Keeping the Books for the Environment and Society: The Unification of Emergy and Financial Accounting Methods

2013-06-15DanielCampbell

Daniel E. Campbell

1US EPA, Office of Research and Development, National Health and Environmental Effects Research Laboratory, Atlantic Ecology Division, 27 Tarzwell Drive, Narragansett, RI 02882, United States

Keeping the Books for the Environment and Society: The Unification of Emergy and Financial Accounting Methods

Daniel E. Campbell1†

1US EPA, Office of Research and Development, National Health and Environmental Effects Research Laboratory, Atlantic Ecology Division, 27 Tarzwell Drive, Narragansett, RI 02882, United States

Submission Info

Communicated by Zhifeng Yang

Environmental accounting using emergy

Financial accounting methods

Double entry bookkeeping

Emergy Income Statement

Emergy Balance Sheet

Development of the concept of emergy established a medium for accounting that made it possible to express economic and environmental work of all kinds on a common basis as solar emjoules. Environmental accounting using emdollars, a combined emergy-monetary unit, can be used to produce a single income statement and balance sheet giving comprehensive accounts for the economy, society, and the environment that can be expressed on a single income statement and balance sheet. At present, emergy accounting is rapidly developing and this paper uses well-known methods from financial accounting and bookkeeping to guide the further development of emergy accounting methods. The important concept of environmental liability is defined and a conceptual basis for applying this idea in ecologicaleconomic systems is presented in the form of an Energy Systems Language model. Four categories of environmental debt are recognized and a scheme for payment of these debts is proposed based on the criterion that economic production be sustainable. Also, a system of double entry emergy and money bookkeeping is proposed, which uses a combined emergy and money journal, separate emergy and money ledgers with this data transferred to a unified emdollar balance sheet to keep one set of books for the environment and the economy. Further development, testing, and adoption of environmental accounting tools like the ones proposed here will allow governments and managers to finally determine the true solvency (i.e., the ability to pay economic, social and environmental debts) and therefore the sustainability of the firms and economic systems for which they are responsible.

© 2013 L&H Scientific Publishing, LLC. All rights reserved.

1 Introduction

The idea that the methods and models of accounting and bookkeeping might be useful in evaluating, understanding, and managing environmental systems is implicit in the title of H.T. Odum’s 1996 book,“Environmental Accounting: Emergy and Environmental Decision Making”. Development of the concepts of emergy and transformity [1] established a medium for environmental accounting (i.e., emergy) that made it possible to express economic, environmental and, indeed, social work of all kinds on a common basis. During the 1980s and 1990s, many emergy analyses of nations and states were performed and the results of these analyses invariably included tables of annual economic and ecological flows and a table of stored assets [2-10]. In standard financial accounting practice annual monetary flows would be placed on the income statement and storages of cash and other assets would appear on the balance sheet. Thus, emergy accounting already uses summary statements that are similar to those found in financial accounting. In this paper, theory and methods that can be used to expand emergy accounting procedures so that they conform more closely to financial accounting and bookkeeping methods are presented. The end result of emergy accounting methods expanded in this manner will be a single income statement and balance sheet giving comprehensive accounts for the economy, society, and the environment.

This work had its origin in a talk presented at the Emergy Synthesis 3 conference held in 2004 at the University of Florida, Gainesville, FL, USA. A paper on this subject was included in the proceedings of that conference [11]. At this same conference Enrique Ortega [12] presented an example of the application of parallel emergy and money bookkeeping methods to evaluate the operation of a water buffalo farm in Brazil. In this paper, the theoretical basis for environmental accounting methods using emergy is further developed and the method for obtaining a unified emergy-money balance sheet is explained by drawing on the research of [13-15].

Accounting is the systematic measuring and reporting of financial information to decision-makers [16]. Accountants communicate results by classifying and summarizing financial information into standard forms,e.g., income statements and balance sheets, that match the decision-making needs of managers,e.g., to determine the solvency and profitability of a firm. Managers use the data, analysis, and interpretation of accountants to distinguish the financial advantages and disadvantages of alternative economic, social, or individual choices. More information about alternative choices reduces uncertainty, which should lead to better decisions. Accounting methods are widely used and many people in positions of responsibility know how to read financial statements and they understand their importance.

Environmental accounting using emergy parallels financial accounting in that it is a systematic method of measuring and reporting environmental, economic and potentially social changes to decisionmakers in terms of changes in emergy or real wealthi.e., what something can do when used in a system for its intended purpose (e.g., a liter of gas will only allow a given car to drivenmiles, regardless of the pricempaid at the pump). However, communicating Emergy Analysis methods and results so that others understand the importance of the findings has been difficult. If emergy accounting methods can be adapted to more closely conform to financial accounting methods, parallel and/or joint accounts can be created and then unified by relating them to one another using an appropriate emergy to money relationship. To accomplish this end, the concept of environmental liability as a debt to the environment quantified in terms of emergy credits and debits is examined and applied by using the fundamental equation of accounting to determine solvency on an emdollar balance sheet. The bottom line on such a balance sheet is an accurate measure of the sustainability of any institution or enterprise. In addition, the methods of double entry bookkeeping were examined to determine how they might be used in emergy accounting to document credits and debits in accounts for the economy and the environment. Social accounting using emergy is in its inchoate stages and thus its development has been left for another time. Because income statements and balance sheets are familiar to many people in positions of responsibility, these new emdollar denominated accounts should help improve the ability to communicate andunderstand the results from environmental accounting studies using emergy.

2 Theory: Environmental liabilities

The idea of a balance sheet for environmental systems leads to the question, “What is an environmental liability and how can it be measured?” This is the central question that must be answered to complete the emergy balance sheet for any system and to make emergy accounting conform to financial accounting practice. A liability is simply a debt. When a firm receives goods from another firm on credit,i.e., without rendering payment, a debt is incurred. The work contributions of the environment to economic production are almost always received by an economy or by a firm without payment to the environment for its work. Thus, in almost all cases, the work of the environment used to support economic production is obtained on credit. In some cases partial payment may be made in the form of feedback, reinforcing environmental production processes,e.g., work done in reseeding forest land after harvesting the timber.

Everyone knows that monetary debt that is allowed to accumulate without repayment leads to financial ruin. Similarly, running continuous or increasing empower deficits in ecosystems will lead to the eventual collapse of those systems. Economic activity is not possible without the use of environmental resources and since theory indicates that all the energy flows and storages of long standing natural ecological systems are already being used to generate maximum empower in the ecosystem network [17-19], human use or diversion of the energy inflows, stored components or products of a natural ecosystem will result in an empower decrease, a loss of stored emergy, or both, which in turn will decrease renewable production in the natural system. If such losses become too great, the ecosystem will collapse; or if they continue for too long, it will be replaced in evolutionary competition. Thus, if modern societies are to survive in the long run, the use of renewable resources must be linked to the obligation to ensure that those resources will be replenished, thereby preserving the integrity of the combined system of man and nature that depends on them. This obligation includes planning for the inevitable variability in the supply of renewable natural resources that apparently has been a primary factor in the collapse of past civilizations,e.g., Mayan urbanization [20] combined with recurrent drought [21], as well as, the collapse of socioeconomic systems on all scales of development [22].

2.1 Should society be responsible for its debt to the environment?

Franz and Campbell [23] give a philosophical rationale for recognizing society’s debts to the environment. They argue that just as we have fiduciary responsibilities to ensure the well being of socioeconomic institutions and structures, we have a “vivantary” responsibility [24] to ensure the health of our ecological life support systems. From an historical viewpoint, many of the fundamental premises of economics were developed during the 17th, 18th and 19th centuries [25] when the environmental effects of less extensive economic activities did not limit resource availability and the support capacity of the environment, except locally. Debt to the environment for its contributions to economic productivity has never been accepted as important in economic theory. In the history of Western civilization, the origin of this idea can be traced to John Locke’s observation that wealth and therefore the right to property is not created until humans combine their labor with nature’s products [26,27]. From this viewpoint, it is human labor that makes the difference in the value of things and nature is seen as a passive contributor whose work would have little or no value without human intervention. Our 21stcentury views on private property and the role of the environment in creating wealth are derived from Locke’s 17thcentury thesis.

Today resource consumption by modern industrial economies has made formerly “unlimited”resources scarce, [28] and the negative effects of resource extraction and waste production threaten the long-term viability of society [29]. Under these circumstances, the environment’s work contributions to economic production and wealth can no longer be taken for granted. As a result, the question of whether to acknowledge our debt to the environment for its work contributions to society’s well-being is no longer a prerogative of private ownership, but a matter that affects the survival and future prosperity of us all. To prevent the ultimate collapse of our modern industrial economic systems, environmental resource users must be held liable to compensate the environment for its unpaid work. An energy systems model illustrating this concept and the classes of economic debt is shown as Figure 1.

Fig. 1 Energy Systems Language diagram showing the categories of environmental debt.

2.2 Classes of environmental debt

Four categories of environmental debt may be recognized, where the real work contributions of the environment are used in economic production often without sufficient payment in the form of reinforcing feedbacks. (1) The emergy of renewable resources as natural capital (e.g., topsoil) or flow (e.g., instream flow) extracted or diverted to be used in economic production (e.g., soil erosion, groundwater extraction, stream diversions, or timber and fish harvests) are liabilities, if use exceeds replenishment. (2) Annual environmental empower deficits in impacted ecosystems that occur as a result of natural capital removal and/or impaired production from natural capital due to the effects of wastes, land conversion,etc.(i.e., this amounts to “interest” on the debt incurred through the original removal or appropriation of renewable resources). (3) The emergy of nonrenewable resources removed from nature for use in economic production. (4) The emergy of natural capital destroyed through the extraction of renewable and nonrenewable resources or the conversion of lands from natural to socioeconomic activities.Environmental debt is not necessarily bad; in fact, our modern industrial civilization could not exist without incurring debt from the use of renewable and nonrenewable resources. The central point of this paper is that such debts exist and that we need to develop methods to document them, so that we can determine the extent to which various social and economic activities are sustainable. A certain amount of debt may be both necessary and appropriate to maximize overall system well-being (i.e., emergy flow or empower) in ecological-economic systems for a given level of resource availability [19,30].

Fig. 2 Energy Systems Language model of an economic entity showing examples of financial credit and debit transactions for assets, liabilities, and equity.

2.3 Double entry bookkeeping with money and emergy

If society acknowledges the obligation of the users of environmental resources to compensate the environment adequately for its unpaid work, there will be a great need for accurate and complete environmental accounting methods. Double entry bookkeeping for emergy and emdollar accounting is a logical extension of the use of this method in financial accounting.

Double entry bookkeeping was developed during the Middle Ages as a tool to determine the net monetary worth of joint endeavors [25]. A system of double entries (credit and debits) is employed to show the dual effects of any economic transaction on the assets and liabilities of a business, the difference between the two being equity or the value of ownership (Figure 2). When applied to emergy accounting, the system of double entries makes it possible to determine the net real wealth (i.e., the capacity to do usefulwork) of an entity after all its debts have been paid, including those owed to the environment.

3 Methods

Energy Systems Language, ESL, [32,33] was used to create the models shown in this study. In this paper, ESL was applied in its general or conceptual form to interrelate environmental and economic storages, flows, and forcing functions in a manner that illustrates the operation of the environmental economic interface in a region of a country, including the processes by which environmental debt is incurred and paid.

In this study the standard methods of financial accounting were used to guide the further development of emergy accounting methods and a method for unifying these two approaches is described in Section 3.3. The two methods are first compared and differences noted between the two are used to develop and modify emergy accounting tools. The method used to create annual emergy income statements documents the imports, exports, production and consumption of emergy and conforms fairly well to the accounts for revenues and expenses used in financial income statements. Emergy balance sheet methods are not as developed, therefore, this study focused on defining environmental liabilities and demonstrating how they might be added to the emergy balance sheets. However, we also outline a comprehensive method to achieve closure on the balance sheet when emergy and monetary accounts are combined. The fundamental equation of accounting was applied to the emergy balance sheet and the system of double entry bookkeeping was adapted for use in keeping emergy and combined emergy and money accounts.

3.1 The fundamental equation of accounting

The Fundamental Equation of Accounting is: Assets = Liabilities + Equity. This relationship allows a trustee to determine the financial position or solvency of the organization for which he or she is responsible. In the equation assets are defined as economic resources,e.g., cash, accounts receivable, notes receivable, inventory, land, buildings, equipment, furniture, fixtures. Liabilities are economic obligations or debts,e.g., accounts payable, notes payable, taxes payable and the owner’s equity as paid in capital or the amounts invested by owners, along with retained earnings or income earned from operations. Earnings are equal to revenues minus expenses. Wages, interest, rent, and normal profit from entrepreneurial activities are the usual categories of expenses [34]. Equity is the remaining wealth after all debts have been paid. It includes paid in capital and retained earnings, which are the economic profits in excess of all expenses. The fundamental equation of accounting was used to guide the construction of emergy and emdollar balance sheets.

3.2 Double entry bookkeeping methods

The ESL diagram in Figure 2 illustrates the operation of the system of double entry bookkeeping as it is applied in financial accounting. This figure shows the operation of the system of credits and debits used to keep track of financial transactions of an economic entity; however, it does not provide a complete representation of that economic entity or of the system of which it is a part. Also, all the classes and combinations of credits and debits have not been represented. Purchased resources are debits increasing assets as money is paid out. When goods are sold,e.g., from inventory, money is received and a credit is given for the decrease in assets. When investment funds are received as cash, monetary assets increase and a credit is given to liabilities. When debts are repaid, the liability account is debited and cash is paid out.Equity increases as retained profits accumulate and is diminished by net losses.

The financial model (Figure 2) is used to show how a system of credits and debits might be used to account for the unpaid contributions of environmental work to economic production. Emergy credits and debits can be entered on an account keeping track of environmental liabilities and equity adjusted using the appropriate emergy to money ratio to reconcile the accounts. Bookkeeping tools like the journal of transactions, the ledger with debits in the left-hand column and credits in the right-hand column, and the balance sheet detailing, assets, liabilities and equity can be used to create emergy and emdollar accounts in the same way that they are used to keep track of monetary transactions. Journal entries are made for both the money and emergy transactions. Separate ledgers with debits and credits are kept for emergy and money. The emergy and money flows are then combined on a comprehensive balance sheet and related using the appropriate emdollars ratios.

3.3 A new method for relating emergy and money

Money flows must be related to emergy flows on the combined balance sheet to allow a balance for all assets and liabilities to be determined. Historically, emdollars have provided the means to relate money to emergy. In this paper we will use the emdollar to stand for any combined emergy-money unit,e.g., the emeuro (Em€), empound (Em£), emyuan (Em¥), etc. The emdollar (Em$) value of an emergy flow or storage is its solar emergy divided by the emergy-to-money ratio for the economy [18]. The emergy to dollar ratio is determined by dividing the emergy used in the economy in a given year by a measure of gross economic activity,i.e., GSP, GDP, GNP, for that year. Emergy flows in the environment and economy are usually converted to emdollar flows by dividing by the emergy-to-money ratio. This operation redistributes the total money flow in the GDP in proportion to the emergy flows giving an Em$ value to all the products and work of nature and humanity. However, to determine an accurate value for the work contributions of the environment and human beings, both must be assessed by independent means. The common practice of using the emergy to dollar ratio to estimate the emergy of human service contributed to the total emergy use of a nation is circular and leads to a convoluted solution when applied to the emdollar balance sheet. The unique emergy contributions of human learning and shared information also must be recognized, explicitly, to create an accurate emdollar balance sheet on which the accounts for the environment, economy and, indeed society can be brought to closure,i.e., all values can be expressed in both emergy and monetary units in a manner that allows all accounts to balance. All value cannot originate from either people or the environment, if the conversion to emdollars is to give an accurate measure of what each contributes. This problem is examined in more detail and a solution offered.

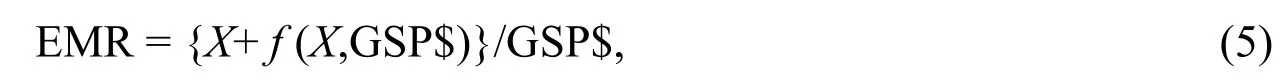

Money assigns all value to human work and none to the work of nature; therefore, money undervalues economic products in proportion to the fraction of the total emergy required that is derived from the unpaid work of nature. Current practice in emergy analysis allows the average value of human service, as represented by the emergy-to-money ratio for the economy of concern, to be used to estimate the human work contributions to products and to the total emergy used in the system (U). This logic is circular and a value for the emergy-to-money ratio cannot be found except through a recursive approximation. For example, the money flowing through the economy of a state in a year is the Gross State Product (GSP$). If the emergy to dollar ratio (U/GSP$) of the state’s economy is assumed to represent the average emergy contributed by human service, equations (1-5) show the nature of the problem, where EMR is the emergy-to-money ratio.

where

then

and

substituting forU

where,Ra, is the renewable emergy absorbed by the system;N0, is the renewable emergy used in a nonrenewable manner;N1, is the nonrenewable input from local sources;F, is all the emergy in energy and materials purchased from outside the system, and PI is the work of human services of all kinds,i.e., work for which money is paid. Our convoluted estimate of EMR can be untangled, if we can obtain an independent estimate for the emergy of human service, PI. Campbell and Lu [13,14] and Campbellet al.[15] established the basis for obtaining an independent estimate of the emergy of human service in the United States by assuming that money is paid for the education and experience delivered in the work done and as a result we can write:

wherePIis now a direct measure of the emergy contributed by human service in solar emjoules, which is based on the emergy required for the education and experience of the labor for which money is paid. EMRSis the emergy to money ratio for human service, and ExB is the total emdollar amount flowing in an expanded income statement. In this same way, the balance sheet can be expanded to include the formerly unrecognized value of the work contributions of the environment as GDP-dollar denominated assets and liabilities. By including additional GDP dollars on the balance sheet in proportion to the emergy of the environmental assets and liabilities, GDP dollars are increased and the new total defines emdollars, i.e., the assets, liabilities, and annual flows in the system are represented by an emergy-monetary measure, the emdollar, which is directly proportional to the emergy of the environmental or economic storage or flow. In contrast, the usual way of defining an emdollar is to hold the GSP dollars constant and prorate them in proportion to the emergy flows in the system, so that an emdollar is a GDP dollar that has been reassigned in proportion to the emergy of each environmental or economic quantity in the system. In both cases the emdollar is a combined emergy-money measure that is directly proportional to the emergy storages or flows in the system. However, the former method may be a solution that is more compatible with monetary valuation, because it leaves the monetary values of things unchanged,i.e., the emdollar value of an economic product or service is equal to its dollar value. However, there are more emdollars than dollars on the income statement and balance sheet and the system’s annual flows, assets and liabilities will be expanded accordingly to include environmental and eventually social credits and debits. This newly defined relationship between emergy and money results in an expanded balance sheet, as well as more emdollars flowing on the income statement than dollars. In summary, (i) to convert money to emergy using this new method multiply $ by EMRS, (ii) to convert emergy to emdollars divide solar emjoules by EMRSand (iii) under these assumptions the emdollar value of an economic product or service will be equal to its dollar value.

4 Results and Discussion

The results of this study include: (i) a description of an ESL model characterizing environmental liabilities in the context of a regional system, (ii) a rationale for crediting and debiting the environmental liabilities account (iii) a rationale for determining debt load and repayment, and (iv) an illustration of the application of double entry bookkeeping in environmental accounting using some numbers from an emergy analysis of the State of West Virginia [35] supplemented with hypothetical parameters where values were unknown.

4.1 Regional system model showing environmental liabilities

An energy systems model showing how environmental debts are accumulated and repaid within a regional economy is given in Figure 3. This conceptual model represents the environment and economy within a region. The environmental energy received by the regional system is shown atRr. Some of this energy with emergyRais absorbed by the system doing work to produce renewable environmental products such as wood, water, soil, fish,etc. Renewable products can be used in regional economic production,IP, exported,EP, or remain in place,Rs, to participate in natural production processes. The products of economic production that are sold in the larger economy produce an inflow of money that increases the monetary assets,M, held in the region. Economic production also requires the use of nonrenewable resources (coal, oil, etc.),Nu, found in the region or imported from outside,No. Both renewable,Rs, and nonrenewable,Ns, resources of the region can be exported directly (ReandNe, respectively) without adding value in the region by being used in further economic production processes. People,P, and assets,A, also make necessary contributions to economic production. Money flows to people,M1, not only for their labor but also for their resource ownership rights and concomitant expenses. However, no compensation goes directly to the environment for the real work contributions that it makes to economic production. It is true that there are always feedbacks from economic systems to the environment (often in the form of wastes or other unwanted products), but there is no check to determine the extent to which these feedbacks support the maintenance of renewable resource production or are detrimental to it.

The larger national economic system provides markets for regional products and supplies goods, services, and investment capital to the region as shown on the far right of the diagram. Prices,P1toP5, are determined in the larger economy and govern the inflows of emergy in the goods and services used for (i) restoring the environment,P1, (ii) supplying the needs of the populace,P2, (iii) supplying business,P3. In addition, externally set prices govern the sale of exported renewable and nonrenewable emergy,P4, and the sale of products,P5. Monetary debts are accounted for in the usual manner [36]. Monetary debt,Di, is incurred when money is borrowed either from within,Vi, or from without,Vo, the regional system. Interest,Im, is paid to investors in proportion to a rate,r, which may be set externally, and the size of the debt assuming that monetary assets do not limit the ability to pay. At regular intervals and in proportion to the debt,Dm; payments,Pm, on the principal are made.

Debts to the environment for its unpaid work contributions to economic production are represented in the model as the emdollar storage,Dem. Environmental liabilities increase as a result of the accumulation of debt from the use of renewable emergy,Rd, (when use exceeds the rate of replenishment), as well as losses due to the concomitant effects of waste production, extraction damage and land conversion. Damage from the extraction of nonrenewable resources,Nd, also increases environmental debt. An emergy debt is incurred from the use of nonrenewable resources, but it is not shown in this figure ; however it could be included on the emdollar balance sheet of the Region. Renewable production losses are a measure of the benefits forgone, when they are compared to the annual empower generated in a similar or reference ecosystem (Annual Loss Program). Each year these losses,Iem, accumulate in the storage,Dem, asa kind of interest on the natural capital “borrowed” from the environment.

A logic program, Debt Service, is used in the model to determine a payment schedule for the environmental debt and to keep track of emergy payments,Pem, and the debt remaining. This program evaluates a regional system assumed to be operating in a steady state on flow-limited energy sources,Rr. The object is to operate the system in a sustainable manner. When the emergy available to support system organization is different, other logical constructs would be used to evaluate the debt and to determine the amount and timing of payments. The debt service program receives information on available emergy,Rr, renewable production,Rpand renewable production used by the economic system,Ru, and exported directly,Re, retained profits of businesses,RP, environmental debt load for the region,Dem, and determines if a payment is due. For example, under the guidelines for sustainable use, a payment is due ifRu+Re>Rp. Payment is made by using some of the retained profit to purchase goods and services that are then used to restore lost resources or mitigate damage to existing production. If the economic system is losing money and also damaging the environment, government regulation might be needed to manage the environmental debt by determining a reasonable payment schedule for the entity responsible for the damage. In such cases, the logic program in Debt Service could be altered to fit the circumstances.

Fig. 3 An Energy Systems Language model of a regional system showing the processes that govern the creation and repayment of environmental and economic debts. Environmental liabilities,Dem, are an integral part of the economic production systems of the region.

4.2 Rationale for credits and debits to environmental liabilities

If society acknowledges its liability to the environment for the use of nature’s work in economic production, the question becomes, “How will this environmental liability be determined?” In this section, a rationale for recognizing debts that can be repaid in a reasonable time and several methods, by whichsuch payments might be made are discussed. The removal of stored emergy (natural capital) from ecosystems for or because of human use is a loss to the ecosystem. In some cases,e.g., an endangered species, the loss is practically irreversible. In general, the renewable resources taken,Ru, or exportedReare used in economic production without payment for the work of the environment (money is only paid to the owners of the resources not to the environment); therefore, a debt to the environment is incurred whenRu+Re>Rp. If no payment is made for the work needed to make the excess renewable resources used, an emergy credit is issued for the use of these resources, thereby increasing the environmental liabilities of the economic system and decreasing equity.

Nonrenewable resources also make a necessary contribution of work to economic production that is not paid for, since no money was paid to the environment for its work over the millions of years required for the creation of these resources. However, industrial civilization is completely dependent on the rapid consumption of nonrenewable resources. Since replenishment is slow, the accumulated debt cannot be repaid; thus it is untenable to credit the environmental liability account for the use of these resources,per se. However, any environmental damage that results from the extraction, processing, and use of these resources is recorded as an emdollar credit on the environmental liabilities account. Nonrenewable resource production and use cannot be brought into balance in the same way that renewable resources can; however, their use can be tracked through off balance sheet records of nonrenewable debits and credit could be given for slowing the rate of use,e.g., by recycling materials. This information provides a context for determining what is sustainable in the long run and for estimating the value and efficacy of recycling materials.

Environmental debts incur their own form of “interest” because of the unrealized benefits that would have accrued to an impacted ecosystem. Annual ecosystem productivity,Rp, can be reduced due to renewable resource use and the environmental damage from renewable and nonrenewable resource extraction and waste production in economic systems. The annual empower loss (Rp0–Rp) in these support systems accumulates similar to interest on the “borrowed” (removed or impaired) natural capital. If restoration payments are not made commensurate with the lost productivity an equivalent emergy credit is issued to the environmental liability account.

Retained profits can be used to purchase goods and services to restore environmental production or to reduce the harmful effects of wastes. When these goods and services are converted to an equivalent emergy flow,Pem, an emergy debit, EDp, to the environmental liabilities account is recorded,i.e., payment for a prior credit has been made thus debt is decreased. The environmental liability account might be debited in response to other actions that increase renewable production or prevent its loss. For example, system design changes that increaseRpor decrease losses toRpwould result in an equivalent emergy debit to the environmental liabilities account. If a firm uses a renewable harvest strategy whereRpexceedsRu, a credit to the environmental liabilities account might be recorded. If a company recycles a percentage of its mineral requirements a credit might be given for the extraction damage avoided. Social organizations that take action to restore or improve the environment also make an emergy contribution that might count toward decreasing the debt.

4.3 Rationale for determining debt load and repayment

The marginal effect of debt accumulation or repayment in determining a change in system empower on the emergy income statement can be used to determine the debt load that will result in maximum power for a given system. The decision criterion must also satisfy the condition that empower in the whole system be maximized over a period of time that is ultimately determined by the availability of resources [37]. For a sustainable system running on flow-limited sources the annual debt payment, when one is due, should be at least equal to the difference betweenRu+ReandRpplus any losses due to degradation.Under other conditions empower in the system may be maximized by carrying and/or accumulating some level of environmental debt. When a repayment schedule begins, it is logical that debts owed for the use of environmental resources are repaid in proportion to the accumulated environmental debt as allowed by the retained profits of the economic system. The overall criteria for deciding how much environmental debt can be carried by a sustainable system is that renewable resource use,Ru+Re, plus the annual degradation of renewable resources,Iem, incurred as a result of carrying the debt, should not exceed the replenishment of those resources by natural and/or anthropic means. If this condition is not met, an emdollar payment is due to compensate for the difference {Rp– (Ru+Re+Iem)}.

Monitoring the change in renewable resource production and other environmental parameters is needed to verify the emergy gains from restoration and mitigation. The monitored environmental parameters can be used to estimate emergy increases in annual renewable production that result from restoration, remediation, and system design changes or through protecting some sources of renewable production. The emergy flow increase in environmental systems compared to the emergy in the purchased goods and services used in restoration is a measure of the relative efficacy of restoration and mitigation alternatives. Monitoring allows managers to determine the amount of environmental debt repaid by measuring the direct emergy benefits realized by ecosystems (the change inIem).

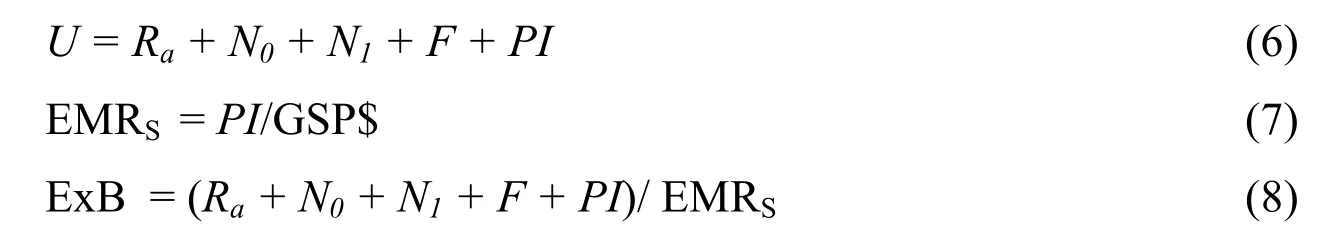

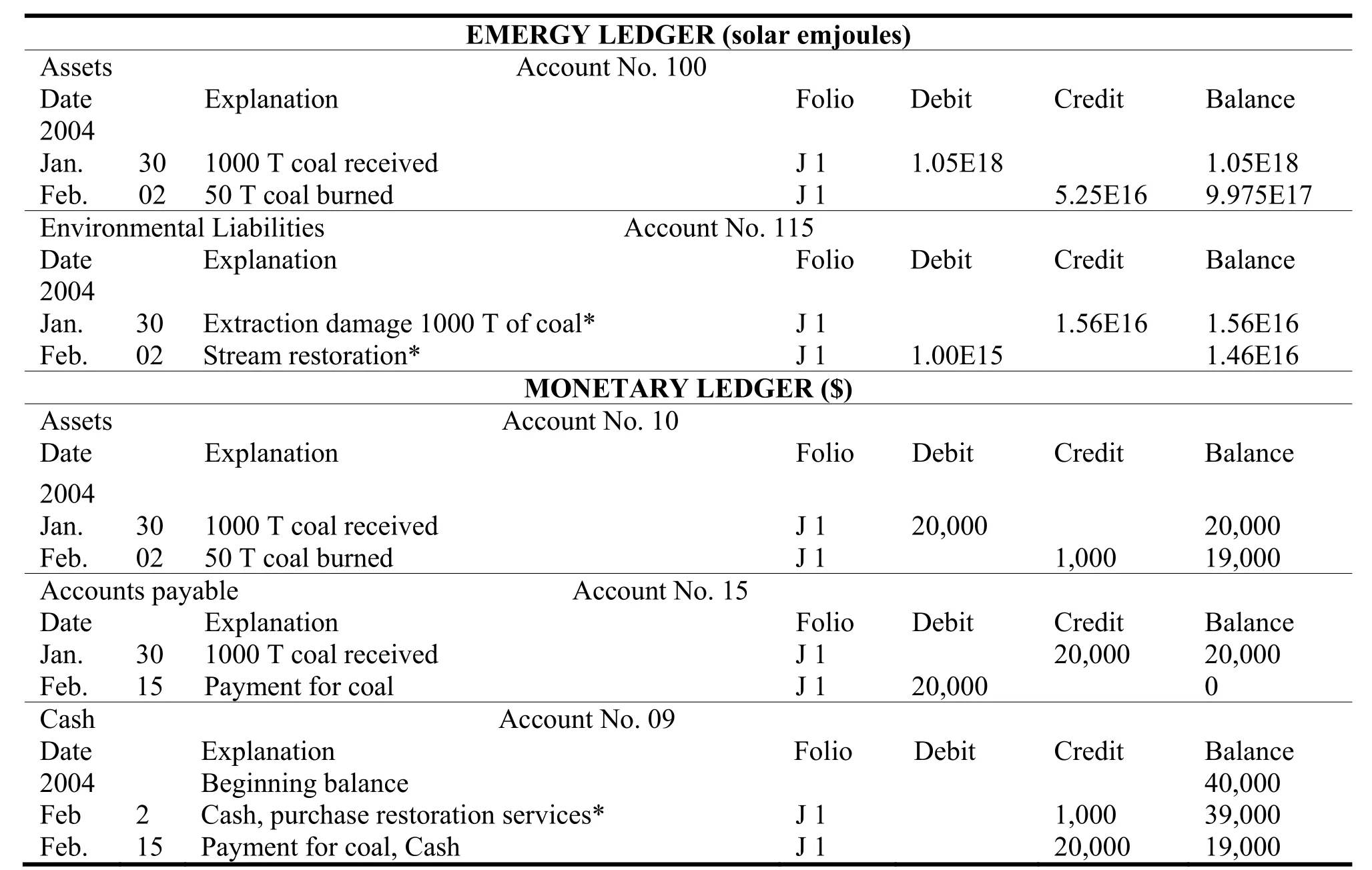

Table 1 An example of mixed journal entries for the transactions of a firm with entries cross-linked to the ledgers account numbers (L.F.) in Table 2

4.4 Emergy accounting: Journals, ledgers, and balance sheets

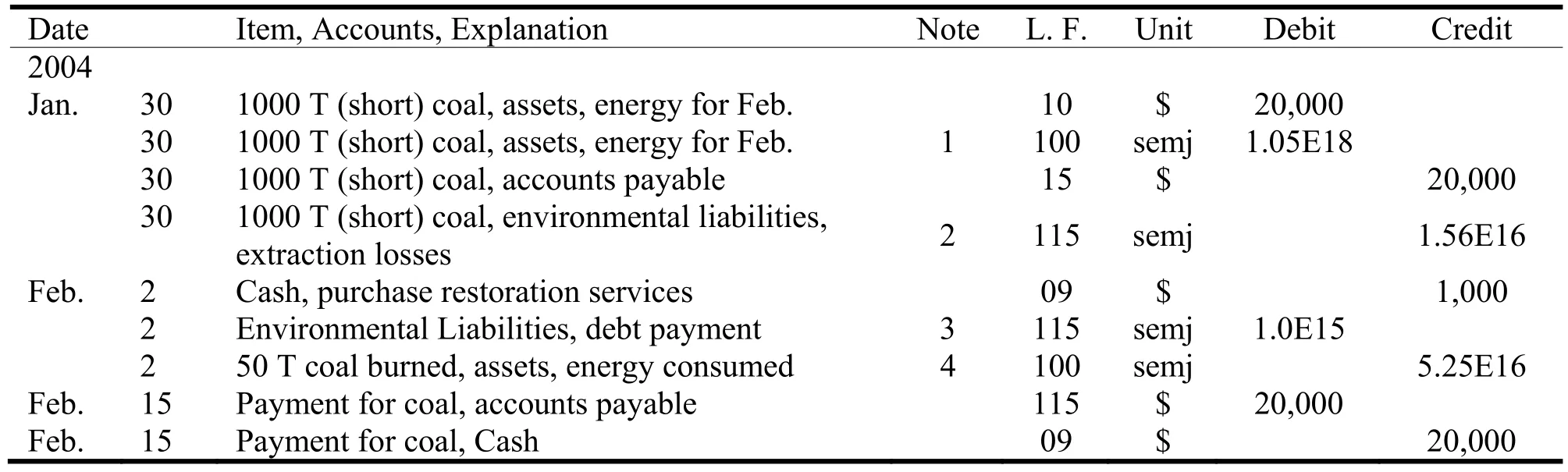

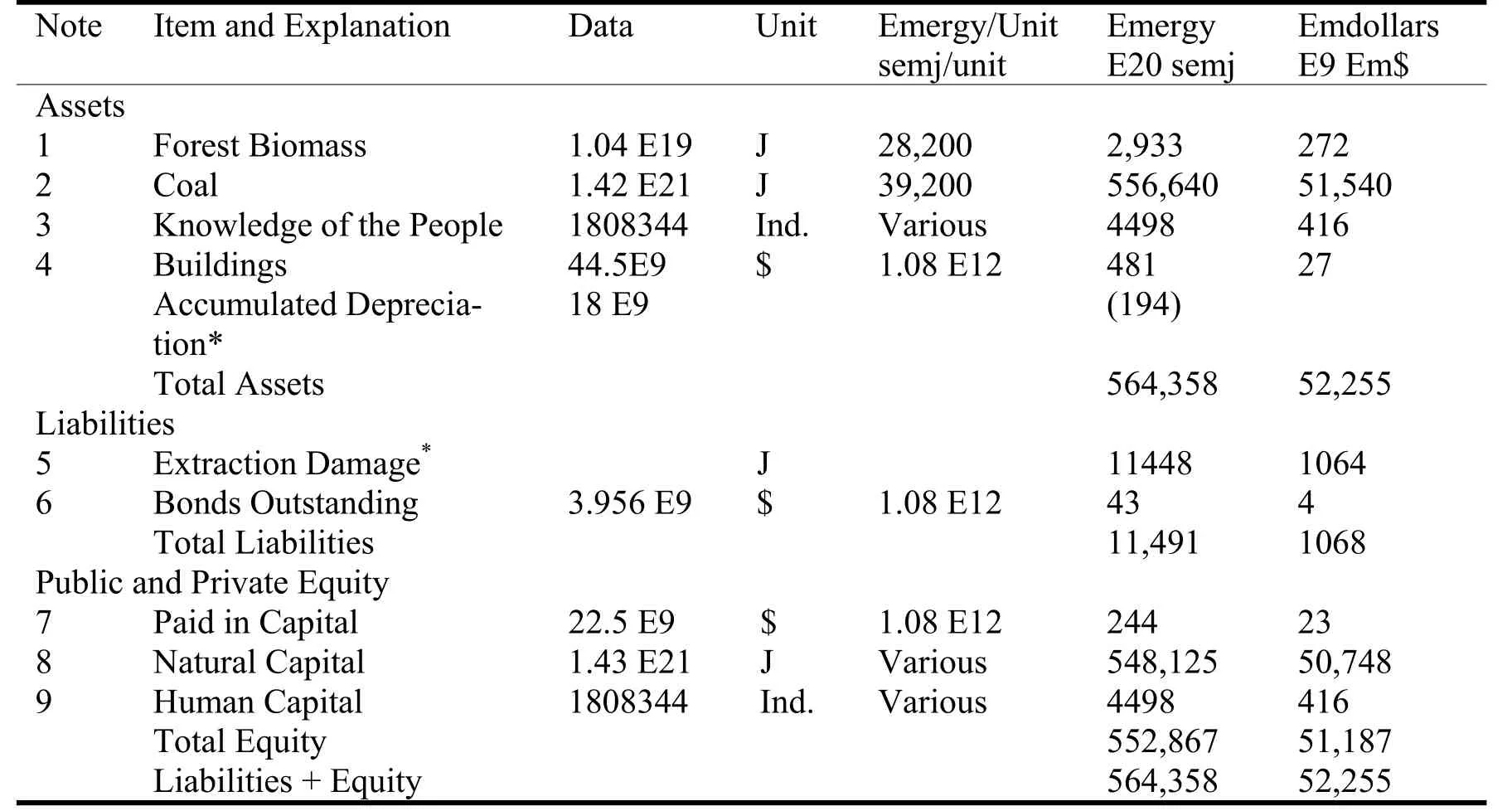

The creation of emergy and emdollar accounts for the environment will require emergy accounting tools such as the journal, ledger, and balance sheet used in financial accounting. Conversely, financial accountants who want to estimate the environmental liabilities of their institution or firm will need to adapt financial accounting methods to keep track of their system’s environmental liabilities. A complete development of unified monetary and emergy accounting methods lies in the future; however, a possible approach is to create a combined journal of transactions (Table 1) cross-indexed to parallel money and emergy ledgers. The ledgers (Table 2) can be used to produce money and emergy balance sheets and both series of accounts can be expressed in emdollars and brought together on a single unified balance sheet that shows both environmental and economic assets and liabilities (Table 3). The difference between assets and liabilities expressed in emdollars is the public or private equity or in other words the net real wealth of the system. The emergy or emdollar value of the nonrenewable resources is an indicator of the present capacity to repay environmental debt.

Table 2 An example of accounts in the Emergy and Monetary Ledgers with entries linked to appropriate page in the mixed journal of transactions (Folio) in Table 1

The details of economic transactions are recorded in the journal (Table 1). Financial journals record the following information: the date of the transaction, an explanation of the transaction, the accounts credited and debited, the number of the account credited or debited in the ledgers, and the amounts of the credit and debit. For emergy-money combined journaling the explanation must include the physical units and quantity of energy or material purchased or exchanged in the transaction or sufficient information to allow the determination of these quantities. A column needs to be added to the journal that references a note where the energy exchanged in the transaction is determined. This note will give a reference to the source of the transformity or the emergy per unit value of the energy, materials, or information exchanged or it will present a derivation of that value. Mass units and specific emergies rather than energy and transformity may be used where they are more convenient. When this method is fully developed the notes will refer to a large look-up table that contains the emergy per unit values of all the quantities normally needed to conduct business. An example of a combined journal page for a firm is given as Table 1.

Table 3 A partial emergy and emdollar balance sheet for the State of West Virginia in 2000 illustrating the operation of the fundamental equation of accounting to determine solvency. Starred items (*) are hypothetical estimates, thus no data is given. Transformities are expressed relative to the 9.26E+24 semjy-1baseline [31]

An account can be created for any category of asset, liability, or equity (including expenses and revenues) that might alter the balance in the fundamental equation of accounting for the reporting period. All money accounts are kept in the ledger (Table 2), which has columns for the date, an explanation of the entry, the journal page where the original transaction can be found and columns to indicate credits, debits, and the account balance. A similar format can be used for the emergy ledger with the addition of appropriate environmental and social accounts,e.g., environmental liabilities. An example of parallel ledgers for a firm is given in Table 2.

The emdollar balance sheet should be a statement of the overall position of an organization with respect to its solvency,i.e., the ability to pay its debts including debts owed to the environment for its unpaid work contributions to economic production. Using the method described above will allow us to equate human and environmental contributions to value as long as the necessary information on the education and experience of the human population of the system is available. At present, all the informationneeded to create a unified emdollar balance sheet for West Virginia has not been calculated. To show how it might be accomplished, the emergy to money ratio for the U.S. in 2000 [35], available data from West Virginia, along with an estimate for two unknown quantities (i.e., the environmental damage caused by extracting coal and building depreciation) were used to create a partial emdollar balance sheet for West Virginia (Table 3).

5 Conclusions

Environmental accounting using emergy can be used to document environmental liabilities and to construct a balance sheet that accounts for all economic and environmental work contributions to economic production. With minor modifications, emergy and emdollar measures fit logically into the format of standard financial accounting and bookkeeping tools. These tools show promise as models for further development of emergy accounting. In this paper a method for equating money and emergy accounts on the emdollar balance sheet was presented, thus solving a major technical impediment to developing a unified system of emergy and money accounting. Standard financial accounting tools are understood and accepted by managers, and therefore, they are expected to be helpful in communicating the results of emergy and emdollar accounting to decision-makers. The ability to make quantitative determinations of environmental liabilities and relate them to monetary measures may cause responsible people to explicitly recognize the magnitude of the debt that industrial society owes to the environment. If sustainable economic production systems are the goal, recognition of environmental debts implies an obligation to repay or perpetually service the debt. Environmental liabilities are balanced by the empower gains to society from using and possibly degrading environmental resources. Once all credits and debits in an environmental-economic system are known, recorded, and analyzed in emdollar units, the political process can be used to address questions of the appropriate debt load to be carried by society, and the schedule for repaying existing debts.

Acknowledgements

I thank Jerry Pesch, Sherry Brandt-Williams, Tingting Cai, Denis White and Lu Hongfang for reviewing this paper. Although the research described in this paper has been funded wholly (or in part) by the U.S. Environmental Protection Agency, it has not been subjected to Agency review. Therefore, it does not necessarily reflect the views of the agency.

[1] Odum, H.T. (1988), Self-organization, transformity, and information,Science, 242, 1132-1139.

[2] Odum, H.T. and Odum, E.C. (1983),EnergyAnalysisOverview of Nations. Working Paper WP-83-82, International Institute for Applied Systems Analysis, Austria: Laxenburg.

[3] Odum, H.T., Odum, E.C., Brown, M.T., Scott, G.B., Lahart, D., Bersok, C., and Sendzimir, J. (1986),Florida Systems and Environment: A Supplement to the Test Energy Systems and Environment, University of Florida, Center for Wetlands.

[4] Odum, H.T., Odum, E.C. and Blissett, M. (1987),The Texas System, Emergy Analysis and Public Policy, A Special Project Report, L.B. Johnson School of Public Affairs, University of Texas at Austin, and The Office of Natural Resources, Texas Department of Agriculture, Austin.

[5] Brown, M.T., Woithe, R.D., Odum, H.T., Montague, C.L. and Odum, E.C. (1993),Emergy Analysis Perspectives on the Exxon Valdez oil Spill in Prince William Sound, Alaska, Report to the Cousteau Society, Center for Wetlands and Water Resources, University of Florida, Gainesville.

[6] Ulgiati, S., Odum, H.T., and Bastianoni, S. (1994), Emergy use, environmental loading, and sustainability: An emergy analysis of Italy,Ecological Modelling, 73, 215-268.

[7] Campbell, D.E. (1998), Emergy analysis of human carrying capacity and regional sustainability: An example using the State of Maine,Environmental Monitoring and Assessment, 51, 531-569.

[8] Odum, H.T., Romitelli, S., and Tighe, R. (1998),Evaluation of the Cache River and Black Swamp in Arkansas, Final Report on Contract #DACW39-94-K-0300, Center for Environmental Policy, Environmental Engineering Sciences, University of Florida, Gainesville, FL.

[9] Odum, H.T., Odum, E.C. and Brown, M.T. (1998),Environment and Society in Florida, Boca Raton FL: St. Lucie Press, 449 pp.

[10] Tilley, D.R. (1999),Emergy Basis of Forest Systems, Ann Arbor MI: UMI Dissertation Services.

[11] Campbell, D.E. (2005), Financial accounting methods to further develop and communicate environmental accounting using emergy, In: Brown MT, Bardi E, Campbell DE, Comar V, Huang S-L, Rydberg T, Tilley DR, Ulgiati S. eds. Emergy Synthesis 3, Proceedings of the 3rd Biennial Emergy Research Conference, The Center for Environmental Policy, University of Florida, Gainesville FL, 185-198.

[12] Ortega, E., Scarcinelli, O., and De Souza, P.B.M. (2005), Combining bookkeeping techniques and Emergy Analysis, In: Brown MT, Bardi E, Campbell DE, Comar V, Huang S-L, Rydberg T, Tilley DR, Ulgiati S. eds. Emergy Synthesis 3, Proceedings of the 3rd Biennial Emergy Research Conference, The Center for Environmental Policy, University of Florida, Gainesville FL, 215-227.

[13] Campbell, D.E. and Lu, H.F. (2009), The emergy to money ratio of the United States from 1900 to 2007, In:Brown MT, Sweeney S, Campbell DE, Huang SL, Ortega E, Rydberg T, Tilley DR, Ulgiati S. eds. Emergy Synthesis 5, Theory and Applications of the Emergy Methodology, Proceedings of the 5th Biennial Emergy Research Conference, The Center for Environmental Policy, University of Florida, Gainesville FL, 413-448.

[14] Campbell, D.E. and Lu, H.F. (2009), The emergy basis for formal education in the United States, In:Brown MT, Sweeney S, Campbell DE, Huang SL, Ortega E, Rydberg T, Tilley DR, Ulgiati S. eds., Emergy Synthesis 5,Theory and Applications of the Emergy Methodology, Proceedings of the 5th Biennial Emergy Research Conference, The Center for Environmental Policy, University of Florida, Gainesville FL, 467-484.

[15] Campbell, D.E., Lu, H.F. and Kolb, K. (2011), Emergy evaluation of educational attainment in the United States, In:Brown MT, Sweeney S, Campbell DE, Huang SL, Ortega E, Rydberg T, Tilley DR, Ulgiati S. eds., Emergy Synthesis 6: Theory and Applications of the Emergy Methodology, Proceedings of the 6th Biennial Emergy Research Conference, The Center for Environmental Policy, University of Florida, Gainesville F, 483-500.

[16] Edwards, J.D., Hermanson, R.H., and Salmonson, R.F. (1975),The Basic Accounting Cycle, Learning Systems Company, Homewood, IL.Richard: D. Irwin, Inc., 214 pp.

[17] Odum, H.T. (1971),Environment, Power, and Society, New York:Wiley-Interscience, 336 pp.

[18] Odum, H.T. (1996),Environmental Accounting: Emergy and Environmental Decision Making, New York: John Wiley and Sons.

[19] Campbell, D.E. (2001), Proposal for including what is valuable to ecosystems in environmental assessments,Environmental Science and Technology, 35(14), 2867-2873.

[20] Deevey, E.S., Rice, D.S., Rice, P.M., Vaughan, H.H., Brenner, M., and Flannery, M.S. (1979), Mayan urbanism: Impact on a tropical karst environment,Science, 206, 298-306.

[21] Haug, G.H., Gunther, D., Petersen, L.C., Sigman, D.M., Hughen, K.A., and Aeschlimann, B. (2003), Climate and collapse of Maya civilization,Science, 299, 1731-1735.

[22] deMenocal, P.B. (2001), Cultural responses to climate change during the late Holocene,Science, 292, 667-673.

[23] Franz, E.H. and Campbell, D.E. (2005), Vivantary responsibility and emergy accounting, In:Brown MT, Bardi E, Campbell DE, Comar V, Huang S-L, Rydberg T, Tilley DR, Ulgiati S. eds. Emergy Synthesis 3, Proceedings of the 3rd Biennial Emergy Research Conference, The Center for Environmental Policy, University of Florida, Gainesville FL, 229-233.

[24] Franz, E.H. (2001), Ecology, values, and policy,Bioscience, 51(6), 469-474.

[25] Giesbrecht, M.G. (1972),The Evolution of Economic Society, W.H.Freeman&Co. San Francisco, CA. 353 p.

[26] Locke, J. (1690), Chapter 5, Of Property, In:The Second Treatise of Civil Government, http://www.constitution.org/jl/2ndtreat.htm Accessed 02/11/13.

[27] Gates, J.R. (1998),The Ownership Solution, Reading, MA.: Perseus Books, 388 pp.

[28] Campbell, C.J. and Laherrere, J.H. (1998), The end of cheap oil,Scientific American, (March), 78-83.

[29] Vitousek, P.M., Mooney, H.A., Lubchenco, J., and Melillo, J.M. (1997), Human domination of Earth’s ecosystems,Science, 227, 494-499.

[30] Odum, H.T. (1995), Self-Organization and maximum power, In:C.A.S. Hall ed. Maximum Power, the Ideas and Application of H.T. Odum, University of Colorado Press, Niwot, CO, 311-330.

[31] Campbell, D.E. (2000), A revised solar transformity for tidal energy received by the earth and dissipated globally: Implications for Emergy Analysis, In:Brown MT ed. Emergy Synthesis, Proceedings of the First Biennial Emergy Analysis Research Conference, The Center for Environmental Policy, Department of Environmental Engineering Sciences, Gainesville, FL, 255-263.

[32] Odum, H.T. (1971), An energy circuit language for ecological and social systems, its physical basis, In:Patten BC ed. Systems Analysis and Simulation in Ecology, Vol. 2, Academic Press, New York, 139-211.

[33] Odum, H.T. (1994),Ecological and General Systems: An Introduction to Systems Ecology, Niwot: University Press of Colorado, 644 pp. (Revised Edition of Systems Ecology).

[34] McConnell, C.M. (1966),Economics, Principles, Problems, and Policies, New York: McGraw-Hill Book Company, 792 pp.

[35] Campbell, D.E., Brandt-Williams, S.L., and Meisch, M.E.A. (2005), Environmental Accounting Using Emergy: Evaluation of the State of West Virginia, USEPA Research Report, USEPA/600R-05/006.

[36] Odum, H.T. (1989), Simulation models of ecological economics developed with energy language methods,Simulation, 53, 69-75.

[37] Campbell, D.E., Brandt-Williams, S.L., and Cai, T.T. (2005). Current technical problems in Emergy Analysis, In: Brown MT, Bardi E, Campbell DE, Comar V, Huang S-L, Rydberg T, Tilley DR, Ulgiati S. eds., Emergy Synthesis 3, Proceedings of the 3rd Biennial Emergy Research Conference, The Center for Environmental Policy, University of Florida, Gainesville FL, 143-157.

[38] DiGiovanni, D. (1990),Forest Statistics for West Virginia. U.S. Forest Service, Northeastern Research Station, RB-NE-114.

[39] West Virginia Research League (2000),2000 Statistical Handbook, West Virginia Research League, Inc., Dunbar Printing Company, Dunbar, WV.

26 January 2013

†Corresponding author.

Email: campbell.dan@epamail.epa.gov

ISSN 2325-6192, eISSN 2325-6206/$- see front materials © 2013 L&H Scientific Publishing, LLC. All rights reserved.

10.5890/JEAM.2013.01.003

Accepted 25 February 2013

Available online 2 April 2013

杂志排行

Journal of Environmental Accounting and Management的其它文章

- Global Gold Mining: Is Technological Learning Overcoming the Declining in Ore grades?

- Multi-scale Input-output Analysis for Multiple Responsibility Entities: Carbon Emission by Urban Economy in Beijing 2007

- Analysis of the Scientific Collaboration Patterns in the Emergy Accounting Field: A Review of the Co-authorship Network Structure

- Environmental Performance and Biophysical Constrains of Italian Agriculture Across Time and Space Scales

- Carbon Footprint and Life Cycle Assessment of Organizations

- Sustainability Ethics and Metrics: Strategies for Damage Control and Prevention