Guangdong, Macau Team Up on Renminbi Infrastructure Investments

2018-06-19ByChenGuosong

By Chen Guosong

RQFLP proves useful in bringing foreign capital into the domestic market.

C ross-border fundraising using the renminbi has taken a major step forward with the creation of the Guangdong-Macau Cooperative Development Fund - an investment vehicle set up to promote domestic infrastructure development and enhance the role of the nation's currency on the global stage. The fund was set up in June of 2018 with an initial investment of just over 20 billion yuan. It makes use of the Renminbi Qualified Foreign Limited Partnership (RQFLP) program to channel offshore renminbi back into the mainland, a key part of China's effort to internationalize the currency.While there have been similar moves to set up renminbi foreign limited partnerships in Shenzhen and Shanghai this is the most ambitious to date.

In April 2015, the Guangdong provincial government issued its Notice on Implementing the 2015 Key Tasks of the Guangdong-Macau Cooperation Framework Agreement. A major objective was to promote the development of cross-border renminbi business between Guangdong and Macau and boost cooperation in the financial sector.Senior officials of Guangdong and Macau reached an accord on implementing the framework agreement, and they turned to Guangdong Hengjian Investment Holding Co. Ltd, a wholly-owned unit under the Guangdong provincial government investment platform, which teamed up with the Monetary Authority of Macau and the Guangdong Nanyue Group to make use of the RQFLP format to make infrastructure investments.

This led to the creation of the Guangdong-Macau Cooperative Development Fund, which introduced funds from Macau to participate in basic infrastructure projects in Guangdong province, including the construction of a free trade zone, to serve the real economy and help upgrade industry.The innovative formula is also aimed at promoting financial integration and encourage two-way cross-border flows of renminbi.

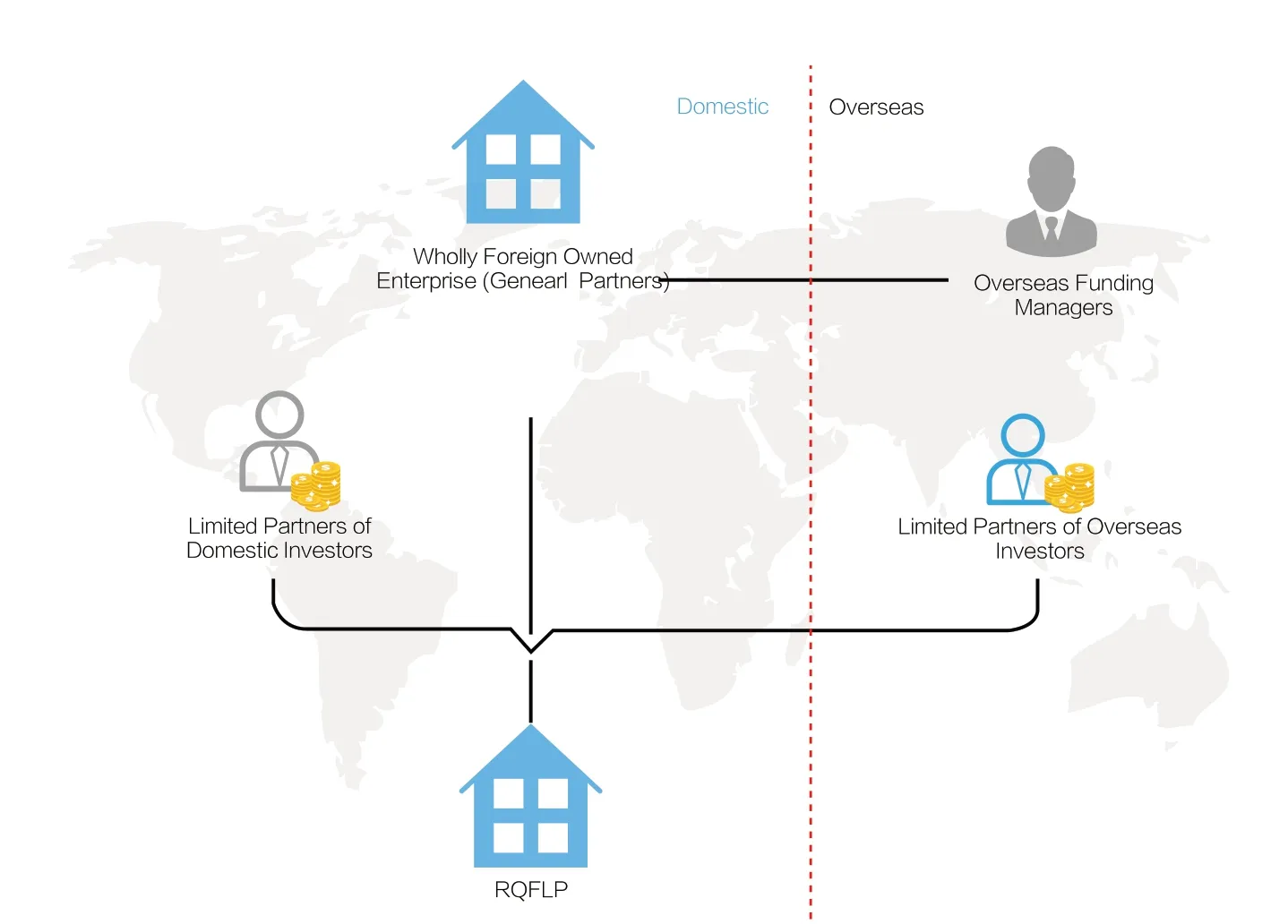

Renminbi funds raised offshore under the RQFLP program will be used directly in various domestic private equity investments. The rules are generally the same as those of the existing Qualified Foreign Limited Partnership program,though the RQFLP formula eliminates the need for pre-approvals of settlement amounts and multiple purchase and payment steps related to foreign exchange use. These include capital reduction, profit distribution and eventual liquidation of the investment fund. RQFLP also reduces the difficulties of valuation accounting, avoiding risks from exchange rate fluctuations, and avoids the impact on the domestic foreign exchange rate from large purchases or sales of foreign exchange. As the RQFLP entity is funded in local currency, it does not require a settlement account to make payments. It enjoys significant advantages in terms of opening bank accounts and transferring funds, though there are still a number of drawbacks to the program, which will be discussed later in this article.

Chart 1: Mode One of RQFLP

Chart 2: Mode Two of RQFLP

Investment Fund Structure

The Guangdong-Macau Cooperative Development Fund does not make use of a wholly owned foreign enterprise as the manager and general partner- a practice often used by offshore fund managers when making foreign currency investments in China. Instead,the general partner is the Guangdong-Macau Cooperation Development Fund Management Co., set up by Guangdong Hengjian Investment Holding Co. Ltd and Guangdong Nanyue Group. The Macau government entrusted ICBC Macau Investment Co. Ltd as an offshore limited partner to set up a foreign-invested limited partnership in the Hengqin Free Trade Zone in Zhuhai City. The amount of the first phase reached 20.01 billion yuan,all of which was funded in cash. The total subscribed capital contribution of the fund is expected to be raised to 100 billion yuan eventually.

The Guangdong-Macau Cooperative Development Fund Management Company, as the initiator of the fund and general partner, invested 10 million yuan. ICBC Macau Investment Co. Ltd.subscribed for 20 billion yuan as the limited partnership fund shares through the RQFLP program. The fund has a 12-year operating period, after which it can be extended or dissolved.

The fund aims to invest in safe,effective, standardized and reliable projects, mainly infrastructure, including the Hengqin Free Trade Zone in Zhuhai.The Guangdong-Macau Fund entrusts a large-scale national commercial bank as the fund's depository agent.A requirement is that the agent has overseas renminbi clearing qualifications and experience recognized by both Guangdong and Macau.

While the framework agreement was reached in 2015 - it took three more years to finalize the fund. This was due to the newness of the structure and the complicated procedures for gaining regulatory approval and putting the funds in place.

Shenzhen already has a comparatively mature QFLP policy so the fund borrowed Shenzhen's existing QFLP practices.Issues to be considered included the qualifications of overseas investors, the organization of the fund, the regulatory approval path, bank account creation and money transfer formalities, fund filings, fund depository arrangement,reinvestment, profit distribution, exit mechanism and taxation issues.

The core issue was obtaining necessary approvals from regulatory authorities. The approval process involved the local arms of the National Development and Reform Commission, the Commerce Commission,the State-owned Assets Supervision and Administration Commission of the State Council, the Securities Regulatory Commission, the Financial Services Offices, the Market and Quality Supervision Commission, tax authorities,the Industry and Commerce authorities,the People's Bank of China and SAFE.From the author's personal experience,the existing approval mechanism lacks an effective leading authority, and this resulted in a long preparatory period for the establishment of the RQFLP entity.In addition, there was a considerable amount of time spent addressing issues such as the need to open a renminbi capital account and numerous of other accounts, as well as the money transfer paths for the fund-raising, the profit distribution and exit mechanism, and capital preservation and appreciation issues among others.

The first phase of the fund has successfully invested in projects in infrastructure such as the free trade zone but also including expressways, airports and rail transport.

Policy Improvements

RQFLP has proved itself to be another useful method for foreign capital to enter the Chinese market - alongside other vehicles such as the Qualified Foreign Limited Partnership and Qualified Foreign Institutional Investor programs.By using renminbi, RQFLP has eliminated the cumbersome approval procedures for the settlement of foreign exchange in the partnership liquidation process,circumvented the risks of exchange rate fluctuations, and reduced the difficulty of accounting for the valuation of the fund due to exchange gains and losses.At the same time it has contributed to the internationalization of the renminbi.

But there is considerable room for improvement in the RQFLP program.It needs a top-level design to clarify regulatory authority and the investment approval process. The current patchwork of regulatory bodies involved needs streamlining in order to promote efficiency and ease concerns of overseas investors about the use of renminbi capital for their investment projects on the mainland.

Greater effort is also needed to take advantage of free trade zones to formulate a special cross-border renminbi policy that applies to such zones under the RQFLP framework. At present, the cross-border settlement of RQFLP funds is largely based on the Management Measures for Foreign Settlement of Renminbi Settlement Business(Document 23 issued by the People's Bank of China in 2011) and related regulations of Notice on Clearing the Operation Rules for Foreign Direct Investment Renminbi Settlement Business (Document 165 issued by People's Bank of China in 2012).

The funds in a special renminbi deposit account are subject to certain limits on usage and investment scope. Although the No. 3 document issued by People's Bank of China in 2018 allowed multiple accounts to be opened in different places, RQFLP funds are still subject to restrictions regarding capital transfer accounts and depository accounts.Additionally, there are limited channels for capital appreciation. Document No. 16 issued by State Administration of Foreign Exchange in 2016 basically relaxed the usage of foreign exchange funds for capital projects but the same treatment needs to be given to local currency used in this kind of program.

Despite the significant advantages in using domestic currency, there is still room for improvement in many areas related to the RQFLP framework. Due to the long investment period, uncertainties abound in the process of fund-raising,investment and investment exit. A critical problem facing the RQFLP program is how to smoothly transfer funds overseas after exiting the domestic capital market.Some investors may need to pre-allocate profits while others may want to make capital reductions. Some investors may want to transfer all or part of their share in the invested companies to other domestic and foreign investors or re-invest in the domestic market. Improvements of the existing mechanisms are needed to meet the diverse requirements of investors in order to enhance the attractiveness of the RQFLP program.

The RQFLP formula has created many opportunities for financial institutions such as banks. It is one of a number of pilot projects in the reform of the domestic capital market. More breakthroughs are likely in the future and financial institutions need to strengthen their policy and product research and development to take advantage of market opportunities. This will help them find new business directions and areas of growth in the increasingly competitive market environment in China.

The author is from Industrial Bank Co., Ltd, Guangzhou branch