Profit Delivery Proportion,Operation Performance and Bond Rating of Agricultural State-owned Enterprises

2019-03-20,

,

College of Economics and Management, Huazhong Agricultural University, Wuhan 430070, China

Abstract The distribution relationship between the profits of state-owned enterprises and the state has been constantly changing with the times. From the state implementing the policy that state-owned enterprises not pay profits to the state in 1994 to the constant growth of state-owned enterprises in the 21st century, their profits have become more and more abundant. Until 2007, the state issued a document stipulates that the state-owned enterprises should pay part of their profits to the state, but at the initial stage of trial implementation of the policy, the implementation was not effective, and finally in 2010 the state officially announced the collection of profits from state-owned enterprises and increased the proportion of collection. From the perspective of agricultural state-owned enterprises, using the difference-in-difference (DID) model, this paper studied the state policy of increasing the profit delivery proportion of state-owned enterprises in 2020. Through CSMAR database, we selected agricultural state-owned listed companies in the 2008-2013 as samples, tested the impact of the implementation of the new policy in 2010 on the operation performance of agricultural state-owned enterprises, evaluated the implementation effect of the policy through comparing the operation performance before and after the policy, and explored whether the policy has an impact on the bond rating. Through empirical research, it found that increasing the profit delivery proportion of state-owned enterprises is helpful for improving the operation performance of state-owned enterprises and improving the quality of bond ratings, and this policy has more prominent effects on stimulating the performance of monopolistic state-owned enterprises. Therefore, collection of some profits from state-owned enterprises can promote better development of state-owned enterprises and also benefit both the state and the people.

Key words State-owned enterprises, Operation performance, Profit delivery, Bond rating

1 Introduction

The assets of state-owned enterprises are invested by the state and thus belong to the state. However, state-owned enterprises are also established by the state to protect social development and thus belong to the whole people of the society. Besides, state-owned enterprises not only get profit from their own business activities, but also enjoy the subsidies provided by the government. The government, as a "referee" to safeguard social justice, has the administrative power to manage state-owned enterprises, and can also formulate rules for distributing "cakes" to pursue its own interests. In order to prevent spread of rent-seeking and unfair distribution, the problem of reasonable income distribution system and the profit delivery of state-owned enterprises are urgent to be solved. In the 1990s, state-owned enterprises got into difficulties, and most of them suffered losses. The state stipulated that state-owned enterprises may not deliver their retained profits to reduce the pressure of enterprises. With the deepening of the reform of state-owned enterprises, state-owned enterprises have made great progress and achieved profits of more than 1 000 billion yuan by 2006. State-owned enterprises have grown into strong national "eldest son", and the problem of profit distribution between the state and state-owned enterprises has become a hot spot once again.

As early as the beginning of the founding of the people’s Republic of China, the profit distribution system connected with the profit delivery proportion of state-owned enterprises and the destination of profits was introduced, and reforms were constantly changed and reformed. The specific development process is as follows. From 1951 to 1978, the profit system included unified income, incentive fund system, profit retention system, and enterprise fund system. At this stage, state-owned enterprises need to pay most of their profits. From 1983 to 1994, the profit system included replacement of profit delivery by taxes, and separation of profit from tax. At this stage, state-owned enterprises did not pay retained profits. Since 2007, state-owned enterprises have been divided into four types, and each type of enterprises should delivery profits in specified proportion, and the proportion was increased in 2010, 2012, and 2014, respectively.

These profit distribution systems have different historical characteristics with different times, but they all reflect the financial allocation relationship between state-owned enterprises and the government. When the national economy is backward, state-owned enterprises pay more to support the country, and when the state-owned enterprises have difficulties, the state suspends the distribution of dividends. As an important foundation for national development, state-owned enterprises should make progress and retreat with the state and the people. However, in recent years, criticism about the high wages of state-owned enterprise executives and the waste of state-owned enterprises can be heard without end, the state-owned enterprises have already had the ability to pay profits to the state, and the voices of the masses demanding state-owned enterprises to return to the country become higher and higher. In this situation, the Ministry of Finance and the State-owned Assets Supervision and Administration Commission of the State Council issued theInterimMeasuresfortheAdministrationoftheCollectionofProceedsfromState-ownedCapitalofCentralEnterprises, stipulating that the state-owned capital of central state-owned enterprises shall be paid in three proportions, which ended the history of the state-owned enterprises not paying profits for several decades. Three years after the trial of the policy, on November 3, 2010, the State Council executive meeting decided for the first time to increase the proportion of state-owned capital gains collected by state from central enterprises and expand the scope of collection. In April 2014, the Ministry of Finance further increased the proportion of collection. The highest proportion of the company (up to 25%) was China National Tobacco Corporation. InGuidingOpinionsonDeepeningtheReformofState-ownedEnterprisesissuedbytheCPCCentralCommitteeandtheStateCouncilin April of 2015, it stipulated that the profit delivery proportion of state-owned enterprises would be increased further. The original intention of these series of policies is to increase the efficiency of state-owned enterprises and promote social equity. It is time for state-owned enterprises to return to the state and people. Implementing these policies will not only benefit the society, but also is favorable for the state-owned enterprises to optimize their own structure and realize comprehensive development.

Since the recovery of the profit delivery of state-owned enterprises in 2007, the delivery proportion has been continuously increasing. How does state-owned enterprises respond, and how about the effect on the development of state-owned enterprises, and whether the original intention of the policies can be achieved? These problems are worthy of our attention. In 2010 the state increased the proportion of collection for the first time. In this paper, we would test the influence of implementation of this policy on the operation performance of state-owned enterprises, objectively evaluate the implementation effect through comparing the operation performance before and after the policy implementation, so as to come up with some empirical evidences and theoretical recommendations for improving the profit distribution relationship between the state and state-owned enterprises and improving the management mode of state-owned enterprises.

2 Literature review

2.1Foreignliteratureontheprofitdeliverysystemandoperationperformanceofstate-ownedenterprisesIn fact, the state-owned enterprises are not unique to China. There is also the concept of state-owned enterprises in the world. Foreign state-owned enterprises have different profit delivery system. In Italy, the general principle of profit distribution of state-owned enterprises is that 65% of annual profits should be turned over to the country. In the United States, the operation mode of state-owned enterprises is flexible, and the law stipulates that they do not have to turn over profits, but they may voluntarily turn over their profits to the local state government to benefit the people. In Sweden, state-owned enterprises adopt the state holding or shareholding, and the government can obtain dividends like other shareholders. However, since state-owned enterprises are not universal in the West, there are few studies about the system of state-owned enterprises paying profits to the state, but the studies on the impact of corporate dividend policy are extensive.

From theories, Vernon analyzed the dilemma of the relationship between state-owned enterprises and the government. In the first place, the government supports state-owned enterprises and sets a series of goals for the development of state-owned enterprises. Therefore, unlike private enterprises, obtaining profits is not the sole goal of state-owned enterprises[1]. As a result, the management of the government over state-owned enterprises has become a problem. In the second place, he used the case of Air France refusing the passenger aircraft selected by the French government in 1974-1978, and stated that most state-owned enterprises would undertake the tasks of monopoly industries such as national manufacturing, railways and public facilities, and to ensure the stable development of the country and social undertakings. State-owned enterprises have a certain ability to negotiate in response to national profits and other policies, which is also a difficult problem when the state issues the profit delivery policy.

Lang, Larry and Litzenberger defined Tobin Q value lower than 1 as an excessive investment level. Through empirically studying the enterprise’s dividend policy, and testing companies with change of dividend greater than 10%, it found that distributing cash dividends and reducing free cash holdings can limit the company’s motive of excessive investment, increase the wealth of investors, can also increase corporate value and improve the operation performance[2]. Harry, Linda and Skinner studied the dividend decisions of 145 companies listed in New York Stock Exchange. Through empirical test using various normative models, the results showed that 99 companies (68.3%) still decided to increase dividends during the year when the annual income declined for many years, and 67 of them increased their dividends, which was higher that in the peak income year, indicating that the dividend increase does not mean that the company’s profit prospects are optimistic, which undermines the reliability of the dividend signal, in other words, the company would still be willing to pay cash to increase dividends when their profit growth prospects are not optimistic[3].

2.2Domesticliteratureontheprofitdeliverysystemandoperationperformanceofstate-ownedenterprisesDomestic scholars have studied a wide range of issues related to the reform of state-owned enterprises and the distribution of profits of state-owned enterprises. In the study of the impact of the profit delivery system on state-owned enterprises, scholars have analyzed the significance of the introduction of the profit delivery system and the continuous reform of policies.

2.2.1Related literature of theoretical analysis. The following literature analyzed from a theoretical perspective, and studied the reform on profit delivery system of the state-owned enterprises and its impact on the operation performance of state-owned enterprises. Li Youzhong analyzed why state-owned capital needs to share the benefits. He believed that the collection of state-owned enterprises is favorable for adjusting the state-owned economic structure and the key is to make the state-owned enterprises in different industries have a unified assessment standard, which is favorable for improving the operation performance of state-owned enterprises[4]. From the perspective of the government as a major shareholder of state-owned enterprises, Liu Wei and Cai Zhizhou stated that the use of dividends to shareholders to assess the shareholders’ profit maximization indicators measured the performance of enterprises, thus, state-owned enterprises distributing dividends to the government is an important sign of enterprise development[5]. Through summarizing the practices of western countries, Wang Ping, Li Guanggui and Yuan Chen analyzed China’s state-owned enterprise dividend policy and concluded that the state-owned enterprise dividend policy can optimize the development of the entire state-owned economy, adjust the financial status of state-owned enterprises, and promote the sustainable development of state-owned enterprises[6]. In addition, they stated that there is lack of sufficient theoretical support for how to determine the specific and most appropriate dividend ratio. Therefore, the problem of determining the optimal dividend ratio should be further explored in future practice and theoretical research.

2.2.2Related literature of empirical analysis. The literature of empirical analysis is mainly to test the effect of the profit delivery policy of state-owned enterprises. In line withInterimMeasuresfortheAdministrationoftheCollectionofProceedsfromState-ownedCapitalofCentralEnterprisesissued in 2007, Zhang Jianhua and Wang Juncai, using the group regression method, tested the policy effect; based on the data before and after the implementation of the policy, taking state-owned listed companies from 2006 to 2009 as samples, they divided the data before and after the policy implementation into two groups to compare the policy effect before and after the implementation of the policy, and the regression results showed the positive correlation between the state-owned enterprises turning over the profits and the performance of the enterprises after the implementation of the measures was significantly improved[7].

The following literature empirically analyzed the impact of state-owned enterprises’ profits on their operation performance from different impact paths. The results of different impact path analysis indicate that they have positive effects on corporate performance. Wei Minghai and Liu Jianhua carried out an empirical analysis from the perspective of reducing cash flow and thus suppressing excessive investment. Taking the state-owned listed companies from 2001 to 2004 as samples, using the Richardson model (2006) to measure excessive investment and testing the relationship between state-owned cash dividend policy and over-investment. The results indicate that increasing the cash dividend level of state-owned enterprises and reducing the free cash flow that can be controlled by enterprises can strengthen the supervision of the remaining retained profits of state-owned enterprises and can inhibit excessive investment. Besides, they found that there indicates no favorable condition when state-owned listed companies retain too much profit in their hands and do not improve their profitability[8]. Based on the financial data of 306 state-controlled listed companies from 2009 to 2012, Jiao Jianetal. made an empirical analysis and concluded that the state-owned enterprise dividend policy can enhance the value of state-owned enterprises from the perspective of suppressing excessive investment[9]. Through combining the profit delivery system of state-owned enterprises with the on-the-job consumption, Luo Hong and Huang Wenhua explored the impact on the performance of state-owned enterprises. Based on the data of state-owned listed companies from 2003 to 2006, the empirical study found that the profit delivery system of state-owned enterprises suppressed on-the-job consumption of executives, while the level of on-the-job consumption has a negative impact on the performance of enterprises, so the profit delivery proportion of state-owned enterprises has improved the performance of state-owned enterprises by reducing the level of on-the-job consumption[10]. Based on the theory of sustainable growth, Yang Hanming discussed the relationship between the profit delivery system and performance of state-owned enterprises. He found that the sustainable growth is the continuous increase of corporate value in the future. Through the comparison of the results of state holding listed companies and non-state-owned enterprises, it is concluded that there is a positive correlation between the state-owned enterprises turning over profits to the state and the sustainable growth of state-owned enterprises, and the future sustainable growth of state-owned enterprises to distribute profits to the state is favorable for improving the operation performance of state-owned enterprises[11].

The analysis results of the following literature indicate that the existing profit delivery system of state-owned enterprises has an effect on improving corporate performance, but the effect is not significant. In order to further test the effect of the profit delivery system of state-owned enterprises, Wang Jiajieetal. expanded the sample selection period. Based on the state-owned listed companies from 2004 to 2012, they made an empirical study and concluded that raising the profit delivery proportion of state-owned enterprises can inhibit the excessive investment of enterprises and accordingly influence the performance of state-owned enterprises[12], which is similar to the above-mentioned literature . Ma Lei studied the impact of state-owned enterprise dividend policy on profit management. Taking the period of 2007 to 2008 as the data period, the sample selected the 2007 policy implementation of state-owned enterprises and state-owned enterprises that did not implement policies as the control, using the modified Jones model, he tested the surplus management behavior and found that after the implementation of the policy, the enterprise will obviously increase the profit management. Further testing indicates that the larger the scale of the assets, the greater the degree of influence by the policy. Therefore, it is considered that by the time for the trial of the three-year profit delivery policy up to 2010, the policy still has shortage and experience is to be accumulated and further improved[13]. In the doctoral thesis, Li Jing divided the state-owned listed companies from 2005 to 2008 into three categories according to the control of central state-owned enterprises, local state-owned enterprises and private property rights control, and found that state-owned enterprises had negative profit management behavior after the implementation of the state-owned enterprise dividend policy, that is, state-owned enterprises will reduce the profits paid to the state and retain more cash flow in their hands, which weakens the suppression of state-owned enterprises’ profit delivery system over the excessive investment and on-the-job consumption and affects the performance of state-owned enterprises and the effect of policies[14].

2.3Literatureonthemonopolisticstate-ownedenterprisesandoperationperformanceState-owned enterprises in monopoly industries are strong and play an important role in the process of China’s economic operation, especially in their own industry, the monopoly position is significant, and they can obtain huge monopoly profits. Using the industry concentration, Cowling and Waterston measured the monopoly degree of enterprises and found that the higher the monopoly level of the industry, the higher the profit they earn, and the higher the operation performance of the monopolistic enterprises[15]. Using the financial data of UK listed companies, Dimson and Marsh analyzed the relationship between the company’s stock return and the size of the company, and found that the larger the company, the higher the stock yield, the better their performance, and compared with the non-monopolistic enterprises, monopolistic enterprises are large in size, so their performance will be better[16]. Kong Dongming and Xiao Tusheng carried out an empirical study on the changes in the performance of the company’s monopoly expansion, and concluded that there is a linear positive correlation between industry monopoly and company performance, and monopoly has an inverted U-shaped effect on company performance[17]. In other words, the industry monopoly brings more monopoly income to the enterprise on the whole, but when it is below a critical point, the performance of the enterprise increases with the increase of the monopoly level. If it exceeds this critical point, the performance of the enterprise will decline with the increase in the level of monopoly, and the critical point between different industries is different. Thus, it is concluded that the impact of monopoly on the performance level of enterprises is both advantageous and disadvantageous.

2.4LiteraturereviewFrom extensive studies, it can be found that state-owned enterprises in western countries generally have a higher profit delivery proportion, and the decisions made by enterprises themselves tend to be willing to pay profits to benefit the people, while the profits of the state-owned enterprises in China delivered to the state are relatively low, and it is also a mandatory requirement of the state, rather than the voluntary performance of state-owned enterprises. Therefore, scholars in China should not merely compare or accept western theories, but should carry out studies in accordance with the actual situations of China. In addition, the test of policy effects should not be limited to the short period before and after the implementation of policies. For example, Jiao Jian and Li Jing used only four years of data for research. The sample period was too short and did not take into account the adjustment time of the response measures of enterprises, so it needs further research and test[9, 14]. Zhang Jianhua and Wang Juncai also used only four years of data and made the regression analysis before and after the implementation of policy. It may not exclude the different interference factors of enterprises at different times. The investment rate of new fixed assets is used to measure the level of excessive investment. There is also a lack of rich theoretical support, so it may affect the reliability of the test of policy effects[7]. Considering these, we adopted a total of six years of data before and after the implementation of policy, and used the difference-in-differences (DID) model to eliminate all interference factors to study the effect of increasing the profit delivery proportion of state-owned enterprises in 2010.

3 Empirical design

From the above-mentioned literature, we know that no matter from which perspective, profit delivery of state-owned enterprises is favorable for improving the performance of state-owned enterprises. Although some papers pointed out that the effect of the current policy is not obvious, it may be due to the fact that the policy needs to be improved, but we should not completely negate the necessity of the current policy. We tested the policy effect through selecting data from state-owned listed companies from 2008 to 2013. According to theNoticeonImprovingtheRelevantMattersConcerningtheCentralState-ownedCapitalOperatingBudget(Cai Qi[2010]No. 392), a total of 128 enterprises were collected with increase of profit delivery proportion. Such enterprises include four categories. The first category is industrial enterprises with monopolistic characteristics of resources such as tobacco, telecommunications, petroleum and petrochemicals, coal, electricity,etc., and the profit delivery proportion is 15% of the company’s after-tax profits. The second category is general competitive industry enterprises such as transportation, steel, trade, construction, electronics,etc., and the profit delivery proportion is 10%. The third category is mainly military enterprises and research institutions, and the profit delivery proportion is 5%. The fourth category includes China Grain Reserves Group Limited Company and China National Cotton Reserves Corporation, and these two companies continue to be exempted from paying the state-owned capital gains that was implemented since 2007.

3.1ProposalofhypothesesBased on the above literature, we put forward the following hypotheses. Hypothesis 1: increasing the profit delivery proportion of state-owned enterprises is helpful for improving the operation performance of state-owned enterprises. Besides, because the first category of state-owned enterprises in the policy is an industry enterprise with monopolistic characteristics, it can be considered from the above literature that compared with the second category competitive state-owned enterprises, monopolistic state-owned enterprises have stronger ability to obtain profits and higher performance, then improvement of performance of state-owned enterprises may come from monopolistic state-owned enterprises.

Hypothesis 2: The effect of policy of increasing the profit delivery proportion on the operation performance of the first category of state-owned enterprises is significantly higher than that of the second category of state-owned enterprises.

3.1.1Sample selection and data source. In the document issued in 2007 to collect state-owned capital gains, the maximum rate of collection is not more than 10%, and 34 third category enterprises can be suspended for payment for three years. However, in the second year of the collection of state-owned capital gains, due to the impact of the international economic crisis, the profits of state-owned enterprises fell, and many enterprises applied to the Ministry of Finance for the reduction of payment of profits, so the implementation of policies in 2007 was not well in place. Till 2010, the state increased the rate of collection, clearly listed enterprises of four categories, and the policy was not trial implementation any more, but was strictly mandatory implementation. Therefore, we initially selected the data of this list of companies in the 2010 to analyze the impact of policy reform. In order to study the behavior of state-owned enterprises before and after the implementation of the policy, we selected the data of the three-year period before and after 2010, that is, the period from 2008 to 2013 is the data selection period.

Because the purpose of this paper is study the impact of increase of the profit delivery proportion on the operation behavior of state-owned enterprises, while the third category of enterprises do not focus on commercial profit operations, the fourth category does not turn over profits, so the third and fourth categories of enterprises were not used as samples in this study. In the sample data of the first and second categories of enterprises selected in this study, in order to ensure the availability and completeness of the data, the following enterprises were excluded: the enterprises that have not been officially listed during the data selection period (2008-2013); listed companies in the holding company ST; companies that are not listed on the A-share market, and enterprises that are lack of data; listed companies whose holdings are less than 50% and are not as the largest shareholder.

Data in this paper was mainly sourced from China Stock Market Accounting Research (CSMAR) database of GUO TAI AN Information Technology Co., Ltd. The data not available in this database was supplemented by websites of Shanghai Stock Exchange and Shenzhen Stock Exchange. We obtained panel data of 90 effective listed companies for a total of six years.

3.2VariableandmodeldescriptionTo evaluate the impact of a policy on the economy, the difference-in-differences (DID) model is often used. In this study, two category of enterprises with different profit delivery proportions in the policy were divided into two groups, represented as "treated". The first category of state-owned enterprises was assigned with the value of 1, and the second category of state-owned enterprises was assigned with value of 0. Besides, the time before and after the implementation of the policy was represented byt, the year before the implementation of the policy of increasing the rate of increase was 0, and the value of the year after implementation was 1.t×treatedis the cross-term of two categories of state-owned enterprise dummy variables and the year before and after the implementation of the policy. In the DID model, the coefficient γ of the cross-term is the difference between the first category of state-owned enterprise and the second category of state-owned enterprise before and after implementation of the policy. The difference represents the processing effect and indicates the difference between the two after the implementation of the policy, that is, the effect after the implementation of the policy.

3.2.1Explained variables. The explained variables in this study are the operation performance of two categories of state-owned enterprises, expressed in terms of ROA total return on assets. The operation performance of the enterprise reflects the operation benefit level. One of the accepted accounting indicators for measuring the profitability and operation performance of the enterprise is the return on total assets. Therefore, we used the total return on assets (ROA) to represent the operation performance of the state-owned enterprises, as the explained variable.

3.2.2Explanatory variables. To study the impact of the policy of increasing the profit delivery proportion on the operation performance of state-owned enterprises, we introduced two dummy variables.tdenotes the time before and after the implementation of the policy,treateddenotes the enterprise in the list of certain category of state-owned enterprises, DID model was used.

(i)treated=0,t=0, representing the second category of state-owned enterprises before the implementation of the profit delivery proportion increase policy.

(ii)treated=0,t=1, representing the second category of state-owned enterprises after the implementation of the profit delivery proportion increase policy.

(iii)treated=1,t=0, representing the the first category of state-owned enterprises before the implementation of the profit delivery proportion increase policy.

(iv)treated=1,t=1, representing the the first category of state-owned enterprises after the implementation of the profit delivery proportion increase policy.

t×treatedis the product cross term of two dummy variables, and the coefficient of the cross term represents the DID processing effect.

(i)t×treated=0, representing all other cases except for the first category of state-owned enterprises after the implementation of the profit delivery proportion increase policy.

(ii)t×treated=1, representing the the first category of state-owned enterprises after the implementation of the profit delivery proportion increase policy.

3.2.3Control variables. (i) Enterprise size. The operation performance of an enterprise is related to the size of the state-owned enterprise. Generally, the enterprise with a larger size may be affected by the scale effect, and will have better performance. We used LNSIZE to indicate the size of a state-owned enterprise, where SIZE represents the total assets of the enterprise. (ii) Capital structure. Both the MM theorem and the trade-off theory explain the relationship between capital structure and corporate value. The asset-liability ratio, as an important indicator of capital outcome, reflects the company’s solvency, and also reflects the company’s governance model, accordingly affects the operation performance. Therefore, we took the capital structure as one of the control variables, and used the asset-liability ratio (LEV) to measure the capital structure of state-owned enterprises. (iii) Macro-economic environment. All enterprises stay in a macroeconomic environment. The comprehensive results of domestic investment and consumption will be reflected in the GDP data. Macroeconomic fluctuations will generally affect the operation performance of enterprises. As an important pillar of the national economy, state-owned enterprises may also be affected by macroeconomic fluctuations. We usedLNGDP to represent the macroeconomic environment, where GDP represents the macro annual gross domestic product, and the data were selected from the official website of the National Bureau of Statistics.

3.3ResearchmodelIn order to examine how policy implementation affects the performance of state-owned enterprises, we built the following DID model:

ROA=β1+β2t+β3treated+β4treated×t+β5LEV+β6LN(size)+β7LN(GDP) +ε

whereβ1denotes the constant term,β2-β7denotes the coefficient of each variable, ε denotes residual error,β4is the degree of impact.

4 Empirical results and analysis

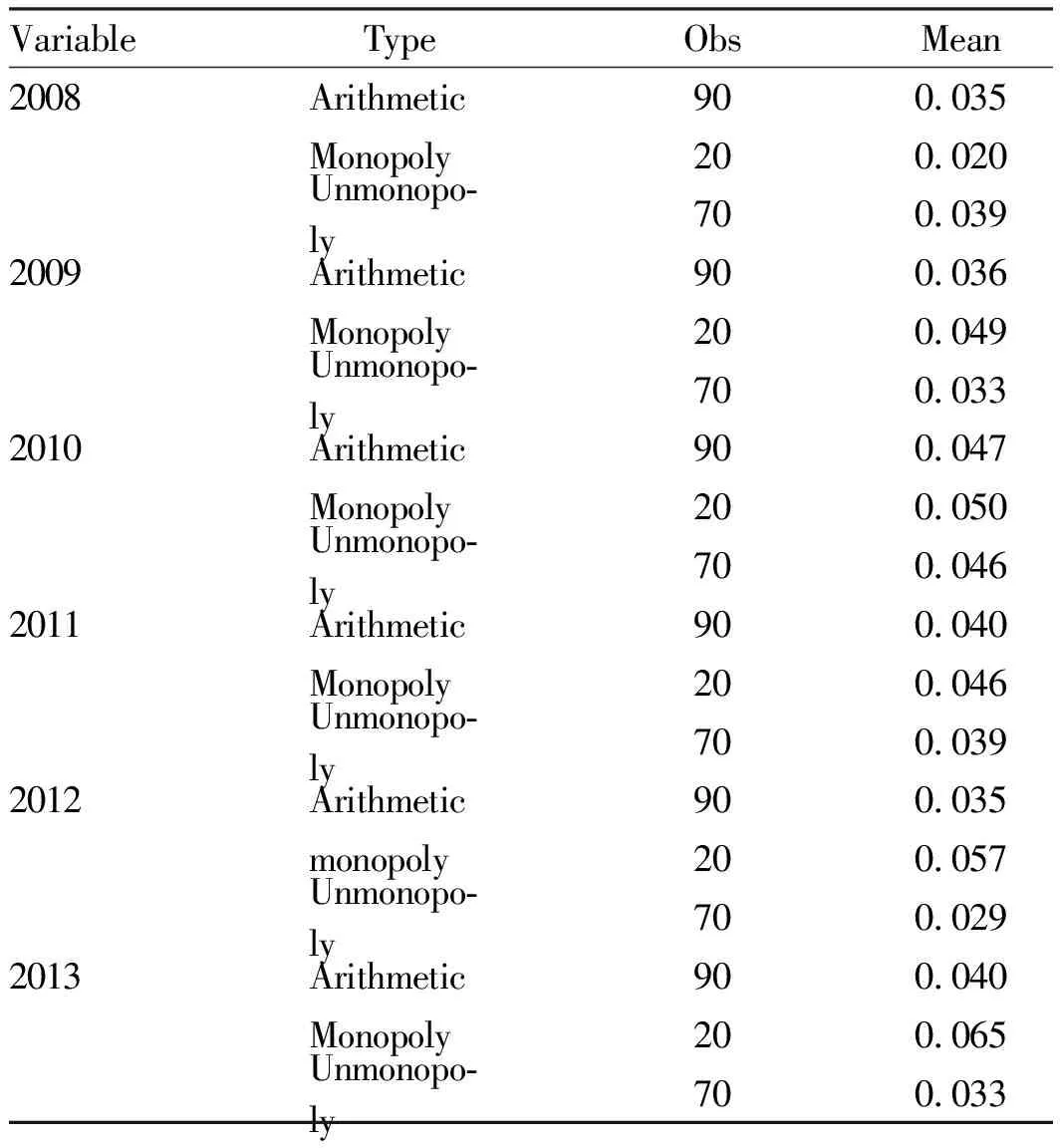

4.1DescriptivestatisticsIn this paper, we studied the effects of policy of the profit delivery increase implemented since 2010. Table 1 lists the average results of the ROA of the first category of state-owned enterprises (SOEs) and the second category of SOEs from 2008 to 2013 using the stata13 software. There was no significant change in the overall operation performance of all enterprises. For the first category of state-owned enterprises and the second category of state-owned enterprises, there was no significant difference in their performance before the implementation of the policy in 2010. However, after the implementation of the policy, the difference between the first category of state-owned enterprises and the second category of state-owned enterprises was significant. The performance of the first category of state-owned enterprises after the implementation of the policy has increased significantly compared with the second category of state-owned enterprises. This also shows that the Hypothesis 2 proposed in this paper holds true.

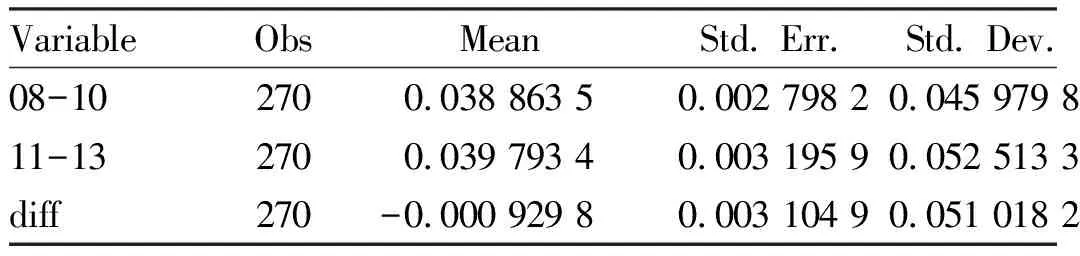

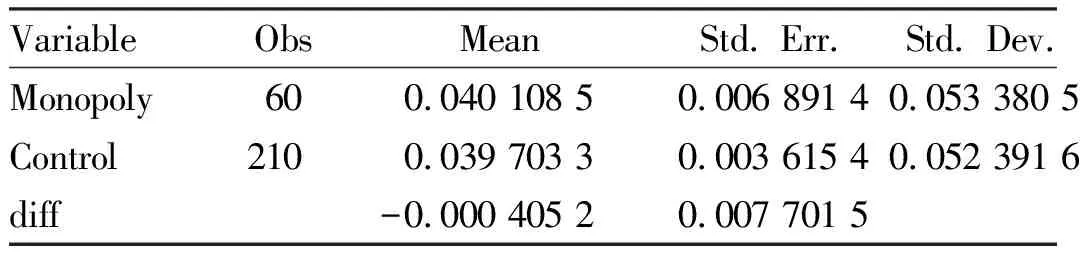

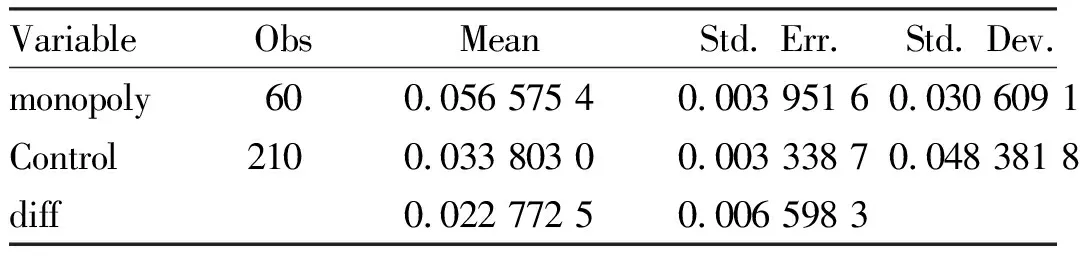

4.2TestofthemeandifferenceIn this study, we tested the mean value of the three groups of data. The results are shown in Table 2. The first group of tables is the mean value analysis of the operation performance before and after the implementation of the policy. Tables 3 and 4 indicate the comparison of the operation performance mean value between the first category of state-owned enterprises and the second category of state-owned enterprises before and after the implementation of the policy. For all enterprises, after the implementation of the policy, their operation performance has increased to a certain extent, theTvalue was -0.299 5, the difference was not significant, so it can be believed that the implementation of the policy has improved the operation performance of the company to a certain extent, but the increase is not obvious. For the first category of state-owned enterprises and the second category of state-owned enterprises, there was no significant difference in their performance before the implementation of the policy andT=0.052 6. However, after the implementation of the policy, the operation performance of the first category of state-owned enterprises was higher than that of the second category of state-owned enterprises,T=3.451 3, and the absolute value was larger than 1.645, so it can be deemed that the performance of the first category of state-owned enterprises after the implementation of the policy was significantly higher than that of the second category of state-owned enterprises. This also verifies the Hypothesis 2 proposed in this paper.

Table1DescriptionofaverageROAofoperationperformanceofthefirstcategoryandsecondcategoryofSOEs

VariableTypeObsMean2008Arithmetic900.035Monopoly200.020Unmonopo-ly700.0392009Arithmetic900.036Monopoly200.049Unmonopo-ly700.0332010Arithmetic900.047Monopoly200.050Unmonopo-ly700.0462011Arithmetic900.040Monopoly200.046Unmonopo-ly700.0392012Arithmetic900.035monopoly200.057Unmonopo-ly700.0292013Arithmetic900.040Monopoly200.065Unmonopo-ly700.033

Table2Testofthemeandifferenceofoperationperformancebeforeandaftertheimplementationofthepolicyforallenterprises

VariableObsMeanStd. Err. Std. Dev.08-102700.038 863 50.002 798 20.045 979 811-132700.039 793 40.003 195 90.052 513 3diff270-0.000 929 80.003 104 90.051 018 2

Note:t=-0.299 5.

Table3TestofmeandifferenceofoperationperformancebeforetheimplementationofthepolicyforthefirstcategoryandsecondcategoryofSOEs

VariableObsMeanStd. Err. Std. Dev.Monopoly600.040 108 50.006 891 40.053 380 5Control2100.039 703 30.003 615 40.052 391 6diff-0.000 405 20.007 701 5

Note:t=0.052 6.

Table4TestofmeandifferenceofoperationperformanceaftertheimplementationofthepolicyforthefirstcategoryandsecondcategoryofSOEs

VariableObsMeanStd. Err. Std. Dev.monopoly600.056 575 40.003 951 60.030 609 1Control2100.033 803 00.003 338 70.048 381 8diff0.022 772 50.006 598 3

Note:t=3.451 3.

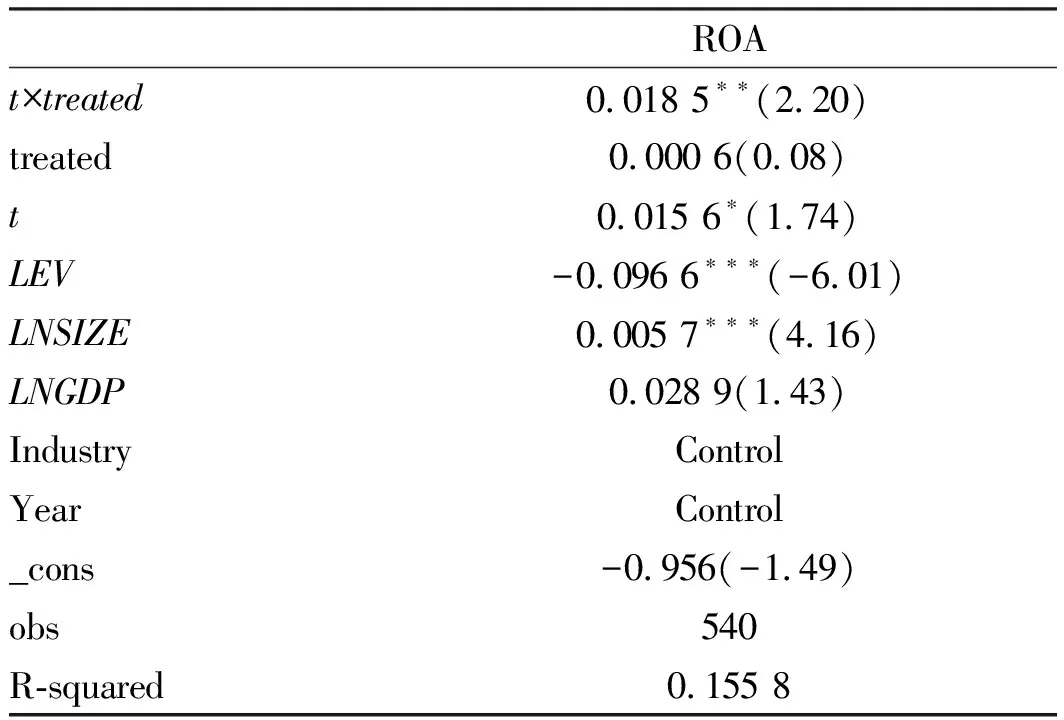

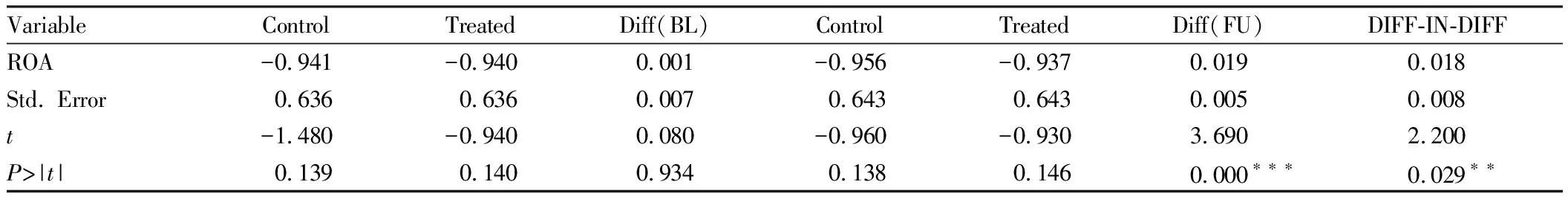

4.3Difference-in-differences(DID)regressionanalysisThe following table shows the regression and DID analysis results of the DID model used in this paper. Table 5 shows the model’s overall regression analysis, and Table 6 shows the DID analysis. As can be seen from Table 5 and Table 6, the equation passed the significance test on the whole. The implementation of the policy has a significant positive correlation with the ROA of the operation performance. Therefore, it can be considered that the implementation of the policy has a positive effect on the performance of the enterprise, which verifies the Hypothesis 1 of this paper.

There is almost no difference between the first category of state-owned enterprises and the second category of state-owned enterprises before the implementation of the policy,P=0.934>0.1. However, after the implementation of the policy, the difference between the two categories is significant, andP=0.000<0.01. At the same time,Pof DID=0.029<0.05. Therefore, it can be considered that there is a significant difference in the impact of the policy on the operation performance of the first category of state-owned enterprises and the second category of state-owned enterprises, which is consistent with the Hypothesis 2 in this paper.

In terms of control variables, the asset-liability ratio (LEV) is significantly negatively correlated with the operation performance. Thetvalue is -6.01, indicating that the operation performance of these two categories of state-owned enterprises will have better operation performance as the asset-liability ratio decreases. The enterprise size is significantly positively correlated with the operation performance of the enterprise. Thetvalue is 4.16, indicating that the larger the enterprise size, the higher the operation performance of the enterprise. The macro environ-ment is significantly negatively correlated with the operation performance of the enterprise, but thetvalue is 1.43, indicating that the impact of the macro environment on the operation performance of state-owned enterprises is not significant.

Table5Modelregressionanalysis

ROAt×treated0.018 5(2.20)treated0.000 6(0.08)t0.015 6(1.74)LEV-0.096 6(-6.01)LNSIZE0.005 7(4.16)LNGDP0.028 9(1.43)Industry ControlYearControl_cons-0.956(-1.49)obs540R-squared 0.155 8

Note:**Inference:***P<0.01;**P<0.05;*P<0.1.

Table6Difference-in-difference(DID)modelanalysis

VariableControlTreatedDiff(BL)ControlTreatedDiff(FU)DIFF-IN-DIFFROA-0.941-0.9400.001-0.956-0.9370.0190.018Std. Error0.6360.6360.0070.6430.6430.0050.008t-1.480-0.9400.080-0.960-0.9303.6902.200P>|t|0.1390.1400.9340.1380.1460.0000.029

Note:**Inference:***P<0.01;**P<0.05;*P<0.1.

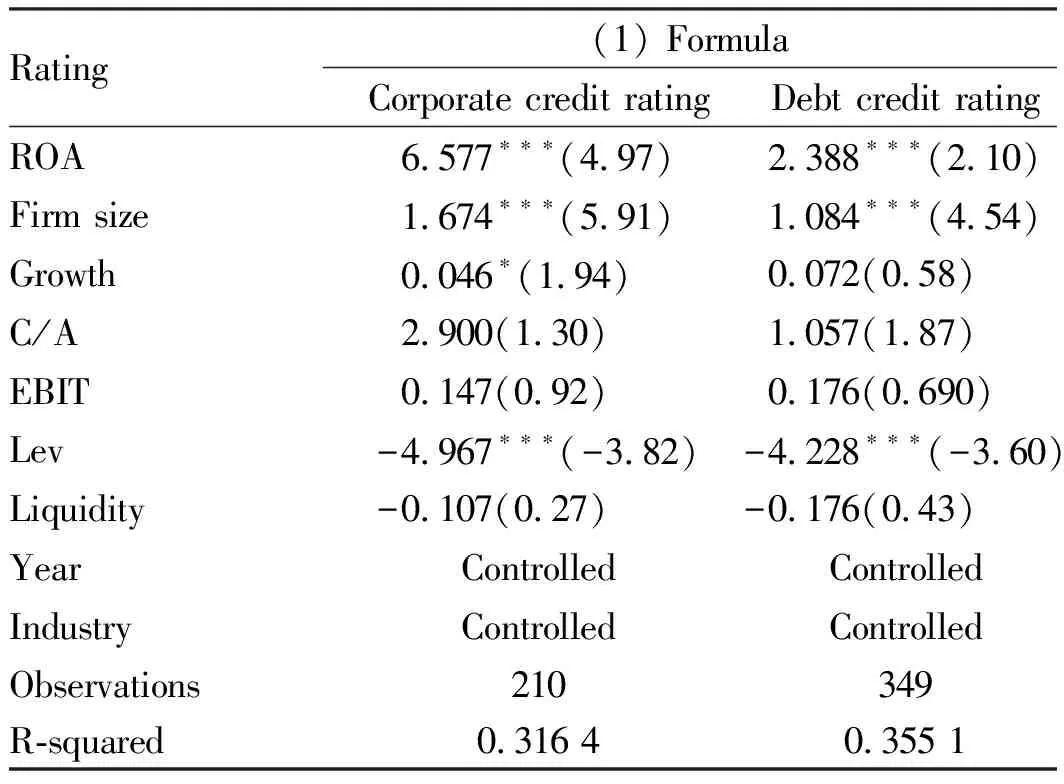

5 Further test

Considering the rapid development of the bond market in recent years, the credit rating made by rating agencies has a great research significance. Therefore, after the increase in the profit delivery proportion of state-owned enterprises, whether it will improve the bond credit rating of state-owned agricultural enterprises is very worth exploring and it can be understood as an indirect economic consequence. Thus, based on the previous research, we explored the relationship between operation performance and bond rating. From Table 7, it can be seen that the higher the operation >performance, the higher the corporate bond rating and the bond credit rating obtained by the agricultural state-owned enterprises. Therefore, it can be inferred that the change of in the profit delivery policy of the state-owned enterprises may affect the bond market. Specifically, the policy will influence the bond rating through affecting the operation performance of the enterprises.

Table7Regressionresultsofrelationshipbetweentaxavoidanceofenterpriseandcorporatecreditrating

Rating(1) FormulaCorporate credit ratingDebt credit ratingROA6.577(4.97)2.388(2.10)Firm size1.674(5.91)1.084(4.54)Growth0.046(1.94)0.072(0.58)C/A2.900(1.30)1.057(1.87)EBIT0.147(0.92)0.176(0.690)Lev-4.967(-3.82)-4.228(-3.60)Liquidity-0.107(0.27)-0.176(0.43)YearControlledControlledIndustryControlledControlledObservations210349R-squared0.316 40.355 1

Note:**Inference:***P<0.01;**P<0.05;*P<0.1.

6 Conclusions and recommendations

In China, the state-owned enterprises have experienced more than 30 years of reform, but the problem of state-owned enterprises’ turning over profits is still of great concern and has many shortcomings and faces enormous challenges and difficulties. In 2007, the state restored the policy that state-owned enterprises should turn over profits. This may be not perfect, but it pointed a new direction for the dividend policy of state-owned enterprises. In 2010, the policy of increasing the profit delivery proportion for the first time made a great step forward and made a great contribution to the healthy development of state-owned enterprises. Taking the listed companies in Stock A with controlled shares of central enterprises in the list of 2010 policy as samples, and selecting the period from 2008 to 2013 as the sample period, we made an empirical analysis on the impact of this policy on the operation performance of state-owned enterprises, and arrived at the following conclusions.

(i) Increasing the profit delivery proportion of state-owned enterprises is helpful for improving the operation performance of state-owned enterprises, helping state-owned enterprises realize profit and benefit the whole society, and stimulating state-owned enterprises to improve their performance. (ii) The effect of this policy on the first category of state-owned enterprises, namely the monopolistic enterprises, is more significant. Therefore, the policy of increasing the profit delivery proportion in 2010 has significant effect. It is favorable for better development and progress of state-owned enterprises and conforms to the original intention of the State Council in formulating this policy. (iii) The improvement of operation performance of state-owned enterprises can make them obtain higher corporate bond rating and the bond credit rating.

According to the above conclusions, we came up with the following policy recommendations.

(i) State-owned enterprises should pay attention to serving the society while achieving economic goals. As long as state-owned enterprises have this ability, they must return to the state. Therefore, it is undoubtedly necessary and necessary to strictly implement the policy that the profits of state-owned enterprises should be turned over to the state and to the society. (ii) The time for state-owned enterprises to actually restore dividends to the state is not long. There is still a long way to go before finding out specific policies and implementation methods for the state-owned enterprises turning over profits to the state. At present, the beginning of this policy is good, and the profit delivery proportion should continue to increase in the future. Besides, it is recommended to further increase the proportion and make greater efforts to promote the development of state-owned enterprises, expand the scope of implementation of this policy, so as to urge state-owned enterprises to make more contribution to China’s construction.

杂志排行

Asian Agricultural Research的其它文章

- Design and Realization of Communication Platform"CDream Creating a Dream"for College Students

- Economic Value Evaluation of Fine Individual Plants ofRibesrubrum Linn.Based on AHP

- Driving Force of China’s Agricultural Exports to Japan

- Causes of Recurrence of RiceChilosuppressalis(Walker)in Longyou County and Prevention and Control Measures

- Effects of Bacterial Manure from Cassava Alcohol Fermentation Mash on Yield and Starch Content of Cassava

- Landscape Space Creation of Red Star·Xintiandi Exhibition Area in Liuzhou