Board af liation and pay gap

2014-02-22ShenglnChenHuiMDnluBu

Shengln Chen,HuiM ,Dnlu Bu

aDepartment of Accounting,School of Econom ics and M anagement,Inner M ongolia University,China

bDepartment of Accounting,Southwestern University of Finance and Econom ics,China

Board af liation and pay gap

Shenglan Chena,*,HuiM aa,Danlu Bub

aDepartment of Accounting,School of Econom ics and M anagement,Inner M ongolia University,China

bDepartment of Accounting,Southwestern University of Finance and Econom ics,China

A R T IC L E I N F O

Article history:

Received 25 April 2013

Accep ted 8 M arch 2014

Availab le online 26 Ap ril 2014

JEL classif cation:

G 34

J33

M 12

Board af liation

This paper exam ines the ef ects of board af liation on the corporate pay gap. Using a sam p le o f Chinese listed f rm s from 2005 to 2011,w e fnd that boards with a greater p resence of directors appointed by block shareho lders have lower pay gaps.Furthermore,the governance ef ects of board af liation w ith and without pay are distinguished.The em pirical resu lts show that board af liation w ithout pay is negatively related to the pay gap,while board af liation w ith pay ispositively related to the pay gap.Overall,the resu ltsshed light on how b lock shareholders af ect their com panies’pay gaps th rough board af liation.

©2014 Production and hosting by Elsevier B.V.on behalf o f China Journalo f Accounting Research.Founded by Sun Yat-sen University and City University o f Hong Kong.

1.Introduction

Com pensation packages are an im portant part o f a m odern com pany’s incen tive system.M ost relevan t research has focused on exam ining the level o f execu tive pay and the diferen t com ponen ts of execu tive compensation,while ignoring fu rther discussion about a com pany’s pay gap.O riginally,the pay-gap phenom enon could be chiefy exp lained by tournament theory.That is,an app rop riate pay gap increases employee m otivation and productivity.However,in recent years,company pay gapshave continuously w idened,which appears to be due to company executivesmanipu lating the formulation processo f compensation to increasetheir salaries beyond the optim al level(Bebchuk and Fried,2003).A ccord ing to the executive-power theo ry, executivem isuse of their power to obtain excessive pay hasa seriesof negative econom ic consequences,such as the failure of salary–incentivemechanisms and a decline in overall company performance(Bebchuk et al., 2011).

W ithin the ongoing development of the Chinese economy,the compensation received by executives in Chinese companies is increasing rapidly and company pay gaps arew idening.For examp le,the 2010 annual report of China International M arine Containers(G roup)Ltd.(stock code 000039)indicates that the company’s largest compensation package o f that year was 6.0 m illion RM B yuan,while its average annual employeewagewas only 65,800 yuan.In 2011,the highest executive compensation reached 9.6m illion yuan, while the average annual em p loyee wage was on ly 78,600 yuan.The com pany’s pay gap thus increased between 2010 and 2011,from a highest 90 tim es o f the average em p loyee pay,to a highest 121 tim es of the average em p loyee pay.W hen considering the possib le negative efect o f the pay gap,it is necessary to determ inewhether the company’s governancemechanisms are ab le to efectively reduce its pay gap and ease the agency p rob lem during the p rocesso f formu lating compensation packages.

In China’s specif c institutional setting,block shareholders are entitled to appoint personnel to listed companies as directors.This is one o f themajor ways for b lock shareho lders to supervise com pany executives. Once the block shareho ldersof a company have realized that an agency p rob lem isafecting the salary-setting process,they appoint certain personnel as company directors responsib le for supervising executives’opportunistic behavior.However,the governance efect of board af liationmay dif er substantially due to dif erences in receiving compensation.Currently,the directorsappointed by block shareho ldersmay either receive or not receive pay from the listed com panies fo rwhich they wo rk.Salaried d irecto rsappoin ted by b lock shareho lders are m ore relian t than their non-salaried coun terparts on the execu tives o f the listed com pany,which m ay reduce director independence and thus impair the ef ciency o f their executive supervision.In contrast,nonsalaried directorsappointed by theb lock shareholdersaremore independent,better able to rep resent the interests o f b lock shareho lders to supervise executives,and ultim ately achieve a better supervision efect.As a result,only non-salaried directors appointed by block shareho lders can help signif cantly to ease the agency prob lem and reduce a company’s pay gap.

Using a samp le of Chinese A-share listed f rms from the 2005–2011 period,we exam ine the ef ects of the company-governancemechanism of board af liation on the pay gap.Follow ing other studies on this topic, we interpret the pay gap between executives and emp loyees,and the pay gap among executives as proxies fo r the pay gap(Bu and Peng,2010;Banker et al.,2011;K ato and Long,2011).W em easu re board af liation using the ratio o f the num ber of directors appoin ted by block shareholders to the to talnum ber o f directo rson the board(Yeh and W oidtke,2005;Chen et al.,2013).W e also exam ine the d if erent ro lesof salaried and nonsalaried directors appointed by b lock shareho lders.Wemeasure the proportion o f salaried directors as the ratio of the number of salaried directors appointed by block shareho lders to the total number of directors on theboard.Wemeasure the p roportion o f non-salaried directorsas the ratio of thenumber of non-salaried directors appointed by b lock shareholders to the total number o f directors on the board.

Consistent w ith our prediction,we fnd that board af liation is negatively related to the pay gap. Furtherm ore,the results show that a greater p resence of salaried directors appointed by b lock shareho lders is associated w ith a higher pay gap,whereasa greater presence of non-salaried directors appointed by block shareholders is associated w ith a lower pay gap.These fndings still ho ld when tested w ith a two-stage regression m odel,so endogeneity issues are less likely to bias ou r em pirical fndings.

Next,we investigate certain factors thatm ay afect the relationship between board af liation and the pay gap.W e begin by exam ining whether d iferences in p roductm arket com petition af ect how board af liation reduces the pay gap.If a f rm uses its pay gap as an incentivemechanism and the productmarket is high ly competitive,the salaried directors appointed by the f rm’s block shareholders w ill increase the pay gap to stimu late executives to work hard.However,under the same conditions,non-salaried directors appointed by block shareholdersw ill decrease rather than increase the pay gap.We fnd that the governance ef ect o f board af liation on the pay gap is particu larly prom inent in industries in more competitive productmarkets.

Second,we investigatewhether dif erences in ownership af ect the extent that board af liation reduces the pay gap.The results indicate no signif cant dif erences in the efects of salaried and non-salaried directors appointed by block shareholders on the pay gap between state-owned and non-state-owned enterp rises.Thisim p lies that pay-gap issues resulting from the agency p rob lem receive considerable atten tion from block shareholders in both state-owned f rms and non-state-owned f rms.

Third,ascontrolling and non-controlling shareho ldersmay havedif erentmotivations for appointing directors,we separately exam ine the ef ectson the pay gap of directorsappointed by controlling shareholders and those appointed by non-contro lling shareholders.W e f nd no signif cant dif erence in the governance function o f board af liation between contro lling shareholders and non-contro lling shareholders.

Finally,we determ ine whether diferent adm inistrative duties afect the extent to which board af liation reduces thepay gap.W edistinguish between theadm inistrativedutieso f thehighest-paid executivesand investigate the relationship between board af liation and the pay gap in each case.The results suggest that dif erences in adm inistrative duties do no t afect the governance function o f board af liation.

This paper contribu tes to the literatures in the follow ing ways.First,it o fers supportive evidence on company pay gaps.For exam p le,Bebchuk et al.(2011)f nd that execu tive pay gaps are associated w ith lower f rm value and lower future cash f ows.Our resultssuggest that the presenceo f non-salaried directorsappointed by b lock shareho lders decreases thepay gap.Second,our study provides imp lications for research on board af liation.For a sample of Japanese companies,Colpan and Yoshikawa(2012)investigate the governance ef ect o f directorsappointed by block shareho lderson theagency p rob lem.Our paper adds to the literatureby using a samp le o f Chinese listed f rms and explores the dif erent ro les o f salaried and non-salaried directors appointed by block shareho lders.

The rest o f the paper p roceeds as follows.In Section 2,we review the relevant literature.In Section 3,we develop hypothesesbased on an analysisof the institutionalbackground.In Section 4,wedescribeour sample, variab lesand research design.In Section 5,we p resent our em p irical resu lts and analysis.Section 6 concludes the paper.

2.Literature review

Recently,the rapid grow th in executive compensation has caused company pay gaps to bigger.Bebchuk and G rinstein(2005)exam ine the changes in executive compensation in U.S.listed companies from 1993 to 2003,and fnd that the grow th in execu tive com pensation during this period wasm uch higher than com pany grow th in term s of size and perform ance,w ith the grow th in CEO com pensation exceed ing the to talgrow th in the com pensation of executivesat thesecond,third,fourth and f fth levels.Specif cally,thep roportion of CEO compensation in the total compensation received by top-f ve executives increased from 39%in 1993 to 43%in 2003.Li(2011)exam ines 1993–2006 data on executive compensation in U.S.capital-market listed companies and fnds that the diference between CEO compensation and No.2 executive compensation increased from 40%in 1993 to 60%in 2006.Using a sample of Canadian listed companies during 2000–2005,Sapp(2008) reports thatw ithin thissix-year period,thepay gap between CEOsand other executivesdoubled.Investigating Chinese listed companies in 1999 to 2000,Lin etal.(2003)report that the compensation received by CEOswas 1.43 times greater than the compensation provided to other executives.The pay gap has also expanded after 2001,w ith CEO com pensation 2.328 tim es that o f other execu tives’com pensation in 2009.

In add ition to the w idening pay gap am ong executives,the pay gap between execu tives and em p loyees is also expanding.Hall and M urph(2003),using S&P500 f rm s as their sam p le,repo rt that executive com pensation increased from 30 times that of other emp loyees in 1970 to 1990 times in 2002.Studieson Chinese listed companies describe a sim ilar phenomenon.The proportion of companieswith thepay gap w ithin f ve times is declining,while the com paniesw ith the pay gapmore than eight times increased from 10%to 24.53%(Zhang, 2008).In a recent study,Liu and Sun(2010)fnd that theabso lute pay gap between executivesand em ployees in state-owned enterprises reached 290,000 yuan in 2007,which is almost double the pay gap in 2004.Thus, the expansion o f company pay gaps now seems to be a common worldw ide phenomenon.

“Tournament theory”hasbeen used to explain the ef ectso f the pay gap.This theory explains that increasing the pay gap can help enhance executives’enthusiasm for work,reduce supervising costs and ultimately im p rove corporate perfo rm ance.W hen a com pany designsa com pensation package based on tou rnam ent theo ry,the level o f executive com pensation depends on relative perfo rm ance rather than absolute perform ance. As a result,the pay gap gradually increases as p rom otions occur(Lazear and Rosen,1981;Rosen,1986).This kind salary structure can have a positive and incentivizing efect on executives,p romp ting them to exertmoreefo rt to com pete for better positions.However,as econom ic activities have becom em ore com p lex and supervising executiveshasbecome amore dif cult and costly process,companies’need for an internalpay gap has increased.An approp riate pay gap can help to reduce opportunistic behavior among competitive executives, therefore reducesupervising costs.Research in thisarea hasalso add ressed thenecessity of a company pay gap from the perspective o f internal CEO candidate structure and CEO succession risk(Schwarz and Severinov, 2010).W ith these criteria in m ind,an internalpay gap isone o f themost importantmeans for a company to motivate emp loyees and attract the talents,making it a form of valuable expenditure that shareholders are willing to accept.It can thus have a positive efect on company perform ance.

However,the phenom enon o f the continuously w idening pay gap has in recent years led people to ref ect and som etim es castdoubt on the positive,incentivizing efect o f tournam ent theo ry.“Executive-power theory”exp lains that w idening pay gaps lead to excessive pay gaps as a resu lt o f executivem isuse of their power to increase their own level of pay and obtain private benef ts(Bebchuk and Fried,2003).Fundam ental to this theory is the assumption that company executives,especially CEOs,are eager to pursue and secure greater power.W ith a su f cient level of power,they can control the board of directors and thereby inf uence the design of their companies’compensation contracts to increase their own compensation w ithout the constraints and lim itations imposed by shareho ldersand regulators.This leads to the expansion o f the company pay gap (Adams et al.,2005).According to executive-power theory,therefore,excessive pay gaps are likely to result from them isuse of executive power to inf uence the design of compensation contracts.

The f ndingso f recent empirical studies support the executive-power theory.Bebchuk et al.(2011)analyze 12,011U.S.companies from the 1993–2004 period and report that the larger thepay gapsbetween the top-fve execu tives,the lower the value of the com pany.Chen et al.(2011b)exam ine U.S.listed com panies between 1993 and 2007,and argue that a large pay gap between execu tives signif es to those external to the com pany that the company has a seriousagency p rob lem.This leads to a signif cant increase in the company’s cost o f capital.Theauthorsalso observe that theagency problem ismore serious in companiesw ith greater cash fows and those that have experienced changes in executive structure.In other words,the positive relationship between the pay gap and agency p rob lem s ismuch stronger under these conditions.

3.Institutional background and research hypothesis

3.1.Institutional background

Until the end o f 1992,although the Chinese governm en t encouraged en terprises to w iden their pay gaps to som e extentwhen designing em p loyee-com pensation p lans,a clear restriction was still in p lace:executive compensation was not perm itted to exceed three times that of the average emp loyee.However,egalitarian compensation designs tend to reduce employee enthusiasm,thus impairing overall com pany productivity.To accelerate the developm ent of China’smarket economy,the government advocated from 1993 to 2003 that companies“give priority to ef ciency w ith due consideration to fairness.”Relevant lawsand regulationswere introduced to facilitate the expansion of pay gaps“among allkindso f personnel”to increase employee enthusiasm and maxim ize social wealth.Encouraged by the government,companies’internal pay gaps expanded rapidly.The data disclosed by the SASAC(the State-owned Assets Supervision and Adm inistration Comm ission)show that executive compensation in China’s central government controlled enterp rises was 12 times than average em p loyee salary in 2002,reached 13.6 tim es in 2003,and continues to expand.

The negative ef ects o f these excessive pay gaps aroused great concerns from China’s governm ent,which acco rdingly m ade several ad justm ents to its po licy during m ajo r con ferences.In 2009,during the f rst session of the 11th National People’sCongress,the governmentexpressed the intention to“progressively reverse”the widening trend of the pay gap.In 2012,during the second session o f the 11th National Peop le’s Congress,it prom ised to“speedily reverse”the trend.Analysis of the rhetoric of the Congress suggests that the government became less to lerant o f the excessive pay gap and thus increased its eforts to reduce the excessive pay gap.From expressing“encouragement”o f the w idening gap,it proposed“gradually reversing”this trend, and eventually described a“resolute”and“speedy”reversal.This indicates that the negative efects of an excessive pay gap on the developm ent o f China’seconomy now urgently require a so lution from the Chinese governm ent.

3.2.Research hypothesis

Once theblock shareholders in a company realize that the company’sexcessivepay gap isdue to theagency cost of executive power,they are likely to introduce governancemechanisms to m itigate these agency p roblems.Fam a and Jensen(1983)pointout thata company’sboard of directors playsan important role in supervising executives and reducing the agency costs.It is common for block shareho lders to directly appoint personnel to a company’sboard of directors in a supervisory capacity,in order to ensure that executives efciently represent the interestsof the company’s shareho lders(Yeh and Woidtke,2005).The contribution of a shareholder-appointed director signif cantly imp roves company governance.For example,Co lpan and Yoshikawa(2012)exam ine Japanese listed com panies and f nd that d irecto rsappointed by b lock shareho lders can reduce com panies’agency problem sby enhancing the sensitivity of the relationship between com pensation and perform ance.In supervising executives,the directors represent shareholders’in terestsand dep loy ef ective governancemechanisms to control the pay gap caused by them isuse of executive power,thereby reducing the opportunistic behavior o f executives in pursuit o f excessive compensation,and u ltimately reducing the company’s overall pay gap.W e thus propose the fo llow ing hypothesis.

Hypothesis1.The ratio of d irecto rs appoin ted by shareho lders to the to tal num ber o f d irecto rs is negatively related to the company pay gap.

Generally,company directorshave two main functions:supervising other employeesand p roviding strategic recomm endations(Brickley and Zimm erman,2010).However,high performance in oneareamay comprom ise the success of the o ther.M asulis et al.(2012)repo rt that based on their sam p le,foreign independen t d irectors hired by U.S.listed com panies successfully provide strategic advice,such as helping execu tives to imp lement cross-bordermergers and acquisitions strategies,and achieve high returns.However,the authors also observe that such directors fail to fu lf ll their supervisory role.They are frequently absent from board m eetings and CEO compensation tends to be too high.M oreover,when company performance is poor,foreign independent directorso ften fail to dism iss incompetent CEOs in a timely fashion.Investigating directors’supervisory role,Faleye et al.(2011)report that in companiesw ith stronger director supervision,there is a greater correlation between change in CEO and performance.In addition,the CEOs of these companies receive less excessive compensation and perform less earningsmanagement.However,the strategic perform ance of the directors o f these com panies is comparatively weak.

Two k inds of directorsm ay be appointed by b lock shareho lders to China’s listed com panies:salaried and non-salaried directors.Salaried d irectors appointed by block shareho lders o ften p rovide executivesw ith strategicm anagem ent advice and either participate in o r are responsib le fo r com panym anagem en t.Such d irecto rs are independent,but arealsom ore suscep tib le to the in fuenceo f other executives,making it dif cult for them to efectively perform the duties required of them by the company shareholders.In contrast,non-salaried directors appointed by shareho lders who receive compensation directly from the shareholders and work to further their interests through participation in company governanceand thesupervision of executivebehavior. Such directorsare less susceptib le to the in fuence of the listed company’sother executivesand thus actmore independently.In short,when directorsappointed by shareholders receive com pensation from the companies, they aremoresusceptible to the constraintsof executivepowerwhen participating in company governanceand m aking decisions.As they are also more likely to share the interestsand p rioritieso f the company executives, theym ay sacrif ce shareholders’interests to gain m ore private incom e,which increases the com pany’s pay gap. In contrast,when d irecto rs appoin ted by shareholders receive com pensation from the shareho lders,they do not have a direct econom ic connection w ith executives and arem o re likely to share and pursue shareho lders’interestsby strengthening their supervision o f executive behavior,and ultimately reducing the company’s pay gap.This suggests the follow ing hypotheses:

Hypothesis2.The ratio of salaried d irectors appoin ted by shareho lders to the total num ber o f directors is positively related to the com pany pay gap.

Hypothesis3.The ratio of non-salaried directorsappointed by shareholders to the totalnumber of directors is negatively related to the company pay gap.

4.Research design

4.1.Sample

The 2005 revision o f the“Annual Reporting Standards”required listed companies for the f rst time to disclose executive compensation on an individual basis.To ensure the integrity of the samp le and to ef ectively investigate the relationship between shareholder-appointed directorsand thepay gap,we exam ine listed companies in the 2005–2011 period,using all typesof listed com panies in our initial study samp le except f nancial and insurance companies.A fter excluding incomplete observations,our sample comprises9186 observations. Ownership data o f listed com panieswas hand-collected from com pany annual reports and com pensation and fnancial data were ob tained from the China Stock M arket and A ccounting Research(CSM AR)database.As the sam p le is com posed o f diferen t com panies in diferent years,givingm ixed(pooled)data,the annualobservations of a given company do notmeet the requirement of independence,which cou ld lead us to overvalue the statistical signif cance of the regression results.To correct this statistical p rob lem,we use a“clustering”method to adjust the standard error o f the estimated coef cient for each company(Petersen,2009).

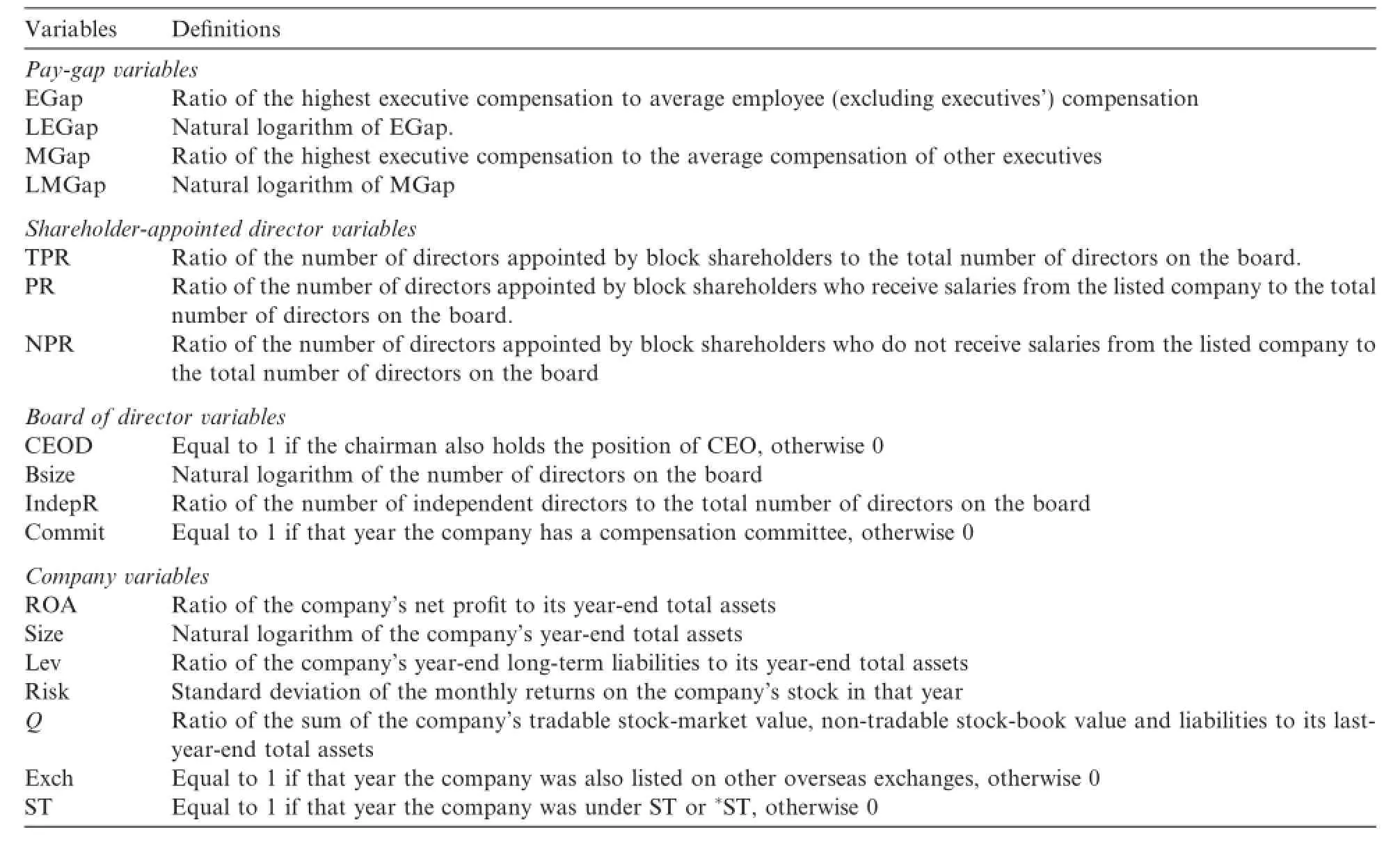

4.2.Variables

4.2.1.Company pay gap

In linew ith existing research,we use the relative pay gap between executives and employees,and the relative com pensation am ong executives to m easu re the com pany pay gap(Bu and Peng,2010;Banker et al., 2011;K ato and Long,2011).

We use the fo llow ing equation to calcu late the relative pay gap between executives and emp loyees.

We use the follow ing equation to calculate the relativepay gap between the highest paid top executiveand the other top execu tives.

In the equationsabove,LEGap represents thenatural logarithm of the relativepay gap between executives and employees,LMGay represents the natural logarithm o f the relative pay gap between the highest paid top executive and the other top executives,and M axM Pay rep resents a company’s highest executive compensation.CashPay rep resen ts the cash paid by the com pany to its em p loyees,SalPayCh represen ts the change in the em p loyee com pensation paid by the com pany,TotM pay rep resents the total execu tive com pensation awarded by the com pany,Em pNum rep resen ts the to tal num ber of em p loyees and To tM Num represen ts the total number of executives.

4.2.2.Directors appointed by shareholders

Our measure o f directors appointed by block shareho lders is rep resented by the ratio of the number o f directors appointed by b lock shareho lders to the total number o f directors on the board(Yeh and Woid tke,2005;Chen et al.,2013).In Chinese listed companies,directors appointed by shareho ldersmay receive compensation directly from the company forwhich they work,or from a source external to the company.Therefore,wedefne the fo llow ing threevariables:(1)directorsappointed by shareho lders(TPR),which is rep resented by the ratio of the num ber o f d irectors appoin ted by shareho lders to the total num ber o f directo rs on the board;(2)salaried directors appoin ted by shareho lders(PR),which is represen ted by the ratio o f the num ber of shareho lder-appoin ted directorswho receive com pensation d irectly from the listed com pany fo r which they work to the total number o f directors on the board;and(3)non-salaried directors appointed by shareholders(NPR),which is represented by the ratio o f the number of shareholder-appointed directorswho do not receive compensation directly from their companies to the total number o f directors on the board.

4.2.3.Control variables

Fo llowing recommendationsmade in the literature,we include the follow ing controlvariables(Fang,2009; Xin and Tan,2009;Chen et al.,2011a):(1)Chairman and CEO duality(CEOD),which is equal to 1 if the chairman also ho lds the position of CEO,otherw ise 0;(2)the size of the board of directors(Bsize),which isequal to thenatural logarithm o f the number o f directorson the board;(3)independent directors(IndepR), which is equal to the ratio o f the number o f independent directors to the total number o f directors on the board;(4)compensation comm ittee(Comm it),a dummy variab le equal to 1 if the company hasa compensation comm ittee in the year under study,otherw ise 0;(5)company performance(ROA),which isequal to the ratio o f the company’snet pro f t to its year-end totalassets;(6)company size(Size),which isequal to the natu ral logarithm of the com pany’s total assets in that year;(7)the com pany’s leverage(Lev),which is equal to the ratio o f the com pany’s year-end long-term liabilities to its year-end to tal assets;(8)com pany risk(R isk), which is equal to the standard deviation o f them onth ly returns of the com pany’s stock in that year;(9)company grow th potential(Q),which is equal to the ratio o f the sum o f the company’s tradable stock-market value,non-tradab le stock-market value and liabilities to its last-year-end totalassets;(10)cross-listing(Exch), which isequal to 1 if that year the company wasalso listed on other overseasexchanges,otherw ise 0;and(11) special treatment(ST),which is equal to 1 if that year the company was under ST or*ST,otherw ise 0.

4.3.Research model

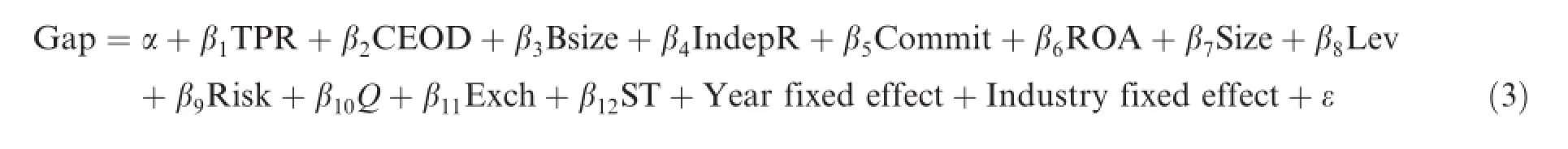

First,we use the fo llow ing regression model to exam ine the relationship between the p resence of shareholder-appointed directors and the pay gap.

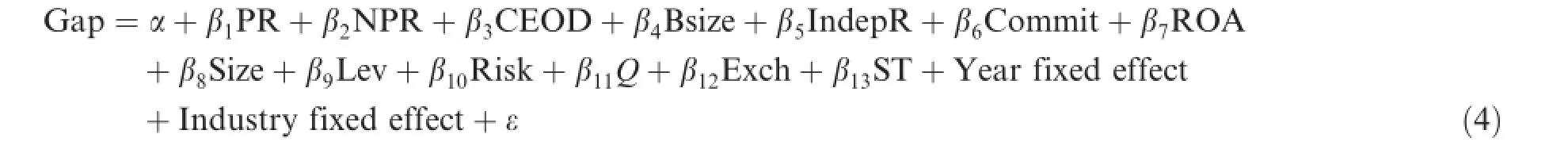

Table 1 Variable defnitions.

The follow ing regression m odel is used to further investigate the diferent ef ects on the pay gap of salaried and non-salaried directors appointed by block shareho lders.

The defnitions o f the variables used in themodel are listed in Table 1.“Gap”signif es either LEGap or LM Gap,as appropriate.

5.Empirical results and analysis

5.1.Descriptive statistics

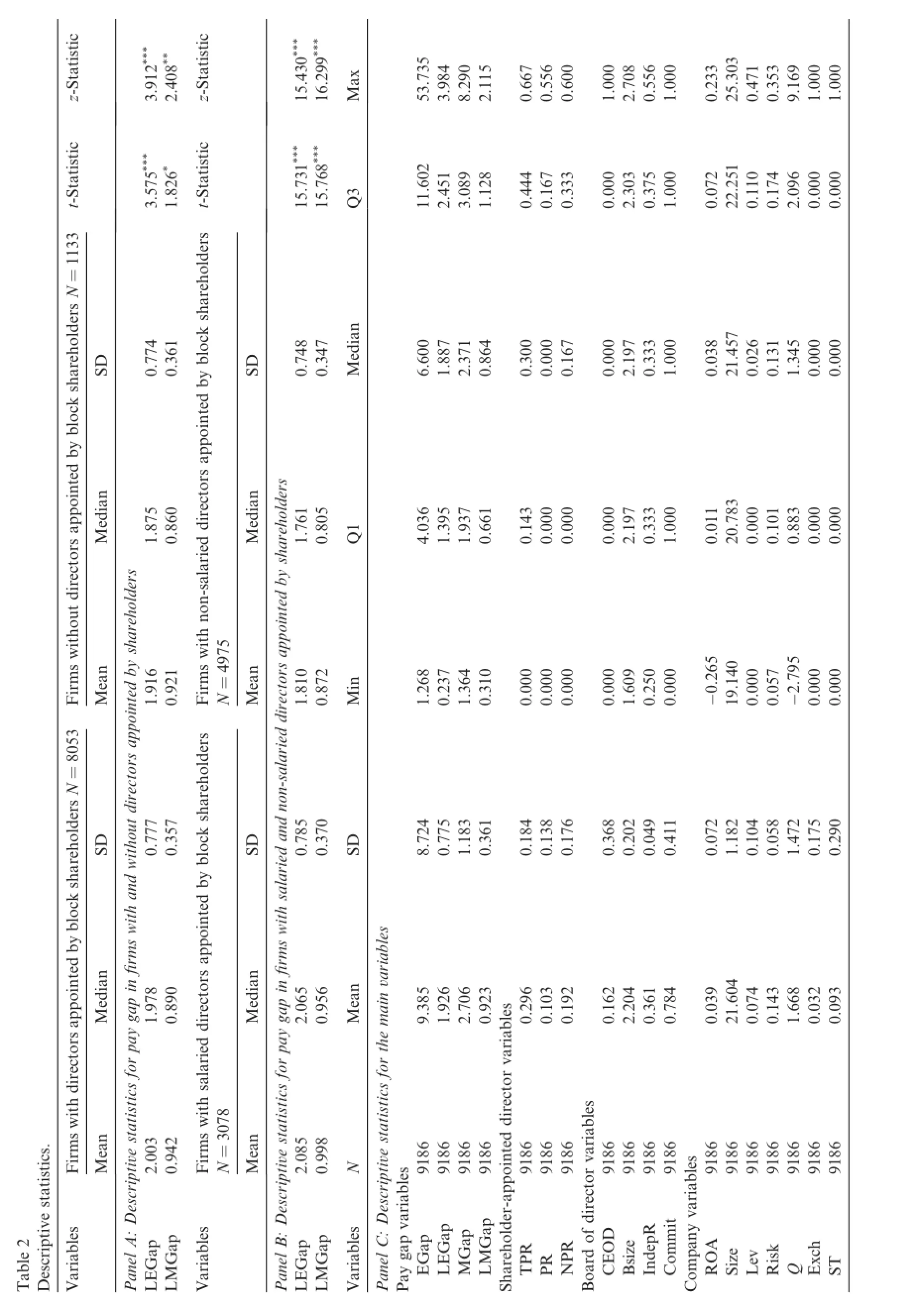

To m itigate the ef ect o f extrem e values on ou r em p irical analysis,wew inso rize the top and bottom 1%o f values for all continuous variab les.Tab le 2 p resents the descrip tive statistics.In Panel A,we provide descriptive statistics for sub-groups o f f rms w ith and w ithout directors appointed by shareho lders.In f rms w ith directorsappointed by b lock shareho lders,themean(median)of the pay gap between executivesand employees is2.003(1.978).In f rmsw ithout directorsappointed by block shareholders,themean(median)o f the pay gap between executives and emp loyees is1.916(1.875).The dif erencesbetween themean andm edian for the two groups are signif cant at the 1%level(t=3.575,z=3.912).There are also signif cant dif erences in the mean andmedian of executives’pay gap between f rmsw ith and w ithout directorsappointed by shareho lders. In Panel B,we divide f rmsw ith shareholder-appointed directors into f rmsw ith company-salaried and noncom pany-salaried d irecto rs to analyze d if erences in the com pany pay gap.In f rm sw ith salaried shareho lderappointed directors,them ean(m edian)of the pay gap between executives and em p loyees is 2.085(2.065)and them ean(m edian)of the pay gap between executives is 0.998(0.956).In f rm sw ith non-salaried shareho lderappointed directors,themean(median)of the pay gap between executivesand emp loyees is1.810(1.761)and themean(median)of the pay gap between executives is0.872(0.805).Furthermore,the pay gap in f rmsw ith salaried directorsappointed by shareho lders is signif cantly larger than that in f rmsw ith non-salaried directors(t=15.731,z=15.430;t=15.768,z=16.299).This isprobably due to the tendency for salaried directors appointed by b lock shareho lders to increase the pay gap and for non-salaried directors appointed by block shareholders to decrease the pay gap.

In PanelC,we report thedescrip tivestatistics for thispaper’smain variables.The average pay gap between executivesand emp loyees is9.385,w ith thehighest at53.735.The averagepay gap between executives is2.706 and the highest is8.290.Them ean of the ratio of d irectorsappointed by shareholders is 0.296.As them ean o f the ratio o f salaried shareholder-appointed directo rs is 0.103 and them ean o f the ratio of non-salaried shareholder-appointed directors is 0.192,the ratio of non-salaried directors appointed by shareho lders is nearly tw ice that o f salaried directors.These fndings indicate that the shareholders o f the listed companies under study appointmore non-salaried than salaried directors.Regarding board of director variab les,it isuncommon for CEOs to also be chairmen o f the board,and there is little variation in the size o f the boardso f directors.Generally,independent directors comp rise nearly one third o f the board o f directors and most o f the companies have a compensation comm ittee in the year under study.Of the samp le com panies,3.2%are cross-listed and 9.3%are classifed as ST in the year under study.

5.2.Correlation analysis

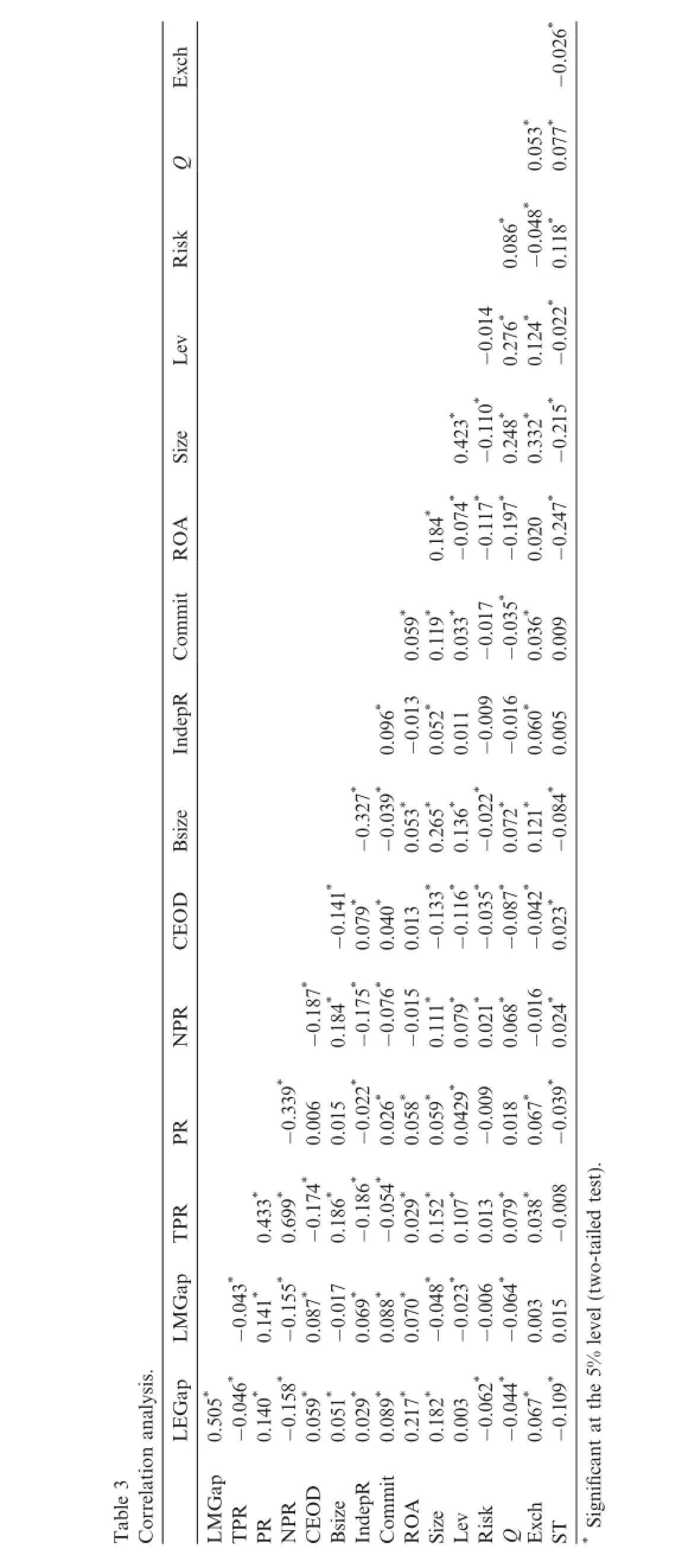

In Table 3,we provide the resultso f the correlation analysiso f themain variab les.The correlation coefcientso f TPR and LEGap or LMGap are-0.046 and-0.043,respectively,and aresignif cantat the5%level. The co rrelation coef cients of PR and LEGap o r LMGap are 0.140 and 0.141,respectively,and are signif can t at the 5%level.The co rrelation coef cients of NPR and LEGap o r LM Gap are-0.158 and-0.155,respectively,and are negatively signif can t at the 5%level.The resu lts show that there is a negative correlation between the ratio of directors appointed by shareho lders and the pay gap.M ore specif cally,the ratio o fsalaried d irectors appointed by shareholders is positively correlated w ith the pay gap,while the ratio of nonsalaried directorsappointed by shareho lders isnegatively correlated w ith the pay gap.This indicates that due to diferences in their means of receiving compensation,directors appointed by shareho lders have diferent efects on the pay gap.The pay gap increasesw ith the increased p resence of shareho lder-appointed directors who receive compensation from a listed company,and decreasesw ith the increased presence of shareho lderappointed directors who do not receive compensation from the company.Company risk(Risk),company grow th potential(Q)and special treatment(ST)are negatively correlated w ith LEGap and are signif cant at the 5%level,whereas the other variab les are positively correlated w ith LEGap.The size of the board o f directors(Bsize)and the company’s size(Size),leverage(Lev),risk(Risk)and grow th potential(Q)are negatively correlated w ith LMGap,whereas the o ther variab les are positively co rrelated w ith LM Gap.

5.3.Regression analysis

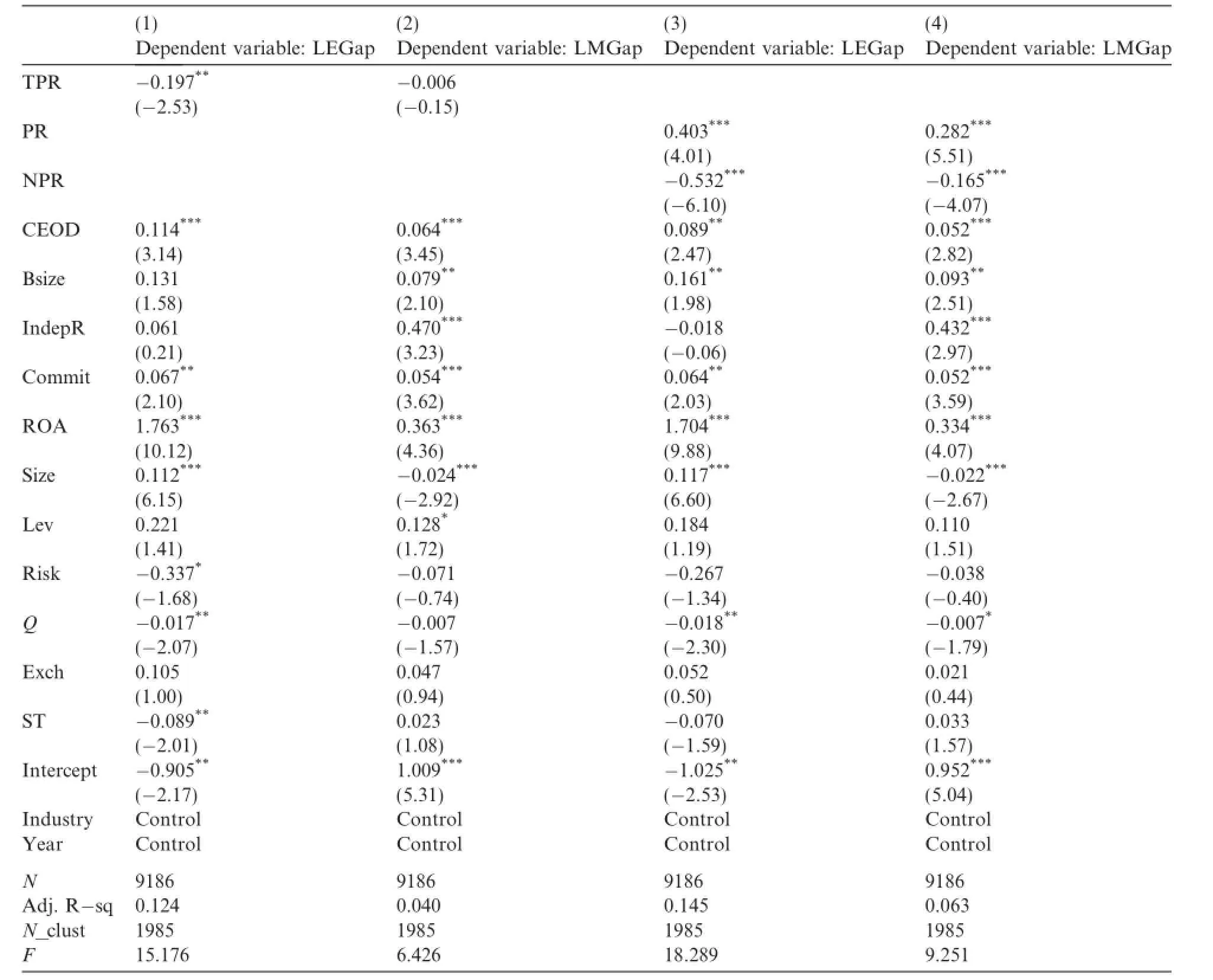

Table 4 shows the regression results for the efects on the pay gap of directors appointed by block shareholders,salaried directors appointed by block shareholders and non-salaried directors appointed by block shareholders.W e f rst exam ine the efects on the pay gap o f the ratio of directors appointed by block shareholders and provide the co rrespond ing regression resu lts in colum ns(1)and(2)of Table 4.W hen the dependent variable is LEGap,TPR’s regression coef cien t is-0.197 and is signif cant at the 5%level(t=-2.53). This show s thatwhen the ratio of d irecto rs appointed by block shareholders increases by one standard deviation,the pay gap between executivesand employeesw ill signif cantly decrease,by 3.63%.When the dependent variable is LMGap,TPR’s regression coef cient is-0.006,so the pay gap between executives and employeesw ill decrease by 1.10%w ith a one standard deviation increase in the ratio o f directors appointed by shareholders.However,this coef cient isnot signif cant(t=-0.15).Overall,these regression results show that thehigher the ratio o fdirectorsappointed by b lock shareho lders,thesmaller thepay gap.Thismeans that directors appointed by shareholdersare to some extent ab le to represent shareholders’interests by ef ectively supervising executives,reducing their opportunistic behavior in pursuit of excessive pay,and thereby decreasing the company’s pay gap.The regression results described above thus support our f rst hypothesis.

The d irectors appointed by block shareholders can be further d ivided into salaried directo rs appointed by b lock shareholders and non-salaried d irectors appoin ted by b lock shareholders,accord ing to whether they receive compensation from the listed companies for which they work.W e compare the efects on the pay gap of salaried and non-salaried directors appointed by b lock shareholders and report the corresponding regression results in columns(3)and(4)o f Table 4.W hen the dependent variab le is LEGap,the regression coef cient of the variab le PR is 0.403,and that of the variable NPR is-0.532,both signif cant(t=4.01; t=-6.10)at the 1%level.These resu lts show thatwhen the ratio of salaried directors appointed by block shareholders increases by one standard deviation,the pay gap between executives and employees increases by 5.56%.W hen the ratio o f non-salaried directorsappointed by shareholders increasesby one standard deviation,the pay gap between executives and employees decreases by 9.36%.W hen the dependent variable is LM Gap,PR’s regression coef cient is 0.282 and NPR’s regression coef cient is-0.165,and both are significant at the 1%level(t=5.51;t=-4.07),which is consistentw ith the resu lts for LEGap given in co lum n(3). The results show that the higher the ratio of salaried d irecto rsappointed by block shareho lders,the larger the pay gap,and the higher the ratio of non-salaried directors appointed by b lock shareholders,the smaller the pay gap.This suggests that only non-salaried directors appointed by block shareholders are able to p rovide efective supervision and thereby a better governance ef ect,namely decreasing the company pay gap.W hen the directors appointed to a listed company by its block shareho lders receive compensation from the listed company itself,they aremore likely to rely on the company’sexecutives than to act independently on behalf o f shareholders.As a resu lt,they increase the company’s pay gap further.In contrast,when the directors appointed by shareho lders do not receive compensation from the listed company,they aremore independent and are ab le to represent shareho lders’interests by supervising executives and reducing their opportunistic eforts to obtain excessive pay.As a result,non-salaried directo rs reduce both agency costs and the com pany pay gap.The regression resu lts p rovide suppo rtive em pirical evidence for our second and third hypotheses.

To elim inate the po tential adverse efects o f endogeneity,we also use the instrum en tal-variable regression m ethod.In linew ith recent studies(Hoech leetal.,2012;W intokietal.,2012;Jayaraman and M ilbourn,2012),our instrumentalvariab les for the two-stage least-squares regression are the industry’smean and the p revious year’s valueo f the ratio of directorsappointed by shareholders(ratio o f salaried directorsappointed by block shareholders and ratio o f non-salaried directo rs appoin ted by block shareho lders).Follow ing the recomm endations by Larcker and Rusticus(2010),we also conduct a validation test on the correlation conditionsand exogenous conditions of the two instrumental variables.

Table 4 Regression results for the efects on pay gap of d irecto rs appo inted by b lock shareholders.

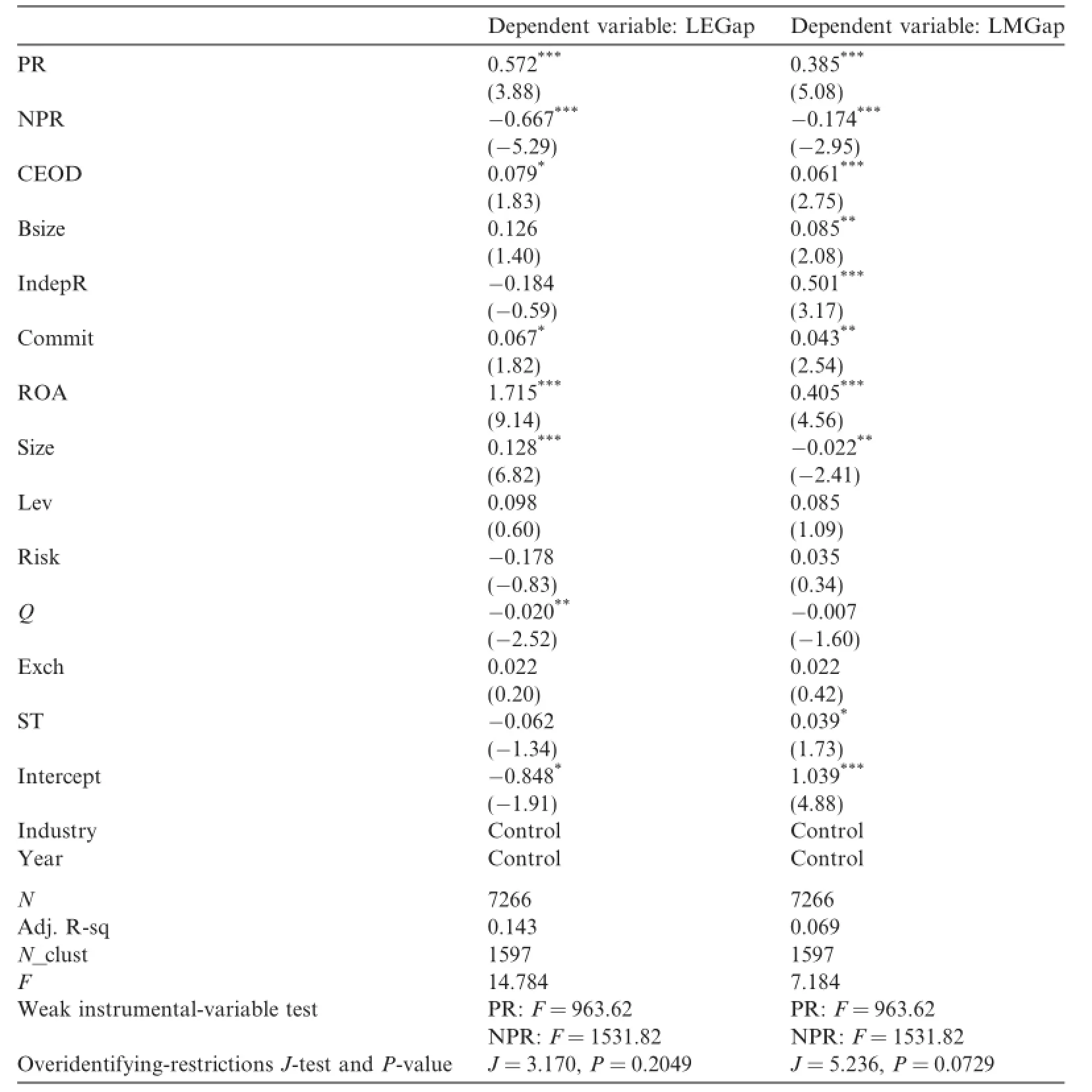

In Table 5,we report the resu lts o f the instrumental-variable correlation test,the exogenous test and the instrumental-variable regression.When the dependent variable is LEGap,the instrumental-variable correlation test gives F-values for PR and NPR that are both larger than 10(F=963.62>10;F=1531.82>10), which means that our selected instrumental variables fulf ll the correlation conditions.The resu lts of the instrumental-variableexogenous test do nothave statisticalsignif cance(J=3.170,P=0.2049),so we cannot reject the nu ll hypothesis.That is,our results pass the instrumental-variable exogenous test.As they fulf ll both the correlation conditions and the exogenous cond itions,ou r instrum ental variab les can be consideredvalid.U sing the instrum ental variables,the regression results fo r PR and NPR are 0.572 and-0.667,which are both signif cant at the 1%level(z=3.88,z=-5.29).When the dependent variable is LMGap,the results arealmost the same.Therefore,after add ressing the endogeneity p rob lem,the resu ltsof the study stillhold.In short,salaried directorsappointed by b lock shareholders signif cantly increase their companies’pay gap,while non-salaried directors appointed by b lock shareholders signif cantly decrease their companies’pay gap.

Table 5 Regression results using instrum ental variables.

5.4.Additional tests

5.4.1.The ef ects of industry competition

Table 6 show s the regression resu lts fo r the efects of d if eren t levels of industry com petition on the governance ef ectso f d irecto rsappointed by block shareholders,w ith the totalnum ber o f com panies in the industryused asa proxy for industry com petition.Thism easu re is comm on in existing papers(e.g.Li,2010).W e d ivide thesample into a group o f f rms facing high com petition and a group o f f rms facing low competition,according to themagnitude of each company’s industry.When the dependent variable is LEGap,PR’s regression coef cients in the high-competition group and the low-competition group are 0.414 and 0.405 respectively, and both are signif cantly positive at the 1%level(t=2.85,t=3.05).The dif erences in the regression coefcients for these two groups do not pass the signif cance test(p-value=0.94),so diferent levels o f industry competition can be considered to haveno signif cantefectson the relationship between the governanceo f salaried shareholder-appointed directorsand the pay gap.NPR’s regression coef cients in the high-competition and low-competition group are-0.664 and-0.432,respectively,and aresignif cantat the 1%level(t=-5.40, t=-3.68).It is clear that when an industry is high ly com petitive,the role of non-salaried shareho lderappointed directors in decreasing the pay gap is m uch larger,w ith this diference statistically signif can t (p-value=0.09).W hen the dependent variable is LM gap,the results are consisten t.In highly com petitive industries,the governance ef ects of non-salaried shareho lder-appointed d irectors on the pay gap are m o re

signif cant.The regression resu lts ind icate that the pay-gap phenom enon exhibited by China’s listed com panies isdue to agency problemsw ithin the companies,rather than the resulto f incentivizing pay.This isatodds w ith our competitive hypothesis:that the increased pay gap is due to the use of incentives.It also shows that thep resence of non-salaried directorsappointed by b lock shareho ldersand external industry competition play comp lem entary roles in the p rocess by which efective governance decreases the pay gap.

Table 6 Regression results of the ef ects of productm arket com petition.

5.4.2.The infuence of state ownership

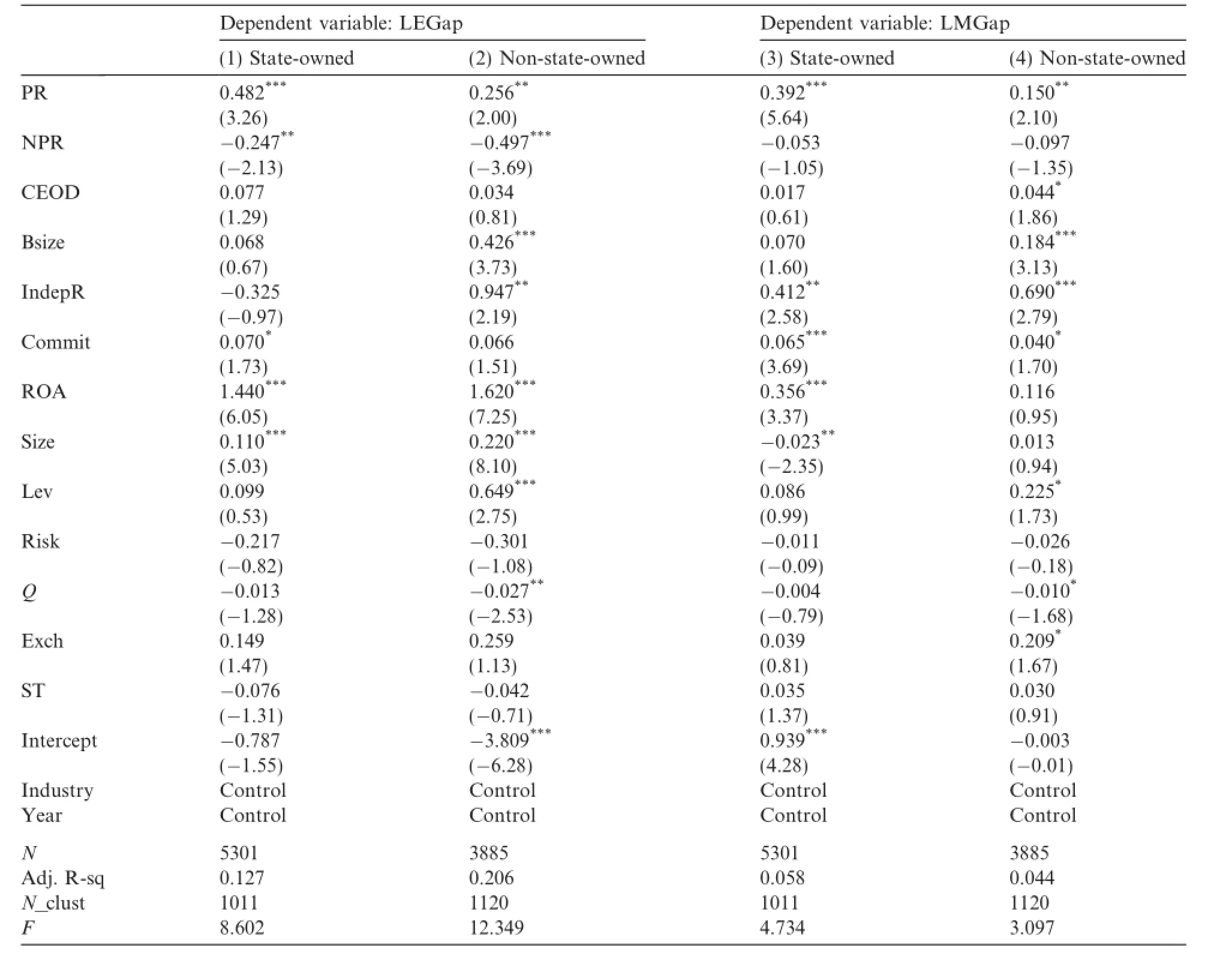

We also exam inedif erences in thegovernance efectsof directorsappointed by block shareho ldersbetween state-owned enterprises and non-state-owned enterp rises.In Tab le 7,we report the regression resu lts for the efects of salaried and non-salaried directors appointed by block shareho lderson the pay gap in state-owned enterprises and non-state-owned en terp rises.As shown in the table,when the dependent variable is LEGap, PR’s regression coef cien tsare 0.482 and 0.256,signif can tat the 1%level(t=3.26)and the 5%level(t=2.00)for the group o f state-owned enterprises and the group o f non-state-owned enterp rises,respectively.NPR’s regression coef cients are-0.247 and-0.497,respectively,signif cant at the 5%level(t=-2.13)and the 1%level(t=-3.69).When the dependent variab le is LMGap,PR’s regression coef cients are 0.392 and 0.150,signif cant at the 1%level(t=5.64)and the 5%level(t=2.10)for the group of state-owned enterprises and the group o f non-state-owned enterp rises,respectively.NPR’s regression coef cients are-0.053 and -0.097 respectively,but are insignif cant(t=-1.05,t=-1.35).The regression results indicate that salariedd irectors appointed by b lock shareholders increase the pay gap,while non-salaried d irectors appointed by shareholders decrease the pay gap,and that there is no diference in these relationshipsbetween state-owned enterprises and non-state-owned enterp rises.In other words,the relationship between the pay gap and the p resence of directors appointed by block shareho lders is not afected by state ownership.

Table 7 Regression resu lts for the efects of state ownership on the governance of directors appointed by shareholders.

Table 8 Regression results for the efects on pay gap of d irecto rs appo inted by controlling shareholders and non-controlling shareholders.

5.4.3.The ef ects of directors appointed by controlling shareholders and non-controlling shareholders

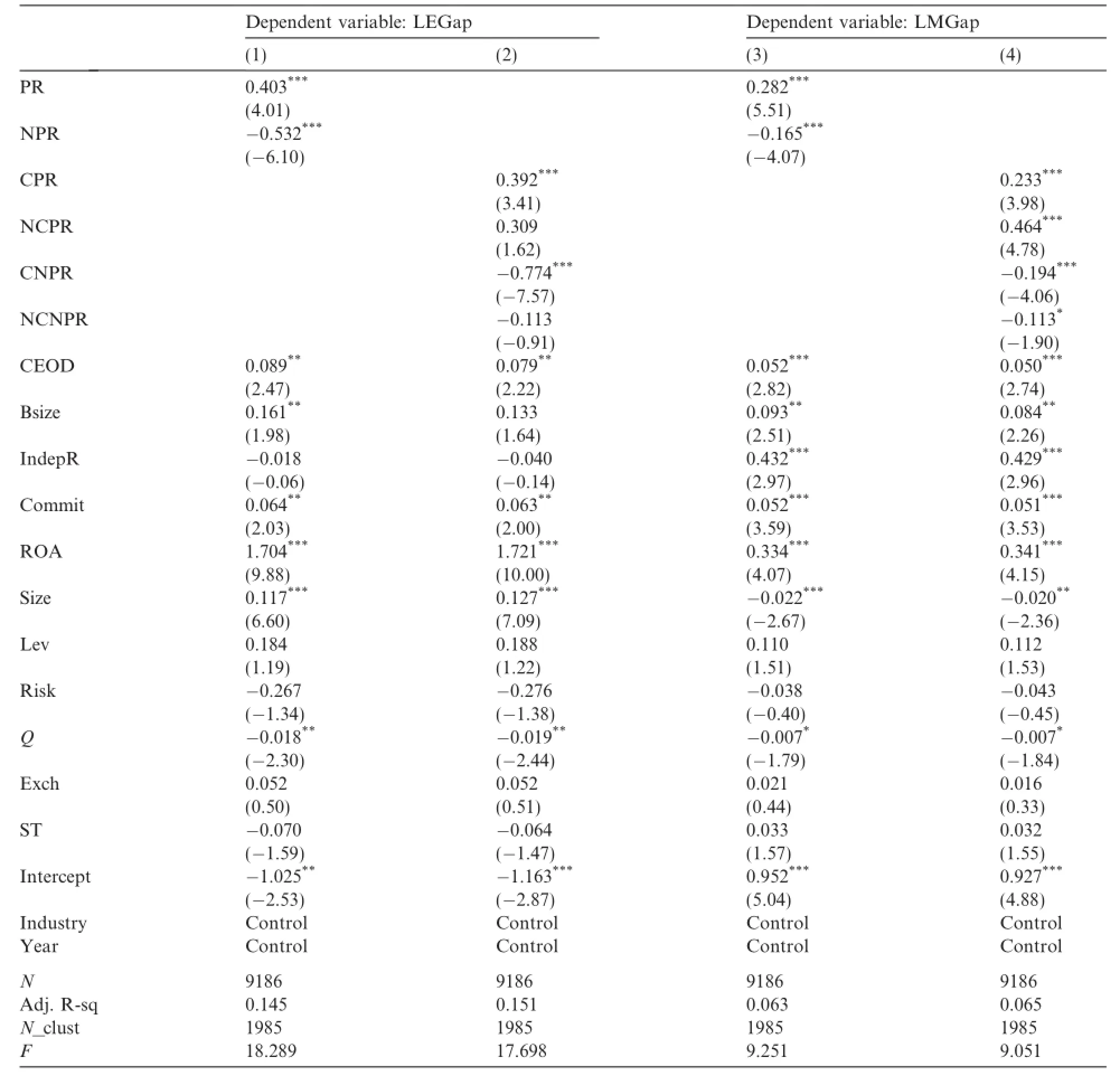

To assess the diferentmotivations of directorsappointed by controlling shareholders and non-contro lling shareholders,we exam ine separately the efects on the pay gap of directors appointed by contro lling shareholdersand those appointed by non-controlling shareholders.W emanually obtain the data for the two variables(directors appointed by contro lling shareholders and directors appointed by non-contro lling shareholders)by extracting details o f the directors appointed by all types of shareholders from the CSM ARdatabase,check ing them one by one,and thus d istinguishing the d irectorsappointed by con tro lling shareho lders from those appointed by non-controlling shareholders.To exam ine further efects of this variable,if any, on the pay gap,we divide the ratio o f salaried directors appointed by shareholders(PR)into the ratio o f salaried directors appointed by contro lling shareho lders(CPR)and the ratio of salaried directors appointed by non-controlling shareho lders(NCPR),and divide the ratio o f non-salaried directors appointed by shareho lders(NPR)into the ratio o f non-salaried directorsappointed by contro lling shareholders(CNPR)and the ratio of non-salaried directorsappointed by non-controlling shareholders(NCNPR).

Table 9 Regression results for theefectsof directorsappointed by shareholderson pay gap when the individualw ith thehighestcom pensation has diferent administrative positions.

In Tab le 8,we report the corresponding regression results.W hen the dependent variab le is LEGap,the regression coef cientso f PR and NPR,as shown in column(1),are 0.403 and-0.532,respectively,both signif cant at the 1%level(t=4.01,t=-6.10).The regression coef cient of CPR,as shown in colum n(2),is 0.392,signif can t at the 1%level(t=3.41),whereas the regression coef cient o f NCPR is0.309,which is insignif cant(t=1.62).The regression coef cient of CNPR is-0.774,signif can t at the 1%level(t=-7.57), whereas the regression coef cient of NCNPR is-0.113,which is insignif cant(t=-0.91).W hen the dependent variab le is LMGap,the regression coef cients o f PR and NPR,as shown in column(3),are 0.282 and -0.165,respectively,both signif cant at the 1%level(t=5.51,t=-4.07).The regression coef cients o f CPR and NCPR,as shown in co lumn(4),are both signif cantly positive,whereas the regression coef cients of CNPR and NCNPR are both signif cantly negative.Taken together,these results indicate that the governance of directorsappointed by controlling shareho lders does not dif er from that o f directors appointed by non-controlling shareho ldersw ith regard to pay gaps resu lting from agency problems.

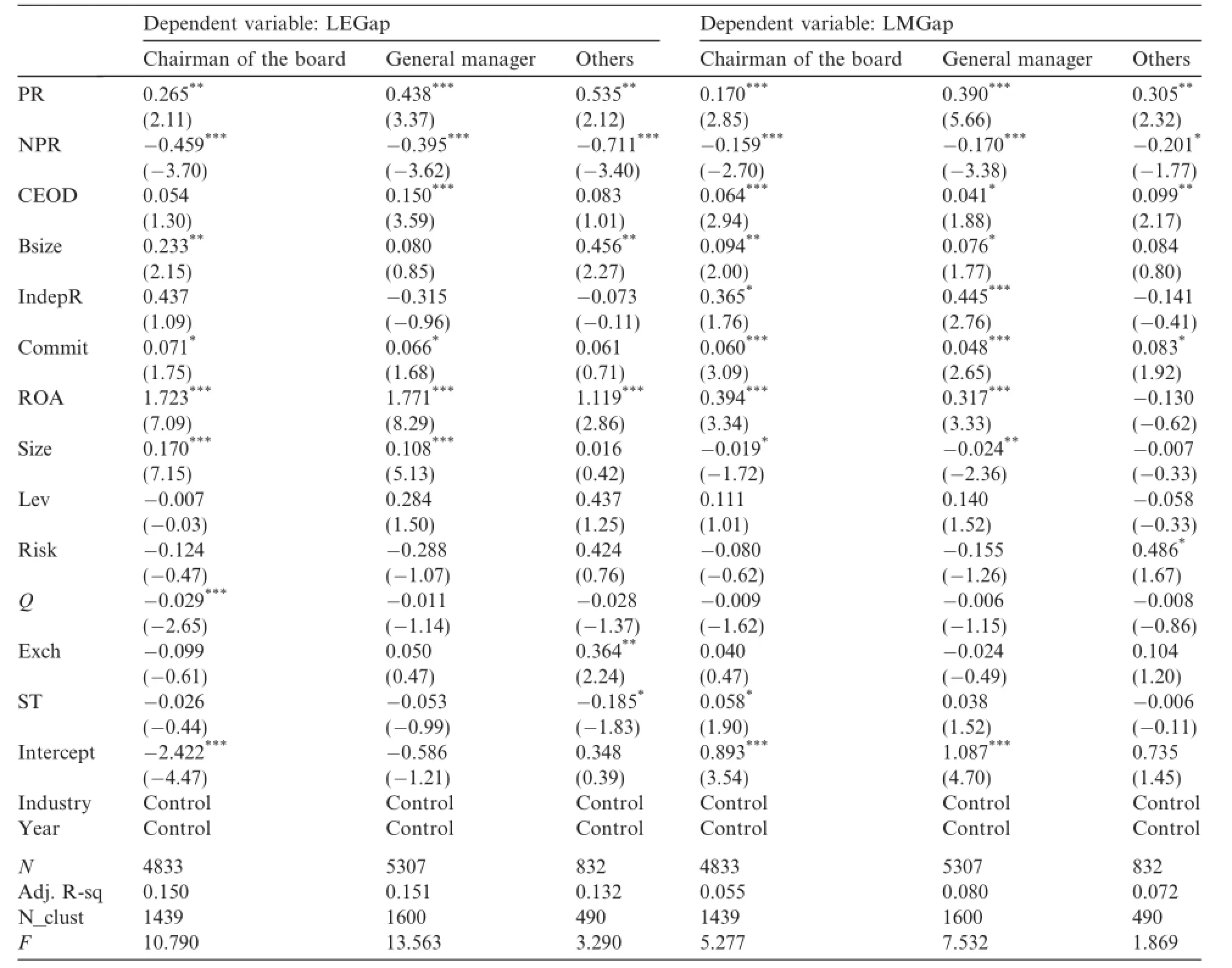

5.4.4.The infuence of administrative posts

To assess thepotential inf uenceo f the adm inistrativeposto f the company executiveswho receive the highest compensation,we f rst divide the company personnelw ith the highest compensation into chairmen of the board(includ ing Vice Chairm en),generalm anagers(includ ing Vice Presiden ts)and other executive positions. Next,we use these subsam p les to exam ine the governance efect o f d irectors appointed by block shareholders on the pay gap.In Tab le 9,we report the corresponding regression results.The results for the three subsam p les show that salaried directorsappointed by shareholderssignif cantly increase thepay gap,whereasnon-salaried directorsappointed by shareho lderssignif cantly decrease the pay gap.The resu ltsobtained from carrying out separate regressions on the three categories—chairmen o f the board,generalm anagers and other executive positions—indicates that the adm inistrative posthasno signif cantef ect on the results reported in this paper.

6.Conclusion and discussion

Originally,thepay gap phenomenon cou ld generally beexp lained by tournament theory.That is,an appropriate pay gap can increase emp loyeemotivation and p roductivity.However,in recent years,company pay gaps have continued to w iden,which now seems to be due to them isuse of power by company executives to inf uence the formu lation of compensation.Therefore,based on the executive-power theory,this paper exam ines the efects o f com panies’governance m echanism s on their pay gap.A cco rding to the execu tivepower theory,CEOs are particularly likely to use their power to in fuence the design o f com pensation packages in o rder to increase their own com pensation beyond the op tim al pay level,thereby producing an excessive pay gap.Such a pay gap hasa serieso f negative econom ic consequences,such as the failure of salary–related incentivemechanismsand a decline in com pany performance.Therefore,it isnecessary to exam ine how companies’governance mechanisms ease the agency problem during the formu lation o f salary structure and thereby reduce excessive pay gaps.

Using a samp le of Chinese A-share listed companies during the 2005–2011 period,we f rst exam ine the efects on pay gap of the presence of directors appointed by shareholders.The results show that on average, directorsappointed by shareholdershavea negativeef ecton thepay gap.Next,wedistinguish between shareholder-appointed directorsaccording to whether they are salaried by the company or an external source.The results show that the p resence of salaried d irecto rs appoin ted by shareho lders signif can tly increases the pay gap,while the presence o f non-salaried d irecto rs appointed by shareholders signif cantly decreases the pay gap.Therefore,it m ay be dif cu lt fo r salaried d irectors appoin ted by the shareho lders of listed com panies to ef ectively supervise the company’s executives,due to a lack of independence.In contrast,non-salariedd irectors appoin ted by block shareholders are better ab le to represen t shareholders’interests in carrying ou t efective supervision of executives.In this paper,we also use the instrumental-variab le regression method to elim inate the potential adverse efect of endogeneity and conduct some further tests to reduce the potential efect of correlated factorson the resu ltso f the paper.Our conclusions cast light on the pay-gap phenomenon exhibited by China’s listed companies and o fer insights into the decision-making behavior o f salaried and non-salaried directors appointed by b lock shareholders to supervise executives.

Acknowledgments

This paper is the resu lt of research supported by the National Nature Science Foundation o f China (71263034,71002111),the Hum anities and Social Science Project o f the M inistry o f Education o f China (10XJC630003)and the Program of H igher-level Talen ts at Inner M ongo lia University,China(Z20100103). W e acknow ledge the executiveeditor and theanonymous reviewer for their useful commentsand suggestions.

Adam s,R.,A lmeida,H.,Ferreira,D.,2005.Powerful CEOs and their impact on corporate performance.Rev.Financ.Stud.18,1403–1432.

Banker,R.D.,Bu,D,M ehta,M.N.,2011.Pay Gap and Performance:Diferences Across Cultures.W orking Paper.

Bebchuk,L.A.,Cremers,M.,Peyer,U.,2011.The CEO pay slice.J.Financ.Econ.102,199–221.

Bebchuk,L.A.,Fried,J.M.,2003.Executive com pensation as an agency problem.J.Econ.Perspect.17,71–92.

Bebchuk,L.A.,G rinstein,Y.,2005.The grow th in execu tive pay.Oxford Rev.Econ.Policy 21,283–303.

Brickley,J.A.,Zimmerman,J.L.,2010.Corporate governancem yths:commentson A rm strong,Guay,andW eber.J.Account.Econ.50, 235–245.

Bu,D.L.,Peng,S.B.,2010.Pay Gap,Social Equality and Corporate Performance.Working Paper.

Chen,J.,Ezzamel,M.,Cai,Z.,2011b.M anagerial power theory,tournam ent theory,and executive pay in China.J.Corp.Finance 17, 1176–1199.

Chen,E.T.,G ray,S.,Now land,J.,2013.Fam ily rep resentatives in fam ily f rm s.Corp.Gov.Int.Rev.21,242–263.

Chen,Z.,Huang,Y.,W ei,K.C.J.,2011.Executive Pay D isparity and the Cost of Equity Capital.Working Paper.

Colpan,A.M.,Yoshikawa,T.,2012.Performance sensitivity of executive pay:the ro leof foreign investors and af liated directors in Japan. Corp.Gov.In t.Rev.20(6),547–561.

Faleye,O.,Hoitash,R.,Hoitash,U.,2011.The costs of intensive board monitoring.J.Financ.Econ.101,160–181.

Fama,E.F.,Jensen,M.C.,1983.Separation of ownership and contro l.J.Law Econ.26,301–325.

Fang,J.,2009.D o Ch ina’s listed com panies’wages have viscid ity?Econ.Res.J.3,110–124(in Chinese).

Hall,B.J.,M urph,K.J.,2003.The trouble w ith stock option.J.Econ.Perspect.17,49–70.

Hoechle,D.,Schm id,M.,Walter,I.,Yermack,D.,2012.How much of the diversif cation discount can be explained by poor corporate governance.J.Financ.Econ.103,41–60.

Jayaram an,S.,M ilbourn,T.T.,2012.The role o f stock liquidity in execu tive com pensation.A ccount.Rev.87,537–563.

Kato,T.,Long,C.,2011.Tournam ents and managerial incentives in Ch ina’s listed f rm s:new evidence.China Econ.Rev.22,1–10.

Larcker,D.,Rusticus,T.,2010.On the use o f instrumental variables in accounting research.J.Account.Econ.49,186–205.

Lazear,E.,Rosen,S.,1981.Rank-order tournaments as optimum labor contracts.J.Po lit.Econ.89,841–864.

Li,X.,2010.The impacts of productmarket com petition on the quantity and quality o f voluntary disclosu res.Rev.A cc.Stud.15,663–711.

Li,Z.C.,2011.Pay Gap,Corporate Governance,and Firm Performance.W orking Paper.

Lin,J.,Huang,Z.,Sun,Y.,2003.The pay gap among the group o f executives,the com pany’s performance and thegovernancestructure. Econ.Res.J.4,31–41(in Ch inese).

Liu,C.,Sun,L.,2010.The pay gap and the com pany’s perform ance:emp irical evidence from state-owned listed companies.N ankaiBus. Rev.2,30–39(in Chinese).

M asulis,R.W.,W ang,C.,Xie,F.,2012.Globalizing the board room–the efects of foreign directors on corporate governance and f rm performance.J.Account.Econ.53,527–554.

Petersen,M.A.,2009.Estimating standard errors in fnance panel data sets:com paring approaches.Rev.Financ.Stud.22,435–480.

Rosen,S.,1986.Prizesand incentives in elimination tournaments.Am.Econ.Rev.76,701–715.

Sapp,S.,2008.The impact of corporate governance on executive compensation.Eur.Financ.M anage.14,710–746.

Schwarz,M.,Severinov,S.,2010.Investment tournaments:when should a rational agent put all eggs in one basket?J.Labor Econ.28, 893–922.

W intoki,M.B.,Linck,J.S.,Netter,J.M.,2012.Endogeneity and the dynam ics o f internal corporate governance.J.Financ.Econ.105, 581–606.

Xin,Q.,Tan,W.,2009.M arket-oriented reform,com pany performance and state-owned enterprises pay.Econ.Res.J.11,68–81(in Chinese).

Yeh,Y.H.,W oidtke,T.,2005.Comm itment or entrenchm ent?Controlling shareholders and board com position.J.Bank.Finance 29, 1857–1885.

Zhang,Z.,2008.An empiricalanalysisof theefectof com pany internalpay gap on com pany futureoperating performance.Account.Res. 9,81–87(in Chinese).

*Corresponding author.Tel.:+86 13948107562.

E-mail address:chen_shenglan@126.com(S.Chen).

Production and hos ting by Elsevier

1755-3091/$-see frontmatter©2014 Production and hosting by Elsevier B.V.on behalf of China Journal of Accounting Research. Founded by Sun Yat-sen U niversity and City U niversity of H ong Kong.

h ttp://dx.doi.org/10.1016/j.cjar.2014.03.001

Pay gap

Agency p roblem