Impact of Sino-US Trade Friction on Import and Export Trade Pattern of Soybean in Heilongjiang

2019-04-25,,

, ,

College of Economics and Management, Tianjin Agricultural University, Tianjin 300384, China

Abstract Under the background of Sino-US trade friction, soybean, as an important variety in the important and export trade of agricultural products, has become a key bargaining chip. After the Ministry of Commerce of China announced the counter list of agricultural products including soybean, the price fluctuations of domestic soybean and related agricultural products are rapidly expanding. Under the background of Sino-US trade friction, taking the soybean-producing areas in Heilongjiang as an example, the impact of Sino-US trade friction on the important and export pattern of soybean in Heilongjiang was explored to provide a certain theoretical basis for the development of soybean industry in Heilongjiang.

Key words Sino-US trade friction, Soybean, Import and export, Trade pattern

1 Introduction

In the early morning of March 23, 2018, Trump signed memo at the White House. It was confirmed that tariffs on Chinese products worth 60 billion yuan would be imposed, and Sino-US trade friction began since then. The Customs Tariff Commission of the State Council of China issued a counter list against the United States. The products were all small goods, and soybean products were not on the list. The real crisis to the prices of soybean is as follows. On the morning of April 4, the US government issued an exact list of good subject to tariffs. A 25% tariff was imposed on 1 333 items of 50 billion yuan of Chinese exports to the United States. The costs of soybean import from the United States increased by 25%, so China’s manufacturers stopped purchasing US soybean, leading to blocked import demand. If Sino-US trade friction continues, it was estimated that China’s soybean imports will be greatly reduced from December 2018 to March next year. There is a need to reduce the demand for soybean meal by adjusting the feed formula, increase the export countries of protein meal, adjust the rhythm of domestic miscellaneous meal consumption, and timely release the strategic soybean stocks to achieve a rebalancing of soybean supply and demand[1].

At present, 58% of China’s soybean demand comes from trade imports. The imports from the United States accounted for 76% of China’s total soybean imports. Obviously, the development of Sino-US trade friction has had a certain degree of impact on soybean supply, thereby further influencing the prices of soybean. According to the statistics of the National Bureau of Statistics of China, the cumulative weight of soybean-related products in the consumer price index (CPI) is about 7.5%. If soybean prices rise, it will directly affect China’s consumer price index[1]. Therefore, in order to safeguard China’s core interests and the fundamental interests of the people, it is necessary to further propose countermeasures. Heilongjiang Province is one of the main production areas of soybean in China. In the field of China’s soybean industry, it plays a very important role. However, in recent years, under the pressure of genetically modified soybean entering the Chinese market, the development of China’s soybean industry has become very difficult. Using the literature collection method and data analysis method, this article combined the soybean industry situation in the main soybean producing areas of Heilongjiang with the world trade environment, and conducted an empirical study on the rapid growth of soybean imports in Heilongjiang based on the root cause of import shocks under Sino-US trade friction to determine the main factors that hinder the development of soybean industry in Heilongjiang Province of China and provide effective guidance for the development of soybean industry in Heilongjiang Province of China[2].

2 Impact of Sino-US trade friction on China’s soybean import and export trade pattern

2.1 Import and export status of soybean industry in Heilongjiang under Sino-US trade friction

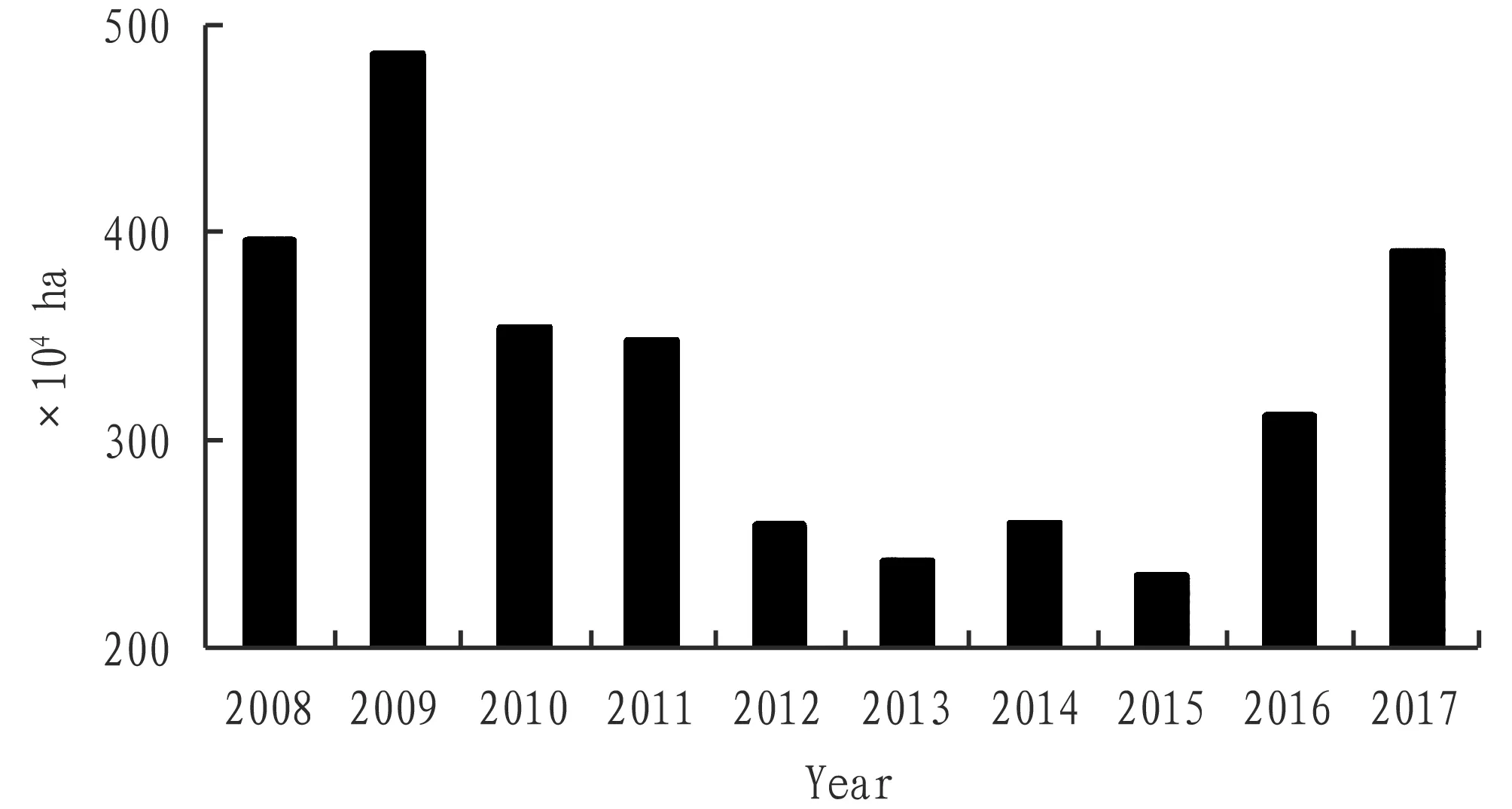

2.1.1Planting area of soybean in Heilongjiang. In 2017, China adjusted the target price policies for soybean and began to implement a market-based acquisition and subsidy mechanism. At the same time, the producer subsidy system has been improved. Subsidies are provided to soybean probers to encourage increased soybean cultivation and reasonably reduce production in non-dominant production areas. According to national deployment, Heilongjiang Province has accelerated the adjustment of crop plant structure and improved crop planting structure and variety quality structure[4]. According to the planting intention survey at the beginning of 2017, the planting area of soybean in Heilongjiang would reach 3.4 million ha, increased by 280 000 ha compared with last year, an increase of 8.97%. In addition, the pilot project of cultivated land rotation system started in 2016 also has a certain promoting effect on soybean planting in Heilongjiang[3]. In accordance with the requirements ofNoticeonExploringthePilotProgramforImplementingtheFarmlandRotationSystemissued by the Ministry of Agriculture, the Office of the Central Rural Work Leading Group, the Ministry of Finance, and other 10 national departments and units and the National Annual Work Plan, Heilongjiang Province has formulated thePilotProgramforExploringandImplementingFarmlandRotationSysteminHeilongjiangProvinceand thePilotWorkPlanforFarmlandRotationinHeilongjiangProvincein2017, the pilot tasks of about 333 300 ha will be decomposed into seven municipal and provincial agricultural bureaus, including Heihe, Yichun, Qiqihar, Suihua, Jiamusi, Shuangyashan and Hegang, which have a large production of cultivated land in the third, fourth and fifth temperate zones. It is equivalent to 2 250 yuan/ha. Most of the above-mentioned areas belong to traditional soybean producing areas. In recent years, due to the imbalance of comparative benefits of soybean, more farmers are inclined to grow soybean, and the potential for increase is greater. Rotational pilots have effective motivated some growers to rationally rotate soybean. Affected by the fall in maize prices in 2016, the benefits of planting soybeans in parts of Heilongjiang are greater than those of growing maize. This also prompted some farmers to switch to planting soybean in the next production year. Under the combined effect of policy guidance and market regulation, in 2017, the soybean planting area in Heilongjiang Province increased by about 25% year-on-year to reach 3.91 million ha. The recovery growth is close to the second highest level of planting area in the last ten years[4].

Fig.1PlantingareaofsoybeaninHeilongjiangProvinceduring2008-2017

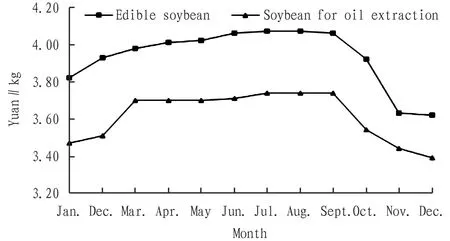

2.1.2The trend of soybean prices in Heilongjiang Province. In 2017, the soybean market in Heilongjiang showed a stable and weak situation. The operation range of soybean prices in Heilongjiang was similar to that of the previous year. Among them, the monthly average price of soybean for oil extraction was 3.39-3.74 yuan/kg, and the monthly average price of edible soybean was 3.62-4.07 yuan/kg. Soybean prices had been relatively stable before the new soybeans went on the market[5].

In 2017, the national soybean planting area reached 7.8 million ha. It accounted for 75.48% of the total sown area of beans, an increase of 5.82 million ha over the previous year, an increase of 8.1%. As the agricultural climate is more conducive to the improvement of autumn grain yields, on the basis of increased soybean production in Heilongjiang Province, the total domestic soybean production increased. In 2017, the total domestic soybean production was 19.169 million t. Since soybean yield is generally higher than that of miscellaneous beans, according to area ratio, it is estimated that the soybean production should be above 14.46 million t. At present, there is no significant change in the domestic soybean industry structure and downstream demand. Domestic beans still have no price advantage in terms of oil use, mainly relying on food processing and consumption. Domestic consumption of edible soybean is relatively stable. The sharp increase in domestic soybean supply in the new season in 2017 had created a downward pressure on soybean process[5]. As of December 31, Heilongjiang and other seven major producing areas had acquired 2.65 million t of soybean. Based on estimates of total soybean production, the acquisition was less than 20% of total production. In 2017, the pattern of domestic soybean consumption mainly depended on imported soybeans did not changed. From January to November, the cumulative import of soybean was 85.99 million t, a year-on-year increase of 14.8%. In the fall of 2017, domestic soybean that was mainly produced in Heilongjiang fell after the listing. It was not because the domestic soybean production was absolutely oversupply, but the domestic demand for soybean was weaker than supply. As the time goes, soybean consumption increased, soybean stocks decreased, and soybean prices had gained some support[6].

Fig.2MonthlytrendofsoybeanpriceinHeilongjiangProvincein2017

2.2 Impact of Sino-US trade friction on import and export trade pattern of soybean in Heilongjiang

2.2.1Appreciation of the renminbi has led to a decrease in export profits of soybean. China has a high dependence on important soybean. In recent years, the proportion of imported soybean in China’s domestic consumption has increased significantly. At present, it is basically stable at around 90%. In 2017, China imported 97 million t of soybean, accounting for 87.55% of domestic soybean consumption. The domestic soybean production was 14.20 million t, accounting for only 12.82% of domestic soybean consumption. Thus, soybean is serious import-dependent agricultural product in China. Imports are the main source of domestic supply, and cutting off imports is equivalent to cutting of supplies. The recent close of the renminbi against the US dollar was basically at 6.831 6-6.9, a new high in the short term. It rose 24 basis points compared with the previous trading day and rose nearly 400 basis points in early trading[7]. The central parity of the renminbi against the US dollar rose by 118 basis points to 6.831 3, which was a two-day increase. The resulting decline in the profit of important soybean crushing had gradually become more and more obvious. The profit of crushing companies had been adjusted back to the break-even point. According to the data of BOC Securities, the profit of imported soybean crushing in Heilongjiang had been reduced from the previous highest of 500 yuan/t to 200 yuan/t, and the profit per day on May 15 was even as low as 2.5 yuan/t, which had been adjusted back to the break-even point. Since entering May, the oil and fat market fell sharply due to the expected increase in soybean production and the intensification of European debt problems. Data show that soyoil futures fell 7.62%, and palm oil futures fell 9.12%. Under the pressure of unreduced stocks, the recent oil market will continue to interpret the bottoming process, with more obvious wide fluctuations[8].

2.2.2RCAindex and market share decrease. The revealed comparative advantage index (RCA), which shows the ratio of the world share of a country’s exports of a certain product to the ratio of the country’s total exports to the world’s total exports, was used to examine the strengthen of international competitiveness of soybean[6]. When soybeanRCAis greater than 2.5, it indicates that export product has stronger competitiveness; whenRCAis between 1.5 and 2.5, it indicates that export product has strong competitiveness; whenRCAis between 1.0 and 1.5, it indicates that export product has moderate competitiveness; and whenRCAis less than 1.0, it indicates that export product is less competitive. In 2018, theRCAvalue of Heilongjiang soybean reached 6.37, indicating that the Heilongjiang soybean industry was highly competitive internationally; and theRCAvalue of soybean was 1.08, indicating that soybean’s international competitiveness was at a lower level.

At the same time, soybean is the main product of foreign exchange earning in the history of Heilongjiang Province. In recent years, it has gradually lost its role in foreign exchange and soybean has become one of the products that Heilongjiang Province needs to import a large amount each year. Due to the high price sensitivity of soybean and the trend of international prices, improving the soybean yield and stabilizing the market is also of great significance for protecting the interests of soybean farmers. Heilongjiang Province needs to improve its position in the soybean industry, re-emphasize the soybean production and processing, provide policy support for the production and processing of soybean, improve soybean yield relying on scientific research, strengthen the popularization and construction of agricultural science and technology, and invest in the quality optimization and new variety development of soybean. In economic life, it needs to improve the support for national soybean processing enterprises, and guide the deepening and diversification of soybean processing. By making full use of the superior resources of the soybean industry in Heilongjiang Province, it should encourage industrial operations using technological innovation, and improve the overall level of the industry to withstand the impact of international soybean and Sino-US trade friction[9].

2.2.3Downstream commodity destocking risk increases. In recent years, China’s soybean imports have remained high, which has also changed the pattern of domestic oil crushing. At present, China is mainly dominated by imported soybean, and domestic soybean rarely enters the crushing field, except for some non-GMO soybean oil and high-end soybean oil. However, in this trade war, opportunities and risks coexist[8]. First of all, for the oil extraction plant that has already done the hedging, the hedging position is facing losses, and the short-term pressure on the oil plant is relatively high. Second, for some upstream without layout and some small oil extraction plants, there may be a risk of a staged shortage of soybean. Finally, in the trade season of soybean in South and North America, domestic crushers will import more Brazilian and Argentine soybean in advance, and the risk of port soybean storage cannot be ignored[7].

3 Conclusions and prospects

At present, China is already the world’s largest soybean importer, and the volume of imports is increasing year by year. With the increase in imports and changes in international soybean prices, soybean trade has had a serious impact on China’s soybean planting industry and related industries. Therefore, the government, enterprises and related groups must unite as soon as possible and make efforts to improve and reverse this unfavorable situation to promote the development of China’s soybean industry. Combined with China’s current grain and oil market and the development direction of China’s soybean, the large-scale implementation of the soybean reserve plan is obviously unrealistic. It is recommended that China should implement the edible soybean reserve plan nationwide and insulate the soybean industry indirectly by protecting the price of edible soybean. The start of the trade war has given strong feedback to policy makers. Structurally, on the basis of the staged progress in the structural reform of the agricultural supply side, the reform process will continue to be accelerated. On the production side, the land transfer speed will be faster than expected, and the scalization and modernization of agriculture has been accelerated, which has led to a qualitative leap in agricultural production efficiency. The upstream seed industry and farmland have become more prominent in strategic value. The trade war continues to advance. The relevant sector valuation center is expected to move up.

杂志排行

Asian Agricultural Research的其它文章

- Study of the Discount on Private Placements and Risk of Stock Market Crash in Listed Companies

- Breeding of a New Tussah Variety "Gaoyou 1"

- Impact of Equity Pledge Behavior on Cash Holdings

- Establishment and Optimization of Two-dimensional Electrophoresis System for Spleen Proteome of Sillago sihama Forsskål

- Investigation and Analysis on Diversity of Lucanidae spp. in Fanjing Mountain National Nature Reserve

- Study on Communication Effect of Food Safety Risk in Social Media: the Influence of Response Effort Level on Consumption Willingness Change