Dividend Policy

2019-09-10赵佳琦

1. Introduction

The vital decision made by the enterprise to correctly distribute the profits of the company has become one of the topics of debate among experts. Typically, companies have three options for distributing profits. The first is to keep profits in the company to invest in good projects in the future. When suitable investments are hard to find, and shares float enough, companies may buyback options to dilute them. The last way is to distribute profits to investors in the form of dividends. This policy of distributing cash to shareholders is called dividend policy. (Hillier, Grinblatt and Titman, 2012). When analyzing dividend policies from the perspective of a company, it is necessary to combine many practical situations and consider potential factors. Potential factors include taxes, future growth opportunities, shareholder expectations, stable earnings, and the need for capital.

2. Literature Review

2.1 Dividend Irrelevance Hypothesis

Modigliani-miller (1963) theorem (M&M) points out that investors do not care about the distribution of corporate dividends without personal tax and transaction costs. The proportion of profits paid does not affect the value of the company, the market value of the enterprise, and has nothing to do with its capital structure. Companies choose not to pay dividends to increase revenue and increase the value of the company. In this theory, the following assumptions are made: the company’s investment policies have been determined and are supposed to be understood by investors. There are no stock issuance and transaction costs; there are no personal or corporate taxes. The information is open, transparent, and symmetric. There is no agency cost between managers and outside investors. (Bose, 2010) Modigliani-miller (1963) studied and added the impact of the tax on their theoretical basis. Although this theorem opened up the capital structure and the establishment of modern financial theory has indelible importance. (Luigi&sorin, 2011). However, this theory also has limitations. The assumptions made by Modigliani-miller are too optimistic. The market is not entirely perfect. Therefore, the information is not transparent and asymmetric, which will lead to more complicated dividend policies. (Breuer & Gurtler, 2008; Gifford, 1998) In real life, different tax situations will lead to varying positions of shareholders. Baker and Powell (1999) interviewed with the cost of 603 listed companies in New York, USA, and found that only 10% of them believed that dividend policy had nothing to do with corporate value. According to these conditions, the scholars put forward four other theoretical hypotheses.

2.2 The bird in the hand hypothesis

In this theory, a bird in the hand is the cash dividend currently available, while a bird in the forest represents future capital gains. Suppose that shareholders or creditors prefer cash dividends to capital gains. The reason is that cash dividends are considered as a guaranteed return with low risk and more certainty than future increases in capital gains. In order to maximize the interests of shareholders, enterprises should implement the dividend policy of high dividend distribution rate. Increasing dividend payment may increase corporate value (Gorden & Lintner, 1962).

Many scholars disagree with this theory. (Lintner, 1962; Gordon& Shapiro,1956.) Some scholars believe that risk and income go in the same direction. Although the amount of cash dividend risk is low, the benefit is far lower than the capital gains investors.

Modigliani-miller (1961) also referred to the “bird in the hand theory” as the “bird in the hand fallacy.” Bhattacharya (1979) argued that increased dividends would affect the company’s cash flow and not increase its value.

2.3 Clientele effect hypothesis

Tax differences can affect changes in investor preferences. (Elton and Gruber, 1970) Differences are reflected in two aspects. First, there are differences in tax rates. The dividend income tax is higher than capital gains tax to protect and encourage investment in the capital market

Second, there is a difference in time. Shares in cash will be paid after dividends.

Different investors have different tax burdens and risk preferences due to separate returns. Investors are attracted to companies with dividend policies appropriate to their situation. (Baker and Wurgler, 2004; Graham and Kumar, 2006; Li and Lie, 2006). Investors experience high income and risks. This kind of investors required a top marginal tax rate who bear a high tax burden and prefer stocks with capital gains and low cash dividend payout rate. Investors prefer cash dividends and more retention. The example of people who own lower boundary are Investors with lower marginal tax rates, low-income, and risk-averse investors. This group of people required to pay higher dividends compared to others. We found that age difference also affects investor income and dividend yield. Older people are cautious about risk, avoiding transaction costs, and opting for high cash dividends; younger people are the opposite. (Petti, 1977; Han, lee and Suk, 1999; Dhaliwal, Erickson and Trezevant,1999) Therefore, not all companies can use dividends as a signal of prospects. Some companies would prefer to use stock buybacks instead of profits. The reason is that share buybacks require lower transaction costs than dividends.

2.4 The signaling hypothesis

It is worth noting that there is also a cost for communicating information to outside investors. (Bhattacharya, 1979). If the firm made a decision to buy its shares back, it does not mean that the company has a long-term revenue growth prospect. It may be that the company has a lot of cash but no good projects to invest. The stock repurchase does not have the dividend to convey the company’s quality signal; from this point of view, the stock repurchase is not a substitute for the dividend payment. (John and Williams 1985).

3. The merit of dividend-based investment strategies

The relationship between dividend yield and dividends is positive. The more dividends a company has, the greater the dividend yield. The relationship between dividend yield and the stock price is just the opposite. The greater the price of stock purchases, the smaller the dividend yield. (Fama and French, 1996) The dividend yield is one of the essential indicators when investors invest in stocks. The higher the stock dividend rate, the more worth buying. (John Slatter, 1988) According to a 2017 survey, the level of dividend yield in each country varies according to social conditions. New Zealand’s dividend yield has the highest dividend yield in 32 countries (Hunkar, 2017).

Source:Hunkar(2017)

O’Higgins and Downes (1991) coined the theory of “Beating the dow” the idea of investing in stocks with high dividend yields. The argument can be described merely as the selection of ten companies with the highest dividend yield each year. Companies are sorted according to their dividend yield. The stocks of the companies that have not been selected again will be sold to buy the shares of the newly listed companies. The authors applied the theory to the US market and found that performance was indeed higher than the market. (McQueen, Shields and Thorley, 1997). In countries with relatively low market efficiency and opaque information in the Middle East and North Africa, companies with high dividend payouts will generate higher returns (Farooq, Shehata and Nathan, 2018). Companies with a good dividend history will generally stably pay dividends. The Coca-Cola Company is one of an example of bonuses that have been paid since 1920 and have a long history of dividends (Hillier, Grinblatt, and Titman, 2012). Especially in the company, reducing or stopping the payment of dividends is something that managers do not want to see. The distribution of dividends represents its confidence in the company’s profitability (Lintner, 1956; DeAngelo, DeAngelo, and Skinner, 2008). In the UK, paying dividends to shareholders is a common strategy for companies (Benito and Young, 2001; Renneboog and Trojanowski, 2005). Paying dividends is more stable (Jagannathan, Stephen, and Weisbach, 2000), which offers investors the possibility to use dividend-paying strategies to generate returns. However, during the economic crisis, due to the impact of the macroeconomy, dividends are still likely to be reduced.

According to Fama and French (2001a), industrial companies, also known as non-financial and financial companies, showed a lower propensity to pay dividends during the two years from 1978 to 1998. In recent years, many companies have begun to use the repurchase policy. (DeAngelo, DeAngelo, and Skinner, 2004)

For investors, the dividend-based investment strategies enable investors to gain the ability to speculate again, alleviating the losses caused by falling stock prices. When the stock price falls, the payment of dividends can reduce the loss of investors.

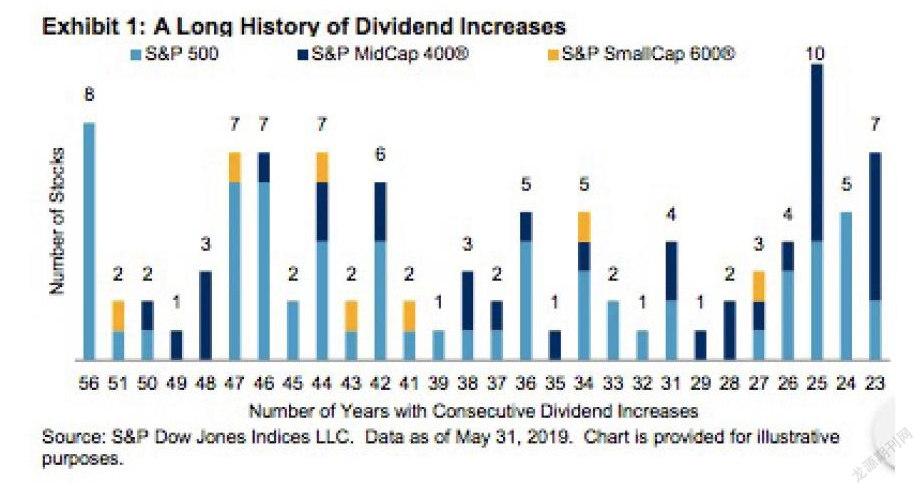

Source: S&P Dow Jones Indices

The Dividend investment strategy is a simple and easy to understand approach to managing portfolios. This method is easy to operate and does not have high requirements for investor experience and knowledge. Investors can use this method to generate income (Pardo, 2008). The dividends can be reinvested. Dividends earned each year can be used as capital to buy shares. The cost of this strategy is cheap. Over time, dividends paid out by companies can ease inflationary pressures and increase cash flow for investors. In a bear market, a plan of reinvesting dividends helps mitigate the value of a portfolio. In a bull market, this strategy earns investors higher returns. However, some investors are too narrow-minded. They only consider dividend yields and neglect other influencing factors, such as the company’s internal financial situation, may lead to wrong decisions, etc. When measuring strategy performance, you should not only consider revenue, but the risk is also one of the factors to consider. There are usually two measures methods: Sharpe ratio and Treynor measure. Sharpe ratio influenced by cumulative risk. Treynor ratio is different, considering systemic risk. Their primary use is to use threat and return to evaluate the decisions made by investors. Using beta in Treynor ratio to compare portfolio and overall market performance. Kuo, Stratling, and Zhang (2019) authors conducted a study on the dividend market in China and found that the critical factor in China’s dividend fluctuations is the change in systemic risk.

Companies that pay high dividends outperform non-dividend payers. One reason is that dividends reduce retained earnings. For this reason, company managers tend to invest cautiously. There are limits to this view. Many of the non-dividend payers are high-growth tech companies. They can use retained earnings to invest in promising projects and then reap the benefits. The number of dividends paid does not necessarily determine a company’s profits. High dividend payers also use loans to pay dividends in order to stabilize shareholders’ confidence in the company’s prospects.

The chart made a comparison between the performance of the highest-yielding stocks with the FTSE 100 performance from the five years from 2014 to 2019. Dividend investment strategy lags behind the production of FTSE in the short term, and the most important thing is that investors need to make a rational assessment (CHING, 2019). When you find a company with a very high rate of return, make a careful choice to prevent falling into the “dividend trap.” Many companies have already built up their debt walls, but continue to pay dividends (Smith, 2019).

Source:(Brewin,2019)

The improvement in the quality of information disclosure can be achieved through high dividend payout rates. (Farooq, Shehata and Nathan, 2018) Distributing the free cash flow of a company’s earnings to shareholders in a dividend can help alleviate agency conflicts. (Jensen, 1986; Rozeff, 1982) The increase in cash paid to shareholders reduces the administrative costs used by managers and reduces agency costs.

4. Conclusion

In the initial part of this paper, the methods and related policies for the company’s distribution of company profits are briefly introduced.

The second part mainly analyzes five different dividend theories. It can be divided into two categories through the recognition of dividend correlation; one is dividend irrelevance and dividend related theory. In the dividend described method, a bird in the hand hypothesis, clientele effect hypothesis, signaling hypothesis, and agency costs hypothesis were analyzed. The development of these theories is an attempt to explain the dividend policy from different perspectives, but on the whole, these theories are not conducive to operation. In “the bird in the hand hypothesis,” it emphasizes the present value of shareholders’ preference to receive dividends. However, it does not provide answers to such questions as the degree of choice, which still has limitations.

The third section discusses investment strategies based on dividends. The payment of dividends is seen as a signal to prove the manager’s information about the company’s prospects. However, investing only in companies with high dividend payout rates and ignoring risks can easily cause investors to fall into the trap of dividends. Meanwhile, it will bring losses to investors’ interests.

References:

[1]Alli, K., Khan, A., and Ramirez, G. Title: Determinants of Corporate Dividend Policy: A Factorial Analysis[J]. Published on: The Financial Review,1993,28(4):523-547.

[2]https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1540-6288.1993.tb01361.x[OL].

【作者簡介】赵佳琦(1994-),女,汉族,河北邯郸人,研究生,研究方向:股利政策,金融稳定性。