Contract stability and default risk control of pig farming in the company and farmer mode

2022-04-19RenXuejieZhaoLindu

Ren Xuejie Zhao Lindu

(School of Economics and Management, Southeast University, Nanjing 211189, China)

Abstract:To investigate contract stability in the company and farmer mode and to explore control measures of market price risk and production risk, a multiperiod game model was established in this study.Considering multiple periods and losses caused by deaths simultaneously, a stable contract price interval depending on the breaching penalty, transaction cost, spot market price, and quantity of pigs was observed.Results indicate that the higher the penalty and transaction cost savings, the better the stability of the contract; the contract price should be negotiated around the weighted average of the spot market price.When the production risk is higher, hog insurance can significantly improve the contract stability; when the market price is lower, hog price index insurance improves the contract stability by guaranteeing the company income; when the market price is higher, the profit-returning mechanism improves the stability by protecting farmers’ incomes.Applying three measures simultaneously results in the best stability.Examples based on data from 2014 to 2018 in Henan Province, China, were given.

Key words:contract farming; contract stability; risk-sharing; profit-sharing

Pig farming and stable pork supply are common fundamental issues in rural economic development and social stability in China.China’s natural conditions enable farmers to focus their daily work on the farming sector, resulting in insensitivity to market information.Therefore, the contradiction between the “small-scale production” and “big market” of rural farmers is prominent.Consequently, the “company + farmers” mode is established.It is also commonly called contract farming[1].It has been increased rapidly in recent decades because of demand-side factors such as consumers’ increased incomes and supply-side factors such as technological improvement[2].

Contract farming helps transfer risks and ensures farmers’ incomes[3].It increases agricultural productivity and profitability and ensures food quality[4-6].Despite these benefits, it involves a potential conflict between companies and farmers[4].Farmer production efficiency, technical assistance, and welfare affect farmers’ decisions on whether to enter the contract[5].The contract compliance rate is low due to the unbalanced power position, lack of proper incentive mechanism, improper design, and price risk[6].

This study focuses on two major risks of pig farming.The first is market price risk, which refers to price fluctuations and the difficulty in predicting price.It is related to the number of pigs slaughtered, epidemics, climate, temperature, and other aspects.For example, a light diet in summer results in a decrease in pig demand, and the price reduces appropriately; the Spring Festival leads to more demand, and price increases appropriately.The second is production risk[2].Live pigs may die on a large scale caused by frequent epidemics.For example, the outbreak of African swine fever was first reported by the Chinese government on August 1, 2018, and all 400 pigs died in the month following the appearance of clinical signs[7].

Risk management, which has become popular in economic decisions, is characterized by minimizing the losses caused by various sources of uncertainty.Kouvelis et al.[8]proposed integrated risk management of financial and operational tools.To avoid price risk, the U.S.government provides subsidy programs to farmers[9].Applying the credit-based minimum support price scheme can induce production[10].Yield uncertainty increases fluctuation in supply and results in unstable market prices; several countries adopt the guaranteed support price scheme[11].In the lean hog futures market, Trujillo-Barrera et al.[12]estimated and evaluated ex-ante density forecasts of hog futures prices.Shen et al.[13]focused on estimating nonstationary crop yields.Jensen et al.[14]explored how basis risk and spatiotemporal adverse selection affect the demand for index-based livestock insurance.

The current study makes the following theoretical and managerial contributions.First, we develop a multiperiod game model that considers price fluctuations, which helps managers focus on long-term profits.Second, we employ the pig growth curve to estimate losses due to deaths in pig farming.Third, we derive a stable contract price interval that depends on the spot market price, quantity of pigs, breaching penalty, and transaction cost.Finally, we verify that hog insurance can reduce the losses caused by production risk, hog price index insurance can reduce the influence of price fluctuation, and the profit-returning mechanism can improve contract stability.

1 Game Model

One period is denoted byT, beginning with the breeding of piglets and ending with the sale of adult pigs.During the initial period, a company and a farmer conclude a contract stating that they will trade with each other at a contract price at the end of the period.If both players perform the contract, then they will enter the next period until the end of the contract.In this case, the contract is stable.Unfortunately, both the company and the farmer have incentives to breach contracts due to the uncertainty of spot market prices and yields.

This study aims to explore the range of contract prices within which both sides will perform the contract.This range is defined as the stable contract price interval.The larger the interval, the more stable the contract.Fig.1 depicts the decisions and processes over all periods.

Fig.1 Decisions in the game

1.1 Profit functions

Profits from the sale of livestock usually depend on weights.A pig’s weight in t days isW(t).To capture the potential growth of pigs, Gompertz modelW(t)=A0e-bexp(-kt)or logistic modelW(t)=A0/(1+ek(b-t))are formed[15].The three parameters have important biological meanings:A0andkrepresent the mature weight and maturation rate, respectively;bis the logarithm of the ratio of the mature weight to the birth weight.

Let subscripts A, B denote the farmer and the company, respectively.Obeying and defaulting the contract are denoted by superscripts O and D.

Case1If the company and farmer obey the contract during thei-th period, then the profits are

(1)

(2)

Case2If the company defaults while the farmer performs the contract, then the profits are

(3)

(4)

Case3If the farmer defaults while the company performs the contract, then the profits are

(5)

(6)

The total profits inNperiods are

Case4If both sides default, then the profits are

(7)

(8)

The total profits inNperiods are

1.2 Stable interval of the contract price

(9)

From the farmer’s perspective, we obtain

(10)

1.3 Analysis of contract stability

Corollary2Default penaltiesεAandεBhave positive influences on contract stability.

Corollary3The saved transaction costsfAandfBhave positive influences on contract stability.

Corollaries 2 and 3 indicate that the stability depends on default penalties and transaction cost savings.

Corollary4We treatwias the weight, and then contract pricepcshould be around the weighted mean of the spot market pricepi.

This corollary is illustrated by

This corollary again highlights the price risk and yield risk and gives an approximate formula for estimating the contract price.

2 Risk Control

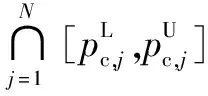

In the hog industry, the ratio of pork price to grain priceθiis commonly used to describe the market state.That is, if the pig-to-grain ratio is lower than the warning level(generally 6∶1), then the market price is depressed(piis lower).Otherwise, the market is booming(piis higher).As shown in Fig.2, we divide a plane into four parts according to the levels of the two risks.

Fig.2 Working regions of different methods

To control risks, three methods are proposed.

Hog insurance works if production risk is higher(regions 1 and 2).Hog price index insurance works if the market price is lower(θi<6, regions 2 and 3).The profit-returning mechanism works when the market price is higher(θi≥6, regions 3 and 4).A comprehensive method adopts the three methods simultaneously.It works regardless of the high yield risk and whetherθiis larger or less than 6(all regions).

2.1 Hog insurance to reduce production risk

Theorem2Considering hog insurance, for anyj∈{1,2,…,N},

2.2 Hog price index insurance to reduce price risk

Theorem3Considering hog price index insurance, for anyj∈{1,2,…,N},

2)The stability is improved if the market price plummets to an alarming level, that is,θj<6, whereas it remains the same if no such price risk exists.

This theorem shows the effectiveness of hog price index insurance against the risk of the market price collapse, which means this measure can be used in practice.The extended ratio is

2.3 Profit-returning mechanism to the farmer

In a flourishing market,θi≥6.The farmer tends to breach the contract because the contract price is lower and the market price is higher.To retain the farmer, the company can return part of the profits as long as the farmer fulfills its obligations.Denote the amount returned per unit weight asη, and the total amount isηwi.

Theorem4Considering the profit-returning mechanism, for anyj∈{1,2,…,N},

1)The new steady contract price interval is nonempty,

2)The stability is improved ifθj≥6, but it is unchanged if no such price risk exists.

2.4 Comprehensive method

To cover all situations, the three measures should be adopted simultaneously, which is called a comprehensive approach.

Theorem5Considering all three methods, for anyj∈{1,2,…,N},

1)The new stable contract price interval is nonempty,

3)The stability is improved compared with the separate method.

This theorem illustrates that adopting three methods simultaneously results in the best stability.It works regardless of whether the yield and price are high or low.The extended ratio is

3 Numerical Experiments

Values used in the simulation are shown in Tab.1.They are the 2014—2018 data of Henan Province derived from the China Feed Information Network(www.feedtrade.com.cn)and Pig Baba Net(www.yz88.cn).Given that pigs can be mature twice a year, we choose September 2014,March 2015,September 2015,…, March 2018 as eight periods.We calculate the average over a month because the original data are reported every day.

Tab.1 Hog, pork prices and pig-to-grain ratios

Fig.3 shows the upper and lower bounds of the steady contract price.The triangle-based line is above the dotted line, which indicates that upper and lower bounds are higher than the corresponding bounds of the basic model after adding the hog price index insurance.The star-, square-, and diamond-based lines are below the dotted line, suggesting that contract prices corresponding to these three methods decrease.

Fig.3 Upper and lower bounds

During the 6th period, pigs die on a large scale, and how hog insurance works is shown in Fig.4(a).Hog insurance increases the original stable contract price range(2.547 7 to 2.699 8), with an increase of 5.97%.Fig.4(b)illustrates that during the 1st, 2nd and 8th periods, the pig-to-grain ratios are below the warning level and hog price index insurance works.The length of the original stable contract price ranges from 3.056 1, 2.788 6, and 2.621 7 to 3.394 4, 3.056 7, and 2.718 8, showing increases of 11.07%, 9.61%, and 3.71%, respectively.During the 4th and 5th periods, the pig-to-grain ratios are greater than the normal value, and the company returns part of the profits to the farmer, as shown in Fig.4(c).The length of the original stable contract price ranges from 2.669 7 and 2.651 6 to 2.712 2 and 2.689 5.

Fig.4(d)also illustrates that the solid curve is above the dotted curve at most points, which depicts that when adopting comprehensive measures, the stable contract price range is the largest and the contract is the most stable.

(a)

4 Conclusions

1)This article establishes a basic game model between a company and a farmer to investigate contract stability over multiple farming periods.The results show a nonempty interval that makes the contract stable for any period.The stability is affected by penalty and transaction cost savings—the higher the penalty, the greater the stable contract price range.The transaction costs saved through contracts have a positive effect on stability.

2)The stability is also affected by market price risk and production risk.Three measures are proposed to control risks.Hog insurance is effective against production risk, hog price index insurance is effective in protecting income when the market price is lower, and the profit-returning mechanism is effective against farmers’ default when the market price is higher.Applying the three methods simultaneously results in the best stability.

3)Managerial insights are obtained to help guide decisions in contract farming.First, the “company + farmer” mode works successfully within a nonempty space.Second, the company and the farmer can raise the penalty when signing contracts.Finally, the contract price is preferably around the weighted average of market prices.

杂志排行

Journal of Southeast University(English Edition)的其它文章

- Statistical analysis of nondestructive testing results of cast steel joints in civil engineering structures

- Novel sensitivity analysis method and dynamics optimization for multiple launch rocket systems

- Detection of solar radio burst intensity based on a modified multifactor SVM algorithm

- Metrics analysis of tactile perceptual space based on improved NMDS for leather textures

- Short-term traffic flow prediction with PSR-XGBoost considering chaotic characteristics

- Finite rate of innovation sparse sampling for a binary frequency-coded ultrasonic signal