Impact of Equity Pledge Behavior on Cash Holdings

2019-04-25

College of Economics and Management, Huazhong Agricultural University, Wuhan 430074, China

Abstract Since the promulgation of the Guarantee Law of the People’s Republic of China, the pledge of equity in China’s capital market is becoming more and more frequent. This paper attempts to study the relationship between equity pledge, the individual behavior of shareholders and cash holding level of enterprises. Based on the data of Shanghai-Shenzhen A-share listed companies in 2009-2016, multiple regression model was established to study the impact of equity pledge behavior on corporate cash holdings. It is found that equity pledge and pledge ratio are significantly negatively correlated with cash holding level. This can effectively alleviate the financial constraints of listed companies in China.

Key words Equity pledge, Cash holdings, Financing

1 Introduction

According to the statistics of the Wind Economic Database, only from 2016 to October 2017, equity ledge by listed companies in China reached 11 967 times. It can be seen that the controlling shareholders’ equity ledge behavior has become the norm in the capital market. In the context of the macro policy of preventing systematic financial risks, equity pledge is a right pledge. In the case of stock price crash, it will be difficult for creditor financial institutions to recover their loans. Therefore, it has a high financial risk and gradually began to receive the attention of the academic circle. Taking LeTV as an example, in the second half of 2015, Jia Yueting once pledged 507 million shares. He cashed out nearly 10 billion yuan, which was invested in LeTV’S ecological business. The pledgeable stocks had fallen all the way and touched the warning line. LeTV announced in early July 2017 that the 591 million shares held by the company’s controlling shareholder and actual controller Jia Yueting and Leshi Holdings had been frozen by Shanghai Higher People’s Court, accounting for 26.03% of the company’s total share capital and 99.06% of the shares held by Jia Yueting. Simultaneously, at the time of the general meeting of shareholders, the news on LeTV’s debt collection by suppliers due to the break of the capital chain had also frequently explored. In this case, the equity pledge of LeTV’s controlling shareholder Jia Yueting was like a "firewire", eventually leading to the break of the company’s capital chain. When the sample size is expanded to China’s Shang-Shenzhen listed companies, what role does equity pledge pay in the process of corporate cash decision-making? On the one hand, due to the high risk property of equity pledge, companies tend to increase their holdings of cash for precautionary motive. On the other hand, equity pledge behavior has introduced the external governance role of debt financial institutions, thereby inhibiting the agency motive of companies to hold cash. At the same time, the leverage nature of equity pledge will also encourage companies to reduce their cash holdings. The holding-increasing and holding-reducing effect will act simultaneously, ultimately affecting companies. This will be the focus of this paper.

2 Literature review

2.1Equitypledgebehavior

2.1.1Agency problems caused by equity pledge. After the Asian financial turmoil, due to the stock price plunging, the banking industry in Taiwan of China has suffered huge losses from equity pledge, which has attracted the attention of scholars. Therefore, for the agency problem of equity pledge, scholars in Taiwan, China have conducted in-depth research. It is concluded that equity pledge will lead to an increase in agency costs[1-4]. The seriousness of the agency problem caused by equity pledge depends on the market conditions. Under the bull market, the agency problem derived from equity pledge is relatively small. In the bear market, the problem of agency will be serious. The decline in stock price makes the board of supervisors of equity pledge face the pressure of financial repayment, thus the possibility of depriving external shareholders will increase. Shen Yangbinetal.[1]believe that equity pledge is an expansionary financing leverage operation, which binds the personal wealth of large shareholders to the company’s stock price. The agent problem of the director’s shareholding pledge mainly comes from the company’s share price falling. The board of supervisors is facing the pressure to make up collateral, so the directors and supervisors may use their control to sacrifice the interests of minority shareholders, thus hurting company performance.

Mainland scholars started late on the issue of equity pledge, starting with case studies. Based on case study, Zheng Xueying[5]found that the majority shareholder pledges the equity on the one hand, and on the other hand uses the identity of the major shareholder to occupy the listed company’s resources for short-selling behavior. In the case analysis of Hongyi Department, Li Laifang[6]pointed out that the pledge of listed company equity is one of the means by which its controllers short sell the company. In the case analysis of Sunshine, Jiangsu, LU Changjiangetal.[7]found that the company’s ultimate controller had applied for pledge loans with its sponsored legal person shares since 2003. Taking Star Power as an example, Li Yongweietal.[8]illustrated how large shareholders can use the tunnel effect to encroach on minority shareholders’ equity. From the perspective of ultimate controller, Hao Xiangchaoetal.[9]consider that equity pledge may result in a decline in the real cash flow rights of the ultimate controller. The impact can be summarized as two aspects: weakening the incentive effect and strengthening the encroachment effect. The impact of these two aspects was verified using the data from listed companies in China. Zheng Guojian[10]believes that when a large shareholder finances a financial institution by means of equity pledge, it may indicate that its capital chain is tight and its financing capacity is limited. This is an important signal that major shareholders face financial constraints. Starting from this point, the behavior of the major shareholder’s asset appropriation while facing serious financial constraints (the equity is pledged or frozen) is studied. The asset appropriation also has a negative impact on the performance of the listed company.

2.1.2Pressure transmission effect and governance effect brought by equity pledge. Equity pledge binds the interests of the pledged shareholders and the stock price. Therefore, when shareholders are facing the pressure of falling stock prices and timely repayment, it will be passed to the corporate governance level. Wang Bin[11]believes that compared with state-owned major shareholder, private major shareholder will worry about the risk of control transfer after equity pledge, so it has higher incentives to improve the company’s performance. The equity pledge ratio is positively related to the improvement in performance. Xie Deren[12]studied the relationship between equity pledge and stock price collapse risk. It is found that the controlling shareholder is committed to reducing the risk of stock price collapse in order to protect its own interests. It is concluded that the company with controlling shareholder’s equity pledge has a lower risk of stock price collapse. Among non-state-owned listed companies, the negative correlation between the controlling shareholder’s equity pledge and the stock price collapse risk is stronger. After the equity pledge occurs, to guarantees the timely recovery of the loan, the pledgee will supervise the pledged company, which will bring about certain governance effects. Tan Yanetal.[13]believe that creditor banks uses the "incentive effect" of pledge quality to control credit risk to reduce debt agency costs. Starting from this point, the governance effectiveness of collateral quality in bank credit decision-making, as well as the impact of the nature of equity and financial development on the governance effectiveness of collateral, is analyzed. The study found that the earnings management level and the short-selling level of the equity pledge samples were significantly lower than the unpledged ones. Wang Binetal.[14]found that the large shareholder’s debt financing by equity pledge introduces the external governance role of pledgee, strengthens external supervision of listed companies, suppresses the "accrual surplus" manipulation behavior of listed companies, and transforms the earnings management approach into more subtle true earnings management.

Cash holding decision is one of the important decisions of companies, and it will lead to different consequences for business. Domestic and foreign scholars elaborate on the economic consequences of cash holding decision in terms of corporate value, competition and strategic effect, investment efficiency and M&A performance. Kusnadi[15]found that when corporate governance is weak and the principal-agent problem cannot be effectively controlled, there is a significant negative correlation between the company’s excess cash holding level and corporate value. Based on the theory of enterprise life cycle, Zeng Zhijianetal.[16]studied the impact of excess cash holding level on the value of company. It is found that there is an inverted U-shaped relationship between the level of excess cash holding and the value of company. Based on the theory of corporate strategic economics, Zhang Huilietal.[17]studied the strategic effects of excess cash holding level. The study found that excess cash holdings of enterprises have a strategic effect. Thomas W. Batesetal.[18]consider that high cash flow can enable companies to better capture investment opportunities, thereby increasing investment efficiency. Based on the nature of property rights and the level of financial development, from the perspective of capital investment intermediary effect, Yang Xingquanetal.[19]studied the impact of financing constraints on the cash-holding competition effect. The study found that the competitive effect of corporate cash holdings through the intermediary effect of capital investment is more pronounced in companies with financing constraints, private companies, and regions with lower financial development level. Zhang Fangfangetal.[20]studied the relationship between cash holdings and M&A decisions and M&A performance. The results showed that compared to companies with insufficient cash holdings, companies with excess cash holdings are more likely to launch mergers and acquisitions and cash holding level of companies with excess cash holdings is negatively correlated with long-term M&A performance. There is no significant relationship between cash holding level and long-term M&A performancein companies with insufficient cash holdings.

2.2FactorsaffectingcashholdingsSince the 1990s, enterprises in western developed countries have large-scale cash and cash equivalents. This has aroused the attention of scholars, which have explored the factors affecting the level of cash holdings from the theory of trade-offs, the theory of pecking order, the theory of motives for currency need and the theory of free cash follow. Early research on cash holdings focused on corporate governance structure and financial characteristics. Kimetal.[21]conducted empirical study on US-listed manufacture companies. It is found that companies with high external financing costs, high earnings volatility and low return to assets will choose to hold excess cash. Opleretal.[22]systematically studied the determinants of cash holdings of US listed companies and found that investment opportunities are positively correlated with cash holding level, and credit ratings and firm size are negatively correlated with cash holding level. Taking 2 800 small businesses in the United States as sample, Faulkender[23]found that the degree of leverage, R&D investment, degree of information asymmetry and business life are positively correlated with the level of cash holdings, while the size of company and the shareholding ratio of management are negatively correlated with the level of cash holdings. Ozkan[24]conducted an in-depth study of the impact of management shareholding on cash holdings and found that when management shareholding ratio ranges from 24% to 64%, cash holding level is positively correlated with management shareholding and negatively correlated with management shareholding in other cases. Taking the listed companies in China as a sample, Yang Xingquan[25]studied the impact of corporate governance and financial characteristics on cash holdings. It is concluded that cash holding level is negatively correlated with financial leverage, bank debt, state-owned shares, and board size, and is positively correlated with investment opportunities and operator shareholding.

After entering the 21st century, the academic research on cash holdings has gradually shifted from a micro perspective to a macroeconomic perspective. Especially after the global financial crisis broke out in 2008, the impact of the macroeconomic environment on micro enterprise cash holdings has become a research hotspot. Custodioetal.[26]found that when the economy is in recession, companies with strong financial constraints are more likely to hold more cash to cope with future uncertainties. Zhu Jigaoetal.[27]studied the relationship between monetary policy and corporate cash holdings. It is found that when monetary policy tends to be tight, external financing constraint will be strengthened, and enterprises will raise their cash holdings. When monetary policy tends to be loose, external financing constraint will be alleviated, and enterprises will reduce their cash holdings. Taking China’s tenth round of economic cycle (2000-2009) as the research background, Jiang Longetal.[28]examined the impact of macroeconomic factors on company’s cash holding behavior. The results show that companies have a higher level of cash holdings during recession compared to the period of economic prosperity, and private companies have significantly higher cash holdings than state-owned companies. During recession, listed companies have a higher tendency to accumulate cash. From the perspective of product market and capital market, Lu Zhengfeietal.[29]studied the effects of macroeconomic policies on market competition effect and value effect of corporate cash holdings. Wang Jianhongetal.[30]studied the specific mechanism of economic policy uncertainty affecting the company’s cash holding level and its economic consequences. All of the above studies confirm that companies will adjust their cash holding decision to maximize their benefits in light of current macroeconomic conditions. At present, the research on cash holdings is mainly carried out by combining the "new and old", that is, combining the current hot issues of corporate governance and finance with cash holding theories.

2.3LiteraturereviewAt present, the research on equity pledge at home and abroad mainly deals with the agency cost problem and economic consequences. The research on the influencing factors of cash holdings is mainly based on the internal financial characteristics and the internal and external governance factors. Verification is conducted from the theory of motives for currency need, the theory of trade-off, the theory of pecking order and the theory of free cash flow, but the conclusions are not consistent. However, there has been no literature on the relationship between equity pledge, the individual behavior of shareholders, and corporate cash holdings. Therefore, this paper follows the theoretical framework of cash holding research and focuses on the impact of equity pledge behavior on corporate cash holdings.

3 Theoretical bases

3.1TheoryofmotivesforcurrencyneedThe theory of motives for currency need was proposed by Keynes in 1936. The theory holds that there are three motives for holding cash in a company: transaction motive (i.e., need to deal with daily trading activities), precautionary motive (i.e., need for some urgent cash payments that may occur in the future but not anticipated) and speculative motive (i.e., need for cash holding to avoid capital loss or increase capital gains taking uncertainty of future interest rates into account).

3.2Trade-offtheoryAccording to the viewpoints of Jensen and Meckling[31], Myers[32], and Myers and Majluf[33], there is a conflict of interest between shareholders and creditors. Holding cash can help companies get better investment opportunities. Of course, there are certain costs for companies to hold cash, such as opportunity costs. Therefore, the amount of cash held by company is the result of a trade-off between costs and benefits.

3.3PeckingordertheoryMyers and Majluf[33]consider that the existence of information asymmetry will enable companies to follow a certain sequence when raising funds for investment projects: first internal financing, then debt financing and finally equity financing. According to this theory, when there is sufficient internal financing source, companies will accumulate cash and repay debts. In the absence of sufficient internal financing, companies will reduce their cash and finance their liabilities. The theory holds that companies do not have optimal cash holdings. Instead, cash is used as a buffer between retained earnings and investment demand. There is a negative correlation between financial leverage and cash holdings.

3.4FreecashflowtheoryAccording to the free cash flow hypothesis of Jensen[34], compared with other assets, cash is more likely to be abused. Therefore, when managers have strong control over the company and the company lack constraints on their power, managers tend to let companies hold more cash, instead of returning the cash to investors through dividends. Similarly, when the agency problem between the company’s major shareholders and minority shareholders is more serious, since cash assets are more conducive to the interests of major shareholders than other assets, major shareholders may be inclined to let the company hold more cash, instead of returning these cash to small and medium investors.

4 Hypotheses proposed

Equity pledge behavior may have two effects on the company’s cash holding level: holding-increasing effect and holding-reducing effect. Equity pledge is a pledge behavior with equity as a pledge. The controlling shareholding is facing the risk of falling stock price. Once the stock price hits the open line, the controlling shareholder will lose control of the company, that is, the risk of control transfer. According to the Keynes’s theory of motives for currency need, when the company is at risk, for preventive motive, the cash holding level will be increased. At the same time, the controlling shareholder has strong control over the company. The free cash flow hypothesis believes that managers will trend to hold more cash at this time to encroach on the interests of minority shareholders. Therefore, equity pledge behavior may bright about an incremental effect on cash holdings. But at the same time, equity pledge is essentially a financing act. The pecking order theory believes that companies prefer internal financing in financing activities. When internal financing is insufficient, they turn to relying on external financing. When the controlling shareholder pledges the shares, it reflects from the side that enterprises are facing financing constraints. Leveraged financing has brought about a reduction in cash holdings. At the same time, the equity pledge behavior introduces the role of external pledgee. In order to ensure the timely recovery of funds, financial institution, as a pledgee, will supervise the pledged company. This external monitoring effect may also result in a reduction in the level of cash holdings. Therefore, the equity pledge behavior may bright about the reduction of the cash holding level.

Based on the holding-increasing effect and holding-reducing effect of equity pledge, a pair of opposite hypotheses is proposed: H1a, the controlling shareholder’s equity pledge behavior is positively correlated with the cash holding level; H1b, the controlling shareholder’s equity pledge behavior is negatively correlated with the cash holding level.

5 Model settings

In order to test the impact of equity pledge behavior on the level of corporate cash holdings, referring to the method of Opleretal[22], the following panel regression model is established:

(1)

whereCASHpresents the company’s cash holding level;PLEDGErepresents variables that have significant influence on the company’s cash holding level under the condition of equity pledge, such as nature of company’s property rights, shareholding structure, company size, financial leverage, cash flow status, working capital status, asset structure, and company growth. In addition, this article also sets annual dummy variable and industry dummy variable to control annual and industry effect.PLEDGEis the main explanatory variable. If its coefficient is greater than zero, it means that with the occurrence of equity pledge (increased pledge ratio), the company’s cash holding level is increasing; otherwise, if its coefficient is less than zero, it means that with the occurrence of equity pledge (increased pledge ratio), the company’s cash holding level is decreasing.

6 Sample composition and variable definitions

6.1SamplecompositionThis paper selects all the listed companies in the Shanghai-Shenzhen A-share market as the research object, and makes the following screening for the samples: (i) excluding the samples of financial listed companies; (ii) excluding listed companies that have implemented abnormal status such as ST; (iii) excluding samples with missing data. Finally, a total of 10 099 observations were obtained. In order to eliminate the influence of outliers on the estimation results, this paper performs tailing processing (Winsorize, ±1%) on all related continuous variable samples.

6.2DefinitionofvariablesCASHpresents the ratio of the company’s cash assets to non-cash assets.PLEDGE-DUMis a dummy variable. If pledge behavior occurs, its value is 1; otherwise, its value is 0.PLEDGE-PERindicates the proportion of shares pledged in the shares held by the controlling shareholder.SOEis a dummy variable of property right attribute.LEVis the company’s asset-liability ratio.SIZEis the logarithm of the total assets of the company.GROWindicates the growth of company, and is represented by year-on-year growth rate of the company’s operating income.CGis the ratio of cash flow from operating activities to total assets.JISHis the shareholding ratio of institutional investors.PPEis the ratio of fixed assets to total assets.

6.3DescriptivestatisticsofmainvariablesTable 1 shows the results of descriptive statistics of the main variables. As shown in Table 1, the average cash holding level is 0.24, with a median of 0.14. The mean is significantly greater than the median. It indicates that China’s listed companies have a higher level of cash holdings. The proportion of equity pledge behavior is 0.99, and the average ratio of shares pledged to the total shares is 14.26. The means ofLEV,PPE, andINTAare all significantly greater than their medians.

7 Results of regression analysis

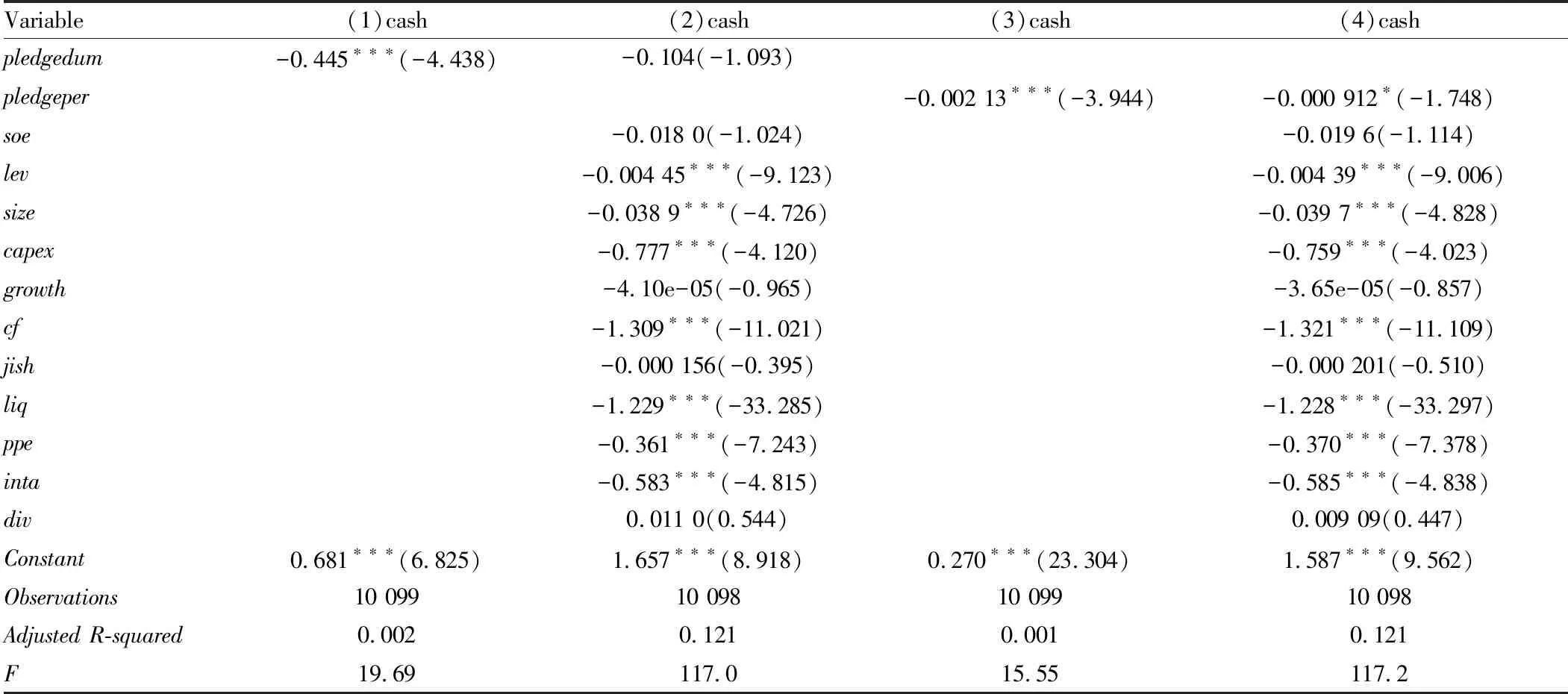

Table 2 shows the results of the regression analysis. The first column in the table is the impact of the equity pledge behavior on the cash holding level when the relevant variables are not controlled. The correlation coefficient is 0.445, significant at the 1% level. After controlling the relevant variables, the analysis results are statistically insignificant. The third column shows that the equity pledge scale variablePLEDGE-PERis significantly negative at the 1% level when no new variable is added. In the fourth column, the coefficients are still significantly negative at the 1% level after controlling the relevant variable, with strong explanatory powder, supporting the hypothesis 1b. The results of the third and fourth columns shows that with the increase in the equity pledge of the controlling shareholder, the company’s cash holding level has gradually declined. It suggests that in China’s capital market, the holding-reducing effect brought by equity pledge is greater than its brought holding-increasing effect. It has played a certain supervisory role for listed companies. In terms of control variables, asset-liability ratio, company growth, cash flow, and fixed asset investment are significantly negatively correlated, basically consistent with the research conclusions of other scholars.

Table1Descriptivestatistics

VariableNMeanP50MinMaxSDcash10 0990.2400.140072.280.870pledge dum10 0990.9901010.090pledge per10 09914.2608.870085.5416.000soe10 0990.3100010.460lev10 09941.87040.3700.910239.4020.910size10 09922.17022.03014.94028.101.300capex10 0990.0400.03000.6400.050growth10 09825.70010.960-1008 748191.900cf10 0990.0400.040-0.8900.8800.080jish10 09937.36037.9100156.823.590liq10 0990.0400.050-1.5200.8700.240ppe10 0990.2500.21000.9900.180inta10 0990.0600.04000.9400.070div10 0990.7601010.430

Table2Resultsofregressionanalysis

Variable(1)cash(2)cash(3)cash(4)cashpledgedum-0.445∗∗∗(-4.438)-0.104(-1.093)pledgeper-0.002 13∗∗∗(-3.944)-0.000 912∗(-1.748)soe-0.018 0(-1.024)-0.019 6(-1.114)lev-0.004 45∗∗∗(-9.123)-0.004 39∗∗∗(-9.006)size-0.038 9∗∗∗(-4.726)-0.039 7∗∗∗(-4.828)capex-0.777∗∗∗(-4.120)-0.759∗∗∗(-4.023)growth-4.10e-05(-0.965)-3.65e-05(-0.857)cf-1.309∗∗∗(-11.021)-1.321∗∗∗(-11.109)jish-0.000 156(-0.395)-0.000 201(-0.510)liq-1.229∗∗∗(-33.285)-1.228∗∗∗(-33.297)ppe-0.361∗∗∗(-7.243)-0.370∗∗∗(-7.378)inta-0.583∗∗∗(-4.815)-0.585∗∗∗(-4.838)div0.011 0(0.544)0.009 09(0.447)Constant0.681∗∗∗(6.825)1.657∗∗∗(8.918)0.270∗∗∗(23.304)1.587∗∗∗(9.562)Observations10 09910 09810 09910 098Adjusted R-squared0.0020.1210.0010.121F19.69117.015.55117.2

8 Conclusions and implications

Taking the data of the Shanghai-Shenzhen A-share listed companies from 2009 to 2016 as the samples, the impact of equity pledge behavior on corporate cash holdings is studied empirically through the establishment of multiple regression model. The study found that equity pledge and equity pledge ratio are significantly negatively correlated with cash holdings. The equity pledge behavior introduces the external governance role of financial institution pledgee, and has played a good regulatory role in corporate governance. At the same time, the research conclusions of this paper support the theory of pecking order of cash holdings. That is, the leverage behavior of equity pledge is negatively correlated with the level of cash holdings. The introduction of equity pledge policies can transform the company’s internal economic stock into economic momentum, effectively alleviating the problem of financing difficulties that are common in listed companies in China. At the same time, the introduction of third-party pledgee has also strengthened the governance of listed companies. Therefore, generally speaking, the advantages of equity pledge behavior of listed companies in China outweigh the disadvantages. While vigorously supporting, we must continue to standardize in order to improve China’s capital market and prevent systemic financial risks.

杂志排行

Asian Agricultural Research的其它文章

- Establishment and Optimization of Two-dimensional Electrophoresis System for Spleen Proteome of Sillago sihama Forsskål

- Breeding of a New Tussah Variety "Gaoyou 1"

- Study of the Discount on Private Placements and Risk of Stock Market Crash in Listed Companies

- Investigation and Analysis on Diversity of Lucanidae spp. in Fanjing Mountain National Nature Reserve

- Spatio-temporal Variability of Disastrous Convective Weather in China from 1961 to 2016

- Impact of Sino-US Trade Friction on Import and Export Trade Pattern of Soybean in Heilongjiang