Effect of contract choice on upstream carbon emission reduction considering carbon taxation

2019-04-04YuWeiHanRuizhu

Yu Wei Han Ruizhu

(School of Economics and Management, Southeast University, Nanjing 211189,China)

Abstract: In order to curb the manufacturer’s product carbon emission levels, the leading retailer usually offers three contracts to the manufacturer, i.e., wholesale-price contract (WC), cost-sharing contract (CC) and revenue-sharing contract (RC). The results of implementing the three contracts are discussed and compared. The results reveal that as long as the government levies carbon taxations, all the three contracts can effectively stimulate the manufacturer to invest in carbon emission reduction. Among the three contracts, RC can achieve the highest level of carbon emission reduction of products and the maximum profits for both the manufacturer and retailer in a supply chain. However, the RC fails to reach the level of the centralized supply chain (CSC), thus it cannot coordinate the supply chain. The supply chain members’ contract choices are consistent. Both members prefer RC to the other two contracts. In order to effectively reduce the manufacturer’s carbon emission levels, the government should impose the highest carbon taxation level under RC, the medium carbon taxation level under CC, the lowest carbon taxation level under WC, and the same carbon taxation level as RC under the CSC.

Key words:carbon taxation; wholesale price contract; cost-sharing contract; revenue-sharing contract; first-mover advantage

Carbon emissions lead to global warming, which has attracted world-wide concern from governments, firms and scholars. To curb carbon emissions, many countries have enacted and implemented various carbon emission regulations. For instance, in 2005, the European Union imposed carbon emission limits to control the output of carbon emissions[1]. In 2008, by levying a carbon taxation, Britain and Canada decreased their atmosphere carbon emissions by 9.9%[2]. In 2009, the Chinese government also passed regulations to decrease carbon emissions per unit of GDP by 40% to 45% by 2020 compared to its 2005 level[3]. In China, some provinces (e.g., Jiangxi, Hunan and Gansu) have been designated as experimental regions for the adoption of environmental tax regulations by the relevant ministries[4]. Pope and Owen[5]showed that the carbon taxation policy is a more effective tool for economic growth and curbing emissions in certain cases. As a consequence, introducing carbon taxation is certainly a better choice for firms when governments try to curb carbon emissions by imposing a proper carbon taxation.

Low carbon products can effectively help firms obtain increasing market shares. For example,Gree, which is one of the largest household electrical appliance manufacturers, is concerned with designing and innovating low-carbon products. The decrease of products’ emissions enhances firms’ competitiveness[6]. However, this decrease is not free. Although low carbon products can entice consumers to buy them more than regular products, it is a costly commodity that requires manufacturers’ investment in carbon emissions reduction. Thus, it is necessary for manufacturers in supply chains to balance the costs and benefits from abatement investments and decide whether to make the investment or not.

As for a big-box retailer that is frequently affected by various stakeholders (e.g., customers, governments, NGOs and environmental groups), they must do their best to stimulate the manufacturers’ carbon emissions reduction. For example, in 2007, Target Store declared that it would methodically reduce polyvinyl chloride (PVC) in its stores’ distribution chain[7]. With the first-mover advantage of the retailer, the problem has been mainly studied by considering a first-mover Stackelberg retailer. Ertek and Griffin[8]analyzed the impacts of a dominant bargaining power buyer on the prices and profits for buyers in a two-stage supply chain. Lau et al.[9-10]investigated the effect of the production costs’ information asymmetry on the contract design when considering a newsvendor type product. Su and Mukhopadhyay[11]illustrated that the dynamic quantity discount or revenue sharing contract can limit the dominant retailer’s gray market activity, but can be beneficial to coordinating the supply chain. Kolay and Shaffer[12]considered the quantity discounts and two part tariff contracts to perfectly coordinate the supply chain under certain conditions. Xiao et al.[13]examined the manufacturer’s incentives to sell different products through dual channels. Yan et al.[14]investigated the influence of the first-mover advantage on a retailer’s incentives to improve quality when two different strategies are chosen by a retailer. Yenipazarli[15]inspected the impacts of the first-mover advantage of the retailer on an upstream supplier (who is accountable for investing in an eco-efficient innovation) when the investment costs and revenues are shared by the supplier and retailer. This paper differs from the above literature in two aspects. First, we consider a game theory problem with a leading retailer under a carbon taxation regulation. Secondly, we investigate the impacts of three contracts, i.e., the wholesale-price contract (WC), cost-sharing contract (CC) and revenue-sharing contract (RC) on the retailer’s and manufacturer’s profits.

Under a carbon taxation regulation, by adopting the contracts of WC, RC and CC, this paper seeks to answer the following questions. Which contract form is the most effective in spurring on the retailer to order more low carbon products, in encouraging the manufacturer to take part in carbon emissions reduction, and in maximizing firms’ profits? Can the government effectively push the manufacturer to reduce carbon emissions with a proper carbon taxation for different contracts?

To answer these questions, this paper studies a two-stage supply chain that consists of a manufacturer and retailer under a carbon taxation regulation. In the model, demand is linked to the order quantity and carbon emission reduction level. The retailer first offers a simulative contract (WC, RC or CC) to the manufacturer. Then, the manufacturer sets a wholesale price and the reduction level. Finally, the retailer orders the manufacturer’s low-carbon products.

The main contributions of this paper are as follows. First, we find that when the retailer has the first-mover advantage, both the retailer and manufacturer are consistent in contract type choice. Secondly, compared with CC and WC, RC enhances the manufacturer’s motivation for carbon emission reduction, but fails to reach the optimal abatement level under the CSC and to achieve supply chain coordination. Thirdly, we find that when the three contracts are available, the retailer prefers to choose RC instead of both CC and WC. Finally, we find that, carbon taxations levied by the government is effective to spur the manufacturer on to reduce their carbon emissions and to improve the supply chain members’ profitability under various contracts.

1 Model

We model the carbon emission reduction level and quantity decision as a four-stage Stackelberg game, in which, the retailer is the leader and the manufacturer is the follower. That is, the retailer can provide three motivating contracts (i.e., WC, CC and RC) to the manufacturer. The decision timeline is depicted in Fig.1. In stage 1, the retailer determines whether to cooperate with the manufacturer and which contact(CC,RC and WC) will be provided for them. Based on this choice, in stage 2, the proportions of costs and profits are determined by the retailer alone. In stage 3, the manufacturer decides the emission reduction level and the wholesale price. Subsequently, in stage 4, the order quantity is determined by the retailer.

Fig.1 Sequence of the game

In this paper, we have the following assumptions:

1) A two-stage supply chain, consisting of a retailer who sells the low carbon products to end consumers and a manufacturer who engages in carbon emissions reduction to curb products’ carbon emissions, is modeled.

2) The market information is symmetrically known to both the retailer and the manufacturer.

3) Assume thatλe2/2 is the emissions reduction cost, whereλis the low-carbon technology cost coefficient andedenotes the emission reduction level. Furthermore, the carbon emission reduction level per unit product can be decreased fromy(without carbon emission reduction) toy-e(with carbon emission reduction). A similar solution can be found in Refs.[16-18].

4) To establish the model and ensure a positive market demand, we also assume thatby

5) The retailer’s order quantity is represented byq=a-p+ke.ais the base market size.kdenotes the effect of the carbon emission reduction on demand, which follows Gurnani and Erkoc[19]and Yenipazarli[15]. Hence, the retailer’s selling price isp=a-q+ke, which is linearly linked toq.

1.1 Centralized model

(1)

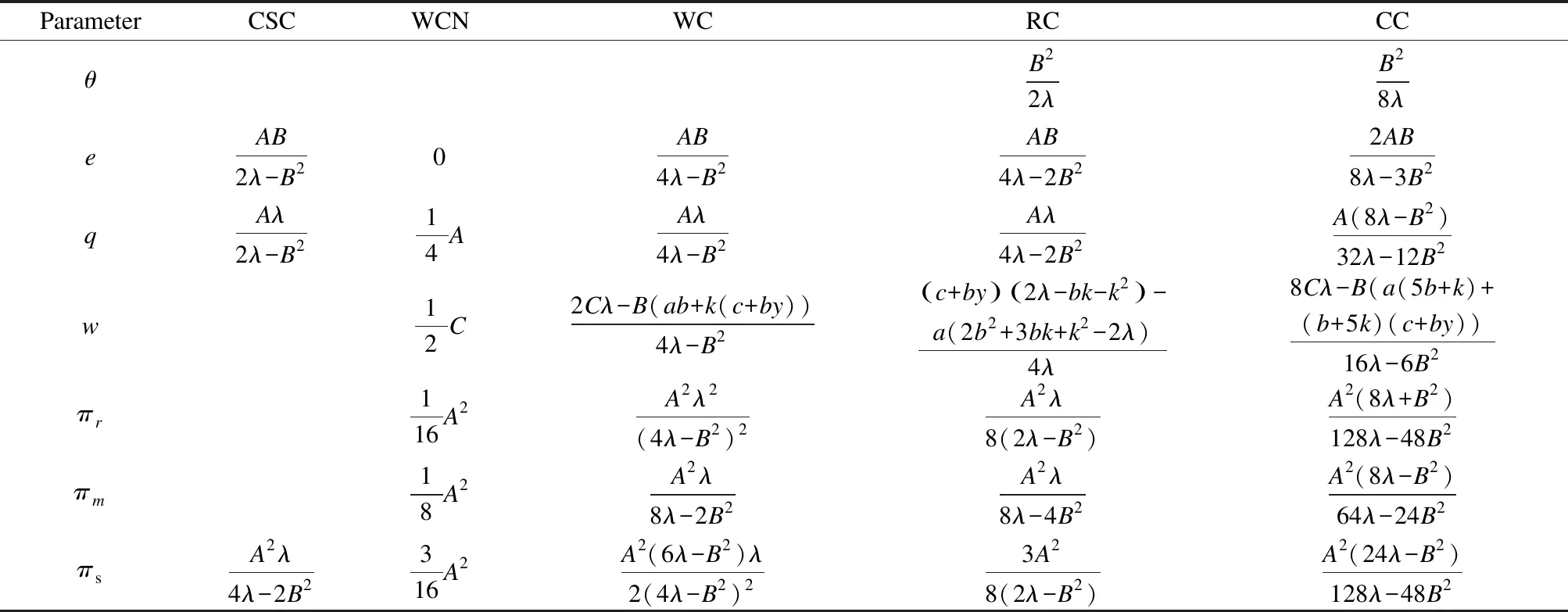

According to the total profit function Eq.(1), which can be solved by backward induction, we characterize the supply chain decisions and the supply chain firms’ profits under the centralized supply chain (see Tab.1).

Tab.1 Equilibrium solutions under different contracts

Note:A=a-c-by,B=b+kandC=a+c+by.

1.2 Decentralized model

In the decentralized supply chain, the manufacturer and retailer make their decisions to maximize their own profits. Meanwhile, to enhance the manufacturer’s motivations to reduce emissions, the retailer provides a certain contract, which can be wholesale-price, revenue-sharing or cost-sharing contracts, for the manufacturer. Next, we discuss both firms’ operational decisions under the above three contracts. In addition, for ease of analysis, we also consider the optimal decisions and profits without a carbon emission reduction under wholesale-price contracts.

Following the game sequence shown in Fig.1, the retailer first provides the manufacturer with a contract (θcc,θrc), whereθrcandθccdenote the fraction of the manufacturer’s carbon emission reduction investment costs and the retailer’s revenues, respectively. When the contract is a WC,θrc=0 andθcc=0; when the contract is a RC, 0<θrc<1 andθcc=0; and when the contract is a CC,θrc=0 and 0<θcc<1. Then, the manufacturer invests in carbon emission reduction. Meanwhile, the manufacturer charges the wholesale price. Finally, the retailer orders the low carbon product and profits are received. Therefore, the retailer’s and the manufacturer’s profits are as follows:

(2)

(3)

wherei∈{wc,wcn,cc,rc} refer to the wholesale-price contract, the wholesale-price contract without reduction(WCN), the cost-sharing contract, and the revenue-sharing contract, respectively.j∈{m,r,s} refer to the manufacturer, the retailer, and both firms, respectively.

(4)

(5)

Based on Eqs.(2) to (5), we can easily derive the equilibrium solutions with and without carbon emission reduction, respectively.

2 Analysis and Comparison

2.1 Analysis

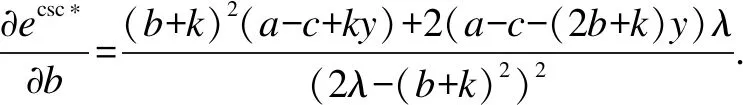

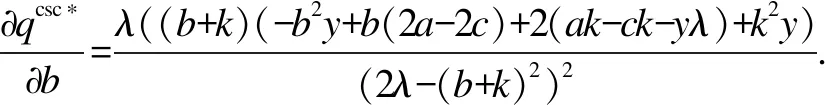

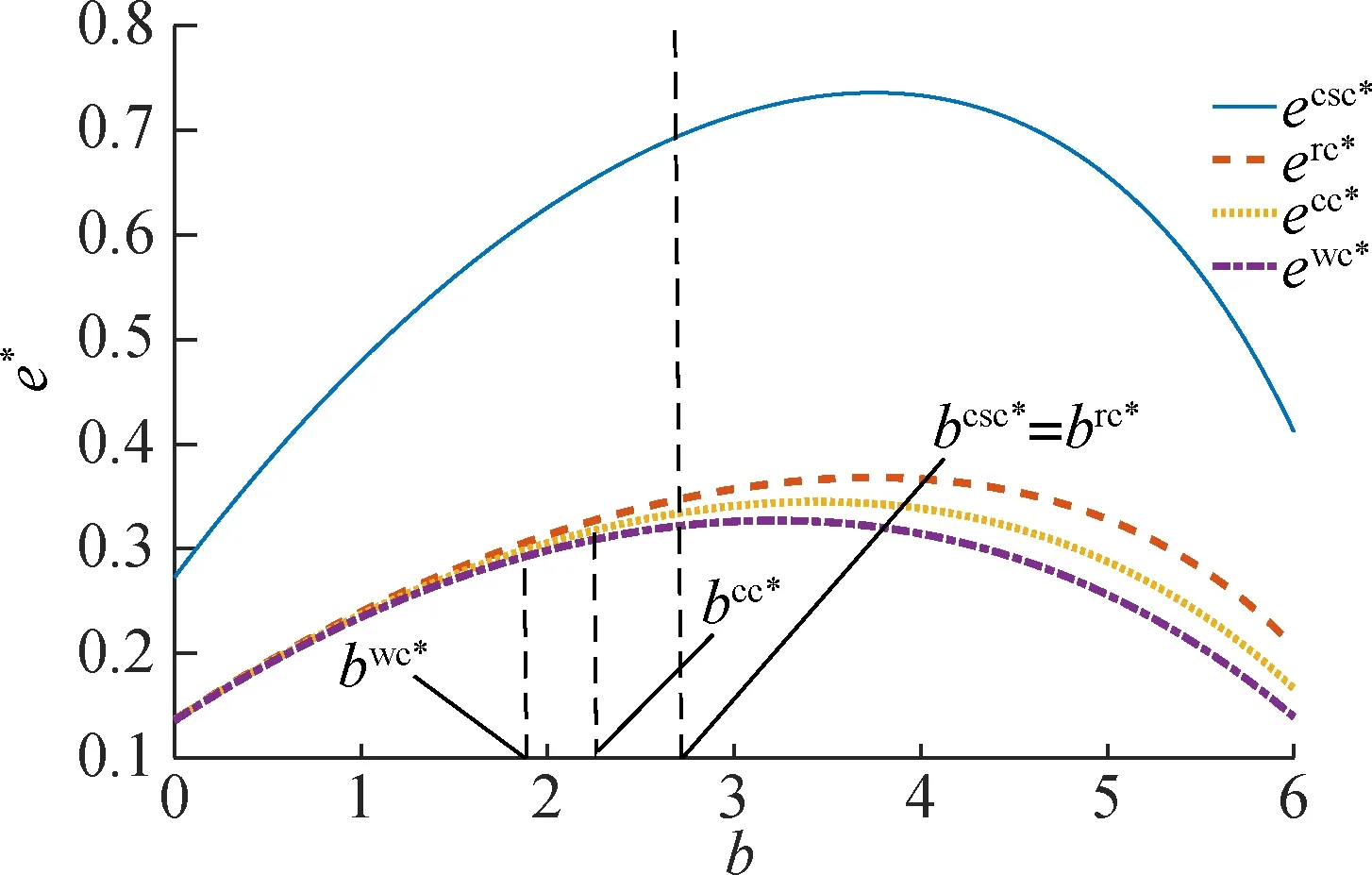

To offer additional perceptions, we investigate the influence of parameterbon the decision variables under the CSC, WC, CC and RC. Thus, we have following proposition.

The proof is similar to that of Proposition 1 and is hence omitted for simplicity.

2.2 Comparison of equilibrium solution

By comparing the equilibrium solutions with the carbon emission reduction investments and without WC, we have the following proposition and the proof is omitted.

Based on Tab.1, the proof can be directly derived and is hence omitted for simplicity.

From Proposition 3, we can know that regardless of the carbon taxation valuebcharged by government, the manufacturer is willing to curb products’ carbon emissions. Moreover, the optimal ordering quantity and the profits of the supply chain members are higher with carbon emission reduction than those without, which is due to the fact that the existence of the carbon taxation can increase both the manufacturer’s and retailer’s profits. That is, if the government introduces a carbon taxation, both firms’ profits will be Pareto improved compared to that without imposing a carbon taxation. This finding implies that when a carbon taxation is present, the manufacturer’s emission reduction efforts can be more effective and either of them can gain more profits. Namely, it is beneficial to both firms’ profits due to the emission reduction under WC.

To study the impacts of the diverse motivated contract modes (i.e., WC, RC and CC) on the manufacturer’s carbon emission reduction levels, we compare the optimal emissions reduction level under the three motivated contracts with that under the centralized contract, as the following proposition reveals.

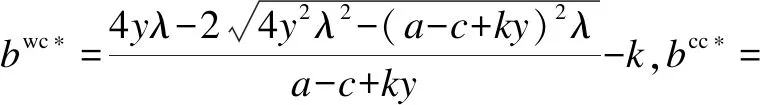

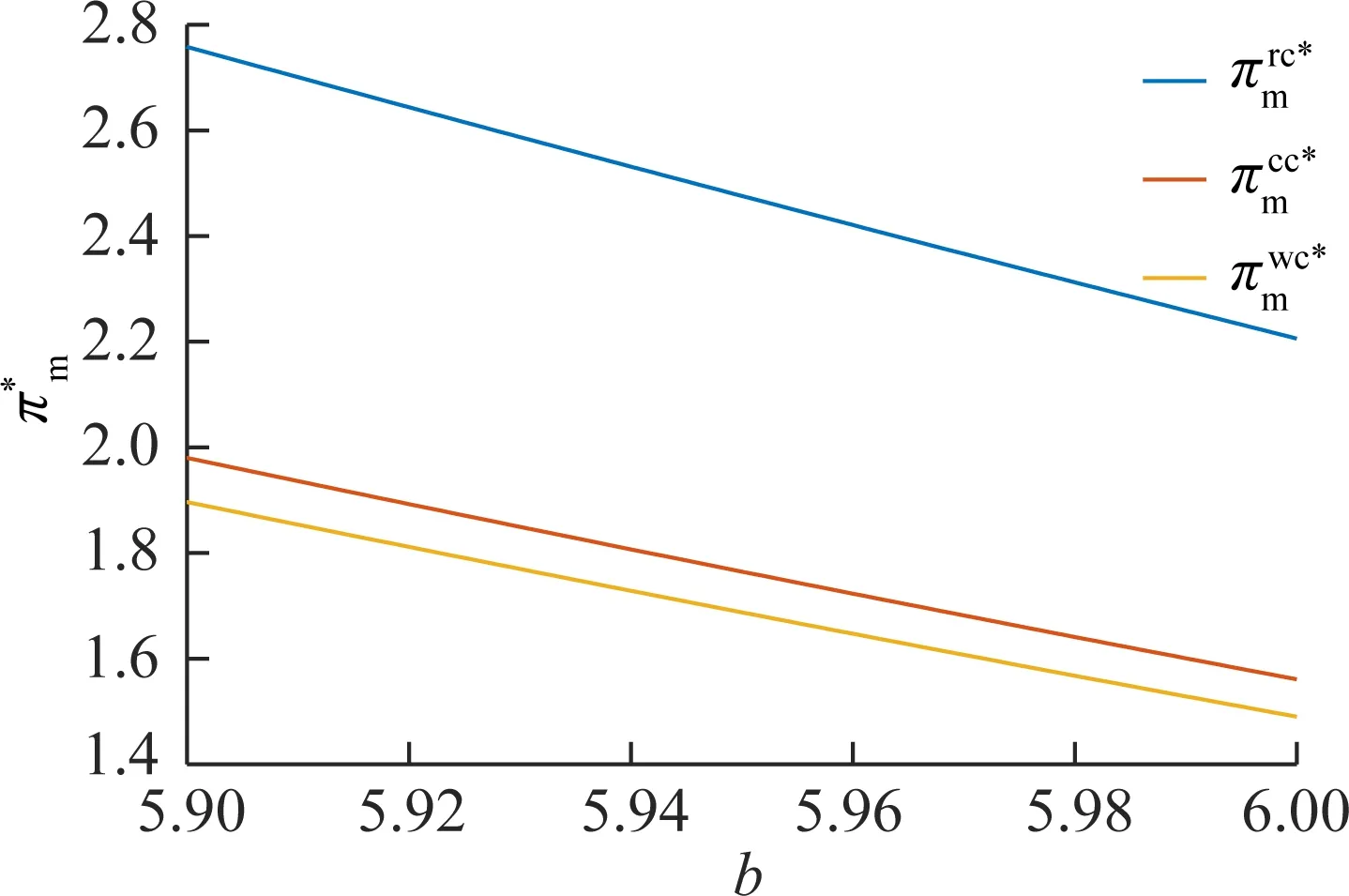

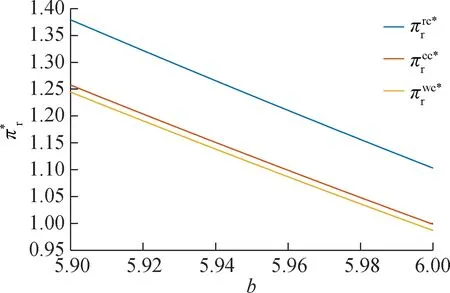

Proposition4Ifb>0,wwc*>wcc*>wrc*, 0 ProofWe only calculate the wholesale price under different contracts. Since the others can be directly derived from this, the proofs are omitted. (a) (b) (c) (d) which is always satisfied whenk>banda-c>by. 2)wcc*-wrc*= Proposition 4 implies that the manufacturer is motivated to participate in the emission reduction under RC and CC than under WC. In addition, the manufacturer’s emission reduction level is greater under RC than that under CC, but is less than that under the CSC. This is due to the fact that when the retailer shares a larger share of the sales revenue with his manufacturer under RC and the manufacturer pays lower abatement investment costs (i.e.,θrc*<θcc*), the manufacturer has the motivation to reduce emissions and implements a higher emission reduction level. Furthermore, when RC is utilized, the manufacturer can obtain a higher fraction of the retailer’s sales revenue. Hence, the wholesale price determined by the manufacturer under RC is lower than that under CC (i.e.,wrc* By comparing the firms’ optimal profits under the three motivated contracts (i.e., WC, CC and RC), we investigate how the different contracts’ structures affect the firm’s profits and their contract choices in equilibrium. We can derive the following proposition. Based on Tab.1, the proof can be directly derived and is hence omitted for simplicity. Proposition 5 shows that, when considering the existence of the carbon taxation, both supply chain members can obtain the highest profits under RC, moderate profits under CC, and the lowest profits under WC. The result reveals that the supply chain members prefer RC to CC and prefer CC to WC. As stated in Proposition 5, the manufacturer has the motivation to reduce emissions when both the retailer and the manufacturer determine the manufacturer’s investment cost-sharing rate (i.e.,CC) or the retailer alone identifies the revenue-sharing rate (i.e.,RC), which can boost the supply chain firms’ profits and ultimately weaken the double marginalization effect. Proposition 4 also indicates that, compared to CC, adopting RC can effectively motivate the manufacturer to increase their emission reduction level (i.e.,ecc* We compare the government’s optimal carbon taxation under different contracts (i.e., WC, CC, RC and CSC), and derive the following proposition. Proposition6bwc* The conclusion can be directly proved, and the proof is hence omitted. With Proposition 6, we see that the optimal carbon taxation under either RC or CC is higher than that under WC and that under RC is larger than that under CC but is the same as that under CSC. This conclusion seems different from that of Wang et al[20]. They indicate that the government’s optimal carbon taxation under the centralized supply chain is lower than that under the decentralized supply chain. In their model, the uncertain demand is considered. Thus, this conclusion indicates that the decentralized system is more beneficial to the government than the integrated system. However, our results state that when demand is a linear function of the order quantity and carbon emission reduction level, the centralized supply chain can lead to a higher carbon taxation, which is reasonable because the product’s profit margin under CSC is greater than that under both CC and WC, and it is identical to that under RC. In this paper, we study the effects of cooperation through the WC, CC and RC on the carbon emission reduction level and firms’ profits when the government levies a proper carbon taxation on a product’s carbon emission. Comparing the equilibrium results under the adoption of the three contracts with those under the centralized model, we obtain some managerial insights. The levying of a carbon taxation by the government is effective to spur on the manufacturer to increase their carbon emission reduction level and to improve the supply chain firms’ profitability. By comparing the three contracts, i.e., RC, CC and WC, it is shown that RC can encourage the manufacturer to curb more carbon emissions than CC and WC, but still fails to reach the level of the CSC. When the three contracts are available, the retailer prefers to adopt RC instead of either CC or WC. However, RC fails to coordinate the whole supply chain. To encourage the manufacturer to reduce their product’s carbon emissions, the optimal carbon taxation level for the government should be higher under RC than that under CC and WC, which is equal to that in the centralized supply chain.

2.3 Comparison of the optimal carbon taxation

3 Conclusion

杂志排行

Journal of Southeast University(English Edition)的其它文章

- Analysis of passenger boarding time difference between adults and seniors based on smart card data

- A fatigue damage model for asphalt mixtures under controlled-stress and controlled-strain modes

- Effect of flexural loading on degradation progress of recycledaggregate concrete subjected to sulfate attack and wetting-drying cycles

- Improved adaptive filter and its application in acoustic emission signals

- GA-1DLCNN method and its application in bearing fault diagnosis

- Multi-relaxation-time lattice Boltzmann simulation of slide damping in micro-scale shear-driven rarefied gas flow