A Study on Foreign Capital M&A of Agribusiness

2016-01-12

College of Economics and Management, Huazhong Agricultural University, Wuhan 430070, China

1 Introduction

After joining the WTO, Chinese government has gradually fulfilled various promises, such as cancellation of restrictions on foreign capital share ratio, and opening up of foreign investment areas. There are new changes in foreign merchants’ direct investment in China. Foreign direct investment in China has two forms: one is the so-called "green investment", namely directly investing in setting up factories in China; the other is the acquisition or merger of existing domestic companies, in order to obtain control over the companies. "Green investment" has a high risk and long period of return on investment, while the second way has the advantages of reducing capital investment, spreading risk, rapidly expanding scale, and rapidly gaining dominance over competitors. Based on this, now the cross-border M&A has replaced green investment to become the most important way of foreign direct investment for cross-border companies[1].

2 Definition of related concepts

2.1ForeignM&AM&A includes mergers and acquisitions, and foreign scholars generally combine the two together and abbreviate them as M&A. M&A is a general term that refers to the consolidation of companies or assets. While there are several types of transactions classified under the notion of M&A, a merger means a combination of two companies to form a new company, while an acquisition is the purchase of one company by another in which no new company is formed. It is generally believed that foreign capital M&A means that based on some purposes, the foreign companies have some or complete de facto control over the management of Chinese enterprises by taking all or part of the assets or shares of Chinese enterprises. Foreign capital M&A is usually divided into horizontal M&A, vertical M&A and conglomerate M&A. Horizontal M&A refers to the mergers and acquisitions between two or among many competitive independent legal entities. Vertical M&A refers to the mergers and acquisitions between the upstream and downstream parts of the same industry. Vertical M&A is a business model aimed at optimizing the allocation of resources, expanding the scale of entities and achieving full industrial chain. Conglomerate M&A refers to the cross-industry mergers and acquisitions carried out by investors to spread management risk, expand industry coverage and seek economies of scale.

2.2AgribusinessThe agribusiness is a relatively broad concept, and Dr. Zhong Qi from CASS believes that the agribusiness, as a unit of social production, has the right to determine specified land for productive purpose, and to achieve this purpose, it can determine the purchase of production materials, land and labor distribution, and the final processing and sale of agricultural products. With the economic development, the boundaries and the division of labor between industries have gradually blurred. Therefore, in the process of modernization, agricultural enterprise is actually a concept combining characteristics of agriculture and commonness of modern enterprises, and we can define agribusiness as the business that is active in farming, forestry, animal husbandry and fishery, and engages in the production, processing, marketing, research and development, service and other activities concerning farm produce and agricultural production materials. It typically includes four types: (i) the agricultural productive means enterprise which provides production materials and services for agricultural production; (ii) the agricultural production enterprise; (iii) the agricultural processing enterprise; (iv) the agricultural circulation enterprise[2].

3 Change in the scale of foreign capital M&A of China’s agribusiness

In fact, the agricultural sector is an area for the earliest opening to foreign capital. China is a large agricultural country, and a major country introducing FDI, so China’s agriculture is conspicuously attractive to international capital. Foreign investment in China’s agriculture is expanding each year. During 2006-2012, the actual foreign capital for China’s agriculture was about $ 10 billion. In 2012, there were 882 foreign-funded agricultural projects, and the actual amount of investment was $ 2.06 billion, an increase of 2% and 2.7%, respectively, accounting for 3.5% and 1.8% of total foreign investment, respectively.

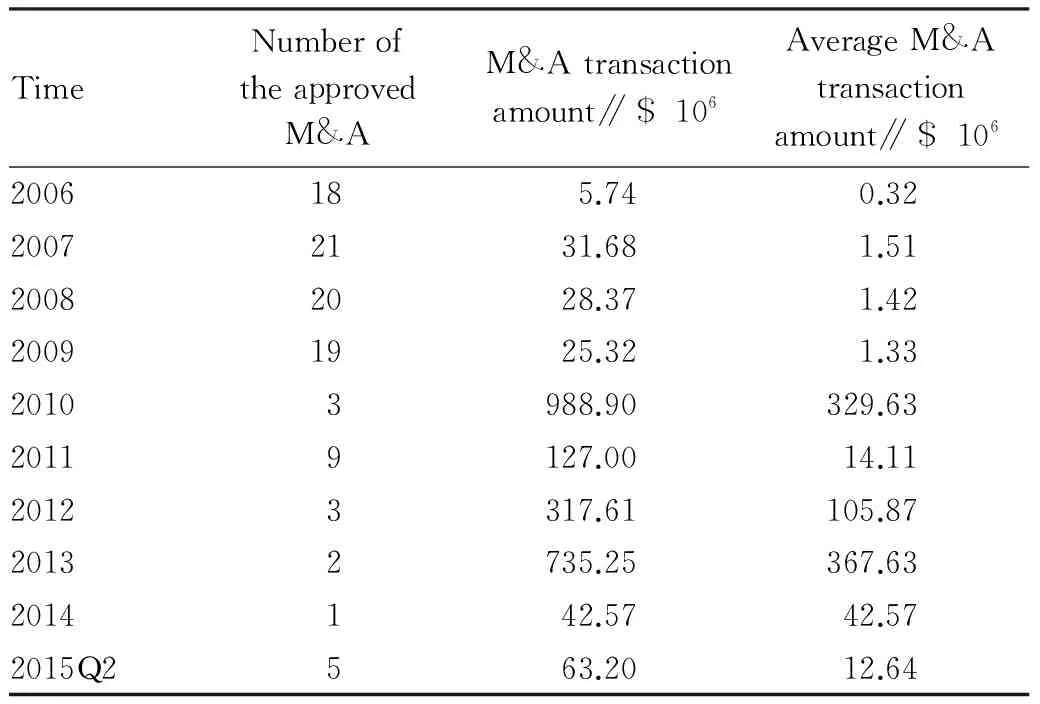

3.1GreatinterannualfluctuationsintheforeigncapitalM&AcasesIn the early period of reform and opening up, foreign merchants made exploratory investment in China’s agriculture, and the direct investment scale was small. Then foreign businesses began to merge and acquire China’s agribusiness on a small scale, but the number was small. Before 2000, there were a total of 27 incidents of foreign capital M&A of listed companies in China, but few of M&A activities occurred in the agricultural sector. In December 6, 2000, Danone Asia Co., Ltd. invested about 1.8 billion yuan in acquisition of 50% of share in Shanghai Meiling Drinking Water Co., Ltd. and 10% of share in Zhengguanghe Online Shopping Co., Ltd., which broke the M&A deadlock in the agricultural sector, and kicked off the foreign capital M&A in agriculture. In recent years, China’s agriculture has become a hot area that multinational corporations fiercely compete for, and there are a growing number of M&A incidents involving wine, dairy, food processing and beverage. Even the leading agricultural enterprises are continuously targeted. From 2006 to the second quarter of 2015, there were great interannual fluctuations in the number of foreign capital M&A cases about agribusiness approved by the Chinese government; the number was largest in 2007, reaching 21, while the number was only 2 in 2013. The main reason is related to the adjustment of foreign investment in China and change in China’s international political and economic status.

Table1ChangeinthenumberofChina’sagribusinessmergedandacquiredbyforeignmerchants

TimeNumberoftheapprovedM&AM&Atransactionamount∥$106AverageM&Atransactionamount∥$1062006185.740.3220072131.681.5120082028.371.4220091925.321.3320103988.90329.6320119127.0014.1120123317.61105.8720132735.25367.632014142.5742.572015Q2563.2012.64

Data source: Foreign capital statistics of the Ministry of Commerce; ChinaVenture China Statistical Report on M&A Transaction.

3.2GrowingcapitalinagribusinessM&AcasesBefore 2009, the average capital scale in foreign capital M&A of China’s agribusiness was less than $ 30 million, but after 2010, it rose to about $ 380 million. In 2013, the average capital scale was largest, reaching $ 367 million[3]. During 2006-2009, the M&A number of China’s agribusiness was large, but the capital scale was small. After 2010, foreign capital M&A of China’s agribusiness slowed down, but the capital involved showed an increasing trend. The sum (up to $ 988 million) involved was largest in three M&A cases occurring in China’s food and beverage processing industry in 2010. Japan’s Asahi Breweries Ltd. invested 43.5 billion yen in acquiring 6.5% of share in Tingyi Holding Group; Denmark’s Carlsberg Brewery invested $ 350 million in buying 12.5% of share in Chongqing Brewery Co., Ltd.; US Heinz invested US $ 165 million in acquisition of Fuda Food Company, a company producing soy sauce and fermented bean curd in China. In 2011, the number of cases of agribusiness M&A approved in China rose to 9, and the sum involved was $ 127 million, mainly concentrated in the food and beverage industry. Swiss Nestle acquired 60% of share in Yinlu Food Company and Hsu Fu Chi International Group. After 2012, there was an economic slump overseas, the business operating conditions declined, and the quantity and scale about acquisition of Chinese enterprises began to decline. But in general, the overall capital scale in M&A of China’s agribusiness tended to increase.

3.3ForeigncapitalM&AofChina’sagribusinessbyUS-ledcountriesAccording to the statistical report of China’s Ministry of Commerce on foreign investment, from 2010 to the second quarter of 2015, in terms of stock, the countries using capital to merge and acquire China’s agribusiness were mainly distributed in Europe, Asia and North America. It was led by the US which invested capital stock of about $ 2 billion in China’s agribusiness, which was inextricably related to its international status as a superpower of FDI outflow and cross-border expansion strategies. It was followed by Denmark, Japan, France, South Korea and Switzerland, with M&A sum of $ 1367 million, $ 835 million, $ 604 million, $ 348 million and $ 318 million.

4 Industrial change in foreign capital M&A of Chi-na’s agribusiness

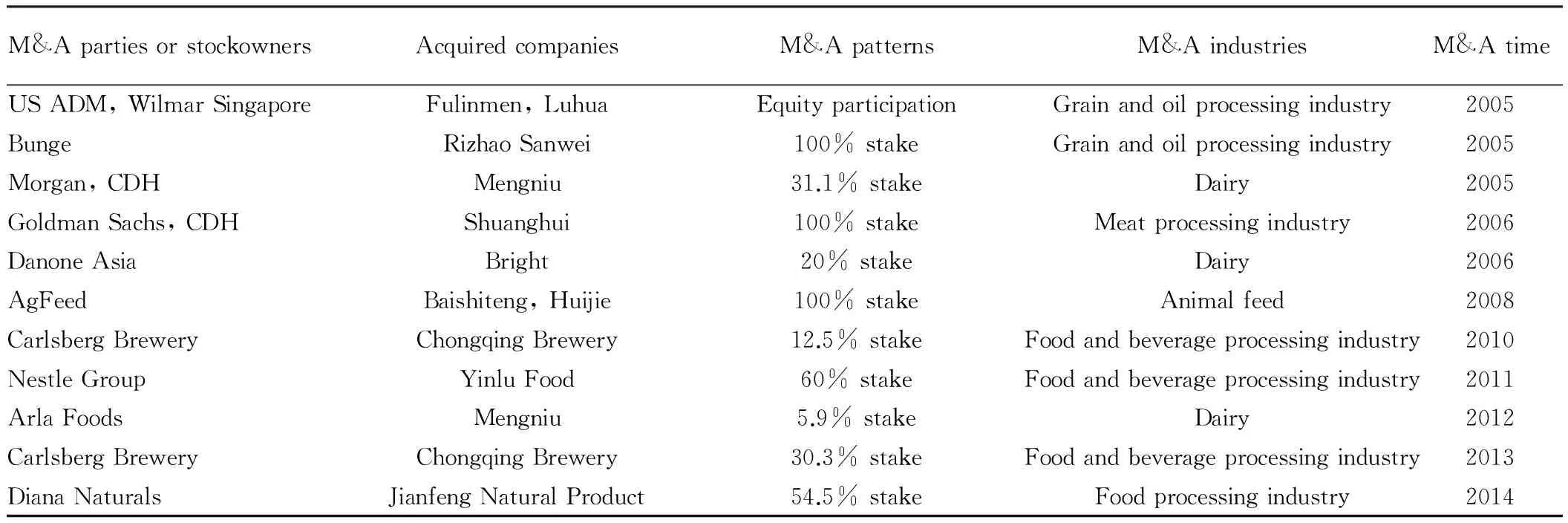

Now China’s agriculture is opening, and it is gradually forming a multi-level opening pattern. Since 2000, with the development and advance of China’s industrialization of agriculture, as well as rising profit margins, foreign capital has entered into many agricultural areas in China, and the capital has been found in all aspects of the industry chain. The industrial distribution also shows new features and trends. Currently, the M&A purpose of multinational companies has been more than simply seeking to maximize short-term profits, and they want to include China’s important agricultural sector into their global agricultural industry chain from the production, cultivation to the final sale, in order to have great influence on China’s agriculture. Table 2 shows the industrial change in foreign capital M&A of China’s agribusiness over the past decade. From the foreign capital M&A or holding of China’s agribusiness over the past decade, we can see that there are significant changes in the strategic layout of foreign capital into China’s agriculture.

Table2ForeigncapitalM&AorholdingofChina’sagribusinessoverthepastdecade

M&ApartiesorstockownersAcquiredcompaniesM&ApatternsM&AindustriesM&AtimeUSADM,WilmarSingaporeFulinmen,LuhuaEquityparticipationGrainandoilprocessingindustry2005BungeRizhaoSanwei100%stakeGrainandoilprocessingindustry2005Morgan,CDHMengniu31.1%stakeDairy2005GoldmanSachs,CDHShuanghui100%stakeMeatprocessingindustry2006DanoneAsiaBright20%stakeDairy2006AgFeedBaishiteng,Huijie100%stakeAnimalfeed2008CarlsbergBreweryChongqingBrewery12.5%stakeFoodandbeverageprocessingindustry2010NestleGroupYinluFood60%stakeFoodandbeverageprocessingindustry2011ArlaFoodsMengniu5.9%stakeDairy2012CarlsbergBreweryChongqingBrewery30.3%stakeFoodandbeverageprocessingindustry2013DianaNaturalsJianfengNaturalProduct54.5%stakeFoodprocessingindustry2014

4.1ExtendingfromthebasicprocessingandplantingindustryatthefrontendofindustrychaintoimportantfoodprocessingindustryandretailtradeSince 2000, the foreign capital M&A of China’s agribusiness has been mainly concentrated in the basic raw material cultivation and processing industries at the front end of industry chain. China’s grain and oil processing industry is the most typical example. Soy is the earliest China’s agricultural product opening to the outside world. Since 2000, through the strategy of investment in building factories combined with merger, the foreign companies have achieved the goal of controlling China’s soy industry. However, with the development of agricultural economy and rising level of agricultural industrialization, the agricultural raw material cultivation and processing markets have been gradually saturated, and foreign companies get less and less profit margins from it. Therefore, the foreign capital flows from the traditional, basic agricultural processing industry to food and beverage, agro-processing industries. The foreign capital M&A is targeted at the monopolized industries or the industries with promising market[4]. It particularly favors the juice beverage industry with few constraints, low barriers and obvious scale effect. From this, we can see that there have been significant changes in the strategic layout of foreign capital M&A of China’s agribusiness, from the initial food areas that affect the basic livelihood to the current everyday consumption.

4.2Increasingmarketconcentrationofagro-industriesmergedandacquiredbyforeigncompaniesThe foreign capital M&A patterns mainly include horizontal M&A, vertical M&A and conglomerate M&A, and currently, horizontal M&A and vertical M&A are common in China’s market. The horizontal M&A in agriculture means the M&A for the competitors in the same industry increasing market share and pursuing economies of scale by reducing the number of competitors. The vertical M&A means that enterprises extend up and down the industry chain, and integrate the upstream and downstream research, development, production, processing and marketing resources to enhance the bargaining power and build closed-loop trade barriers. A typical example is that the transnational capital, led by four major grain merchants-"ABCD", continues to merge and acquire many time-honored grain and oil companies in China, and inexorably squeeze their living space.

4.3Leadingorhigh-qualityChina’sagribusinessesoftenchosenastheforeigncapitalM&AtargetsThrough the recent cases about foreign capital M&A of China’s agribusiness, it is found that in the choice of acquisition targets, the cross-border enterprises pay close attention to company strengths, technological content of light industry, trade barriers and experience of cooperation. For example, the Swiss Nestle Group acquired 60% stake in Yinlu Food Company and Hsu Fu Chi International Limited in April and July, 2011, respectively. The two transactions are two foreign capital acquisition cases in China’s food and beverage industry in recent years. Presently, the "Decapitation Strike" launched by multinational corporations in China, not only aims to seize the strategic high ground as soon as possible, but also aims to gradually take control of the entire chain of agricultural production, and implement the vertical integration strategy dominated by a few developed countries on agricultural industries in other countries.

5 Conclusions

Agriculture is the basic industry of the national economy, and the configuration of resources at local, national and world levels has become a new opportunity for solving the issues concerning agriculture, countryside and farmers in China. From the national perspective, the foreign investment is actively attracted and used in recent years to develop China’s agricultural industry. However, as foreign investment is pouring into the host country, on the one hand, it makes important contribution to making up for the funding gap, introducing advanced technology, promoting exports, and upgrading the industrial structure. On the other hand, along with increased efforts to attract investment, foreign market share surges, and the industry security of the host country becomes a potential risk, posing a threat to some important industries and even the

entire national economy. Based on the cases about foreign capital M&A of China’s agribusiness in recent years, this paper analyzes the change and current situation concerning the scale and industrial choice during the foreign capital M&A of China’s agribusiness. There is a need to strengthen the survey and research in enterprises to obtain first-hand data and enhance reliability and scientificity of data, and carry out in-depth studies on the follow-up issues concerning foreign capital M&A of China’s agribusiness.

[1] CHEN XY. Study on the effect of foreign merger-and-acquisitions in agro-industry in China based on industrial security[D]. Chongqing: Southwest University, 2010.(in Chinese).

[2] CAO H, ZHU HW, DENG Y,etal. Discussion on the employment field of undergraduate graduates majoring in rural area development from our school[J]. Jiaoyu Jiaoxue Luntan, 2013(10):185-186.(in Chinese).

[3] YANG G, ZHANG Q, YU M. On the safety review mechanism of foreign capital acquiring Australian agriculture-related enterprises and its enlightenment[J].Rural Economy,2014 (2): 125-129. (in Chinese).

[4] XIE C. Study on the legal review of foreign capital in China’s agricultural industry on the perspective of industry safety[D]. Wuhan: Wuhan University, 2012.(in Chinese).

[5] YANG R. On the status quo of foreign capital acquiring China’s agricultural industry and its influence[J]. Modern Business, 2010(12): 47-47. (in Chinese).

[6] LONG KQ. On the influence of foreign capital acquiring China’s agricultural industry and its countermeasures[J]. Legal and Economic, 2014, (5). (in Chinese).

[7] WANG S. Agricultural multinationals’ investment in China:Status, problems, suggestions[J]. China Business and Market, 2012, 26(1):58-62.(in Chinese).

杂志排行

Asian Agricultural Research的其它文章

- Economic Analysis on the Rational Allocation of Agricultural Production Factors in Henan Province

- Special Space and Plant Landscape Design of Urban Ecological Buildings

- Main Methods Applied in Fertigation Technology

- A Study on the Ultrasonic Extraction and Antioxidant Activity of Lychee Pericarp Polysaccharides

- The Fishery Industrial Structure in China Based on the Application of Shift-Share Analysis

- Spatial Structure of Tourism Resources in Liaoning Province