Revenue optimization strategy of V2G based on evolutionary game

2020-05-10LinGuoyingFengXiaofengLuShixiang

Lin Guoying Feng Xiaofeng Lu Shixiang

(1College of Electrical Engineering, Zhejiang University, Hangzhou 310000, China)(2Guangdong Power Grid Corporation, Guangzhou 510080, China)

Abstract:In order to protect the interests of electric vehicle users and grid companies with vehicle-to-grid (V2G) technology, a reasonable electric vehicle discharge electricity price is established through the evolutionary game model. A game model of power grid companies and electric vehicle users based on the evolutionary game theory is established to balance the revenue of both players in the game. By studying the dynamic evolution process of both sides of the game, the range of discharge price that satisfies the interests of both sides is obtained. The results are compared with those obtained by the static Bayesian game. The results show that the discharge price which can benefit both sides of the game exists in a specific range. According to the setting of the example, the reasonable discharge electricity price is 1.106 0 to 1.481 1 yuan/(kW·h). Only within this range can the power grid company and electric vehicle users achieve positive interactions. In addition, the evolutionary game model is easier to balance the interests of the two players than the static Bayesian game.

Key words:evolutionary game; electric vehicle; vehicle-to-grid; electricity price

In recent years, the rapid development of vehicle-to-grid (V2G) technology has become a new way of alleviating the current energy crisis and improving the environment[1]. It is necessary to guide the charging-and-discharging behavior of large-scale electric vehicles (EVs) through electricity prices[2]. Ordered charging-and-discharging behaviors can eliminate the adverse effects of overload and power quality degradation caused by disordered charging or discharging[3]. In addition, they can also effectively support the operation of the power grid (PG), achieve peak cutting and valley filling, reduce network losses, suppress renewable energy fluctuations, and participate in frequency modulation[4], which will improve the reliability and economics of PG operation[5].

In the V2G process, the relationship between EV and PG is equal and independent. The interests of both are antagonistic and competitive, so V2G has the characteristics of game[6]. The key to realizing effective V2G is how to distribute the benefits brought by the cooperation between the two parties. The distribution of this part of benefits is mainly reflected in the formulation of the discharge price. Only by formulating a reasonable discharge price can the enthusiasm of both parties to participate in the interaction be fully utilized. If the discharge price is too low, few EV users will be attracted to participate in the interaction. Thus, the PG company will gradually increase the discharge price until the EV user’s discharge capacity meets the number of loads that PG needs to reduce. There have been many studies on the EV charging price, but less research on the price of discharging.

In existing research,Refs.[7-10] used the game theory to establish a bi-level programming model with the goal of maximizing the revenue of the PG company and minimizing the EV users’ cost. The Nash equilibrium solution of the PG company and the EV users is obtained, which is used as the basis for formulating the discharge price. In Ref.[11], the maximum benefit of PG and EV group was set as the goal, and the established Cournot model was solved by KKT condition. Refs.[12-13] considered the non-cooperation and cooperation aspects, established the interaction model between EV-users’ needs and PG company’s strategy, and studied the corresponding demand response and pricing strategy optimization. Aiming at maximizing the operating income of electric vehicles, Refs.[14-19] constructed the model of maximizing the charging-and-discharging revenue of electric vehicles. By reasonably arranging the charging-and-discharging plan and responding to the real-time electricity price, EV users can achieve good economic benefits. However, due to the diversity of demand for EV users and the uncertainty of the operating state of the power grid, it is difficult to ensure that EVs and PGs make completely rational decisions based on complete information. Unlike the traditional game theory, the evolutionary game (EG) theory does not require that both sides of the game be completely rational, nor does it require that they have all the information.

Therefore, based on the evolutionary game theory and PG with two-way smart charging piles[6], this paper will analyze the dynamic evolutionary relationship and stable evolution process of benefit distribution between EV users and PG companies, and determine the benefit distribution method that satisfies the interactive needs of both parties. The results are compared with the results obtained by the static Bayesian game. Finally, a reasonable V2G discharge price range is obtained, which can provide a reference for the formulation of V2G strategy.

1 Establishment of Evolutionary Game Model Between PG Company and EV Users

1.1 The basic theory of evolutionary game

Evolutionary game is a new theory combining the traditional game theory with dynamic evolution analysis. By assuming the possible benefits of both sides of the game, it can analyze the income trends of the two parties under different strategies and obtain the evolutionary stability strategy of the two sides in different situations. The evolutionary stable strategy (ESS) and replicator dynamics (RD) are the two core concepts of the evolutionary game theory. ESS is defined as follows: If and only if a policy satisfies the following conditions, the policy is an ESS[5].

S(v,o)≤S(o,o) ∀v

(1)

S(v,o)=S(o,o)⟹S(v,v)=S(o,k) ∀v≠s

(2)

whereois the original strategy;vis the mutation strategy;Sis the expected return.

The ESS emphasizes the role of variability. Any tactical variation will lead to a smaller expected return. Therefore, the ESS is the ultimate stable solution of the evolutionary game. The RD emphasizes the role of selection. Individual decision-making in the group is achieved through dynamic processes such as learning, imitation, and variation between individuals. In the process of group dynamic adjustment, individuals in the group will choose to obtain higher-payment decisions in the previous game. Replicator dynamics can be expressed as

(3)

whereS(v,o) is the utility function, which represents the expected return obtained when the individual in the group adopts the pure strategyv;S(o,o) represents the average expected return;xvis the proportion of the pure strategyvselected by the group.

1.2 V2G evolutionary game model

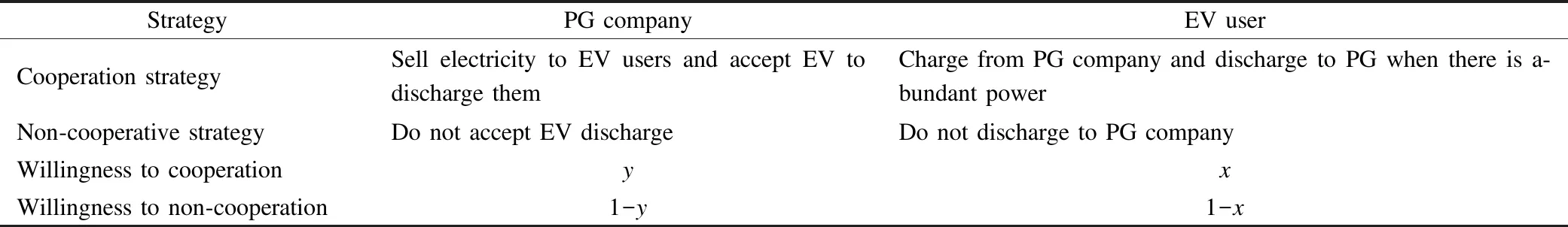

In the V2G evolutionary game, the strategies of PG companies and EV users are shown in Tab.1, wherexrefers to the probability of EV users participating in cooperation, andyrefers to the probability that the grid participates in cooperation.

Tab.1 The strategies for power grid companies and electric vehicle users

Thereby, a policy set {PGx,EVy}(0≤x≤1,0≤y≤1) of V2G game is formed. For EV users, when choosing a cooperation strategy, the expected reciprocation is

SEV1=y[UEV+Edpd-Ecpc-(Ed+Ec)LB]+

(1-y)(UEV-Ecpc-EcLB-LEV)

(4)

whereUEVis the normal income of EV users, mainly for the benefits brought by normal driving, and in this paper it is set to be 0.5374 yuan/(kW·h);Edis the amount of EV-discharging energy (kW·h);pdis the discharge price of EV;Ecis the amount of charge of the EV;pcis the charging price of the EV;LBis the unit cell loss of the EV during charging or discharging;LEVis the loss that EV users may cause when EV users choose to cooperate but PG does not cooperate.

For EV users, the expected return when choosing a non-cooperative strategy is

SEV2=y(UEV-Ecpc-EcLB)+(1-y)(UEV-Ecpc-

EcLB)=UEV-Ecpc-EcLB

(5)

The average expected reciprocation for EV users is

(6)

According to Eq.(3), the dynamic equation of EV user’s replication is

(7)

For PG companies, the expected return when choosing a cooperation strategy is

SPG1=x[UPG+EdEG-Edpd-(Ed+Ec)PPG]+

(1-x)(UPG-EcPPG-LPG)

(8)

whereUPGis the normal income of the PG company, mainly for normal sales revenue, and is set to be 0.498 5 yuan/(kW·h) in this paper;EGis the unit’s additional revenue brought to the PG company by cooperation, which mainly is the unit equipment investment saved by reducing the peak-to-valley difference of the power grid;PPGis the unit payment cost added by PG company when it chooses cooperation, which mainly is the construction cost of infrastructure such as charging piles;LPGis the loss that PG company may cause when it chooses cooperation and EV users do not cooperate.

For the PG company, the expected return when choosing a non-cooperative strategy is

SEV2=xUPG+(1-x)UPG=UPG

(9)

Then, the average expected return of the PG company is

(10)

PG’s replication dynamic equation is

xEdPPG-ECPPG-LPG+xLPG)

(11)

According to Eqs.(1) and (2), the stable evolution strategy of the V2G problem satisfies

S(PGx+Δx,EVy)≤S(PGx,EVy)

(12)

S(PGx,EVy+Δy)≤S(PGx,EVy)

(13)

2 V2G Evolutionary Game Equilibrium Point and Stability Analysis

Fig.1 shows the dynamic evolution phase diagram of V2G. The arrows in the figure indicate the evolution direction of the game. Let dx/dt=0, dy/dt=0. We obtain 5 points on the planeα={(x,y)|0≤x,y≤1}, i.e.,O(0,0),A(1,0),B(0,1),C(1,1), andD(xD,yD).

Fig.1 The dynamic evolution phase diagram of V2G

PointAin Fig.1 indicates that the EV user adopts a cooperation strategy, while PG adopts a non-cooperative strategy. PointBindicates that the PG company adopts a cooperation strategy, and EV users adopt a non-cooperation strategy. Obviously, pointsAandBare two unstable equilibrium points. PointCand pointOare the stable strategy points of the V2G evolution game. PointCindicates that both parties participating in the game adopt a cooperation strategy, and pointOindicates that both parties participating in the game adopt a non-cooperative strategy. PointDis the saddle point. When Eq.(11) is equal to 0, its abscissaxDcan be calculated. Similarly, letting Eq.(7) be equal to 0, we can obtain its ordinateyD.

(14)

(15)

The saddle pointDreflects the critical point of profit and loss in the V2G process. In Fig.1, theADBOpart indicates that the proportion of the two parties participating in the cooperation is too low, and the obtained income cannot compensate for the cost loss caused by this strategy. At this point, the evolutionary game will converge to pointO, that is, both sides of the game will choose the non-cooperative strategy. The ADBC part indicates that the revenue from the interaction of V2G will be higher than the cost. The higher proportion of cooperation will lead to greater return. Therefore, it will eventually converge to pointC, that is, both sides of the game will choose a cooperation strategy.

In the case of stabilizing strategy pointC, when both parties cooperate, in order to make the income satisfy the interests of both parties and form a stable interactive relationship, the relationship to be satisfied should be

UEV+E′dpd-Ecpc-(Ec+E′d)LB>UEV

(16)

UPG+E″dEG-E″dpd-(Ec+E″d)PPG>UPG

(17)

whereE′drepresents the amount of discharged electricity required to ensure the profitability of the EV user;E″drepresents the amount of discharged electricity required to ensure the profitability of the PG company. This means that the gains from participating in the game should be greater than the gains from not participating in the game. Solving Eqs. (16) and (17) can obtain

(18)

(19)

In a stable interactive state, the discharge electricity quantityE′dof the EV is equal to the discharge electricity quantityE″dreceived by the PG company, that is,Ed=E′d=E″d. According to Eqs. (18) and (19), the range of the discharge pricepdcan be found.

(20)

The left side of (20) reflects the unit cost paid by EV user for the game, and the right side reflects the unit revenue that the PG company can obtain from the game. Only when the discharge price satisfies (20), can both sides of the game gain advantages at the same time and continue to cooperate steadily.

3 Case Study

3.1 Assumptions

Taking the power grid with smart charging piles and electric vehicles in a city as an example, the process of the evolutionary game between them is analyzed, and the interaction implementation strategy between EVs and PG at a certain scale is obtained.

The number of EVs in the city is about 80 000. One EV battery has a capacity of 25 kW·h and a discharge depth of 0.8. The unit battery lossLB=0.41 yuan/(kW·h). Each EV charging pile is about 14 000 yuan. Its service life is 10 years. The average working time in a day is 12 h. The output power is 10 kW. The unit payment cost of the EV charging pilePPGis 0.035 5 yuan/(kW·h). The valley-period electricity price of PG is 0.285 6 yuan/(kW·h), and the peak-period electricity price is 0.491 0 yuan/(kW·h). For the convenience of analysis, the EV is charged during the valley period, and the amount of charge is the same as the battery capacity. According to Ref.[5], when the EV user cooperates with the PG company, the investment cost of the power grid unit will be reduced to approximately 14 900 yuan/kW. The service life of the unit is generally around 15 years. The time to participate in peak shaving is 3.5 h per day. The working time for one year is 200 d. Hence, the extra income of the unit brought to the PG by the EV participation interaction isEG=14 900/(15×3.2×200)=1.552 1 yuan/(kW·h).

3.2 Results and discussion

According to the foregoing analysis, the coordinates of the saddle pointDare obtained as

(21)

(22)

The saddle pointDis related to the cost (LEVandLPG) when the EVs or the PG cooperate unilaterally. The larger theLEVandLPG, the more the saddle pointDtends to pointC(1,1) in Fig.1. WhenLEVandLPGare known, the saddle pointDwill be determined by the discharge pricepdand the discharge quantityEd. The relationship between the discharge quantity and the discharge price calculated by Eqs.(18) and (19) is

(23)

(24)

Eq.(23) reflects the discharge capacity required by the EV in the case of the discharge pricepd. Eq.(24) reflects the discharge capacity required by the PG in the case of the discharge pricepd. If Eq.(23) is satisfied, the EV user’s requirement for the amount of discharge will be satisfied. If Eq.(24) is satisfied, the PG’s requirement for the amount of discharge will be satisfied.

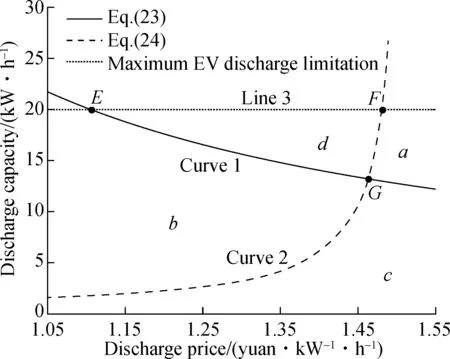

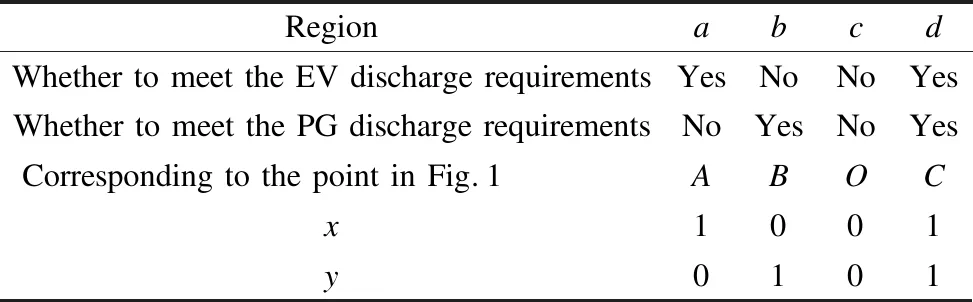

The relationship between the discharge electricity pricepdand the discharge electricity quantityEdis shown in Fig.2. The coordinates of the three intersections in Fig.2 areE(1.106 0,20),F(1.481 1, 20), andG(1.463 2, 13.162 2), respectively. Curve 1 is determined by Eq. (23), reflecting the constraint relationship between discharge power and discharge price from the perspective of EV. Curve 2 is determined by Eq.(24), reflecting the constraint relationship between the discharge power received by the PG and the discharge price from the perspective of the PG company. Line 3 is the maximum discharge capacity defined by the capacity of the EV battery. There are four intervals in Fig.2. Referring to Eqs.(23) and (24), the evolutionary game relationships corresponding to each region are shown in Tab.2.

Fig.2 The dynamic evolution diagram of V2G

RegionabcdWhether to meet the EV discharge requirementsYesNoNoYesWhether to meet the PG discharge requirementsNoYesNoYesCorresponding to the point in Fig.1ABOCx1001y0101

In areasaandb, only one party can profit from V2G. This will seriously affect the enthusiasm of the non-profitable party to participate in the interaction and encourage the non-profitable party to choose the non-cooperative strategy. This will increase the cost of the originally profitable party and reduce its income. The result of the final evolution will tend to pointO, making the interaction impossible. In areac, neither party can profit, and the players will not choose to interact. In aread, both the EV and the PG can benefit from the interaction, so areadis an optional range set for V2G. The interactive decision of the EV and the PG can be selected within this range.

When the discharge electricity pricepdis between 1.106 0 and 1.463 2 yuan/(kW·h), the discharge electric quantityEdis determined by curve 1 and line 3. As the discharge electricity price increases, the profit per unit of EV increases. In this case, the limitation of the discharge amount is gradually relaxed, and the adjustable range of the discharge amount is increased. When the discharge electricity pricepdis between 1.463 2 and 1.481 1 yuan/(kW·h), the discharge electric quantityEdis determined by curve 2 and line 3. As the discharge electricity price increases, the profit per unit of PG decreases. In this case, the requirement for the discharge amount is gradually increased, and the adjustable range of the discharge amount is gradually reduced. When the discharge price is 1.463 2 yuan/(kW·h), the benefits of the interaction are relatively balanced, and the dischargeable power can be adjusted to the largest extent.

Therefore, in order to achieve a benign interaction between EV and PG, the range of EV discharge price determined by PG is 1.106 0 to 1.481 1 yuan/(kW·h), and the reasonable range of discharge power determined by EV is 13.162 2 to 20 kW·h. Within the range of reasonable discharge price, the optimal discharge price should be 1.463 2 yuan/(kW·h). Within the range of the discharge price, the minimum discharge required for both parties to make a profit is 13.162 2 kW·h.

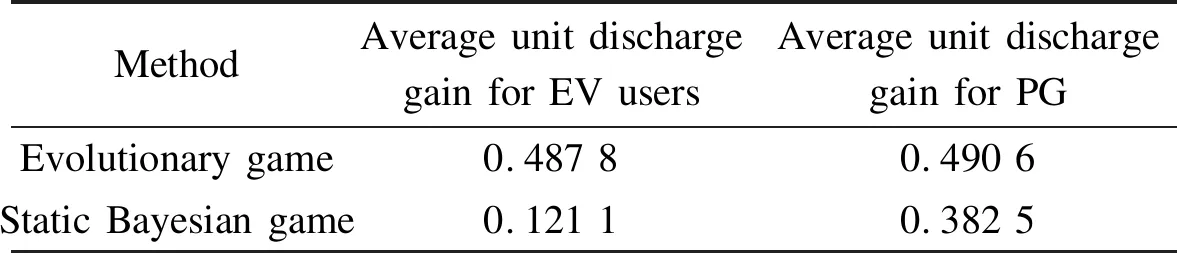

Under the optimal electricity price, the average unit energy gains of EV users and PG companies obtained by Eqs.(4) and (8) are shown in Tab.3 and compared with the returns from the static Bayesian game[20].

Tab.3 Comparison of EV and PG income under different methods yuan

It can be seen from Tab.3 that when the optimal discharge price is adopted, the difference between the EV and PG in the evolutionary game is only 0.002 8 yuan. This value is much smaller than the result of the static Bayesian game, which is 0.261 4 yuan. At the same time, compared with the fixed strategy points determined by the static Bayesian game under the limited information, the evolutionary game is more fully used to mine the EV and PG interaction strategies, and more profits based on the optimal discharge price are gained.

4 Conclusions

1) There are four states in the interaction process, but the result of interaction evolution only has two kinds: cooperation and non-cooperation.

2) In the cooperative interaction state, as a means of participating in the interaction, there is a certain constraint relationship between the discharge price determined by PG Company and the quantity of discharging energy determined by the EV users.

3) Within a certain range of discharge rates, there is a specific response range for the discharge capacity. Only within this scope can both sides benefit from the interaction, thus achieving a benign interaction between the EV users and the PG company.

杂志排行

Journal of Southeast University(English Edition)的其它文章

- Effects of curing age on compressive and tensile stress-strain behaviors of ecological high ductility cementitious composites

- The cause of human fatigue and scenario analysisin the process of marine transportation

- An explicit representation and computation for the outer inverse

- Dispersion of graphene in silane coupling agent aqueous solutions

- Fault diagnosis method of rolling bearing based onthreshold denoising synchrosqueezing transform and CNN

- Evaluation of rutting and low-temperature cracking resistancesof warm-mix recycled asphalt bindersunder the secondary aging condition