咨询

2015-08-07

咨询

综合Comprehensive

中国银行荣膺第12届东博会首席战略合作伙伴

8月17日,第12届中国—东盟博览会首席战略合作伙伴揭牌仪式在中国北京举行,中国银行股份有限公司(以下简称“中国银行”)成为第12届东博会首席战略合作伙伴。

自2004年首届东博会起,中国银行就成为东博会唯一主办银行。目前,中国银行已在东盟10国中的7国设立了分支机构。实力雄厚加上多元化的业务运营优势以及在东盟国家的深厚基础,使得中国银行成为东博会的首席战略合作伙伴。

投资Investment

菲律宾明年将大幅增加基础设施建设支出

菲律宾预算部日前公布了向国会提交的2016年政府预算草案,总额达3万亿比索,其中用于公共基础设施建设支出的预算资金达到7665亿比索,与2014年相比猛增35%,与2010年相比则猛增4倍。

据透露,在菲政府2016年预算中,将划出至少3000亿比索用于修建公路以及连接机场、海港和旅游景点的公路、铁路、港口、机场等设施。中国相关企业可借机赴菲投资。

印尼设8个经济特区并将予投资优惠

据印尼投资统筹机构消息,日前印尼政府开设了8个经济特区并将予经济特区投资优惠。这8个经济特区包括苏北省塞芒吉经济特区、南苏门答腊省丹绒阿比阿比经济特区、万丹省丹绒勒松经济特区、西努省曼达利卡经济特区、东加里曼丹省马雷经济特区、中苏拉威西省巴鲁经济特区、北苏拉威西省比通经济特区和北马鲁古摩罗泰经济特区。

印尼投资统筹机构主任弗朗基称,从2015年开始,政府鼓励投资者投入经济特区并将给以投资优惠,其中包括免税期、免税额、免除进口税、免除增值税和印花税等。

旅游Tourism

泰国将推出半年多次免签签证

为了扩大旅游市场,日前泰国政府表示将在2015年10月初推出6个月有效的多次入出境签证。

泰国旅游官员指出,2014年泰国出口表现不够理想,为稳固旅游收益,泰国政府决定推出6个月有效多次入出境签证,让外国旅客在泰国停留更长时间消费。这项多次入出境签证的措施,预计在10月初实施,收费5000泰铢,目前实施的单次签证收费 1000 泰铢,停留 1 个月。

46家企业成为第12届中国—东盟博览会合作伙伴

9月2日,2015中国—东盟博览会合作伙伴新闻发布会在南宁举行。46家企业成为第12届东博会合作伙伴。东博会秘书处秘书长王雷、副秘书长黄平西出席新闻发布会并向合作伙伴企业颁发荣誉牌匾。

其中,中国国旅(广西)公司是东博会连续12年的合作伙伴,孔家钧窑、综路传媒是东博会连续10年的合作伙伴。新增来自本届东博会主题国泰国等一批涵盖食品、保健、汽车、酒店、家具等领域的国内外企业,为东博会合作伙伴大家庭注入了新的活力。

8月份缅甸再批准11个投资项目

据缅甸国家投资委员会(MIC)消息,8月份委员会再批准了11个投资项目。其中,外商独资7个,内资和合资各2个。从类别看,11个项目包括5个制衣厂项目、2个木材加工项目、1个塑料生产项目、1个玻璃和铝合金家具生产项目、1个数据中心服务项目和1个矿业开采项目,以上项目均获得投资所在地省邦政府和相关行业部门支持。

农业及食品Agriculture & Food

马来西亚燕窝有望登上中国网购市场

燕窝作为马来西亚优势传统产业,年产量约200吨,产值10多亿美元,其中70%出口到中国大陆和港澳台地区。

为满足中国消费者对马来西亚燕窝的需求,阿里巴巴集团天猫网邀请马来西亚燕窝商在其网站售卖获得中国国家质检总局认证的燕窝。天猫是中国线上购物的地标网站,提供100%品质保证的商品,7天无理由退货等优质服务。

阿里巴巴集团网站注册费为每年5000林吉特,为促进马来西亚燕窝出口中国,马来西亚外贸发展局(MATRADE)表示将在第一年补贴注册企业2500林吉特。

1 China intensif es crackdown on insider trading

Aug. 8, 2015 (Xinhua) -- The China Securities Regulatory Commission (CSRC) said that punishment on insider trading will become harsher in order to "purify" the capital market environment. The CSRC said in a statement that it will make more ef orts to clamp down on the leaking and prying of non-public information involved in securities trading. The commission has busted 20 cases of insider trading this year and penalized one institution and 31 individuals.

2 Corporate tax cuts to ease burden for small enterprises

Aug. 13, 2015 (China Daily) -- A series of new corporate tax cuts are expected to reduce the tax burden on small businesses by more than 100 billion yuan ($15.64 billion), the Ministry of Finance said. An executive meeting of the State Council decided to increase the number of businesses eligible for a 50 percent reduction in their corporate tax. The policy, ef ective through the end of 2017, will extend f rms that are eligible for a 10 percent tax rate to those with an annual taxable income below 300,000 yuan from 200,000 yuan. Those above the 300,000 yuan thresholds are levied a 25 percent rate. In addition, the State Council also extended the exemption of value-added tax and business tax for small businesses with less than 30,000 yuan in monthly sales. That exemption was set to expire at the end of this year.

3 China's property taxes coming soon

Aug. 6, 2015 (Xinhua) -- The Standing Committee of the National People's Congress (NPC), China's top legislature, has included Property Tax Law in a legislation plan released recently. "Conditions to enact these laws are ripe, and the 12th NPC plans to review them within its tenure which ends in early 2018," said the Standing Committee website. "According to the NPC plan, the property taxes law will probably be passed by the end of 2017," said Shi Zhengwen, a professor of f scal and f nancial law with the China University of Political Science and Law. There is no of cial timetable for the implementation of property taxes but the market widely expected 2020 to be the time.

4 NDRC plans steps to bolster bond market

Aug. 6, 2015 (China Daily) -- The National Development and Reform Commission, the nation's top economic planner, said that it will come out with more initiatives to develop the debt market, particularly to boost funding for infrastructure projects and stabilize the overall economy. The NDRC will soon permit two policy banks to fund big ticket infrastructure projects through bond issues, but it was yet to finalize the details, said sources close to the issue. The bonds will be issued by the China Development Bank Corp and the Agricultural Development Bank of China and the debt will be purchased by the Postal Savings Bank of China. The central government is likely to subsidize 90 percent of the interest on the securities, they said.

5 China to build unif ed resource trading platform by 2017

Aug. 1, 2015 (Xinhua) -- China aims to integrate public resource platforms and foster a unified system by the end of June 2017, the State Council announced. By the end of June 2016, local governments will be required to complete the integration of platforms such as those for construction project bidding, trading of land use rights and government procurement, with an aim to form a regulated, unified and transparent national system a year later, according to a statement released after a State Council executive meeting presided over by Premier Li Keqiang.

6 Antitrust rules for auto sector soon

Aug. 13, 2015 (China Daily) -- China's anti-monopoly regulator has started the drafting of antitrust guidelines for the automobile industry, which are likely to involve issues emerging from online sales and parallel car imports. A f rst draft is expected for public consultation by the end of the year with a final version to be published by the anti-monopoly commission under the State Council "in due course", sources close to the process told China Daily. The National Development and Reform Commission sent out its first round of questionnaires which form the basis for the guidelines in early July, to automakers, suppliers, dealers, service providers and trade associations.

7 China improves exchange rate formation system

Aug. 13, 2015 (China Daily) -- China's currency fell sharply in value following the central bank's decision to improve its "central parity system" to better reflect market development in the exchange rate between the Chinese yuan against the US dollar. Daily central parity quotes reported to the China Foreign Exchange Trade System before the market opens should be based on the closing rate of the inter-bank foreign exchange rate market on the previous day, supply and demand in the market, and price movement of major currencies, the People's Bank of China (PBOC) said. The PBOC cited a strong US dollar and sharp appreciation in the yuan real ef ective exchange rate as key considerations behind the policy change.

8 China to resume levying VAT on fertiliser

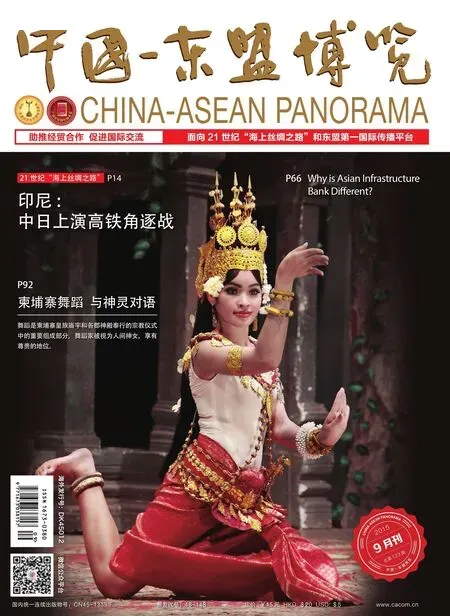

Aug. 11, 2015 (Xinhua) -- China will resume levying value-added tax on fertilizer sales and imports to meet new market conditions, according to a joint ministry statement. The VAT taxation rate stands at 13 percent and the new rule will take place starting from September 1, according to the statement released by the Ministry of Finance, Central Administration of Customs and State Administration of Taxation. Agricultural production and farmers' income will not be affected by the policy change as China has set up a real-time agricultural supply subsidy to keep related prices stable, the statement said.