Feasibility Analysis of Agricultural Product Price Index Insurance Based on Pilot Cases

2016-01-12,

,

College of Economics and Management, Huazhong Agricultural University, Wuhan 430070, China

1 Introduction

After entry to the new century, with acceleration of global economic integration, market exchange process is increasingly complex, and market risk becomes an essential unstable factor in production and sales of agricultural products[1]. The phenomena such as Kidding Mungbean, Brutal Garlic, and Mad Corn, fully reflect the impact of unusual price fluctuation on income and production decisions of farmers[2]. In recent years, China constantly strengthens support for agricultural insurance. In 2007, No. 1 document of central government pointed out that "all levels of finance provide premium subsidy for farmers participating in agricultural insurance"; theRegulationsonAgriculturalInsuranceissued in November, 2012 stipulated that central finance provides premium subsidies for specified insurance. In 2016, No. 1 document of central government clearly stated that it is required to explore price insurance for important agricultural products. By now, more than 20 provinces have carried out agricultural product price insurance pilot and innovation projects. For example, Shanghai Anxin Agricultural Insurance Co., Ltd. launched the green leaf vegetable price insurance in 2011, covering high demand vegetable types in Shanghai, to guarantee income of vegetable farmers and satisfy demands of citizens[3]. In the whole country, although pilot regions are wide and types are varied, regions are small and insurance types are few, it is difficult to extend agricultural product price index insurance. On the basis of analysis of pilot cases, we summarized characteristics of agricultural product price index insurance in China and analyzed feasibility of extending agricultural product price index insurance in an all-round way.

2 Overview

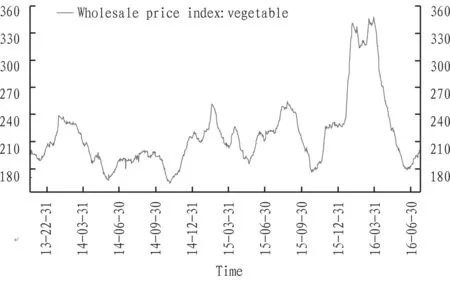

2.1AgriculturalproductpriceindexinsuranceBecause the price regulation mechanism of agricultural products is not perfect in China, there is frequent occurrence of violent fluctuation in price of agricultural products. Taking national average vegetable wholesale price index as an example, as shown in Fig. 1, the vegetable price index fluctuated greatly in September, 2015. Agriculture can be risk industry benefited from insurance, while it is also weak industry[4]. Agricultural product price index insurance is a new index insurance. Like weather index insurance, agricultural product price index insurance also belongs to index insurance products. The price index insurance is to cover market risks[5]. The price or price index is determined through contract. When actual price or price index is lower than the agreed value, the insurance company will make compensation. Agricultural product income security insurance is to agree on expected gross profit. When the actual gross profit is lower than the expected profit, compensation will be provided. Agricultural product income insurance covers losses of income incurred from decline in yield or price of agricultural products. Compared with traditional insurance, the index insurance greatly reduces working cost in agricultural insurance, and avoids adverse selection and moral hazard[6].

Data source: wind information

Fig.1Vegetablewholesalepriceindexsince2013

2.2GeneralsituationsofforeignresearchesMany countries have tried traditional agricultural insurance, but most failed. Reasons for the failure are varied. In insurance product design, most insurance products mechanically applied methods of property insurance, but not considered uninsurable risks in agricultural production, accordingly violating principles of insurance[3]. For example, crop (rice) insurance plan of Vietnam lasted only three years, because of 100-300% loss rate. Besides, traditional crop insurance needs high amount and sustained state subsidies. Nevertheless, for developing countries, government has no sufficient funds to provide subsidies, and farmers have no additional funds for high premium, leading to failure of traditional agricultural insurance. Developed countries also attach great importance to protecting interests of farmers. US government tried swine price insurance in the form of government subsidy from 2001[7], and introduced animal husbandry price insurance and veterinary insurance in 2002. The United States of America has included most agricultural product price risks into agricultural insurance plan. However, in agricultural product price insurance, most risks are covered by income insurance, not suitable for price index insurance. The trend of price in all areas is basically the same, and risks brought by price system will lead to huge amount compensation, so the risk is high. In addition, in principle, the yield is negatively correlated with price, the income insurance may smoothen the overall guarantee risk[8].

2.3GeneralsituationsofdomesticresearchesShanghai firstly introduced the vegetable price index insurance, covered by Shanghai Anxin Agricultural Insurance Company, with all levels of government provide 90% premium and farmers paying 10% premium[3]. In recent years, many areas of China launched price index insurance pilots, such as egg price index insurance and swine price index insurance in Beijing, and green-leaf vegetable price index insurance promoted by Zhangjiagang City. They have improved and accumulated certain experience. Many scholars studied agricultural product price index insurance. However, current research level still remains at the stage of preliminary study. Tuo Guozhuetal. (2016) introduced suitable risks and fields of agricultural product price index insurance[5]. Wang Keetal. (2014) studied feasibility of extending agricultural product price index insurance from the perspective of separate insurable risks[9]. Tian Xiaoping (2016), from the perspective of demands of agricultural product price index insurance, based on survey data, studied how to walk out of the situation of insufficient demands of agricultural product price index insurance[10]. Wang Yiqiuetal. (2016) briefly introduced practical situations of agricultural product price index insurance in China and introduced general situations of some pilot areas[11]. Ju Guangweietal. (2016), taking Beijing, Shandong and Sichuan as examples, introduced practice of swine price insurance and came up with establishing catastrophe risk diversification system[12]. On the whole, studies on agricultural product price index insurance still remain at pilot and experience exploration stage, and there are few feasibility studies.

3 Characteristic analysis on vegetable and swine price index insurance cases

3.1PilotsofvegetablepriceindexinsuranceWith increasing market risks, various circles of the society actively explore to establish price index insurance to respond to market risks. By 2015, more than 20 provinces have started target price insurance pilots. At present, the value index insurance mainly includes swine and vegetable price index insurances. In 2011, Shanghai Anxin Agricultural Insurance Company firstly launched the green-leaf vegetable cost price insurance. In this insurance, the agreed cost price is determined from five aspects, namely cost of agricultural means of production, labor cost, land rent, transaction cost, transportation cost. The cost price is sum of these five aspects. The compensation criterion is based on vegetable wholesale price of 5 main wholesale markets in Shanghai. However, since vegetable kinds and price are different everyday, the reference price fluctuates sharply.

In 2013, Chengdu City also launched vegetable price index insurance pilot, provided insurance for 11 main local vegetable types with high demands, such as lettuce, celery (not including western celery), round-headed cabbage, and cabbage. Chengdu survey team of State Statistics Bureau is responsible for collection of price data. The price collected is off-field price, namely, the first-hand information collected from planting farmers in towns where the vegetable price index insurance is carried out. When the off-field price is lower than the agreed insurance price, compensation will be provided. Zhangjiagang City is hot in summer. Vegetable imported from other places is vulnerable to be perishable, green-leaf vegetable planting needs high technology and it is difficult[11]. To ensure stable price and sustained supply, Zhangjiagang City introduced summer green-leaf vegetable price index insurance in 2013. When the insurant insures more than 3.33 ha green-leaf vegetable planting area, and when the average market retailer price provided by the Price Bureau for certain batch of green-leaf vegetable is lower than the insured price, compensation will be made. In 2015, Shandong Province launched target price pilot projects in Jinxiang of Jining City, Tengzhou of Zaozhuang City, Feicheng of Taian City, Zhangqiu of Jinan City for garlic, potato, cabbage, and green Chinese onion. According to statistics, the coverage area in Shandong Province was 0.58 million mu, including 0.23 million mu garlic, 0.216 million mu potato, 0.128 million mu cabbage, and 0.012 million mu green Chinese onion, and the total insured amount was more than 1.2 billion yuan. These pilot projects have obtained benefits and basically realized benefiting farmers and stabilizing yield and price.

3.2PilotsofswinepriceindexinsuranceThe swine target price insurance has functions of evading price risk and protecting basic income of breeding farmers. Since 2014, many areas have launched pilot projects of swine target price insurance. Beijing firstly introduced the swine price index insurance in 2013. Taking swine-grain price ratio as candidate indicators, when this ratio is lower than 6:1, compensation will be made according to contractual agreement. Beijing swine target price insurance is mainly undertaken by Anhua Agricultural Insurance Co., Ltd. Since 2013, Anhua Agricultural Insurance Co., Ltd has extended the business scope to 6 suburban counties of Beijing, upgraded swine target price insurance, established swine-grain ratio indicator, increasing the ratio to 5.8:1, 5.9:1, and 6:1, to increase the security level of swine price insurance. In 2013, Sichuan Province implemented swine target price insurance in Chengdu City and Nanchong City and local government provided subsidies for premium. In 2014, Sichuan Province expanded the pilots in Suining City and Ziyang City, and the financial subsidy proportion increased to 50%, and the rest 50% is paid by breeding farmers. Shandong Province started swine target price insurance pilot in 2014, and determined the swine-grain ratio as 6:1. In 2015, the swine-grain ratio was increased to 5.8:1, and the insurance period was 12 months. Insured breeding farmers may select monthly, quarterly or yearly compensation according to swine slaughter time and market situation, and pay the premium according to corresponding rate (5.5% for monthly, 3% for quarterly, and 1.2% for yearly).

3.3Characteristicanalysisofpilotcases

3.3.1Insured kinds are regional characteristic. For vegetable price index insurance in Shanghai and Chengdu, the insured vegetable kinds are those with high demands, difficult to store, and high self-sufficiency rate. Shanghai annually consumes 6.9 million tons of various kinds of vegetable, in which other places supply 50%. Since other kinds of vegetable are mainly supplied by other places, price of local characteristic agricultural products is vulnerable to suffering impact, accordingly affecting normal benefits of vegetable farmers and normal demands of citizens. Therefore, Shanghai vegetable price index insurance only covers 5 kinds of vegetable with medium level of demand (green vegetable andPterocladiatenuisOkam)[13].

3.3.2Insurance design strategy is flexible. Taking Shanghai vegetable price index insurance as an example, it introduces "summer off-season" and "winter off-season" insurance to guarantee income of local vegetable farmers and stabilize living standards of residents. Beijing swine price index insurance sets different swine-grain ratio as compensation trigger point, to satisfy actual demands of different breeding farmers.

3.3.3Financial support of pilot areas is stable. The price index insurance attracts insurance organizations to participate, and government provides premium subsidies, which conforms to WTO green box policy. In 2011, Shanghai provided subsidies up to 101.52 million yuan for vegetable price index insurance premium, government subsidy proportion was up to 100%, and many farmers paid no money for the insurance. Financial subsidies for premium accounted for 90% of premium income. This is closely connected with subsidy policy of agricultural insurance. The financial subsidy for Sichuan swine price index insurance is also up to 80%, and breeding farmers only need to pay 20% premium, which greatly raises their enthusiasm for buying this insurance. In Beijing, the financial subsidy for swine price index insurance is also up to 80%. This also indicates that extension of price index insurance needs strong financial support of local areas.

4 Feasibility of extending agricultural product price index insurance in an all-round way

The development of insurance is based largely on the fact that some risks are insurable, which restricts scope of business of insurance company[14]. From experience of all pilot areas, China has essential characteristics of implementing agricultural product price index insurance in regional space. Although some areas have accumulated rich experience in agricultural product price index insurance and have gradually improved design and extension of agricultural product price index insurance, in the whole country, price risks of agricultural products are still systematic, which obviously can not satisfy the Law of Large Numbers or independence of the insurance principle[10]. In actual life, risks covered in the insurance do not fully meet conditions of insurability. Besides, with political and economic development and technological progress, as well as improvement of social living conditions, and some risks that are not insurable will change to objects of insurance. Following is the analysis of present insurance market environment.

(i) Government implementation conforms to international policies and rules. Premium subsidy for agricultural insurance is major content of WTO green box policy, thus increasing subsidies for agricultural insurance is favorable for healthy development of agriculture and promoting stable people’s livelihood. Since 2007, Chinese government gradually increased input into agricultural insurance. In all areas, the subsidy proportion of agricultural product price premium is more than 50%. Farmers invest little, so their enthusiasm for participating in the insurance will be high. Agricultural insurance needs great support of financial funds. High input of Chinese government in subsidies for premium of agricultural insurance becomes the policy basis of development of agricultural product price insurance.

(ii) Design of insurance product is scientific and consistent with market situations. Through improvement and development, all pilot areas have designed agricultural product price index insurance conforming to local production and living conditions, with reasonable premium, and avoiding adverse selection due to seasonal price fluctuation. For example, the "summer off-season" and "winter off-season" green-leaf vegetable insurance introduced by Shanghai Anxin Agricultural Insurance Company is based on local demand characteristics and combined with actual production realities, to reach the purpose of adjusting market price and guarantee income of farmers.

(iii) Production entities have strong willingness of buying the insurance. Survey of Tian Xiaopingetal. (2016) on 1025 farmers indicates that when government subsidizes more than 50% premium, more than 90% farmers are highly willing to buy the insurance[10]. A responsible person of Sichuan branch of a large insurance company said that breeding farmers are worry about fluctuation of market price. Large breeding farms and farmer households assume huge pressure of market risks. Agricultural product price insurance is helpful for stabilizing fluctuation of market price and evading market risks. Thus, breeding farmers have high expectation and strong demands for such insurance. The ultimate purpose of agricultural product price insurance is to help farmers to separate the impact of market risks.

(iv) The difficulty of target price setting and insurance period design is high. In China, the future market is still not well established. Grain, cotton, and oil have corresponding future contract, but agricultural products such as swine and vegetable are still not established with future market. Therefore, it is impossible to determine the claim contract through future price. The setting of target price (relative price index or absolute price index) directly determines final results of claims. However, different areas have different breeding level, economic development level, and different production costs. Although they set different swine-grain ratio as multiple choice, the determination of costs in production links needs to be improved. At the same time, it is difficult to set proper insurance premium to avoid adverse selection, and determine appropriate premium.

(v) Catastrophe risk diversification mechanism is not perfect. Relative to traditional insurance, the price index insurance can not be measured by traditional rules. Once the risk is generated, it is easy to lead to huge losses and affects normal operation of insurance company. Besides, characteristics of such risks make the insurance company unwilling to cover. In addition to imperfect subsidy mechanism of government for huge amount risks, once there are huge amount claims, insurance company will suffer a great loss. These reduce enthusiasm of insurance company for providing security. It is true that option based future market hedge mechanism can diversify insurance risks[15]. Nevertheless, there is still no future market for vegetable, swine, and characteristic agricultural products. What’s more, if using the option based future market to offset the risks, it will bring insurance company to future market, which will lead to increase in premium, far higher than fair premium, farmers’ enthusiasm of buying insurance will drop, and the efficiency of government fund use will decline. Obviously, these are not proper.

(vi) Financial input is high. At current stage, the extension of agricultural product price insurance inevitably needs strong support of government and has high demand of premium subsidies. Pilot cases also indicate that the premium subsidies exceed 50% of premium for agricultural product price insurance. For Beijing and Shanghai with powerful financial strength, there is little difficulty of extension, while Shandong Province will have high difficulty in extending agricultural product price index insurance. When city level financial expenditure for agricultural product price index insurance is high, it is not favorable for extension because high financial pressure will make local government become inactive to support agricultural product price index insurance.

5 Conclusions and policy recommendations

5.1ConclusionsAccording to pilots of agricultural product price index insurance in China, the agricultural product price index insurance should limit the coverage in certain region and should be implemented in accordance with actual situations. On this basis, new insurance type and policy may be determined. It should be careful when expanding the price index insurance to all crops because the opportunity is not mature. For example, for cotton, grain and oil, although there is mature future market, the system of risks will pose high risk of huge amount compensation, and there is no excellent risk diversification mechanism. For characteristic agricultural products, it is also required to combine local realities, select those kinds with difficult production, transportation, storage, high self-sufficiency level, and high demands, and also it is necessary to design scientific target price and insurance period.

5.2Policyrecommendations(i) Close cooperation and gradual promotion. The promotion of agricultural product price index insurance should be implemented in suitable regions by proper phases. Economic development level is unbalanced in different regions of China, and financial strength is different in levels of government. At present, only some areas with powerful financial strength have the ability to implement agricultural product price index insurance, all-round implementation still needs a long process. Insurance subjects should gradually advance from large production farmers or enterprises to separate farmers, and government needs to provide financial subsidies for separate farmers. (ii) Reasonable determination and scientific design. The key for agricultural product price index insurance lies in designing convincing price index for both insurance company and the insured. Reasonable index will directly determine stable income of producers and market situation. It is recommended to determine the price index according to regional economic development level and cost of production means. Besides, it is recommended to adjust the insurance price index from time to time according to market situation, to conform to market development and guarantee basic benefits of both insurance company and the insured. (iii) Open and transparent system. It is highly necessary to establish and improve open, fair and transparent market price monitoring system as compensation basis. Among this, important factors include strengthening price monitoring of planting, processing and sales of agricultural products, improving information collection, and platform of information issue. (iv) Government security and multiple parties sharing of risks. A difficulty is systematic risk when establishing catastrophe risk diversification system for extending agricultural product price index insurance. With expansion of scope of insurance, the possibility of catastrophe occurrence will become higher. It is recommended to include the price insurance into catastrophe risk diversification system for agricultural insurance of insurance company and government. It is recommended to make scientific evaluation of huge amount compensation risk of insurance company and establish a multi-level risk transfer mechanism. Besides, government should establish the catastrophe compensation response mechanism, try to establish fund operation system, and establish catastrophe insurance fund, to guarantee continuous operation of insurance company under the support of government.

[1] HU YT, LUO BL. On the evolution of agricultural market risk in China: judgement and assessment [J]. Rural Economy, 2010(4):10-13. (in Chinese).

[2] XIONG W, QI CJ, GAO Y,etal. Study on the short-term prediction of the market price of agricultural products based on composite pattern [J]. Journal of Agrotechnical Economics,2015(6): 57-65. (in Chinese).

[3] LI X. Research on crop cost price insurance [D]. Beijing: University of International Business and Economics,2012. (in Chinese).

[4] ZHANG HR. Index-based insurance contract -Innovation in agricultural insurance [J]. Journal of Central University of Finance & Economics, 2008(11): 49-53. (in Chinese).

[5] TUO GZ, ZHU JS. We should make clear several basic issues if you want to do the insurance sbout the price of agricultural products [N]. China Insurance News, 2016-06-02004. (in Chinese).

[6] JIANG GD, WU K. Study on the insurance of farm produce price index [J]. Southwest Finance, 2016(8):1-5. (in Chinese).

[7] BARRY KG. Problems with market insurance in agriculture [J]. American Journal of Agricultural Economics, 2001, 83(3): 643-649.

[8] BABCOCK BA. Implications of extending crop insurance to livestock [C]. Proceed of the Agricultural Outlook Forum 2004, United States Department of Agriculture,Agriculture Outlook Forum.

[9] WANG K, ZHANG Q, XIAO YG,etal. The feasibility of farm produce price index insurance [J]. Insurance Studies, 2014(1): 40-45. (in Chinese).

[10] TIAN XP. An economic analysis on the incurance demand characteristics of agricultural products [J]. World Agriculture,2016(3):51-57. (in Chinese).

[11] WANG YQ, ZHU QQ. The practice and application of price indices insurance of innovative agriculture [J]. Jiangsu Agricultural Sciences, 2016(3): 462-465. (in Chinese).

[12] JU GW, WANG HMM CHEN YL,etal. Study on the evaluation of the efficiency of target price insurance practice of live pig in our country and the feasibility [J]. Journal of Agrotechnical Economics, 2016(5): 102-109. (in Chinese).

[13] ZHAO J, GONG J, MENG H. Understanding and thinking on the policy of target price insurance of fresh agricultural products[J]. Rural Economy,2016(4): 68-72. (in Chinese).

[14] KONG QX. "Insurable risks":The foundation of insurance business development [N]. China Insurance News, 2009-12-16002. (in Chinese).

[15] ZHANG Q. Design and risk diversification of agricultural price insurance based on futures market [J]. Agricultural Outlook,2016(4):64-66, 80. (in Chinese).

杂志排行

Asian Agricultural Research的其它文章

- Forecast on Price of Agricultural Futures in China Based on ARIMA Model

- Model Building for Community Participating in Rural Tourism and Game Analysis of Core Stakeholders

- Embedded Programmable Single Point Multiple Output Intelligent Data Acquisition and Transmission System

- A Study of the Factors that Affect Farmers’ Willingness to Transfer Land in the Central Regions Based on a Survey of 180 Farmers in Suizhou City

- Comparative Study of Cotton Plant Height Difference in the Arid Areas Based on LandSat8 OLI Data

- How to Enhance the Brand Competitiveness of Ginseng Enterprises?