My reflection after watching Inside Job

2016-05-14QinhanHou

Qinhan Hou

Summary:I think only by reviewing the history can we predict the future especially in this fluctuating market. And the most meaningful lesson is the 2008 economic crisis.

Key words:2008 economic crisis, the regulation of the economy, Wall Street

After watching the documentary inside job, I do want to share it with those who are going to see this distinguished documentary.

To begin with, I would like to present the main contents of it concisely and my own attitude towards it as well.

It is a documentary telling why the 2008 crisis happened and tends to figure out some effective solutions. The whole video consists of 5 parts: 1、how do we get there 2、the bubble 3、the crisis 4、responsibility 5、where are we now.

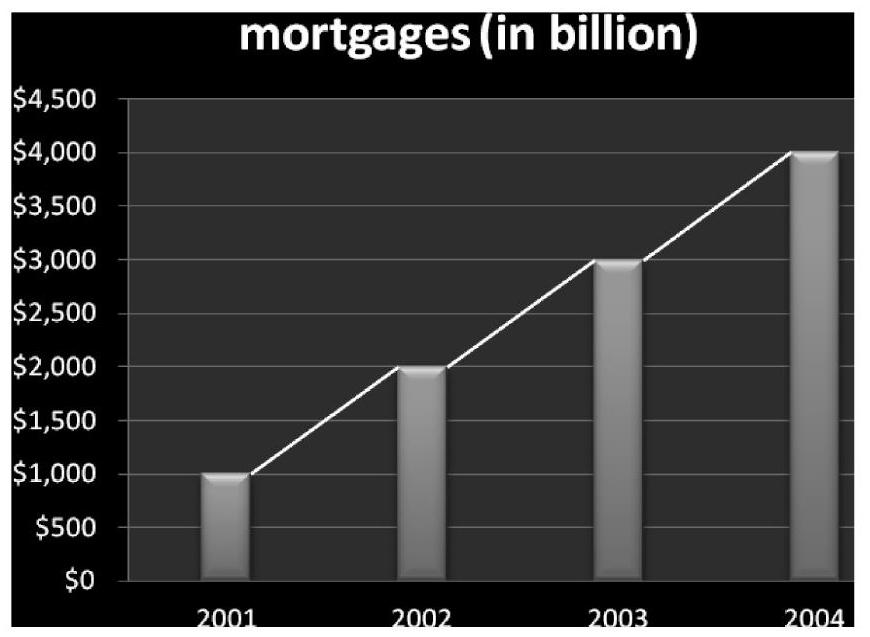

The first part started with a paradox that why the Iceland banks went bankruptcy in 2008 but without any indication in this perfect country with solid economy and policy. In addition, there is a statement that the financial sector has skyrocketed its value in the following 40 years after the Great Depression. What I learned from it as a financial learner we should be extremely accurate and objective to the reality. Here is a vivid data showing how the financial industry exploded over the past 30 years.

When observing the graph, it is very easily to ask why the financial industry has soared exponentially far quickly than any other industry.

The following answers are the most marvelous things we can learn from this film. After my own analysis and summarization, I reckon the reasons lie the following two points.

1、The deregulation has been much more slacker than ever before esp. the pass of Gramn-leach-Bliley Act made the derivatives trade more prosperous.

2、The politics and great bankers formed a solid alliance based on their own respective interests.

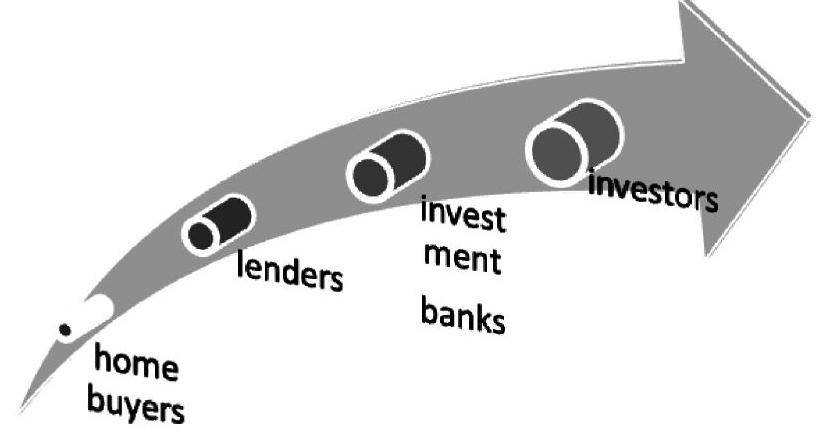

On the other hand, one thing called CDO(collateralized debt obligation)which is a ticking time bomb to the 2008 crisis was created in 2001. And the following is based on my own comprehension of it.

The procedures can be illustrated as following

1.Home buyers borrowed money from lenders.

2.Lenders sold the mortgage to the IB.

3.IB created CDO(with kinds of debts) and sold them to investors all over the world.

3.IB paid the rating agency money in order to be rated as triple-A security. And home buyers paid the mortgage payments to investors.

And it is obvious that

1.Home buyers can get the money more easily.

2.IB did not care about the CDO because the more they sold, the more money they made.

3.Rating agency did not care about the quality because they were fed by IB.

The consequence was bubble was becoming bigger and bigger and made the world economy involved dramatically.

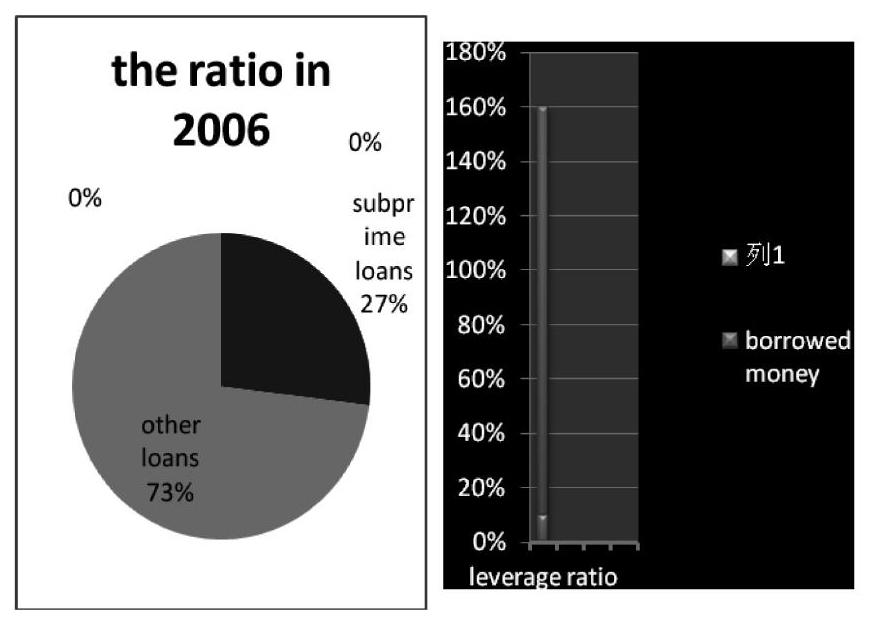

The mortgages scale went 4 times in four years as a consequence of the subprime loans accounted more than 25% in all loans and the leverage ratio grow to 15:1.

Eventually,the bubble broke in 2008 with the symbol of Lehman Brothers in bankruptcy. The following is expected to:

1.Wall Street is not only a heaven filled with whatever an “American Dream” or “Chinese dream” but a hell with eternal greed and dirtiest side of human soul.

2.Never be an “exquisite sheep” just living for money but forgot the poems and future.

3.Do tighten a comprehensive and transparent regulation system which is the essential way to decrease the possibility of crisis.

4.Do not follow some so-called authorities like “Harvard professional” or even Greenspan.

5.Crisis stems from the innocence of financial knowledge and the greed for money.

Anyway, go to see this documentary now to have a totally new acquaintance of 2008 crisis and help yourself to foresee the future.

The brief introduction to the author

Qinhan Hou(1995/1/25) Male Manchu A sophomore in Minzu University

Major:Finance

Experience: I won the first-class scholarship in the first year.

I had an internship in AXA security in HK for one month.