Driving Force of China’s Agricultural Exports to Japan

2019-03-20,

,

School of Business, East China University of Science and Technology, Shanghai 200237, China

Abstract Japan is the largest export destination for Chinese agricultural products. The export status to Japan is directly related to the overall trend of China’s agricultural exports. Based on the HS9-coded agricultural product trade data of the Japanese Ministry of Finance in 2001- 2017, using the ternary marginal analysis method, the driving force of China’s agricultural exports to Japan was analyzed in this paper from a static and dynamic perspective. The results showed that 98.89% of the driving force of China’s agricultural exports to Japan was from the contribution of quantity margin. The contribution of the extensive margin had been decreasing year by year after 2006, and it has been negative for many years. The reason was that technical barriers such as the Positive List System lead to less export of agricultural product in varieties and types. The average marginal contribution rate of price was 8.26%. The average price of exported agricultural products has been basically higher than the world average level since 2013, suggesting that the quality of exported agricultural products has been improved. While maintaining the quantity of agricultural exports, improving the quality of agricultural products, expanding export varieties and increasing export value added are the sources of sustainable growth of China’s agricultural exports in the future.

Key words Agricultural exports, Ternary marginal analysis, Quality, Price

1 Introduction

Since the accession to the WTO, China’s agricultural exports have grown rapidly, from 15.448 billion U.S. dollars in 2001 to 73.583 billion U.S. dollars in 2017, increased by 3.76 times. Japan is the largest market for China’s agricultural exports. China’s exports of agricultural products to Japan increased from 5.674 billion U.S. dollars in 2001 to 10.094 billion U.S. dollars in 2017, an increase of only 0.79 times. The share of exports to Japan in China’s total agricultural exports also fell from 36.55% in 2001 to 13.725% in 2017. In addition, the varieties of agricultural products exported to Japan are also in decline. For example, the number of HS9-coded varieties decreased from 826 in 2001 to 797 in 2017. According to the statistics of the General Administration of Quality Supervision, Inspection and Quarantine, in 2017, a total of 1 581 batches of Chinese agricultural products and food exports were blocked. Although the number of total batches was reduced compared to 2016, the number of unqualified agricultural products and foods that were detained or recalled by Japan increased by 50 batches compared with 2016. Reasons for export obstruction include unqualified residues and unqualified quality of non-food additives. What is the main driving force behind the growth of China’s agricultural exports to Japan? Is it Quality, variety or price? To what extent of its contribution is? Is this a sustainable way for the exports? How to improve the potential of China’s agricultural exports?

Theoretically, if a country’s agricultural exports depend only on quantity growth, the driving force for economic development would be temporary. Only a combined increase in price and variety can lead to an effective and sustainable economic development. To a certain extent, the growth of price and variety margin can reflect the improvement of the quality of the agricultural products. Because in an effective market, only through the improvement of the internal quality and the effect of a product can the value be improved. It can be reflected in the price increase. Based on the above questions, the ternary marginal analysis was introduced in this paper to explore the internal motivations for the growth of China’s exports of agricultural products to Japan.

2 Literature review

Melitz pioneered the new-new trade theory based on research on heterogeneous firm. The binary margin refers to dividing a county’s export trade growth into an intensive margin and an extensive margin in the new-new trade theory[1]. Hummels and Klenow further decompose the intensive margin into quantitative margin and price margin on the binary margin. Based on this, the evolution trend of quality of products exported was assessed[2]. If a country’s products win by quality and rely on technology and human capital to promote trade growth, it can be viewed as a sustainable trade growth model. But if it wins only by quantity, promotes export growth by lowering the prices of products, labor, land or other resources, it is regarded as an unsustainable pattern of trade growth. From the perspective of price margin in the intensive margin, when a long-term low-price export growth is vulnerable to trade barriers in importing countries, a series of problems such as the depletion of domestic environmental resources, lead to "immiserising growth" easily[3]. Chinese scholars have also conducted researches on the factors affecting China’s agricultural exports from various perspectives. Wang Qi pointed out that although agricultural R&D cannot have an effect on agricultural exports in the short term, in the long run, it is conducive to the improvement of agricultural export performance[4]. Yi Aijun and Wang Changhai believe that China’s agricultural product quality standards, brand influence and export processing value-added are all at a disadvantage. The government’s appropriate subsidies for agricultural products can help promote mechanization and agglomeration of agriculture, and reduce costs to promote exports[5]. Tan Jingrong and Pan Huaxi proposed that trade facilitation has a significant positive impact on China’s agricultural exports[6]. In addition, trade cooperation between countries also has a positive effect on promoting agricultural exports. Sun Lifang and Wei Suhao emphasized the impact of international cooperation and the promotion of inter-country differentiation on agricultural exports. However, these factors do not constitute the fundamental driving force for the growth of agricultural exports in a country[7-8]. Yan Xiaoting and Qi Chunjie found that whether the growth of China’s agricultural exports is driven by the quality margin or the quantity margin depends on the counter country of import, indicating that selecting a reasonable and effective destination country is necessary to scientific researches on the growth momentum of exports and setting of the export growth model[9].

This paper believes that most of the exports of agricultural products are to neighboring countries based on the consideration of transportation costs and preservation. Japan is a net importer of agricultural products, and is also a close neighbor of China, but China’s exports to Japan are relatively shrinking. It is necessary to conduct in-depth research. This paper uses historical data to examine the driving force of export growth of China’s agricultural products to Japan and its changes, analyzes the reasons behind, and decomposes the contribution rate of each margin in detail, in order to provide a basis idea for the sustainable development of China’s agricultural products.

3 Model and data

3.1ModelFirst, the proportion of the exporting countryj’s exports to the importing countrymin the reference countryk’s exports to the importing countrymis defined asRjm/km:

(1)

This paper considers China’s comparison with the world average, so the reference country is the world.IjmandIkmrepresent the collections of exported products from countryjto countrym, and from the world to countrym, respectively;PjmiandPkmirepresent the prices of products exported from countryjto countrym, and from the world to countrym, respectively; andXjmiandXkmirepresent the corresponding volumes of exports, respectively.

The extensive margin (breadth) of exports of countryjrefers to the ratio of the trade volume of exports from countryjto countrymto that from the world to countrym. The greater the ratio is, the more the varieties of products exported from countryjto country m are. The calculation formula is as follows:

(2)

The intensive margin of exports of countryjrefers to the proportion of the export volume of countryjin the world exports in terms of the same products exported from countryjand the world to countrym. The greater the proportion is, the more the export volume of countryjthan the rest of the world is (in overlapping exports). The calculation formula is as follows:

(3)

The intensive margin of countryjis further decomposed into price margin and quantity margin, and the formula is as follows:

IMjm=Pjm×Xjm

(4)

The price margin and quantity margin are measured by the following formulas, respectively:

(5)

(6)

The weightWjmiis obtained by the following formula:

(7)

(8)

(9)

whereSjmiandSkmirepresent the proportion of export value of productiin the total export value of countyjto countymand in the total export value of the world to countym, respectively.Wjmiis the logarithmic mean of both.

In summary, the market share of countryjin countrymcan be decomposed into extensive margin, price margin and quantity margin.

Rjm/km=EMjm×Pjm×Xjm

(10)

where the increase in any of the extensive margin, quantity margin and price margin will increase the market share of countryjin countrym. Therefore, the growth rate of countryj’s share of agricultural exports in countrymcan be obtained from first-order difference transformation of the above formula, as follows:

gm=gem+gp+gx

(11)

wheregem,gpandgxrepresent the growth rates of extensive margin, price margin and quantity margin, respectively. The sum of the three is the growth rate of market share of agricultural exports. The contribution rates of the three to the export trade of agricultural products can be expressed by formula (12):

(12)

3.2DatasourceandprocessingAt present, the research on agricultural product export mostly uses the HS6-coded in the CEPII-BACI database or the Uncomtrade database[10]. This paper believes that different databases may cause statistical differences due to standards, dimensions,etc. Thus, the most accurate reflection of the actual import and export trade of a country’s agricultural products should be the statistics of the importing countries themselves. In addition, the more subdivided the data is, the more accurate the ternary marginal analysis result is. Therefore, based on the 192 443 pieces of HS9-coded import data of agricultural products of Japanese Ministry of Finance (http:∥www.customs.go.jp/toukei/info/tsdl.htm) during 2001-2017, ternary marginal analysis was performed in this paper. In the process of data processing, the data about the agricultural products with export amount of zero were deleted. Since there were no more than three pieces of such data per year, very small portion compared to the overall data, the deletion of such data did not produce big impact on the final results.

4 Empirical results

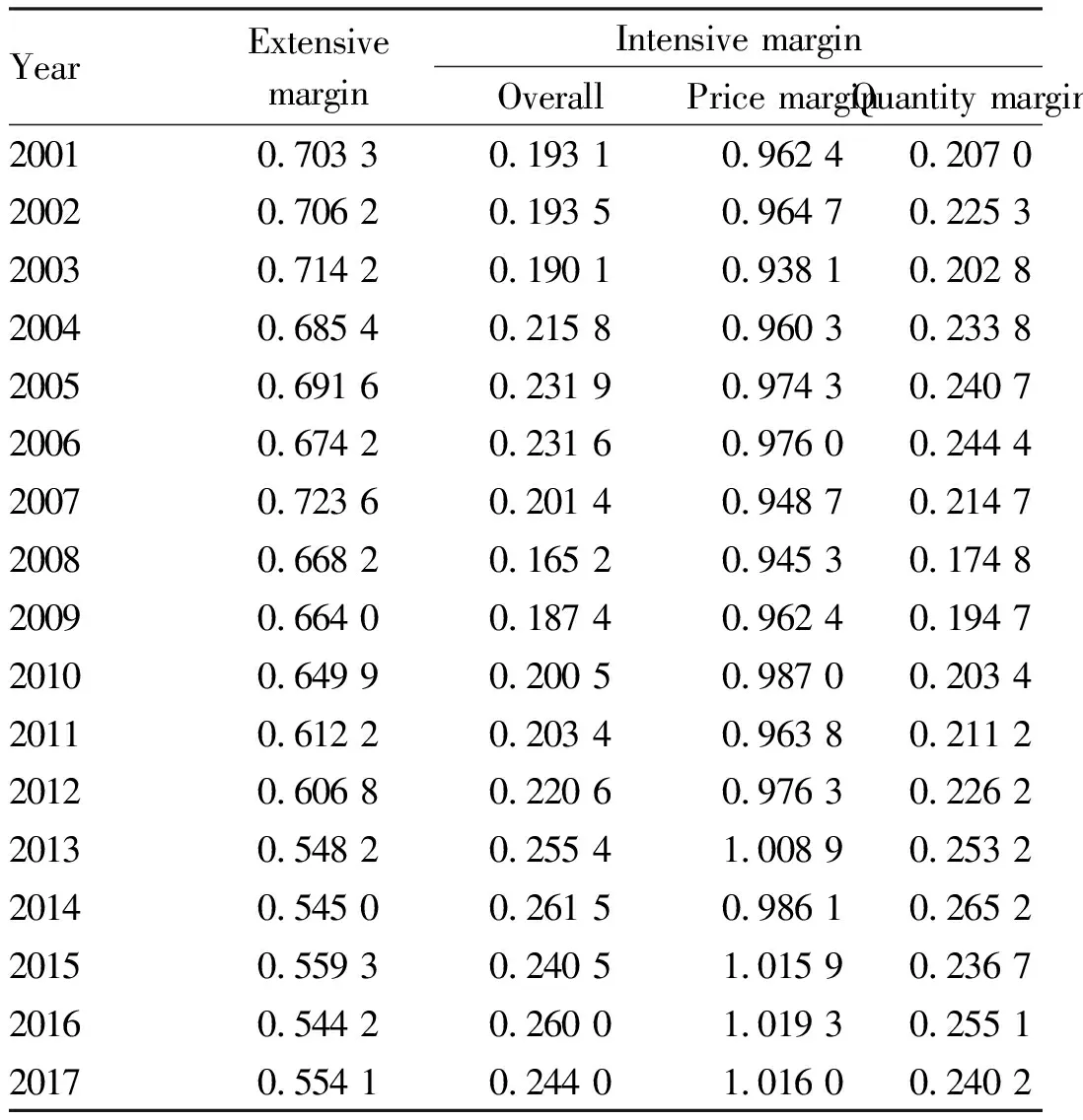

4.1StaticanalysisThe results of the static analysis showed that the extensive margin of China’s agricultural exports to Japan in 2001-2017 had shown a decline, the price margin first dropped and then slowly rose, and the quantity margin basically showed a trend of slowly rising.

Table 1 shows the overview of the ternary margins of each year. As shown in Table 1, the extensive margin of China’s agricultural exports was 0.703 3. This meant that in 2001, 70% of the agricultural products exported to Japan by the world faced the competition from China’s agricultural products; and in 2017, this proportion dropped to 55.4%, indicating that during this period, the varieties of China’s agricultural exports had been shrinking. Japan’s 15% of agricultural products imported from China in 2001 had been imported from other markets in 2017, and Chinese agricultural products had partially withdrawn from the Japanese market. In contrast, the intensive marginal growth of China’s agricultural exports to Japan was faster, from 0.193 1 in 2001 to 0.244 0 in 2017. The growth rate was 26.36%. After further decomposing the intensive margin, it was found that the marginal growth of the quantity was faster, and the growth rate was 16.04%. The growth rate of the price margin was small, only 5.57%. However, considering the absolute value of the price margin, after 2013, the average value of the price margin was over 1, suggesting that the price level of China’s agricultural exports to Japan was higher than the average level of world exports to Japan after 2013, and the overall quality of China’s agricultural exports to Japan had been improved. Some scholars believe that this quality improvement was the results of Japan’s strict SPS measures[11]. Therefore, although the growth rate of quantity margin was high, China’s agricultural exports to Japan still had the advantage in price. In terms of price, China’s agricultural exports to Japan were also improving year by year.

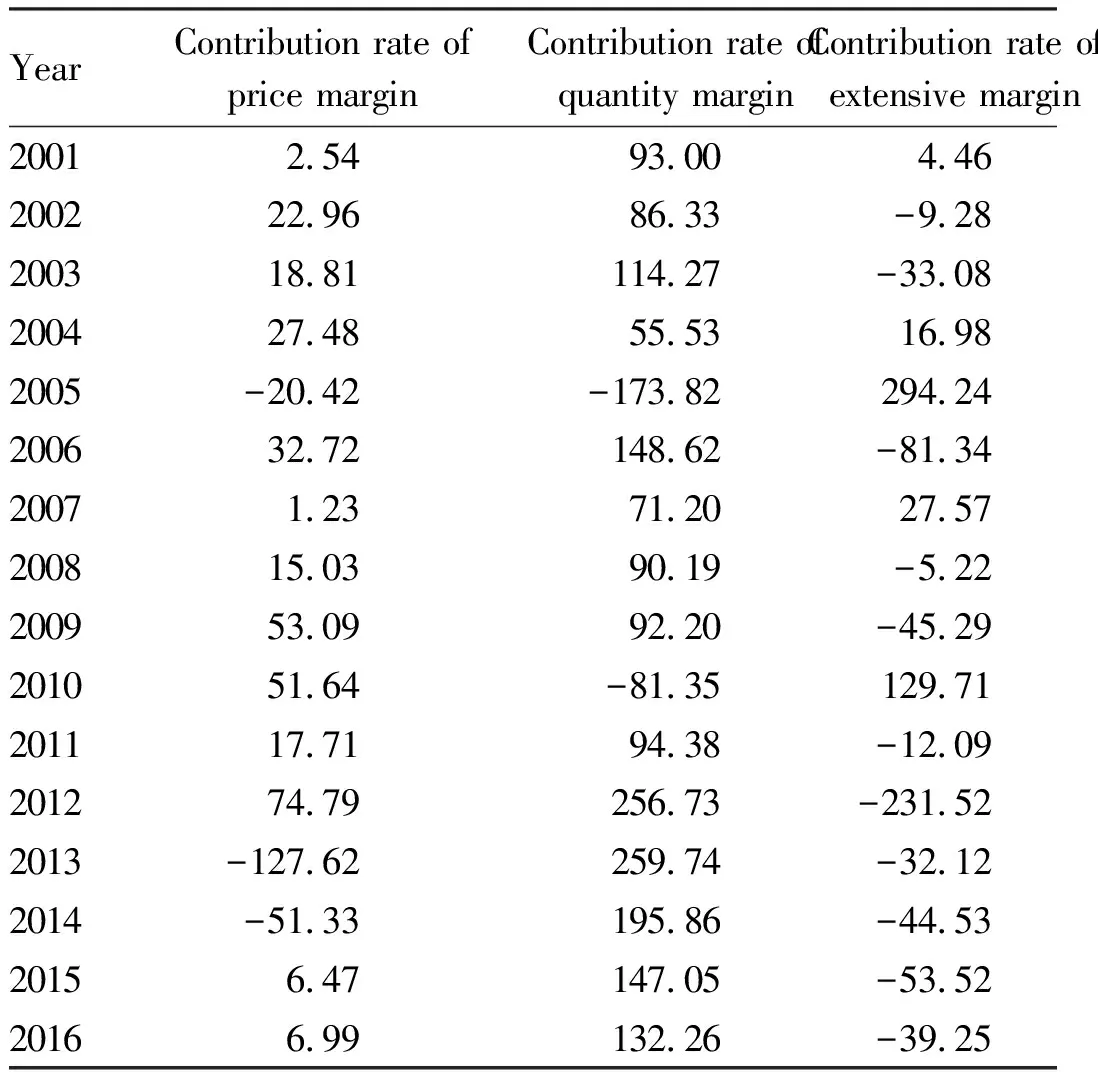

4.2DynamicanalysisDynamic analysis focuses on the contribution rate of each margin. During the sample period, the quantity margin had the highest contribution rate to the growth rate of China’s agricultural exports (Table 2). That is, the trade growth of China’s agricultural exports to Japan still depended mainly on the growth of the number of existing product categories, rather than the increase in new product categories or prices. During 2001 and 2016, for the growth of China’s agricultural exports to Japan, the average contribution rate of quantity growth was 98.89%, followed by that of price margin (8.26%), and the average contribution rate of extensive margin was negative. The quality of agricultural products reflected by the price margin had increased during this period. To a certain extent, it also promoted the export of Chinese agricultural products to Japan. The varieties of Chinese agricultural products exported to Japan had decreased, which had produced a negative impact on China’s agricultural exports to Japan as a whole.

Table1TernarymarginaldecompositionofChina’sagriculturalexportstoJapanduring2001-2017

YearExtensivemarginIntensive marginOverallPrice marginQuantity margin20010.703 30.193 10.962 40.207 020020.706 20.193 50.964 70.225 320030.714 20.190 10.938 10.202 820040.685 40.215 80.960 30.233 820050.691 60.231 90.974 30.240 720060.674 20.231 60.976 00.244 420070.723 60.201 40.948 70.214 720080.668 20.165 20.945 30.174 820090.664 00.187 40.962 40.194 720100.649 90.200 50.987 00.203 420110.612 20.203 40.963 80.211 220120.606 80.220 60.976 30.226 220130.548 20.255 41.008 90.253 220140.545 00.261 50.986 10.265 220150.559 30.240 51.015 90.236 720160.544 20.260 01.019 30.255 120170.554 10.244 01.016 00.240 2

From the perspective of ternary marginal contribution rates of each year, the contribution rate of quantity margin increased as a whole, and its average in recent years was even higher than 100%; the contribution rate of extensive margin was basically negative except two years from the period, indicating that the extensive margin had a negative effect on China’s export trade with Japan. The contribution rate of the price margin was positive on average. The contribution rate of price margin was higher during 2006-2012 and then decreased gradually. It suggested that China’s agricultural exports to Japan were insufficient in terms of price, and they had not been able to maintain their price advantage in the trade of agricultural products.

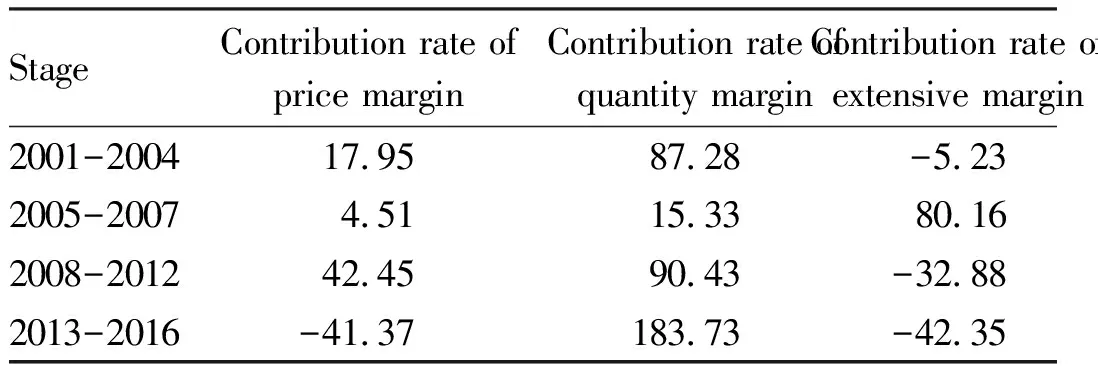

Due to the instability of economic data, based on important time nodes (China jointed the WTO in 2001, the Japanese Positive List System was issued and implemented between 2005 and 2006, and financial crisis broke out in 2008), this paper divided the sample period into four stages, 2001-2004, 2005-2007, 2008-2012, and 2013-2016 to examine the stability of the above conclusions (Table 3). The results showed that the decisive factor for the export of Chinese agricultural products to Japan at different stages was still the quantity margin. Specifically, after China’s accession to the WTO, the quantity margin had always maintained the highest contribution rate. In 2005-2007, after the promulgation and implementation of the Positive List System, Japan has substantially increased its pesticide content standards for imported agricultural products, and increased the requirements for the control of agricultural production processes. These standards and requirements have increased the time cost of China’s agricultural exports to Japan, thus the quantity margin plummeted. After the 2008 financial crisis, the contribution rate of quantity margin had increased again, and the contribution rate of price margin had also increased significantly. In this stage, in order to adapt to the standards of the Japanese Positive List System, Chinese enterprises had improved the quality of agricultural products exported to Japan, so that the contribution rate of price margin had increased. The contribution rate of the extensive margin was always negative except during 2005-2007, suggesting that China’s agricultural export structure had been gradually centralized, while the concentration of export products was not conducive to the growth of China’s agricultural exports to Japan. On the other hand, the shrinking of China’s agricultural exports to Japan since 2001 was mainly due to the reduction of varieties of agricultural exports. Since the new century, Japan has continued to strengthen its SPS measures to control the import of agricultural products. China’s agricultural products have partially withdrawn from the Japanese market due to rising costs and falling export profits, turning to Southeast Asian market instead[12].

Table2TernarymarginalcontributionratesofChina’sagriculturalexportstoJapanduring2001-2016(%)

Table3TernarymarginalcontributionratesofChina’sagriculturalexportstoJapanatdifferentstages(%)

5 Conclusions and discussions

Combined with the status of China’s agricultural exports to Japan, based on the HS9-coded of the Japanese Ministry of Finance, the contribution rates of extensive margin, quantity margin and price margin to export growth were calculated. The results showed that the export of Chinese agricultural products to Japan had mainly relied on the quantity margin since 2001, and the price margin had reached the world average of exports to Japan after 2013, suggesting that Chinese agricultural products had certain competitiveness in the Japanese market. However, the extensive margin had been decreasing year by year overall, indicating that the varieties of Chinese agricultural products exported to Japan had decreased. In terms of contribution rates of the ternary margins, the quantity margin had contributed the most to China’s agricultural exports to Japan. After the implementation of the Positive List System, the contribution rate of the quantity margin to agricultural exports has declined, indicating that the promulgation of relevant food safety regulations in Japan has a significant negative effect on China’s agricultural exports. The price margin had contributed little to China’s agricultural exports. In recent years, China’s exports of agricultural products to Japan have improved in price and quality.

Based on the above conclusions, this paper believes that measures should be taken to enhance the competitiveness of agricultural products. First, while maintaining the quantity of exports, the quality of agricultural products should be promoted, the investment in agricultural scientific research and technology should be strengthened, and the deep processing of agricultural products should be promoted, thus fundamentally enhancing the competitiveness of China’s agricultural products. Second, from the breadth of the varieties of agricultural products, China should continue to enrich the varieties of agricultural products exported to Japan and vigorously develop green agricultural products. As consumers’ living standards continue to improve, consumer orientation is crucial. The varieties of agricultural exports should be expanded to meet the different preferences of consumers. Third, an information sharing mechanism for agricultural products should be established to improve the communication of information. At present, due to lack of information exchange mechanisms, insufficient transparency and limited information release, the efficiency of China’s agricultural product export market has been reduced, the production and export costs have increased, and many agricultural export enterprises have no access to information. Therefore, establishing an effective and transparent market is conducive to strengthening cooperation in the future.

杂志排行

Asian Agricultural Research的其它文章

- Design and Realization of Communication Platform"CDream Creating a Dream"for College Students

- Economic Value Evaluation of Fine Individual Plants ofRibesrubrum Linn.Based on AHP

- Profit Delivery Proportion,Operation Performance and Bond Rating of Agricultural State-owned Enterprises

- Causes of Recurrence of RiceChilosuppressalis(Walker)in Longyou County and Prevention and Control Measures

- Effects of Bacterial Manure from Cassava Alcohol Fermentation Mash on Yield and Starch Content of Cassava

- Landscape Space Creation of Red Star·Xintiandi Exhibition Area in Liuzhou