Competitiveness of China's Agricultural Product Export to the U-nited States of America

2014-04-10AipingYAOLipingWAN

Aiping YAO,Liping WAN,2*

1.College of Economics and Management,Southwest University,Chongqing 400715,China;2.College of Medicine Information,Chongqing Medical University,Chongqing 400016,China

1 Introduction

Since China’s accession to the WTO,Sino-US bilateral trade has been growing substantially,rising from 80.48 billion USD in 2001 to 484.7 billion USD in 2012 having annual growth rate up to17.55%.At the same time,the favorable trade balance of China to USA also grows considerably,rising from 28.08 billion USD in 2001 to 218.9 billion USD in 2012,having annual growth rate up to 19.81%.However,Sino-US agricultural product trade volume is small.In 2012,the trade volume of agricultural product was 30.708 billion USD and accounted for a small portion of Sino-US trade.In 2001,the proportion was4.35%.In 2004,it dropped to2.44%.Later,it took on slow rising trend.In 2012,it reached 6.34%.It should be noted that except2004,China’s agricultural product trade with USA was always adverse trade balance and gradually deteriorated(as shown in Fig.1).On the one hand,the development speed of Sino-US agricultural product trade lags behind other fields of industrial products,and agricultural product trade does not obtain its due position and the development potential is huge.On the other hand,Sino-US agricultural product trade is extremely unbalanced.As a large agricultural country,China must energetically develop agricultural product export to the USA.We believe that constantly raising the competitiveness of China’s agricultural product export to the USA is the key to solve these problems.

Fig.1 Balance of Sino-US agricultural product trade in 2001-2012

By now,researches about competitiveness of agricultural product exporthavemade outstanding achievements,such as Bowen and Pelzman(1984)[1],Traill&da Silva(1996)[2],Thorne(2005)[3],Qu Xiaobo et al(2007)[4],Maria Crescimanno,Antonino Galati(2012)[5],etc.Nevertheless,most researches adopt World Market Share(WMS),Revealed Comparative Advantage Index(RCA),Trade Competitiveness Index(TC),and Grubel-Lloyd(G-L)index(i.e.Index of Intra-industry Trade).In this study,with reference of existing documents,we took major agricultural product importers at the American market as reference objects,studied the competitiveness of China’s agricultural product export to the USA by the market share,growth rate,and the Exports Similarity Index,as well as the shift share method,to make clear competitiveness situation of China’s agricultural products at American market,provide practical basis and decision making reference for Chinese government and agricultural product export enterprises,so as to further explore American market and promote China’s agricultural product export to the USA.

2 Research area and data source

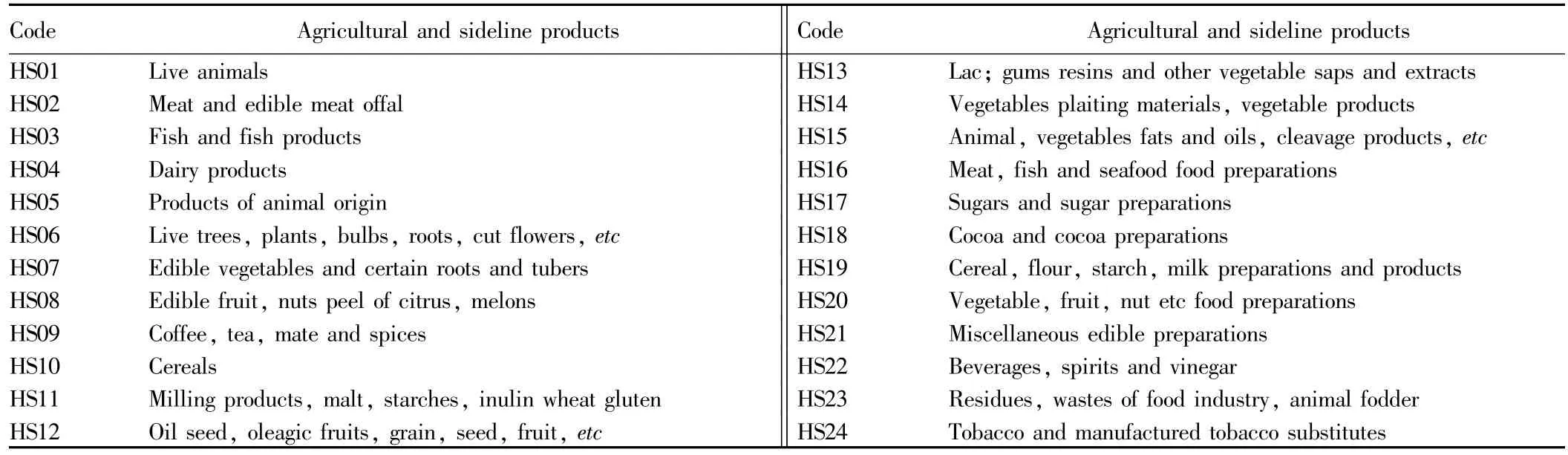

2.1 Scope of agricultural products and definition of comparison objectsIn this study,we adopted the Harmonized Com-modity Description and Coding System(HS classification method).HS is the commodity classification catalogue widely used in the world.Agricultural products refer to all agricultural products listed in chapter 01-24 in HS catalogue(Table 1).

Table 1 Agricultural and sideline products listed in HS coding system

This study belongs to scope of international competitiveness researches,while the international competitiveness researches are inseparable from international comparison.We selected major importers at American agricultural product market to make comparative analysis.Agricultural product importers of the USA include Canada,the EU,Mexico,India,Brazil,Thailand,Australia,and Indonesia.Since there are many developing countries,we selected New Zealand but did not select Chile.In 2012,agricultural products of China and these 9 countries(regions)accounted for 70%of agricultural product import of the USA.Thus,the study on competitiveness of China’s and these countries’agricultural product export to the USA can reflect the competitive structure and form of China’s agricultural products at American market.

2.2 Study methods

2.2.1 The Exports Similarity Index.Since there is difference in structure of exported products of all countries,the comparison results of market share and growth rate can not fully reflect competition degree of countries.We used the Exports Similarity Index(ESI)to evaluate the competitiveness of China’s agricultural products at American market.The calculation formula is as follows:

2.2.2 Shift Share Analysis(SSA).The Shift Share Analysis method is a method for measuring export competitiveness(Herschede F,1991[6],Voon JP 1998/2003[7-8],Wilson P,2005[9],and Du Liet al.2011[10]).A shift-share analysis,used in regional science,political economy,and urban studies,determines what portions of regional economic growth or decline can be attributed to national,economic industry,and regional factors.The analysis helps identify industries where a regional economy has competitive advantages over the larger economy.A traditional shift-share analysis splits regional changes into just three components,but other models have evolved that expand the decomposition into additional components.In this study,we took description of Du Liet al.(2011)about Shift Share Analysis as reference.Namely,we took several countries to be compared with each other as the control group to study export situation of each country relative to the control group.A single country in the control group is called a competitor.Net Shift(NS)reflects the export competitiveness of a country.When NS>0,the country has advantage in export competition;when NS<0,the country stays in inferior position in export competition.Actual Change(AC)in export represents actual change in export volume.SE)refers to Share Effect.The calculation formula is as follows:

andare export volume of the productlof countryiat the early period and periodt;is the total export volume of the countryiat the early period;refers to the export volume of productlin the control group to total export volume at the early period;Glris the growth rate of export of productlin the control group at[0,t]period.

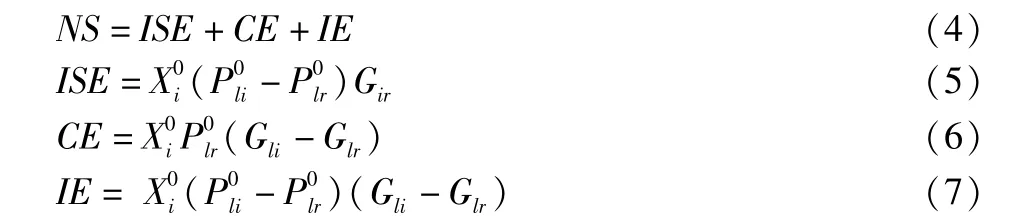

The Net Shift is result of 3 effects:Industry Structure Effect(ISE),Competitive Effect(CE)and Interactive Effect(IE).The calculation formula is as follows:

whererefers to the export volume of productlin the control group to total export volume at the early period;refers to the export volume of productlof the countryito total export volume at the early period;Gliis the growth rate of export of productlof the countryiat[0,t]period.

2.3 Data sourceFollowing data in this study were selected from UN Commodity Trade Statistics Database(UN Comtrade)using HS1996 commodity classification method.The selected data are mainly China’and major competitors’agricultural product export to the USA.We used the data to make comparison and analysis of competitiveness of China’s agricultural product export to the American market.

3 Calculation results and analyses

3.1 Comparative analysis of competitiveness of China's agricultural product export to the USAFrom Table2 and Table 3,it is known that:

(i)The market share of China’s agricultural products at the American market remains in the fourth or fifth position.In 2012,market share of China’s agricultural products at the American market was 5.57%,greatly lower than Canada(18.65%),the EU(13.53%)and Mexico(12.74%),but higher than Brazil(3.66%),Thailand(2.88%),Australia(1.86%),Indonesia(1.70%)and New Zealand(1.58%),similar to India(5.76%).

(ii)The market share of China’s agricultural products at the American market keeps steady rising.In 2001,the market share of China’s agricultural products at the American market was 2.19%.In 2012,it rose to 5.57% (except 2004 and 2010).The market share of Canada,the EU,and Australia takes on declining trend,while that of New Zealand,Mexico,India,Indonesia,Thailand,and Brazil has fluctuation.It should be noted that the market share of India takes on declining trend in 2001-2010,but it rapidly rose in 2011 and 2012.

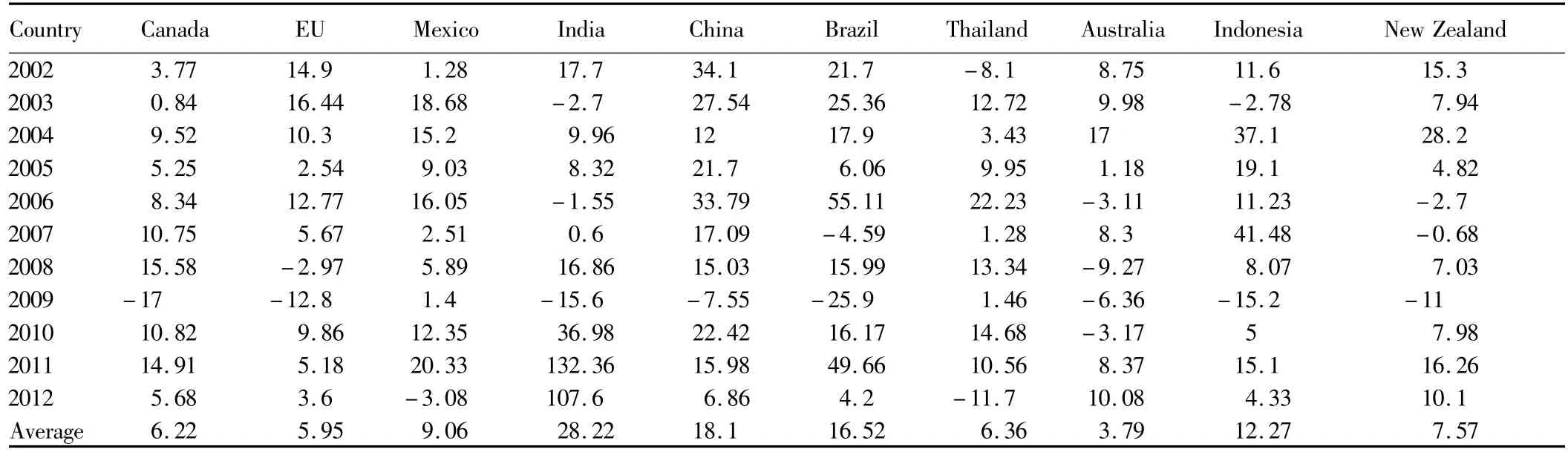

(iii)As for the growth rate,except India,China has the highest growth rate,followed by Brazil and Indonesia.From comparison,we can know that rapid growth countries are mainly developing countries,indicating that competitors of China at the American market are mainly developing countries.

Table 1 Market share(%)of China's and major competitors' agricultural products at the American market in 2001-2012

Table 3 Grow th rate(%)of agricultural product export of China and major competitors in the USA in 2002-2012

3.2 Comparative analysis of competition degree of China's agricultural product export to the USAUsing the above Exports Similarity Index calculation formula,we calculated ESI of China and competitors and plotted the Fig.2 according to calculation results.

From Fig.2,we can know that:

(i)The Exports Similarity Index of China and major competitors to the USA is relatively high.From the average value of ESI in 2001-2012,the highest Exports Similarity Index is Thailand(65.94),Indonesia(50.61),India(43.27)and Brazil(42.01).This means that China has similar exported product structure and intense competition with these countries(regions).

Fig.2 The Exports Similarity Index of China and major competitors to the USA in 2001-2012

(ii)The similarity is low between China and developed countries in products exported to the USA.Canada is the developed country with the highest export similarity with China.In 2001-2012,the average ESI of Canada and China was 44.91,while the average ESI between China and the EU,Australia,and New Zealand was 25.31,12.95,and 22.26 respectively.

(iii)Except the Exports Similarity Index of China and India gradually declining,the ESI of China and other countries has no significant decline.This reflects that there will be no great change in the competition trend of China with these countries at the agricultural product import market of the USA.

3.3 Comparison and analysis of competitiveness of China's agricultural product export to the USAThrough calculation by the above stated Shift Share method,we obtained following results:

Table 4 Analysis results of agricultural product shift share of China and major competitors in 2001-2012(unit:10 8 USD)

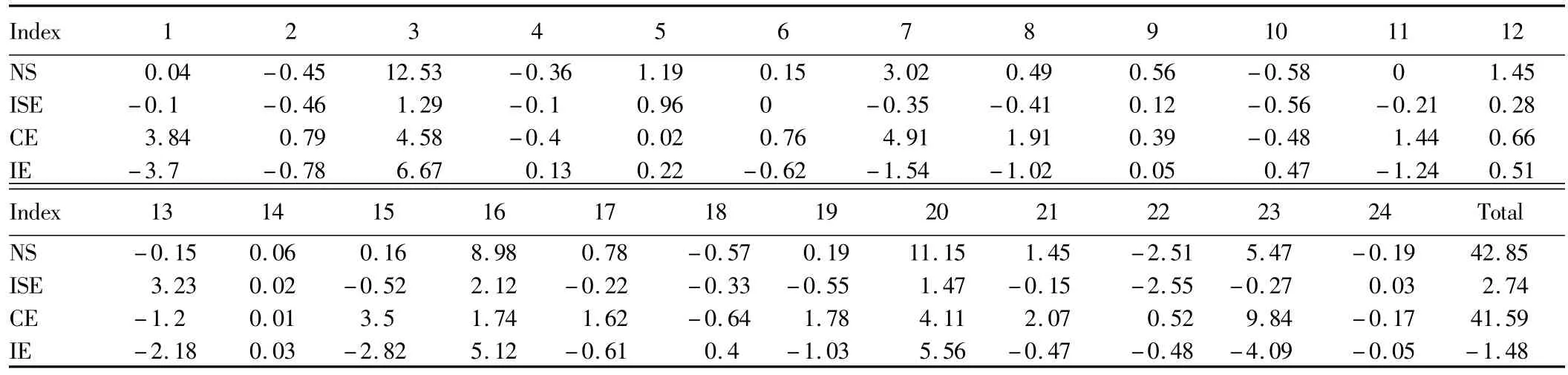

Table 5 Analysis results of shift share of China's various agricultural products in 2001-2012(unit:108 USD)

From Table 4 and Table 5,we can know that:

(i)From total NSof agricultural products,the overall export competitiveness of developing countries is higher than developed countries.In the developing countries,except Thailand having negative NS,all other countries have positive NS,indicating that these countries are competitive in their agricultural products exported to the USA.China ranks the second place following India,showing that China has high competitiveness in agricultural products exported to the USA.Developing countries have negative NS,reflecting they are inferior in exporting agricultural products to the USA.

(ii)From specific product types,chapters(01),(03),(05),(06),(07),(08),(09),(12),(14),(15),(16),(17),(19),(20),(21),and(23)of China’s agricultural products have positive NS,indicating these products are competitive at American market,especially chapters(03),(20),(16)and(23).Chapters(22),(10),(18)and(02)products are not competitive.

(iii)As Net Shift effect,China’s industrial structure effect and competition effect are positive,but the interaction effect is negative.In the control group,China’s industrial structure effect ranks the third place,only second to the EU and Brazil,indicating that China has industrial structure advantage in exporting agricultural products to the USA.The export competitiveness of China’s agricultural products is benefited from faster development of China’s agricultural product export than major competitors.Specific to product types,China’s export structure advantages mainly come from chapters(13),(16),(20)and(03)products.

(iv)From the competition effect,Brazilian agricultural products have competition advantage of 59.002 billion USD,which is difficult to match for China and other competitions.China ranks the fourth place.Although it is positive(41.59)and has competition advantage,the advantage is not significant.China’s competition advantages mainly come from chapters(23),(07),(03)and(20)products.

(v)As for interaction effect of exported product structure and growth rate of export,China’s interaction effect is negative,but the overall value is small,reflecting that China fails to fully use benign interaction between structural advantages and competition advantages.Chapters(03),(16)and(20)products have higher positive value,indicating excellent interaction effect and thus it is required to keep the situation.Chapters(23),(01),(15)and(13)products have higher negative value,so China should make further specialization in production of higher competitive products,such as chapter(23),(15)and(01)products.Alternately,in existing structural advantage,China should further cultivate competitive products,for example,chapter(13)products,or reduce production of uncompetitive products,such as chapter(4),(10)and(18)products.

4 Conclusions and recommendations

4.1 Conclusions(i)Since China’accession to the WTO,the growth of China’agricultural products exporting to the USA is rapid and the market share keeps rising.China is also expanding the export of agricultural products to the USA,but the overall export volume is still small,only 5%of the American market,far behind Canada,the EU and Mexico.

(ii)China has similar with developing countries in exporting agricultural product to the USA.Therefore,at the American agricultural product market,China has intense competition with developing countries,such as Thailand,Indonesia,India,and Brazil.

(iii)China has overall competitiveness in exporting agricultural products to the USA.In the ten importers of the USA,China ranks the second place following India.Specifically,China has significant competition advantage in chapters(03),(20),(16)and(23)products.But the competition is inferior in chapters(22),(10),(18)and(02)products.

(iv)China has structural advantage and competition advantage in export of agricultural products to the USA,but the interaction effect is negative.The structural advantages mainly come from chapters(13),(16),(20)and(03)products,while the competition advantages mainly come from chapters(23),(07),(03)and(20)products.The interaction positive effect mainly comes from chapters(03),(16),and(20)products,while the interaction negative effect mainly comes from chapters(23),(01),(15)and(13)products.

4.2 Recommendations(i)China should strengthen the support for export trade of agricultural products,to promote development of agricultural products exporting to the USA.Agriculture is the industry with the weakest self-support.Developing countries(such as India and Thailand)and developed countries(the USA and France)provide great support for production and export of agricultural products.Therefore,China should formulate new agricultural support policies within the framework of WTO rules,to support and develop export trade of agricultural products,raise international competitiveness of agricultural product export,so as to boost export trade of China’s agricultural products to the USA.

(ii)It is recommended to implement differentiated agricultural product strategy and launch"dislocated competition".China has similar with developing countries in exporting agricultural product to the USA.Therefore,at the American agricultural product market,China has intense competition with developing countries,such as Thailand,India,and Indonesia.Therefore,to avoid defeat of both parties,China should implement differentiated agricultural product strategy and launch"dislocated competition".

(iii)China should optimize the structure of agricultural products exporting to the USA and speed up export of advantageous agricultural products to the USA.It is recommended to optimize the structure of agricultural products exporting to the USA with the aid of advantages of diversity of China’s agricultural products and low labor cost.China has competition advantage in aquatic products,vegetable,fruit,and nuts.Therefore,China should accelerate export growth of these agricultural products,to promote transformation of overall growth of agricultural products to competitive products.

(iv)China should fully grasp demands of American agricultural product market and cultivate competitiveness of major agricultural products.Through fully knowing demands of American agricultural product market,it is feasible to work out agricultural product development and marketing plan,to promote development of agricultural products exporting to the USA.For example,green and organic agricultural products are being favored by American consumers,China can support and encourage production of green and organic agricultural products and cultivate competitive advantage of green and organic agricultural products.

[1]Bowen H,Pelzman J.USExport Competitiveness1962-1977[J].Applied Economics.1984(16):461-475.

[2]Trail B,da Silva JG.Measuring international competitiveness:The case of the European food industry[J].International Business Review,1996,5(2):151-166.

[3]FSThorne.Analysis of the competitiveness of cereal production in selected EU countries[R].The Paper Prepared For Presentation,2005(8):24-27.

[4]QU XB,HUO XX.The analysis of agro-products’export structure and competitive capacity in China[J].Journal of International Trade,2007(3):9-15.(in Chinese).

[5]Maria Crescimanno,Antonio Galati.The Atlantic Bluff in tuna structure and competitiveness of Italian fishing in the international trade[J].Mediterranean Journal of Economics,Agriculture and Environment,2012(1):58-64.

[6]Herschede F,Trade between China and ASEAN:The impact of the Pacific Rim Era,Pacific Affairs[J].1991(64):179-195.

[7]VOON JP.Export competitiveness of China and ASEAN in the U.S.market[J].ASEAN Economic Bulletin,1998,14(3):1-55.

[8]VOON JP,YUE REN.China-ASEAN export rivalry in the US market[J].Journal of the Asia Pacific Economy,2003,8(2):157-179.

[9]WILSON P,CHERN T S,PING T S,et al.Assessing Singapore’s export competitiveness through dynamic shift share analysis[J].ASEAN Economic Bulletin,2005,22(2):160-186.

[10]DU L,XIEH.Analysis of competition between China and Mexico on high technology products in the US market based on ESI and SSA[J].China Soft Science,2011(10):46-53.(in Chinese).

杂志排行

Asian Agricultural Research的其它文章

- Evaluation of Grow th of Agricultural Listed Companies Based on AHP Weighting Method

- Studies on the Development of Walnut Industry in Shangluo City Based on SWOT

- Land Use Conflict Changes and Driving Forces of Beibu Gulf Economic Zone

- Research on the Grain Producers around the Year of Chinese Population Peak

- The Curriculum System Development of Sightseeing Agriculture Major Based on Work Flow

- Analysis of Social Capital's Effect on Income of Poor Households:A Case Study in Sichuan Province