Effect of market integration on green economic growth: Evidence from 30 Chinese provinces

2023-12-05GanQinghuaChenShumei

Gan Qinghua Chen Shumei

(1School of Economics and Management,Southeast University,Nanjing 211189,China)(2School of Economics and Finance,Shanghai International Studies University,Shanghai 201620,China)

Abstract:Based on panel data for 30 provinces in China from 2000 to 2019,the super slacks-based measure (SBM) model combined with the global Malmquist-Lenberger (ML) index is utilized to determine green total factor productivity to measure green economic growth.Then,the impact of market integration on green economy is explored.The findings indicate that integration has a significant role in accelerating the green economy,with notable spatial,temporal,openness,and policy heterogeneity.A series of robustness tests support the conclusions.The impact mechanism test reveals that market integration bolsters the green economy via green efficiency improvements.Furthermore,a threshold effect is evident between market integration and the green economy based on rationalization and ecologicalization of industrial structure and innovation input.Based on the results,policy suggestions regarding how to further enhance the level of market integration and the green economy are proposed.

Key words:market integration; green economic growth; industrial structure upgrading; regional coordinated development; green total factor productivity

With the continuous advancement of market economic restructuring,the rapid growth of China’s economy created the “China Miracle” that has attracted worldwide attention; however,this kind of growth is premised on extensive development that has generated serious environmental challenges.Achieving the harmonious development of China’s economy and environmental protection has become the fulcrum in all sectors in China over the past decade.Market integration is a crucial institutional guarantee to improve the efficiency of green economic growth.Therefore,exploring the logical connection between market integration and green economic development is of important practical significance for building a unified domestic market and realizing sustainable growth.

Three streams of research are closely related to this study.The first is research regarding market integration effects on economic growth.Studies mainly explore this topic from the dual perspective of market integration-market segmentation.The prevailing assumption is that an inverted U-shaped connection exists between market segmentation and economic growth (i.e.,a threshold effect on the influence of market segmentation on economic growth is evident in which the degree of market segmentation below the threshold can accelerate economic growth,whereas market segmentation that exceeds the threshold hinders economic growth)[1].Some studies empirically verify this inverted U-shaped relationship[2-4].The second stream is the effect of market integration on environmental pollution.Researchers find that eliminating market segmentation and realizing market integration can help optimize regional industrial structure[5],decrease the ratio of polluting occupations[6],and efficiently reduce enterprises’ pollution emissions[7].In addition,scholars assert that market integration and environment pollution have an inverted U-shaped connection,in which continuous improvement of market integration causes an initial increase in emissions of environmental pollutants and then a decrease[8].The third research stream is the influence of market integration on the green economy.For example,Du et al.[9]propose that the primary paths by which market segmentation affects the efficiency of the green economy in the Yangtze River Economic Belt are industrial structure and openness.Li et al.[10]examine the impact of market integration on the green economy in the Yangtze River Delta and the middle reaches of the Yangtze River urban agglomeration,finding that market integration has an important influence on accelerating urban green development,with notable geographic location heterogeneity.Li et al.[11]determine that the integration of the electricity market improves the efficiency of the regional green economy and impacts neighboring regions through spatial spillover effects.

This study examines how market integration affects the green economy at the provincial level.First,we reassess the green total factor productivity (GTFP) of 30 provinces in China from 2000 to 2019 to represent green economic growth.Then,the GTFP is broken down into green efficiency improvement (GEC) and green technology progress (GTC) to examine the influence mechanism of market integration on the green economy more in-depth.Second,we examine the impact of market integration on the overall green economy.A variety of robustness and heterogeneity tests are conducted.Third,we build a panel threshold model to measure the nonlinear characteristics of market integration affecting the green economy from the perspectives of industrial structure upgrading and innovation investment,with certain practical significance.

1 Mechanism Analyses and Research Hypotheses

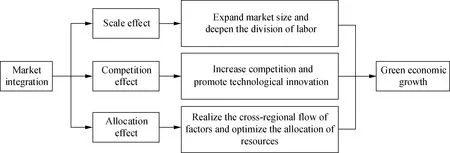

For a considerable time,under the influence of fiscal decentralization and political championship,to develop local economies and enhance competitiveness,local governments may have practiced local protectionism strategies to limit the flow of local resources,which has led to market segmentation.Market integration is the process of breaking down trade barriers,eliminating market segmentation,and establishing a large,unified market.Scale and technology diffusion effects related to market integration can facilitate local economic improvement and enhance the green economy[12].Based on relevant theories and existing literature,this section explores the influence of market integration on the green economy,summarizes the basic characteristics,and proposes related research hypotheses.Fig.1 shows the main mechanisms by which market integration influences the growth of green economy.

Fig.1 Influence mechanism of market integration on green economy

Existing research identifies three main mechanisms through which market integration affects the growth of green economy,including scale,competition,and allocation effects.The three mechanisms are as follows:

1) Scale effect.Market integration breaks down administrative trade barriers between different regions,accelerates the free flow of factors,and expands market size,which promotes green economic growth.Both the “local market effect” and Adam Smith’s “market scope” hypotheses assert that market scale growth is beneficial to deepening the division of labor,which can improve the production efficiency[13]and boost the efficiency of environmental governance through the centralized treatment of pollutants.Based on demand-driven innovation theory[14],companies will have more incentive to conduct research and development activities in pursuit of higher profits under the condition of increasing demand,which advances regional scientific and technological innovation.The endogenous incentives of a virtuous cycle and the continuous improvement of regional innovation capabilities enrich GTFP[15].

2) Competition effect.Market integration increases the competition faced by local enterprises,which will continue to innovate to enhance competitiveness,advancing the growth of green economy.The competitive effect of market integration affects the green economy in two ways[16].First,market integration forces enterprises to pursue technological innovation and human capital accumulation.The expansion of market scale increases the competition between enterprises.To obtain and retain a competitive edge,enterprises must pursue measures such as introducing or training talent,upgrading production lines,and technological innovation,which benefit the development of the green economy.Second,market competition promotes the survival of the fittest.In the early stage of market integration,the rapid expansion of the market may lead to duplication problems,resulting in low price competition or slow sales.If enterprises do not take action to increase productivity,inadequate production capacity and low-productivity enterprises will become obsolete.Enterprises’ efforts to enhance competitiveness will eliminate low-tech industries,and high-tech industries will further evolve to achieve technological upgrading[17].The above process optimizes the regional industrial structure while also contributing to green economic growth.

3) Allocation effect.Market integration can promote the cross-regional flow of factors,optimize the allocation of resources,and advance green economic growth.Market segmentation creates barriers to the free flow of production factors between different regions,efficient use of production factors is low,and economies of scale cannot be achieved.In addition,factor prices are also distorted when the market is fragmented,which restricts the improvement of regional production efficiency and aggravates regional environmental pollution[18-19].Market integration allows factors to flow freely in a more expansive area.Under the guidance of the price mechanism,based on the principle of prioritizing efficiency,factors will continue to flow to high-quality and efficient enterprises,improving the incumbent enterprises’ production efficiency.This means that enterprises can produce more output with less input and accelerate the improvement of GTFP[15].Thus,the allocation effect of market integration primarily facilitates the green economy by reducing environmental pollution and improving enterprise production efficiency.

Based on the above theoretical analyses,this study proposes Hypothesis 1:

H1Market integration can positively facilitate regional green economies.

The environmental Kuznets curve (EKC) demonstrates that economic development will eventually reduce environmental pollution[19].Research shows that the same is true regarding the influence of market integration on environmental pollution.Market integration references the free trade of commodities and the free flow of factors,which improves resource allocation efficiency and production technology progress and promotes pollution reduction[12,20].The expansion of trade and market scale produced by market integration will not increase pollution emissions with the increase in product output but reduce them based on the scale effect.Determining the final consequence necessitates a comparison of different forces.Advancing green economic efficiency is a target that comprehensively considers resource consumption and environmental pollution,the environmental policies in the initial stage of integration are not unified,and there is an environmental “race to the bottom” between different regions to gain more investment,which aggravates environmental pollution.Therefore,when integration is meager,its development will initially restrain green economic efficiency.When the integration reaches a certain threshold,the regional cooperation mechanism is relatively complete,and the demand for high-quality development becomes increasingly evident.Based on the analysis above,this study proposes Hypothesis 2:

H2Market integration has a nonlinear effect on the green economy.Industrial structure upgrading and innovation input are the primary regulatory factors through which market integration affects green economy.

2 Empirical Model and Methodology

2.1 Econometric model

Based on past theoretical mechanism analyses,this study constructs the following benchmark model to empirically test how market integration impacts the regional green economy:

lnGit=C+β1lnIit+β2Xit+μi+γt+εit

(1)

whereGitis the green economy of regioniin yeart;Cis the constant term;Iitis the market integration of regioniin yeart;Xitis a series of control variables;μiandγtdenote individual and time effects,respectively;εitis the error term.

2.2 Indicator descriptions and measures

2.2.1 Green economic growth

As GTFP includes both economic and environmental factors,this study uses GTFP to measure the green economy.Referencing Qi et al.[21],using the super slacks-based measure (SBM),this study incorporates various inputs and expected and unexpected outputs into the measurement framework.Specifically,we assume that there are decision-making units (DMUs),and each DMU usesmkinds of inputs (x0) to obtains1kinds of outputs (y0) ands2kinds of outputs (z0).The model is as follows:

(2)

To determine the dynamic change in DMUs,we adopt the global Malmquist-Lenberger index (GML) based on the super SBM model to measure GTFP,which is expressed as

(3)

whereL>1 means that GTFP increased compared with the previous year;L=1 indicates that GTFP is unchanged; andL<1 means that GTFP decreased.Furthermore,GML can be decomposed into GTC and GEC as follows:

(4)

The input indicators used in this study are listed below:

1) Capital investment.Referencing Shan[22],this measure is estimated using the perpetual inventory method and deflated by the fixed asset price index based on the year 2000.

2) Labor.This variable indicates the number of employees in each province at the end of the year.

3) Energy.This variable is measured by the total energy consumption of each province each year.

The output indicators used in this study are listed below:

1) Expected output.The GDP of each province is selected as the expected output indicator,and the year 2000 is used as the base period to apply the GDP deflator.

2) Undesired outputs.Industrial sulfur dioxide emissions and chemical oxygen demand emissions in industrial wastewater are used as undesired output indicators.

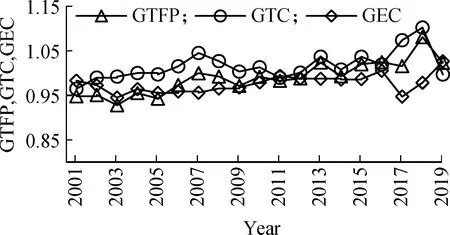

Using MATLAB R2021b,we calculate the GTFP of 30 provinces in China from 2000 to 2019 and decompose GTFP into GTC and GEC.Fig.2(a) presents the results.Notably,we calculate the GML index as the rate of change compared with the previous year and not the GTFP itself; thus,the GML index must be transformed accordingly.Referencing Qiu et al.[23],the GTFP in the year 2000 is set to 1,and the GTFP of subsequent years is the product of the GML index of the current year and the GTFP of the previous year.GTC and GEC are calculated in the same way as GTFP.Fig.2(b) presents the results.Fig.2 reveals that GTFP decreases before 2012 and shows an upward trend thereafter.Except for the decline in individual years,GTC is on the rise overall.

(a)

Contrary to the circumstances of GTC,GEC exhibits an overall downward trend.This indicates that in the course of advancing the green economy in China,technological progress has had a major role,with increased progress in green technology over two decades,yet inadequate attention has been paid to GEC.

2.2.2 Market integration

Market integration is the key independent variable of this study.Referencing Sheng et al.[24],we apply the price index method to determine the market integration of 30 provinces in China using commodity retail price indices.Given to the consistency of the data,this study selects 12 categories of commodity retail price indicators,including grain; textiles; clothing and shoes; cosmetics; household appliances,music,and video equipment; gold,silver,and jewelry; fuels; articles for daily use; books,newspapers,magazines,and electronic publications; aquatic products; beverages,tobacco,and alcohol; and traditional Chinese and Western medicines and health care articles.According to the method,we first calculate the relative price,

Second,we eliminate the irreducible effect and obtain the relative price change,

The market segmentation index is then determined,

Finally,we obtain the market integration index using the following formula:

2.2.3 Control variables

Referencing existing research on the green economy,this study selects the following control variables.1) Economic level.Referring to Liao et al.[25],we estimate this variable by per capita GDP,deflated using 2000 as the base period.2) Capital stock.We reference Shan[22],taking 2000 as the base period.First,we calculate the actual capital stock using the perpetual inventory method,and then we divide the result by the total population of the region to obtain the per capita stock.3) Scale of financial expenditure.Referencing Zhang et al.[26],this variable represents the proportion of fiscal expenditure in GDP.4) Opening level.Following Tuo et al.[27],we estimate this using the ratio of total imports and exports to GDP.5) Population density.Referring to Li et al.[10],this variable is measured using the ratio of the region’s total resident population to the region’s area.6) Human capital.We use the number of students in colleges and universities per 10 000 people in each province to measure the level of human capital[28].7) Technology development level.Referencing Bian et al.[29],we use the number of patents granted in each region,and weights of 0.5,0.3,and 0.2 are assigned to invention,utility model,and design patents,respectively,and the weighted average is used as the final patent grant number indicator.8) Environmental regulation intensity.We use the proportion of regional pollution control investment in GDP[29].9) Level of industrialization.Following Wei et al.[30],we use the level of industrialization by the ratio of industrial output value to GDP for this variable.10) Institutional environment.The most significant institutional variable is regional marketization,which uses the proportion of the number of employees in state-owned enterprises to the total number of employees to represent the nationalization level.There is a negative correlation between nationalization and marketization,with negative signs expected.For the sake of data stationarity,we take the logarithm of all data.Tab.1 presents all the variables.

Tab.1 Definitions and description of main data

2.2.4 Data sources

The time period examined in this study is 2000 to 2019.Based on the validity of the data,we select 30 provinces in China as objects to research.Notably,Hong Kong,Macau,Tibet,and Taiwan in China are not included due to incomplete data.The data sources include the China Statistical Yearbook from 2001 to 2020 and the statistical yearbooks of each province and city concerned,with missing data supplemented via interpolation.

3 Results and Analyses

3.1 Benchmark model tests

After applying the Hausman test,we select the fixed effect model to estimate the benchmark Eq.(1),with individual and time effects controlled.Tab.2 presents the regression results.Firstly,we exclude control variables to test the direct effect of market integration on the green economy.The influence parameter of market integration is 0.150 9,at a 5% significance level.Then we add control variables sequentially,the results reveal that the parameter of market integration remains positive significantly,indicating that market integration can significantly accelerate the regional green economy.Therefore,Hypothesis 1 is verified.

Tab.2 Benchmark model

As for the control variables,the parameter of lnEis significant and positive,indicating that it has a positive role in accelerating the green economy.An improved economic level can provide sufficient material and financial support for regional environmental governance and technological innovation,thereby promoting green economic efficiency.The coefficient of population density (lnP) is negative but insignificant.In areas with higher population density,the corresponding energy consumption will also increase,which can cause environmental pollution problems and does not advance the green economy.The parameter of the level of industrialization (lnS) is insignificantly negative.Industrial production processes consume considerable energy and produce pollution emissions,which is not beneficial to the green economy.Fiscal expenditure (lnF) has a negative influence on the green economy,which may be due to an overabundance of government intervention in the market,which causes market disorder and reduces resource allocation efficiency,negatively affecting the green economy[31].The institutional environment (lnL) has a negative influence on the green economy,which is consistent with expectations.Technology development level (lnT) produces a negative result,which may be because less green technology innovation is involved in current scientific and technological development processes,with an adverse effect on the green economy.Environmental regulation intensity (lnR) is negative and insignificant,which may be because the proportion of pollution control investment is used as a proxy indicator for environmental regulation,and most of this indicator is derived from enterprises’ self-financing.According to the follow-the-cost effect,increased investment in pollution mitigation will squeeze the funds for innovation R&D,inhibiting the advancement of green development efficiency.The parameter of capital stock (lnK) is significantly negative,which may be attributable to the misallocation and distortion of local capital factors.Under the fiscal decentralization system and the mode of officials’ promotion tournament,local governments may invest large amounts of money in high-polluting and high-energy-consuming industries with rapid results and small risks,which aggravates environmental pollution and hinders green economy development[29].

3.2 Heterogeneity tests

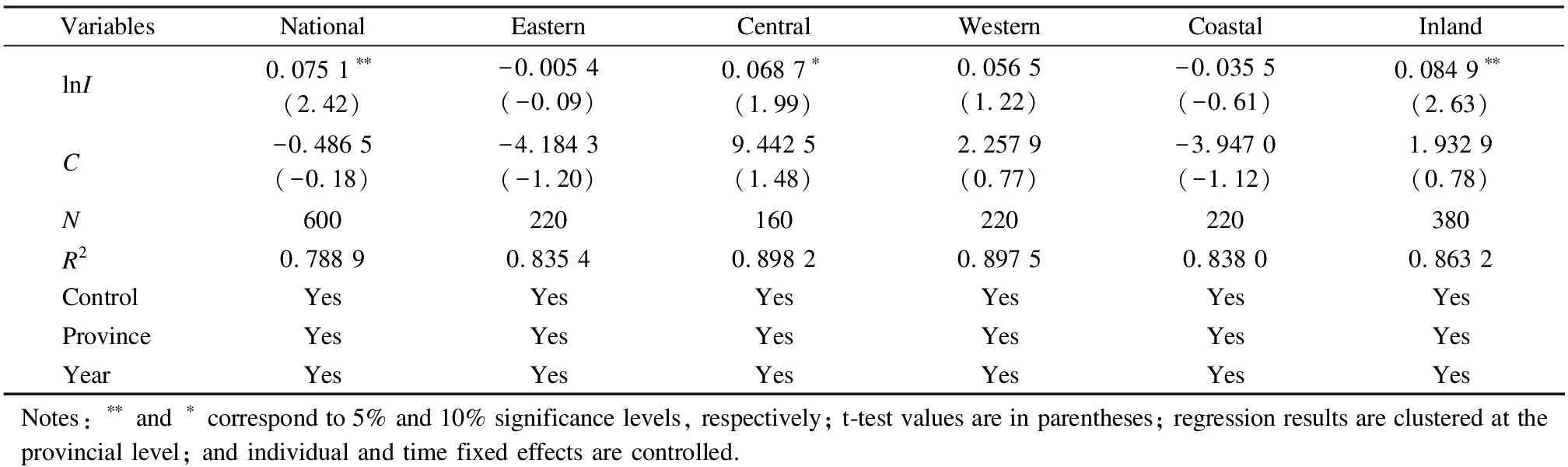

China’s vast territory with imbalanced economic levels in different regions leads to different market integration and green economy development.Considerable errors can occur when considering market integration’s effect on the green economy at the national level; hence,this study divides the samples into geographic location,openness,and temporal heterogeneity,and the results are presented in Tabs.3 and 4.

3.2.1 Geographic location heterogeneity

Concerning geographic location,this study divides the 30 provinces of China into eastern,central and western regional subsamples to test the connection between market integration and green economy.The results are listed in Tab.3.We find that market integration can positively affect green economy in the three regions,but this promotion is not significant in the eastern region,while the central and western regions are significant at a 5% level.The effect of market integration on the eastern region is the largest,the second is the central region,and the western region is the smallest.The cause of this difference may be that the eastern region’s economic level is comparatively high,and the efficiency of resource allocation is also relatively high; thus,market integration is not the major driving force of green economy development in the eastern region.In contrast to the eastern region’s economic level,China’s central and western regions are comparatively falling behind,and resource allocation efficiency is low.Market integration can facilitate factor flow and optimize resource allocation,enhancing the development of the green economy.

Tab.3 Results of heterogeneity test for geographic location and openness

3.2.2 Openness heterogeneity

The sample is next divided into coastal and inland areas according to the degree of openness to examine the effect of market integration on the regional green economy.The results are presented in Tab.3,revealing that market integration can positively facilitate the green economy in coastal and inland areas,with coefficients of 0.049 7 and 0.088 1,respectively.Notably,the impact on coastal areas is not significant,while that in inland areas is at the 5% significance level,and its coefficient value is larger than that of coastal areas.At the same time,we can see that openness in coastal areas is positive and significant.Specifically,every 1% increase in openness in coastal areas will cause green economic growth to rise by 0.383 7.The coefficient of openness in inland areas is only 0.000 2 and not significant.Sheng et al.[24]determined that market integration and openness to the outside world have a substitutive role in influencing economic growth.Our findings indicate that this also holds true for the green economy.Coastal areas are more open to the outside world based on their geographic location,meaning that the green economic growth in coastal areas is more dependent on overseas markets,which makes coastal areas engage in more trade cooperation activities with foreign developed countries.These economic activities in coastal areas can absorb advanced foreign technology,promoting green economic growth in coastal areas through technological spillover effects.In comparison,inland areas are more dependent on the domestic market; thus,the influence of domestic market integration on the green economy in inland areas is greater than in coastal areas.

3.2.3 Temporal heterogeneity

We next divide the sample into two stages (2000—2008 and 2009—2019) to examine the temporal effect of market integration on the regional green economy.Tab.4 presents the findings.In the period 2000—2008,market integration positively affected the green economy,with a parameter of 0.103 2 and a 5% significance level.In 2009—2019,although market integration still influenced the green economy in a positive way,it was not significant,and the coefficient also dropped to 0.061 2 compared with the previous period.This indicates that as the extent of market integration continues to deepen,its impact on green economic growth gradually decreases.In addition,as the green economy is affected in many ways,the function of market integration is weakened.

Tab.4 Results of heterogeneity test for temporal and policy effects

3.2.4 Policy heterogeneity

China has attached great importance to advancing market integration,introducing a number of related policies.For example,in 2014,a series of instructions on the coordinated development of the Beijing-Tianjin-Hebei (BTH) region were issued,mentioning market integration of the region at the national strategic level.In addition,in 2019,the government issued the Outline of the Integrated Regional Development of the Yangtze River Delta to boost the integrated development of the Yangtze River Delta (YRD) and enhance the innovation and competitiveness of the region.In this study,firstly,we divide the sample into pilot and non-pilot groups for regression based on integration policy implementation.Then,we divide the pilot group into the YRD and BTH for regression,and the results are presented in Tab.4.The results reveal that market integration has had a significant promotional effect on green economy development for the pilot group but no significant effect in the non-pilot group.Market integration significantly promoted green economy development in the YRD and BTH regions.The role of market integration in promoting the green economy in the YRD region is slightly higher than that in the BTH region.Policy support has had a considerable impact on the effect of market integration on the development of a green economy in these regions.Such policies can improve the degree of economic agglomeration,regional connectivity,and policy coordination efficiency and are of great significance to advancing the country’s high-quality development and establishing a modern economic system.

3.3 Robustness tests

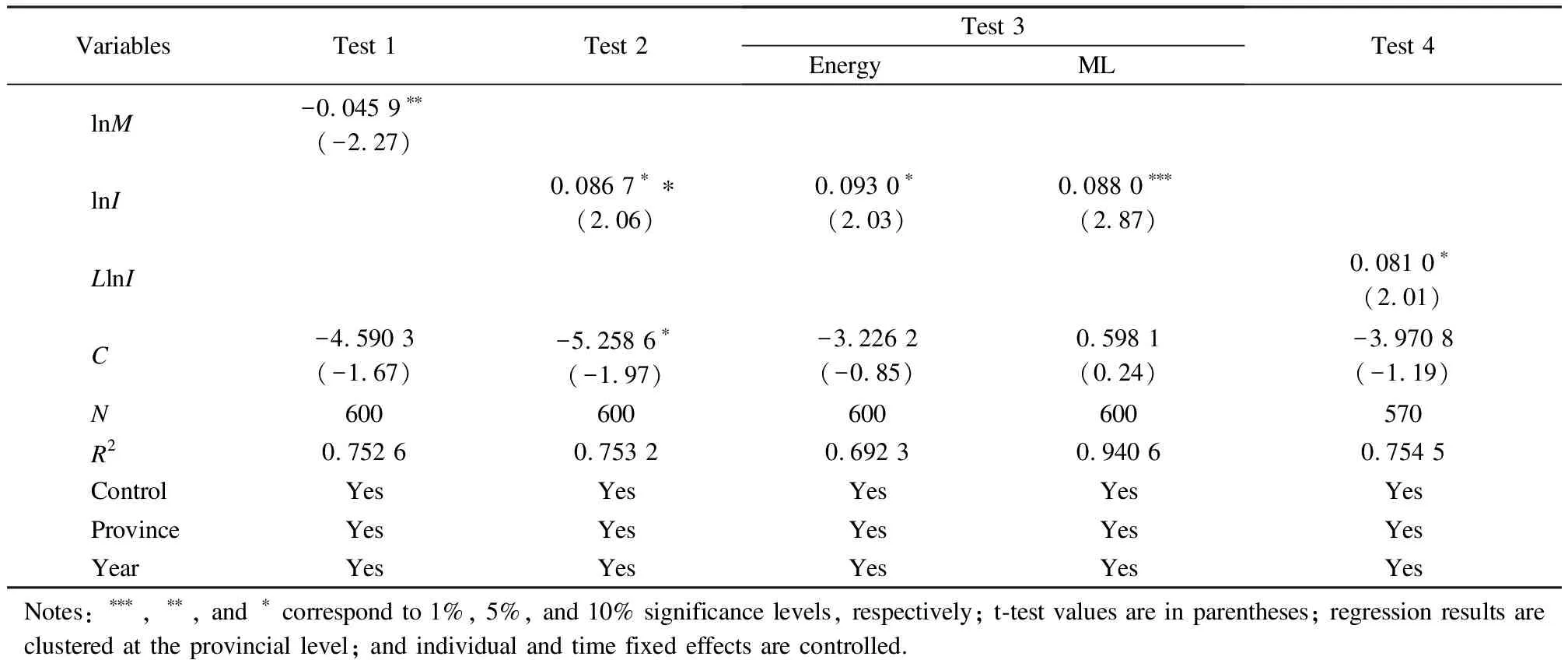

We next conduct robustness tests by using reverse indicators,excluding unnatural samples,replacing explained variables,and addressing potential endogeneity problems.Tab.5 presents the results.

Tab.5 Robustness tests

We first use inverse indicators.Market integration and market segmentation are two opposite concepts regarding one question.Thus,we use a market segmentation index (lnM) as an inverse proxy variable for market integration.The estimation approach of the market segmentation index is the reciprocal square of the market integration.Since the value is small,we multiply the market segmentation index by 1 000 and take the logarithm.Second,we exclude abnormal samples to remove the influence of extreme outliers on test results,conducting a 1% tail reduction for lnGand lnI.Third,we substitute the original explained variable using energy consumption per unit of GDP and recalculate GTFP according to the ML index.Finally,we consider potential endogeneity.The two most common methods for addressing endogeneity problems in the existing literature are using instrumental variables and introducing lag terms.Combined with the actual circumstances,we select the first-order lag term of lnIto examine the potential endogeneity problem.All results are presented in Tab.5.

The results of Test 1 in Tab.5 indicate that market segmentation can affect green economy development in a significant and inhibitory way,confirming that market integration can significantly facilitate the green economy.Tests 2 to 4 in Tab.5 confirm that market integration can affect green economy in a positive and significant way,indicating that market integration can positively accelerate the green economy,in accordance with the benchmark results,demonstrating that our conclusions are robust.

3.4 Mechanism tests

To investigate the influence mechanism of market integration on the green economy and determine whether green economic development is promoted through GEC or GTC,we separate GTFP into GEC and GTC to further explore the source of market integration affecting the green economy.Tabs.6 and 7 present the results.

At the national level,the result indicates that the impact of market integration on GEC is significant and positive.From a regional perspective,the influence of market integration on GEC is negative but insignificant in the eastern region,positive and significant in the central region,and positive but insignificant in the western region.The rationale for this outcome may be that the market integration level is already high in the eastern region,and the distribution of green resources is relatively complete; thus,the allocation effect of market integration does not significantly affect GEC.In contrast to the eastern region,central and western regions have lower resource allocation efficiency; thus,market integration improves the regions’ GEC through the allocation effect.The economic level in the western region is relatively low,environmental challenges are prominent,and the allocation efficiency of green resources is relatively low.Although market integration can positively promote GEC,it is not significant.The central region’s economic level falls between that of the eastern and western regions.The region has paid adequate attention to environmental protection while developing its economy; therefore,market integration can significantly accelerate GEC.For the coastal and inland areas,market integration has an inhibitory and insignificant influence on reforming the GEC in coastal areas.Nevertheless,it has a positive and significant influence on GEC in inland areas.The underlying rationale is that the coastal areas have a high level of economic development and efficient allocation of green resources.Furthermore,coastal areas have a relatively high level of openness and can improve GEC by absorbing advanced foreign green technologies,diminishing the effect of market integration on GEC.Compared with coastal areas,inland areas have a lower economic level,openness,and allocation efficiency of green resources; therefore,market integration can affect the GEC of inland areas in a significantly positive way.

Tab.7 presents the effect of market integration on GTC.The results indicate that although nationwide market integration can affect green technology in a positive way,it is not significant.Market integration can positively affect GTC in the eastern and coastal regions at 10% and 5% significance levels,respectively.In contrast,the parameter of market integration in central,western,and inland regions is positive but insignificant.The rationale for this outcome may be that the eastern and coastal regions have a relatively high level of openness,and absorbing advanced foreign green technologies and processes helps to optimize the structure of energy utilization,reduce environmental pollution,and promote the development of green technology.Combined with the results in Tab.6,the findings indicate that the effect of market integration on the green economy demonstrates regional heterogeneity.The eastern and coastal regions primarily advance green economy development by promoting GTC,whereas the national,central,western,and inland regions advance the green economy via GEC.

Tab.6 Influence of market integration on GEC

Tab.7 Influence of market integration on GTC

3.5 Threshold tests

Previous research has indicated that market integration can significantly affect the green economy.However,this impact has been based on linear estimation results that cannot reflect its specific change process.Therefore,to examine the nonlinear characteristics of the impact of market integration on green economy,we select industrial structure rationalization (Q1),industrial structure ecologicalization (Q2),and innovation input (Q3) as threshold variables to test whether market integration has a threshold impact on the green economy referencing the panel threshold model proposed by Hansen[32].The formula for calculating industrial structure rationalization refers to Han et al.[33]which is as follows:

whereYrepresents outputs,Lrepresents labor,andirepresents the industrial sector (i=1,2,3).The ecologicalization of industrial structure references Yang et al.[34]and is estimated as the proportion of total energy consumption in the GDP.The innovation input is estimated via the proportion of internal R&D expenditure to GDP.The rationalization and ecologicalization of industrial structure are both negative indicators,so we use the reciprocal for positive processing.We also take the logarithm of these three mediation variables (lnQ1,lnQ2and lnQ3are used to represented the three threshold variables in the following).

3.5.1 Threshold model construction

The threshold model proposed by Hansen[32]is as follows:

lnGit=β1lnIit·I(Tit≤γ1)+β2lnIit·

I(Tit>γ1)+θXit+μi+γt+εit

(5)

whereTitis the threshold variable,representing lnQ1,lnQ2,and lnQ3.γ1is the threshold value to be measured,andI(·) is the indicator function.Other multiple thresholds are obtained by extending Eq.(5).

3.5.2 Threshold effect tests

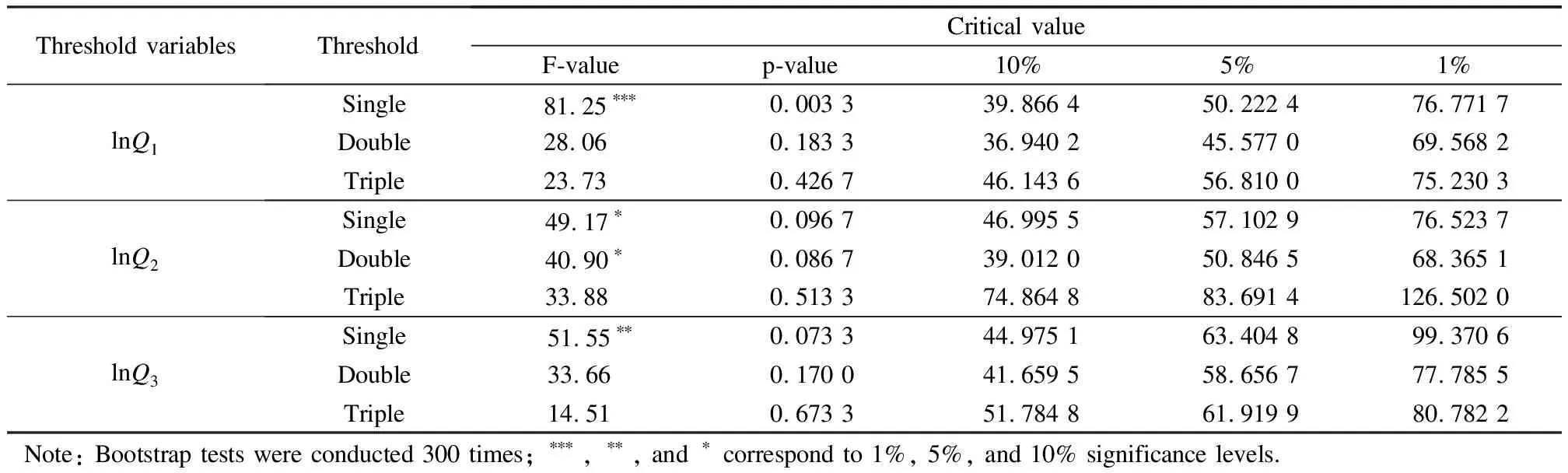

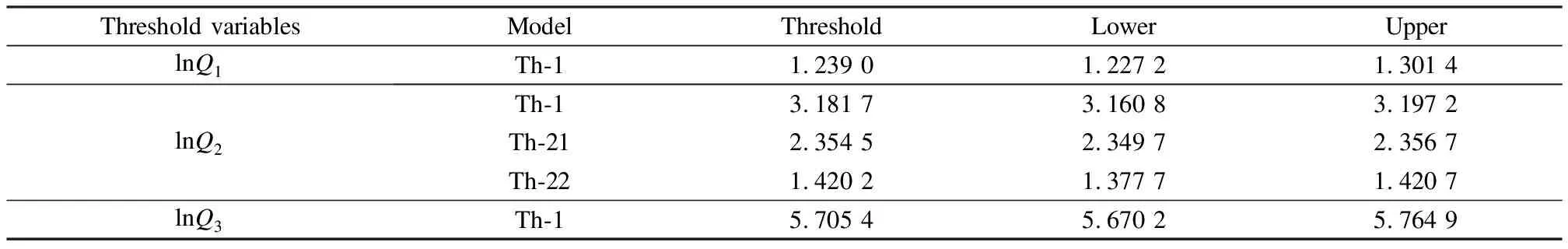

Before conducting the threshold effect test,we must first identify the number of thresholds.The results are presented in Tab.8,revealing that there is a single threshold for industrial structure rationalization (lnQ1) and innovation input (lnQ3),while industrial structure ecologicalization (lnQ2) presents a double threshold,and all thresholds are not significant.Tab.9 presents the threshold results.The model is tested based on the threshold values obtained by taking lnQ1,lnQ2,and lnQ3as threshold variables.Tab.10 presents the test results.

Tab.8 Threshold effect test results

Tab.9 Threshold estimator (level 95%)

Tab.10 Threshold model regression results

We next combine the test results in Tabs.9 and 10 for analysis.When lnQ1is used as a threshold variable,the threshold value is 1.239 0; when lnQ1≤1.239 0,the regression parameter of market integration is 0.105 8,at a 5% significance level; and when lnQ1>1.239 0,the parameter is 0.045 6 but not significant.This indicates that the rationalization of the industrial structure has different effects on the green economy in different threshold ranges.Before the rationalization of the industrial structure reaches the threshold value,market integration can significantly promote the green economy,whereas when the rationalization of the industrial structure exceeds the threshold,although market integration can still positively promote the green economy,it is not significant.When lnQ2is used as the threshold variable,the threshold values are 1.420 2 and 2.354 5,respectively.When lnQ2≤1.420 2,although market integration can affect the green economy positively,it is not significant.When 1.420 2

4 Conclusions

1)Using the panel data of 30 provinces in China from 2000 to 2019,we explore the influence of market integration on the green economy.The results demonstrate that market integration can significantly accelerate the development of the green economy.The impact of market integration on green economic growth is heterogenous,primarily including geographic location,openness,temporal,and policy heterogeneity.

2)The impact of market integration on the green economy is nonlinear,and threshold effects are evident based on the rationalization and ecologicalization of industrial structure and innovation input.When the rationalization of industrial structure and innovation input are used as threshold variables,a single threshold effect is revealed between market integration and green economic growth.When the ecologicalization of industrial structure is used as the threshold variable,a double threshold effect is evident between market integration and green economic growth.

3)The results indicate that strategic policies can significantly expand market integration’s influence on the green economy.To unleash the green function of market integration,it is essential to fully leverage the expanding effect of policy dividends on market integration’s influential effects on green economy development.All regions should prioritize continued market integration,designing corresponding policies to support the integrated development of all regions and optimize the role of market integration in promoting regional green development.

杂志排行

Journal of Southeast University(English Edition)的其它文章

- Vibration analysis of circular Janus MoSSe plates

- Experimental study on the static load performance of steel-concrete composite external joints after fatigue loading

- Database-based error analysis of calculation methods for shear capacity of FRP-reinforced concrete beams without web reinforcement

- Improved complex modal superposition method with inclusion of overdamped modes

- A multilayer network model of the banking system and its evolution

- Influence of consumer information investment on supply chain advertising and pricing strategies