Impact of H1N1,H7N9,ASFV,dengue virus and COVID-19 on pharmaceutical manufacturing firms' R&D investments and economic consequences: Evidence from China

2023-11-17JieLiuWanqingZhengZhenLiuXiujingJiang

Jie Liu ,Wanqing Zheng ,Zhen Liu ,Xiujing Jiang

1College of Economics and Management, Fujian Agriculture and Forestry University, Fuzhou China

2Department of Social Economy and Business Administration, Woosuk University, Wanju-gun, Republic of Korea

ABSTRACT Objective:To determine the impact of major disease epidemics on pharmaceutical manufacturing firms' Research &Development(R&D) investments and economic consequences.Methods: The sample consists of 1 582 firm-year observations from 2009 to 2022 in China,of which,26.6% of pharmaceutical companies are involved in the diagnosis and treatment of prevalent diseases.Linear models using R&D investments,patent applications,operating performances and stock returns as dependent variables are constructed separately to examine the response of pharmaceutical companies to disease epidemics and the resulting economic consequences.Results: The prevalence of five major diseases led to a 17.5%increase in the amount of R&D investment and an 87.8% rise in the ratio of R&D investment to total assets by disease-related pharmaceutical companies,compared to unrelated pharmaceutical companies.Further evidence indicated that the patent applications for disease-related firms increased by 44.3% relative to unrelated firms after the epidemics.Though the impacts of the epidemics on firms’ operating performances were insignificant in the short term,a major disease epidemic was associated with an increase in stock returns of 67.4% and 44.6%,respectively,as measured by the capital asset pricing model and Fama-French five-factor model.Additional analysis revealed that the impacts of the epidemics on R&D investments and patent applications were more pronounced for nonstate-owned enterprises than state-owned enterprises.Conclusions:This study demonstrates that disease-related pharmaceutical firms respond to the disease epidemics through increasing R&D investment.More patent applications and higher market value are the main gains from the firms’ increased investments in R&D following the epidemic,rather than the improvements of short-term operating performances.

KEYWORDS:Exogenous demand shock;Research &Development;Disease epidemic;State-owned enterprise;Pharmaceutical manufacturing

1.Introduction

The National Health Commission of China defines major public health emergencies as "significant infectious disease outbreaks,widespread enigmatic illnesses,extensive foodborne intoxications,and other events precipitously arising that gravely jeopardize public health[1]." In recent years,the recurrent emergence of formidable diseases,such as COVID-19 in 2019,has engendered deleterious ramifications on both human health and economic growth[2-6],culminating in a 6.8% year-on-year contraction in GDP and a 4.9%year-on-year escalation in the Consumer Price Index (CPI) in the first quarter of 2020,as COVID-19 proliferated throughout China.

The emergence of pervasive diseases generates a significant exogenous demand shock for the relevant pharmaceutical manufacturing companies,primarily because such diseases increase the need for medical and healthcare services,especially novel therapeutics[7-10].The People's Bank of China promulgated the "Report on the Implementation of China's Monetary Policy in the First Quarter of 2020",which unequivocally advocated for the amplification of Research &Develop (R&D) investments in pharmaceutical entities and the fortification of the financial sector's backing for the pharmaceutical manufacturing industry[11].Prevalent diseases severely undermine societal public health,and pharmaceutical commodities constitute a vital instrument in combating these pernicious maladies.The R&D decision-making of disease-related pharmaceutical manufacturers is more susceptible to the influence of major diseases compared to unrelated enterprises.Consequently,it is imperative for policymakers,corporate managements,and market investors to ascertain whether major diseases,as exogenous demand shocks,impinge upon the R&D of pharmaceutical manufacturing firms,and to discern the economic repercussions of intensified R&D investments.

Drawing upon the lens of exogenous demand shocks,this study delves into the repercussions of large-scale disease outbreaks on the R&D investments of pharmaceutical enterprises specializing in the treatment of diseases.Our empirical findings reveal that these firms react to pandemics by augmenting their R&D investments,consequently catalysing an upsurge in patent applications.Moreover,the epidemics enhance the stock performance of disease-related firms compared to unrelated firms.Nevertheless,no discernible ramifications on operational performance are observed.Further analyses denote that the ramifications of exogenous demand shocks on R&D investments and outputs are more salient for non-stateowned enterprises (non-SOEs) compared to their state-owned counterparts (SOEs).

This research constitutes a substantial contribution to the burgeoning body of literature examining the determinants of firms'R&D investments.First,while the existing literature delineates factors influencing corporate innovation activities,encompassing managerial attributes[12],fintech advancements within urban environments[13],and fiscal policies[14],scant attention has been devoted to exploring exogenous demand shocks caused by the epidemics as a catalyst for R&D investment[15].By scrutinizing the repercussions of large-scale disease outbreaks on corporate innovation,this study enriches the extant literature on firm innovation.Moreover,unlike all prior studies which focus on the impact of the epidemics on the whole pharmaceutical industry,we divide pharmaceutical manufacturing companies into disease-related and disease-unrelated companies based on manually collected data,thus providing a clearer examination of the impact of disease prevalence on firms' R&D investments compared to the existing literature.Although pandemics affect all pharmaceutical companies simultaneously in the form of macro shocks,differences in operating characteristics lead firms to react differently to exogenous shocks.Pharmaceutical companies whose core business is directly related to a pandemic will respond more positively to an increase in external demand,so the impact of exogenous demand shocks can be examined in more details when these pharmaceutical companies were categorized into disease-related and disease-unrelated groups according to whether or not their core business styles suit to the pandemic.

Further,the consequences of the exogenous demand shock caused by the epidemics in an economic sense remain understudied.We originally examine the impact of disease epidemics on the stock price performance and operating performance of disease-related companies,which indicates that market investors react positively,thus boosting the market value of the companies,but that the shortterm operating performance is not significantly improved.For the first time,our results suggest that the main driver for increased R&D investment in the aftermath of a pandemic is to improve the company's long-term competitiveness rather than to enhance shortterm operating performance,while the capital markets recognize the positive role of the innovative activities.Finally,although Yuan and Wen[16] underscore significant disparities between SOEs and non-SOEs concerning innovation,the extent and manner in which these entities divergently respond to pandemics through R&D investment and output enhancement remain inadequately explored.Addressing this lacuna,we furnish empirical evidence elucidating the moderating effect of state ownership on corporate innovation.

2.Material and methods

2.1. Research hypothesis

It is well documented in literatures that demand shocks caused by government policies stimulate innovation in the pharmaceutical industry.The government's policy guidance and support create a favourable market environment for the pharmaceutical industry,stimulating more innovation and technological progress[17-19].The adoption of health policies aimed at stimulating the use of drugs and vaccines will stimulate research into innovative drugs and clinical trials of new vaccines[20].Meanwhile,the model developed by Duboiset al.[21] demonstrates a significantly positive elasticity of innovation to expected market size,with an additional $200 million in revenue incentivizing the invention of a new chemical entity.In addition,emerging epidemics create a surge in demand for vaccines because getting the majority of people vaccinated with effective and safe vaccines to create herd immunity is an important way to stop the spread of epidemics[22-25].Furthermore,the complications of epidemics lead to a shortage of related medical supplies[26].Major epidemics trigger a surge in public demand for medical products.As the epidemic spreads,hospitals and healthcare facilities often face shortages of medical supplies[25].To meet this urgent demand,pharmaceutical companies must not only increase the production and supply of existing products,but also step up their research and development efforts to develop more effective,safer and innovative medical products[27,28].A major disease is therefore an external demand shock for the pharmaceutical industry,leading to an expansion of the market size and demand for pharmaceutical products,and thus prompting pharmaceutical companies to increase their innovation efforts[29].Based on the theoretical and empirical evidence,we expect a positive relationship between major diseases and R&D investments by disease-related firms.

Hypothesis 1: The epidemic of a major disease will result in significantly higher R&D investment by disease-related firms than by unrelated firms.

The management of companies are highly interested in determining whether R&D investment generates sufficient returns to offset the significant costs associated with the R&D process.The number of patent applications is a critical metric for measuring a company's innovation capabilities and gauging the outcomes of R&D investment[30].Literatures suggest that adequate R&D investment is an essential prerequisite for achieving innovative outcomes[14,31,32].Consequently,we posit that the growth of R&D investment prompted by disease epidemics can increase a company's R&D output,leading to an increase in the number of patent applications.Moreover,the growth of R&D investment serves as a mediating variable for the increase in the number of patent applications.Based on this fact,we put forth Hypotheses 2a and 2b.

Hypothesis 2a: The epidemic of a major disease will result in significant more patent applications for disease-related firms than for unrelated firms.

Hypothesis 2b: The increased R&D investments play a mediating role in the impact of disease epidemics on increasing the number of patent applications for disease-related firms.

The literature show evidence that an increase in R&D investment leads to an improvement in operating performance[33,34].Higher R&D intensity can improve firms' competitiveness and increase the quantity and quality of operating revenue[35].In addition,Panditet al.[31] reported that high quality patents with a large number of citations are positively associated with future operating performance and can reduce the instability of operating performance.Therefore,we infer that the increased R&D following exogenous demand shocks caused by the epidemic of major diseases will lead to improved operating performance of disease-related firms.

Hypothesis 3: The epidemic of a major disease will result in significant better operating performance for the disease-related firms than for the unrelated firms.

Theoretically,an increase in a firm's intangible assets will be reflected in its market value,which will manifest itself in an increase in the share price.The existing literature highlights the essential role of R&D investment in asset pricing.For example,Eberhartet al.[33]show that firms have significant higher stock returns in the five years following an increase in R&D.Houet al.[34] confirm the role of R&D investment in the asset pricing of international stock markets,indicating that R&D-intensive firms tend to have significantly higher stock returns and that the relationship is driven by the risk premium of investors.Since the value of intangible assets created by R&D investment following exogenous demand shocks will be reflected in the stock price and stock returns will be enhanced,we propose Hypothesis 4.

Hypothesis 4: The epidemic of a major disease will result in significant higher stock returns for disease-related firms than for unrelated firms.

The research model is presented in Figure 1 and is based on the demand shock,innovation,and asset pricing literature.We aim to examine the effect of the epidemic of major diseases on corporate R&D investment.We are also interested in the economic effects(i.e.,patent application,operating performance and stock return)following the epidemic.

Figure 1.The hypothetical model.H1: Hypothesis 1;H2a: Hypothesis 2a;H2b: Hypothesis 2b;H3: Hypothesis 3;H4: Hypothesis 4.

2.2. Data and variable construction

Our sample consists of the pharmaceutical manufacturing firms in China from 2009 to 2022.The data sources include: (1) China Stock Market &Accounting Research Database (CSMAR),which provides financial data,stock return and major diseases in China;(2)China Research Data Service Platform (CNRDS),which provides data on firms’ patent applications.We exclude the ST (Special Treatment) stocks for their trading rules are significantly different from other stocks.The filtered sample contains 241 pharmaceutical manufacturing firms with a total of 1 582 firm-year observations.

2.2.1.Dependent variables:R&D investments and economic consequences

Following Renet al.[32] and Chiet al.[36],we adopt the natural logarithm of the total amount of R&D investment (RD_amount) and the ratio of R&D investment to total assets (RD_asset) to measure the intensity of R&D investment.In the robustness test,we also take the ratio of R&D investment to operating revenue (RD_revenue) as a measure of R&D investment.

To examine the economic consequence of the increased R&D investment caused by the exogenous demand shock,we take three aspects into consideration,including patent applications,operating performances,and stock returns.First,following Cumminget al.[37],we use the logarithm of 1 plus the total number of patent applications to measure the patent creation (Patent).We use the logarithm of 1 plus the number of invention patent applications to measure the patent creation (PatentInv) for the robustness test.Besides,we use patent applications instead of patent granted because Grilicheset al.[30] suggest the patent application is more representative of the innovation and therefore significantly more informative.Second,following Changet al.[38],we use the return on assets (Roa) and the operating revenue (OR) to measure the firm's operating performance.Finally,we measure the firm's stock performance using the cumulative abnormal return adjusted by Capital Asset Pricing Model(CAR_CAPM) and the cumulative abnormal return adjusted by Fama-French five-factor model (CAR_FF5F),following Fama and French[39].

2.2.2.Explanatory variables:major diseases and diseaserelated firms

We manually collect information related to 5 major diseases from the official website of the National Health Commission of the People's Republic of China,which were widespread and had significantly adverse impact on public health in China.Table 1 presents the detailed information on the 5 major diseases prevalent in China during the period between 2009 and 2022,including the disease name,the virus name,the city where the first case is detected,the date when the first case is detected,and the epidemic duration.The dummy variableEpidequals 1 if there is an epidemic of major diseases during the year,and equals 0 otherwise.

Table 1.Major diseases prevalent in China from 2009 to 2022.

Importantly,we construct an indicator to measure whether an enterprise is related to the major disease based on whether its core business is involved in the prevalent disease (Related).Specifically,we manually collect and read the annual reports to determine the correlation between a pharmaceutical manufacturing company and the prevalent disease of the year.An enterprise is defined as a disease-related firm (Related=1) if its core business involves the research,production and marketing of drugs and vaccines for related diseases.

2.2.3.Control variables

Halloa! you Turkish nurse, said he, what is that great castle there close to the town? The one with the windows so high up? The sultan s daughter lives there, she replied

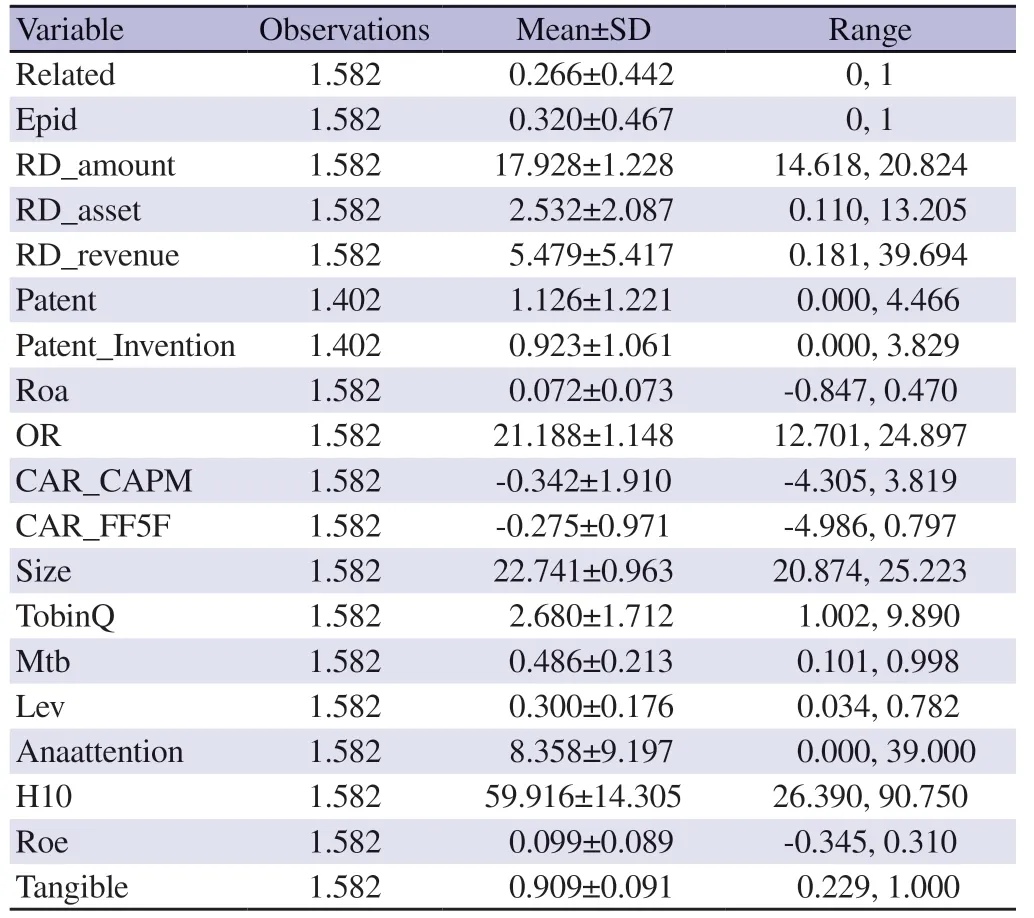

Following previous studies[13,37],the market value (Size),Tobin's Q value (TobinQ),market-to-book ratio (Mtb),leverage ratio (Lev),analyst attention (Anaattention),equity concentration (H10),return on equity (Roe) and the proportion of tangible assets (Tangible) are adopted as control variables.The detailed definitions of all of the variables used in the paper are presented in the notes of Table 2.

Table 2.Summary statistics for all the variables.

2.3. Empirical model

To investigate the effect of a major disease on disease-related firms' R&D investment,we adopt the ordinary least squares (OLS)regression model as specified in Model (1):

WhereRDi,tis the R&D investment intensity of firmiin yeart.Epidtis a dummy variable indicating whether there is an epidemic of major diseases in yeart.Relatedi,tis a dummy variable indicating whether firmiis related to the major diseases in yeart.Controlsi,tis a set of control variables.YearFEare year fixed effects.εi,tis the error term.

Moreover,we investigate the economic consequence of the prevalence of major disease from three respects: patent applications,operating performances and stock returns.First,we establish the OLS regression Model (2) to examine the impact of the major disease epidemics on the patent applications.

WherePatenti,t+1is the patent applications of firmiin yeart+1.Epidtis a dummy variable indicating whether there is an epidemic of major diseases in yeart.Relatedi,tis a dummy variable indicating whether firmiis related to the major diseases in yeart.Controlsi,tis a set of control variables.YearFEare year fixed effects.εi,tis the error term.

Further,following Baron and Kenny[40],we construct Model (3) to test the mediating role that increased R&D investment plays in the number of patent applications boosted by the prevalence of major diseases.

WherePatenti,t+1is the patent applications of firmiin yeart+1.Epidtis a dummy variable indicating whether there is an epidemic of major diseases in yeart.Relatedi,tis a dummy variable indicating whether firmiis related to the major diseases in yeart.RDi,tis the R&D investment intensity of firmiin yeart,which is the mediating variable of interest to us.Controlsi,tis a set of control variables.YearFEare year fixed effects.εi,tis the error term.

WhereOPi,tis the operating performance of firmiin yeart,including the return on assets (Roa) and the operating revenue(OR).Returni,tis the stock return of firmiin yeart,including the cumulative abnormal return adjusted by Capital Asset Pricing Model(CAR_CAPM) and the cumulative abnormal return adjusted by Fama-French five-factor model (CAR_FF5F).Epidtis a dummy variable indicating whether there is an epidemic of major diseases in yeart.Relatedi,tis a dummy variable indicating whether firmiis related to the major diseases in yeart.Controlsi,tis a set of control variables.YearFEare year fixed effects.εi,tis the error term.

3.Results

3.1. Descriptive statistics

All continuous variables used in the paper are winsorized at the 1% and 99% percentiles.Table 2 reports descriptive statistics for the key variables.During the sample period,32.0% of the firmyear observations have witnessed an epidemic of a certain disease.Moreover,the mean value of the ratio of R&D investment to total asset (RD_asset) is 2.532% which is consistent with previous reports.

3.2. R&D investment and economic consequence

3.2.1.R&D investment

Epidemic-driven demand shocks expand the market size of pharmaceutical products and thus promoting pharmaceutical companies’ innovation activities.We examine whether diseaserelated firms tend to increase R&D investment when faced with major diseases using Model (1).Columns (1) and (2) of Table 3 presents the regression results,which shows that the coefficients of the interaction term (Epid*Related) are significantly positive,indicating that the prevalence of major diseases leads to a 17.5%increase in the amount of R&D investment and a 87.8% rise in the ratio of R&D investment to total assets by disease-related pharmaceutical companies,compared to unrelated pharmaceutical companies.

Table 3.The impact of the epidemic on R&D investment and patent application.

Overall,the results support our Hypothesis 1 that when faced with the epidemic of major diseases,related firms tend to increase R&D investments to respond to the following demand shock,which is in line with Finkelstein[17] and Blume-Kohout and Sood[20] that the increases in market size introduced by public health policies will stimulate firms' R&D investments.

3.2.2.Patent application

The extant literature[14,32] posit that sufficient investment in R&D is a critical prerequisite for achieving innovative outputs.We employ Model (2) to examine the impact of disease epidemics on the number of patent applications for disease-related pharmaceutical companies.Column (3) of Table 3 reports the estimation results,which shows that the coefficient of the interaction term (Epid*Related) is positively significant at the 1% level.The results indicate that the patent applications (Patent) for disease-related firms increase by 44.3% relative to unrelated firms after the epidemics,which is consistent with the findings of Grilicheset al.[30],providing supporting evidence for Hypothesis 2a.

To further investigate the mechanism underlying the relationship between major diseases and patent applications,we examine the mediation effect of R&D investments following Baron and Kenny[40].Specifically,we estimate the magnitude of the mediation effect by multiplying the coefficient on the impact of disease epidemics on R&D investment with the coefficient on the impact of R&D investment on patent applications.Columns (4) and (5) of Table 3 present the regression results of Model (3),demonstrating the mediating effect of R&D investments,measured by R&D expenditure (RD_amount) and the ratio of R&D investment to total asset (RD_asset),on innovation output,with the estimated mediation effects of 3.5% (0.175*0.198) and 4.6% (0.878*0.052),respectively.The results indicate that the firms’ investment in R&D pays off in terms of more innovative outputs,thus confirming Hypothesis 2b.

3.2.3.Operating performance

The literature provides evidence that increasing R&D investment can enhance a company's operating performance,such as Eberhartet al.[33] and Houet al.[34] reported.We construct Model (4) to examine the impact of the epidemics on disease-related firms’operating performances in the short term and the empirical results are presents in Table 4.Columns (1) and (2) of Table 4 show that the coefficient of interaction term (Epid*Related) are statistically insignificant,thereby implying that exogenous demand shocks resulting from disease epidemics exert no significant effect on firms’operating performances measured by the return on assets (Roa)and the operating revenue (OR) in the short term.Consequently,our findings fail to lend support to Hypothesis 3,which could be attributed to the fact that heightened investments in R&D triggered by major disease epidemics can potentially enhance firms' long-term market competitiveness without commensurately ameliorating shortterm operational performance.Our results challenge the findings of previous literature[33] that increased R&D investment can improve operational performance in the short term,but are congruent with other literature that argues that the beneficial effect of R&D investment on operational performance exhibits a lag of 2-3 years[41],while innovation enhances long-term competitiveness and elicits an immediate response in market valuation[42].

Table 4.The impact of the epidemic on operating performance and stock return.

3.2.4.Stock return

We examine Hypothesis 4 by testing the effect of major diseases on stock returns with Model (5).Columns (3) and (4) of Table 4 demonstrate significant differences in stock returns between disease-related and unrelated firms following a major disease.The coefficients of interaction term (Epid*Related) are all positive and significant at the 1% level.Specifically,on average,a major disease epidemic is associated with 67.4% and 44.6% higher stock returns for related firms relative to unrelated firms,measured by the capital asset pricing model (CAPM) and Fama-French five-factor model(FF5F),which consistent with results of previous literatures that R&D investments increase market values[33,34].In comparison,Houet al.[34] point out that the difference in stock returns between the highest and lowest quartile of R&D investment in listed companies amounted to approximately 7%.For these disease-related firms,high R&D investments caused by disease-driven demand shocks enable them to exploit growth opportunities and to possess intangible assets,thus leading to higher stock returns.The Hypothesis 4 is therefore verified.These results suggest that the main economic motivations for companies to increase their R&D investments following the demand shock caused by the epidemics is to improve the longterm competitiveness rather than to enhance short-term operating performance,while the financial market investors are willing to give higher stock valuations and recognize the company's efforts in innovation.

3.3. State ownership

We further investigate the difference of the impact of the epidemics on the R&D investment between state-owned enterprises (SOEs)and non-state-owned enterprises (non-SOEs).The literature suggests that SOEs may be committed to social and political goals rather than economical goals,and therefore SOEs are less efficient than non-SOEs in innovation activities[16].As a result,we expect that disease-related SOEs respond more positively to the exogenous demand shock than disease-related non-SOEs in terms of both R&D investments and patent applications.The empirical results shown in Table 5 indicate that the coefficients of interaction term(Epid*Related) are more significant in the subsample of non-SOEs,demonstrating that the epidemic of major diseases results in increasing innovations of the disease-related non-SOEs,while has insignificant effect on SOEs.The results are consistent with the report of Yuan and Wen[16],supporting the argument that SOEs are less motivated to innovate than non-SOEs.

3.4. Robustness test

To confirm the robustness of the empirical results,we adopt an alternative measure of R&D investment intensity,which is taken as the ratio of a firm's R&D investment to the operating revenue (RD_revenue).Columns (1) and (2) of Table 6 report the estimation results of Model (1),which indicates that major diseases have a positive and significant relationship with the R&D investment of disease-related firms,confirming that our baseline results are robust for different measures of the R&D intensity.

Table 6.Robustness test-alternative measure of R&D investment and patent application.

Furthermore,patents in China are divided into three categories:invention patents,utility model patents,and design patents.Invention patents mainly involve the proposal of new products or processes,which have the highest technological content and novelty among the three types of patents.In order to take into account the quality of the patents obtained by firms,we use the logarithm of 1 plus the number of invention patent applications (Patent_Invention) as an alternative measure of R&D output to confirm the robustness of our results.The estimation results of Model (2) are reported in Columns (3) and(4) of Table 6,suggesting that there is a strong positive correlation between major epidemics and patent creation by disease-related firms,supporting the robustness of our baseline results.

4.Discussion

This paper examines the effect of exogenous demand shocks caused by the epidemic of major diseases on the R&D investments and outputs of pharmaceutical manufacturing firms in China.Wefind evidence that the epidemic of major diseases promotes R&D investment,hence leading to significantly more patent applications.Moreover,the epidemics enhance the stock performance of diseaserelated firms compared to unrelated firms.However,there is no significant difference between their operating performances in the short term.Further,we find that the R&D investments and outputs of non-state-owned enterprises are more significantly promoted by exogenous demand shocks. This study makes valuable contributions to the literature by demonstrating whether and how firms,especially disease-related firms,respond to exogenous demand shocks through R&D investment.The mediation effect test shows that major diseases boost the number of patents produced by firms by increasing their R&D investments,which proves the effectiveness of firms’ efforts on innovation.Even though the enhanced R&D investments cannot promote their operating performance immediately,stock prices respond significantly positive to the higher R&D investments,offering the policy insight that increasing R&D investments will have a powerful positive effects on firm values.These results show that stronger long-term market competitiveness and higher market value are the main gains from the firms’ increased investments in R&D following the epidemic,rather than short-term operating performances.

Our findings have rich policy implications regarding the enhancement of innovation dynamics in the pharmaceutical industry.Firstly,companies should be fully aware of the positive role of innovation in improving patent outputs and market values,and increase their R&D intensity when faced with exogenous demand shocks to seize growth opportunities.Moreover,the positive feedback from the financial markets on pharmaceutical companies' R&D investments can be leveraged to guide the financial markets to better serve the real economy.In addition,the government may formulate industrial policies to increase the willingness of pharmaceutical manufacturing companies to participate in innovation,for example by providing subsidies and tax breaks to reduce the cost of innovation.In fact,the Chinese government has introduced a number of policies to support R&D in pharmaceutical companies in recent years.For example,in 2020,the Chinese government has reduced the tax burden on enterprises by providing full refunds of incremental VAT credits to manufacturers of key materials for epidemic prevention and control.In 2023,the Chinese government expects to provide RMB 1.8 billion in financial resources to support enterprises in research and development for monitoring key infectious diseases and health hazards.Finally,given the shortcomings of the incentive mechanism of state-owned enterprises,the government is supposed to improve the management efficiency of state-owned enterprises to increase the enthusiasm of state-owned enterprises in R&D activities.

We acknowledge that there are several limitations that need to be addressed in future studies.Firstly,we confirm the impact of major diseases on the quantity of R&D inputs and outputs of firms,while the efficiency or quality of innovation have not been taken into consideration and need to be further explored in future studies.Secondly,we find that increased R&D investment driven by exogenous demand cannot significantly improve firm operating performance,and future research needs to further examine the mechanism by which the increased R&D investments increase firm value.Finally,future research could utilize global cases to provide more comprehensive findings.

Conflict of interest statement

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Funding

This work was supported by the National Natural Science Foundation of China (No.71903030),the Natural Science Foundation of Fujian Province (No.2020J01562),and the Funds for Distinguished Young Scientists of Fujian Agriculture and Forestry University (No.XJQ2020S3).

Data availability statement

The data that support the findings of this study are available from China Stock Market &Accounting Research Database (CSMAR)and China Research Data Service Platform (CNRDS),but restrictions apply to the availability of these data,which were used under license for the current study,and so are not publicly available.Data are however available from the authors upon reasonable request and with permission of CSMAR and CNRDS.

Authors’contributions

Conceptualization by JL and WQZ;Formal analysis by WQZ and ZL;Methodology by JL;Supervision by JL,ZL and XJJ;Writingoriginal draft by JL and WQZ;Writing-review &editing by JL,ZL and XJJ.

杂志排行

Asian Pacific Journal of Tropical Medicine的其它文章

- Malaria slide bank plays a crucial role in achieving and sustaining malaria elimination in India

- Insecticide resistance status of Aedes aegypti and Aedes albopictus in Malaysia (2010 to 2022): A review

- South Asian dairy smallholders: A scoping review of practices and zoonoses

- Risk estimation of chronic kidney disease in a leptospirosis endemic area: A casecontrol study from south Andaman Islands of India

- Aeromonas hydrophila infection in acute myeloid leukemia: A case report

- Protection against symptomatic SARS-CoV-2 infection during the second wave among individuals with pre-existing binding antibodies to SARS-CoV-2: A population-based study from Puducherry,India