Research on the Impact of the Pension Insurance System on the Optimization of the Consumption Structure of Rural Families

2022-08-24XueLeiandLiYanping

Xue Lei,and Li Yanping

Party School of Sichuan Committee of C.P.C

Abstract: Presently, the growth of residents’ consumption is slowing, which necessitates the expansion of domestic demand. Against this backdrop, research on the impact of pension insurance on the optimization of the consumption structure in rural areas not only facilitates the welfare of rural residents and improves their consumption structure but also boosts the sustainable and healthy development of the Chinese economy. This paper applies China Family Panel Studies (CFPS) microdata in 2018 and adopts Propensity Score Matching (PSM) to research the impact of China’s pension insurance system on the consumption structure in rural areas and its heterogeneity. This paper draws a conclusion at four levels. First, pension insurance effectively optimizes the consumption structure in rural areas, increases the current overall consumption level by 0.0024 percent, and objectively releases the consumption potential in rural areas. Second, participation in pension insurance enhances the overall consumption level of rural families in eastern China, central China, and northeastern China by 0.08 percent, 0.146 percent, and 0.0446 percent respectively, yet, that inhibits the overall consumption level of rural families in rural areas in western China by 0.1057 percent. Third, from eastern China to western China, with regard to pension insurance, as its impact on consumption shifts from a higher level to a lower level, its impact on the optimization of consumption structures sinks to a lower level. Fourth, in terms of major factors, age (older), matrimonial res (married), years of education (longer), health (poor), and the number of family members (small) contribute to the stronger willingness to participate in pension insurance.

Keywords: pension insurance, consumption structure, regional heterogeneity

Introduction

Today, the world is undergoing major changes unseen in a century, and various countries are facing the challenges of the prevention and control of the COVID-19 pandemic. It is an urgent task for China to enlarge domestic demand and stimulate national consumption to stabilize economic growth, vitalize economic development and spur high-quality economic development. According to 7th national population census, the agricultural population accounts for 36.11 percent in China, which indicates that the consumption demand of rural residents possesses great potential. Therefore, the central government is prioritizing the work to invigorate the consumption willingness and ability of rural residents and tap their consumption potential at the macro-economic level. InThe Notice on Several Measures to Boost Bulk Stock and Key Materials Consumption and Reinforce the Release of Consumption Potential in Rural Areasissued by 12 departments (including the Ministry of Commerce of the People’s Republic of China) in 2021, it is explicitly stated: “To further provoke the consumption demand and potential of rural residents, strengthen the consumption ability of rural areas and optimize their consumption structure will play an important part in promoting domestic circulation and sustainable economic development.” However, the scale of rural consumption has remained relatively small, and the savings rate in rural areas remains generally high (Gao, 2020). In this regard, domestic scholars commonly observe that this is because China has not established a perfect social security system. In comparison with cities and towns, the per capita income and social security level of rural residents stays at a lower stage, which elicits considerable uncertainty about the future. Simultaneously, rural families invest a high proportion of their incomes into precautionary savings to hedge against various potential risks in the future, which bridles their consumption levels and stagnates their consumption demands (Fan et al., 2015; Sui et al., 2021). Additionally, the imbalance in consumption structures will remain prominent in China in the long term.

In the social security system, the pension insurance system plays a vital role. In rural areas, the pension insurance system serves as a major measure to increase the income of rural residents, release their consumption ability, and expand domestic demand. It can effectively guarantee a decent future life in the old age of rural residents, thus helping with the aging problem in China. Yet, in rural areas, pension insurance starts late, coupled with the low level of insurance and the existence of welfare arrears. This intensifies the problem concerning the livelihood and social welfare of rural residents (Wu et al., 2020). The Fourth Plenary Session of the 19th Central Committee of the Communist Party of China proposed to “improve the mechanism of secondary distribution regulating income distribution mainly through taxation, social security, and transfer payments.” Continuously improving the pension insurance for rural residents can ease their uncertainty about future life and release the consumption ability of rural areas. Therefore, the research on the impact of the pension insurance system in rural areas on the consumption structure of rural families helps not merely to ensure the lives and welfare of rural residents but also to advance rural modernization, rural revitalization and the sustainable and high-quality development of the Chinese economy, which embodies great theoretical and practical significance.

Literature Review

The impact of the pension insurance system on consumption can be explained by the life cycle theory. Dating back to Franco Modigliani (1970), the life cycle theory suggests that the current consumption of a live, rationalhomo economicuswould be adjusted in alignment with their income status and expectations for the future to balance the consumption in each stage of the life cycle and achieve the maximum utility under the life-long inter-temporal budget constraints. Similarly, family consumption will be adjusted on the basis of total assets in order to avoid potential risks and achieve Pareto Optimality (Hubbard et al., 1994). As the pension insurance system will have an impact on the income in the individual life cycle, it functions as an important factor in individual consumption-savings decisions (Feldstein, 1974). As the existing literature reveals, scholars have widely highlighted the impact of pension insurance on regional consumption yet held various views and attitudes on the impact of the pension insurance system.

The core view emphasizes that the pension insurance system plays a positive role in promoting consumption because the system will increase the predictable income of residents and reduce their uncertainty about the future, thus releasing the consumption ability of residents. H. Yigit Aydede (2007) gropes for the impact of the social security system on consumption in accordance with the empirical data of Turkey from 1970 to 2003, arguing that the social security systems in developing countries can significantly ameliorate overall consumption levels. Social security hedges against the invisible risks for residents’ life expectancy, and the impact of the social pension insurance system on residents’ consumption expenditures proves positive. As the wealth of the social security pensions multiplies, the per capita consumption expenditures of residents increase, and the “crowdingout effect” on savings grows (Zhang, 2008; Shi et al., 2010). Zheng et al. (2020) comprehensively evaluated the impact of the new rural insurance policy on poverty alleviation and confirmed that the new rural insurance policy remarkably benefits the poverty alleviation of rural elderly residents. By analyzing the impact of rural social pension insurance on rural resident’s consumption levels and structures, Wang et al. (2021) consider that rural social pension insurance produces an obvious economic effect, which can not only significantly increase the overall consumption levels of rural families, but also optimize the consumption structures of rural families.

Yet other scholars put forward entirely different ideas, questioning the idea that pension insurance produces a positive effect on consumption growth and insisting that pension insurance will crowd out residents’ consumption expenditures, reduce their current consumption and increase their savings, owning to payment burdens and low-level expected incomes. In spite of the fact that enlarging the coverage of pension insurance helps to stimulate consumption, raising the pension-contribution rate will significantly curb the consumption or overall consumption levels of paying families. Besides, as life expectancy lengthens, pension insurance tends to inhibit consumption (Bai et al., 2012; Yang et al., 2016). Hu et al. (2017) examined the impact of the urban-rural-dual-structure pension insurance system on the consumption of rural families and affirmed that the former has significant inhibitory effects on the latter, with greater inhibitory effects on the consumption expenditures of rural families in the low-consumption group and the high-consumption group. Sui et al. (2021) focused on the perspective of precautionary saving, revealing that under the influence of the interactions of consumption inertia, variable factors, and the “low security” levels of urban-rural residential insurance, urban-rural residential insurance can significantly increase the resident’s savings rate, based on empirical evidence.

Other scholars underscore that pension insurance fails to generate a significant economic effect because it cannot effectively affect consumption expenditures. The rise of pensioninsurance coverage rates does not necessarily synchronize with residents’ consumption rates (Qiu et al., 2014). Jie (2015) offered the conclusion that the new rural insurance policy has a positive effect on the growth of overall rural consumption, but this has not yet been affirmed by significance tests. Besides, with the factor of freedom of choice of rural residents considered, the income from the new rural insurance policy promotes their consumption levels only in a minor way (Wang, 2017).

Thus, the existing relevant literature at home and abroad provides helpful ideas for us to research the economic effect of pension insurance on consumption. Noticeably, the existing scholarship has mostly analyzed pension insurance and has ignored the impact of pension insurance on consumption in a comprehensive way. Likewise, the existing scholarship seldom touches upon the empirical studies on the impact of pension insurance on rural consumption structure, and the analysis of regional heterogeneity proves inadequate. Therefore, based on the CFPS micro-data for 2018, this paper uses the PSM to analyze the impact of pension insurance on the consumption structures of rural families and regional heterogeneity in various regions. This paper chooses the latest data in the CFPS database, yet it cannot cover all social and economic realities, and therefore cannot fully discuss the internal causes of the impact. These need further investigation.

Internal Mechanisms and Research Hypotheses

As the existing literature and research suggest, the pension insurance system can affect the consumption structures of rural residents in two ways. First, participation in pension insurance increases the pensions of rural residents and quells their budget constraints. For rural residents who can receive their pensions, the budget constraints will continue to expand because they obtain incomede facto. The life cycle theory and permanent income theory assert that the current consumption of residents is determined not only by their current income but also by their future permanent income to a certain extent. Therefore, rural residents who pay for pension insurance will slacken their budget constraints with the increase in income in the future. In cases where the expected income of rural residents is augmented, their consumption ability will be further released. In cases where the income of rural residents remains low, they will invest more of their income into basic consumption and restrain their demands for high-level consumption. After participating in the pension insurance system, as their budget constraints continuously expand, rural residents who originally restrained their demand for high-level consumption will spend more income on higher-level consumption, and their Engel coefficients will continue to decline. The consumption structure of rural residents will be optimized rather than limited to basic consumption. Second, pension insurance guarantees the life of elderly residents in the future, which will reduce the uncertainty of income risks for rural residents. According to precautionary savings theory, the uncertainty about future life is a major reason for residents to increase their savings. When residents are not sure whether there will be significant consumption expenditures or a negative impact on income in the future, they will tend to increase income and reduce expenditures. This counts against the optimization and upgrading of the consumption structure of rural residents. Rural residents who participate in pension insurance (as a guarantee for the future) strengthen their confidence in current consumption and invest more current income into development consumption and enjoyment consumption, which optimizes their consumption structure. As stated above, pension insurance mainly affects the current consumption of rural residents from two aspects. Participation in pension insurance can trigger rural residents’ demand for higher-level consumption and optimize their consumption structure as a result. Practically, however, the levels of pension insurance, the status quo of rural residents, and the economic development of the regions also have an effect.

China has a vast territory and a large population. Economic levels and local conditions in various regions differ significantly. In eastern China, central China, western China, and northeast China, economic conditions vary enormously. Simultaneously, in the pension insurance system in China, the payment and distribution of pensions are implemented in line with regional conditions. In particular, economic levels determine the standards of pensions. In some regions, the level of pension insurance is high, while in other regions, the level of pension insurance is low. To actualize a system in various regions is affected not only by exogenous heterogeneous factors like politics, the economy, and the environment but also by endogenous heterogeneous factors, like personal behaviors. Rural residents with better economic conditions probably choose the type of pension insurance with higher payment standards, whereas rural residents with worse economic conditions may only choose the type of pension insurance with the latest standard or even give up the chance to participate in pension insurance. Evidently, a systemper sewill have different impacts in different regions. Previous studies have disclosed that the impact of rural social security on rural residents’ consumption embodies distinctive regional heterogeneity, and that the incentive effect of overall rural social security on rural residents’ consumption proves relatively obvious in economically developed regions. In different regions, rural social pension insurance has different impacts on rural residents’ expenditures on food and medical care as well as consumption structure and plays a greater role in improving the economic welfare of rural residents in eastern China.

This paper therefrom proposes two hypotheses as follows.

Hypothesis 1: Pension insurance can optimize the consumption structure of rural families.

Hypothesis 2: The impact of pension insurance on the consumption structure of rural families features regional heterogeneity.

Research Design

Data Source

The data used in this paper come from China Family Panel Studies (CFPS). CFPS is a national, large-scale, and multidisciplinary social tracking-survey project that the Institute of Social Science Survey, Peking University, carries out. CFPS aims to represent changes in the society, economy, population, education, and medical care in China by tracking and collecting data at three levels (i.e., individual, family, and community) and establish a data-foundation for academic research and public-policy analysis. CFPS has been officially opened to the public since 2010. So far, five-year data (i.e., 2010, 2012, 2014, 2016, and 2018) are available, covering 25 provinces in China, with the representativeness of samples reaching 95 percent. This paper mainly used CFPS data from 2018, the latest data available so far. This paper takes rural areas as a research object and excludes the data of urban families as well as unavailable data. Totally, 8,566 pieces of rural data were chosen, which were divided into 4,903 pieces of sample data (the insured group) and 3,663 pieces of sample data (the non-insured group), covering 25 provinces in China, with large-sample characteristics and extensive regional representativeness.

Research Methodology

With regard to the analysis of the heterogeneous impact of pension insurance on consumption, if ordinary least square (OLS) estimation is directly used, it is presupposed that whether rural residents choose to participate in pension insurance, or understood as a random choice, is not affected by any factors. But in fact, the choices of rural residents are not randomly made but are affected by manifold factors. Individual choices differ and embody selection bias. In the meantime, PSM can effectively redress biased estimates and selection biases of samples. Besides, PSM does not need to suppose the function forms, parameter constraints, or error distributions in advance or raise any strict exogenous requirements for explanatory variables, thus possessing advantages in solving the endogenous problems of variables. Therefore, this paper uses the PSM to establish a research model. The basic idea of PSM is to construct a control group that is not subject to policy interventions and observe the factual results of the control group (i.e., non-insured group) and the experimental group (i.e., insured group), to obtain the true causal relationships between policies and facts. PSM basically covers three steps. The first step is to select the covariateXi, which should include as many key variables as possible that affect the resident’s willingness to participate in pension insurance in order to ensure the realization of the negligibility. Based on the existing literature, this paper selected the covariates at the individual and family levels. The second step is to estimate the propensity score of the insured group, which can be roughly estimated by using the logistic model. The formula is as follows:

In particular,P(Xi)stands for the conditional probability for rural residents to participate in pension insurance,βstands for the coefficient to be estimated, andXistands for the explanatory variable of the model (including the respondent’s age, gender, marital status, type of work, health status, per capita annual income of the family, total family assets and the number of family members). Theexp() function stands for an exponential function based on the natural constante.

The third step is to use the propensity score obtained in the first step to match the scores of the insured group and the non-insured group. This paper mainly uses k-nearest neighbor matching and kernel matching and calculates the average processing effect according to the matched samples.

Based on the above theoretical analysis, this paper constructs the following measurement model:

In particular,Consumeistands for the consumption of a rural resident.Promacyistands for the core variable in this paper, which indicates whether a rural resident has participated in pension insurance.Controlistands for the control variable in this paper.uistands for the random error term.

Variable Selection and Description

Following the practices of Wang (2020), Sun (2021), and other scholars, this paper divides the explanatory variable consumption into overall consumption at the family level of rural residents, basic consumption, enjoyment consumption, and development consumption. Noticeably, the larger proportion of enjoyment consumption and development consumption in overall consumption signifies the deeper optimization of the consumption structure. This paper mainly analyzes the impact of participation in pension insurance on the basic, development, and enjoyment consumption of rural families, via which it judges whether pension insurance can optimize the consumption structures of families. The CFPS database records various types of consumption of rural families in detail, including expenses on clothing, shoes and hats, food and residence (i.e., expenses related to daily life like rent, heating, water, and electricity, etc.), expenses on cultural and educational affairs and entertainment, expenses on medical care and health, expenses on transportation and communications, expenses on household equipment and daily necessities, expenses on welfare and other expenses. Among them, this paper categorizes the expenses on shoes and hats, food, residence, household equipment, and daily necessities into basic consumption (which are mainly used to meet the needs in resident’s daily life), the expenses on transportation and communications, welfare and others into enjoyment consumption (which are mainly used to improve the quality of life), and expenses on cultural and educational affairs and entertainment as well as on medical care and health into development consumption (which are mainly used to enhance human capital).

This paper specifies ten independent variables. Among them, the core explanatory variable is a dummy variable, which indicates whether rural residents participate in pension insurance, e.g., pension insurance for urban residents, basic pension insurance, pension insurance for rural residents, supplementary pension insurance in enterprises, commercial pension insurance and new rural pension insurance. If yes, it is set up as 1; if no, it is set up as 0. Agreeing with the existing research of Yang (2019) and He (2020), this paper includes nine controlled variables, which indicate the factors that affect rural residents’ willingness to participate in pension insurance. To be specific, they are: the age of the respondent; the gender of the respondent (if male, 1; if female, 0); the marital status of the respondent (if married or cohabitation, 1; if unmarried or divorced, 0); years of education of the respondent; type of work of the respondent (if a non-agricultural job, 1; if an agricultural job, 0); health status of the respondent (in self-assessment, unhealthy for an ordinary condition or poor health, 0; healthy for good health or excellent health, 1); per capita annual family income of the respondent; total family assets of the respondent; the number of family members of the respondent.

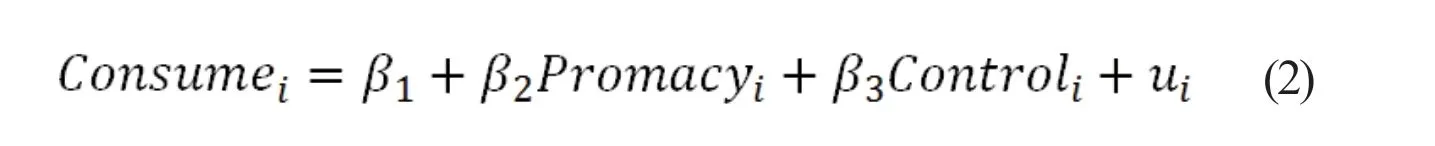

The descriptive statistics of corresponding variables are shown in Table 1.

Table 1 The descriptive statistics of corresponding variables

Variables Meaning of variables Treatment effect Number of samples The maximum value The minimum value The average value Standard deviation Age Age Insured group 4,902 86 19 39.4957 9.5461 Non-insured group 3,662 88 19 36.0475 10.6735 Gender Gender Insured group 4,902 1 0 0.5206 0.4996 Non-insured group 3,662 1 0 0.5213 0.4996 Married Marital status Insured group 4,902 1 0 0.8441 0.3628 Non-insured group 3,662 1 0 0.7245 0.4468 Edu Years of education Insured group 4,902 19 0 8.2601 4.7212 Non-insured group 3,662 21 0 8.461 4.4716 Work Type of work Insured group 4,902 1 0 0.6406 0.4799 Non-insured group 3,662 1 0 0.7133 0.4523 Health Health status Insured group 4,902 1 0 0.7813 0.4134 Non-insured group 3,662 1 0 0.8269 0.3784 lnfinp Logarithm of per capita annual family income Insured group 4,898 15.0094 5.0106 9.6484 0.9226 Non-insured group 3,658 15.5489 5.5215 9.6829 0.9145 TA Total family assets/10,000 Insured group 4,902 5,008.875 -87.8875 60.8785 176.4624 Non-insured group 3,662 5,046.1 -247 49.376 125.9536 Num The number of family members Insured group 4,902 16 1 4.6065 1.9506 Non-insured group 3,662 21 1 4.5691 2.3739

Empirical Test and Result Analysis

As this paper used cross-sectional data sets, the possible multicollinearity and heteroscedasticity of variables were tested. In order to discuss the impact of the pension insurance system on consumption structure and its regional heterogeneity, this paper tested the relevant multicollinearity and heteroscedasticity of variables. For the collinearity test, this paper tested the variance inflation factor (VIF) value of the data, which turned out to be 1. This small value demonstrates no obvious multicollinearity problem. For the heteroscedasticity test, this paper adopted the White test, with thePvalue of 0.23, which demonstrates an obvious heteroscedasticity problem of the rejection variable.

The Impact of Participation in Pension Insurance on the Consumption Structure of Rural Families

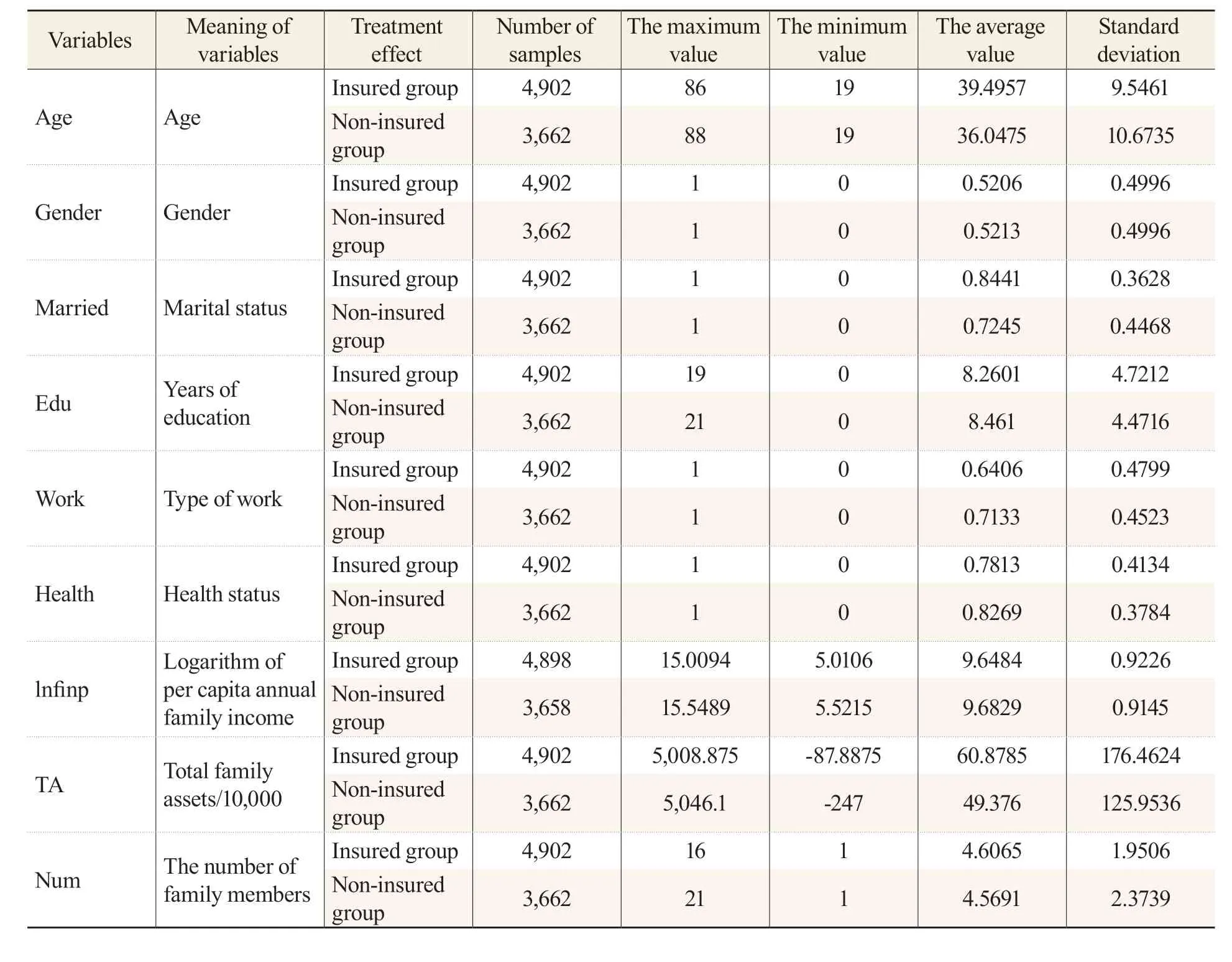

Table 2 represents the impact of participation in pension insurance on the consumption structure of rural families. As column (1) suggests, participation in pension insurance slightly boosts overall consumption levels of rural families, with a coefficient of 0.0024, which has not yet been affirmed by a significance test. This bespeaks that pension insurance plays a part in ensuring the future life of residents, reducing the uncertainty about the future of residents, increasing future expectations, and thus improving their current consumption. However, as this paper juxtaposes the statistics of national data, the responses of different regions to the system vary. In some regions, residents bear low expectations for future income from pension insurance. Coupled with the heavy burden of the payments for pension insurance, there is a negative correlation between consumption and participation in pension insurance. In some regions, residents enjoy higher-level pension insurance and bear higher expectations for future, with a positive correlation between consumption and participation in pension insurance. Taking national data into account, the national response to the system is weakened, resulting in a smaller value. As Wang (2017), Xie (2015), and other scholars conclude, pension insurance plays a minor role in improving the consumption level of individuals across the country. The regression results evince that the impact of participation in pension insurance on basic consumption is negative, with a coefficient of -0.0147, insignificant. The impacts of participation in pension insurance on development consumption and enjoyment consumption are positive, with the coefficients of 0.0783 and 0.0729, statistically significant at the level of 5 percent and 1 percent, respectively. This clarifies that rural families that participate in pension insurance reduce the proportion of basic consumption in their consumption behaviors and significantly increase the proportion of development consumption and enjoyment consumption. That is to say, participation in pension insurance can effectively optimize the consumption structure of rural families and foster the upgrading of the consumption structure in China. Moreover, for rural families, the impact of participation in pension insurance on development consumption is deeper than that of enjoyment consumption. The reason probably lies with economic development. Rural families increase their income, reduce the most basic consumption, and put stress on personal development and enjoyment. Yet, limited by the lowlevels of income in rural areas, rural residents are presently focused on development consumption.

Table 2 The impact of pension insurance on the consumption structure in rural areas

Analysis on Regional Heterogeneity

Owing to the imbalance of economic development among different regions, residents’ willingness to participate in pension insurance and the impact of pension insurance on various types of consumption are heterogeneous. In order to analyze the regional heterogeneity of the impact of pension insurance on consumption structures, based on the existing research, this paper divided the national data into four regions, i.e., eastern region, central region, western region, and northeastern region. To be specific, there are 2,654 samples in the eastern region, with an insured rate of 56.6 percent; 1,922 samples in the central region, with an insured rate of 56.6 percent; 3,168 samples in the western region, with an insured rate of 63.2 percent; 824 samples in the northeastern region, with an insured rate of 37.5 percent. From the western region to the eastern region, as economic levels rise, the insured rate of pension insurance declines simultaneously. That is probably because, with higher economic levels, residents who enjoy higher living standards and own more savings attach less attention to pension insurance with a smaller cost. On the contrary, in some regions with lower economic levels, residents who have lower incomes and own fewer savings attach more importance to pension insurance that can guarantee their life in the future. The northeastern region boasts unique natural and geographical conditions, advanced agricultural development, and a solid industrial foundation, so rural residents seldom rely on pension insurance to hedge against future risks. Coupled with continuous population loss in recent years, the insured rate remains low in the northeastern region.

Table 2 also represents the regional heterogeneity of the impact of participation in pension insurance on consumption structure. Particularly, columns (2), (3), (4), and (5) show the regression results of the eastern region, central region, western region, and northeastern region, respectively. Regionally, column (2) suggests that pension insurance has a positive effect on overall consumption levels at the significant level of 1 percent and has a positive effect on basic consumption, enjoyment consumption, and development consumption to varying degrees, with the coefficients of 0.0388, 0.1182 and 0.1639 respectively. Enjoyment consumption and development consumption are significant at the levels of 5 percent and 1 percent, respectively. In terms of regression results, in the eastern region, participation in pension insurance plays a greater role in promoting development consumption than enjoyment consumption and basic consumption (the least), or it optimizes consumption structures. One possible reason is that in rural areas of the eastern region, rural residents who obtain higher incomes that can meet the demand for basic consumption pursue higher-level satisfaction from consumption and display lower-level sensitivity to basic consumption than development consumption and enjoyment consumption. Column (3) implies that in rural areas of the central region, the impact of participation in pension insurance on consumption is positive at a significance level of 1 percent. This plays a significant role in promoting basic consumption and enjoyment consumption. Rural families that participate in pension insurance will increase basic consumption by 8 percent and enjoyment consumption by 24 percent. As overall economic levels in the central region are lower than those in the eastern region, residents in the central region show higher-level sensitivity than in the eastern region, in terms of their increases in consumption. In the light of the regression results in column (4), in the western region, participation in pension insurance inhibits overall consumption levels in rural areas (significant at the level of 1 percent), and each rural family that participates in pension insurance reduces its consumption by 11 percent. The reason perhaps is that in rural areas of the western region, rural residents have low incomes and own fewer savings. The payment for the early-stage pension insurance means a large expenditure for them, which replaces their current consumption. Besides, rural residents mainly participate in low-level pension insurance. Since they do not bear high expectations for future income, they increase their savings to make economic preparations for life in old age. With respect to the three types of consumption, the coefficient of basic consumption is -0.0974, significant at the level of 5 percent; the coefficient of development consumption is 0.2033, significant at the level of 1 percent; the coefficient of enjoyment consumption is 0.0353, insignificant. This indicates that albeit rural families reduce their level of overall consumption and the proportion of basic consumption, they increase the proportion of development consumption, because residents emphasize personal development more now than before. Column (5) reveals that in the northeastern region, participation in pension insurance plays a role in promoting overall the consumption levels of rural families. Notably, rural residents reduced basic consumption, increased development consumption and enjoyment consumption, and optimized their consumption structure. However, the changes were statistically insignificant. To summarize, pension insurance generally optimizes consumption structures and plays a positive role in promoting consumption in all the regions except the western region. From the eastern region to the western region, the impact of pension insurance on consumption gradually shifts from a higher level to a lower level, and the impact on the optimization of consumption structures gradually weakens.

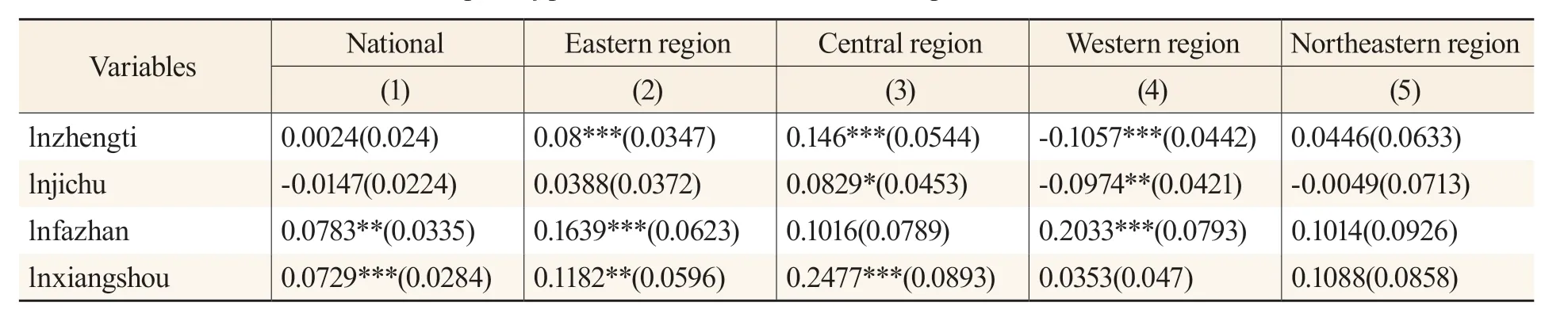

Table 3 represents the regression of controlled variables in different regions. In relation to the willingness to participate in pension insurance, controlled variables have various forms in different regions. First, for the variable of the type of work, except for the central region, the statistical data in other three regions are negative. This indicates that rural residents who engage in agricultural work display a stronger willingness to participate in pension insurance. One possible reason is that non-agricultural work is more profitable than agricultural work, with lower uncertainty about the future and with higher expectations for future life. Second, in the regression results of per capita annual family income, the eastern region and western region are negative, while the central region and northeastern region are positive. This indicates that in the eastern region and western region, rural families with higher per capita annual incomes show a stronger willingness to participate in pension insurance, as rural families with lower per capita annual income in the central region and northeastern region do. Third, in the variable of total family assets, the regression results are positive in the eastern region and the central region, and negative in the western region and the northeastern region. Remarkably, some controlled variables have similar forms in practice. One, the factor of age is significantly positive at the level of 1 percent in all the four regions. This supports the idea that elderly residents have a stronger willingness to participate in pension insurance. The reason is that those elderly residents who lack the ability to obtain income and lower their expectations for future life have a stronger willingness to participate in pension insurance to reduce the risks of uncertainty in the future. Two, the factor of marital status remains consistent in all the regions except for the northeastern region, where marital status is significantly positive at the level of 1 percent. This implies that married rural residents have a stronger willingness to participate in pension insurance. Three, the factor of years of education remains consistent as well, all are significantly positive. This implies that residents with more years of education or a higher level of education show a stronger willingness to participate in pension insurance. Four, the factor of health status is not statistically significant, yet it is basically consistent in all the four regions. This means residents with poor health have a stronger willingness to participate in pension insurance. Five, the factor of the number of family members is negative. This means rural families with fewer family members have a stronger willingness to participate in pension insurance.

Table 3 The factors that affect rural resident’s willingness to participate in pension insurance

Robustness Test

In order to further test the robustness of the above-stated regression results, this paper applied kernel matching to re-estimate relevant results, as presented in Table 4. As the results suggest, although the regression results of models (1) — (6) slightly diverge from previous data, the orientation, scale and significance of the data basically remain consistent. It substantiates that the above empirical research results in this paper are relatively robust.

Table 4 Robustness test

Note: The values in brackets are the corresponding standard errors. * * *, ** and * stand for significance at the levels of 1%, 5% and 10% respectively.

Conclusion and Policy-Related Suggestions

On the basis of the CFPS data from 2018, this paper mainly analyzed the impact of China’s pension insurance system on the consumption structures of rural families and its heterogeneity in different regions by using PSM. This paper examined and reported on four outcomes: (a) The pension insurance system raises the consumption levels in rural areas to a certain extent, with a coefficient of 0.0024 percent. It also alters the proportion of basic consumption, development consumption and enjoyment consumption, and effectively optimizes the consumption structures in rural areas. (b) For rural families in the eastern region, the central region and the northeastern region, participation in pension insurance fosters overall consumption levels of families by 0.08 percent, 0.146 percent and 0.0446 percent respectively. For rural families in the western region, participation in pension insurance inhibits the overall consumption levels of families by 0.1057 percent. (c) For rural families in all four regions, participation in pension insurance effectively promotes the optimization of consumption structures to a varying degree. In the western region, participation in pension insurance raises the proportion of development consumption in overall consumption; in the central region, it stimulates basic consumption and enjoyment consumption; in the eastern region, it has a significantly positive impact on development consumption and enjoyment consumption; in the northeastern region, it reduces basic consumption and increases development consumption and enjoyment consumption. (d) In terms of factors that affect rural residents’ willingness to participate in pension insurance, age, marital status, years of education, health status and the number of family members are relatively consistent in different regions.

Based on the results of theoretical and empirical analyses, as well as the characteristics of China’s economic and social development, this paper proposes the following suggestions. (a) We should strengthen the publicity of participation in pension insurance. Some rural residents have not participated in pension insurance because they have no idea pension insurance is available, or to learn the benefits of pension insurance, which does not mean they refused to participate. Therefore, we should enhance the publicity of pension insurance by various means so that rural residents can understand and trust the system. (b) We should enlarge the benefits of pension insurance. Participation in the present configuration of pension insurance can inhibit consumption levels, partially because rural residents bear low expectations for future pensions. Therefore, enlarging the benefits of pension insurance can heighten the expectations of rural residents for the future and stimulate their consumption or elevate their consumption levels. Presently, pension insurance in rural areas has basically achieved “meeting resident’s basic needs with a broad-based coverage.” In the future, it is necessary for us to further improve pension-insurance paymentsubsidy policies, raise the pension standard for rural residents, promote the economic levels and optimize welfare systems to give full play to the economic benefits of pension insurance in rural areas. (c) We should effectuate different pension insurance systems in line with local conditions. Different regions have forged different economic levels and various cultures and customs, so the one-size-fits-all measures cannot be appropriately taken in different regions. Accordingly, adopting differential strategies will enable pension insurance systems to play a guaranteeing role in a better way. In economically underdeveloped areas, we should reinforce financial support for pension insurance, narrow the gap among various regions, and realize the fairness of basic services for elderly residents. Simultaneously, we should subsidize different groups in different ways. Greater efforts should be taken to support vulnerable groups.

杂志排行

Contemporary Social Sciences的其它文章

- Determination of Relationships and Allocation of Responsibilities—Taking the Adjudication of Household Service Contract Disputes as an Example

- A Brief Analysis of Competitive Sports Depicted on the Portrait Bricks and Stones of the Han Dynasty

- Tri-Engine Structure and Industrial Composition of Cultural Productivity

- Full Empowerment and the Participatory Governance in Rural Communities: A Comparative Study Based on Two Cases

- Measurement and Spatial Difference Analysis of Innovation-Driven Urban Development Levels in Sichuan Province

- Stock Market Turnover and China’s Real Estate Market Price: An Empirical Study Based on VAR