Understanding Farmers’ Preferences Towards Insurance Schemes that Promote Biosecurity Best Management Practices

2022-12-14RosaMatoAmboageJuliaTouzaMarioSoli

Rosa Mato-Amboage 1 · Julia Touza 1,2 · Mario Soliño 3,4

Abstract Plant pest and disease outbreaks, which occur with increasing frequency and intensity, cause catastrophic losses and threaten food security in many areas around the world. These impacts are expected to be exacerbated by climate change. Tackling this challenge requires mechanisms that ensure the f inancial security of farmers while incentivizing private biosecurity eff orts to prevent future outbreaks.This study explored crop producers’ preferences for a subsidized insurance scheme as an instrument to manage novel biotic risks. Specif ically, we developed a choice experiment to evaluate Spanish growers’ willingness to pay for a crop insurance product that promotes compliance with best biosecurity management practices. Our results show that while growers are willing to pay more for high coverage products that increase the resilience of crops to potential catastrophic outbreaks, there is neither a strong demand nor widespread availability of such tools. Farmers required reductions in premiums before undertaking risk prevention measures; they are more willing to pay for schemes that link their eligibility to access to ad hoc funds in the eventuality of a catastrophic outbreak than they are to purchase insurance. Our f indings also suggest that Spanish growers prefer expanding the eligible risks covered by insurance and envisage a role for insurance in off ering biosecurity protection.

Keywords Biosecurity protection · Choice experiment ·Crop insurance · Pest risk · Spain · Subsidized insurance

1 Introduction

Plant pest outbreaks, plant disease epidemics, and uncontrolled invasive species can result in signif icant losses in food crop production, which are ref lected in lower yields and outbreak-specif ic response strategies such as trade movement restrictions. These outbreaks can also cause disruptive impacts on ecosystem functions and human health, as well as knock on eff ects on trade relations that disrupt entire economic sectors (Pejchar and Mooney 2009; Savary et al.2019; Ristaino et al. 2021). Climate change and trade-related factors, including agriculture production specialization, are likely to aggravate the frequency of crop failure or destruction due to pest and disease outbreaks (Bebber et al. 2013;Perrings 2016). Therefore, we should expect new risk management tools to be developed that deal with such devastating events, and promote private biosecurity practices, which would gain importance in coming years (Bate et al. 2021;Vyas et al. 2021).

Some studies have discussed innovative insurance schemes by treating the spread of invasive species as an insurable peril that would encourage prevention efforts(Liesivaara and Myyrä 2015; Epanchin-Niell 2017; Stoneham et al. 2021). For specif ic commodities, industry-led risk markets exist to manage biosecurity risks, although for catastrophic events related to outbreaks from quarantine or emerging plant pests, infectious diseases, and invasive non-native species, agricultural insurance markets are still not well developed. This leaves farmers dependent almost solely on ad hoc relief payments (Bielza Diaz-Caneja et al.2009; Bulut 2017). Major outbreaks cause problems for insurance markets because they are systemic in nature and insurers face asymmetric information problems (Miranda and Glauber 1997 ; Esuola et al. 2007). This means that insurance schemes often need support from the public sector to develop successful risk management strategies (Miranda and Glauber 1997; Goodwin 2001; Wright 2014). No private multi-peril insurance program has managed to survive without government support in Spain (Wright 2014). The question is: how can governments support a subsidized insurance to cover novel threats and to encourage growers’ biosecurity behavior? Hennessy ( 2008) and Beckie et al. ( 2019),for example, proposed insurance designs where those who comply with certain biosecurity management practices are entitled to receive linked reductions in premiums, or government compensation beyond a certain minimum level in the event of an outbreak. This article focuses on understanding crop producers’ preferences for some design attributes of a subsidized insurance for emerging pest and disease problems. Thus, we conducted a choice experiment (CE)to investigate Spanish farmer’s preferences for or against a subsidized insurance that covers emergent plant pest and disease risks, something currently is not off ered in Spain,as an incentive policy to achieve higher biosecurity through requiring compliance with certain production practices.

There is a large literature that explores factors that aff ect farmers demand for crop insurance by using stated preference approaches such as CE, with an increasing interest in investigating the eff ect of farmers’ characteristics on purchasing decisions and their willingness to pay (WTP)for extreme weather-related insurance, particularly in lowincome countries (Budhathoki et al. 2019; Doherty et al.2021; Vyas et al. 2021). Recent studies that also have a focus on investigating preferences about insurance attributes include: (1) Liesivaara and Myyra ( 2017), who used a choice experiment to evaluate the WTP of farmers to buy crop insurance in Finland, showing the eff ect of farmers’expectation regarding support by the government with ad hoc payments; (2) The CE analysis conducted in Denmark by Jørgensen et al. ( 2020) for an insurance product where land management practices to improve soil sustainability is a precondition for obtaining access to climate risk-related insurance. Jørgensen et al. found that farmers whose farms have poor quality soils were more likely to purchase insurance; (3) Huang et al. ( 2020) examined preferences for multiple- perils insurance and showed that farmers who have suff ered insect, pest, or plant disease damages are willing to pay a high premium for an insurance with a high minimum compensation ratio for production loss and multiple crops covered; and (4) Our article contributes to this literature by focusing on novel biotic risks to growers, and evaluates farmer preferences for alternative crop insurance products that provide protection from emerging pests and diseases.Our analysis therefore contributes to the limited literature that examines social preferences over the role of designing agricultural insurance to incentivize on-farm biosecurity(Beckie et al. 2019; Vyas et al. 2021). In particular, we focus on exploring the potential role of cost-sharing arrangements between the private and public sectors (that is, governments,industry, and farmers) in designing an insurance scheme that can contribute to higher farmer uptake.

The results of this study show that there is limited demand for crop insurance, even though farmers prefer insurance products with full coverage, including novel pests and diseases. Linking government ad hoc compensation payments to the purchase of insurance through a co-payment can act as an additional incentive for insurance uptake. We also explored the eff ects of requiring additional biosecurity-related production measures, and found that farmers negatively react to purchase of an insurance if biosecurity constraints are mandatory.

The next section presents crop insurance in Spain as case study. Section 3 describes the hypothetical insurance scheme used in the choice experiment as well as our modelling approach. The results of the survey are presented in Sect. 4,while in Sect. 5 we discuss the results, and our conclusions are off ered in Sect. 6.

2 Case Study: Crop Insurance in Spain

Agricultural insurance in Spain, founded in 1978, is an example of subsidized schemes based on joint participation between public and private institutions. It is considered one of the most advanced crop insurance systems in the EU (OECD 2011). It is voluntary, and the participation of private insurance companies is achieved through a coinsurance pooling scheme in which insurance companies market the products, and the governmental insurance agency subsidizes the premium and provides reinsurance. The State Entity for Agricultural Insurance (ENESA), an autonomous body linked to the Ministry of the Environment and Rural and Marine Aff airs (MAPAMA), acts as the policy-making body. The ENESA creates the Annual Plan of Agricultural Insurance Policies, which determines the level of subsidies and establishes the technical conditions of insurance policies. Agroseguro is a private company that participates in the scheme, is in charge of administering the insurance policies and claims, and conducts the statistical and actuarial research. Farmers pay Agroseguro the net of the insurance subsidy, and Agroseguro collects the subsidy directly from ENESA and the government.

Since the insurance program has been established, farmers cover between 35 and 55% of the insurance premium,and autonomous communities in some years subsidize up to nearly 20% of the remaining cost of insurance; the remainder is subsidized by Agroseguro (Agroseguro 2015). Despite the high subsidization, the total liability of crop insurance is still roughly 35% of the total insurable agricultural output, and the size of the program is still modest compared to the total economic size of the sector (OECD 2011). It is important to note that this hybrid insurance market is thought to have limited the scope of ad hoc and ex post assistance (OECD 2011).

Currently, agricultural, livestock, forestry, and aquaculture production are covered against most of the climate risks that may aff ect them. However, pest and disease damage to crops is not covered. By using as an entry point the ongoing struggles to eradicate a recently introduced potato pest,Tecia solanivora, in northern Spain (EPPO Global Database 2015), we hope to gather data that will assist in the design of new insurance policies to manage comprehensive multiperil risks.

Our case study targeted crop producers in the region of Galicia, northwest Spain. The reason for concentrating on a particular regional jurisdiction was the fact that the structure of subsidized insurance payments is partly determined at the regional level, as is the creation of ad hoc compensation payments. In Galicia, only 2% of the cultivated area is currently insured, making it the region with the lowest percentage of insured cultivated area in the country, despite having a strong agroeconomic sector (Agroseguro 2015). The area is mostly rural, with many farmers characterized as “hard to reach” due to their remote location, old age, and limited educational background (Rodriguez-Couso et al. 2006).Many farmers in the region practice multiple cropping and have relatively small holdings. Currently available insurance policies are often not designed with this consumer type in mind and, in order to enhance small farm participation in insurance, there is a need to better understand farmer needs(European Commission 2018). Insurance has the additional benef it that, by focusing on an area where a rare but potentially very damaging pest outbreak is occurring, respondents would, in principle, be aware of such extreme risks and not underestimate them.

3 Methods

In our analysis, we assume that a farmer’s decision to opt for a given insurance contract is determined by the relative utility he can gain by choosing the contract (characterized by its attributes) compared to choosing no insurance. Data were collected using a choice experiment (CE) to elicit farmers’preferences. One advantage of CE is that it is possible to value hypothetical changes in goods and services (Johnston et al. 2017). Thus, CE was used because there are no available crop insurance markets that off er coverage for pest and disease risks in Spain.

3.1 Attributes and Levels

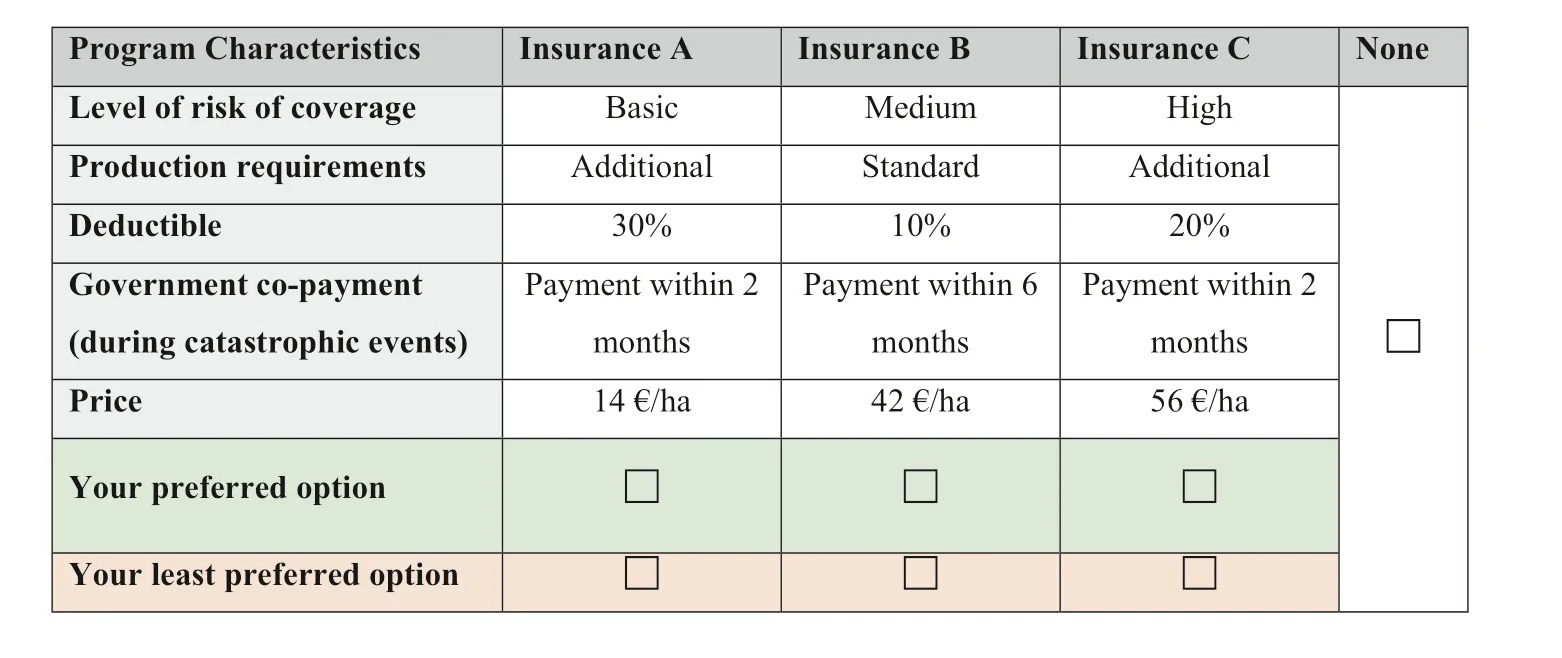

Each choice alternative consisted of f ive attributes: coverage, production requirements, deductible, government copayment option, and insurance premium. The attributes and their levels are partially based on Heikkilä et al. ( 2016),Liesivaara and Myyrä ( 2014), Civic Consulting ( 2006),and Asseldonk et al. ( 2006). The levels of the attributes and the attribute combinations (and therefore the products off ered) are hypothetical; however, they were all set at realistic ranges, based on the literature of European insurance schemes cited in Sect. 2 and similarities to existing insurance products. The description of the attributes and levels is included in Table 1.

An insurance scheme should incentivize producers who purchase insurance to take risk prevention measures thereafter. The attribute “production requirements” evaluates the trade-off s faced by farmers on biosecurity risk reduction eff orts. Some farmers may be willing to adopt costly enhanced biosecurity measures compared with the national standard in return for having a lower insurance premium,or vice versa.

Another insurance characteristic is the “level of coverage”that the insurance product provides. Increasing the coverage raises the premiums, but it also means a better safety net for farmers. Previous studies concluded that farmers are often not willing to purchase insurance that covers extensive losses (Asseldonk et al. 2006). In order to explore preferences for comprehensive insurance, in particular that which also off ers coverage against potential catastrophic emerging plant pests and diseases, we identif ied three incremental levels of coverage (Table 1).

The “deductible” is the minimum percentage of the loss in production value required to take a claim into consideration. It is a crucial part of insurance schemes, as it reduces moral hazard and incentivizes disease prevention and good practices by growers. In current crop insurance products,this percentage is variable depending, for example, on the type of risk, but it is often set at 30% (Mercadé et al. 2009).

Government support of crop insurance is described through two mechanisms: the already subsidized premium amounts in the Spanish insurance market, and an additional payment to cover part of the deductible amount of those insured during catastrophic events (including climate-related catastrophes or pests or diseases of great risk that can also lead to catastrophic consequences and that require special biosecurity control measures to limit further spread, such as quarantine of outbreak areas) within a specif ied period (two months or six months, see Table 1). By including a “copayment” of the deductible, the insured farmers would have a more comprehensive coverage during catastrophic events,with the total costs being shared among the government, the private sector, and farmers.

Table 1 Description of attributes and levels

The “insurance premium” determines the annual amount that a farmer pays to the insurance provider for the production insured (price is set as the amount paid per ha insured).When the insurance is fairly priced, risk-averse producers should insure. There are a number of factors that aff ect the level of premium rates, which include, for example, the frequency of risks in a particular area, the type and number of risks covered, the sensitiveness of the insured crops, the number of farms insured, bonuses and subsidies, and other technicalities (Bielza Díaz-Caneja et al. 2009). Thus, in this context, since it is not possible to obtain real prices for the choice alternatives, we have considered as a starting point the crop insurance premium paid in the area of study. The premiums displayed in the choice cards (see Table 1) represent the f inal cost to the farmers, after the government applied a subsidy.1The motivation for including only the post-subsidized premium was the desire to follow the current procedures used in insurance products in Spain, and thus to avoid causing a respondent confusion and easiness during the CE.

3.2 Construction of the Choice Set

The experimental design was based on a B-effi cient design(Olsen and Meyerhoff 2016) with the restriction that high coverage choice alternatives must have higher prices than those that off er lower coverage–a requirement for actuarial fairness. The B-effi ciency criterion relies on preventing choice sets containing alternatives that may be strongly dominated. Olsen and Meyerhoff ( 2016) obtained the interesting result that choices from a B-effi cient design are more consistent than when using D-, C-, and S-effi ciency designs. We used the NGENE (ChoiceMetrics 2012) software and each farmer was presented with six choice cards to avoid respondent fatigue. Each choice card consisted of four alternatives(three insurance products and an option of no insurance).An example of a choice card is shown in Fig. 1. A ranking experiment using a best-worst approach was employed, but only the best ranks were used for the analysis as suggested by Caparrós et al. ( 2008), Scarpa et al. ( 2011), Varela et al.( 2014), and Agúndez et al. ( 2022), among others.

3.3 Questionnaire Design and Sampling Strategy

In addition to the described choice experiment, we also surveyed respondents’ experience with: (1) crop insurance products and their general satisfaction with insurance products available to them; (2) their risk perceptions regarding plant pests and disease outbreaks; and (3) their previous investment in biosecurity measures. A pilot version of the questionnaire was distributed among producers as well as agricultural academics, insurance experts, agricultural cooperative managers, and policy advisers. Modif ications were made following suggestions from the experts and farmers. In particular, the questionnaire was shortened to avoid respondent exhaustion and clarif ications were added to the text.

Fig. 1 Example of a choice card

Due to the lack of a dataset of active crop producers in the area, potential participants were identif ied through local agricultural cooperatives and agricultural groups. Agricultural organizations were contacted through email and invited to forward the questionnaire to associated members of their group to participate in the choice experiment. Because the study area is rural and the sample population was anticipated to be inexperienced with online questionnaires, data collection was complemented with face-to-face surveys over a period of three weeks. Main agricultural cooperatives and vegetable collection centers were identif ied and permission was requested to invite potential participants during their designated offi ce hours. Participants who still preferred to complete the questionnaire at a more convenient time were forwarded the online version.

At the beginning of the data collection process, potential respondents were presented with a summary of the project.This document detailed the objectives of the work as well as provided background information regarding current insurance products and mandatory requirements during pest outbreaks. Participants were also given a consent form, outlining their agreement to take part in the study and emphasizing the voluntary and conf idential nature of the questionnaire.Stated preference methods have been subject to criticism,particularly regarding the validity of the results due to the hypothetical nature of the experiments. Hypothetical bias is thus an undeniable issue in CE, but empirical evidence does not render CEs unable to represent real-world preferences (Haghani et al. 2021a). We applied bias-mitigation methods (List and Gallet 2001; Murphy and Stevens 2004)2Studies have found that the magnitude of hypothetical bias is statistically less for willingness to pay (WTP) as compared to willingnessto-accept (WTA), for private compared to public goods, and that a choice-based method reduces the bias. Moreover, most farmers were expected to have experience with insurance products.to enhance behavioral realism in hypothetical choice data.An opt-out reminder (Ladenburg and Olsen 2014) is a useful approach to reduce the cheap talk, since it explicitly reminds respondents that they can choose the opt-out alternative, and it contributes to hypothetical bias mitigation (Haghani et al.2021b).

3.4 Statistical Analysis

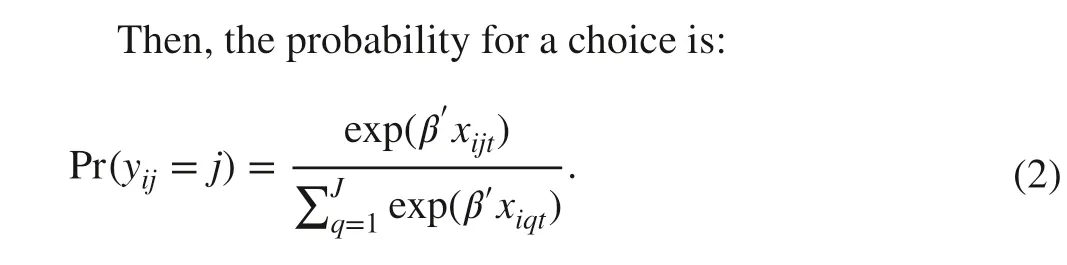

Eliciting preferences through a choice experiment assumes that a respondent maximizes his utility through the choices over the alternatives presented (Train 2009). Random parameters logit (RPL), also known as the mixed logit model, is a commonly used model to analyze choice data because the model’s f lexibility permits it to represent a range of respondent behaviors. This model assumes that the unobserved utility of a crop insurance programjcan be split into two components: a deterministic one expressed by an indirect utility function,V, and a random error term,e.Vis a function of the attributes of the alternatives and a set of unknown parameters to be estimated, andecaptures unobservable factors that inf luence utility. Thus, the random utility gained by individualifrom choosing insurance programjin a particular choice tasktcan be written as:Uijt=Vijt+eijt. We assume that the indirect utility derived from a crop insurance program is a linear function of all the program’s attributes and of an alternative specif ic constant (ASC), which is coded as 1 when a program is presented and zero otherwise. A negative coeffi cient of the ASC represents farmers’ preferences for no insurance, that is, it is an initial welfare loss when the farmers purchase a nonspecif ied insurance. We also included two interaction terms between price and the coverage attributes. The interaction terms represent the imposed restriction in the choice design that higher coverage products are more costly than low coverage products.

The specif ication of the indirect utility function becomesVijt=β′xijt, wherexijtis the matrix of attribute levels (ASC,basic coverage (BC), high coverage (HC), additional measured (addit), deductible (deduct), government co-payment within 6 months (copay6), government co-payment within 2 months (copay2), price, and the interaction variables of price with coverage), andβis the vector of coeffi cients(р,α1,α2,γ,δ,η1,,η2,Ψ,λ1,λ2).

Because the design includes a constraint that premiums depend on coverage levels (more coverage implies higher premiums), the mean implicit prices for each attribute could be calculated as3If the price coeffi cient is distributed lognormally, and the coeffi -cients of nonprice attributes are normal, then the WTP is the ratio of a normal term to a lognormal term.:

Nevertheless, as the WTP is an estimate of the ratio of two random variables, the WTP has a distribution of its own(Train 2009). There are several ways to compute the WTP,such as to consider the moments for estimation or to follow the Bayesian approach proposed by Greene et al. ( 2005).For the calculation of WTP for the diff erent attributes from the RPL estimates, we used the software developed by Hess( 2010), moving from the typical unconditional distribution(at sample population level) to a conditional distribution based on 10,000 simulated draws from the farmers participating in the study.

4 Results

The survey was completed by 181 farmers. Some observations were deleted due to respondents being outside the case study area, or not being crop producers at the time the questionnaire was released. This was probably due to the sampling procedure reaching farmers outside the scope of the study. The f inal dataset included 142 respondents. This is consistent with recent CE applications focusing on farmers/landowners in rural settings (Zandersen et al. 2021) and it is above the minimum sample required for our experimental design (Cranford and Mourato 2014).

Most farmers (75%) had not purchased insurance in the past, and 67% claimed to have little knowledge of insurance products available to them. Nineteen percent of the respondents were dissatisf ied with current insurance programs off ered, and the main reasons were “main risks not covered,” and “compensation payments too low.” While crop insurance is voluntary in Spain, roughly half of the respondents claimed that crop insurance should be mandatory, and over 75% believe that insurance is a better risk management mechanism than ad hoc compensation payments. On average, our sample self-identif ied as risk-prone.Of the correspondents, 57% claimed to have suff ered important losses due to plant pest and disease outbreaks and 68%believed that they will experience substantial economic losses in the future. Almost 70% of the respondents claimed that they always or often make biosecurity control eff orts such as destroying infected crops, using pesticides, using certif ied seeds, and so on, and 60% thought that they should be partially or fully compensated for the costs of biosecurity controls; while 25% thought that they should be compensated in full and receive additional funds because their prevention and control eff orts would avoid costs to others.

A number of models were estimated over respondent choices, including multinomial logit, willingness to pay in space, and latent class models. Both normal and lognormal forms of distribution were tested for the insurance attributes as well.4With the normal distribution, some individuals will have negative coeffi cients and others positive, and the lognormal distribution is useful when the coeffi cient is known to have the same sign for every person, such as the price coeffi cient that is known to be negative for everyone in a mode choice situation (Train 2009).The best statistical f it and most parsimonious model was found to be a RPL purely based on the functional form used in the experimental design, that is, with attributes,interaction terms between the price and coverage attributes,and a nonrandom ASC. The model assumes a normal distribution for all attributes except for the premium, which follows a lognormal distribution. The results in Table 2 include the values of the random parameters logit coeffi cients, their statistical signif icance, and the standard error. The McFadden pseudo R-squared for the RPL model was 0.316, that is,higher than the minimum value recommended in the literature (Christie et al. 2007).

The estimated coeffi cient for the ASC was negative and signif icant, meaning that there are some unidentif ied variables that induce farmers to prefer to not purchase any of the off ered insurance products. These variables might include other types of insurance design attributes, but might also ref lect the existing reluctance to join insurance schemes,as previously mentioned. The positive coeffi cients for both coverage levels, basic and high, mean that respondents prefer a basic or a full coverage, instead of the medium coverage. This can be due to farmers perceiving that it is not worth insuring against recurrent pests and pathogens, which may be due to growers’ commonly adopting management strategies to address common pest and diseases, availableat cheaper costs, such as the use of pesticides (Santeramo and Ramsey 2017; Beckie et al. 2019). Higher coverage is the preferred option, as evidenced by a signif icantly higher positive coeffi cient. Requiring compliance with additional production measures to increase crop health decreases the preference for insurance. Similarly, the higher the deductible percentage, the lower the likelihood that farmers would take an insurance contract. Off ering government co-payments of the deductible amount during catastrophic outbreaks increases the demand for insurance, especially if the payment is promised in a shorter period. The demand for crop insurance decreases with the insurance premium, as expected by the Law of Demand (basically, that at a higher price consumer will demand a lower quantity of a good).The interaction of the coverage attribute with prices represents the restriction we imposed on the choice experiment design to represent the general condition that insurance products that off er coverage against more risks carry higher premiums. Therefore, the interaction terms are signif icant and negative, that is, an increase in the premium for low or high coverage decreases the demand. The nonstatistical signif icance of the standard deviation of these random parameters suggests that preferences of individuals are similar on these interacted attributes, namely, on how a change in price changes their preferences about the coverage.

Table 2 Results of the random parameters logit model

Economic interpretation of the results can be obtained from the implicit prices–the marginal rates of substitution between price and insurance attributes. These changes reveal how willing growers are to trade one insurance design attribute for another. The results are included in Table 3. We also included the standard deviation for the mean values and the conf idence intervals at 95% level.

The negative WTP for the ASC represents farmers’ preferences for no insurance. Farmers are willing to pay over 51€/ha for a high coverage against potential catastrophic novel pests, and 43€/ha for a basic coverage that covers only climatic risks. Regarding the cost-sharing element, growers require a discount of 11€/ha if the insurance product requires compliance with additional biosecurity-related production measures, such as certif ication requirements. The implicit price for the deductible describes farmers’ preferences towards 1% changes in the deductible. Thus, for a 10%increase in the deductible, the implicit price is a deduction of 5.90€/ha. Lastly, if the government agrees to bear the deductible amount during catastrophic events, farmers are willing to pay 14.74€/ha more if the payment is promised within 6 months and 17.87€/ha if the payment is received within 2 months from the time of the claim.

Because of the restriction in the design regarding the coverage and premiums, the total WTP for an insurance of certain coverage needs to account for the implicit price of the coverage amount as well as the eff ect of the interaction term. When the implicit price for the interaction term for high coverage is more negative than for basic coverage,this implies that while farmers are willing to pay more for high coverage products that protect them against novel plant pests and diseases, this result only holds for lower insurance premium amounts. The WTP for high and low coverage diff ers for low price levels, since once the price reaches approximately 50€/ha, the WTP for either coverage insurance drops to zero.

Table 3 Implicit prices of insurance attributes

5 Discussion

In this study we explored preferences for comprehensive crop insurance products based on private-public partnerships that off er farmers the f lexibility to face common and novel pest and disease risks, while encouraging prevention eff orts,and we identif ied the scheme attributes that would increase the uptake of insurance. We developed a choice experiment to evaluate grower’s willingness to pay for diff erent crop insurance products in Spain. Thus, our analysis represents a contribution to the emerging literature on the use of CE data for crop insurance demand modelling.

Insurance premiums and their subsidies are often key factors in determining the demand for insurance (Garrido and Zillbermann 2008; Bielza Diaz-Caneja et al. 2009).We found that Spanish farmers are not willing to pay substantially for a crop insurance on novel biological threats.This result is in line with the broad literature (Smith and Glauber 2012). As Hazell et al. ( 1986) mentioned, farmers are sometimes even unwilling to pay the full cost of all risk insurance or the actuarially fair premium rate. For example, Mercadé et al. ( 2009) found that if they estimated the WTP for vegetable insurance using levels similar to those currently in off er, the resulting willingness to pay is negative, which conf irms the low rate of insurance participation.The low WTP values found in this study could be a latent connection with previously negative experiences with insurance products, because the vast majority of our respondents were unaware of or unsatisf ied with policies currently off ered. Interestingly, while the statistical results show limited demand for crop insurance, the respondents agreed that insurance is a better mechanism than ad hoc catastrophic compensation; and roughly half of the producers stated that crop insurance should be made mandatory, presumably to force uptake in the face of the low demand. The respondents preferred insurance products with full coverage, including protection from novel pests and diseases. Thus, moving away from specif ic peril insurance to comprehensive coverage can provide the f lexibility that farmers require and thus may improve insurance penetration (European Commission 2018). Moreover, the WTP for a 10% increase in the deductible was − 5.90 €/ha, lower than found in similar literature (Mercadé et al. 2009). While most insurance products off ered in Spain require a 30% deductible (Agroseguro 2015), it might be worth reevaluating this condition in preference to a lower threshold of uncovered damages to make insurance products more suitable to farmers (Mercadé et al. 2009).

In considering the design of insurance schemes, we also investigated the potential of linking farmer eligibility to access ad hoc funds for the purchase of agricultural insurance. Linking government payments to the purchase of insurance through a co-payment in the eventuality of a catastrophic event can act as an additional incentive for uptake. We found that, when government catastrophic outbreak support is connected to insurance, the respondents are willing to pay up to 17.89 €/ha more for those policies. Other authors have also explored the boundaries of insurance and ad hoc compensation. For example, Liesivaara and Myyrä( 2017) found that in order for a crop insurance market to develop in Finland, the government should either pay disaster relief payments or provide insurance premium subsidies,but refrain from using both. We provide an alternative in which crop insurance could be a prerequisite for eligibility for participation in government programs such as disaster relief, thus separating the role of catastrophic assistance and risk management subsidization.

We also explored the eff ects of requiring additional biosecurity-related production measures for insurance purchase,such as requiring traceability of the seeds and vegetables planted and health certif ication that would contribute to limit the spread and impacts of pests and diseases. Farmers require a decrease in insurance premium of 11 €/ha if biosecurity constraints are required. Previous literature already mentioned the co-benef its of crop insurance, such as Reyes et al. ( 2017), who claim that crop insurance can even be a climate change mitigation and adaptation strategy since it can provide farmers with the risk management tools to invest in more risky and higher value crops. For example, PCIC (the crop insurance program implemented in the Philippines) has dual objectives–enhancing access to credit, and managing risks from natural calamities, pests,and diseases (Reyes et al. 2017). It is important to note that from a biosecurity policy perspective, subsidized agricultural insurance can be also justif ied because insured farmers are more likely to report the incidence of infectious plants and diseases without delay because they will receive compensation for their losses (Goodwin and Vado 2007). The early reporting of outbreaks also provides governments and the private sector with information about the spread and abundance of diseases, which makes early and quick action possible. Recognizing the value of ancillary benef its adds signif icant value to crop insurance as a risk management tool for both farmers and governments (Santeramo and Ramsey 2017).

6 Conclusion

There is a consensus among insurance companies, governments, and farmers’ associations that crop insurance markets tailored to diff erent types of farms should exist and be promoted (European Commission 2018). Subsidized agricultural insurance can lead to higher penetration into the potential market of uninsured farmers, more accountability of risks and damages, and improved f inancial performance,as well as deliver additional biosecurity benef its (Reyes et al.2017). The main challenge for the Spanish subsidized system is to ensure its development within a changing policy environment, while simultaneously modulating and lessening ex post facto disaster assistance. Insurance products could be developed further to best serve the needs of farmers against novel threats. In particular, it seems that partially subsidizing national systems, expanding eligible risks covered for crops, developing more f lexible and simplif ied policies, and providing more information could go a long way to increase farmers’ participation in insurance schemes. Although the aim of this study was not to evaluate the supply and actuarial fairness of insurance policies, the article provides a foundation to stimulate further contributions that explore farmer’s preferences for diff erent risk management policies that limit the societal impacts of emerging plant pest and disease outbreaks. To this end, we studied the potential role of crop insurance that can promote ancillary benef its. Subsidized crop insurance can be used to encourage farmers to adopt appropriate biosecurity practices, thus helping reduce adverse environmental consequences of agriculture. Such practices can also promote a culture of agricultural health by encouraging detection of and early action against crop pests and diseases.

Some f inal important remarks to consider are that once a government subsidizes the insurance program, the private sector has incentives to lobby for increased subsidies to enhance their revenues and returns (Smith and Glauber 2012). Any income transfer program that requires market interventions creates distortions in the markets, and crop insurance subsidies are no exception (Smith and Glauber 2012). Potential ancillary benef its also f low from subsidized insurance, which might justify the ineffi ciencies created.Regarding the eventual presence of hypothetical bias, most of the survey respondents selected the opt-out alternative presented in the choice cards, that is, the respondents show a clear preference for no insurance. This preference, consistent with previous works (List and Gallet 2001; Murphy et al. 2004), suggests that the eff ect of hypothetical bias in our WTP results is, as was expected, low in our case study.A shortcoming of the study was that the relatively short and simple CE questionnaire, needed to engage a hard-to-reach population of small farmers typical of the studied region, did not allow us to capture the complexity of attitudes towards risk and uncertainty as an important factor determining limited adoption of insurance. A further analysis of heterogeneity would require a new CE study specif ically designed for the exploration of the heterogeneity in farmer preferences.In addition, this research combines data collection methods. Although it is recommended to limit data collection to one method to avoid biases, due to the geography and demographics of the respondents and the absence of a recent census, a mixture of methods was used to reach more farmers. Lastly, we acknowledge that the monetary values that farmers place on accepting diff erent insurance conditions are specif ic to each case study. Thus, the results of this study need to be tested in other regions to verify the extent of their broader applicability.

AcknowledgmentsWe would like to thank all the participants of this study–without their opinions and experiences this work would not have been possible. We would like to express our gratitude to the following agricultural associations for distributing the survey among their members: Cooperativas Agroalimentarias, AGACA–Asociación Galega de Cooperativas Agrarias, Sindicato Labrego, UPA–Unión de Pequeños Agricultores y Ganaderos, A Pementeira, Melisanto Sociedade Cooperativa, Horsal Sociedade Cooperativa, Postoiro Sociedade Cooperativa, and Patatas Ama. We would like to extend special thanks to Ramon Mato Sánchez, Javier Rodríguez Sánchez, Inés Amboage García, Higinio Mougán, Paula Kreisler Moreno, José Ramón Pedreira Dono, Oscar Antón Pérez García, Adolfo Leiva Quintela, Ganadería Fisteus y Bolaño SC, A Carpaceira de Campos SC, Pedro Martínez Escalona, and Santiago Ruiz Suso. Lastly, thanks to Dr Jon Pitchford,for proofreading the article, and Prof. Stephane Hess for developing the free software for the estimation of WTP using conditional parameter estimates from mixed logit models.

Open AccessThis article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing,adaptation, distribution and reproduction in any medium or format,as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http:// creat iveco mmons.org/ licen ses/ by/4. 0/ .

杂志排行

International Journal of Disaster Risk Science的其它文章

- Sendai Framework’s Global Targets A and B: Opinions from the Global Platform for Disaster Risk Reduction’s Ignite Stage 2019

- Perceptions About Climate Change in the Brazilian Civil Defense Sector

- Is Being Funny a Useful Policy? How Local Governments’Humorous Crisis Response Strategies and Crisis Responsibilities Inf luence Trust, Emotions, and Behavioral Intentions

- The Eff ect of Natural Hazard Damage on Manufacturing Value Added and the Impact of Spatiotemporal Data Variations on the Results

- Institutional Capacity and the Roles of Key Actors in Fire Disaster Risk Reduction: The Case of Ibadan, Nigeria

- Disaster Impacts Surveillance from Social Media with Topic Modeling and Feature Extraction: Case of Hurricane Harvey