCREi,k Unit adjustment cost of oil product k within supplier i, CNY/t cCDEj,k Unit adjustment cost of oil product k within consumer j, CNY/t cCDDj,j’,k The unit freight cost of oil product k which is redelivered from consumer j to consumer j', CNY/t qSmini,k Lower supply volume of supplier i for oil product k,t qSmaxi,k Upper supply volume of supplier i for oil product k,t qDminj,k Lower demand volume of consumer j for oil product k, t qDmaxj,k Upper demand volume of consumer j for oil product k, t qCREi,k Upper adjustment volume within supplier i for oil product k, t qCDEj,k Upper adjustment volume within consumer j for oil product k, t vTmini,j,k,z Lower transportation capacity of oil product k from supplier i to consumer j by transportation mode z, t vTmaxi,j,k,z Upper transportation capacity of oil product k from supplier i to consumer j by transportation mode z, t vSmini,z Lower loading capacity of supplier i for transportation mode z, t vSmaxi,z Upper loading capacity of supplier i for transportation mode z, t vDminj,z Lower unloading capacity of consumer j for transportation mode z, t vDmaxj,z Upper unloading capacity of consumer j for transportation mode z, t M A large constant Variables QPREi,k The final supply plan of supplier i for oil product k, t QPDEj,k The final demand plan of consumer j for oil product k,t QCREi,k The adjusted supply within supplier i for oil product k, t QCDEj,k The adjusted demand within consumer j for oil product k, t QCDDj,j’,k The volume of oil product k which is redelivered from consumer j to consumer j', t QAREi,k The absolute value of the adjusted supply within supplier i for oil product k, t QADEj,k The absolute value of the adjusted demand within consumer j for oil product k, t SSREi,k The backlog volume of supplier i for oil product k, t SSDEj,k The stockout volume of consumer j for oil product k,t VTRAi,j,k,z The volume of oil product k which is delivered from supplier i to consumer j by transportation mode z, t

However, the logistics management of oil products in China is rather complicated due to the complex transportation network,diverse transportation modes,and numerous logistics nodes.At the same time, the information asymmetry of upstream and downstream departments leads to the contradiction between supply and demand, including the mismatch of oil volume and oil structure.The existing logistics optimization model fails to consider the above-mentioned contradictions,thus cannot further complete the logistics planning effectively. Usually, manual modification is adopted to balance supply and demand plans before the step of logistics optimization. Then, the logistics optimization model will work based on the balanced supply and demand plans.This process is time-consuming and cumbersome, and manual adjustment cannot guarantee the global optimality of the final logistics scheme.As far as we know, dispatchers lack practical model tools to coordinate resource adjustment between oil suppliers and consumers.Therefore, this paper aims to design an integrated optimization model of primary logistics that couples the process of resource adjustment and logistics optimization. The proposed model is expected to efficiently compile oil product allocation and transportation schemes under the imbalance of supply and demand,provide methodological support for logistics managers in petroleum enterprises within and beyond China.

This section describes the research background of this paper.In the next section, the relevant literature about logistics planning of oil products is reviewed. In Section 3 and Section 4, an integrated method is firstly introduced to deal with the logistics planning under the imbalance of supply and demand;later,a corresponding mathematical model is proposed in detail. Section 5 provides the data source of the case, as well as a comparative analysis of the resource adjustment and logistics schemes.Finally,conclusions and recommendations are drawn in Section 6.

2. Related work

Oil product logistics is a branch of the oil product supply chain,and its corresponding research consists of the following aspects:strategic design, tactical planning, and operational scheduling.Generally, strategic design involves the construction and modification of supply chain networks throughout decades (Zhang et al.,2017; Zhou et al., 2020). Tactical planning deals with issues of procurement, production, distribution, and sales over months(Sahebi et al.,2014).Operational scheduling focuses on the specific operational status of facilities with the smallest period (Liao et al.,2019; Xu et al., 2021; Bi et al., 2021). The primary logistics planning discussed in this paper is typical tactical planning involving the distribution process of oil products.

The mathematical programming method is a popular and effective way for oil product supply chain and logistics planning(Liao et al.,2018;Zhou et al.,2019a;Qiu et al.,2019).By optimizing the supply chain,the overall revenue can be increased or operating costs can be reduced significantly on the premise of ensuring market demand.Fernandes et al.(2013)proposed a mixed-integer linear programming(MILP)model for the supply chain planning of oil products at the strategic and tactical levels. The model aims to maximize the profit of the entire supply chain system, including refining,transportation,and sales stages.The model was applied in a real oil product supply chain in Portuguese. Kazemi and Szmerekovsky (2015) developed a MILP model to determine the lowest-cost oil product logistics scheme at the strategic and tactical levels. The model considers the feature of the transportation system with multi modes and multi products.A case study was carried out in a real oil product logistics system in America. Other researchers also considered the uncertainty in design,planning, and operation of supply chain planning of oil products (Al-Othman et al., 2008). Stochastic programming, chance-constrained programming, robust optimization, and fuzzy mathematical programming are applied for model improvement to enhance the robustness of the scheme. Tong et al. (2014c) demonstrated the advantages of a robust optimization model of liquid biofuel supply chain compared with the deterministic one. The case study in Illinois achieved a balance between the robustness and economics of the final scheme. Pudasaini (2021) integrated uncertainty and multi-objective analysis into the supply chain planning of oil products at the strategic and tactical levels. These models are designed for the management of the entire supply chain.However,in a large-scale and complex-structure supply chain, models specifically developed for different links are more practical, such as optimization models that only focus on the logistics process.

Based on the previous research,some researchers are devoted to optimizing the logistics system.Wang et al.(2019)provided a new idea to promote the economic benefit of the oil product logistics system by planning new pipeline construction. The objective function and constraints related to pipeline planning are added to the basic optimization model. Lima et al. (2018) considered the uncertainty of sales price and demand in the optimal process of oil product logistics. Scenario-based stochastic programming is introduced to determine the economic logistics scheme at the tactical level. Yuan et al. (2019) evaluated the impact of pipeline reform on the oil product logistics in China from the perspective of economy,environment,and energy. Logistics optimization models were updated to determine logistics scheme under specific reform strategy and policy recommendation was given to strengthen business cooperation between petroleum enterprises. Later, Yuan et al. (2020) introduced fuzzy mathematical programming into facility renovation and logistics planning to address the demand uncertainty of oil products.The study quantified the economic and environmental impact of facility renovation on China's oil product supply chain. These models are customized for the logistics planning of oil products, taking into account more detailed business constraints.However,these studies can only optimize the logistics schemes under the balance of supply and demand, and fail to propose effective methods for logistics planning under the imbalance of supply and demand.

In addition, the integration and coordination of multiple departments in the supply chain are also concerned(MirHassani and Noori, 2011; Tong et al., 2014b). In this case, a collaborative environment can be established to improve the economic and environmental benefits of the entire system by coordinating activities carried out by different entities upstream and downstream.Ghatee and Hashemi(2009)detailed the state of the storage tank in oil supply chain management and developed an effective algorithm for this large-scale problem. Some researchers discussed the synergies effect of the integration and coordination of the biofuel supply chain with the existing oil supply chain.Tong et al. (2014a)built a multi-period MILP model to optimize the tactical and strategic plans of this hybrid supply chain.Yang et al.(2018)compared the role of principal-agent agency contracts and quantity discount contracts in the supply chain of waste cooking oil. Zheng et al.(2020) pointed out that it is necessary to optimize the entire system and coordinate each department to obtain appropriate returns.An optimization model considering profit allocation was proposed for supply chain design and operation.These studies prove that the supply chain system still has room for benefit improvement.However, the implementation of integration and coordination is affected by policies and the level of market opening.

Currently,most petroleum enterprises in China still perform the mode of separation of production and sales. In this mode, information of suppliers and consumers is asymmetry, resulting in a mismatch of oil volume and oil structure. The traditional logistics optimization model cannot deal with logistics planning under the imbalance of supply and demand. Different from previous studies on primary logistics planning, this paper couples resource adjustment with logistics optimization for the first time.The adjustment methods include resource adjustment within oil suppliers, within oil consumers,and between oil consumers.A unified mathematical programming model is developed to find the balance between supply and demand and to further optimize resource allocation and resource transportation schemes. The contributions of this work are as follows:

●Focus on the contradiction between supply and demand in primary logistics of oil products, an integrated method is proposed to improve the efficiency of logistics planning.

●A tactical mathematical programming model is developed that can simultaneously find the balance between supply and demand and optimize the logistics scheme, which can help to provide a more practical solution for petroleum enterprises.

●The model considers resource adjustment within refineries,within market depots,between market depots,and helps to work out the optimal resource adjustment, allocation, and transportation schemes.

●A comprehensive case of a state-owned petroleum enterprise is carried out and analyzed in detail, which demonstrates the superiority of the proposed method.

3. Methodology

3.1. Problem description

This paper focuses on the activities of resource adjustment and transportation optimization in oil product primary logistics.The oil suppliers are composed of affiliated refineries and procurement departments, and the oil consumers are market depots in provinces. The suppliers transport different types of oil products from upstream to downstream through pipelines, railways, waterways,and roadways to meet the sales demand of the consumers. Due to the asymmetry of information, the supply and demand plans submitted to the logistics dispatching department have the problem of a mismatch in oil quantity and oil structure. Dispatchers play the role of central coordinator, and they are responsible for resource adjustment within suppliers, resource adjustment within consumers, or a second delivery between consumers, and ultimately alleviate the contradiction between supply and demand.

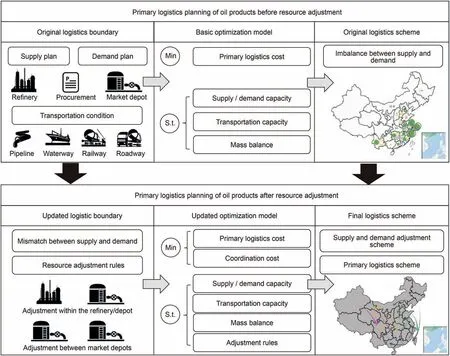

Fig.1 shows the integrated method of primary logistics planning under the imbalance of supply and demand. Firstly, the original logistics boundary should be collected, including supply plans,demand plans,and transportation conditions.Secondly,the tactical primary logistics optimization model is applied to calculate the results of supply and demand imbalance, including the backlog volume of each supplier and the stockout volume of each consumer.Then, based on the results of the basic optimization model, an updated logistics optimization model is developed, combining various resource adjustment rules commonly used by dispatchers.The adjustment rules should ensure that the refineries'production level and market depots'sales level do not fluctuate drastically,and the oil quantity and oil structure also need to meet the supply and demand requirements. The resource adjustment cost is added to the objective function, and the adjustment rules are added to the constraints in the model.Finally,the resource adjustment,resource allocation, and resource transportation schemes with the lowest overall cost can be calculated.

3.2. Model requirements

The above problem can be formulated as a mathematical model to work out the optimal resource adjustment scheme, resource allocation scheme, and resource transportation scheme.

Given:

●Original supply information: production plan for affiliated refineries, procurement plan for procurement departments.

●Original demand information: sales plan for market depots and dedicated consumers.

●Transportation information: transportation capacity of each route,location of each node,loading and unloading capacity of each node.

●Cost information: unit freight cost, unit stockout cost, unit backlog cost, unit adjustment cost.

●Other information: type of oil products.

Determine:

●Resource adjustment scheme: increased or decreased production volume of refineries, increased or decreased sales volume of market depots, redelivery volume between market depots.

●Resource allocation scheme: oil products that are delivered from suppliers to consumers.

●Resource transportation scheme: transportation mode and volume for each route,loading/unloading mode and volume for each node.

●Resource imbalance information: the imbalance between supply and demand before and after resource adjustment.

●Cost results:total logistics cost and resource adjustment cost.

Fig.1. An integrated method of primary logistics planning.

Objective:

This paper aims to find the balance between oil product supply and demand and improve the formulation efficiency of primary logistics for petroleum enterprises. Therefore, a unified optimization model is proposed to minimize the overall resource adjustment cost and logistics cost and consider various logistics business constraints. To ensure the validity of model creation and solution,the assumptions are as follows:

●All supply plans, demand plans, and transportation information can be collected in advance from different departments.

●All oil products can be delivered from the suppliers to consumers before the end of the month, and problems such as oil batches and oil mixture are ignored.

●All logistics participants are departments of one petroleum enterprise, and the purpose of the unified optimization by the sole decision-maker (dispatchers) is to improve the economic performance of the entire enterprise.

●During the resource adjustment process, the interchange of the same type of oil products is acceptable.

4. Mathematical model

4.1. Objective function

The unified optimization model aims to minimize the overall resource adjustment cost and logistics cost.The model constraints include supply capacity, demand capacity, transportation capacity,mass balance, and resource adjustment rules. In the following, i denotes oil supplier,j denotes oil consumer,k denotes oil product,z denotes transportation mode, o denotes oil product type.

The objective function of this model is shown in Eq.(1).It is the sum of freight cost f1,resource adjustment cost f2,penalties for the imbalance between supply and demand f3.

4.2. Constraints

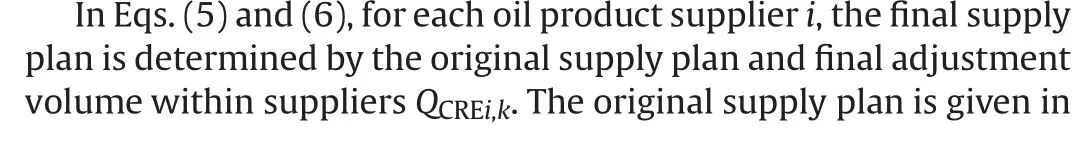

4.2.1. Supply and demand capacity

The redelivery of oil products between consumers is used to make up part of the stockout volume. As shown in Eq. (16), the stockout volume of each oil product k of each consumer j SSDEj,kis equal to the final planned demand volume QPDEj,kplus the redelivery volume to other consumers minus the delivery volume from suppliers and redelivery volume from other consumers.It is noted that if it is not allowed for redelivery between consumer j to consumer j', the redelivery volume is equal to 0.

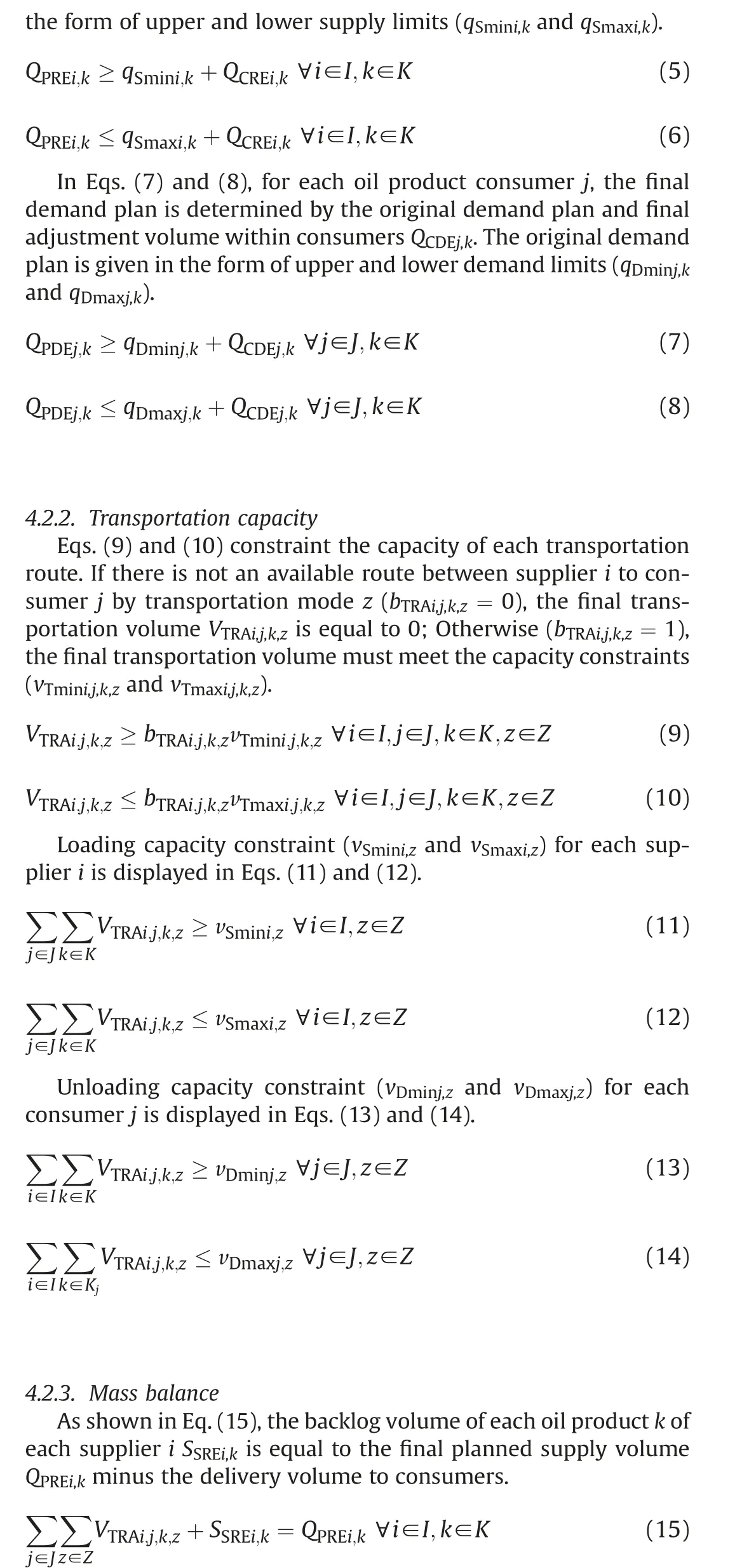

4.2.4. Resource adjustment rule

5. Results and discussion

5.1. Basic data

The integrated optimization method proposed in this paper is applied to the preparation process of the primary logistics scheme in a state-owned petroleum enterprise. The research time horizon is set to one month. The original supply and demand plans of oil products, in this case, are provided in Figs. 2 and 3. Oil suppliers include 37 affiliated refineries (R1-R37) and 31 procurements departments(P1-P31).Oil consumers include 286 market depots and dedicated consumers in 31 provincial regions (excluding Hong Kong,Macau,and Taiwan).22 oil products are divided into 3 types(gasoline:G1-G12,diesel:D1-D9,kerosene:K1).In Fig.2,the depth of color in each provincial region represents the demand volume of oil products.The region with darker color has greater demand,like the southeast coastal region. The yellow circular dots on the map indicate the location of the affiliated refineries and their planned production volume. The circular dots with larger areas correspond to refineries with greater planned production volume,like R15 and R34.The procurement departments are responsible for making up the market demand that the affiliated refineries cannot meet.Fig.3 shows the procurement capacity of each department.Among them,P5,P16,P24,and P31 have greater procurement capacity,especially for gasoline.

The proposed mathematical model in Section 3 is programmed in GAMS Distribution 29.1.0 and calculated by Gurobi solver on a PC with Intel Core i7-8565U CPU@1.80 GHz 1.99 GHz.In the following,firstly, the imbalance of supply and demand under the original logistics boundary is provided; Then, the integrated optimal scheme is given to ease the imbalance of supply and demand;Finally, the economical resource allocation and transportation schemes after resource adjustment are analyzed in detail.

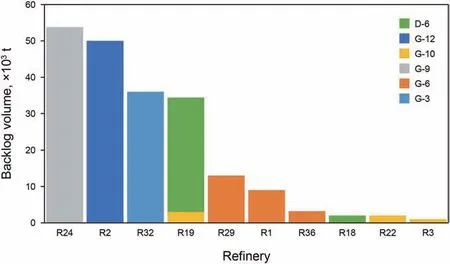

5.2. Resource adjustment results

Based on the original logistics boundary, the imbalance of supply and demand is calculated by the basic logistic optimization model,seen in Figs.4 and 5.In Fig.4,it can be seen that there are 10 refineries with a backlog of oil products.These refineries are evenly distributed in the eastern region. The backlog item is 11, in which one refinery and one oil product are called one item. The total backlog volume is 2×105t,84%for gasoline and 16%for diesel.R24 has the largest backlog volume,followed by R2,R32,and R19.Here,R19 has a backlog for both gasoline and diesel, 3 × 103t for G-10,and 3.1 × 104t for D-6. Also, there are 31 market depots with a stockout of oil products, and the stockout item is 40. The total stockout volume is 2.5×105t,87%for gasoline and 13%for diesel.Among them,D224 has the largest stockout volume of 9.4×104t,6.4×104t for G-9,and 3.0×104t for G-10.D206 has the secondlargest stockout volume of 4.5 × 104t, 3.0 × 104t for G-9, and 1.5 × 104t for G-10. The stockout information of other market depots is given in Fig.5.Take oil product D-6 for example,refineries R19 and R18 have a total backlog volume of 3.3 × 104t, while market depots like D33,D71,D155 have a total stockout volume of 2.3×104t.There are no available transportation channels to deliver oil products between the above refineries and market depots.Thus,reasonable resource adjustment means are needed to alleviate the above imbalance.

Fig. 2. Demand plans and supply plans of oil products.

Fig. 3. Supply plans of procurement departments.

Table 1 shows the comparison of supply and demand imbalance before/after resource adjustment. For refineries, the backlog volume reduces from 2×105t to 0,and the backlog item reduces from 11 to 0. For market depots, the stockout volume reduces from 2.5×105t to 1×104t,and the stockout item reduces from 40 to 6.It can be seen that after the unified optimization by the proposed model in Section 4, the original imbalance between supply and demand has been greatly eased by 97% through resource adjustments within refineries, within market depots, between market depots.

Fig. 4. Refineries with a backlog of oil products.

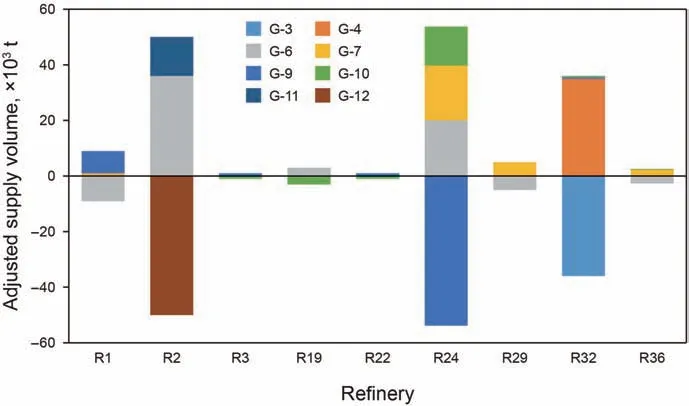

The resource adjustment schemes are detailed in Figs. 6-8.Fig. 6 shows the supply adjustment scheme within refineries. The production plans of 9 refineries are adjusted.Take refinery R24 for example, the planned production volume of oil product G-9 reduces by 5.4 × 105t, and the planned production volume of the same type of oil products rises by the same amount.Oil products G-6,G-7,and G-10 rise by 2×105t,2×105t,and 1.4×105t.In this case, the total production volume of gasoline remains unchanged.This can guarantee the stability of the supply level and the requirements of the production facilities. After adjusting the structure and quantity of oil products, the backlog of refineries is reduced significantly. The demand adjustment scheme within market depots is displayed in Fig. 7. The sales plans of 9 market depots are adjusted. Take market depot D206 for example, the planned sales volume of oil products G-9 and G-10 reduces by 3×105t and 6×104t,and the planned sales volume of the same type of oil product G-6 rises by the same amount. This can reduce the impact on sales levels.

Fig. 5. Market depots with a stockout of oil products.

The redelivery scheme between market depots is another resource adjustment method, presented by a Sankey diagram, as shown in Fig. 8. At the top of the figure, 19 market depots are serving as transit points. Oil products are firstly delivered to these depots from refineries or procurement departments over long distances and then delivered to other depots through other transportation modes.In this case,demand for 15 market depots at the bottom of the figure can be met partly after the second delivery.In the Sankey diagram, the width of the side is proportional to the redelivery volume between market depots. Depot D223, D226,D227 are the three greatest transit points, helping depot D224 make up for oil products demand of 9.2 × 104t. In this way, the imbalance of supply and demand can be eased sharply.

5.3. Resource allocation and transportation results

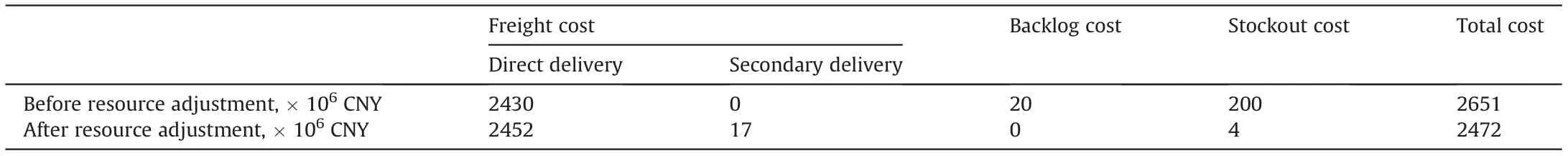

The total cost in primary logistics consists of freight cost for direct delivery and secondary delivery, backlog cost of refineries,and stockout cost of market depots.Table 2 gives the comparison of the total cost before/after resource adjustment. After the unified optimization,the total cost is saved by 7%.Specifically,although the freight cost increases 3.9×107CNY(56%for direct delivery and 44%for secondary delivery), sales loss caused by stockout reduces 1.96 × 108CNY, additional storage costs caused by backlog reduce 2 × 107CNY. It can be seen that the proposed method can help to find the balance between supply and demand.

Fig. 6. Supply adjustment within refineries.

Fig. 7. Demand adjustment within market depots.

Fig. 8. Oil product redelivery between market depots.

Table 1 Supply and demand imbalance before/after resource adjustment.

Table 2 Total cost before/after resource adjustment.

Fig. 9. Resource allocation scheme of refineries.

Fig.10. Resource allocation scheme of procurement departments.

Fig. 9 is a Sankey diagram that provides the optimal resource allocation scheme from affiliated refineries(at the top of the figure)to market depots in different regions(at the bottom of the figure).The Sankey diagram vividly shows the mass balance of the delivery process of oil products. The refineries are concentrated in East Region,Center Region,and South Region in China.The allocation of oil products in most refineries follows the principle of proximity.For example, in the East region, the refinery R1 supplies oil products to Anhui by pipeline and railways. Also, refinery R1 takes advantage of the Yangtze River shipping facilities to supply oil products to Chongqing and Hubei by waterways.For refineries with low oil demand in the province,routes with lower freight rates will be chosen to supply oil products to market depots in other provinces. For example, in the north-east region, the oil demand in Liaoning is relatively low, which can be satisfied by refineries R3,R12,and R21.In addition,refineries R3,R12,and R21 also supply oil products to Beijing,Heilongjiang,Neimengu via railways,to Jilin via roadways, to Fujian, Jiangsu, Shanghai, Zhejiang, Guangdong,Guangxi via waterways.

The procurement department is also an important supplier of oil products. Fig. 10 gives the optimal resource allocation scheme of procurement departments in each province.The provinces with the largest procurement volume are Guangdong and Zhejiang, followed by Jiangsu,Shandong,and Guangxi.The above provinces are also major oil-consuming provinces, and the nearby affiliated refineries alone cannot meet their demand for oil products.Railways are widely used by procurement departments in inland areas such as Guizhou, Hebei, Sichuan, and Shaanxi. Waterways are widely used by procurement departments in riverside and coastal areas such as Anhui, Fujian, Guangdong,Guangxi, Jiangsu, and Zhejiang.

Figs. 11 and 12 conclude the optimized transportation results.The delivery volume proportion of different transportation modes in each region is detailed in Fig.11. The freight cost proportion of different transportation modes in each region is detailed in Fig.12.The total transportation volume is 14.5 million tons. Pipeline transportation accounts for the largest proportion at 41%,followed by waterways at 29%, and roadways account for the smallest proportion at 9%. Pipelines are widely used in four regions due to the low unit freight. Due to the lack of available pipelines and waterways in the North-west region,the delivery of oil products mainly relies on roadways and railways.In addition,the total freight cost is 2.5 billion CNY. Railway freight cost accounts for the largest proportion at 39%, followed by waterways at 38%, and pipeline accounts for the third proportion at 8%. Although pipeline and waterway transportation account for a large proportion, their freight cost proportion is relatively low. It can be seen that the optimized transportation scheme makes full use of the advantages of long-distance, large-volume, and low-freight of pipelines and waterways, and greatly saves the primary logistics costs.

6. Conclusions

To further improve the efficiency of primary logistics planning of oil products,this paper designs an integrated optimization method to alleviate the contradiction between supply and demand caused by the information asymmetry of upstream and downstream departments. A mathematical programming model is established which takes minimum logistics cost, resource adjustment cost as the objective function, and takes supply and demand capacity,transportation capacity, mass balance, and resource adjustment rules as constraints. Going further than previous studies, the proposed model can simultaneously ease the supply and demand imbalance and optimize the logistics scheme. In addition, the model considers three adjustment rules, including resource adjustment within oil suppliers,within oil consumers,between oil consumers. A comprehensive case of a state-owned petroleum enterprise is carried out in detail,involving 37 affiliated refineries,31 procurement departments, 22 oil products, 286 market depots and dedicated consumers. After the unified optimization, the supply and demand imbalance has been greatly eased by 97%.Further,the total cost of the primary logistics has saved 7%.It also visualizes the resource allocation and transportation schemes.

Fig.11. Transportation scheme in six regions.

Fig.12. Freight cost in six regions.

This paper dedicates to easing the existing contradiction between supply and demand in the internal supply chain of petroleum enterprises. However, the way to fundamentally eliminate the contradiction between supply and demand is to achieve the integration of production and marketing.It is necessary to carry out logistics planning from the perspective of time and space dimensions, taking into account the law of supply and demand and the pattern of supply and demand.At the same time,in the future,more attention should be paid to the entire petroleum industry's supply chain, integrate and coordinate different entities in the supply chain, and carefully consider the cooperation and competition between them.

Acknowledgments

This work was partially supported by the National Natural Science Foundation of China (51874325) and the Science Foundation of China University of Petroleum, Beijing (2462021BJRC009). The authors are grateful to all study participants.

杂志排行

Petroleum Science的其它文章

- A fast space-time-domain Gaussian beam migration approach using the dominant frequency approximation

- Predicting gas-bearing distribution using DNN based on multicomponent seismic data: Quality evaluation using structural and fracture factors

- Reflection-based traveltime and waveform inversion with secondorder optimization

- Determination of dynamic capillary effect on two-phase flow in porous media: A perspective from various methods

- Settling behavior of spherical particles in eccentric annulus filled with viscous inelastic fluid

- Laboratory investigation on hydraulic fracture propagation in sandstone-mudstone-shale layers