Pyramid scheme in stock market:A kind of financial market simulation∗

2021-09-28YongShi石勇BoLi李博andGuangLeDu杜光乐

Yong Shi(石勇),Bo Li(李博),†,and Guang-Le Du(杜光乐)

1School of Economics and Management,University of Chinese Academy of Sciences,Beijing 100190,China

2Research Center on Fictitious Economy and Data Science,Chinese Academy of Sciences,Beijing 100190,China

3Key Laboratory of Big Data Mining and Knowledge Management,Chinese Academy of Sciences,Beijing 100190,China

4Wenzhou Institute,University of Chinese Academy of Sciences,Wenzhou 325001,China

5School of Physical Sciences,University of Chinese Academy of Sciences,Beijing 100049,China

Keywords:pyramid scheme,agent-based model,artificial stock market,herd behavior

1.Introduction

Simulation of artificial financial market based on multiagent models is an important method to search for dynamic laws in financial market,[1–4]study the statistical properties of financial time series,[5–8]and evaluate the possible effects of the financial regulations and/or rules.[9,10]The multi-agent models for researching the dynamics in financial market usually assume that the agents are heterogeneous,then study the behaviors of the agents,such as herd behavior or contrarian behavior,[11–13]and the influences of the factors such as event shocks on market dynamics.[1–4]The universal statistical properties in financial time series,autocorrelation and scaling exists in returns,volatility clustering,etc.,generically called stylized facts,[7,8,14]can be reproduced by artificial financial market simulation.[5,6]Artificial market studies for evaluating the effects of the financial regulations and/or rules can give insights to the discussion on whether price variation limits and short selling regulation can prevent bubbles and crushes or not,and estimate the effects of tick size,usage rate of dark pools,rules for investment diversification,order matching systems’speed on financial exchanges.[9,10]

In addition to the research objectives above,we can also roughly divide artificial financial market models from the characteristics of themselves into the agent models developed from minority games,[15–18]the agent models based on existing physical models,[19–21]the agent models based on order book and so on.[6,22]Recently,some studies have combined deep learning with artificial financial markets,Raman and Leidner[23]considered the case that there exists a class of agents who utilize deep learning to make decisions,and Maeda et al.[24]involved taking advantage of deep reinforcement learning in agent based financial market simulation to learn a robust investment strategy with an attractive risk-return profile.

In this work,we propose an agent model to simulate and research a kind of financial phenomenon with the characteristics of the pyramid schemes,[25–28]which have organizers who induce people to participate in the schemes with high returns,and the participants also recruit the next-generation participants until the schemes can not continue.In the secondary market of a certain security,there is often a financial phenomenon with the characteristics of the pyramid schemes:the main funds with a large amount of money and securities may act as the organizers,who influence the price of the security through big orders to induce ordinary trend investors to follow the trend one after another,and profit through reverse operation finally.

The financial phenomenon with the characteristics of pyramid schemes above is somewhat similar to herd behavior in financial markets,[11,29–31]they are all involved in the behavior of following the trend,and there are some works about agent based models with herding or contrarian behaviors.For instance,Zhao et al.[11]and Liang et al.[12]deeply study the mechanisms of herding behaviors and contrarian behaviors in adaptive systems.While the difference between the two phenomena is obvious,the core of the financial phenomenon with the characteristics of pyramid schemes is the main fund inducing the small investors to follow the trend and making profits,while the herd behavior emphasizes the herd mentality of the ordinary investors in financial market.In order to study the financial phenomenon with the characteristics of pyramid schemes,we simulate this kind of financial market by building an agent model with a special investor structure.In our proposed model,we assume that there is only one main fund in the market,and the small investors include homogeneous trend and contrarian investors described by four parameters as follows:(1)Type,which represents the type of the strategy an investor used that is dependent on his or her specific trading directions relative to the market trend,trend or contrarian,and is different from many existing works on financial market simulation which often divides investors into fundamental investors,technical investors and other investors;[5,6,15,16,32](2)rmarket,which determines when a investor decides to participate in trading according to the change of the security price in a certain trading period,due to the confidentiality of investors’strategies in the real market,we do not specify the mechanisms of the investors’strategies as in Refs.[1,6,15,16,18],and only assume that the parameter rmarketof each investor is different and make some assumptions about the parameters’overall distribution;(3)rprofitand(4)rloss,which denote the take-profit point and stop-loss parameters set by investors.In the simulations,in order to fit the real market better,we also set the activation probability pactivefor each small investor as in Ref.[6].

Based on the artificial financial market established,we make use of computer simulation and theoretical analysis to reveal the relationships between the rate of return of the main fund and the proportion of the trend investors in all small investors,the small investors’parameters of taking profit and stopping loss,the order size of the main fund and the strategies adopted by the main fund.Our work clearly explains the financial phenomenon with the characteristics of pyramid schemes in financial markets,and it can help regulators to design trading rules and assist investors in developing trading strategies.

The rest of the paper is organized as follows:in the next section,we introduce our proposed agent model.In Section 3 the simulation results and preliminary analysis are displayed,and Section 4 gives a further analysis.Some discussions and conclusions are given in Section 5.

2.Model

2.1.General aspects

As the objective of our proposed model is to study the financial phenomenon with the characteristics of pyramid schemes,we assume that there are three types of agents in our models,the first one is the main fund,and the other two are small contrarian or trend investors who adopt contrarian strategies or trend strategies to trade.In the trading process,the main fund buy or sell large orders to induce small trend investors,and then profit through reverse operation.The expected rate of return of the main fund largely determines its behavior,which plays a leading role in the financial phenomenon we research,thus our object is to research the relationships between the profit level of the main fund and the strategies of the main fund adopts,the order size of the main fund and the structure of the small investors.The characteristics of the different agents and specific trading rules are described in detail below.

2.2.Types of agents

The other two types of agents are small trend and contrarian investors,who employ trend strategies and contrarian strategies,respectively,in trading.Trend agents participate in trading according to the trend of the security price,if they think that there is a sign of an upward trend in the security price,they will go long the security,otherwise they will go short the security.Contrarian agents go short when the security price rises more than a certain extent,and go long when the security price falls by more than a certain range.We do not divide investors into fundamental investors and technical analysis investors as Refs.[5,6],where the fundamental investors and the technical analysis investors correspond to the investors using contrarian strategies and the investors using trend strategies respectively.However,fundamental investors in fact will also follow the upward trend as the valuation of the security increases,and technical analysis investors often adopt contrarian strategies.Therefore,we adopt a more reasonable way to distinguish investors based on their investment strategies rather than on whether they adopt technical analysis or fundamental analysis.

For the investors with trend strategies and contrarian strategies in our model,the investors with trend strategy trade at the market price and the investors with contrarian strategies trade at the limit price,we use parameter combinations(Type,rmarket,rprofit,rloss)to characterize them,where Type represents the types of strategies used by investors,trend or contrarian;rmarketrefers to the trigger signals for trend investors or determines the prices of limit orders for contrarian investors,and the trend investors will participate in the trading when the security price’s range of rise and fall is more than rmarketover a certain period of time,while the contrarian investors place limit orders at(1+rmarket)P0,where P0is the initial price of the security in the period of time;rprofitand rlossdenote the take-profit and stop-loss parameters set by investors,respectively.

Generally,different parameters rprofitand rlosscan describe investors with different behavioral characteristics.For instance,for an investor with disposition effect,[33]the absolute value of stop-loss parameter is greater than that of takeprofit parameter.

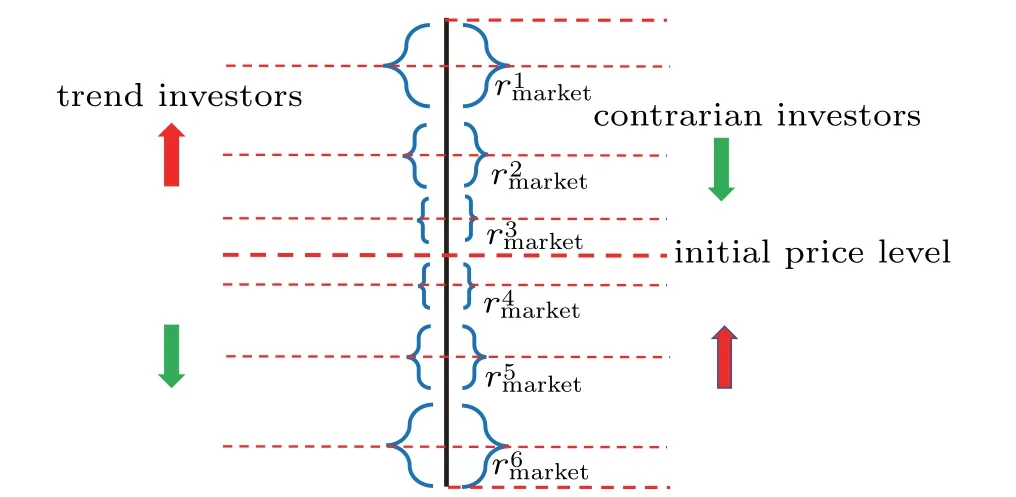

In real financial markets,due to the confidentiality of investment strategies which determine rmarket,we do not know investors’specific investment strategies and when and how they will participate in the trading.However,certain prices of securities may gather a large number of investors to participate in trading for some reasons,for instances,when some common technical indicators such as moving averages(MAs)indicate buy signals,or the prices of securities reach key positions such integer positions,a large number of investors will participate in trading,so we can make a hypothesis that the parameters rmarketare concentrated in the vicinity of some values and are normally distributed.Figure 1 shows the schematic diagram reflecting the structure of small investors,the parameters r1market,r2market,r3market,r4marketand r5marketdenote the rate of increase and decrease relative to the initial price in the figure are different triggering signals for the trend strategies and contrarian investors,and these parameters are normally distributed.

Fig.1.The schematic diagram of the trend investors and contrarian investors in our proposed model.

Small investors in our model do not have the ability to affect the security price,they are passive to participate in trading,only the main fund has the ability to influence the security price.In addition,each small investor only sells or buys orders with size 1,but this does not affect the representativeness of our model,because in actual financial transactions,an small investor who can buy and sell orders with the size greater than 1 can be regarded as a collection of investors who can only buy and sell orders with size 1.

2.3.Details of trading rules and process

In our model,the orders from the main fund and the small investors are divided into market orders which are active buy or sell orders,and limit orders which are passive.The matchmaking trading mode employed in our model is the fashion of time priority and price priority,and we define the process from the issuance of a market order of the main fund,to the time when there is no new transaction unless the main fund issues a new market order as a trading period.In the following,we describe the procedures of the first trading period in a stepby-step way from the issuance of a market buy order of the main fund to the end of all transactions,and any other trading periods are similar.The procedures are:

(i)The main fund issues a market buy order with the size Nmf(Nmfis a positive integer),and it concludes transactions with the limit sell orders placed by Nmfcontrarian investors with rmarket>0.After trading,the market price of the security will rise.It should be noted here that we set the activation probability pactivefor each contrarian investor,so even if its rmarketsatisfies the trading conditions,it only has the probability of pactiveto trade.The same is true for trend investors.

鉴于导游工作的特殊性,如面对游客多元的服务需求,需要协调各类旅游产品要素,非常熟悉景区景点等,有必要对导游主动行为的内涵进行深入探讨。本文采用访谈法,运用扎根理论的编码方法对导游主动行为的内涵进行探究,通过对原始访谈资料进行编码、分类,最终提炼出了导游主动行为的内涵。本研究从理论上拓展了主动行为在导游这一特定职业领域的研究范畴;在实践上,有利于企业采取有效措施去激发导游的主动行为,促进导游自我提升、职业发展的同时,也帮助旅行社建立起自身的竞争优势。

(ii)The contrarian investors who trades with the main fund in procedure(i)set take-profit and stop-loss orders according to their parameters rprofitand rloss,and the take-profit orders are limit orders while the stop-loss orders are market orders.In our setting,the small investors who have taken profit or stopped loss will no longer participate in trading in the same trading period.

(iii)The rise of the security price caused by the buying of the main fund triggers the trend traders whose parameters rmarketare no more than the rise to buy.The triggered trend traders will cause the price to rise again.

(iv)The trend and contrarian investors trade in procedure(iii)set take-profit and stop-loss orders according to their parameters rprofitand rloss.As same as contrarian investors,the take-profit orders of the trend investors are limit orders and the stop-loss orders are market orders.

(v)The rise caused by the triggered trend traders may trigger new trend traders to buy.This process will continue until there are no trend investors that are triggered,and the trading period ends when the process stops.

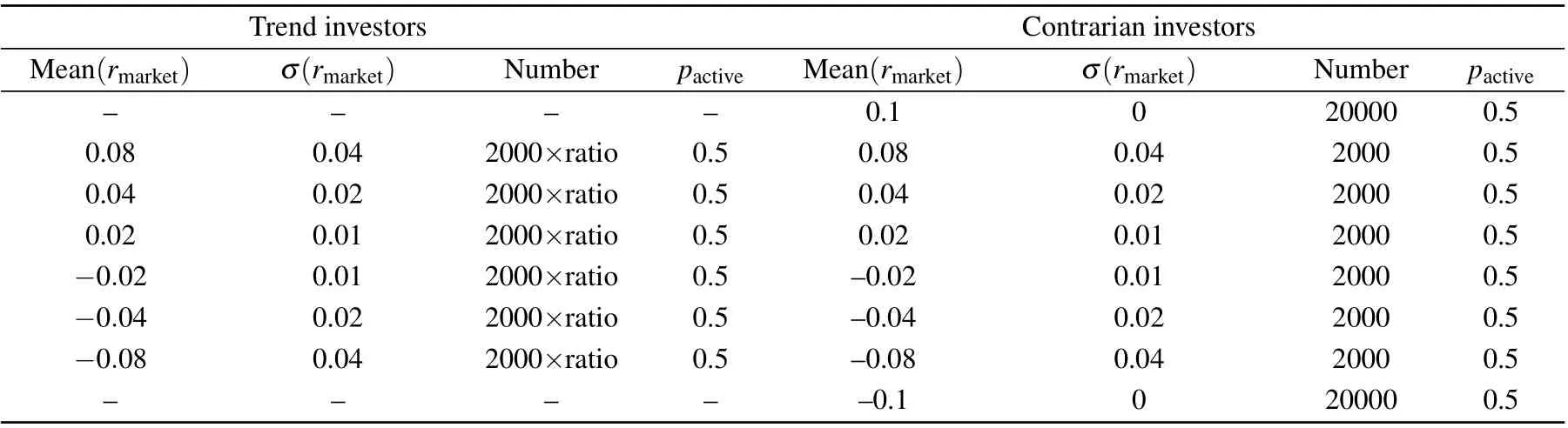

Table 1 shows parameters and numbers of trend investors and contrarian investors,where Mean(rmarket)andσ(rmarket)in each row are the average and standard deviation of the normal distribution satisfied by the parameter rmarketof the investors in the same row,and the parameter ratio denotes the ratio of the trend investors to the contrarian investors.It is worth noting that there are 20000 contrarian investors with the parameter rmarketof 0.1 and−0.1,but no trend investors with the parameter rmarketof 0.1 and−0.1.The purpose of our design is to be close to the real market,because when the price of a security deviates greatly from its due value,it will attract a large number of contrarian investors to participate in the trading.

Table 1.Parameters and numbers of trend investors and contrarian investors.

3.Simulation results and preliminary analysis

We simulate the artificial financial markets with the characteristics of pyramid schemes and obtain the rate of returns of the main fund under different cases.Through the results,we can preliminarily reveal the relationships between the rate of return of the main fund and the proportion of the trend investors in all the small investors,the small investors’parameters of taking profit and stopping loss,the order size of the main fund and the strategies adopted by the main fund.In our simulations,the main fund participates in trading through the way of first buying and then selling,which is not fundamentally different from the situation of selling first and then buying back,this is because the parameters rmarketand numbers of small investors set in our agent model are symmetrical.

3.1.Cases of the main fund adopting single strategy

In this subsection,we assume that the main fund only adopt one strategy,which is,buying a certain amount of securities through a single order in the first trading period and selling all the securities also through one order in the next trading period.In the simulation,we also assume that all the small investors’parameters of taking profit and stopping loss are different,and we consider four different combinations of taking profit parameter rprofitand stopping loss parameter rloss.

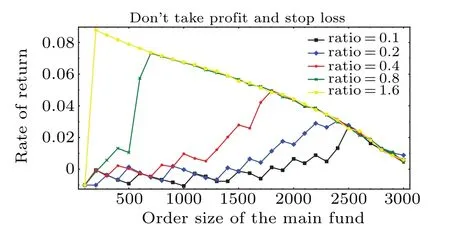

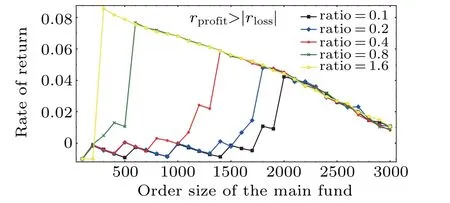

Fig.2.The relationship between the order size of the main fund and its return,when the small investors do not take profit and stop loss.

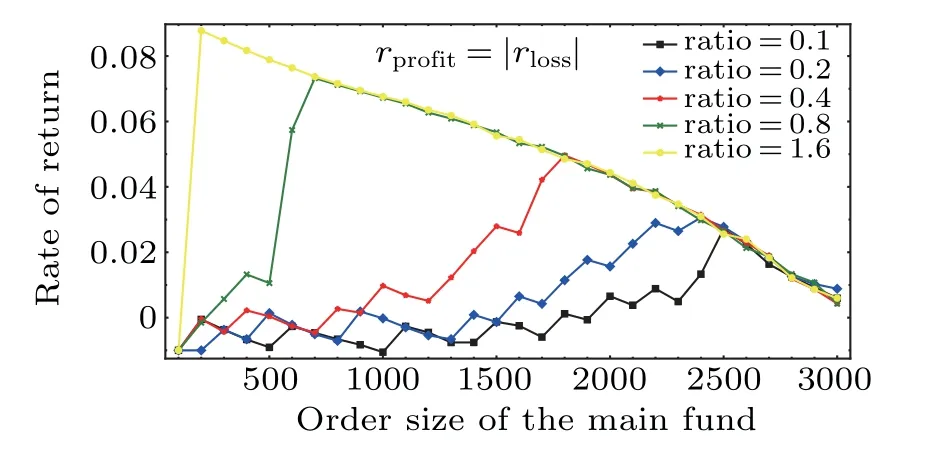

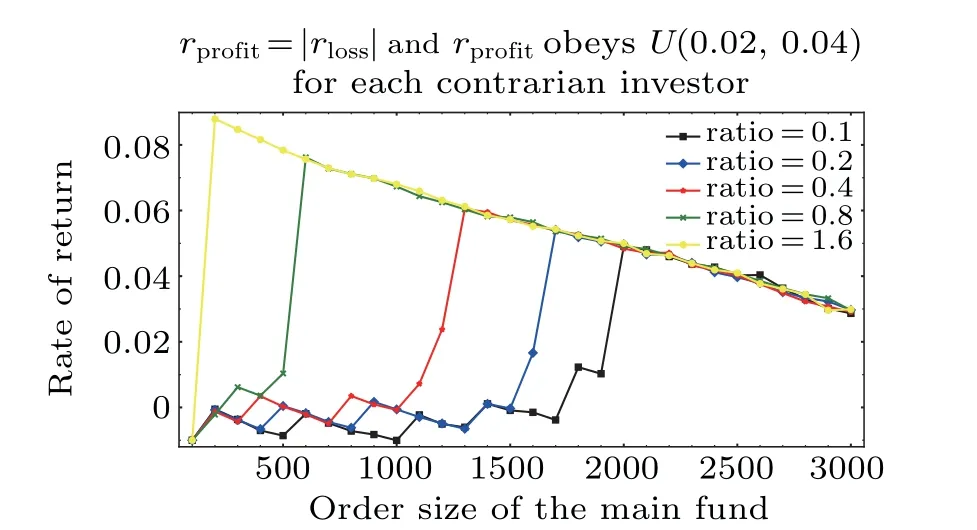

The first case is that the small investors do not take profit and stop loss,we obtain the relationship between the order size of the main fund and its return,as shown in Fig.2.Figures 3–5 shows the relationship between the order size of the main fund and its rate of return under different parameter combinations of small investors taking profit and stopping loss respectively.The parameter combinations of small investors taking profit and stopping loss from Fig.3 to Fig.5 are rprofit=|rloss|,where rprofitobeys the uniform distribution U(0.02,0.08);rprofit>|rloss|,where|rloss|obeys the uniform distribution U(0.02,0.08)and rprofitobeys the uniform distribution U(|rloss|,0.08);rprofit<|rloss|,where rprofitobeys the uniform distribution U(0.02,0.08)and|rloss|obeys the uniform distribution U(rprofit,0.08).In addition,we consider different values of ratio which are 0.1,0.2,0.4,0.8 and 1.6 in these simulations.

Fig.3.The relationship between the order size of the main fund and its rate of return,when the parameters of taking profit and stopping loss of the small investors satisfy rprofit=|rloss|,where rprofit obeys the uniform distribution U(0.02,0.08).

Fig.4.The relationship between the order size of the main fund and its rate of return,when the parameters of taking profit and stopping loss of the small investors satisfy rprofit>|rloss|,where|rloss|obeys the uniform distributionU(0.02,0.08)and rprofit obeys the uniform distribution U(|rloss|,0.08).

From these figures,we can see that when the order size of the main find reaches a critical value,its yield will suddenly increase,which is due to the distribution of rmarketof the small investors is sparse when the parameters rmarketare at larger values,and when the yield reaches the maximum,it will decrease with the increase of the order size.We also find that the higher the proportion of trend investors,the smaller the order size required by the main fund to achieve the maximum yield.In addition,we find that different combinations of stopping loss and taking profit parameters of small investors have an impact on the yield of the main fund.

Fig.5.The relationship between the order size of the main fund and its rate of return,when the parameters of taking profit and stopping loss of the small investors satisfy rprofit<|rloss|,where rprofit obeys the uniform distribution U(0.02,0.08)and|rloss|obeys the uniform distribution U(rprofit,0.08).

In our artificial financial market,the return of the main fund comes from the trend investors being triggered to push up the price,and the contrarian investors accepting and buying the securities at a higher price in the next trading period.The reason why the rate of return of the main fund increases first with the order size is that the larger order size can trigger more trend investors which help the main fund to push the price of the security higher,which increases the yield of the main fund.The reason why the rate of return of the main fund increases quickly first and then decreases slowly is that in the parameter setting of our agent model,only 2000 investors with rmarketparameter distributed around 0.02,0.04 and 0.08,while there are 20000 contrarian investors with parameters rmarketof 0.1,which cannot be swallowed by the main fund in our model,so with the increase of the order size,the yield of the main fund increases quickly when the rise of the security’s price is below 0.1,and decreases slowly when the rise of the security’s price is close to 0.1.In Section 4,we will make an in-depth theoretical analysis of the above conclusions.

3.2.Cases of the main fund adopting different strategies

Next,we consider the cases that the main fund adopts the strategy of buying or selling a certain amount of securities in batches in multiple trading periods.Specifically,we assume that the main fund buys a certain amount of securities in Dbuytrading periods and sell them in next Dselltrading periods,where Dbuy∈[1,5]and Dsell∈[1,5].In the actual financial market,the probability of no change in investor structure in the short term is higher than that in the long term,so Dbuyand Dsellshould not be taken as larger values in our model.In addition,we also assume that in the process of buying or selling securities,the main fund only places one market price order in each trading period,and the sizes of the market price orders in different trading periods are the same.Thus there are 5×5=25 cases in total.In the simulation,the total amount of the securities that the main fund buy is set as 2000,and the ratio is set as 0.4.When setting these two parameters,we refer to the simulation results in the previous subsection.As same as the previous subsection,we also assume that all the small investors’parameters of taking profit and stopping loss are different,and we consider four different situations.

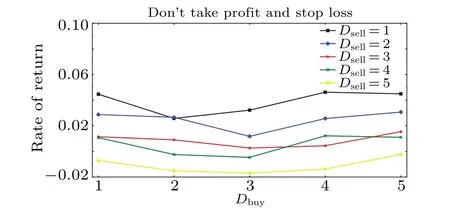

Fig.6.The relationship between the number of buying and selling periods of the main fund and its rate of return when the small investors do not take profit and stop loss.

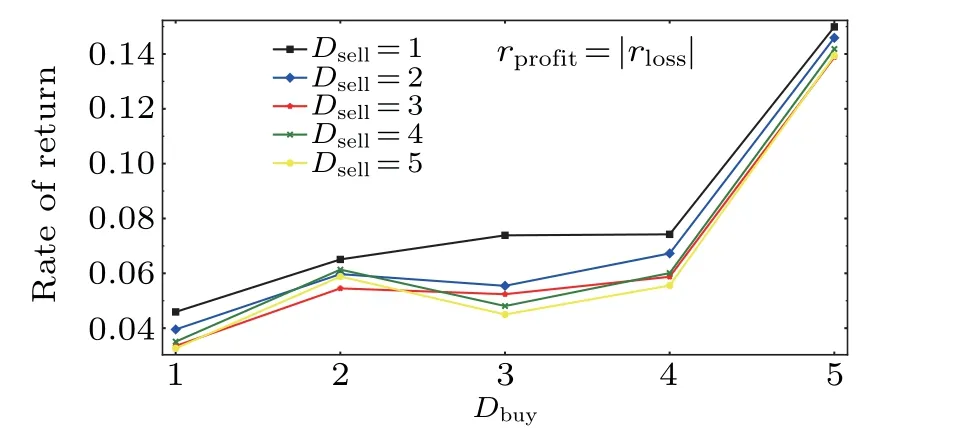

Fig.7.The relationship between the number of buying and selling periods of the main fund and its rate of return when the parameters of taking profit and stopping loss of the small investors satisfy rprofit=|rloss|,where rprofit obeys the uniform distribution U(0.02,0.08).

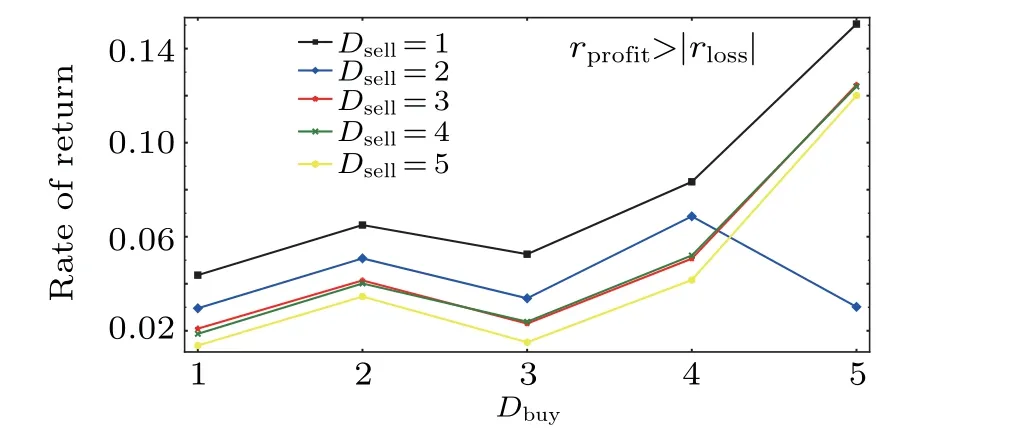

Fig.8.The relationship between the number of buying and selling periods of the main fund and its rate of return when the parameters of taking profit and stopping loss of the small investors satisfy rprofit>|rloss|,where|rloss|obeys the uniform distribution U(0.02,0.08)and rprofit obeys the uniform distribution U(|rloss|,0.08).

The first situation is that the small investors do not take profit and stop loss,we obtain the relationship between the number of buying and selling periods of the main fund and its rate of return,as shown in Fig.6.Figures 7–9 show the relationship between the number of buying and selling trading periods of the main fund and its rate of return under different parameter combinations of small investors taking profit and stopping loss respectively.The parameter combinations of small investors taking profit and stopping loss we consider are also rprofit=|rloss|,where rprofitobeys the uniform distribution U(0.02,0.08);rprofit>|rloss|,where|rloss|obeys the uniform distribution U(0.02,0.08)and rprofitobeys the uniform distribution U(|rloss|,0.08);rprofit<|rloss|,where rprofitobeys the uniform distribution U(0.02,0.08)and|rloss|obeys the uniform distribution U(rprofit,0.08).The above different combinations correspond to the simulation results in Figs.7–9.Fig.9.The relationship between the number of buying and selling periods of the main fund and its rate of return when the parameters of taking profit and stopping loss of the small investors satisfy rprofit<|rloss|,where rprofitobeys the uniform distribution U(0.02,0.08)and|rloss|obeys the uniform distribution U(rprofit,0.08).

From these figures,we can find that under different investor structures,the strategies and corresponding yields of the main fund are different.When the small investors do not take profit and stop loss,the yield curve of the main fund is basically the lowest.Moreover,there are some trends in these figures,that is,the more trading periods of the main fund buying securities,the higher the yield,and the fewer trading periods of the main fund selling securities,the higher the rate of return.Through more careful observation,we find that the effect of changes in the trading periods’number of buying on the yield seems greater than that of the trading periods’number of selling.In addition,we also find that if the investors do not take profit and stop loss,the yield of the main fund is significantly smaller than other situations.

This shows that in the case of unchanged investor structure,the main fund tends to increase the number of buying periods and to reduce the selling periods,which can explain why the real stock market always rises slowly and falls quickly.In the next section,we will make a more in-depth theoretical analysis of the conclusion.

4.Theoretical analysis

To further understand the underlying mechanism of the proposed agent-based model and to avoid illusive results caused by the model setting,we conduct a theoretical analysis on the model as follows.In this section,we analyze in detail the effects of the order size Nmfof the main fund,the parameter ratio between the trend investors and the contrarian investors,the stop-loss parameters rloss,take-profit parameters rprofitand the activation probability pactiveof the small investors on the yield of the main fund when the main fund adopts a single strategy.For the cases that the main fund adopts the strategies of buying or selling a certain equal amount of securities in batches in multiple trading periods,we analyze the impact of different numbers of buying or selling trading periods on the main fund yield.

4.1.Cases of the main fund adopting single strategy

We design simulation experiments to verify our conclusion.We set the absolute values of stop-loss and take-profit parameters of the contrarian investors and trend investors to random values obeying the uniform distribution U(0.02,0.04)respectively without setting take-profit parameters and stoploss parameters of the trend investors or contrarian investors(no take-profit parameters and stop-loss parameters are equivalent to the infinity of the absolute values of them).Comparing our simulation results in Figs.10 and 11 with the results in Fig.2,we find that the returns in Fig.10 are generally higher than those in Fig.2,and the returns in Fig.11 are generally lower than those in Fig.2,which are consistent with our analysis:the smaller the absolute values of the take-profit and stoploss parameters of the contrarian investors,the higher the yield of the main fund,while the situation of the trend investors is just the opposite.

Fig.10.The relationship between the order size of the main fund and its rate of return,when the parameters of taking profit and stopping loss of the contrarian investors satisfy rprofit=|rloss|,where rprofit obeys the uniform distribution U(0.02,0.04),and the trend investors do not take profit and stop loss.

Fig.11.The relationship between the order size of the main fund and its rate of return,when the parameters of taking profit and stopping loss of the trend investors satisfy rprofit=|rloss|,where rprofit obeys the uniform distribution U(0.02,0.04),and the contrarian investors do not take profit and stop loss.

5.Discussion and conclusion

We have established an agent model to study the financial phenomenon with the characteristics of pyramid schemes,and simulated this kind of artificial financial market under different investor structures.Through the simulation results and theoretical analysis,we obtain the relationships between the rate of return of the main fund and the proportion of the small trend investors in all small investors,the small investors’parameters of taking profit and stopping loss,the order size of the main fund and the strategies adopted by the main fund.Our main conclusions are:when the main fund adopts the strategy of buying a certain amount of securities through just one market order in the first trading period and selling them also through one market order in the second period,the higher the proportion of the small trend investors,the smaller the order size of the main fund to obtain the maximum yield,and after that the yield of the main fund decreases slowly with the increase of the order size.When the main fund adopts the strategies of buying and selling securities in multiple trading periods,we find that the more trading periods of buying and the less trading periods of selling,the higher the yield.

Our results are helpful to explain the financial phenomenon with the characteristics of pyramid schemes in financial markets,design trading rules for regulators and develop trading strategies for investors.Specifically,for investors,they can use our model to develop effective investment strategies after evaluating the structure of investors in the market.For financial market regulators,through our agent model and introducing parameters in real financial market,regulators can limit the maximum order size of the big investors in a certain period of time,so as to avoid the inequality of investors with different amounts of money.

猜你喜欢

杂志排行

Chinese Physics B的其它文章

- Multiple solutions and hysteresis in the flows driven by surface with antisymmetric velocity profile∗

- Magnetization relaxation of uniaxial anisotropic ferromagnetic particles with linear reaction dynamics driven by DC/AC magnetic field∗

- Influences of spin–orbit interaction on quantum speed limit and entanglement of spin qubits in coupled quantum dots

- Quantum multicast schemes of different quantum states via non-maximally entangled channels with multiparty involvement∗

- Magnetic and electronic properties of two-dimensional metal-organic frameworks TM3(C2NH)12*

- Preparation of a two-state mixture of ultracold fermionic atoms with balanced population subject to the unstable magnetic field∗