Price and retailer’s service level decision in a supply chain under consumer returns

2013-01-08LiuJianWangHaiyan

Liu Jian Wang Haiyan

(School of Economics and Management, Southeast University, Nanjing 211189, China)

Many reasons can cause consumer returns, for example, product quality failures or product mismatch with consumer taste, etc. The flow of consumer returns brings serious profit losses for manufacturers and it has been frequently reported in recent years. According to Ref.[1], the US electronics industry spent about 13.8 billion dollars to re-box, restock and resell returned products in 2007. It is estimated that only about 5% of consumer returns are truly defective, and as much as 19% of the electronics purchases is returned to the store even though there is no defect.

Therefore, retailers take efforts to increase investment in services (e.g., greater shelf display to properly showcase the full set of models and sizes of the product, or more qualified sales staff) to reduce the likelihood of a product mismatch and hence a return. The key question is whether improving the service level will make a higher consumer demand and a lower consumer return rate; however, it will also increase the retailer’s input cost. The objective of this paper is to build a consumer returns model and investigate how to trade off the cost and the profit resulting from the retailer’s service. Furthermore, we introduce the questions: Can providing service be always beneficial for the retailer? How does the consumer return rate impact the optimal decisions?

Consumer returns has been viewed as an important policy and has received wide attention in academic literature. Consumer returns affect the decision-makers’ price and order quantity decisions. Davis et al.[2]found that when the retailer had a sufficiently high salvage value, a money-back guarantee policy was more profitable than a no-refund policy. In Ref.[3], the refund amount was regarded as a decision variable and a profit-maximization model was developed to obtain optimal policies for price and the return policy in terms of certain market reaction parameters. However, in this paper, we assume that the refund amount is exogenously given, and we intend to reduce the consumer return rate and make profits optimal by providing the service. Chen and Bell[4]addressed the simultaneous determination of price and inventory replenishment when customers returned products to the firm. In addition, the supply chain coordination on consumer returns was investigated in Refs.[5-6].

The service provisions affect the decisions of the supply chain. Ernst and Powell[7]examined the impact of manufacturer’s incentives on profits of the supply chain when the demand was a function of the service level. Wu[8]considered the optimal pricing and service level decisions in four channel strategies: vertical integration, vertical Nash, manufacturer’s Stackelberg and retailer’s Stackelberg. Xiao and Yang[9]discussed the supply chains with risk-averse retailers competing in price and service level, where the demand was seen as a linear function with the price and service levels. However, they could touch upon consumer returns.

Combining the consumer returns policy, Ferguson et al.[10]addressed the problem of reducing false failure returns via a target rebate contract to coordinate the supply chain. In their paper, they only investigated the optimal promotion level through viewing the retail price as an exogenous variable. However, in this paper, we treat the retail price as a decision variable, and the model demand as a linear function with the retail price and the service level. Furthermore, the aim of the service provisions mentioned in Refs.[7-10] is only to increase demand, while, besides that, the service in our context can also be used to reduce mismatches. Ofek et al.[11]investigated the interplay between retailers and consumers in multi-channel systems. Their objective was to explore how the introduction of an online channel affects the retailers’ service level, the pricing strategy and profits. However, in this paper, we consider the optimal decisions of the manufacturer and the retailer in a supply chain under the vertical integration (VI) game and the manufacturer Stackelberg (MS) game. Our goal is to study the decision differences and how the service level affects the decisions of the supply chain in different games.

1 Model and Notations

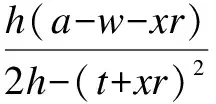

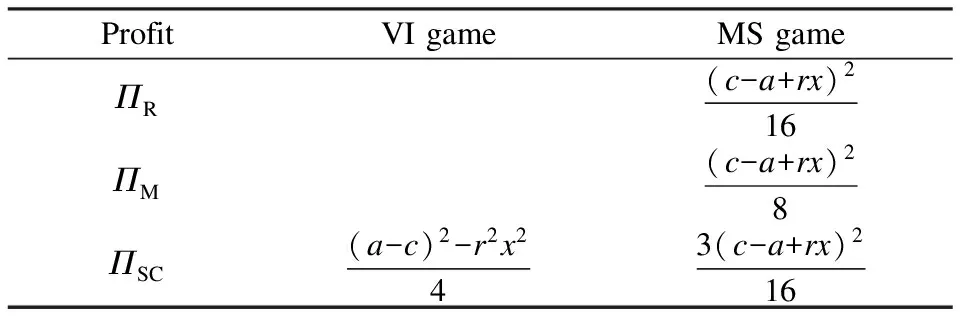

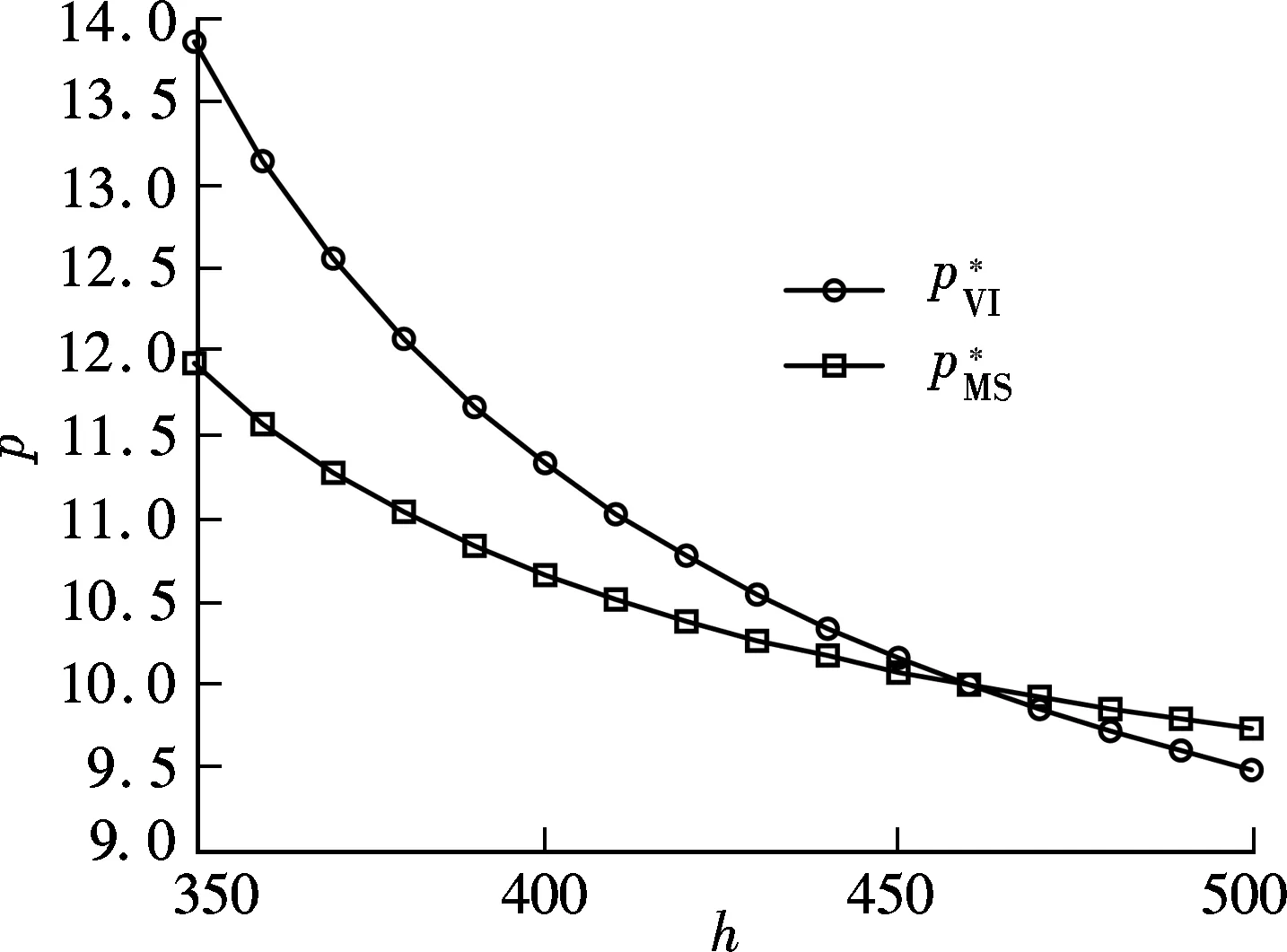

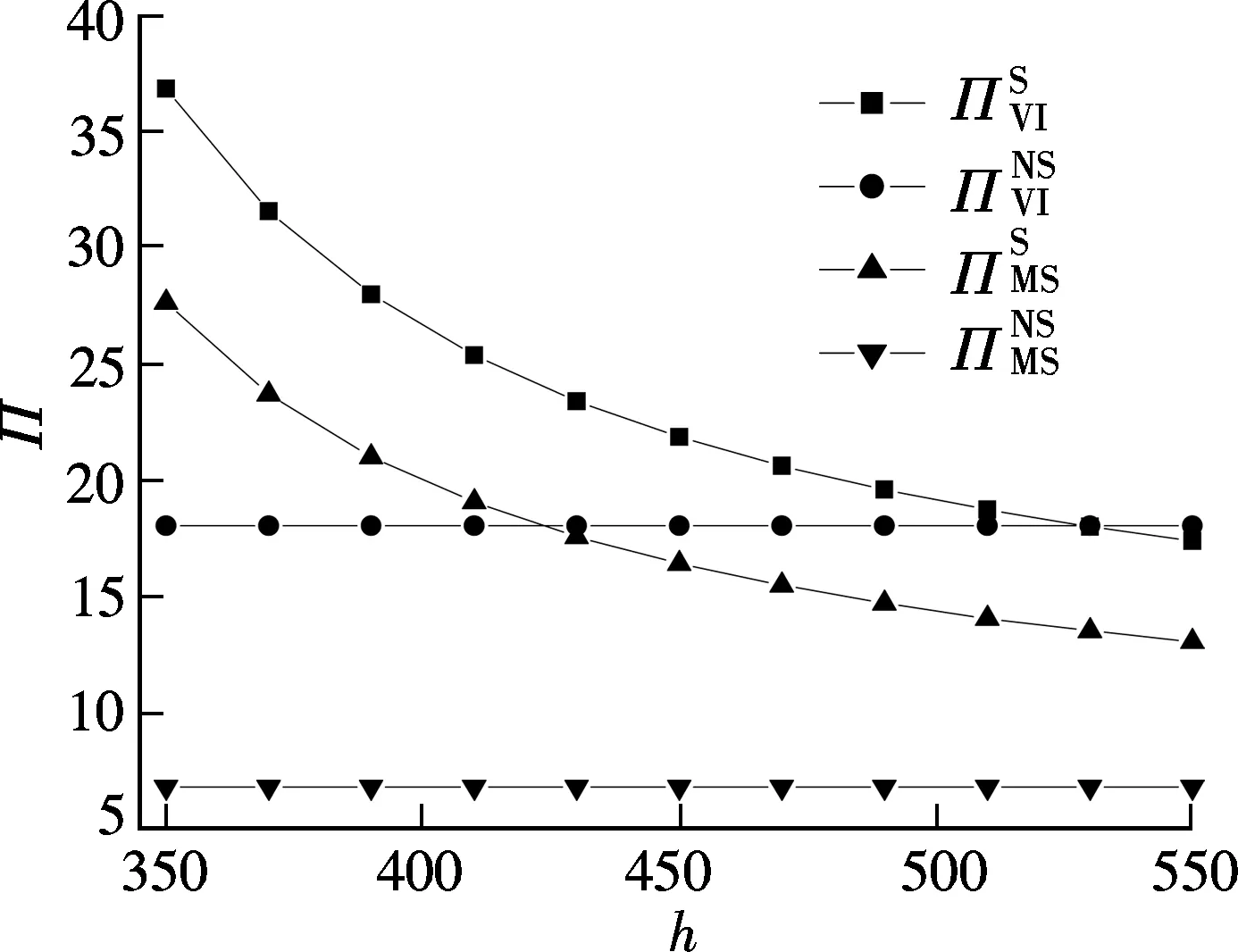

In this paper, we examine a supply chain with a manufacturer and a retailer, where a retailer provides the products for consumers and simultaneously accepts consumer returns. The salvage value of the returned product is assumed to be zero at the end of the sales season, and the manufacturer’s production cost isc. The manufacturer sets the wholesale pricewfor the retailer, and the retailer sells products to consumers at the retail pricep. Also, the retailer accepts consumer returns and the refund amountr(r Letp>w>c. We assume that the market demand is a linear function at the retail price and the service level. A better service level is both helpful to improve the consumers’ purchasing confidence and to increase the demand. So, the demand function is expressed as D(p,λ)=a-p+tλ whereadenotes the primary demand, andtdenotes the service sensitivity of the market demands. The demand sensitivity to retail price is normalized to one. Reasonably, we requireD>0, so we havea-p>0. Then, the retailer’s profit is The above expression ofΠRsuggests that only whenp-w-xr(1-λ)>0, the retailer can make a positive expected profit. In the retailer’s profit function,hλ2/2 is the retailer’s cost of providing the service, which also increases the service level. Specially, whent=0, the retailer only needs to trade off the decrease of consumer return mismatches and the increase in the cost caused by providing the service. The manufacturer’s profit is ΠM=(w-c)D The total profit of the supply chain is The above expression ofΠSCsuggests that only whenp-c-xr(1-λ)>0, the expected channel profit is positive. In the game, manufacturers decide the wholesale pricewand retailers decide the retail pricepand service levelλ. Then, the optimal order quantity is determined according toD. In this section, we further investigate the optimal decision in the VI game and the MS game, respectively. We first examine the condition where the optimal decisions exist, and give Lemma 1 as follows. Lemma1The supply chain’s profitΠSCin the VI game is concave in bothpandλif 2h>(t+xr)2. Under the conditions of Lemma 1, we obtain the optimal decision results in the VI game as follows. Proposition1The supply chain’s optimal retail price and service level are Here, we consider the manufacturer’s and the retailer’s decision in the decentralized case. We assume that the manufacturer is the Stackelberg leader, and the retailer is the follower. The decision sequence is as follows: the manufacturer first sets the wholesale price, and then the retailer determines the retail price and service level. We solve the model backward. After the manufacturer sets the wholesale pricew, the retailer’s reaction functions are According to the retailer’s behavior, the manufacturer’s reaction function is Proposition2In the MS game, the retailer’s optimal decisions are Analyzing the above optimal results, we obtain the following conclusions: 2) The optimal retail price increases with the increase in manufacturer’s costc, but the service level and order quantity decrease with the increase inc. It suggests that when the manufacturer’s cost increases, the retailer should raise the retail price and decrease the service level and order quantity. From Propositions 1 and 2, we can also see that the optimal value seriously depends on the service cost parameterh. So, in the next section, we will further investigate in what cases the service cost parameterhmakes the retailer benefit from providing services. Based on the previous model, letλ=0 and then we obtain the optimal profits without the retailer’s service in Tab.1. Tab.1 Optimal analytical solutions without the retailer’s service Through the comparison, we obtain Proposition 3 and Proposition 4. Proposition3In the MS game, the optimal profits of both the retailer and the manufacturer with service are greater than those without it. ProofComparing the retailer’s optimal profit with service in the MS game with that without service, we obtain that The other case can be proved by the similar way. In this section, we first analyze how the parameterhimpacts the optimal decision of the supply chain. Leta=10,r=6,c=1,t=20,h=350∶10∶500 andx=0.5. From Fig.1, we can see that whenp=460, the optimal retail price in the VI game is equal to that in the MS game. Meanwhile, whenp>460, the optimal retail price in the VI game is lower than that in the MS game, and conversely reverse. Furthermore, the optimal retail price in the VI game is more seriously affected byhthan that in the MS game. Fig.1 The change of p with h From Fig.2, we can conclude that the optimal service level and its degree affected byhin the VI game are greater than those in the MS game. Then, we further analyze the impact ofhon the profit in Fig.3. Fig.2 The change of λ with h Fig.3 The change of Π with h From Fig.3, we can summarize that whenh>529, the total profit of the supply chain with service is greater than that without service in the VI game, and conversely reverse. In addition, the total profit of the supply chain with service is always greater than that without service in the MS game. In the case of service provision, the degree of the supply chain’s profit affected byhin the VI game is slightly greater than that in the MS game. Furthermore, the degree of the retail price and order quantity being affected by the consumer return rate depends on the service cost. From Proposition 6, we obtain that when consumer returns increase, the retailer should lower the service level. In addition, the optimal service level in the MS game is more largely affected by consumer returns than that in the VI game. We also conclude that the profit of the whole supply chain in the MS game is more largely affected by consumer return rate than that in the VI game. Furthermore, the retailer’s profit is more largely affected by the consumer return rate than the manufacturer’s profit in the MS game. In this paper, we examine how to trade off the loss and profit brought by providing service in a single supply chain consisting of a manufacturer and a retailer under consumer returns. We obtain the optimal price, service level decisions and profits in the VI game and the MS game, respectively. Furthermore, through comparing the optimal profits with service provision with those of no service provision, we obtain the conditions where the retailer’s service should be provided. We conclude that in the MS game the retailer should provide services. However, in the VI game, whether the service should be provided is restrained by the service cost. Finally, we derive that in the case of service provision, the profit of the supply chain in the MS game is more largely affected by consumer returns than that in the VI game. In the future, we will consider the strategic consumer behavior in the model, and investigate how the presence of strategic consumer behavior impacts the retailer’s or the manufacturer’s decisions. [1]Lawton C. The war on returns[N]. Wall Street Journal, 2008-05-08. [2]Davis S, Gerstner E, Hagerty M. Money back guarantees in retailing: Matching products to consumer tastes [J].JournalofRetailing,1995,71(1): 7-22. [3]Mukhopadhyay S K, Setoputro R. Reverse logistics in e-business: Optimal price and return policy [J].InternationalJournalofPhysicalDistributionandLogisticsManagement, 2004,34(1): 70-88. [4]Chen J, Bell P C. The impact of customer returns on pricing and order decisions [J].EuropeanJournalofOperationalResearch, 2009,195(1): 280-295. [5]Xu H, Da Q L, Huang Y. Coordination mechanism of supply chain based on stochastic demand and customer returns [J].JournalofSoutheastUniversity:NaturalScienceEdition, 2012,42(1): 194-198. (in Chinese) [6]Su X M. Consumer returns policies and supply chain performance [J].ManufacturingandServiceOperationsManagement, 2009,11(4): 595-612. [7]Ernst R, Powell S G. Manufacturer incentives to improve retail service levels [J].EuropeanJournalofOperationalResearch, 1998,104(1): 437-450. [8]Wu D S. Joint pricing-servicing decision and channel strategies in the supply chain [J].CentralEuropeanJournalofOperationsResearch, 2011,19(1): 99-137. [9]Xiao T J, Yang D Q. Price and service competition of supply chains with risk-averse retailers under demand uncertainty [J].InternationalJournalofProductionEconomics, 2008,114(1): 187-200. [10]Ferguson M, Guide V D R Jr, Souza G. Supply chain coordination for false failure returns [J].ManufacturingServiceandOperationsManagement, 2006,8(4): 376-393. [11]Ofek E, Katona Z, Sarvary M. “Bricks & clicks”: the impact of product returns on the strategies of multi-channel retailers [J].MarketingScience, 2011,30(1): 42-60.2 Optimal Price and Service Level Decisions

2.1 VI game

2.2 MS game

3 Analyses and Managerial Insights

4 Numerical Examples

5 ImpactofConsumerReturnRateonOptimalDecisions

6 Conclusion

杂志排行

Journal of Southeast University(English Edition)的其它文章

- Alcohol dehydrogenase coexisted solid-state electrochemiluminescence biosensor for detection of p53 gene

- Research on development of urban taxi supply based on influence factors classification

- Investigation on transformation process of trip mode choicefor planned special events

- Fuzzy traffic signal control with DNA evolutionary algorithm

- Adjacent vertex-distinguishing total colorings of ∨Kt

- Aggregating metasearch engine results based on maximal entropy OWA operator