Financing Problems in China's Rural Areas

2014-03-07LiMeiniandHanXueping

Li Mei-ni, and Han Xue-ping

1College of Marxism, Northeast Agricultural University, Harbin 150030, China

2College of Humanities and Law, Northeast Agricultural University, Harbin 150030, China

Financing Problems in China's Rural Areas

Li Mei-ni1, and Han Xue-ping2

1College of Marxism, Northeast Agricultural University, Harbin 150030, China

2College of Humanities and Law, Northeast Agricultural University, Harbin 150030, China

Solving the financing problem in rural areas and improving the level of economic development in rural areas become important guarantees for the expansion of domestic demand. This research, through studying the current situation of rural financing, pointed out the main factors restricting the financing in rural areas, such as high risk credit, slow income growth, high financing cost and difficult mortgage and guaranteed loans. Based on those, the author worked out the objectives and direction of China's rural financing reform, from two aspects of path selection of reform and innovation and specific embodiments for adjusting the overall reconstruction, and put forward some relevant countermeasures.

rural area, financing, restricting constraint, countermeasure

Introduction

At present, China's rural financing channels generally contain three patterns: private loan financing, indirect financing in currency market, and direct financing in capital market. Based on the analysis of the current financing environment, it is not difficult to find that the following features: firstly, although the amount of a single financing in rural areas is relatively small, the interest rate of private loan is high, therefore, it is relatively difficult to obtain a large amount of funds from the folk financing (He, 2010); secondly, as the development of China's capital market is less mature, there is not yet an effective mean of direct financing aiming in rural areas. The current level of China's rural economy can not get financing from the capital markets; thirdly, at present, China's rural financing objects including rural credit cooperatives, Agricultural Bank and other commercial financial institutions and banks need a mortgage loan and the threshold is higher; while the majority of rural farmers and mini enterprises, small enterprises and mediumsized enterprises can not provide effective collateral to banks, so that loans are difficult. In addition, although China has introduced a number of credit policies for supporting the rural economic development, the number of SMEs (small medium-sized enterprises) that could get effective loans is limited (Kang et al., 2010).

With China's economic development, the funding needs in rural areas have gradually increased, while the borrowing requirements for capital have become extremely urgent and indispensable. At present, China's rural lending has the following disadvantages. Firstly, the yearly rising demand for civil borrowed funds can not be effectively met. Credit business of the commercial bank of China gradually focuses on largeand medium-sized cities and key advantage industry in recent years, Chinese agriculture and SME lending support gradually betcome weakening, which make the "three rural issues" increase the strong demand for funds to private lending (Hou, 2012). Secondly, the private financing procedure of private lending is extremely simple: as long as the two parties reach agreement on the loar items, along with the guarantee from the third guarantee, financing is assumed to be completed, the agreement can be signed. This mainly depends on the social networks, the lack of lenders asset evaluation, no loan, there are many drawbacks to provide mortgage financing. Thirdly, the current folk lending interest rates excess the affordable levels of generally rural farmers in China. The interest rate of private loan greatly varies in rural areas, the interest rate is generally decided by factors, such as the borrower, the use of money, the emergence, the loan time, the relationship and the consultation between two parties. There are both interest-free loans between relatives and friends and the borrowings referring to the bank loan interest rate. But as the demand for funds increases, coupled with rising prices and other reasons, especially housing price soared, the interest rates of private loan gradually increase in rural areas. The ensuing unhealthy lending is easy to cause the civil dispute.

Constraint Analysis of Rural Financing

To truly understand the rural credit of Chinese farmers, and accuratly grasp the real situation of the contemporary rural credit situation, a survey of farmers on the issue of rural credit was designed, which investigated some farmers from a mountain village, Tonghe County of Heilongjiang Province. This sample survey used a random sampling method, issued a total of 200 questionnaires, and 192 valid questionnaires, which is of 96% effective share of the questionnaire, and this questionnaire approach was taken by secret ballot, so the data quality of the questionnaire can be guaranteed. The questionnaire sample was scientific and reasonable, of certain representation (Figs. 1 and 2).

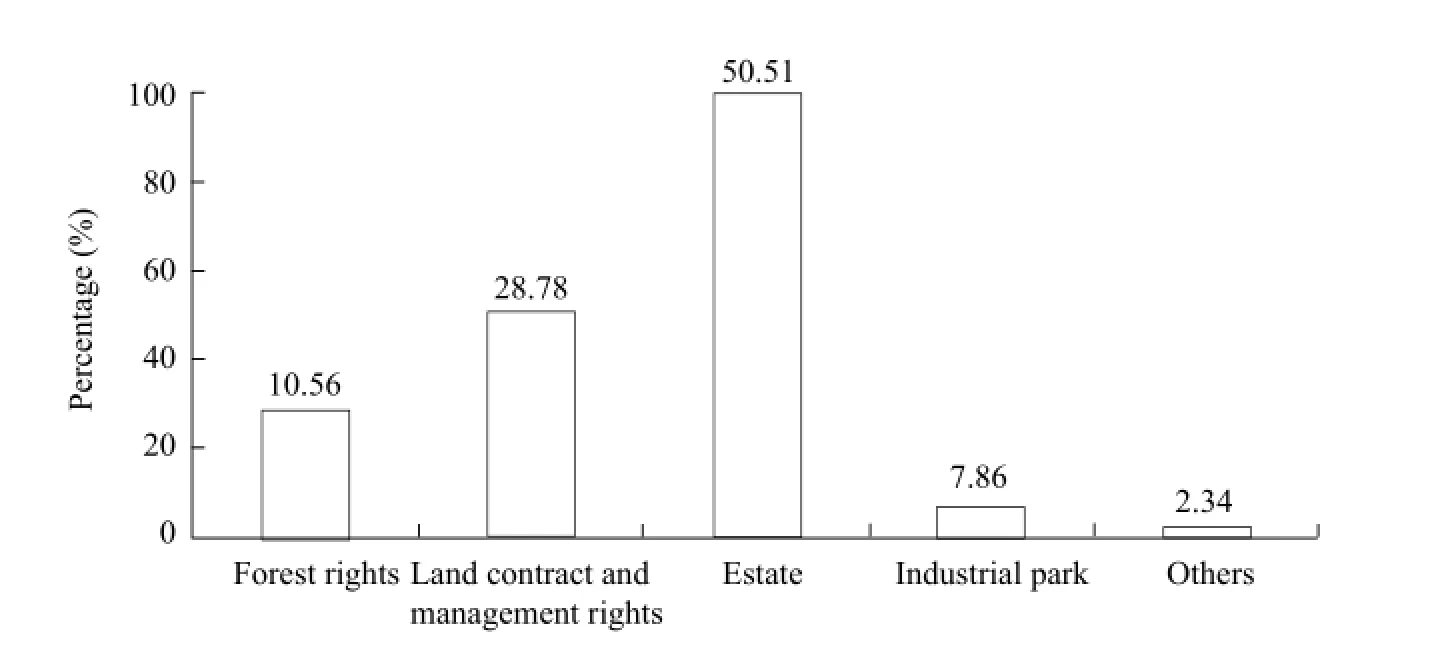

Fig. 1 Loan collateral investigation

Fig. 2 Difficulty of loan approval

High credit risk

In agricultural economy, farmers in small-scale production possess are high homogeneity. Intense competition and vagarious price in the agricultural product market bring higher risk in production. The most obvious difference between agricultural production and other manufacturing industries is those unpredictable natural risk. Especially for China's fragile basic conditions of production and ecology in agriculture, there exists a big uncertainty in the agricultural production (Liu, 2010). If some epidemic spreads, or other serious natural disasters occur, capital chain is easy to rupture. The increasing phenomenon of accounts receivable is difficult for SMEs.

Defaults always appear in SMEs, especially small enterprises. Difficulties in receivable account recovery becom increasingly prominent so that these SMEs are facing a shortage of funds. At present, agriculture supply financial system and credit system can not fully meet the financing needs of SMEs in rural characteristics. On the one hand, the support for SMEs from current banking financial institutions is done politically, commercially and diversified for the participation of the local financial institutions, but still mainly concentrates on the Agricultural Bank of China, Agricultural Development Bank and agricultural credit cooperatives and other financial institutions. On the other hand, since this kind of capital supply has congenital difficulties and problems, its investment in individual companies is objectively limited. Currently, although policies have been carried out, private capital investment is allowed to be given to the rural banks, micro-finance organizations and other financial organizations, which is still at the exploratory stage and lacking effective legal protections and social supervision. Hence, there exists some risks.

High financing costs

Loan procedures in China's commercial banks are much complicated resulting in high financing cost. Rural credit cooperatives are regarded as the main loan providers in rural areas. Except for small amount of agricultural credit which could be got as soon as approved, other commercial loans are generally required to provide the proof of fixed assets, personal income, marriage certificate and other relevant proofs. At the same time, relevant guarantors' signature is also required (Liu, 2012). The guarantor also needs to provide relevant proof of income. And assessment of the fixed assets, such as real estate should be carried out by the relevant departments. Due to bear interest on loans and fees, assessment fees, guarantee fees, notary fees and others related costs, so higher financing costs of the problem can not be avoided.

Difficult mortgage and collateral

In addition to the small loans applied by the farmers and guaranteed loans, other loans from bank financial institutions are required to provide collateral assets. For most farmers, the main asset includes housing, land contract and management rights and homestead. Relevant laws and regulations also have specified that arable land, homestead, private plots and hilly land allotted for private use and other land of collectively owned use rights must not be mortgaged. Meanwhile, banking institutions will focus on assessing the liquidity of the mortgage-backed assets when assessing the collateral, nevertheless, farm machinery and other agricultural productions in the market are unable to be under the reasonable controls. So it is difficult to effectively assess its value, and the agricultural appliances can not be secured as collateral, so farmers have difficulties in providing effective security for loans. From Fig. 1, we can see that 50% farmers used the property as collateral loan, nearly 30% of farmers used land contract and management rights as collateral loan, which means that the question of loan guarantee in rural farmers is still more singleness and limited.

Currently, guarantee organizations designed to provide guarantees for farmers and agriculture-related small business are also difficult to meet the demand of the current "three rural issues"; while the proportionof agricultural insurance invested by the insurance agencies is still very low. Warranty cost is relatively high. In the case of the introduction of the security companies, financing cost for the loans will increase to farmers, which is also one of the main reasons that no farmers ask guarantee companies to provide securities for their loans (Yan et al., 2011).

Difficulty in loan

Rural credit cooperatives have made greater contributions to the economic development in different areas. The growing role of the main force to proagriculture presented. However, with the further development of the rural economy, the weak segments and the exposed problems existing in the loan work in rural credit cooperatives are more and more prominent. After the analyses of the questions encountered in the process of financing as for the "three rural issues", the majority of raisers have declared that there are too many conditions for the loans in rural credit cooperatives; the line of credit in microfinance loan slants small, despite the current loan rate in rural credit cooperatives is relatively low. Most farmers generally consider complicated procedures, terms more, loan difficulty in the bank lending process. In Fig. 2, there are nearly 50% farmers who had the experience of loans considered loan is difficulty, only 12% of households believe that the loan is got easier. However, the current items of the loan are quite demanding, which cause the loans from credit cooperatives difficult.

Aim and Direction of China's Rural Financing Reform

At present, there are many problems existing in China's rural financing system, such as a few rural financial institutions, uneven distribution of rural credit cooperatives, higher overall risk, imperfect management, available financial service is relatively simple and backward. In these problems, lacking of financing is the most prominent one, while rural money seriously pumps. The proportion used in local economic development is very small, which is not conducive to the economic development in rural areas and counties. Therefore, the main aim of China's rural financing reform is to solve the rural financing services, especially the shortage of financial services, improve the supply market construction of the rural financing, make the perfect rural financing market realize multilevel, the source of multi-channel, wide coverage, diverse objects and sustainable development (Zhang and Wang, 2006). Rural finance reform must follow the following directions: firstly, in the aspect of rural financing reform, it is necessary to clarify that the core service principal object of each financing is the "three rural issues", adhering to the service direction be at the "three rural issues", while in the institutional policy formulation of the reform, the fundamental services of "three rural issues" should also be highlighted. Rural financing system should also be encouraged to serve the rural economy, to closely trace the changes in the needs of rural funding trends, adapt to changes, otherwise, that will milk the bull. Secondly, the prospect is to construct a rural financial system of modest competition, and forming a competing situation among Rural Credit cooperatives, Agricultural Bank, rural banks on the general commercial loans; as for the loans for farmers and microfinance, a competition prospect should be established between Rural Credit Cooperatives and rural microfinance organization. It is only via competition that a more reasonable price and an interest rate could be set up, guiding social capital into the agricultural economy through these financial institutions. Thirdly, cooperation is designed to be complementary with moderate competition, the complementation among policy finance, commercial finance, cooperative finance and private finance should be given full play, and supportive measures should be proposed from the prospect of policy and the institution on the promotion of mutual cooperation among the four, while different types of financial institutions should be encouraged to deepen cooperation and mutual support. Different financialmodels' attempts, developments, improvements and mutual integrations would be allowed in the rural financial system. This mutual cooperation would actually satisfy the financing needs of rural financing body, promote mutual development and improve the ability of financing services and innovate new financing service products.

Specific Embodiments of Adjustment and Reconstruction

Path selection of the whole reform and innovation

Rural China's financing reform and innovation ought to moderately promote, reasonably expand, and gradually promote the overall path, the construction of reform path could be built from two dimensions, time and space.

In the time path selection, the first step is to further deepen the commercial reform of rural credit cooperatives, and the rural credit cooperatives would be designed to be of clear property rights, scientific management, strong constraint mechanism, and financial sustainable development, adhering to the commercial principles, mainly serving for the "three rural issues" financial institutions; the second step is to further reform and improve the rural policy-related finance, Agricultural Development Bank is designed to correct market failures in rural finance, mainly to meet the agriculture, rural areas and farmers' demand for the fund of public goods and poverty-relief, to fully satisfy the financial needs of the rural market failure from policy-related financial institutions; the third step is to rebuild and improve a sound financial system of rural cooperative, non-formal financial system would be supported by policy, the government should guide and regulate the healthy development of the private, non-formal co-finance, to which policies on protection and support would be taken, actively promote the legislation of rural cooperative finance, to make private and non-formal cooperative finance legalized, to protect its longterm stability and development (Yang et al., 2011). Meanwhile, we should vigorously develop new rural cooperative economy andencourage the establishment of professional cooperatives, leading companies and other cooperative organizations. The cooperation should be unleashed in the fields, such as finance, insurance, marketing, and processing. Continuously improve farmers' abilities to cooperate, and apply financing from the banking financial institutions through the new rural cooperative economic organizations to expand rural financing channel.

In the space path selection, the path effectively combined with top-down and bottom-up modes of institutional change must be adhered.

On the one hand, the government-led top-down policy promotion is to strengthen and the unity of reform is to enhance, and reform efficiency is to improve. From the perspective of China, the nature of rural financing construction of six decades has started from the national level, mandatory regime change of top-down push, and this top-level design of rural finance system has a positive effect on the rural finance system of the rapid establishment. Next, the government-led top-down promotion model should continue on, but this government-led approach does not mean that not all the specific ways for rural finance reform should be provided by the government, and the government should give more considerations on how to play a role in the aspects, such as the design of the institutional framework, policy institution, legislation, change in organization, rural financing environment optimization. Further refine the policies and requirements in the classification reforms of rural credit cooperatives and classification supervision, the operating authority of the Agricultural Development Bank and the development of business types, content licensing and business property reform of the Postal Savings Bank, clarification of credit union funds' functions, the establishment of agricultural insurance modes and others; in the specific reform and management of the main rural finance institutions, emphasizing the government makes policies come off, con-stitute framework, and give preferential. Various finance subjects play their own initiative within a policy framework with self-management and selfdevelopment; in the rural private cooperative finance and non-formal finance development, the government should give supports on policies, laws and regulations, make sure the initiative of private finance development gives full play, while form a complete set of agencies and service organizations, to strengthen service guidance and risk monitoring, early warning and intervention should be carried out in the regions where private finance organizations and institutions may exist, and to prevent the proliferation of private financial risk to cause systemic risk.

On the other hand, we should actively guide the rural financing institutions, the main body should innovate independently, play a dominant role in reform, the adaptive changes of the rural finance body should be guided by the need change of grassroots, bring out the adaptive changes in the finance organization system, namely the innovation model of "grassroots inventionthe upper certainty-test promotion" and "bottom-up" system. Practice has proved that active participation of farmers is indispensable to the success of any innovation systems in rural China. Next, innovation and development of the finance system in the rural areas should be encouraged, respecting the financing supplyside change triggered by needs of the rural grassroots. Especially because of China's land area is large, economy, culture, and customs vary in a huge majority of the rural areas, the reform of rural finance system must fully respect this diversity, while respect Chinese private finance innovation and naturally rely on the guide from the grassroots to carry out the bottomup reforms. At the policy level, the rationality of the innovation in rural grassroots financing transformation should be fully affirmed, stimulating private finance, co-finance initiative launched by the farmers, as for the financial forms and financial organizations that generate in the rural grass-roots should be given sufficient free-development and strong policy support with standardization and glasnost, and fundamentally make it have a fair competition with exogenous "topdown" finance organizations, complementarily support rural financing needs.

In addition, the reform of the existing rural finance institutions, such as rural credit cooperatives, Agricultural Development Bank should listen to the needs of rural financing side. Demand-side participation and in the game of the reform should be introduced to enhance the endophytism of the reform, and make the rural finance reform organizations can truly understand the financing needs of the "three rural issues", to better support and serve its economic development.

lncreasing policy support for rural financing

While governments follow the market operation of financial institutions, industrial layout should be carried out from industry level. The governments should also conduct appropriate planning and guidance for local agricultural industry, nurture and support the "three rural issues" enterprise brands with core competitiveness according to geographical characteristics, prevent redundant construction; improve discount interest subsidies, guarantee fund and risk compensation fund policy by increasing fiscal support for "three rural issues" enterprises; give full play to leverage function of financial public spending on "three rural issues" enterprise financing; fully satisfy efficient loan demands of various rural customers; breeding farmers and cooperatives, individual industrial and commercial households, as well as SMEs as key support objects.

China's current rural policy finance bank is mainly the Agricultural Development Bank. Agricultural Development Bank should first definite its reform direction as the policy banks rather than commercial banks.

In terms of property rights reform, Agricultural Development Bank should strengthen its state-owned background, enhance government credit, and in addition, it should be given some financial subsidies to protect Agricultural Development Bank funding problems. Integration of financial poverty-relief funds isrecommended; work-relief funds, social contributions, bank credit and other agriculture funds should be under unified deployment used by Agricultural Development Bank. Agricultural Development Bank may issue to the Central Bank and raise funds in the inter-bank bond market (Li and Deng, 2012).

In terms of specific operation, the Agricultural Development Bank can rely on its strength of financial scale, support and guide relatively small local rural financial institutions to provide financial services for the "three rural issues", provide low-interest loans for rural financial institutions serving the "three rural issues", such as fund cooperatives and small loan companies, and ensure adequacy and sustainability of their credit funds. Meanwhile, Agricultural Development Bank could also advance into providing financial support for agricultural construction projects that need large capital investment and long payback period. In addition, some effective operatings and profitable agricultural industrialization leading enterprises should also be its important supporting objects.

In terms of management and operation, the Agricultural Development Bank should further improve and complete implementation of internal management system, improve the level of internal management standardization and refinement, and improve the overall efficiency and effectiveness. For regulation of the Agricultural Development Bank, the state dedicates to introduce related systems and approaches, focusing on its capital investment, capital efficiency, along with the supportive regulation, assessment, auditing, and enhancing external constraints and supervision of "three rural issues".

In addition, in order to maintain the stability of entire rural financial order and reduce the overall risk level of rural financing system, a comprehensive risk prevention mechanism is needed. Hence, it's necessary to establish policy credit guarantee institutions and agricultural insurance agencies to ensure the benefits of rural financial institutions and depositors, reduce the risk of agriculture and promote rural economy and the development of agricultural production.

Building rural credit information disclosure mechanism

Root of difficult rural loans is low credit rating of rural farmers and one important reason is the lack of credit system in rural areas, producing asymmetric information between financial institutions and customers, thus it is difficult for financial institutions to effectively assess customer credit. On the one hand, financial institutions should establish a customer credit collection and an analysis and tracking system, strengthen cooperation with other departments, such as security agencies, industry and commerce, taxation and other departments based on their customers' credit files, and establish customer credit investigation platform and credit information sharing mechanism (Ma, 2011). On the other hand, breeding farmers and SMEs should strengthen their communication with commercial banks, security agencies and other organizations to strengthen information disclosure awareness, initiatively provide business management principles, financial situation and industry development infor-mation, accurately and timely disclose to the lending bank and security agencies, and cooperate with banks and guarantee institutions with insight into their operations and financial status quo. Breeding farmers and SMEs can also select banks and guarantee institutions suitable to their own development and the characteristics of the industry to establish long term stable cooperative relations according to their status of long term financing need, enhance mutual understanding and trust, and reduce the cost of credit caused by information asymmetry.

Efforts improvement of financial institutions such as rural credit coopratives on "three rural issues" service

Rural credit cooperatives are the main forces of rural agricultural economic and financial institutions. The operating and management philosophy of rural credit cooperatives should be conversed. New service of "three rural issues" should be actively explored.Rural credit cooperatives should establish the business philosophy of setting up a foothold in the "three rural issues", carry out innovative ways to support agriculture, and actively expand the development of rural credit cooperatives. Rural credit cooperatives should adapt to local conditions, choose different ways of agriculture services, and determine prospective borrowers, patterns of lending and line of credit combined with the development of local agricultural economy.

Firstly, agricultural credit cooperatives from various regions should firmly establish the business philosophy of serving "three rural issues" and giving priorities to credit funds to invest in the agricultural industry. Rural credit cooperatives should meet farmers' basic farming demand for funds, while increase support for farmers to be engaged in the processing of agricultural products and agricultural activity circulation service of agricultural products (Li, 2011). New agricultural structure adjustments should focus on small and medium agribusiness enterprises. Secondly, through innovative patterns of lending, rural credit cooperatives suit the characteristics of current rural economic development. Species of large local breeding farmers, cooperative economic organizations and SMEs should be provided guaranteed loans, appraised credit and one-time credit loans to guarantee its credit needs. Thirdly, increase value-added services of loans. Through their own grasp of the current economic policy, the collection of agricultural information and the understanding industry, rural credit cooperatives timely transmit information to the customers, establish an effective information collection, transmission and improved service delivery system, increase efficiency for customers, reduce their operational risks and achieve a win-win economic and social benefit.

At present, the reform of rural credit cooperatives has come into deep water zone, and many rural credit cooperatives have been reorganized into rural commercial banks, while the remaining rural credit cooperatives are also actively preparing the restructure of commercial banks. In the commercialization of rural credit cooperatives, China's formal rural cooperative finance almost demises, leaving only rural credit union funds approved in 2006 by China Banking Regulatory Commission. How to reconstruct China's rural cooperative financial system is an important issue.

For formal cooperative finance, the government must first clear its importance and necessity. Legislative bodies exist to promote the legislative work of China's cooperative finance special laws, making them institutionalization and legalization. Financial sector should give financial supports to financial institutions, especially the rural cooperative financial organizations. Supervision departments should introduce relevant ways to encourage cooperative finance to develop differentiation considering local conditions and time and clearly attribute their cooperation, emphasizing that the goal is not profit maximization, but funds available to members. We should encourage farmers to accelerate development through democratic management, supervision of members and relational financing, stick to the community, closely follow-up on the "three rural issues" and service members. In the construction specifications of its operation system, the State sets up specific microscopic laws and regulations on rural mutual cooperatives as soon as possible so that the rural mutual cooperatives conduct business according to the law and the rules. The state should implement specific regulatory rules, a clear regulatory body, regulatory content, supervision and other means as soon as possible to clear regulatory compliance "Blank" of its existing funds operating safety, operational processes loans and other aspects.

The reform of private finance should focus on improving the private finance protection system construction. First, clear legislations, benefits and risks of private financing, and provid legal basis. Second, build a third-party-led by the government, such as registration services platform and debt trading centers. The introduction of third-party oversight makes private financing gradually transparent and legalized, increases binding effects, and reduces the risks of private financing. At the same time, actively improvethe monitoring, early warning and disposal system of private financing, achieve early detection, early warning and early disposal of risks, and reduce the transmission risk of private financing.

Acceleration of developing new rural village banks and other financial institutions

At present, China gradually carries out financial reform and innovation, especially the development of rural banks, small loan companies and other financial institutions, which show prosperous results, but the speed is slow and the scale is very limited. First, it is difficult to attract private capital investment enthusiasm since a promoter of rural banks must be banking financial institutions, resulting in lower capital scale of rural banks and limited service capacity. Private capital should be allowed as a main sponsor to initiate the establishment of village banks and increasing the maximum stake of a single shareholder. Second, develop small loan companies. Developing small loan companies is a national policy to support "three rural issues" and solve the financing difficulties of SMEs. In practice, it has initially reflected the positive remission role of "difficult financing". However, aiming at the equity scattered existence of small loan companies and lacks large shareholders as the primary responsibility body etc. Financing leverage ratio of small loan companies is very low and supply channel of funds is few. The stake should be raised through oriented policy to attract private investment and enhance financing services. At the same time, the introduction of supporting policies for small loan companies should be initiated to implement credit rating system. Credit rating corresponding to financing lever is finance leverage, and building it into marketization. The conditions of small loan companies transferring into rural banks should be relaxed especially the condition that the main sponsor of rural banks must be banking financial institutions.

Rural commercial finance reform on the one hand should make full use of the favorable condition that the Agricultural Bank of China has successfully completed shareholding reform and achieved clear property rights, which means to increase credit support for rural SMEs and farmers by fully using its funds in counties, networking and professions on the basis of stable institution county business. In terms of management, the Agricultural Bank of China should redefine the strategic direction of its service in rural areas and can not "simply" abandon the countryside, instead, should focus on improving the business in rural areas, accurately position commercial finance according to the existing pattern of rural finance, increase product and business innovation, and improve service capabilities according to the policy of gradually transferring to higher level of principle. Break the boundaries of traditional industries to increase according to the policy of by supporting the industrialization of agriculture. In terms of credit review and approval, appropriately relax lending conditions, innovate credit review and approval ways, expand the scope of credit customers, and improve capacity of serving "three rural issues" economy under the premise that ensures the "nature" of credit assets. On the other hand, ensure the Postal Savings Bank plays a good role, make full use of its nationwide branch channel advantage, open up channels of financially serving "three rural issues", actively carry out various credit business meetings according to "three rural issues" demands, continue to strengthen and improve internal risk management and control capabilities, and gradually develop into a rural financial service institution compared with rural credit cooperatives, and overly enhance the "three rural issues" financial service level.

In addition, we should vigorously cultivate new types of rural financial institutions, encourage and support a variety of commercial banks to set up branches in rural areas through initiating village banks, establish SME franchise services, and increase the intensity of rural financial services.

Improving rural credit guarantee system

Government departments must strengthen the management of the existing policy guarantee insti-tutions, regulate their industry and business guarantee scope, and strengthen the policy function of guarantee institutions' support for the industry, through the way of providing credit guarantee for SMEs that operate and develop in good conditions but have no collateral through agricultural credit guarantee fund for SMEs and farmers, establish sharing mechanism that avoids institutions and the lending banks suffering more share risks, to improve the reguarantee mechanism, ensure risk compensation to protect the security agency fund, introduce reguarantee for guarantee institutions and policy banks which will reduce operating risks for guarantee institutions, moreover, it should develop commercial guarantee agencies, provide policy support for agricultural commercial guarantee institutions, attract private finance into guarantee industry, and improve the rural guarantee system.

Conclusions

Solving the difficulty of rural financing is a large and complex systematic process, which can not be done overnight and needs a process of continuous improvement and maturity. This project can be divided into three phases: farmers and rural SMEs themselves, financing mechanisms, and the government. The core part is to enhance farmers and rural SMEs' own ability, with the basic section improving the financing mechanism to actively adapt the appropriate guidance and support of the government. However, the credit issue has always run through these three sections. To solve this problem is not just the amount of money in support, but the improvement in farmers and rural SMEs' financing capacity and credit, focusing on innovative financing system, eliminating financing repression are also included; besides, perfecting the government's macroeconomic functions, improving the institutional supply and financial support, and establishing good social credit system will improve all the mechanisms to play fundamental roles in the resource allocations.

He W B. 2010. Xinjiang rural microfinance development restriction factor and countermeasure analysis. China's Township Enterprises Accounting, 2: 7-5.

Hou Y. 2012. Mandatory institutional change under the analysis of difficulties in rural financial services. Journal of Harbin Institute of Financial, 6: 10-45.

Kang S S, Bao J H, Li Q S. 2010. Financial support the experience and lesson of foreign agricultural development. The Global Financial, 7: 13-15.

Liu Z R. 2010. State of rural small and medium-sized enterprise financing supply and demand for financial services. The Rural Economy, 5: 66-67.

Liu C P. 2012. Thinking of rural folk lending related. The Rural Economy and Technology, 5: 43-45.

Li J S, Deng Y L. 2012. Look from the new type of rural financial development of rural financial reconstruction. Economic Exploration, 9: 32-33.

Li R. 2011. The rural financial system: foreign experience and the route choice of China. The World's Agricultural, 9: 54-57.

Ma D L. 2011. Efforts to increase financial support to leapfrog development in Xinjiang. China's Financial, 18: 10-13.

Yan X C, Gu X Y, Du N N. 2011. Rural financing difficult deep analysis-based on the perspective of mortgage. Economic Research, 20: 27-28.

Zhang L Z, Wang P. 2006. The comparison of foreign rural cooperative financial development model analysis and revelation. The World's Agricultural, 6: 12-14.

F30; F83

A

1006-8104(2014)-02-0080-10

Received 26 March 2013

Li Mei-ni (1985-), female, Master, engaged in the research of ideological and political education. E-mail: 52764969@qq.com

* Corresponding author. Han Xue-ping, professor, supervisor of Ph. D student, engaged in the research of social security and human resource management. E-mail:13359990173@163.com

杂志排行

Journal of Northeast Agricultural University(English Edition)的其它文章

- Regulation of Foliar Application DCPTA on Growth and Development of Maize Seedling Leaves in Heilongjiang Province

- Comparison of Physiological Properties Between Dwarf and Vinetype Cucumbers (Cucumis sativus Linn.)

- Effects of Substitute Media on Development of Potted Cyclamen percicum Mill.

- Expression of HSP72 in Mouse Preimplantation Embryos with Heat Shock

- Effects of Maternal Dietary Energy Restriction on Fat Deposition of Offspring

- Effects of Dietary Protein and Temperature on Growth and Flesh Quality of Songpu Mirror Carp