Optimizing convergence for dual-credit policy and carbon trading in the automobile sector: A bi-layer planning model

2023-11-15HaonanHeJiaxinSunChaojiaZhangJieZhaoandShanyongWang

Haonan He ,Jiaxin Sun ,Chaojia Zhang ,Jie Zhao✉,and Shanyong Wang

1School of Economics and Management,Chang’an University,Xi’an 710064,China;

2School of Public Affairs,University of Science and Technology of China,Hefei 230026,China

Abstract: A growing call has been made to convert the dual-credit policy to carbon trading to further unleash the carbon reduction potential of the automobile sector as China’s dual-carbon strategy progresses.However,controversy exists in academia about the convergence timing of the two policies.Therefore,this paper builds a bi-layer planning model to show the interaction between government policies and automakers’ production and R&D decisions,based on which to explore the optimal decision on carbon trading’s introduction timing and carbon quotas.The results show that the current is not the optimal time to bridge the two policies considering the price difference between carbon pricing and credits.Interestingly,we find that the reduction in carbon emissions per vehicle for new energy vehicles and conventional fuel vehicles has an opposite effect on the optimal timing of the introduction of carbon trading.Moreover,a comparison of the impact of new energy vehicle profits and carbon prices on the timing of introduction shows the former has a greater impact on the adoption of carbon trading in the automobile sector.

Keywords: policy convergence;dual-credit policy;carbon trading;bi-layer planning model

1 Introduction

China currently holds the position of the world’s largest carbon emitter,and the rapid growth of vehicles in the country has made a significant contribution to global CO2emissions.Therefore,reducing automobile emissions has become a critical component in achieving China’s dual-carbon target.Among the available options for vehicle emission reduction,new energy vehicles (NEVs) are widely recognized as offering significant benefits compared to conventional fueled vehicles (CFVs)[1,2].To incentivize automakers to produce more NEVs,the Chinese government implemented the dualcredit policy (DCP) in 2017,which has indeed led to a noteworthy increase in the market share of NEVs.However,the impact of this policy on reducing carbon emissions for the entire industry is limited from a life cycle perspective.Therefore,scholars have recommended that DCP be transformed into carbon trading (CT) and the automobile market be incorporated into the carbon trading market to further unleash the emission reduction potential of the automobile sector.The Decision on Amending the Parallel Management Measures of Average Fuel Consumption and New Energy Vehicle Credits for Passenger Vehicle Automakersissued by the Ministry of Industry and Information Technology (MIIT) of the People’s Republic of China on July 7th,2022,explicitly mentions the need to establish a mechanism linking DCP with other carbon emission reduction systems①https://www.miit.gov.cn/jgsj/zbys/qcgy/art/2022/art_c6e29d118a9042f b9450d7d176463518.html..This indicates that the convergence of DCP and CT is an imperative measure to achieve China’s carbon emission reduction goals.

DCP aims to promote the automobile sector to switch from traditional fuel vehicles to green new energy vehicles.However,CT focuses on improving the production process and emission reduction technology from the perspective of green production.As a result,there is a debate over the timing of their convergence.Some scholars advocated for immediate integration of DCP and CT to increase carbon reduction,while others contend that the current timing is suboptimal②http://www.tanjiaoyi.com/article-34703-2.html..The latter group cited two reasons for their argument.First,the withdrawal of NEV subsidies by the end of 2022 could undermine the competitiveness of NEVs in the market.Credit prices,relative to current carbon prices,have greater potential to replace the subsidy policy and continue driving the development of NEVs[3].Second,technological advancements are likely to reduce the cost of carbon reduction,and delaying the convergence of these two policies may be more conducive to future carbon reduction efforts[4].Therefore,understanding the influence of CT on automakers’ decisionmaking and identifying the optimal timing for introducing CT are critical scientific issues that require urgent attention.

While previous studies have primarily focused on optimizing production and carbon quota decisions by automobile companies and governments after the implementation of CT in the automobile market,few studies have examined the optimal timing for introducing such policies.Therefore,this study aims to complement existing research on this topic.Moreover,it is crucial to consider the fact that policy implementation will inevitably influence corporate decisions,and the performance of automakers’ decisions will drive policy adjustments.As such,it is necessary to understand (i) how do government policies affect automakers’ production and R&D decisions,and (ii) how can the government scientifically determine the timing and carbon quota in response to automakers’ operational decisions.Therefore,this paper constructs a bi-layer planning model to depict the mutual influence mechanism for studying the optimal convergence timing of CT and DCP and carbon quota decisions.

The rest of this paper is organized as follows.Section 2 is a review of the relevant literature.Section 3 presents the benchmark model and optimization objectives of this paper.Section 4 presents the optimal decision of the benchmark scenario based on market data and the sensitivity analysis of some key parameters.Finally,Section 5 summarizes the main results of this paper.

2 Literature review

The literature closely relevant to our topic mainly consists of research on CT in the automobile market and on policy convergence.In the following subsection,we provide a detailed review of these studies.

2.1 Research on CT in the automobile market

The first stream has focused on the implementation of CT in the automobile market.This approach can significantly reduce carbon emissions in the transportation industry and thereby promote comprehensive emission reduction,accelerating the achievement of carbon neutrality.Accordingly,it has been commonly suggested that the transportation industry should be included in the carbon trading market[5].

First,the literature has extensively examined government intervention in the carbon market from various perspectives,including literature analysis,modeling,and empirical approaches[5-10].Scholars generally support the inclusion of the transportation sector in the carbon trading market and have identified several factors that influence the implementation of CT,such as carbon price,carbon emissions,and consumer awareness.Previous research has shown that carbon prices can effectively curb carbon emissions[11,12],while an increase in carbon emissions can decrease social welfare[13,14].Furthermore,low-carbon awareness among consumers can positively impact both carbon emission reduction and social welfare[15,16].However,most of the literature has overlooked the impact of corporate decisions on policy adjustments.Therefore,this study takes into account corporate production and R&D decisions to determine the optimal government decisionmaking process.

Second,existing research from an automaker perspective has mainly focused on the optimization of production and R&D decisions for the automaker.Previous studies have investigated the impact of CT on corporate production decisions by modeling and found that CT promotes automakers’production of NEVs[17,18].Scholars have also reached a consensus that CT has great potential to promote technological innovation[19-21].Empirical studies have further explored the impact of CT on carbon emission reduction efficiency and suggested that CT can lead to low-carbon technological innovation,which in turn has a positive impact on carbon emission reduction[10,22].

Despite extensive research,there is an interrelationship between automakers’ and governments’ decisions that most studies have neglected[13].Therefore,this study depicts the interaction between the government and automakers by building a bi-layer planning model.Specifically,the government considers automakers’ production and R&D levels when formulating CT introduction timing and carbon quotas,while automakers use the policy as a reference when deciding on their production and R&D strategies.

2.2 Research on low-carbon policy convergence

The second stream of research focuses on low-carbon policy convergence.This literature review discusses two aspects:low-carbon policy convergence in the automobile sector and other industries.

The automobile sector is a significant contributor to carbon emissions[23,24].It is a key industry related to national livelihoods and energy consumption,and therefore the formulation of its carbon reduction policies has received widespread attention from the government and academia[25,26].Existing low-carbon policies in the automobile sector include DCP,CT,consumption subsidies,R&D subsidies,and carbon tax policies.Regarding bridging the DCP and the subsidy policy for automakers,Li and Ku et al.[27,28]analyzed the impact of these policies on automakers’ production and R&D decisions.They found that the DCP is more likely to promote the production and technological development of NEVs.Regarding the convergence of CT and subsidies for consumers,for example,Nie and coworkers[2]compared the emission reduction effects of CT and subsidy policies and found that CT is more effective.They suggested that the government adjust the carbon price according to the cost gap between CFVs and NEVs.Furthermore,Kong et al.[17]and Nie et al.[29]explored the optimal decisions of car manufacturers and governments under CT after the withdrawal of subsidies.Their results suggested that car manufacturers should actively layout technology and product innovation,and the government should reduce carbon quotas and raise carbon prices to achieve optimal carbon reduction.In addition,scholars suggested that a phased implementation of carbon tax policies can more steadily popularize NEVs in the postsubsidy era[30,31].

Furthermore,the construction,manufacturing,power,and energy industries play important roles in carbon emissions[32,33].Research on the policy interface between these industries is popular in academia.For instance,in the construction industry,scholars’ research informed the implementation of the carbon tax and CT.The results show that the implementation of carbon tax policies is more likely to encourage automakers to reduce carbon emissions than CT[34,35].Similar conclusions have been reached regarding carbon reduction in the energy sector[34,36].In the manufacturing sector,scholars have compared the effects of these policies on social welfare and have reached a consensus that CT can improve social welfare better than carbon tax policy only if manufacturers improve the efficiency of carbon reduction[37-39].In the power sector,Yin et al.[40]and Liebensteiner et al.[41]analyzed the interaction between carbon pricing and renewable energy subsidies and found that combining the two policies makes it easier to achieve emission reduction targets.

Overall,existing studies on policy convergence have primarily focused on the production and R&D strategies of automakers,as well as the policy optimization strategies of governments.However,there has been little in-depth research on the optimal timing for policy convergence,which remains a controversial issue.To address this gap,this paper proposes an optimization scheme for timing and carbon quota allocation when introducing CT in the automobile sector.Specifically,we construct a bi-layer planning model with CT introduction timing and carbon quota as decision variables to derive the optimal solution while taking into account the interaction of decisions made by both the government and automakers.

3 Model development

The convergence of DCP and CT includes two kinds of decision-makers: government and automobile manufacturers.On the one hand,government policy decisions affect the operational decisions of companies (this paper mainly refers to automakers’ production and R&D decisions).On the other hand,automaker decisions will also make government policies adjust accordingly.Therefore,here a bi-layer planning model is developed to portray the interaction between the decision-making of automakers and the government and to determine the optimal convergence timing of DCP and CT under a social welfare maximization objective.

3.1 Upper-level model

3.1.1 Objective functions

The upper layer of the bi-layer planning model determines the optimal timing (T∗) for the introduction of carbon trading policies and the proportion () of carbon quotas,which maximizes social welfare.As indicated in Li et al.[42],social welfare is composed of two parts: economic and ecological parts.Specifically,the economic part is to maximize the automakers’profit,and the ecological part is portrayed by carbon emission reduction.Therefore,the objective function can be formulated as

where Ω is the government’s trade-off factor between economy and ecology.Meanwhile,AP refers to the automaker’s profit,which consists of the profit of both the DCP and CT periods and can be denoted as

Here,Π1and Π2represent the profits of automakers during the DCP and CT periods,respectively.

CE refers to carbon emission reduction profit.During the DCP period,carbon emission reduction mainly comes from automakers improving the fuel economy of CFVs,while during the CT period,carbon emission reduction is related to the carbon quota set by the government.Specifically,the total carbon emission reduction of automakers during the two policy periods can be expressed as

whereprepresents the unit profit of carbon emissions reduction.Referring to Sun et al.[15],this paper assumes that continuous technological innovation by automakers will increase the unit profit of carbon emissions reduction over time,i.e.,p=a+bt,wherearepresents the initial profit of carbon reduction,andcis the sensitivity coefficient of carbon reduction profit over time.Moreover,earepresents the initial carbon emissions of the automaker,specifically,ea=qe2e1+qf2e2(1-x2).wheree1ande2denote the individual vehicle carbon emissions of NEVs and CFVs,respectively.

3.1.2 Constraints and solutions

Noting that “carbon peaking” in the macroenvironment and the carbon quota ratio are allocated proportionally based on the automaker’s original carbon emissions,we propose the following constraints.

CT introduction timing should meet the following constraints:

Similarly,the carbon quota ratio ought to satisfy the following constraints:

where (TL,TU),(γL,γU) are the upper and lower limits of CT introduction timing and carbon quota ratio,respectively.Therefore,this paper identifies theTand γtthat maximize the social welfare of the government.

3.2 Lower-level model

The lower level of the bi-layer planning model is for the automaker to determine the production ratio of NEVs () and the level of fuel economy improvement () during the CT period based on the introduction time and carbon quota of the carbon trading policy to maximize the automaker’s profit.The automaker’s total profits can be expressed as follows:

During the DCP period,the automaker’s profit mainly includes three aspects: car sales revenue,credit trading revenue,and R&D costs.First,the car sales revenue includes the sales revenue of two types of cars: NEVs and CFVs,as shown below:

whereqe1=qtδ1,qf1=qt(1-δ1),qtis the automaker’s production capacity,δ1is the production ratio of NEVs during the DCP period,andpeandpfrepresent the unit profit of NEVs and CFVs,respectively.

Second,for credit transaction revenue,the DCP comprises two parallel parts: NEV and CAFC (corporate average fuel consumption) rules.The NEV rule concentrates on production volumes,and automobile manufacturers are required to generate sufficient NEV credits to meet specific constraints.However,the CAFC rule sets weighted average fuel consumption targets for automobile manufacturers and helps reduce carbon emissions.Referring to Lou et al.[43],this paper assumes that the production of CFVs by automakers only generates negative CAFC credits.Meanwhile,the CAFC credits are not tradable[44].Therefore,the automaker’s credit trading revenue can be calculated by negative CAFC creditscfand positive NEV creditsceobtained by traditional automakers,i.e.,

where Λfcrepresents the average fuel consumption of CFVs,Λvcrepresents the NEV accounting discount multiple in the NEV rule of DCP,and Λsvis the CAFC’s standard value in the CAFC rule of DCP.

Furthermore,automakers’ revenue through credit trading can be expressed as

wherepdis the unit price of NEV credit.In addition,in line with Meng et al.[45],we adopt the form ofto represent the R&D costs,wherekrepresents the cost coefficient,andx1represents the level of fuel economy improvement during the DCP period.

Therefore,the profit of automakers during the DCP period can be expressed as

Since the automaker’s decisions during the DCP period are not affected by the introduction time of CT and carbon quotas,the decision-making of automakers during this period is to determine fuel economy improvement () and the production proportion of NEVs () to maximize the profits,that is,

Similarly,automakers’ revenue throughout the CT period is

where ω denotes the carbon quota issued by the government to automakers.Notably,the carbon quota is defined as ω=eaγt,while carbon emission reduction isea(1-γt).x2denotes the level of fuel economy improvement of automakers in the CT period,andpcdenotes the carbon price.

In addition,referring to Li et al.[42]and He et al.[46],this paper assumes that the profit per vehicle for CFV remains constant.However,the profit per NEV is expected to shrink as market competition increases and is related to consumers’consumption preferences.Specifically,the per-vehicle profit of NEVs can be expressed as

wherep0denotes the initial profit of the NEVs,crepresents the sensitivity coefficient of the NEV to market competition,andndenotes the consumers’ low carbon preference.

The decision-making of automakers during the CT period is to determine the fuel economy improvement () and the production proportion of NEVs () to maximize the profits,that is,

A summary of the definitions of the adopted parameters in this paper is shown in Table 1.

Table 1.Notations.

4 Results and discussion

This section provides a numerical analysis of the optimal CT introduction timing and carbon quota ratio considering the change in production and R&D strategies by automakers in different periods.

4.1 Calibration of parameters

In this section,we define the values of the parameters to provide a basis for the proposed model.First,we set the values of the policy parameters.Based on the policy document instructions of the MIIT on DCP①https://www.miit.gov.cn/jgsj/zbys/qcgy/art/2022/art_c6e29d118a9042 fb9450d7d176463518.html.,the initial average fuel consumption of CFV is set to 5.1 L per 100 km,and the NEV credit for per NEV produced is set at 2.5.Moreover,according to the goals set by the government,we assumed that the standard value of the CAFC is 4 (i.e.,Λfc=5.1,c1=2.5,and Λsv=4).Furthermore,according to Lou et al.[43],the NEV accounting discount multiple is set at 3 (i.e.,Λvc=3).Then,the values of the credit price and carbon price are determined.Regarding the credit price,based on the annual report (2022)on the implementation of DCP released by the MIIT②http://www.miiteidc.org.cn/module/download/downfile.jsp?classid=0&filename=e9aee87d86c44b6da1e0021ee69bdaed.pdf.,the credit pricepdis set at 1000.Regarding the carbon price,according to the current market price of carbon,this paper sets the benchmark carbon price at 60 CNY/t③http://www.tanpaifang.com/tanhangqing/.,i.e.,pc=60.

Second,we set the values of market parameters.Based on the Volkswagen brand’s delivery data④http://newsroom.vw.com.cn/Home/PressReleaseDetail?id=142.,this paper sets the automakers’ production capacityqtat 2,400,000.Moreover,referring to the announcement by the Volkswagen Group that the Volkswagen Group will invest a cumulative total of approximately 10 billion EUR in internal combustion engine technology to increase efficiency by approximately 10%⑤https://www.volkswagengroupchina.com.cn/news/detail?articleid=02D 42B4DDF044152B3EA9D5F6C6B69FE.,this paper assumes the cost factor for improving the fuel economy of CFV is 10,000,000,000 (i.e.,k=10,000,000,000).In terms of per-vehicle profit,according to Lou et al.[43],this paper determines that the per-vehicle profit of the CFV is 8000CNY(i.e.,pf=8000).Moreover,according to He et al.[46],the profit per vehicle of NEVis slightly lower than that of CFV and is more affected by market competition.Therefore,for the sake of illustration,this paper sets the per-vehicle NEV’s initial profit to 5000 and the sensitivity factor affected by market competition to 1000 (i.e.,p0=5000,c=1000).In addition,the single-vehicle carbon emissions of NEV and CFV are set to 20 t CO2eq and 50 t CO2eq respectively (i.e.,e1=20,e2=50),referring to Qiao et al[47].Furthermore,according to Luo et al.[48]and Wang et al.[49],this paper sets the initial profit of carbon emissions reduction and the sensitivity coefficients of carbon reduction profit relative to time asa=1000 andb=200,respectively.Finally,the cost of capital was set asr=0.08[50].Specific parameter estimations are listed in Table 2.

Table 2.Parameter values.

4.2 Benchmark scenario

4.2.1 Optimal government and automaker decisions under the benchmark scenario

In this section,we determine the optimal strategy under the benchmark scenario.Specifically,this includes the optimal CT introduction timing and carbon quota ratio by the government and the optimal production and R&D strategies by automakers.

As shown in Fig.1,for the government,the optimal CT introduction timing is 1.3 years later than 2022,and the optimal carbon quota ratio is 0.3 (i.e.,T∗=1.3,=0.3).Meanwhile,the optimal NEV production ratio and fuel economy improvement level for automakers are 15% and 61% (i.e.,δ2=15%,x2=61%),respectively.In other words,this performance of automakers also indicates that the current is not the appropriate time to introduce a carbon trading policy into the auto industry.This is because the implementation of CT will make the policy compliance cost of automakers drop compared with the implementation of DCP,and due to the profit difference between CFVs and NEVs,automakers will choose to focus on carbon reduction to improve the fuel economy of CFVs rather than NEV production,which is not conducive to the future development of NEVs.Furthermore,this conclusion is verified in the report “Preliminary Assessment of the Convergence of Passenger Vehicle Dual-Credit Policy and Carbon Trading Market” published by China Automotive Research Center①http://www.tanjiaoyi.com/article-34703-2.html..

Fig.1.Optimal government decision-making under the benchmark scenario.(a) Data represent the changes in social welfare.(b) Data represent the changes in the automakers’ profit.

4.2.2 The impact of the carbon quota ratio on automaker decision-making

We further discusses the impact of governments’ carbon quota ratio decisions on automaker decisions.The specific results are shown in Fig.2.In general,automakers have two options to meet the policy requirements as the government tightens carbon quotas: improving their NEV production scale or investing more in R&D to reduce carbon emissions[51].Interestingly,our results show that automakers will not choose both strategies,and it can be seen that changes in the carbon quota have opposite effects on automakers’ NEV production and R&D decisions.Specifically,automakers will increase the proportion of NEV production with the tightening of government carbon quotas,while simultaneously reducing their R&D investment in the CFVs’ fuel economy,which can be explained by the difference in profit per vehicle between CFVs and NEVs.Therefore,it also reminds policymakers to pay attention to multiple decisions made by automakers,and a persistent easing or tightening of carbon quotas is not conducive to the expansion of NEVs and the development of carbon reduction technologies in the automobile sector.

Fig.2.The impact of the carbon quota ratio on enterprise decisions.Data represent the impact of governments’ carbon quota ratio decisions on automaker decisions.

4.3 Sensitivity analysis

In this section,we delve into the impact mechanisms of several key parameters on the optimal CT introduction timing and carbon quota ratio,including two categories of parameters:technical parameters (e1,e2) and market parameters (pc,p0,n).

4.3.1 Technical parameters

In this subsection,we investigate the impact of technical parameters on the optimal CT introduction timing and carbon quota ratio.Specifically,the technical parameters include the single-vehicle carbon emissions of NEVs (e1) and CFVs (e2).Fig.3 shows the simulation results fore1ande2.

Fig.3.Impact of e1 and e2 on CT introduction timing and carbon quota ratio.Data represent the impact of the single-vehicle carbon emissions of NEVs and CFVs on the optimal CT introduction timing and carbon quota ratio.

As illustrated in Fig.3,the influence of carbon emissions from single NEVs and CFVs on governmental decision making exhibits an inverse relationship.Specifically,an increase in carbon emissionsper single NEV(e1)prompts the government to advance the introduction of CT and tighten carbon quotas.Conversely,a rise in carbon emissions per single CFV (e2) leads the government to defer the implementation of CT and ease carbon quotas.This discrepancy arises primarily from the fact that carbon reduction during the period DCP mainly results from automakers’ research and development investment in CFVs,while carbon reduction during period CT involves the complete life cycle carbon emissions of NEVs.Hence,in response to the increase in NEVs’ carbon emissions,the government endeavors to expedite the implementation of CT to further abate carbon emissions.In contrast,when the carbon emissions of CFVs increase,automakers must adjust their production and compensate for their profits to meet policy requirements,which ultimately hampers the augmentation of social welfare.Consequently,delaying CT is deemed imperative to alleviate this loss.Moreover,this finding highlights that accelerating the introduction of CT to incentivize automakers to reduce the carbon emissions of CFVs constitutes a viable policy measure.

4.3.2 Market parameters

In this subsection,we examine the impact of market parameters on the optimal CT introduction timing and carbon quota ratio.For the purpose of analysis,we divide the market parameters into two categories:the carbonprice (pc)and the initial profit of NEV (p0) and the consumer preference for low carbon (n).

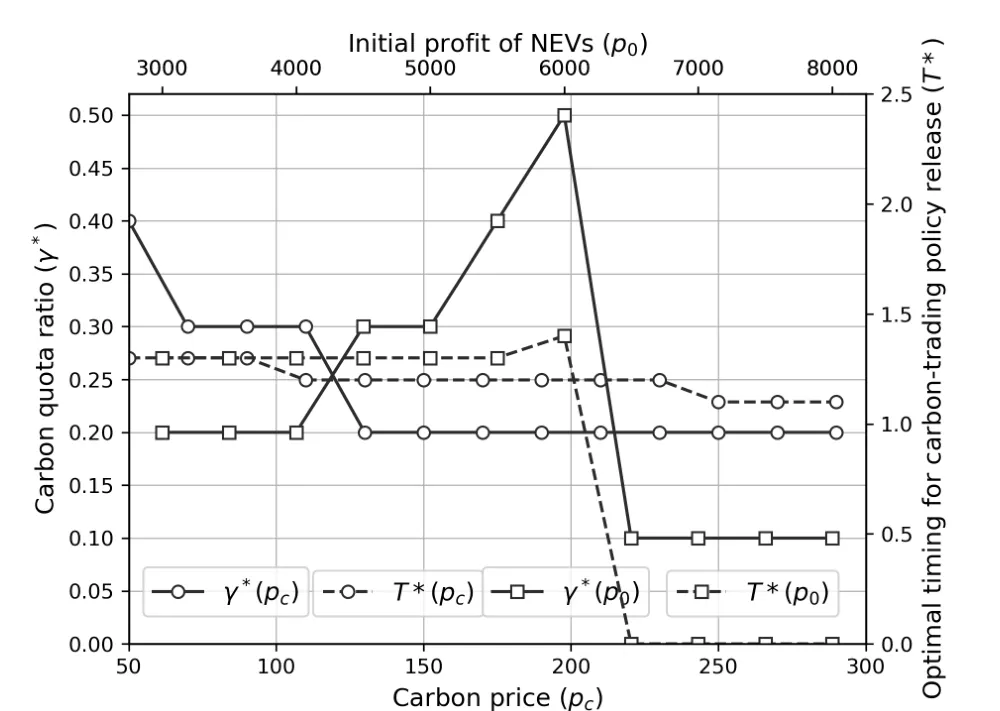

First,we investigate the impact of the carbon price and the initial profit of NEVs on government decisions.Fig.4 shows the simulation results forpcandp0.As we can see,the optimal timing of the introduction of carbon trading is more sensitive to changes in the profits of NEVs than in the carbon price.This is mainly because the increased profit of NEVs makes automakers produce more NEVs,which also contributes to carbon emission reduction and further increase social welfare;therefore,the government chooses to introduce carbon trading earlier.Furthermore,the result also reminds the government that it would be more effective to accelerate the automobile sector’s entry into the carbon trading market to increase the profits of NEVs than the carbon price.Moreover,Fig.4 also indicates that the optimal decision for the government is to further tighten the carbon quota when the carbon price increases.However,as the initial profit of NEVs increases,the carbon quota is better to ease first and then tighten.The reason is that automakers will choose to invest more in carbon-reducing technologies when the carbon price increases and the tightening of carbon quotas at this time will be beneficial to further carbon emission reduction.However,as the initial profit of NEVs increases but is still less than the profit per CFV,automakers still prefer to produce CFVs and need to sacrifice profits to meet policy requirements.Therefore,the government needs to ease carbon quotas to compensate for automaker losses.

Fig.4.Impact of pc and p0 on CT introduction timing and carbon quota ratio.Data represent the impact of the carbon price and the initial profit of NEVs on government decisions.

Then,we explore the impact of consumers’ low-carbon preference levels (n) on the optimal CT introduction timing and carbon quota ratio.It is worth noting that in this paper,we characterize the change in consumers’ low-carbon preference levels by changing thenvalue[42],and the results are shown in Fig.5.As we can see,an increase in consumers’level of low carbon preference accelerates the arrival of carbon trading policies in the automobile market.This is mainly because an increase in consumers’ low-carbon preferences will cause automakers to increase the number of NEVs produced,which is beneficial to carbon emission reduction and social welfare.Moreover,Fig.5 reveals that carbon quotas are eased and then tightened as consumer preferences increase,for the same reason as the mechanism influencing the initial profits of NEVs described above.Additionally,this finding reminds policymakers that to advance carbon trading policies,targeted measures can be taken to increase the level of consumers’ low carbon preferences,such as providing consumption subsidies for green consumers and planning special parking spaces for green cars to motivate consumers.

Fig.5.The impact of n on CT introduction timing and carbon quota ratio.Data represent the impact of consumers’ low-carbon preference levels (n)on the optimal CT introduction timing and carbon quota ratio.

5 Conclusions

This paper investigates the convergence strategy between DCP and CT by considering the interaction of government and automaker decisions.Specifically,we built a bi-layer planning model that portrays the mutual influence of government and automakers’ decisions regarding CT introduction.The upper model considers the government’s decision about the CT introduction timing and carbon quota ratio,and the lower model considers the production and R&D decisions of automakers during the CT period.Furthermore,the optimal timing and carbon quota ratio are determined with the objective of maximizing social welfare.Then,this paper explored the impact of some key parameters (including technical parameters and market parameters) on the optimal timing and optimal carbon quota ratio through sensitivity analysis.The main findings are as follows:

First,this paper identifies the optimal government and automaker decisions under the benchmark scenario.The results show that the immediate introduction of CT into the automobile market is not an optimal decision.Furthermore,by conducting a sensitivity analysis of the impact of market parameters on government decisions,we find that consumers’low carbon preferences have a positive effect on accelerating the arrival of CT.What is even more interesting is that an increase in the profit of NEV is more effective in accelerating CT introduction than the carbon price.In addition,we explore the impact of carbon quotas on automakers’ production and R&D decisions.Our results suggest that changes in government carbon quota decisions have opposite effects on automaker NEV production decisions and R&D decisions.Specifically,with the tightening of carbon quotas,companies will increase the production ratio of NEVs but at the same time reduce their investment in R&D for CFV.

Second,this paper conducts a sensitivity analysis on the impact of carbon emissions from single NEVs and CFVs on the optimal timing and carbon quota.The results show that the influence of carbon emissions from single NEVs and CFVs on governmental decision-making exhibits an inverse relationship.Specifically,an increase in the carbon emissions per single NEV prompts the government to advance the introduction of CT and tighten carbon quotas,whereas the increase in carbon emissions per single CFV shows the opposite effects.Therefore,the government should dynamically adjust the carbon quota constraint according to the carbon emissions of unit NEV and CFV instead of adopting a one-sizefits-all policy.

This paper provides a new perspective on the research of policy convergence and provides theoretical support for the optimal decision of the government and automakers regarding the entry of CT into the automobile market.However,this paper makes some assumptions similar to most modeling papers,and therefore has some limitations.First,this paper portrays government goals by considering the maximization of social welfare,while in reality,the government may have objectives concerning NEV market share,R&D level of NEV,etc.Moreover,this study portrays DCP based on the current policy level,which will be more practically meaningful if the dynamic changes of the policy are taken into account.These issues are expected to be studied in future studies.

Acknowledgements

This work was supported by the Social Science Foundation of Shaanxi Province (2022R004).

Conflict of interest

The authors declare that they have no conflict of interest.

Biographies

Haonan Heis an Associate Professor at Chang’an University.He received his Ph.D.degree in Business Administration from the University of Science and Technology of China in 2019.His research mainly focuses on decision optimization under uncertainty,energy and environmental efficiency assessment,and low-carbon economic statistics.

Jie Zhaois a Lecturer at Chang’an University.He received his Ph.D.degree in Computer Science from Shaanxi Normal University.His research mainly focuses on artificial intelligence,intelligent optimization and decision-making,and transportation science.

杂志排行

中国科学技术大学学报的其它文章

- Supply chain optimization considering consumers’ mental accounting by time dimension in advance selling

- The influence mechanism of green advertising on consumers’intention to purchase energy-saving products: Based on the S-O-R model

- How can ESG funds improve their performance? Based on the DEA-Malmquist productivity index and fsQCA method

- Reaction mechanism of investors of new energy vehicle enterprises to China’s program of retrogressive subsidies in the context of COVID-19 pandemic: Based on the event study method

- Optimal environment design and revenue allocation: Under cap-and-trade policy in the cooperation supply chain