Impact of taxes on the 2030 Agenda for Sustainable Development: Evidence from Organization for Economic Cooperation and Development (OECD) countries

2023-10-24MdMominurRAHMAN

Md.Mominur RAHMAN

Department of Business Administration, Northern University Bangladesh, Dhaka, 1230, Bangladesh

Keywords:Sustainable Development Goals(SDGs)Organization for Economic Cooperation and Development (OECD)countries Effective average tax(EAT)Tax on personal income (TPI)Tax on corporate profits (TCP)Tax on goods and services (TGS)

A B S T R A C T

1.Introduction

The emergence of the sustainable development concept is associated with the industrial revolution (Zhang and Song, 2022).Wasylenko (2019), Yang et al.(2020), and Kouam and Asongu (2022) stated that western countries began to realize that their economic and industrial activities significantly impacted the environment and social balance in the second half of the 19thcentury.Multiple ecological and socioeconomic catastrophes have occurred worldwide,raising the awareness of the need for a more sustainable approach.Myles (2000) and Nellen and Miles (2007) argued that sustainable development is a thought-out approach that embraces progress while utilizing resources more wisely,considering both the short- and long-term advantages for our planet and the people living on the planet.Sustainable development strategies aid in a country adjusting its growth rate based on the problems posed by climate change,thereby protecting vital natural resources for current and future generations (World Bank, 2019).It is predicted that there will be 9.0×1010people on the Earth by 2050 (Neupane et al., 2022; Samour et al., 2022; Faghri, 2023).The challenge of sustainable development is to advance in such a manner that each of these individuals may experience a high standard of living without depleting our natural resources.

At the 2012 United Nations Conference on Sustainable Development in Rio de Janeiro, Sustainable Development Goals (SDGs) were established (World Bank, 2019).The idea creates a set of global objectives that would aid in addressing the pressing political, economic, and environmental problems that our planet is currently experiencing.The SDGs urge all communities companies to use their imagination and ingenuity to address issues relating to sustainable development, in contrast to their predecessor, the Millennium Development Goals.The appeal of SDGs is that everybody can participate, and every contribution, no matter how modest or significant, can affect the globe.Peterson and Bair (2022) observed how the goals have positively changed the business environment in our sector.We mainly work in developing and transitional countries, and we can observe the effects of the goals and how they assist in creating better prospects for the local communities.Sachs et al.(2021) stated the adverse effects of environmental change and increased inequality.The pursuit of sustainable development depends on the effective mobilization of domestic resources.Following this analysis, we believe that tax is a potent tool for aiding in financing SDGs and has the additional potential to promote equitable and sustainable development.Fiscal policies can increase resource mobilization, reduce inequality, and encourage sustainable consumption and production patterns.

The Organization for Economic Co-operation and Development (OECD) countries are now facing the difficulties brought by the economy digitization, so studying on this research topic is a good choice (Mosquera-Valderrama,2019).The OECD countries are included in this study because their efforts to achieve sustainable economic growth are directly related to the outcome variables of research.Harmonizing three key factors including economic growth,social inclusion, and environmental protection, is essential for sustainable development.All of these factors are interrelated with the welfare of people and society.Taxes can also impact a country’s rate of economic expansion(Myles, 2000; Rahman, 2022) and typically influence the gross domestic product (GDP) of a country.Because of this contribution, taxes encourage economic growth, which in turn boosts the country’s economy growth by raising living standards and increasing employment (de Paepe and Dickinson, 2014; Bird and Davis-Nozemack, 2018; Alavuotunki et al., 2019; Barrios et al., 2020; Yang et al., 2020; Yassine, 2020; Adegboye et al., 2022).The country needs decent infrastructures to promote business prosperity, including roads, telephones, and power.Governments or entities with direct government engagement create these infrastructures.Governments invest the taxes they received in infrastructure construction, encouraging economic growth (Mosquera-Valderrama, 2019).Because governments may reinvest this money in the economy as loans or other types of capital, the notion of tax is essential for businesses.

This research contributes in at least four aspects.First, this study found a positive association of taxes in the way of effective average tax (EAT), tax on personal income (TPI), tax on corporate profits (TCP), and tax on goods and services (TGS) with SDGs.As the relationship between taxes and SDGs is novel in the context of OECD countries,it provided a broad picture of the overall impact of tax policies on 17 SDGs.Second, SDGs can inform decisionmaking in taxes, encouraging policy-makers to reform their tax system and having some legal effects on the judicial process.Third, this study employed the theory of optimal taxation (TOT) to examine the relationship between taxes and SDGs.Finally, this study added value to the similar study.This study used two important tax measures, i.e., EAT and TGS, and extended the sample to all OECD countries; it is clear that taxes can positively contribute to achieving better SDGs.

2.Literature review

2.1. Theoretical background

The TOT provides a framework for policy-makers to design tax system that maximizes social welfare while minimizing distortions to economic activity (Mirrlees, 1986).In the context of this study on tax and its impact on the 2030 Agenda for Sustainable Development, the TOT could be used to examine how different types of taxes, such as EAT, TPI, TCP, and TGS, can be optimized to promote the achievement of SDGs (Kanbur et al., 2018).The TOT suggests that tax system should be designed to balance the need for revenue collection to minimize the negative effects of taxes on economic growth and individual incentives.The TOT also highlights the importance of considering the distributional effects of taxes on different income groups and the potential trade-offs between equity and efficiency(Mirrlees, 1986).Using the TOT as a theoretical framework, policy-makers and researchers can assess the potential impact of different tax policies on SDGs and design a good tax system.

The TOT assumes that government can design a tax system that maximizes social welfare while minimizing economic inefficiency (Sørensen, 2007).However, this assumption may not hold true in practice, as tax system is often influenced by political and social factors that may not align with the goal of social welfare maximization.In the context of this study, the TOT can be contrasted with the political economy theory, which suggests that tax system is often designed to benefit powerful interest groups rather than maximize social welfare (Sandmo, 1975).Furthermore,the TOT assumes that individuals are rational and self-interested, which may not always be the case in reality.For instance, individuals may be influenced by social norms and values, leading them to make decisions not solely based on economic self-interest.Additionally, the TOT has been criticized for its reliance on a utilitarian frame work, which measures social welfare solely based on the aggregate levels of happiness or well-being.This approach may not adequately capture the distributional impacts of tax policies on different groups within society, particularly marginalized or vulnerable populations (Sandmo, 1975; Sørensen, 2007).

In the context of the TOT, we can connect different types of taxes with SDGs based on efficiency, equity, and simplicity.For instance, TPI can promote greater income equality and reduce poverty and inequality (Anguelov,2017).On the other hand, TCP can be viewed as a way to reduce income inequality and promote responsible citizenship by making corporations contribute to the common good.Similarly, TGS can also be connected to SDGs.Arguably, a tax on luxury goods could help promote more sustainable consumption and production patterns.Additionally, revenue generated from such taxes can be used to fund public goods and services.Moreover, EAT can be considered as a measure of the overall levels of taxes faced by individuals and firms.In the context of SDGs, EAT can be connected to the TOT through its impact on economic growth and income inequality (Rahman, 2022).High EAT can discourage investment and innovation, lead to lower economic growth, and reduce the progress of SDGs.On the other hand, low EAT can result in insufficient revenue collections, which may limit government’s expenditure on social programs and infrastructure, and hinder the progress of achieving SDGs.

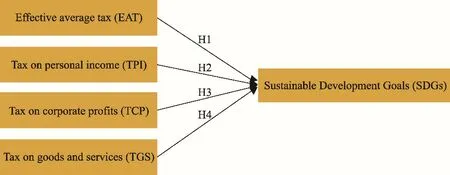

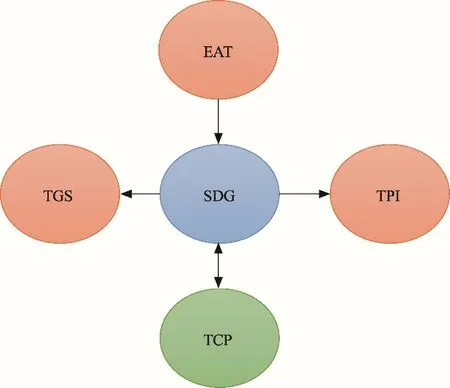

However, it is important to note that applying the TOT in the context of SDGs is not without criticisms and challenges.Implementing the TOT can be difficult due to political and administrative constraints and challenges related to tax evasion and avoidance (Wasylenko, 2019).Additionally, the distributional effects of different types of taxes may not always align with SDGs, as some taxes may inadvertently harm vulnerable populations or perpetuate existing inequalities.Therefore, this study develops the following conceptual research model (see Fig.1).

Fig.1.Conceptual research model constructed in this study.H1, there is an association between EAT and SDGs; H2,there is a relationship between TPI and SDGs; H3, there is a link between TCP and SDGs; H4, there is a connection between TGS and SDGs.

2.2.Effects of effective average tax (EAT) on Sustainable Development Goals (SDGs)

The concept of taxes has been recognized as an essential tool for the government to mobilize revenue for public goods and services (Annuar et al., 2018).Taxes can also promote economic growth, reduce income inequality, and contribute to achieving SDGs.One of the commonly used tax measures is EAT, which captures the average tax burden of taxpayers in a country.

In practically every country, governments impose taxes as mandatory levies on people or things (Samour et al.,2022).The average tax rate paid by taxpayer is called the “effective rate”.The effective tax rate for a company is determined by dividing its total federal and state income tax expenses by its pre-tax profits.Padovano and Galli (2001)argued that in OECD countries, taxes can increase a country’s GDP.Because of this involvement, taxes encourage economic growth, boosting the country’s economy by raising living standards and promoting employment growth.Taxes are plainly necessary to raise funds for all aspects of country’s development and are important to achieve specific SDGs (McGill, 2010; Mathieu-Bolh, 2017; Samour et al., 2022).The ability of emerging countries to enforce their laws, stronger anti-avoidance regulations to prevent avoidance and evasion, and expanding the tax base itself are all necessary to increase the overall taxes.Governments wouldn’t be able to support the needs of societies without taxes.Kaldor (1965) stated that taxes are essential because governments need to utilize the taxes to fund social programs.

EAT, an advanced source of tax collections, can effectively achieve SDGs (Barrios et al., 2020).Taxes are the crucial source of funds for achieving SDGs, enabling governments to invest in infrastructure, education, healthcare,and other areas essential for sustainable development (Chan et al., 2015).EAT can increase tax collections by improving the efficiency of the tax system and reducing tax evasion.EAT measures the average tax burden on a particular sector of the economy.A high EAT implies that the tax burden of the sector is high, while a low EAT indicates a lower tax burden of the sector.By setting a reasonable EAT level, governments can ensure that all sectors of the economy pay their fair share of taxes, which can increase the overall tax collections (Rahman, 2022).

Furthermore, EAT can help reduce tax evasion, which is a significant challenge for tax administrators in many countries.High tax rates can incentivize taxpayers to evade taxes, but a reasonable EAT can reduce this incentive(Samour et al., 2022).By setting an appropriate EAT level, governments can ensure that taxpayers are not overburdened with taxes, which can encourage compliance and reduce tax evasion.However, it is essential to note that EAT should not be the only consideration in tax policies.Other factors, such as fairness, simplicity, and administrative feasibility, should also be considered.For example, tax expenditures, which are tax breaks or government incentives, can complicate the tax system and reduce tax collections (Adegboye et al., 2022; Rahman,2022).Therefore, tax policies should be designed to balance the need for collections with other objectives such as fairness and simplicity.Governments can increase tax collections and support sustainable development by setting an appropriate EAT level.Thus, this research postulated the first hypothesis:

H1: There is an association between EAT and SDGs.

2.3.Effects of tax on personal income (TPI) on SDGs

TPI can provide a stable and reliable source of revenue for governments (Bird, 2013), which can be used to fund public goods and services that are essential for achieving SDGs.A progressive TPI system can promote greater income equality and reduce poverty and inequality.This is because a progressive TPI system imposes higher rate on higher-income individuals, which can help redistribute income and reduce income inequality (Peterson and Bair,2022).In contrast, a regressive TPI system, which imposes higher rate on lower-income individuals, can exacerbate income inequality.TPI can incentivize individuals to work and invest more, promoting economic growth.This is because TPI can affect the after-tax income of individuals, which may influence their decisions to work and invest(Lee and Gordon, 2005).When the rate of TPI is lower, individuals may have more disposable income, thereby increasing their spending and savings.This, in turn, can boost economic activity and promote economic growth.Conversely, when the rate of TPI is higher, individuals may have less disposable income, thereby reducing their spending and savings.Moreover, a well-designed TPI system can encourage work and investment by incentivizing individuals to engage in productive activities (Peterson and Bair, 2022).For example, tax credits or deductions for education, training, or investment can incentivize individuals to acquire new skills, start businesses, or invest in the economy.

TPI can also promote responsible citizenship, as individuals who pay taxes are more likely to demand accountability and transparency from their government (Rahman, 2022).When individuals pay taxes, they have a stake in how the government uses those funds.As a result, they are more likely to take an interest in government policies and demand accountability and transparency from their elected representatives (Diaz-Sarachaga et al., 2018).Furthermore, a well-designed TPI system can foster a sense of civic responsibility among individuals.When individuals see their taxes being used for public goods and services that benefiting the society, they are more likely to feel pride and ownership in their contribution to society (Walker, 2019).This, in turn, can promote responsible citizenship and social cohesion.

The fundamental of the tax system is TPI.Kaldor (1963) argued that it is also one of the most talked-about subjects when implementing tax policies because of its enormous influence on economic development and growth.When residents and non-residents in the country participate in taxable or income-generating activities, they must pay TPI.Tax-related topics, syndicates, and any groups representing businesses, the government, and political parties show heightened interest in and sensitivity to social security contributions and TPI (de Paepe and Dickinson, 2014; Jarboui et al., 2020).Each of them has specific, frequently conflicting interests in TPI.Because of this, Bartik (1992) argued that it is typically challenging to agree on TPI and social security payments.Decisions are frequently reviewed and susceptible to revision to promote economic development and progress.Additionally, in the current socioeconomic environment, concerns about ecological discord, environmental destruction, and wealth inequality are at the forefront of discussions (Angelopoulos et al., 2007).Thus, through implementing macroeconomic and tax policies, scientists and government workers create the circumstances for long-term economic growth and development.To guarantee growth and sustainable economic development simultaneously, it is important to strike a balance between economic efficiency and social fairness when it comes to taxes.

Tax matters concerning economic growth are often analyzed from two distinct views that involve a wide range of frequently conflicting concerns (Gechert and Heimberger, 2022), which include incentives and resources.Those who believe that a lack of adequate incentives is the primary factor in insufficient development and investment are more concerned with changing the tax system by offering further concessions than they are concerned with the detrimental effects on public revenue (Wasylenko, 2019; Yassine, 2020; Wang et al., 2022; Zhang and Song, 2022).For those who believe that a lack of resources is the main reason for insufficient development and investment, increasing the resources available for investment by raising tax is the key objective, even if doing so intensifies the disincentive effects.Taxes help enhance people’s living standard (Simionescu and Albu, 2016; Nerudová et al., 2019).With the improvement of living standards, consumption is more likely to be greater and higher (Weller, 2007).Businesses will flourish when there is a demand for their products and services.Businesses may count on increased domestic consumption due to improved living standard (Hulten and Robertson, 1985; Ángeles Castro and Camarillo, 2014;Bird and Martinez-Vazquez, 2014).Because taxes are necessary, everyone should benefit from them.Therefore,individuals must try to pay their taxes and understand that they paying for a purpose.Thus, this study offered the second hypothesis:

H2: There is a relationship between TPI and SDGs.

2.4.Effects of tax on corporate profits (TCP) on SDGs

TCP is another vital source of taxes that can contribute to achieving SDGs (Samour et al., 2022).TCP is a tax levied on the profits earned by corporations or businesses; it can significantly increase tax collections if appropriately implemented, for example, ensuring corporations pay their fair share of taxes.Taxing corporations’ profits would incentivize them to report their earnings accurately and reduce the possibility of tax evasion (Rahman et al., 2021).This may increase tax collections, which can be used to finance programs and projects to achieve SDGs.

TCP may not always increase tax collections, depending on the specific tax rate and how corporations respond to it (Rahman et al., 2020).If the tax rate is too high, corporations may shift their profits to lower-tax jurisdictions, thus reducing the amount of taxes generated.TCP may also discourage investment and business growth if the tax rate is too burdensome.This could lead to lower economic growth and potentially hinder the achievement of SDGs.While TCP can increase tax collections, it may also exacerbate income inequality if corporations pass the tax burden to their consumers or workers through higher prices or lower wages (Myles, 2000).TCP may also create loopholes or opportunities for tax avoidance, especially if corporations have the resources to employ tax experts and lawyers to exploit such loopholes.Moreover, TCP can help promote responsible corporate behavior if governments design the tax system to incentivize corporations to adopt sustainable and socially responsible practices (Gechert and Heimberger, 2022).By ensuring corporations pay their fair share of taxes, TCP can improve the tax system of government institutions and promote accountability.

The quantity of capital that may be generated and employed is inversely proportional to the tax rate—the higher the taxes, the higher the cost of capital (Martinez-Vazquez and Bird, 2014; Anguelov, 2017; Annuar et al., 2018).A higher rate of TCP may reduce the long-term capital stock and overall economy scale (Bird, 2013).On the other hand,a lower rate of TCP can promote new investment and increase capital stock (Fernando and Chukai, 2018).Although taxes are often used to raise funds for government expenditures, they can also be used for other purposes (Kalkuhl et al., 2018).Although the negative effects of taxes are as apparent as they are in theories of economic growth, they also depend on how much taxes are collected.Reduced taxes may encourage investment and savings; still, they also increase the government deficit, which stifles economic growth by raising the government’s borrowing, spending,and investment (Lee and Gordon, 2005; Marques et al., 2019).

Chan et al.(2015) and Mosquera-Valderrama (2019) stated that the main factors influencing high organizational profitability are investment knowledge strategies and SDGs, attracting policy-makers’ attention.By using SDGs to plan and direct their strategies, objectives, and activities, businesses and corporates have a tremendous opportunity to benefit from various benefits.Businesses are strongly encouraged to support social development (Bird and Davis-Nozemack, 2018; Gechert and Heimberger, 2022).TCP may help countries gain a competitive edge and spur growth by freeing more money for reinvestment, preventing local companies from moving their investment elsewhere, and encouraging foreign companies to open offices in local (Barrios et al., 2020).Reduced TCP has significant, persistent,positive, and long-term effects on the economy (Kaldor, 1963; Kaldor, 1965; Goss and Phillips, 1999).The initiative of SDGs, commonly called taxes for SDGs, helps developing countries to increase the mobilization of domestic resource and achieve SDGs.Tax as a means of raising revenue and encouraging sustainable growth strategies, is moving towards desired outcomes in terms of the climate, nature, well-being, and governance.Based on this, the third hypothesis is developed:

H3: There is a link between TCP and SDGs.

2.5.Effects of tax on goods and services (TGS) on SDGs

TGS, also known as value-added tax (VAT) in many countries, can increase tax collections (Kanbur et al., 2018).TGS is generally broad-based and applies to all goods and services consumed within the country, thus generating significant revenue for the government.TGS can promote fiscal sustainability by reducing reliance on TPI and TCP,which can be volatile and subject to fluctuations (Kouam and Asongu, 2022).TGS is generally more stable and predictable based on consumption patterns, which tend to be more consistent over time.TGS can promote allocation efficiency by reducing market distortions and encouraging investment and savings.When goods and services are taxed, consumers may reduce their spending on non-essential items and increase savings, which can contribute to economic growth and development.

Additionally, TGS can incentivize businesses to invest in capital goods and machinery rather than labor-intensive production processes, thereby improving productivity and competitiveness (Samour et al., 2022).It can promote sustainability by encouraging environmentally friendly consumption patterns.By levying higher taxes on goods and services that have a greater environmental impact, such as fossil fuels and disposable plastics, TGS can incentivize consumers to shift towards more sustainable consumption patterns.Rahman (2022) claimed that there is a positive and substantial association between SDGs and the rate of TCP.In order for emerging countries to achieve SDGs, the rate of TCP must be increased.There is no way to avoid or cut tax collections if countries want to achieve SDGs;thus, policy-makers should establish mandatory measures that ensure rigorous adherence to tax rules and regulations.

Without taxes, governments could not be able to meet the requirements of populations (Artiach et al., 2010; Bird and Davis-Nozemack, 2018).Governments must impose taxes because they utilize them to pay for social programs.Without taxes, governments would not invest in the healthcare sector (de Paepe and Dickinson, 2014).Taxes are used to cover the cost of health services, such as social healthcare, medical research, and social security (Angelopoulos et al., 2007; Weller, 2007; Marques et al., 2019; Gechert and Heimberger, 2022; Samour et al., 2022; Zhang and Song,2022).Governments greatly emphasized that the development of human capital, and education is crucial to this growth(Sachs et al., 2021).The public education system is financed, kept up, furnished, and maintained by taxes.In addition to social programs, governments used taxes to finance critical public services like security, science, and environmental protection (Yang et al., 2020).Bird and Davis-Nozemack (2018) argued that for businesses to thrive, the countries require to build good infrastructure, including roads, phones, and power.Then, governments build this infrastructure with the taxes they collected, which promotes economic expansion.Thus, there is an interconnection between SDGs and taxes.

On the other hand, TGS can be regressive, meaning that it may disproportionately affect low-income individuals and exacerbate inequality (Wang et al., 2022).This can be problematic from an equity perspective and may make achieving certain SDGs related to reducing poverty and inequality more difficult.TGS can also increase the cost of living, which is particularly challenging for low-income individuals and families.This may make it more difficult for them to access basic goods and services, hindering the achievement of SDGs (Zhang and Song, 2022).Additionally,TGS may be subject to evasion and fraud, which can decrease the amount of revenue generated and undermine efforts to achieve SDGs that rely on government funding.This can also erode public trust in the tax system, negatively affecting the achievement of SDGs.Finally, the relationship between TGS and economic growth is not always clearcut.While TGS can generate revenue that can be used to fund public goods and services, it can also discourage consumption and investment, which can dampen economic growth and hinder the achievement of SDGs in areas such as job creation and poverty reduction (Jarboui et al., 2020).Based on this, this study developed the fourth hypothesis:

H4: There is a connection between TGS and SDGs.

3.Data sources and econometric modeling strategy

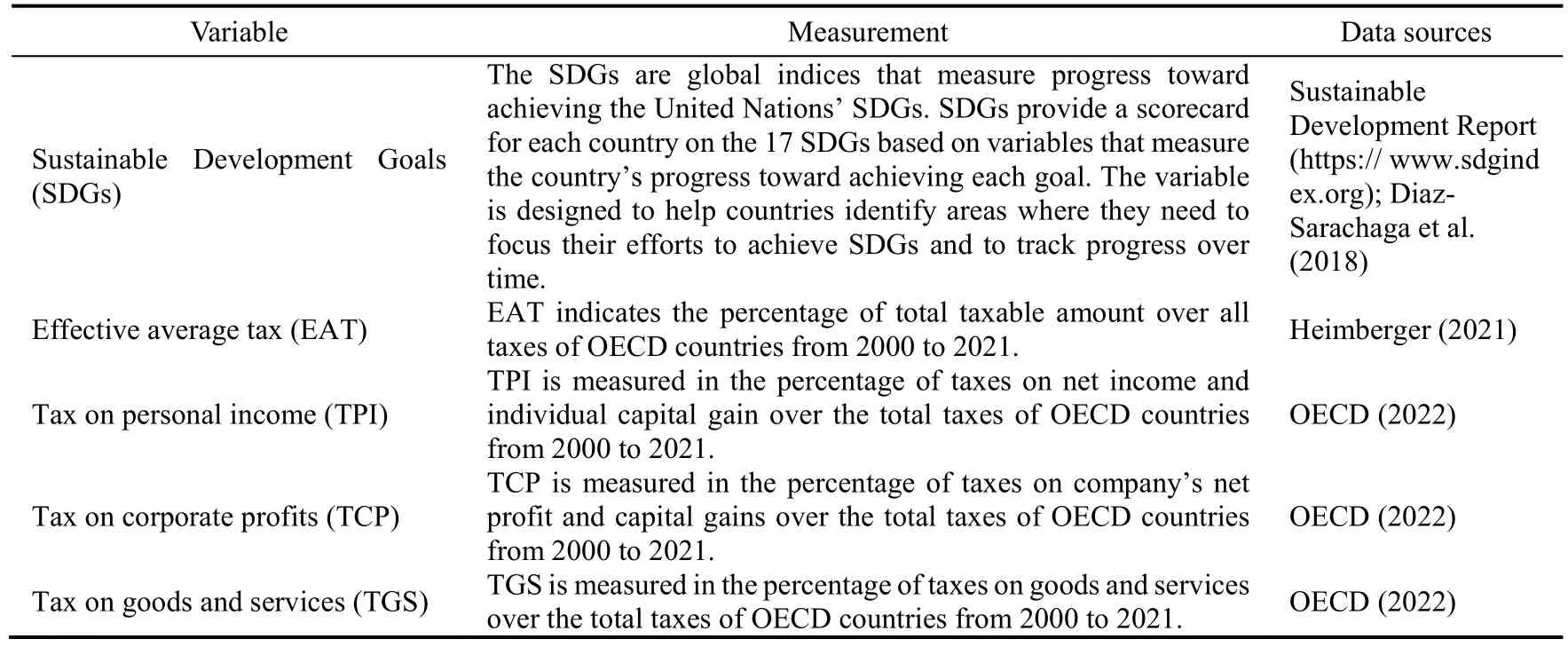

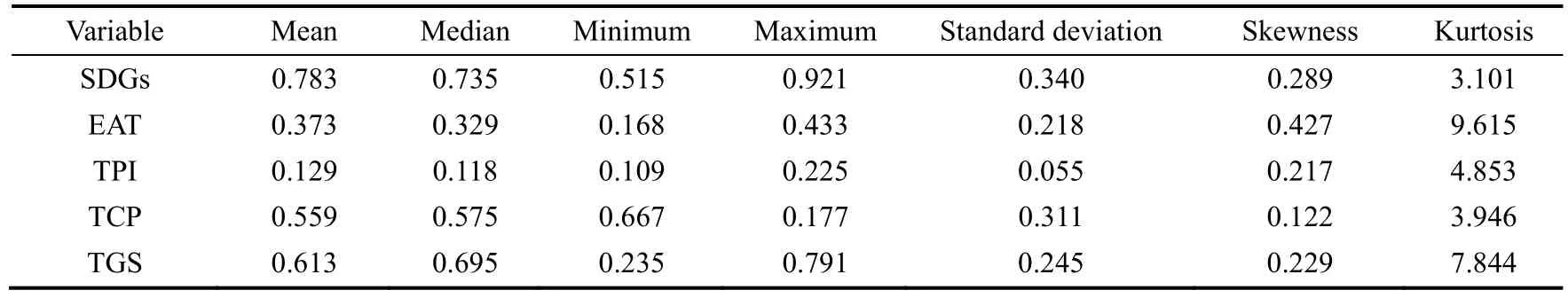

This research used observation data from 38 OECD countries covering 2000-2021.Table 1 represents data sources of the employed variables.SDGs come from Sustainable Development Report (https://www.sdgindex.org), Diaz-Sarachaga et al.(2018), and Sachs et al.(2021); EAT comes from Heimberger (2021); and TPI, TCP and TGS come from OECD (2022).

Table 1Variable description and data sources.

The dependent variable is SDGs, which are global indices that measure progress toward achieving the United Nations’ SDGs towards OECD countries for 2000-2021 years.The higher value (positive value) of SDGs indicates the greater achievement of SDGs, and vice versa.This study used four independent variables as the proxies of taxes,i.e., EAT, TPI, TCP, and TGS.EAT indicates the percentage of total taxable amount over all taxes of OECD countries from 2000 to 2021.TPI is the tax levied on both net income and individual capital gains.TPI is measured in the percentage of taxes on net income and individual capital gain over the total taxes of OECD countries from 2000 to 2021.TCP indicates the taxes on the company’s net profit and capital gains.TCP is measured in the percentage of taxes on company’s net profit and capital gains over the total taxes of OECD countries from 2000 to 2021.VAT and sales tax are also included in TGS.TGS is measured in the percentage of taxes on goods and services over the total taxes of OECD countries from 2000 to 2021.

This study used the following equation for the achievement of SDGs:

where,w,z, andfindicate countries, years, and function, respectively.

Table 2 displays the level of basic features through descriptive statistics for each variable.SDGs, EAT, TPI, TCP,and TGS have mean values of 0.783, 0.373, 0.129, 0.559, and 0.613, respectively.Standard deviations of SDGs, EAT,TPI, TCP, and TGS are 0.340, 0.218, 0.055, 0.311, and 0.245, respectively.This study also presented that the skewness and kurtosis can help to identify the degree of variation and dispersion in the variable values across countries and over time.The results indicated that the data conform to normal distribution.Thus, the descriptive statistics of the variables make it possible to conduct further analysis.

Table 2Descriptive statistics of five variables (SDGs, EAT, TPI, TCP, and TGS).

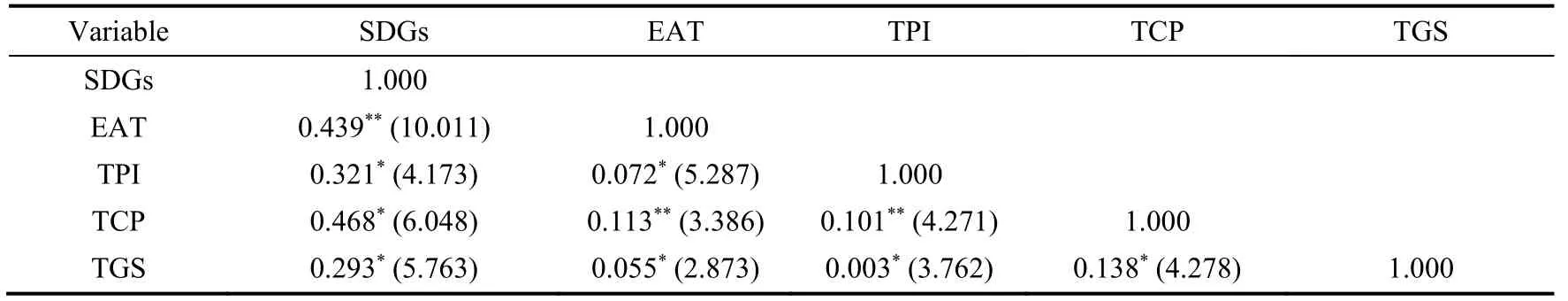

Table 3 represents the correlation matrix of the variables.The study found highly positive correlations SDGs with EAT, TPI, TCP, and TGS.Thus, initially, the study conveyed that SDGs may have positive effects on EAT, TPI,TCP, and TGS.The correlation coefficients between the independent variables (EAT and TPI: 0.072; EAT and TCP:0.113; EAT and TGS: 0.055; TPI and TCP: 0.101; TPI and TGS: 0.003; and TCP and TGS: 0.138) are all less than 0.800, indicating that the study is not undermining by multicollinearity issue (Rahman et al., 2021).

Table 3Correlation matrix of five variables (SDGs, EAT, TPI, TCP, and TGS).

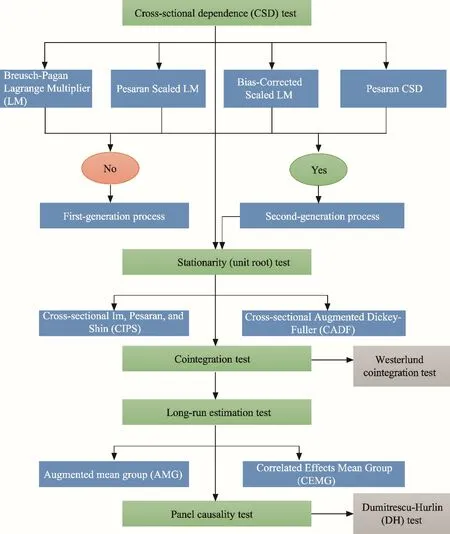

To comprehend the whole research procedure, this study employed a step-by-step econometric modeling technique(see Fig.2).The study first checked for cross-sectional dependency using Breusch-Pagan Lagrange Multiplier (LM),Pesaran Scaled LM, Bias-Corrected Scaled LM, and Pesaran Cross-sectional dependence (CSD) and confirmed its presence.Thus, through the use of second-generation panel unit root tests (Cross-sectional Augmented Dickey-Fuller(CADF) and Cross-sectional Im, Pesaran, and Shin (CIPS)), the study also verified the stationary nature of the variables.Third, using second-generation panel cointegration test (Westerlund cointegration test), the study validated the long-run cointegration of the variables.Finally, this study analyzed a causal and long-term link between the variables.

Fig.2.Technique route of econometric modeling used in this study.

Fig.3.Causality relationship of SDGs with EAT, TPI, TCP, and TGS.The one-way arrow indicates a unidirectional causal relationship; the two-way arrow indicates a bi-directional causal relationship.

4.Estimation results and discussion

4.1.Cross-sectional dependence (CSD) test

CSD test suggested that the variable evaluations are skewed and untrustworthy (Sarafidis and Wansbeek, 2012).Therefore, it is crucial to confirm the presence of CSD.Following the study of Usman et al.(2022), Breusch-Pagan LM, Pesaran Scaled LM, Bias-Corrected Scaled LM, and Pesaran CSD were used in this study.This research used Equation 2 (Pesaran, 2007) to calculate CSD:

where,indicates the correlation among the errors;Tdepicts the number of period; andNindicates the number of individuals (cross-sectional units).The null hypothesis (H0) and alternative hypothesis (H1) for the CSD test are as follows: H0:ρij=Cov(μit,μjt)=0 (There is no existence of CSD) and H1:ρij=Cov(μit,μjt)≠0 (There is an existence of CSD), whereρijrepresents the covariance between the individual-specific effects or characteristics of two different entities (iandj); andμitandμjtrepresent the specific effects or characteristics of theithandjthentities at a given time(t), respectively.

Table 4 represents the results of CSD tests, which exhibit statistically significantP-values (0.01 significance level).Thus, the null hypothesis for CSD is rejected.This CSD test result indicates the existence of CSD in the panel.According to the results of CSD tests, if something happens in one country, it will affect the rest of the panel.So, it is necessary to run second-generation panel unit root tests to analyzing the variables.

4.2.Panel unit root tests

The panel data used in this investigation revealed the presence of CSD.According to Hadri and Kurozumi (2012),in the case of CSD, second-generation panel unit root tests are preferable to first-generation panel unit root tests.Therefore, second-generation panel unit root tests are used (CADF and CIPS) in this study.Equations 3 and 4 are used for CADF test:

where, ΔYitis the change in variableYfor individual (cross-sectional units)iat timet;αiis the fixed effect specific to each individualiaccount for unobserved heterogeneity across individuals;βiis the coefficient of the lagged level of variableYfor individuali;Yi,t-1is the value of variableYfor individualiat timet-1 (one period lag);biis the coefficient of the mean value of variableYacross individuals at timet-1;is the mean value of variableYacross individuals at timet-1;diis the coefficient of the change in the mean value of variableYacross individuals at timet;is the change in the mean value of variableYacross individuals at timet; andμitis the error term for individualiat timet, which captures the unexplained variation in the dependent variableY.

where,is the sum of the lagged valuesj(ranging from 0 top, wherepis the total number of lagged values) of the change in the mean value of variableYacross individuals, each multiplied by their respective coefficientsdij;is the sum of the lagged valuesj(ranging from 1 top) of the change in variableYfor individuali,each multiplied by their respective coefficientsδij;indicates the lagged level mean; and ΔYi, t-1represents the crossfirst section’s variation from the unit.Then, the study used the following equation for the CIPS test:

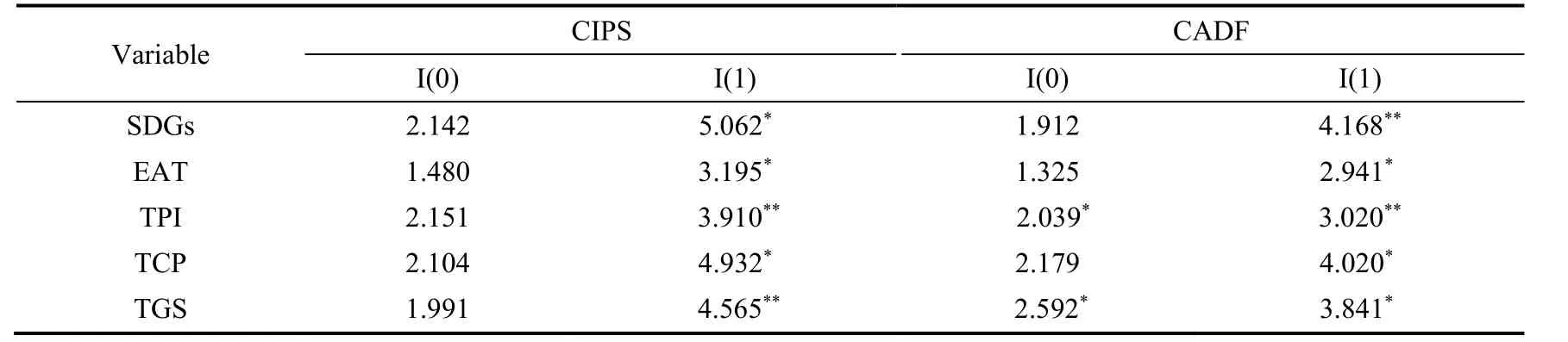

whereNis the number of individuals (cross-sectional units) in the panel data.This term is used to calculate the average of individual ADFt-statistics.is the sum of the individual ADFt-statistics (ti); andiranges from 1 toN.CADF and CIPS tests determine the robust coefficients for controlling CSD and heterogeneity (Table 5).The study determines that variables of CADF and CIPS tests are stationary at I(1) (first-differencing).

Table 5Results of second-generation panel unit root tests (Cross-sectional Augmented Dickey-Fuller (CADF) test and Crosssectional Im, Pesaran, and Shin (CIPS) test) for five variables (SDGs, EAT, TPI, TCP, and TGS).

4.3.Panel cointegration test

Second-generation panel cointegration test was used in this study as the variables are stationary.Using Westerlund cointegration test, the study examined the long-run cointegration of the variables.Compared to first-generationmethods, the Westerlund cointegration test is more reliable and consistent (Danish et al., 2020; Rahman and Halim,2022).This study used Equation 6 for the Westerlund cointegration test:

where,δ′ is the vector of coefficients for the deterministic variables (e.g., constant, time trend) in the structural break termdt;dtis the deterministic variables or structural break term may include a constant, time trend, or other deterministic components;niis the coefficient of the error correction term for individuali;β′ is the vector of coefficients for the long-run relationship between dependent variableYand explanatory variableX;Xi,t-1is the value of the vector of explanatory variablesXfor individualiat timet-1 (one period lag);is the sum of the lagged valuesj(ranging from 1 top) of the change in explanatory variableYfor individuali, each multiplied by their respective coefficientsnij; andis the sum of the lagged valuesj(ranging from 0 top) of the change in the vector of explanatory variablesXfor individuali, each multiplied by their respective coefficientsγij.

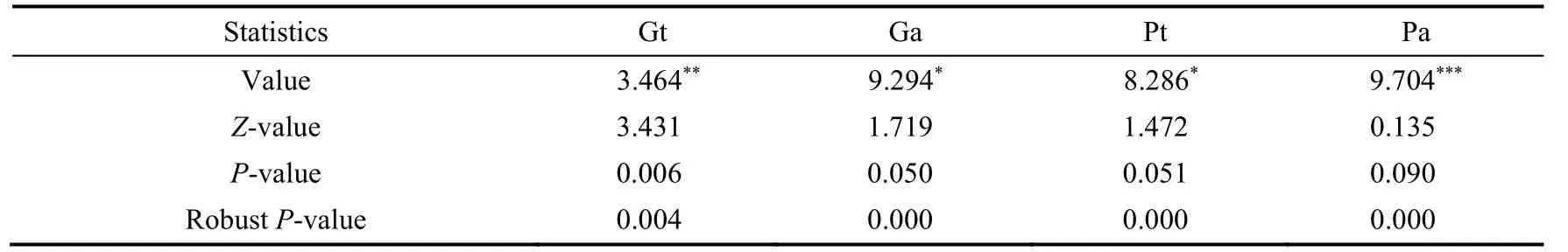

After validating the stationarity of the variables, bootstrap panel cointegration (second-generation panel cointegration test) (Westerlund and Edgerton, 2007) was used to assess the cointegration of the variables for analyzing the long-run association between variables and the sample of 38 OECD countries.Due to these advantages,researchers used bootstrapping panel cointegration more frequently to study long-term relationships (Rahman and Halim, 2022).This method has led to developing a novel panel cointegration test that emphasizes structural dynamics rather than residual dynamics.Danish et al.(2020) argued that these tests are more reliable and have constrained normal distributions.According to Westerlund and Edgerton (2007), we tested the cointegration hypothesis using two separate tests: group mean and panel mean.Westerlund and Edgerton (2007) developed four test statistics based on the Error Correction Model, including the parameters of Ga, Gt, Pa, and Pt.Gt and Pt are the standard errors of Error Correction Model in group and panel, respectively.Ga and Pa are the standard errors corrected by autocorrelations and heteroskedasticity in group and panel, respectively.There are two forms of survey results: rejecting the null hypothesis and accepting alternative solutions.Second-generation panel cointegration test confirms the long-term cointegration of the variables.As shown in Table 6, all variables strongly and significantly support the long-run cointegration process in both tests.

Table 6Result of panel cointegration test with four test statistics based on the Error Correction Model, including the parameters of Ga, Gt, Pa, and Pt.

4.4.Long-run estimation test

Panel estimators may produce inconsistent and biased findings, leading to incorrect interpretations, when an estimated model is susceptible to cross-sectional dependence and economy-specific heterogeneity (Saqib, 2022).Bond and Eberhardt (2013) introduced the augmented mean group (AMG) regression to overcome these constraints.Since AMG regression produces answer specific to the economy, it helps policy-makers achieve more precise policy goals.Equations 7 and 8 serve as representations for the two-phase AMG regression produces.

The first phase of AMG regression is as follows:

where,β''iis the coefficient of the change in the explanatory variableXfor individuali; ΔXitis the change in the explanatory variableXfor individualiat timet;γiis the coefficient of the global factorgtfor individuali;gtis the global factor is common to all individuals at timet; andis the sum of the lagged valuesj(ranging from 2 top) of the change in the residuals ΔRjfor individuali, each multiplied by their respective coefficientsni.The second phase of AMG regression is as follows:

In this study, correlation and variability within individual cross-sections were also explored.This test also tackles unobservable components and is well-suited for non-stationarity, heterogeneous slopes, and CSD (Saqib, 2022;Usman et al., 2022).Equation 9 demonstrates the functional appearance of Correlated Effects Mean Group (CEMG)regression.

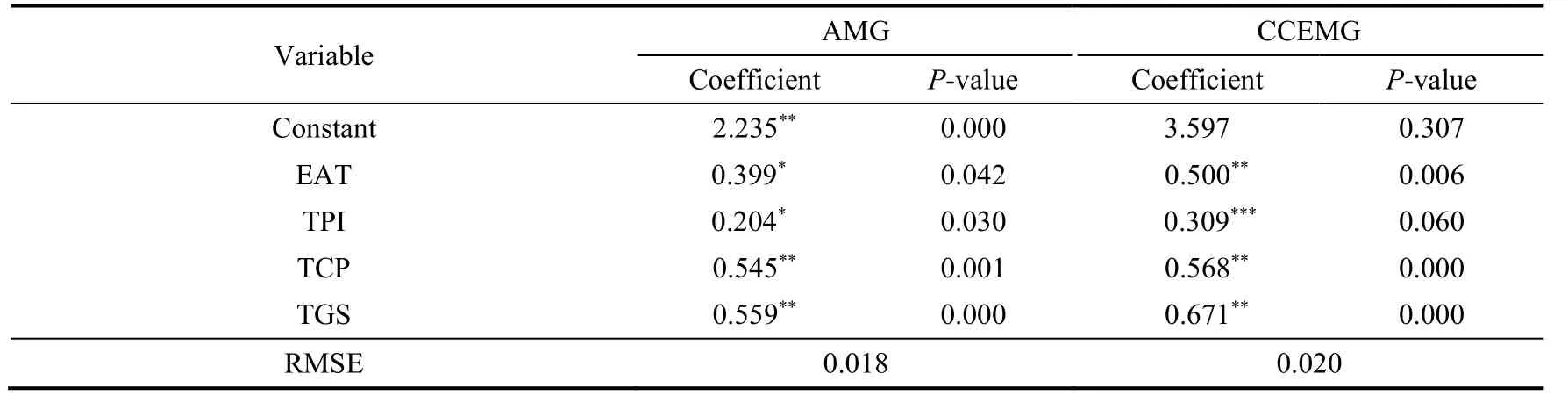

According to Table 7, taxes have a positive association with SDGs.More specifically, the findings indicated that EAT, TPI, TCP, and TGS are significantly improving SDGs.As the result of AMG regression, a 1.0% change in EAT results in a 0.4% increase in SDGs.This finding is consistent with Rahman (2022), who used a composite EAT rate,and other studies (Angelopoulos et al., 2007; Asmah et al., 2020).This finding rationalizes that a country should pay more taxes to achieve the 2030 Agenda for Sustainable Development.The companies in OECD countries are working for the 2030 Agenda for Sustainable Development because they contribute to paying more government taxes.Thus,this finding can be decisive to other countries, implying the importance of taxes as a tool for achieving sustainable development.Tax policies must be carefully designed and implemented to generate sufficient revenue while promoting economic growth and reducing inequality.Monitoring and evaluating tax policies can help achieve SDGs.

Table 7Result of long-run estimation test with augmented mean group (AMG) and Common Correlated Effects Mean Group(CCEMG).

The study used TPI as a proxy for taxes and evaluated its relationship with SDGs.The results show that a 1.0%change in TPI may lead to a positive change of 0.2% in SDGs, indicating that the greater the contribution from personal income, the better the sustainable development in OECD countries.This finding is consistent with Peterson and Bair (2022) and Rahman (2022).Moreover, the research is important for the tax authorities to ensure the maximum TPI.Because of this contribution, TPI helps spur economic growth, which has a ripple effect on the country’s economy, such as raising the standard of living and increasing job creation.The finding implies that governments should consider implementing progressive tax policies, such as TPI, to promote sustainable development.However, it is important to ensure that these policies are designed in a way that is fair and equitable to all taxpayers.

The study used TCP as a proxy for taxes and evaluated its relation with SDGs.We found that a 1.0% change in TCP can result in a 0.5% increase in SDGs, indicating that the greater the collection of TCP, the better the chance of achieving SDGs in OECD countries.This finding is consistent with Jarboui et al.(2020), Gechert and Heimberger(2022), and Rahman (2022).The auditors and tax policy-makers must be cautious to ensure the proper TCP return.TCP significantly contributes to sustainable development in OECD countries.The research implies that governments should consider implementing policies encouraging corporations to pay their fair share of taxes.This may include increasing the rates of TCP, closing tax loopholes, and strengthening tax enforcement mechanisms.By increasing TCP, governments can fund social programs promoting sustainable development, such as education, healthcare, and environmental protection.Therefore, policy-makers must carefully balance the needs for taxes with the needs to promote economic growth and job creation.

Finally, the study used TGS as a proxy for taxes and evaluated its relation with SDGs.The result of AMG regression indicated that a 0.6% positive change in SDGs is caused by a 1.0% change in TGS.This indicated that the greater the TGS, the higher the possibility of achieving the 2030 Agenda for Sustainable Development.This finding is consistent with Rahman (2022), who considered sales tax rate for tax proxy, and other studies (Kanbur et al., 2018; Jarboui et al., 2020; Kouam and Asongu, 2022).Tax policy-makers must be cautious to ensure the healthy collection of TGS.The positive impact of TGS on the achievement of SDGs can be attributed to the fact that TGS is a consumption tax and affects a broad section of the population, including both low and high-income earners.The revenue generated from TGS can fund social welfare programs, such as healthcare, education, and social security, which are crucial for promoting SDGs, for example good health and well-being, quality education, and reduced inequalities.Additionally,TGS can incentivize individuals to consume fewer goods and services, reducing environmental damage, which is a critical SDG.Therefore, policy-makers should consider increasing the rate of TGS to promote sustainable development, especially in developing countries where social welfare programs are often underfunded.However, it is essential to ensure that TGS is implemented equitably to avoid its regressive effects on low-income earners.

It is highly suggested by the existing researchers (Deb et al., 2022; Rahman and Halim, 2022) to check the robustness of the results with at least alternative estimation methods.Thus, following Saqib (2022), the study used CCEMG estimators to confirm the results computed by AMG regression.According to Table 7, the results estimated by CCEMG estimators are consistent and very similar, which signifies the robustness of the estimation.

4.5.Panel causality test

The Dumitrescu-Hurlin (DH) test was developed for models with heterogeneous panel data.Unlike other panel causality tests, the DH test considers cross-section dependence and is effective in panels with imbalances (Dumitrescu and Hurlin, 2012).Equation 10 represents the linear model of DH test.

This study used Wald statistics, a reliable method to evaluate a specific individual’s null and alternative hypotheses(Chou and Bentler, 1990).But Dumitrescu and Hurlin (2012) suggested to employ theZ-test statistic for greater time dimensions as contrasted to cross-sections (T>N).This study used the DH test to see if there is any association between the variables.According to Table 8 and Figure 3, tax proxies and SDGs have unidirectional and bi-directional causality relationships.The result of panel causality indicates that EAT, TPI, and TGS show unidirectional causal relationships with SDGs, while TCP has a bi-directional causal relationship with SDGs.The two-way causal relationship between TCP and SDGs indicates that the higher the TCP, the better SDGs, and the higher SDGs, the greater the TCP in OECD countries.

Table 8Results of the Dumitrescu-Hurlin (DH) test of five variables (SDG, EAT, TPI, TCP, and TGS).

5.Conclusions and implications

5.1.Conclusions

This study examined the impact of different tax types on achieving SDGs using data from 38 OECD countries.EAT, TPI, TCP, and TGS positively impact the achievement of SDGs.Specifically, a positive change in these taxes(EAT, TPI, TCP, and TGS) can lead to positive changes in SDGs, indicating that taxes can be an effective policy tool for promoting sustainable development.However, it is important to note that the impact of taxes on the achievement of SDGs is not uniform across all goals and countries.The impact of taxes on SDGs varies across different income levels, with higher-income countries generally having a stronger positive impact on SDGs than lower-income countries.Moreover, the study highlights the importance of considering the distributional effects of tax policies to ensure that they promote greater income equality and reduce poverty and inequality, in line with the 2030 Agenda for Sustainable Development.In addition, the study emphasizes the need to design and implement tax policies to ensure accountability and transparency, and to promote responsible citizenship.

A worldwide roadmap for ensuring human and environmental well-being both now and in the future is provided by the 2030 Agenda for Sustainable Development.The results of this study provide the important information on how taxes affect the changes of SDGs and help to evaluate 17 SDGs.Sustained and inclusive economic growth can promote social development, create good employment for everybody, and improve people’s living standards(Mosquera-Valderrama, 2019).Taxes are viewed as a tool for generating income, promoting sustainable growth, and changing human behavior to achieve desired results concerning climate, environment, human well-being, and governance.

5.2.Implications

The study builds on the TOT, which holds that a tax system should be designed to maximize social welfare.The theory suggests that a tax system should be designed in such a way that it does not discourage economic growth while ensuring that the tax system is fair and equitable at the same time.In the context of SDGs, the TOT implies that tax policies should be designed to support the achievement of SDGs, reduce inequality, and promote economic growth.Overall, policy-makers should formulate tax policies that can maximize social welfare while supporting the achievement of SDGs based on the TOT at the same time.

The findings of this study have important implications for tax policy and management.First, the study suggests that an increase in EAT can lead to an increase in SDGs.Therefore, policy-makers should focus on designing and implementing effective tax policies to maximize taxes while promoting SDGs.Second, the study indicates that different types of taxes can affect SDGs differently.For example, changes in TPI have less effect on SDGs than changes in EAT, TCP, or TGS.Thus, policy-makers should consider the potential impact of different types of taxes when designing tax policies.Third, the study suggests that tax policies can be an important tool for promoting economic growth, income equality, and poverty reduction.For example, a progressive tax system that places higher tax rates on higher-income earners can promote income equality and reduce poverty.Furthermore, a well-designed tax policy can incentivize individuals to work and invest more, promoting economic growth.Fourth, the study highlights the importance of effective tax administration and compliance.To maximize taxes and promote SDGs,policy-makers should ensure that tax laws are effectively enforced and taxpayers comply with their tax obligations.

Authorship contribution statement

This study is solely written by Md.Mominur RAHMAN.Thus, conceptualization, methodology, formal analysis,writing original draft, review & editing are done by Md.Mominur RAHMAN.

Declaration of competing interests

We declare that the research was conducted without any commercial or financial relationship that could be construed as a potential conflict of interest.

杂志排行

区域可持续发展(英文)的其它文章

- Measuring the agricultural sustainability of India: An application of Pressure-State-Response (PSR) model

- Geotechnical and GIS-based environmental factors and vulnerability studies of the Okemesi landslide, Nigeria

- Environmental complaint insights through text mining based on the driver, pressure, state, impact, and response (DPSIR)framework: Evidence from an Italian environmental agency

- Expert elicitations of smallholder agroforestry practices in Seychelles: A SWOT-AHP analysis

- Examination of the poverty-environmental degradation nexus in Sub-Saharan Africa

- Human-wildlife conflict: A bibliometric analysis during 1991-2023