A Comparative Study of Chinese Personal Credit File between Social Credit System and Sesame

2019-09-10CreditDengYuyang

CreditDeng Yuyang

Abstract:China is undergoing big change in every aspect. In credit industry,Chinese has SCS and Sesame Credit. ……Although there are many differences between these two systems,they both help China to built a more mature credit industry.

Key words:China;Sesame Credit;Credit System;Credit Industry

一、Introduction

This essay is going to compare two main credit system:Credit Reference Centre or Social Credit System(SCS)and Sesame Credit. SCS is a national-wide credit system. Sesame Credit is a private credit agency belonging to Alibaba. This essay focuses on four aspects to find special features of two systems:development history;data sources;scoring system;punishment system. In each respect,there will be an analysis of disadvantages and advantages.

二、Compare data sources of SCS and Sesame Credit

(一)Data sources from SCS

Major data resources of SCS are from all commercial banks,financial companies,leasing companies,asset management companies,some micro-financial companies,and insurance companies,basically covering all types of lending institutions. SCS has the most comprehensive collection of credit information. Basically,SCS will establish a credit file for every enterprise and individual with credit activities in China.

SCShas also been actively collecting the information from public departments including administrative punishment and reward information,court judgment information,tax payment information,etc.(data from 《征信系統建设运行报告2004—2014》).On 16th June 2019,Vice President of PBOC pointed that the credit information system included 990 million natural persons,25.91 million enterprises and other organizations.

(二)Data sources of Sesame Credit

Alibaba has three major ways of collecting credit information:①E-commerce business part:it hasdeveloped six platforms. Every platform has countless orders and huge cloud computing data.②Internet Finance:In 2014,Alibaba established Ant Financial,and also launched various wealth management platforms. Sesame Credit can extract user dataand analysis to assess users' Internet financial behaviors and capabilities.③Aliyun:it was established in 2009. It is the earliest comprehensive cloud computing platform in China and is committed to proving data processing capabilities for customers. In a word,Alibaba sells information processing products. These big data and big information provide great data support for Sesame Credit.

(三)Discussion

The credit information from Sesame Credit is more complex and fresher.Sesame Credit collects extensive information from Internet behaviors of users. Furthermore,Sesame Credit is time-sensitive. Compared with the time lag of SCS,the data used by Sesame Credit is mostly real-time updated.

However,about data quality,data complexity,and data value,SCS has absolute authority. Loan records are mainly from national banks. The Chinese government has strict auditing mechanism for financial institutes,which ensures the reality of data. Personal information is from different public departments. In this way,SCS has enough confidence in reality of data. The data from Sesame Credit is mainly from the internal of Alibaba,so the data from Sesame Credit lacks trust of the public. Besides,because of the competition with other credit agencies,sometimes the data is exaggerated. About the number of individuals or enterprises,they are not of the same order of magnitude:the main credit customers of SCS are companies or individuals with financial power and good credit,while Sesame Credit is targeted to small and micro-enterprises or emerging consumer. From the analysis above,it is found that Sesame Credit and SCS are mutually complementary.

三、Compare the scoring system between SCS and Sesame Credit

(一)The scoring system of SCS

SCS calls its personal credit scoring system “digital interpretation” of personal credit files. SCS cooperates with Fair Lsaac Corporation to conduct a personal credit risk scoring system. Base on the credit data of SCS,this company developed the risk quantification tool by statistical modeling techniques to predict the possibility of a credit default in the future when the customer applies for loans from lending institutions.The credit score ranges from 0 to 1000 points,and each score corresponds to a certain default rate. The higher the score,the lower the possibility of credit default and vice versa.

(二)The scoring system of Sesame Credit

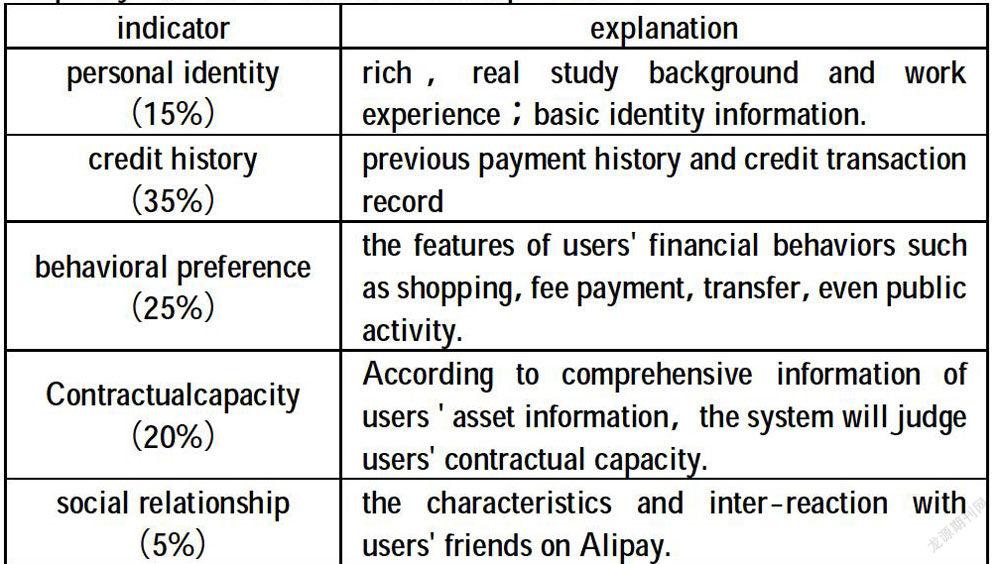

Sesame Credit divides the credit score into five classes:①700~950;fabulous;②650~700;fabulous;③600~650;good;④550~600;moderate;⑤350~550;poor.And the credit scoring system used by Sesame Credit has five evaluation indicators:Personal identity(15%),credit history(35%),behavioral preference(25%),contractual capacity(20%),social relationship(5%).

indicator explanation

personal identity

(15%) rich,real study background and work experience;basic identity information.

credit history

(35%) previous payment history and credit transaction record

behavioral preference

(25%) the features of users' financial behaviors such as shopping,fee payment,transfer,even public activity.

Contractualcapacity

(20%) According to comprehensive information of users ' asset information,the system will judge users' contractual capacity.

social relationship

(5%) the characteristics and inter-reaction with users' friends on Alipay.

Data from Alipay Application

At present,Sesame Credit applied an improved tree model GBDT(Gradient Boost DecisionTree)which can deeply explore the connections between different characteristics and derive a set of combined features with strong credit prediction ability with much higher accuracy. Then the combined feature is trained with the original feature using a logistic regression linear algorithm to obtain an accurate linear prediction model.

(三)Discussion

Due to the technical limitations and lack of practical plan,the credit scoring system developed by SCS is limited to internal testing by financial institutionsand is not actually promoted to the whole nation.

Sesame Credit's personal scoring system mainly uses a machine-integrated learning method based on big data analysis technology.In the machine-integrated learning method,the number of scoring items has reached tens of thousands,so a large number of small predictive summaries become the final predictive score with a higher degree of accuracy compared with a single predictive summary. But it is an inevitable phenomenon that part of credit information Sesame Credit collects is fictitious. And because the data sources and scoring system are both from Alibaba,the independence of Sesame Credit is far from the requirements of Chinese Supervision department.

四、Compare the punishment system between SCS and Sesame Credit

(一)the punishment system of SCS

In China,there is an epithet "Lao Lai" pointing to the citizens whose credit has broken. The “Lao Lai” phenomena is very serious. On November 7,2016,when the Supreme People’s Court issued the《Several Regulations on the Discourse of untrustworthy people subjected execution》,SCS has the public blacklist of untrustworthy people. The blacklist will be provided to financial institutions.

According to the law,besides high consumption behaviors are limited,"Lao Lai" cannot take charge of any legal representative of company or senior executives. With the corporation with Sesame Credit,all online consuming behaviors related to Alipay are limited. About transportation,education fees of children,medical service,private property and community property,all these aspects will be influenced in different degrees. Not only the untrustworthy person himselfbut also his or her family will be influenced.

(二)the punishment system of Sesame Credit

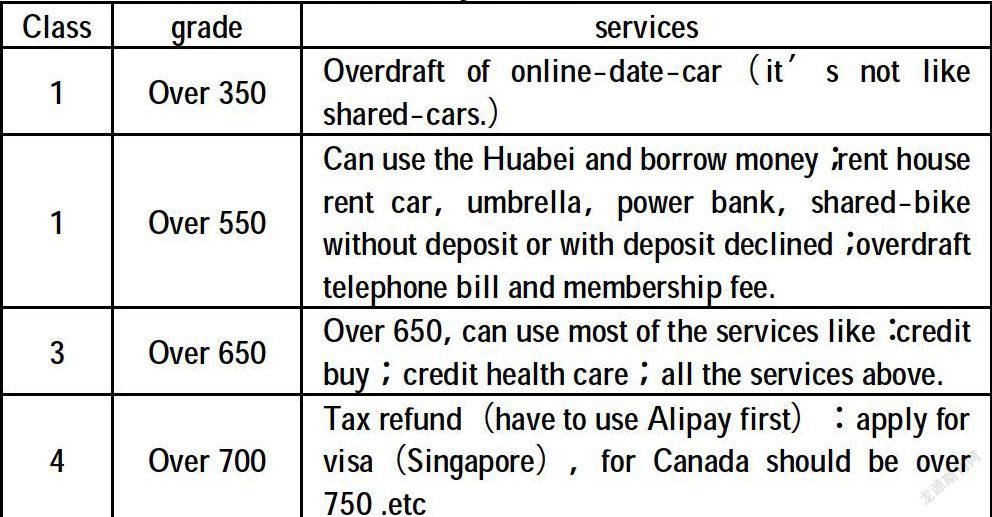

The low score of Sesame Credit will firstly constrain many online services. As shown in the following chart:

Class grade services

1 Over 350 Overdraft of online-date-car(it’s not like shared-cars.)

1 Over 550 Can use the Huabei and borrow money;rent house rent car,umbrella,power bank,shared-bike without deposit or with deposit declined;overdraft telephone bill and membership fee.

3 Over 650 Over 650,can use most of the services like:credit buy;credit health care;all the services above.

4 Over 700 Tax refund(have to use Alipay first):apply for visa(Singapore),for Canada should be over 750 .etc

Data from Alipay Application

The role of Sesame Credit Score is similar to that of credit cards. It relies on the Alipay platform that aggregates more functions. Right now Alipay is growing,providing credit services in hotels,rentals,travel,marriage,student services,and public services.A good credit score allows customers to enjoy these services. The good performance of these services can also improve the user's credit score and let them better enjoy more services.This has constituted a virtuous cycle ofreward and disciplinary punishment.

(三)Discussion

With the establishment of the government blacklist,especially the publish of the joint-punishment policy,the rate of complying instruments has increased,and the list of untrustworthy has shown a downward trend. Since the blacklist of SCS is published on the public platform,many people are forced to implement the relevant obligations under pressure from public opinion. The press conference of Supreme People’s Court held in 2018 announced that:“So far,2.8 million untrustworthy persons subjected enforcement were forced to fulfill their obligations automatically due to pressure on credit punishment.”However,it is very hard for SCS to supervise daily credit behaviors.

In contrast,Sesame Credit is a good response to untrustworthy behavior in everyday life. We have seen a wide range of application scenarios for sesame credit,including hotels,airports,visas,consumer credit,marriage,recruitment,etc.,which are almost cover every aspect of everyday life. With the continuous development and expansion of the Sesame Credit application scenario,many online and offline services will refer to the user's sesame credit score and provide corresponding services. In China,people,especially young people are spoiled by these applications,such as Huabei,Alipay,Taobao,and Elema.

However,although Alipay is so national-promoted,not everyone has Sesame Credit. Young people are much easier to be influenced. according to the report of Sesame Credit 《2019信用住旅行报告 》:Among the people who use credit services,50% of them are 90s. If a person is on the blacklist of Sesame Credit,he can still normally live,just without many online actions. If a person is on the blacklist of SCS,he can not even buy a ticket to another province. The punishment of SCS is always comprehensive and authoritative.

五、Conclusion----the coming of Credit Information-shared Age

SCS is the infrastructure for the Chinese national financial industry,while Sesame Credit is the infrastructure for Chinese business. The Chinese government encourages various credit agencies,like Sesame Credit to the develop in their adept areas. Government want these agencies to complement devoid part of SCS. However,information sharing is still a big problem. China has a strict risk control system and a strong state-owned bank status. PBOC can obtain the most valuable financial information from government departments. For the credit agency Sesame Credit,it is too hard to get as much as SCS.

Even among these credit agencies,there are still many limitations. Famous internet companies have their own independent large-scale data,which is also a main core competitiveness. Even for the biggest internet company Alibaba,it is still difficult to obtain core data from other companies by purchase or cooperation.

For information sharing,cooperating with Sesame Credit,Tencent Credit,etc eight credit bureaus PBOC established Baixing Credit Information LTD in 2018. Relevant laws are going to publish in the next years. Government is trying hard to popular credit conception. All in all,the Chinese government is paying more attention to information construction every year,and more efforts are needed to meet the information age.

Reference:

[1]《征信系统运行报告》编委会.征信系统运行报告[EB/OL],2015.

[2]刘新海. 阿里巴巴集团的大数据战略与征信实践_刘新海[J]. 征信,2014,32(10):10-14,69.

[3]沈陽. 我国互联网个人征信体系的建设研究_沈阳[D]. [出版地不详]:暨南大学,2016