Influence of Sino-US Agricultural Trade on China’s Total Agricultural Output Value Based on Cointegration Model

2019-06-27ZhiyaoLI

Zhiyao LI

Poznan University of Life Sciences, Poznan 60624, Poland

Abstract According to the data of the total trade of agricultural products between China and the United States from 2009 to 2018 and the general description of agriculture in China, this paper adopts the method of econometric model to make a detailed analysis of the agricultural trade between China and the United States by using cointegration analysis, Granger causality test and error correction model in order to explore the impact of agricultural trade between China and the United States on China’s agricultural development. The results of empirical analysis show that there is a balanced relationship between the trade of agricultural products between China and the United States and the development of agriculture in China. The total trade of agricultural products between China and the United States affects the development of China’s agriculture. In addition, in the short term, if the short-term fluctuation deviates from the long-term equilibrium, then the error correction term will reverse it with strength of 0.378, so that the non-equilibrium state will gradually return to the equilibrium state.

Key words Trade of agricultural products between China and the United States, Econometric model, Co-integration analysis, Error correction model

1 Introduction

China is a large agricultural country, and the agricultural economy plays a role that can not be ignored in the development of China’s national economy. The United States is a major importer and exporter of agricultural products in the world. In 2018, the total import and export volume of agricultural products in the United States was $144.5 billion, an increase of about $500 million over the 2017 fiscal year, making it the world’s largest exporter of agricultural products. For a long time, the United States has played an important role in China’s agricultural trade. Undoubtedly, China is also an important market for the U.S. agricultural exports. Agricultural trade between the two countries rose from $17.1 billion in 2009 to $43 billion by the end of 2018, according to figures released by the U.S. Department of Agriculture (US-DA). At the same time, thanks to the active efforts of Chinese government and the agricultural departments, the gross domestic agricultural products China country have also been increasing, from $524.3 billion in 2009 to $1.340 1 trillion at the end of 2018.

2 Data sources

This paper selects two kinds of time series data: the total trade of agricultural products between China and the United States and the total agricultural output value of China from 2009 to 2018. The data are mainly from "USDA" andChinaStatisticalYearbookfrom 2009 to 2018. These data have been tested in an all-round way and have high authenticity and reliability, which can provide a solid basis for the empirical analysis of this paper.

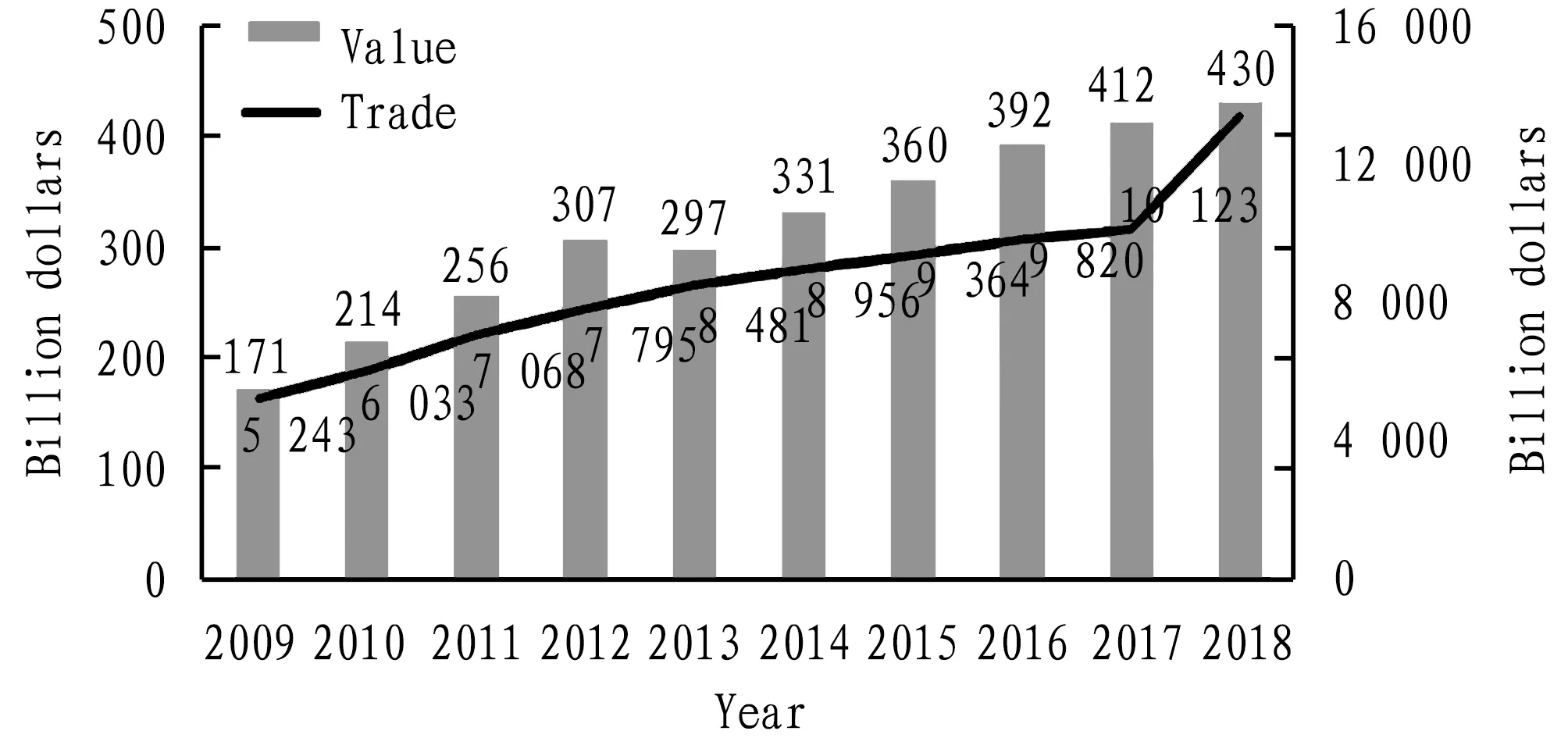

According to the data in Fig.1, the total output value of China’s agriculture grew steadily from $524.3 billion in 2009 to $1.340 1 trillion in 2018. At the same time, trade in agricultural products between China and the United States fluctuated, peaking at $30.7 billion between 2009 and 2012. This was followed by a small decline, but a rapid return to growth. At the end of 2018, the trade volume of agricultural products between China and the United States was $43 billion, an increase of 4.37% over 2017. It can be seen that the changing trend of the trade volume of agricultural products between China and the United States and the total agricultural output value of China is basically the same, but there are also some differences. Coupled with the volatility of the international trade environment of agricultural products, this paper puts forward the following hypotheses:

Fig.1 Trade volume of agricultural products between China and the United States and the total output value of agricultural products in China from 2009 to 2018

H1:There is a positive equilibrium relationship between the trade volume of agricultural products between China and the United States and the total agricultural output value of China, and with the increase of the trade volume of agricultural products between China and the United States, the total agricultural output value of China also increases.

H2:There is no positive equilibrium relationship between the trade volume of agricultural products between China and the United States and China’s total agricultural output value, and there is no inevitable relationship between the two.

3 Empirical analysis

According to the basic principle of econometric model, this paper uses Eview 6.0 software to analyze in detail the equilibrium relationship between Sino-US agricultural trade and China’s agricultural economy, and tests the causality to determine whether there is a causal relationship in this equilibrium. On this basis, this paper constructs an error correction model to analyze in detail the relationship between Sino-US agricultural trade and China’s agricultural economy.

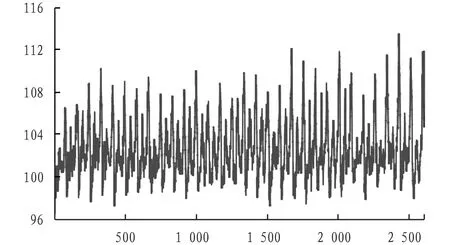

3.1 Unit root testConsidering that there may be pseudo-regression phenomenon in the process of research, in order to improve the accuracy of empirical analysis, this paper first uses time series to test the balance between the total trade of agricultural products between China and the United States and the total agricultural output value of China, and takes the natural logarithm for these two variables. Then the unit root test of two logarithmic sequences and the logarithm after the first order differential treatment is carried out by using Eview 6.0 software. The results of the test are shown in Table 1.

Table 1 Unit root test of time series

Test sequenceTotal trade in agriculturalproducts between Chinaand the United StatesTotal agriculturaloutput value of ChinaFirst-order differential of the total tradeamount of agricultural products betweenChina and the United StatesFirst-order differential oftotal agriculturaloutput value in ChinaVariable symbollnTradelnValue△Trade△ValueADF test statistic-0.8291.557-3.891-3.928P value0.7780.9270.0120.011Test resultsNon-stationaryNon-stationaryStationaryStationary

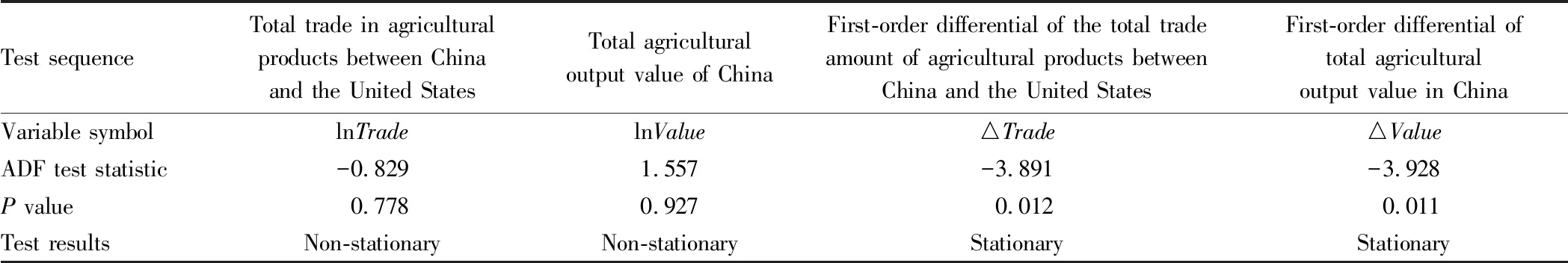

From the test results, the ADF testPvalue of time series "lnTrade" and "lnValue" is more than 10%, indicating that the total trade of agricultural products between China and the United States and the total agricultural output value of China are non-stationary time series. At the same time, the ADF testPvalues of the total trade of agricultural products between China and the United States and China’s agricultural output value after the first order differential treatment are all less than 0.1, indicating that the sequence after the first-order differential treatment is in a stationary state. In other words, the sequences lnTradeand lnValueare integrated of order 1, denoted asI(1), and each variable isI(1), which satisfies the basic conditions of cointegration analysis. Further cointegration tests can be performed based on these data (Fig.2).

Fig.2 First-order differential sequence diagram of lnTrade

3.2 Cointegration test analysisBefore the cointegration test, the optimal lag order of the unconstrained VAR model is determined, and the calculated results are shown in Table 2. The results in the table above show that at the 0.05% level, LR (likelihood ratio), FPE (final prediction error), AIC (Akaike information criterion), SC (Schwarz information criterion) and HQ (Hannan-Quinn information criterion) all select two periods of lag. It is shown that the optimal lag order of the unconstrained VSR model is 2. Based on this, the cointegration analysis of the long-term relationship between variables can be carried out on the basis of the optimal lag order.

First of all, the total trade of agricultural products between China and the United States and the total agricultural output value of China are regarded as two time series. In order to test the cointegration relationship between the two time series, the cointegration regression equation is as follows:

lnValue=-6.188+0.552lnTrade(model 1).

The calculatedFvalue is 176.289 andR2is 0.911. Then, the residual sequence is tested by unit root test. The test results show that thet-statistic is -2.389 1, and the corresponding probability value is 0.019 2, which is less than 0.5% confidence level. This shows that the hypothesis that the residual sequence has a unit root has not passed the test successfully, and it can be considered that the residual sequence is balanced. In other words, there is a long-term equilibrium relationship between the sequences lnTradeand lnValuestudied in this paper. So far, the basic conditions of Granger causality test have been met, and the causality test can be carried out between the trade volume of agricultural products between China and the United States and the total output value of agricultural products in China.

Table 2 VAR model lag standard

Lag012LogL-33.281 18217.289 300266.349 093LRNA426.273 91193.273 891FPE0.000 2811.02e-072.00e-08∗AIC1.572 891-7.289 380-9.271 872∗SC1.638 912-7.117 283-8.381 938∗HQ1.527 844-7.381 938-8.928 310∗

Note:*in the above table represents the optimal lag order selected under each standard.

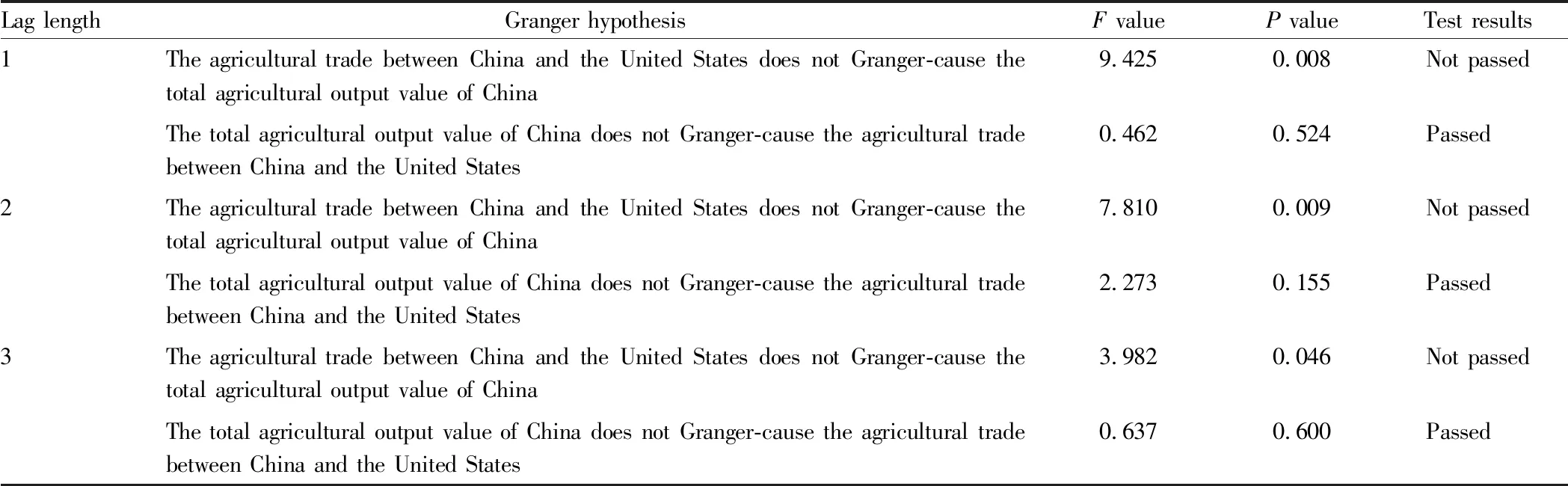

3.3 Granger causality testThrough the cointegration test, it is found that there is a long-term and stable equilibrium relationship between the total trade of agricultural products between China and the United States and the total agricultural output value of China, but it is necessary to further explore whether this relationship can constitute a causal relationship. Therefore, after the cointegration test, this paper uses the Granger causality test to test whether there is a causal relationship between the two variables. The test results are shown in Table 3.

From the test results of the above table, we can see that the causal relationship between the total volume of agricultural trade between China and the United States and China’s total agricultural output value is not stable. At a confidence level of 10%, the total volume of agricultural trade between China and the United States Granger-causes China’s total agricultural output value. But at the same time, the total agricultural output value of China does not Granger-cause the agricultural trade between China and the United States. Thus it can be seen that with the growth of the trade volume of agricultural products between China and the United States, China’s total agricultural output value will also increase to a certain extent, but the growth of China’s total agricultural output value will not have a significant impact on the total trade of agricultural products between China and the United States. In other words, there is a single causal relationship between the two variables studied in this paper.

Table 3 Granger causality test of the total agricultural output value of China and the agricultural trade between China and the United States

Lag lengthGranger hypothesisF valueP valueTest results1The agricultural trade between China and the United States does not Granger-cause the total agricultural output value of China9.4250.008Not passedThe total agricultural output value of China does not Granger-cause the agricultural trade between China and the United States0.4620.524Passed2The agricultural trade between China and the United States does not Granger-cause the total agricultural output value of China7.8100.009Not passedThe total agricultural output value of China does not Granger-cause the agricultural trade between China and the United States2.2730.155Passed3The agricultural trade between China and the United States does not Granger-cause the total agricultural output value of China3.9820.046Not passedThe total agricultural output value of China does not Granger-cause the agricultural trade between China and the United States0.6370.600Passed

3.4 Construction of error correction modelBased on economic knowledge, traditional economic models can often describe the long-term equilibrium relationship between variables. For example, the cointegration regression model describes a long-term equilibrium relationship between sequences lnTradeand lnValue. However, in practice, the relevant economic data are gradually formed in the process of "disequilibrium". Therefore, in the process of building the model, it is necessary to use the dynamic non-equilibrium process of data to approach the long-term equilibrium rules of economic theory, so as to improve the scientificity and accuracy of the model. In the empirical analysis of this paper, in order to comprehensively investigate the dynamic relationship between the total trade of agricultural products between China and the United States and the total agricultural output value of China, it is necessary to construct an error correction model and further consider the relationship between the two. In this error correction model, the error correction term represents the residual sequence. The expression of the error correction model is as follows:

ΔlnValue=0.077+0.116ΔlnTrade-0.378(model 2).

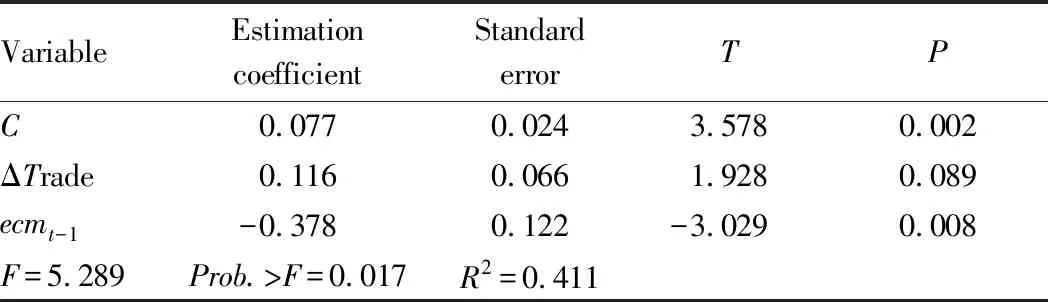

With a confidence level of 10%, we can enter the final results of the error correction model, as shown in Table 4 below. In the significance test results of the model as a whole, thePvalue is less than 0.1, indicating that the overall difference of the model is significant. The estimated value of the coefficient of lnValueis also less than 0.1, which is at a significant level, indicating that the trade volume of agricultural products between China and the United States has short-term elasticity to the change in total agricultural output value of China. In other words, if the trade volume of agricultural products between China and the United States increases by one unit, China’s total agricultural output value will increase by 0.116 units in a relatively short period of time, significantly less than the elasticity of long-term impact (0.552). The estimated coefficient of the error correction termecmt-1is significant at the confidence level of 10%, which directly reflects the adjustment of the total trade volume of agricultural products between China and the United States deviating from the long-term equilibrium. When the absolute value of the estimated value becomes larger, it shows that the speed of restoring the unbalanced state to the equilibrium state is also accelerating. It is worth noting that in the above error correction model, the coefficient of error correction term is -0.378. This value indicates that when there is a short-term fluctuation and it deviates from the long-term equilibrium, the error correction term is corrected in reverse with the strength of 0.378, and the non-equilibrium state is restored to the equilibrium state.

At this point, assuming thatH1is completely valid andH2is not true, there is a positive equilibrium relationship between the trade volume of agricultural products between China and the United States and the total agricultural output value of China.

Table 4 Error correction model

VariableEstimationcoefficientStandarderrorTPC0.0770.0243.5780.002ΔTrade0.1160.0661.9280.089ecmt-1-0.3780.122-3.0290.008F=5.289Prob.>F=0.017R2 =0.411

4 Conclusions and recommendations

4.1 ConclusionsFirst, there is a long-term equilibrium relationship between the total volume of agricultural trade between China and the United States and China’s total agricultural output value. The long-term elasticity of China’s total agricultural output value to the total volume of agricultural trade between China and the United States is 0.552. And whenever the trade volume of agricultural products between China and the United States increases by one unit, China’s total agricultural output value will increase by 0.552 units. Second, from a short-term point of view, the short-term elasticity of China’s total agricultural output value to the total volume of agricultural trade between China and the United States is 0.552. And whenever the trade volume of agricultural products between China and the United States increases by one unit, the total output value of China’s agricultural products will increase by 0.116 units. In addition, when there is a short-term fluctuation and it deviates from the long-term equilibrium, the error correction term is corrected in reverse with the strength of 0.378, and the non-equilibrium state is restored to the equilibrium state. Third, the trade volume of agricultural products between China and the United States has an important impact on China’s agricultural output value, and there is a Granger causality relationship between them. Increasing the trade volume of agricultural products between China and the United States can also help to inject some energy into the growth of China’s total agricultural output value and speed up the development of China’s agriculture.

4.2 RecommendationsFirst of all, we should actively deal with the Sino-US trade war, reduce the negative impact of the trade war on Sino-US agricultural trade, pay close attention to Sino-US agricultural trade, and find out a scientific and fair agricultural product market economy system as soon as possible. In the face of the ever-changing pattern of trade war, China should, while strengthening its diplomatic position, fully convey the mutually beneficial value of agricultural trade between China and the United States, and guide the public of China and the United States to attach great importance to the issue of agricultural trade. We will strengthen communication and cooperation and innovate the trade pattern of agricultural products. Second, it is necessary to give full play to the comparative advantages of agriculture between China and the United States. Due to the differences in development environment, development background and development level, agriculture in China and the United States is complementary and competitive to a certain extent. Therefore, under the background of deepening economic globalization, China and the United States should also actively export agricultural products with comparative advantages and import products with comparative disadvantages. For competitive agricultural products, it is necessary to innovate in an all-round way, introduce the latest agricultural production technology and equipment, and improve the comprehensive quality of agricultural products. Finally, in the face of the complex trade environment, China should also actively improve the technical standard system of agricultural products, do a good job in the "formulation and revision" of the standards, and actively participate in the evaluation and formulation of international standards, so as to keep up with the trend of international agricultural development. At the same time, we should also actively absorb social forces to participate in standardization activities. China should learn from the experience of developed countries and guide industry associations and professional bodies to participate in standardization activities so as to make the formulation of the international standard system more open and transparent. Of course, we should also actively seek and absorb the advices of various associations and enterprises, and constantly optimize the international standard system in practice. In this way, the industry environment of agricultural trade between China and the United States will be more perfect, which will help to promote the steady development of agricultural trade between the two countries, and then promote the progress of China’s agricultural economy.

杂志排行

Asian Agricultural Research的其它文章

- Pilot-scale Study on NCMBR Process for Upgrading of Sewage Treatment Plant in Industrial Park

- Career Planning Education Paths for Students of Aquatic Animal Medicine Discipline in the Context of the Belt and Road Initiative: A Case Study of Construction Achievement of Guangdong Ocean University

- Present Situation and Renovation Strategies of Farmhouses in Yingxi Village, Fuliang County, Jingdezhen

- Delimitation and Zoning of Natural Ecological Spatial Boundary Based on GIS

- Cultivation and Management Technologies for New Banana Cultivar ‘Refen 1’(Musa Spp. ABB, Pisang Awak Subgroup)

- Preliminary Exploration on Design of Green Landscape of Urban Streets: A Case Study of Guangchang East Road in Xihu District of Nanchang City