生产不确定下资金约束供应链的运营决策研究

2020-04-18沈建男邵晓峰

沈建男,邵晓峰

生产不确定下资金约束供应链的运营决策研究

沈建男,邵晓峰

(上海交通大学安泰经济与管理学院,上海 200030)

研究由单一零售商与单一制造商组成的单渠道供应链,其中资金约束制造商的生产不确定以及生产能力有限,同时供应链中企业双方交易存在多种付款方式可供选择。首先以生产确定且不同付款方式下的供应链最优运营决策与期望收益为基准;其次讨论生产不确定且不同付款方式情形,从而提出资金约束供应链最优付款方式的选择策略,通过对比分析讨论生产不确定性、生产能力等因素对供应链最优决策与最优期望利润的影响。研究表明:生产能力较大时,零售商与制造商有非常相近的最优付款选择;生产能力较小时,通过收益共享契约实现供应链双方付款方式上的统一。而且,生产不确定与有限生产能力总体上约束了零售商的订购量,但其中生产能力较少时,不确定性反而增加了订购量;并且制造商采取了更加保守的运营策略,同时减少了双方的期望收益。最后,通过算例分析验证了相关研究结论。

资金约束;生产不确定;有限生产能力;运营决策;最优付款选择

0 引言

供应链运营中面临资金约束时企业往往不能执行最优决策,如上游制造商存在资金不足而生产产量出现短缺导致下游零售商会出现供应中断的风险。资金约束不仅影响到供应链中一方成员的利润,而且还会影响到供应链上游或下游成员的运营决策,最终导致供应链各方以及整体供应链利润的减少。同时,上游制造商受原材料、自然环境、生产工艺等因素影响,承担着生产不确定性的风险,如中药饮片的原材料中草药的种植过程中就会受到外界天气等不确定因素的影响,Health Industry Distributors Association[1]数据显示2004-2005年流感时节,疫苗生产企业Chiron 工厂由于污染减产五百万支疫苗。

在单阶段模型中,权衡库存的主要方式有下游企业观察到需求之前订货,即下游企业承担全部库存风险。同时破解上游企业资金不足的难题,首先是银行等金融机构的融资服务,其次是Petersen和Rajan[2]提出了交易信用的内部融资方式在解决企业资金不足时就有广泛的应用,交易信用也能够减少企业对银行外部融资的需求与依赖。那么,在实际应用交易信用作为供应链内部融资中,最典型的方式有两类:(1)延期付款,为了缓解下游企业的资金短缺,供应链采用由下游企业在产品销售期末所得收益后向上游企业支付货款;(2)提前付款,为了支持资金短缺的上游企业的生产,下游企业在产品生产前向上游企业预先支付货款。因此,包括准时付款方式,运用交易信用的内部融资实际上又丰富了企业间交易中支付货款的方式。在实践中,沃尔玛向供应商支付货款的方式有四种:货到后按账期结算、月底结算、货到付款、预付款;物美集团对上游制造商或供应商的结算货款的方式也有四种:预付货款,货到付款的现结,按账期支付的银行汇款,承兑汇票付款。另外医药零售行业的雷允上、礼安、海王星辰在采购中药饮片时也有提前付款,延期付款等多种付款形式,以此保障货源稳定或者充盈的现金流。

在理论研究中,有关资金约束供应链的运营决策研究。首先是有关资金约束供应链在对外融资中的运营决策:第一是运营与银行融资的联合决策,其中企业利用存货质押,应收账款质押进行银行融资下的运营决策有Dunham[3],朱文贵,朱道立等[4],鲁其辉等[5]研究了存货需求随机波动时,银行的最优质押率决策问题。第二是有关资金约束且银行融资策略影响下企业生产、库存、订货等决策问题:Lai, Debo和Sycara[6]研究了当供应商和零售商都存在资金约束,需要向金融机构借款时,预订模式、寄售模式和组合模式对供应链绩效的影响,论文从供应商的角度证明了组合模式是最佳;Kouvelis和Zhao[7]研究了当存在破产成本时,资金约束的零售商向银行贷款,其自有资金和抵押物对最优融资和订货决策,以及供应商的定价问题。

其次关于资金约束供应链在交易信用中的运营研究,第一,研究了延期付款下供应链的运营、激励与协调等问题,如Babich和Tang[8]分析了当供应商供货存在产品质量风险时,下游买方利用延期付款方式可有限制约风险,并激励供应商保证产品质量。Zhang et al.[9]分析了在延期付款条件下零售商时存在破产风险时,制造商配送量可能会小于零售商的订购量,而且会小于供应链系统最优订购量。第二,以延期付款作为内生变量与激励工具来研究供应链协调。Luo[10]证明了延期付款信用期激励机制是一种不等价于数量折扣的新的供应链激励机制;陈祥锋[11]研究了供应商为资金约束的零售商提供延期付款贸易信用的供应链协调问题,研究表明当零售商存在破产风险且承担有限责任时,延期付款能有效激励零售商增加采购量。第三,研究供应链内部延期付款与银行外部借款的交互问题。如Fabbri和Menichini[12]认为供应商相对于银行来说,具有信息优势和流动性优势,因此供应商有动机向具有资金约束的下游企业提供延期付款信用;Kouvelis和Zhao[13]比较了有资金成本下的供应商融资与银行融资问题,设计了最优两阶段价格延期付款合同的结构,研究表明在一定假设下,供应商总是应该以低于无风险利率的优惠提供延期付款给零售商,最优合同下零售商偏好于供应商融资;Jing,Chen和Cai[14],Jing和Seidmann[15],Chen[16]研究表明制造商的单位生产成本决定了供应链系统的策略均衡,当制造商的单位生产成本较低时,供应链系统唯一的均衡为交易信用,反之,供应链系统唯一的均衡是银行融资。

再次,有关提前付款条件下的供应链运营决策与协调,如Babich[17]分析了当供应商出现债务危机时,制造商向供应商提供财务补贴的融资模式,研究了制造商的联合能力预订和财务补贴决策;Swinney和Netessine[18]研究当供应商存在破产风险时,两阶段需求下制造商在第二阶段面临破产的供应商时,在转换供应商与向供应商提供转移支付融资之间的选择问题;Thangam[19]研究了预付款和交易信用下供应链中易逝品的最优价格折扣和批量订货策略; Mateut和Zanchettin[20]研究了预付款和交易信用之间的关系,研究表明大多数企业中二者是替代关系,但也有些类型的企业中二者是互补关系。王文利和骆建文[21]研究了零售商提前支付与外部融资的对比分析,提出了供应链最优生产与融资决策。

在资金约束供应链运营策略研究中,大多文献假设制造商生产确定以及不考虑其生产能力的限制,而且是单一付款方式下资金约束零售商的运营决策。较少讨论多种付款方式并存,以及生产不确定且生产能力有限下,资金约束制造商如何通过批发价激励策略、零售商如何确定最优订购量以及供应链双方最优付款方式的选择条件、制造商的生产不确定与有限生产能力如何影响供应链运营策略。因此,基于企业实际交易过程中普遍存在的多种付款方式、制造商生产不确定与生产能力有限为背景,零售商在销售期前订购产品,资金约束制造商根据不同付款方式决策批发价折扣或利率等策略。本文基于不同付款方式,首先讨论了生产确定且生产能力有限下的运营决策,其次分析了生产不确定且生产能力有限的情形,从而得到资金约束供应链最优付款方式的选择条件,得出提前付款有助于资金约束制造商解决生产资金不足的困境。并且以生产确定下运营决策是基础,进一步分析生产不确定性、生产能力等因素对供应链运营决策的影响。

1 问题描述与模型假设

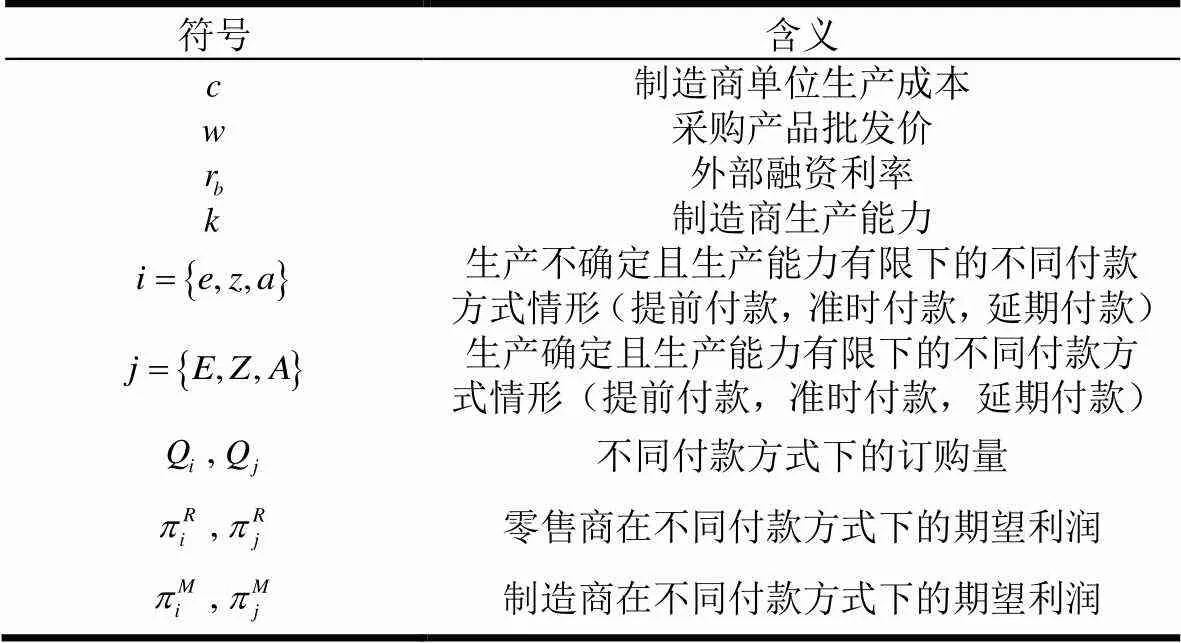

表1 符号含义

2 生产确定下的资金约束供应链运营决策

本节在生产确定下分别讨论了准时付款,提前付款,延期付款下的资金约束供应链运营决策。提出了不同生产规模下的制造商的批发价折扣与利率策略,以及零售商的最优订购策略,从而得到供应链双方的最优期望收益。

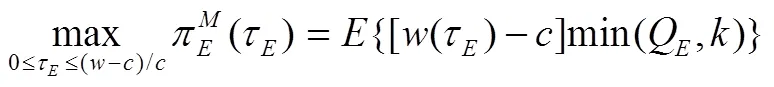

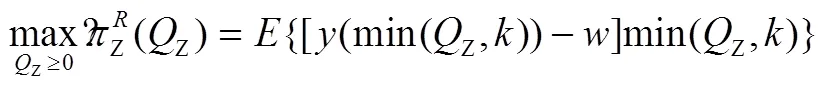

2.1 提前付款下的运营决策

根据决策顺序,具体如表2所示。

表2 提前付款且生产确定下的供应链最优运营策略与期望利润

2.2 准时付款下的运营决策

表3 准时付款且生产确定下供应链最优运营策略与期望利润

2.3 延期付款下的运营决策

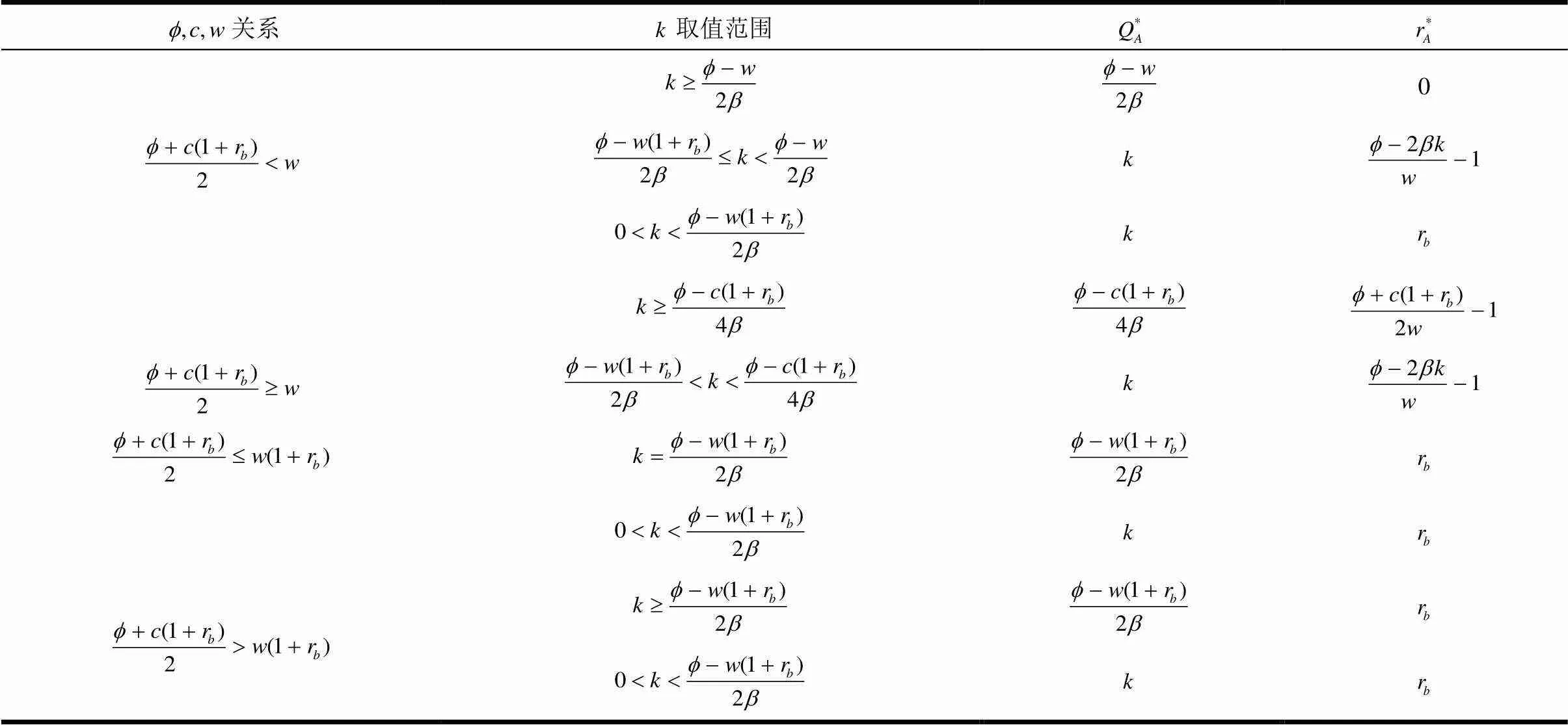

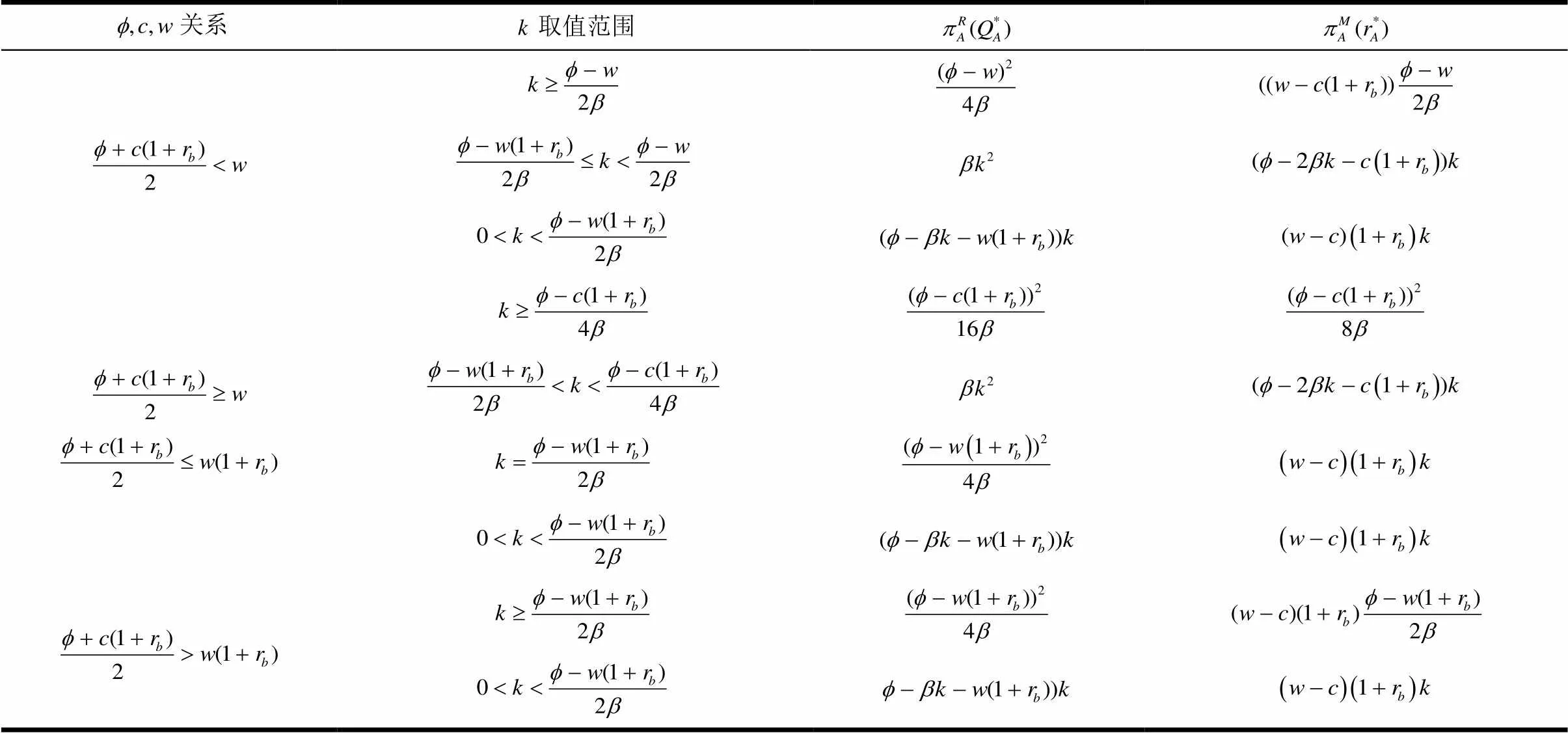

根据决策顺序,采用逆向求解供应链各方的策略均衡,可得运营策略与最优期望收益如表4、5所示。

表4 延期付款且生产确定下的供应链最优运营策略

表5 延期付款且生产确定下的供应链最优期望利润

3 生产不确定下的资金约束供应链运营决策

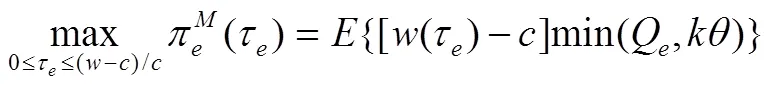

本节分别讨论生产不确定且不同付款方式下的资金约束供应链运营决策。提出了不同生产规模下的制造商的批发价折扣与利率策略,以及零售商的最优订购策略,从而得到供应链双方的最优期望收益。

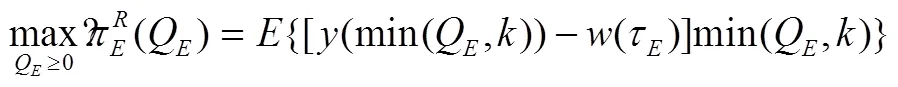

3.1 提前付款下的运营决策

根据决策顺序,采用逆向求解供应链各方的策略均衡,得如下命题。

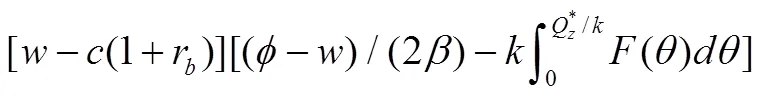

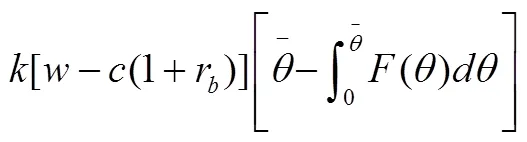

表6 提前付款且生产不确定下的供应链最优期望利润

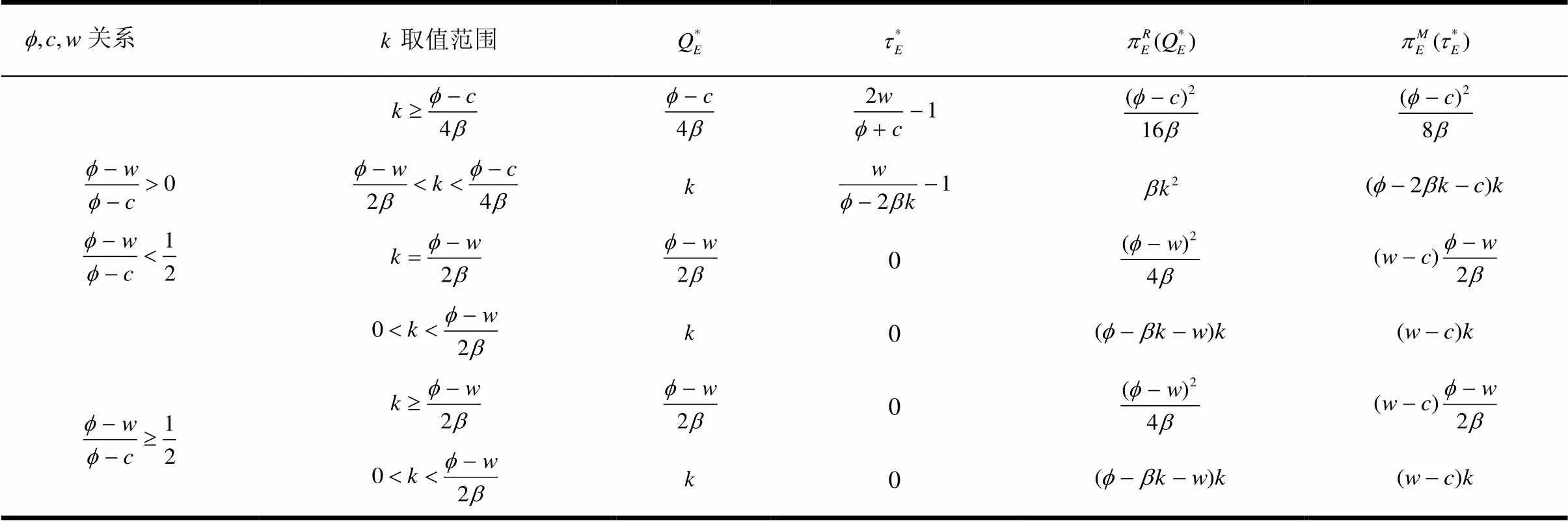

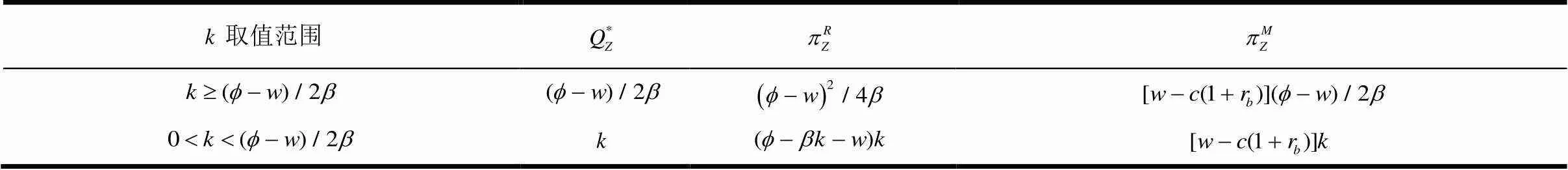

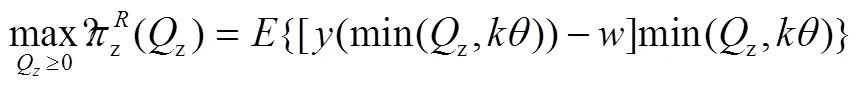

3.2 准时付款下的运营决策

表7 准时付款下供应链最优运营策略与期望利润

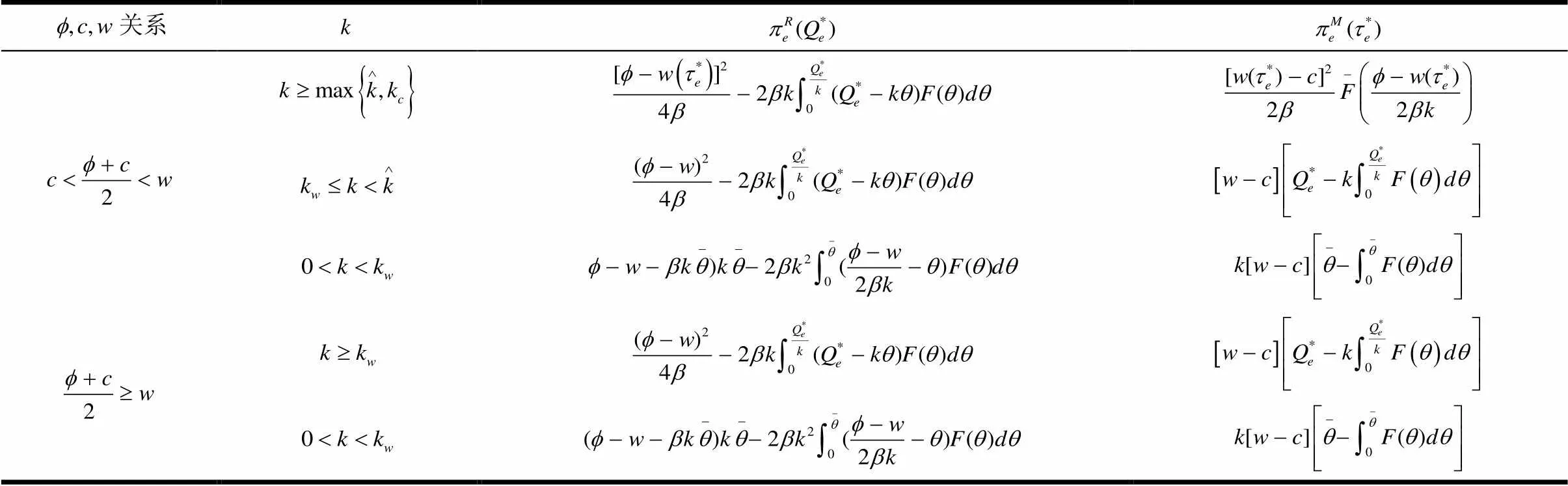

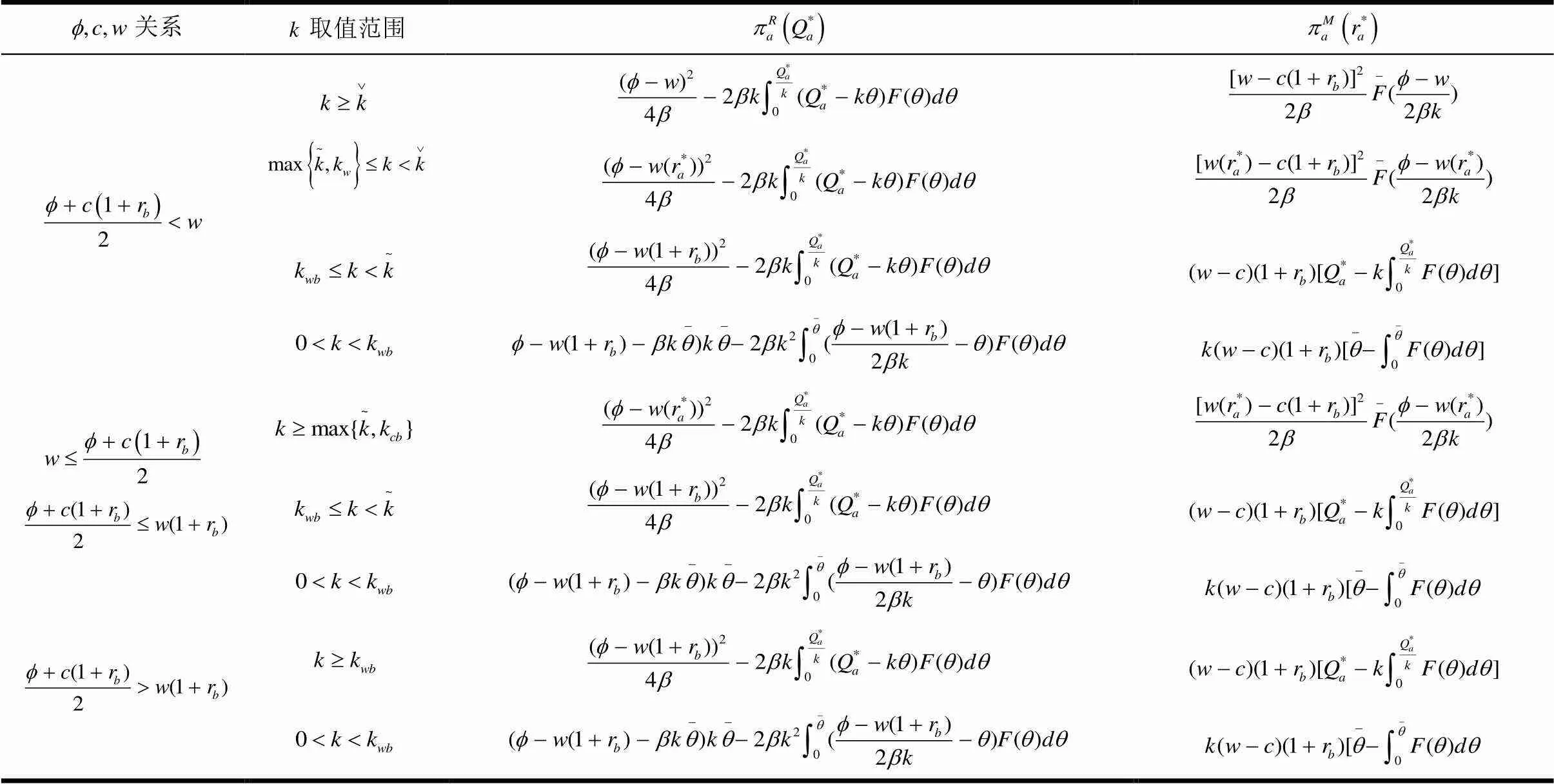

3.3 延期付款下的运营决策

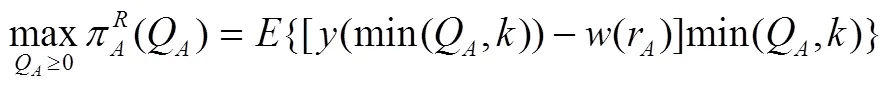

根据决策顺序,采用逆向求解供应链各方的策略均衡,得如下命题。

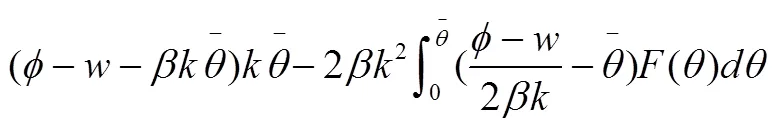

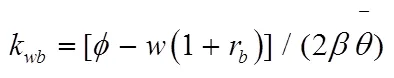

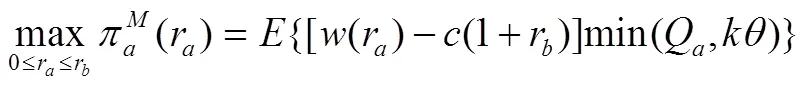

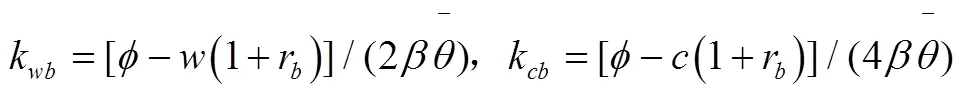

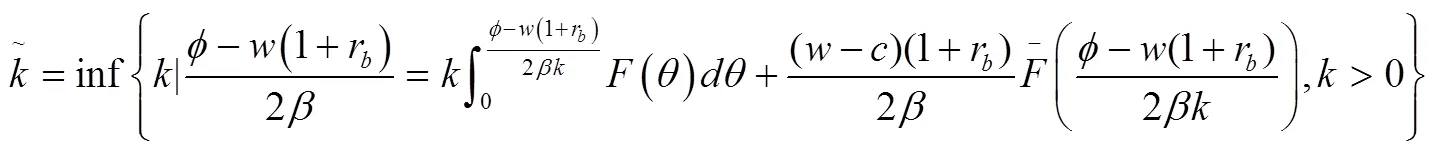

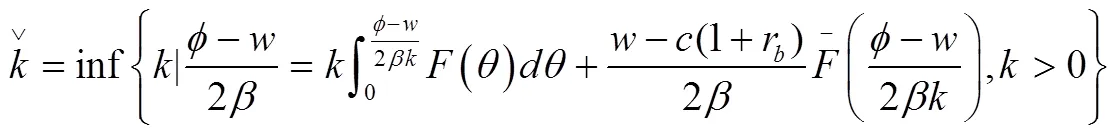

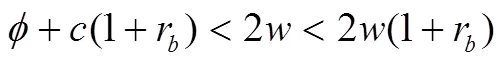

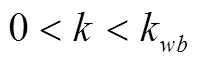

命题3:当生产不确定且延期付款下,供应链双方的最优运营决策为:

其中

表8 延期付款下的供应链双方最优期望利润

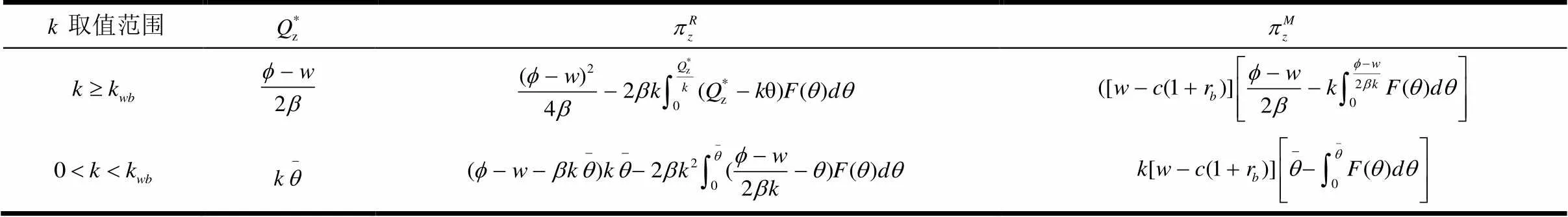

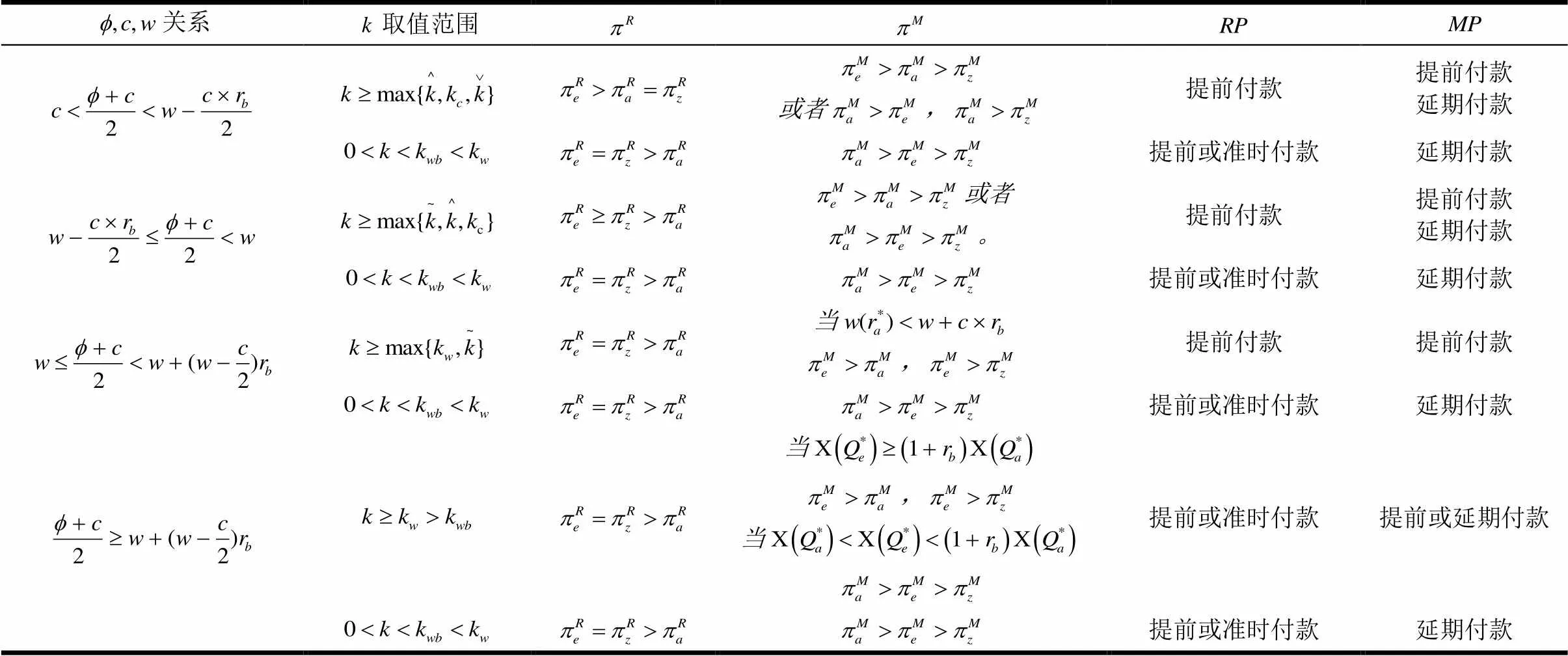

3.4 最优付款方式的选择

从命题4可以得出,无论市场批发价、生产成本、市场价格上限之间的关系如何,以及任意生产不确定参数的分布函数,当生产能力都较大时,零售商的最优付款方式为提前付款。因为当生产能力较大,零售商能采购到最优订购量,通过提前付款获得批发价折扣,能够最大化自身收益;而对于制造商,当生产能力较大且订购量较大时,通过提前付款交易信用的供应链内部融资能有效缓解生产所需的资金;当生产成本与批发价相差较小时,则会偏向延期付款提高批发价。另一方面,当生产能力较低时,零售商的最优付款方式为提前付款或准时付款,资金约束制造商希望的最优付款方式为延期付款。因为,生产能力较低时零售价会更高,零售商希望提前付款获得更多稳定的订购量,以此会获取更多收益。但生产能力较低时制造商则不会提供批发价折扣,同准时付款的批发价相同,那么,零售商会选择提前付款或准时付款。对于制造商来说,有限的生产能力能够最大限度的提升市场批发价,资金约束制造商在延期付款下制定批发价利率等于融资利率,不仅把增加的边际生产成本转嫁到零售商,还可以从高批发价中获取更多单位期望收益,因此,制造商会选择延期付款。另外,提前付款能为制造商解决生产资金,是制造商次优的付款方式。具体见表9。

表9 生产不确定下资金约束供应链最优付款方式

4 生产不确定与容量对运营决策的影响

4.1 提起付款下生产不确定的影响

通过对比表2与表6可得提前付款下生产不确定的影响。

4.2 准时付款下生产不确定的影响

通过对比表3与表7可得准时付款下生产不确定的影响为:

由于制造商按照市场批发价销售,可以获得稳定的单位收益,通过对比生产确定与生产不确定时的供应链运营决策与期望收益,可得:当生产能力较大时,在生产不确定时的订购量等于生产确定时,但供应链双方的期望收益要小于生产确定时,生产不确定首先引起了供应链双方利润的减少;其次,当生产能力较小时,零售商在生产不确定时订购量要大于生产确定时,同时供应链双方期望收益与生产不确定参数的分布紧密相关。

4.3 延期付款下生产不确定的影响

通过对比表4、5与表8可得提前付款下生产不确定的影响。

4.4 生产能力对运营决策的影响

通过与有限生产能力下运营决策相比较,可得:当准时付款下,生产能力有限同样减少了零售商的订购量、供应链双方的期望收益。准时付款下,当市场批发价与生产成本相差较大时,生产能力的限制同样使制造商很可能不提供折扣,零售商只能以最低订购量进行采购,并且都会降低供应链双方的最优期望利润;但当生产成本与市场批发价相差较小时,生产能力对制造商的批发价折扣没有影响,都以最高市场批发价出售,但生产能力的下降会减少零售商的订购量。延期付款下,当生产成本与市场批发价相差较大或中等时,生产能力的下降使制造商会制定最高的延期付款利率,零售商减少订购量,供应链双方的期望收益也不断减少;但当生产成本与市场批发价相差较小时,生产能力对制造商运营决策没有影响,但零售商会降低订购量。

5 数值分析

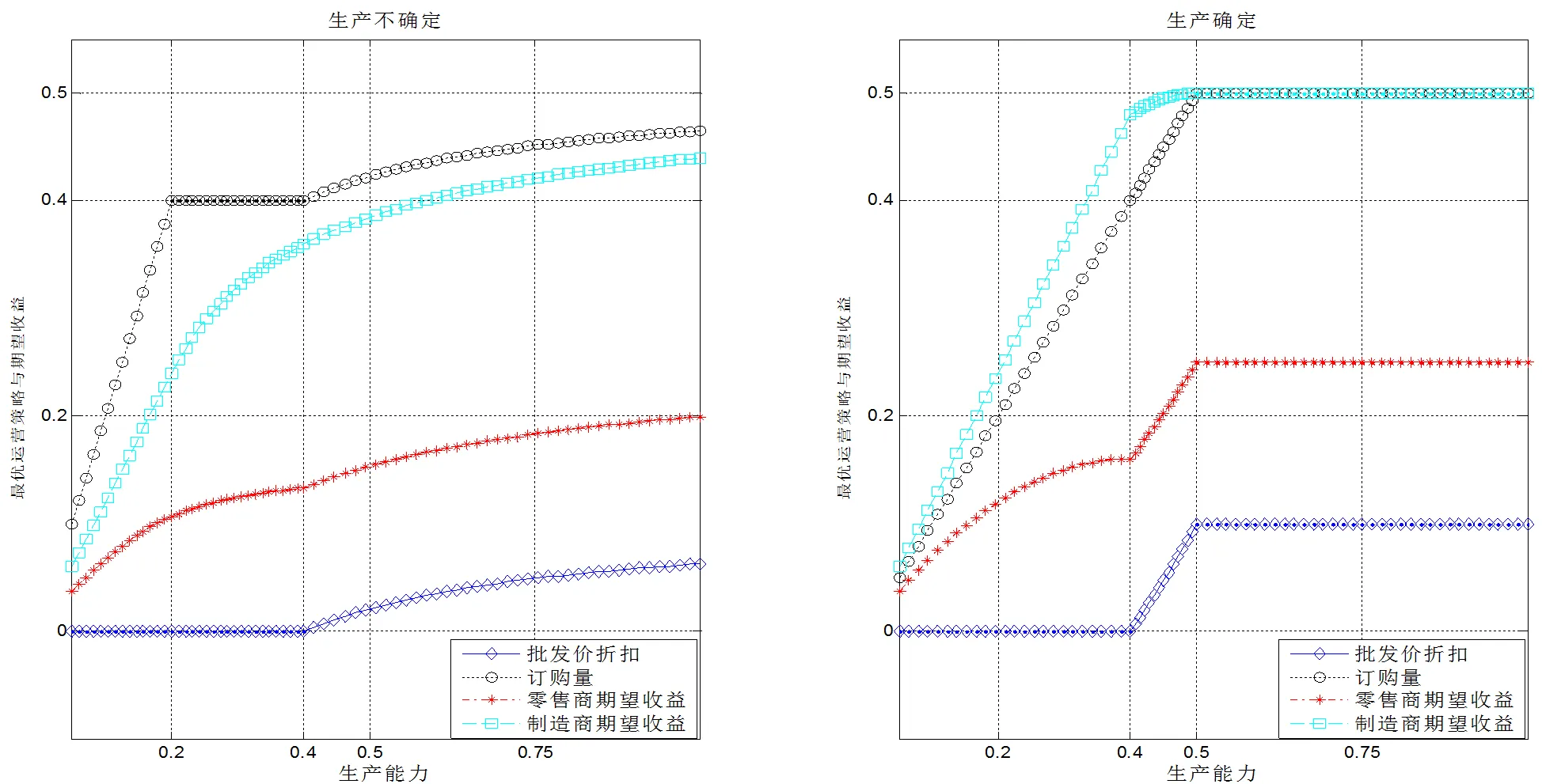

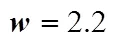

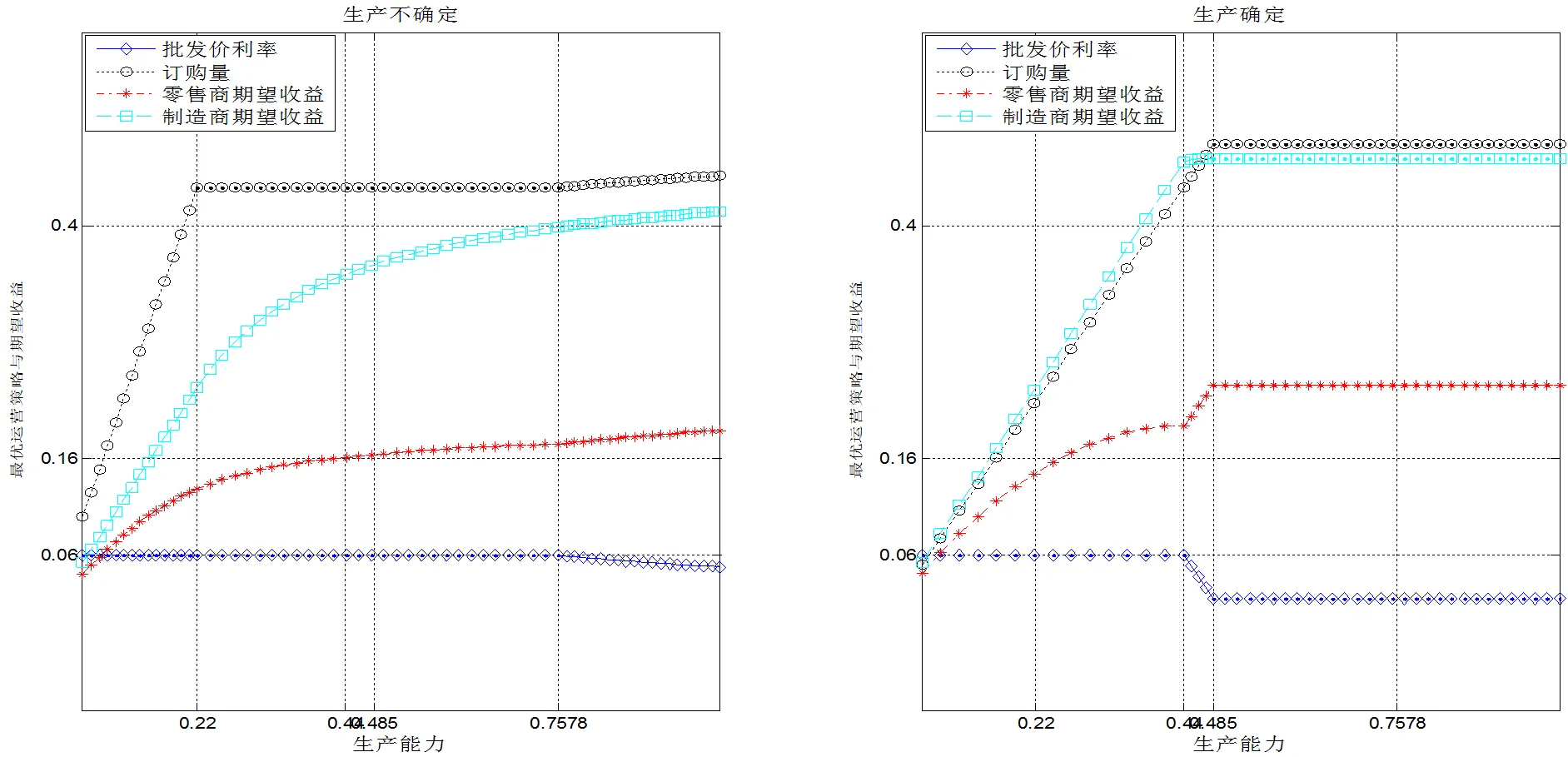

图1 提前付款下的供应链运营决策与期望利润对比分析()

图2 提前付款下的供应链运营决策与期望利润对比分析()

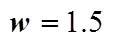

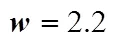

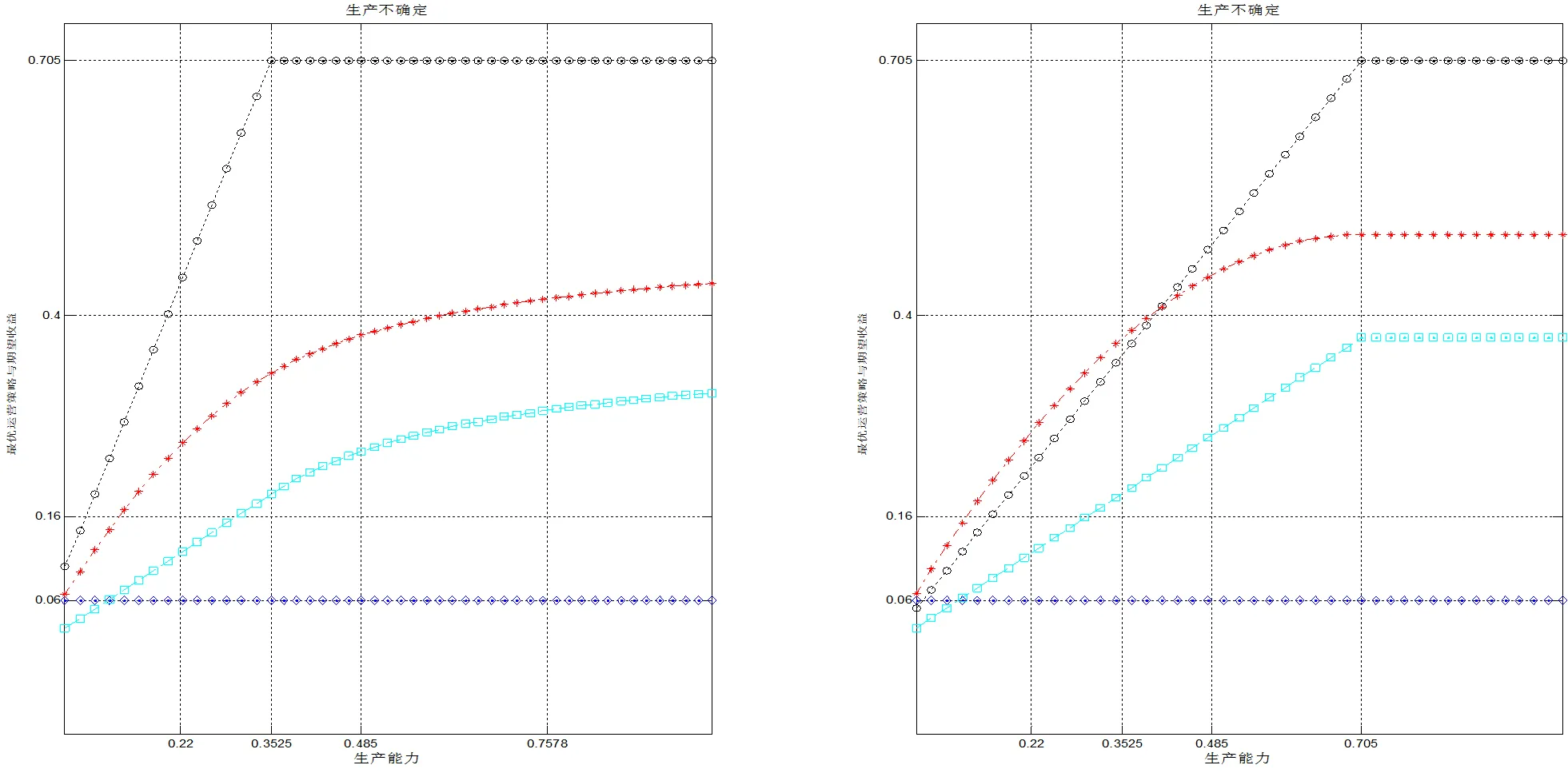

图3 延期付款下的供应链运营决策与期望利润对比分析()

图4 延期付款下的供应链运营决策与期望利润对比分析()

图5 延期付款下的供应链运营决策与期望利润对比分析()

6 总结

本文分析了单个制造商与单个零售商组成的供应链,其中制造商生产不确定、生产能力有限且存在资金约束;零售商采购资金充足,且采取在销售期来临之前向制造商订购并承担全部库存压力。同时,供应链双方交易过程中存在多种付款方式可供协商选择(如提前付款;延期付款;准时付款),制造商针对不同的付款方式提出批发价激励策略:提前付款下的批发价折扣、延期付款的批发价利率或准时付款则按照市场批发价销售;然后零售商在销售期之前选择订购量,生产不确定证实后制造商生产并向零售商进行配送;零售商以市场价格销售获取收益。本文基于不同付款方式重点分析了生产确定与生产不确定时的运营决策,提出供应链成员最优付款方式的选择,讨论生产不确定、有限生产能力对运营决策及期望利润的影响。

研究表明:第一,生产能力较大时:零售商的最优付款方式时提前付款,制造商的最优付款方式很大可能也是提前付款,双方达到了统一;而当生产能力较小时:零售商的最优付款方式是提前付款或准时付款,而制造商的最优付款方式是延期付款,次优是提前付款,最差时准时付款,双方在付款方式上存在矛盾,而通过收益共享契约合同可以实现生产能力较小时供应链双方付款方式的统一。第二,生产不确定性与有限生产能力减少零售商订购量,制造商执行更加保守的批发价策略,同时也减少供应链双方的期望利润;

本文有关制造商的生产能力没有考虑成本,而且单阶段决策。因此未来的研究方向:(1)考虑制造商扩大生产能力时需要支付一定的成本;(2)通过供应链双方的契约合同使得在生产容量较小时,协调供应链双方付款方式;(3)零售商或供应链双方都存在资金约束供时的最优运营决策与最优付款方式的选择;(4)多阶段的资金约束供应链运营决策。

[1] Health Industry Distributors Association (HIDA). 2006-2007 Influenza Vaccine Production and Distribution Market Brief (HIDA, Alexandria, VA, 2007)

[2] Petersen M A, Rajan R. Trade credit, theory, and evidence [J]. The Review of Financial Studies, 1997, 10(3): 661–691.

[3] Dunham A. Invetory and accounts receivable financing[J]. The Harvard Law Review Association. 1949,62(4): 588-615.

[4] 朱文贵, 朱道立, 徐最.延迟支付条件下的库存质押融资服务定价模型[J]. 系统工程理论与实践, 2007, 27(12): 1-8.

Zhu W G, Zhu D L, Xv Z. Pricing Model for Inventory Impawn Financing under Conditions of Permissible Delay in Payments[J]. Systems Engineering-Theory & Practice, 2007, 27(12): 1-8.

[5] 鲁其辉, 曾利飞, 周伟华. 供应链应收账款融资的决策分析与价值研究[J]. 管理科学学报, 2012, 15(5): 10-18.

Ru Q H, Zeng L F, Zhou W H. Research on decision-making and value of supply chain financing with accounts receivables [J]. Journal of Management Sciences in China, 2012, 15(5): 10-18.

[6] Lai G M, Debo L G, Sycara K. Sharing inventory risk in supply chain: The implication of financial constraint[J]. Omega, 2009,37 (4): 811-825.

[7] Kouvelis P, Zhao W F. The newsvendor problem and price-only contract when bankruptcy costs exist[J]. Production and Operations Management, 2011, 20(6): 921-936.

[8] Babich V, Tang C S. Managing opportunistic supplier product adulteration: Deferred payments, inspection, and combined mechanisms[J]. Manufacturing & Service Operations Management, 2012, 14(2): 301-314.

[9] Zhang Q, Dong M, et al. Supply chain coordination with trade credit and quantity discount incorporating default risk[J]. Int. J. Production Economics, 2014, 153(4): 352-360.

[10] Luo J W. Buyer-vendor inventory coordination with credit period incentives[J]. International Journal of Production Economics, 2007, 108 (1-2): 143-152.

[11] 陈祥锋.资金约束供应链中贸易信用合同的决策与价值[J]. 管理科学学报, 2013, 16(12): 13-20.

Chen X F. The value of trade credit contract in capital-constrained supply chains[J]. Journal of Management Sciences in China, 2013, 16(12):13-20.

[12] Fabbri D, Menichini A C. Trade credit, collateral liquidation, and borrowing constraints[J]. Journal of Financial Economics, 2010, 96(3): 413-432.

[13] Kouvelis P, Zhao W F. Financing the newsvendor: Supplier vs. bank, and the structure of optimal trade credit contracts[J]. Operations Research, 2012, 60(3): 566-580.

[14] Jing B, Chen X F, Cai G S. Equilibrium financing in a distribution channel with capital constraint[J]. Production and Operations Management, 2012, 21(6):1090-1101.

[15] Jing B, Seidmann A. Finance sourcing in a supply chain[J]. Decision Support Systems, 2014, 58: 15-20.

[16] Chen X. A model of trade credit in a capital-constrained distribution channel[J]. Int. J.Production Economics, 2015,159: 347-357.

[17] Babich V. Independence of capacity ordering and financial subsidies to risky suppliers[J]. Manufacturing & Service Operations Management, 2010, 12(4): 583-607.

[18] Swinney R, Netessine S. Long-term contracts under the threat of supplier default[J]. Manufacturing & Service Operations Management, 2009, 11(1): 109-107.

[19] Thangam A. Optimal price discounting and lot-sizing policies for perishable items in a supply chain under advance payment scheme and two-echelon trade credits[J]. International Journal of Production Economics, 2012, 139(2): 459-472.

[20] Mateut S, Zanchettin P. Credit sales and advance payments: Substitutes or complements?[J]. Economics Letters, 2013, 118(1): 173-176.

[21] 王文利, 骆建文. 零售商提前支付与贷款担保下的供应商融资策略[J]. 管理工程学报, 2013, 27(1): 178-184.

Wang W L, Luo J W. Strategies for Financing Suppliers Based on Retailers' Prepayment and Loan Guarantee[J]. Journal of Industrial Engineering and Engineering Management, 2013, 27(1): 178-184.

[22] Yano C A, Lee H L. Lot sizing with random yields: A review[J]. Operations Research, 1995, 43(2):311–334.

[23] Cho S. The optimal composition of influenza vaccines subject to random production yields[J]. Manufacturing & Service Operations Management, 2010, 12(2): 256–277.

[24] Cho S H, Tang C S. Advance selling in a supply chain under uncertain supply and demand[J]. Manufacturing & service operations management, 2013, 15(2): 305-319.

[25] Dong L, Rudi N. Who Benefits from transshipment? Exogenous vs. endogenous wholesale prices[J]. Management Science, 2004, 50(5): 645-657.

[26] Yang S A, Birge J R. Trade credit in supply chains: Multiple creditors and priority rules. Working paper, London Business School, 2012.

Research on operational strategies for capital-constrained supply chains with yield random

SHEN Jiannan, SHAO Xiaofeng

(Antai College of Management, Shanghai Jiao Tong University, Shanghai, 200030)

The manufacturer’s financial constraint may lead to unsmooth production. Thus, the downstream firm will face the risk of supply shortages or supply disruption in the supply chain operation, which the firms cannot make optimal decisions, and their profit decrease rapidly. Especially the manufacturer produces under limited production capacity, and the actual output is subject to a random production yield, which further restricts the firms’ decisions. Bank financing and trade credit are commonly used to release financial constraint. As being lack of full business information and avoiding financial risks, the bank may afford a finite credit size. Trade credit, mainly including advance payment and delayed payment, is the business credit between supply chain enterprises or between supply chain enterprises and their customers. Besides punctual payment, trade credit enriches the payment terms between firms. But recently, many studies about the capital-constrained supply chain mainly discussed the optimal decision-making under one payment term and analyzed how to choose the optimal financial channel to solve the limited capital for the retailer. Little research considered that the capital-constrained manufacturer had limited production capacity and random yield under different payment terms.

Under stochastic yield and appropriate financial services, a capital-constrained manufacturer with a traditional partner (i.e., a retailer) sold her products with an exogenously fixed wholesale price. The basic model was classical single-period make-to-order framework under different payments. So the retailer prebooked quantity before the period of selling, and retailer price was a linear function of demand. Without loss of generality, the manufacturer’s initial capital was zero. To keep a successful operation in the supply chain, the manufacturer had a strong incentive as wholesale price discount to advanced payment. But if the retailer implemented delay payment, the manufacturer must be a borrower and announced interest rate of per unit wholesale price to the retailer. Also, because of limited production capacity, the optimal order could not always be satisfied. From the percept of maximizing the profit of enterprises, the model of the operational decision was constructed with different payments. First, this paper took the bench of optimal operational decision and profits under deterministic yield and analyzed them under random yield. Second, according to comparative results under different scenarios, the influences of random yield and limited capacity were proposed.

In the first part, we respectively discuss the optimal strategy and expected revenue under deterministic yield or random yield. So we study the advanced payment scenario that retailer orders quantity and pays the money before producing, and then manufacturer executes a wholesale price discount. Furthermore, we discuss the punctual payment scenario, which product delivering, and financial transactions take place simultaneously. The third scenario, which the manufacturer announces wholesale price with an interest rate replying to delay payment, is analyzed. Using Stackelberg model and backward approach, we respectively show the retailer’s optimal preorder quantity and manufacturer’s optimal discount rate or interest rate under limited production capacity. Calculation formulas of optimal profits are also given. Main results show that the manufacturer will make a heavy discount when capacity and wholesale price is all high so that the retailer will order more quantity, but the discount will be always zero when the wholesale price is low, and whatever capacity is. Also, the rate will be zero when capacity and wholesale price are all high, and the rate will ascend when the wholesale price is intermediate, but the rate will be the highest when the wholesale price is low and whatever capacity is.

In the second part, this study separately compares the retailer’s optimal profits, and manufacturer’s under different payment terms. The result shows that the retailer will choose advanced payment or punctual payment under stochastic yield. Also, we establish the conditions that the manufacturer chooses the optimal payment terms based on production capacity. So when the capacity is high, the manufacturer chooses advanced payment. When the capacity is low, the manufacturer chooses delay payment. The optimal payment between retailer and manufacturer is partly identical under the same conditions. When a coordination contract is designed under low capacity, revenue sharing not only partly coordinates optimal payment terms between retailer and manufacturer under lower capacity but also can improve their profit performance.

In the third part, we further explore the influence of random yield or limited production capacity on operational strategy. The results show that yield random or limited capacity restricts retailer’s ordering. The manufacturer takes a more conservative operating strategy, such as a lower discount or higher rate of the wholesale price. These strategies can reduce their expected revenue. Finally, a numerical example is used to verify the results.

In summary, a manufacturer can use internal financing (i.e., advanced payment) to ease capital pressure when capacity is high. The retailer has the incentive to provide financing to the manufacturer. This conclusion is consistent with prior research. Further, the study under low capacity complements the existing research, and the interesting result is that the capital-constrained manufacturer will prefer external financing when capacity is lower. However, this paper only considers one period and symmetrical information. Asymmetrical information about the capital, multi-period operation will be a direction for future research.

Capital constraint; Yield random; Limited capacity; Operational strategy; Optimal choice of payment terms

2017-06-06

2017-11-02

Supported by the National Natural Science Foundation of China (71372106)

C93

A

1004-6062(2020)01-0210-013

10.13587/j.cnki.jieem.2020.01.023

2017-06-06

2017-11-02

国家自然科学基金资助项目(71372106)

沈建男(1981—),男,江苏苏州人;上海交通大学安泰经济与管理学院博士后;研究方向:供应链金融。

中文编辑:杜 健;英文编辑:Charlie C. Chen