Rural Road Investment and Economic Growth

2022-11-12fuZhihu

fu Zhihu

Xinjiang University

Zuo Zheyu*

Zhongkai University of Agriculture and Engineering

Abstract: The relationship between rural road① Rural roads refer to county roads, township roads and village roads in China. systems and economic systems is interconnectedness. The stimulating effects of investments in rural road infrastructure can be divided into three stages: investment, use,and upgrading. This paper presents this three-stage model of rural road construction to explain the process of stimulating economic growth by investing in rural roads. The investment stage produces a multiplier effect as the investment stimulates the economy. The use stage promotes the development of industries, which determines the stimulation effects of the investment. The upgrading stage produces economic growth leading to the upgrading of additional infrastructure, which generates more investments and also has a multiplier effect. Finally, the total revenue from the three stages,minus their total costs, allows for the calculation of Net Present Value (NPV).The investments can be deemed effective if the NPV is greater than zero.

Keywords: rural road investment, economic growth, three-stage model for investment

Transportation provides a great positive external economy; all aspects of social life depend on it. Transportation is the material foundation for the rapid development of the national economy. Professional, convenient, and low-cost transportation can promote the flow of production factors throughout the country to realize rational allocations. Rural transportation can transport agricultural products, people, means of living, means of agricultural production, and many other needs for social, economic, and cultural support. Rural roads connect both the initial sources of raw materials and the endpoints of commodity consumption. The connectivity, accessibility, and dispersion index of rural road networks play an important role in the efficiency of rural traffic. The infrastructure of rural road systems includes roads and bridges. Rural road investments can lead to economic growth and play an important role in maintaining economic growth in rural areas.

By the 1980s, the overall situation of road traffic systems in China was still poor. The road systems’ quality and density were poor overall and even worse in rural areas. At the end of 2003,according to the deployment requirements of the central government for rural focus, the former Ministry of Communications of the People’s Republic of China put forward the goal of building rural roads, serving urbanization, and enabling farmers to walk on tarmac and cement roads. In 2013, in accordance with the strategic deployment of the 18th National Congress of the Communist Party of China (CPC) to build a moderately prosperous society in all respects, the Ministry of Transport of the People’s Republic of China further put forward the new goal that “on the road to a moderately prosperous society, no area would be left behind because of poor conditions of rural traffic.” In 2015,the Ministry of Transport of the People’s Republic of China issued an opinion on promoting the construction of “four good roads.” It put forward four requirements, and the accessibility of roads ranks first. From “No. 1 central documents” for 2016—2022, the contents on rural roads are all focused on promoting the “four good rural roads.” The government is now paying increased attention to rural roads and other rural infrastructure construction.

Investment has a multiplier effect on economic growth, and investment in transportation infrastructure can stimulate economic growth. China has a large land area, scattered rural residents,and a long mileage of rural roads. Rural road construction and maintenance require a lot of funds;therefore, the multiplier effect is particularly important. In this paper, road construction and subsequent maintenance are counted as part of the investment (as part ofIinY=C+I+G+NX), which is recorded asIgj. However, huge investmentsIgjmay result in tax burdens and fiscal deficits. Rural roads are low-flow roads. Excessive and ineffective investments in rural roads alone will not stimulate rural economies but will instead become a waste of resources. Therefore, the development of road transportation networks should be supplied according to the demand, and in this way, the investments will be more efficient.

We offer some basic criteria in this paper that can be used to judge whether investments in specific rural road networks are effective. Our main contributions are: First, we offer a three-stage model to show how investments in rural roads can stimulate the economy and determine the leading factors in each stage. Second, we provide the criteria to judge whether the investment is effective, that is, whether the total NPV (Net Present Value) is greater than zero. Third, we prove that investments in rural road transportation infrastructure can stimulate economic growth and that it is economical to revise the practice of “paying attention to construction and neglect maintenance.”

Literature Review and Research Hypothesis

The direct stimulation of rural infrastructure construction projects to domestic demand is fast and large (Lin, 2000; Lou, 2004; Guo & Jia, 2006; Liu & Hu, 2010; Liu & Hu, 2010; Chen et al.,2012; Zhang, 2012; Li & Ni, 2013; Zhang et al., 2018; Chen, Chen, Lin & Liu, 2021). Researchers have defined and estimated the scope of infrastructure investment. For example, Jin (2012) defined the scope of infrastructure investments, supplemented and adjusted the official statistical data, and estimated the infrastructure capital stock at the national level from 1953 to 2008 and at the provincial level from 1993 to 2008 through the perpetual inventory method. Hu, Fan, and Xu (2016) corrected the existing infrastructure calculation literature errors, adjusted the statistical caliber to make the data before and after 2003 comparable, and re-estimated the depreciation rate and infrastructure stock.

Investments in infrastructure can promote economic growth and have a spatial spillover effect. Lou (2004) found that exogenous public infrastructure capital can improve the long-term economic growth rate by establishing a theoretical model. Therefore, investing in China’s rural road transportation sector can certainly improve the economic growth rate and promote economic development. Based on China’s annual data from 1981 to 2004 and under the framework of vector autoregression, Guo and Jia (2006) concluded that China’s infrastructure investment has a large and lasting positive impact on output, and the time lag is relatively short. Liu and Hu (2010a, 2010b)used China’s provincial panel data to conclude that transport infrastructure has a significant positive promoting effect and spillover effect on China’s economic growth. Liu et al. (2010) believe that the level of China’s transportation infrastructure has a significant positive impact on the growth of (TFP)total factor productivity. Chen, Xing, and Shi (2012) analyzed the impact of rural infrastructure investments on Farmers’ incomes by using the provincial panel data from 1999 to 2008 and concluded that rural infrastructure investments could promote farmers’ incomes on the whole, but its effect is limited; additionally, in the western regions, the transportation infrastructure investments also had a positive role in promoting farmers’ incomes. Using China’s provincial panel data from 1993 to 2009 and spatial econometric methods, Zhang (2012) built a spatial spillover model of transport infrastructure on regional economic growth and concluded that the spatial spillover effects of China’s transportation infrastructure on regional economic growth were significant. Li and Ni (2013) believe that improving transportation networks will accelerate the factor agglomeration of central cities.Under a unified framework, Zhang, et al. (2018) studied the path of transportation infrastructure promoting economic growth, quantified the contribution of each path, and verified that transportation infrastructure plays an important role in economic growth. Chen, Lin, and Liu, (2021) showed the impacts of different shocks on economic growth, and the capital goods investment shocks are included.

However, some studies have noted that the impact of infrastructure construction on the economy is not that simple but is a complex and changing process. Using the panel data of Chinese manufacturing enterprises from 1998 to 2002, Li and Li (2009) focused on the micro-channels through which transportation infrastructure affects economic growth and found that the investments in ordinary roads have no significant impact on the inventory levels of enterprises, so the impact of China’s rural road traffic on the inventory levels of enterprises is not significant. What is more, for local government, the new local debt has a multiplier effect and the first and the second crowding-out effect on short-term economic growth separately through public investment and liquidity channels (Liu & Li, 2021).

Using the panel data of 28 provinces from 1978 to 2008, Liu (2012) used the basic model, the lag model, and the spillover effect model to verify the relationships between China’s fixed capital stock of road and water transportation and regional economic development and concluded that the elasticity of fixed capital of highway and water transportation to GDP is continuously declining, and that there is a trade-off relationship between infrastructure investments and other investments under the condition of limited social resources. Zhang, Li, and Zhou (2013) found that the incremental expansion of transportation infrastructure investments and regional inequality will form the income crowding-out effect, widening the urban-rural gap in the central and western inland regions.Using the panel data of Chinese manufacturing enterprises from 1998 to 2007, Li and Tang (2015)concluded that provincial roads have a spillover effect on enterprise inventories but not rural roads.Though the spillover effect is important, Fan, Song, and Lin (2017) showed that the effect of spatial spillover of infrastructure construction is insignificant as a whole and different in different stages,therefore, the government should strengthen infrastructure construction and narrow the gap between different areas.

Based on China’s provincial panel data from 1994 to 2016, Liao et al. (2018) concluded that infrastructure investment has a significant positive impact on China’s economic growth but also shows an obvious “inverted U” feature. Asher and Novosad (2020) studied India’s “Prime Minister’s Village Road Scheme.” The results show that after the construction of rural roads, rural enterprises, agricultural production, and investment and consumption in the village have not changed significantly, and the spillover effect of road construction is not obvious. Road constructions in remote villages often have fewer benefits than the expectations of policymakers. Though the effect of rural roads is not so significant, it has been shown that transportation infrastructure disrupts local monopsony power in labor markets using an expansion of the national highway system in India(Brooks, et al., 2021). Sun, Niu, and Wan (2022) present the first systematic generalization of three effects of transportation infrastructure affecting industrial structure from the perspective of intercity interactions: division of labor, convergence effect and learning effect. These results are important for understanding the role of transportation infrastructure networks in promoting industrial structure transformation, economic integration, and regional division of labor.

In 2008, in response to the negative impact of the financial crisis on the economy, China adopted a plan to stimulate economic growth by investing in infrastructure. In 2009, the US Department of Transportation (DOT) proposed a grant program named TIGER (transportation investment generating economic recovery) with a capital of US1.5 billion to provide capital expenditures for investment.The supported investment projects included highways, bridges, public transportation, railways, and port construction. The goal of the TIGER grants were to stimulate the economy by investing in transportation infrastructure. The TIGER grants was to be implemented from 2010 to 2017 and be replaced by Better Utilizing Investments to Leverage Development (BUILD) Transportation Grants Program (formerly TIGER) after 2018. It cannot be an accident that the two countries have both adopted plans to invest in infrastructure to stimulate the economy. However, whether investments stimulate the economy must be based on efficiency and effectiveness. In the case of over-investment,the over-investment part can only be naturally depreciated, which cannot play the role of a multiplier effect to stimulate the economy and will eventually become a waste of resources. Therefore, we propose the first research hypothesis (H1).

H1: Under the premise of “no excessive investment happens,” investments in rural road transportation infrastructure can stimulate economic growth.

After the rural roads are put into use, depreciation will occur, one part of which is caused by natural damage, and the other part is caused by daily use. To ensure the normal use of rural roads,it is necessary to maintain them through additional investments in human, material, and financial resources. The question is whether rural roads must be maintained, and what will happen if they are not maintained? It can be predicted that without maintenance and management, rural roads will need a major overhaul or even reconstruction after n years of service. Therefore, we put forward our second research hypothesis (H2).

H2: If rural roads cannot be regularly and properly maintained over time, they will undergo a major overhaul or even reconstruction in the nth year after they are put into use.

If the research hypothesis H2is tenable, it indicates that the practice of “Paying attention to construction and neglect maintenance” needs to be revised. If rural roads need to be rebuilt after n years of use, whether the cost of reconstruction is more than the cost of annual maintenance is an important issue. If the cost of maintenance and management every year is more than that of reconstruction after n years, it will be meaningless to maintain and manage rural roads every year.Therefore, we propose our third research (H3).

H3: The annual maintenance cost of rural road infrastructure is less than the one-time overhaul cost after n years of service.

If the research hypothesis H3is tenable, it will provide strong support for the position that it is economical to maintain and manage rural roads every year.

The Three-Stage Model for Rural Roads Investments

According to the time sequence of the rural road infrastructure development process, from the investment stage, usage stage, maintenance, and repair stage, to the abandonment or reclamation stage,we analyzed the role of rural road investment in economic stimulation. To simplify the analysis, the maintenance, repair, or abandonment of the rural roads are classified as the third stage, and the annual management and maintenance are also classified as the third stage. Therefore, rural road investments can be simplified into three stages: investment, usage, upgrading, or abandonment.

Investment Stage

In the investment stage, it makes no difference whether the economy is closed or open. Therefore,we considered a closed economy for simplicity. Quoting Keynes’ national income model of a closed economy, written as the following equation (1):

The investment in periodtis equal to the savings in periodt. That is, investmentItequals the savingsSt. We get equation (2):

Equation (3) is obtained from the deformation of equation (2):

LetGtbe an invariant constant, denoted asG—t. The current consumption tendency is determined by the income and consumption of the previous period:

αtis the marginal propensity to consume. We get equation (5) from the deformation of equation (4):

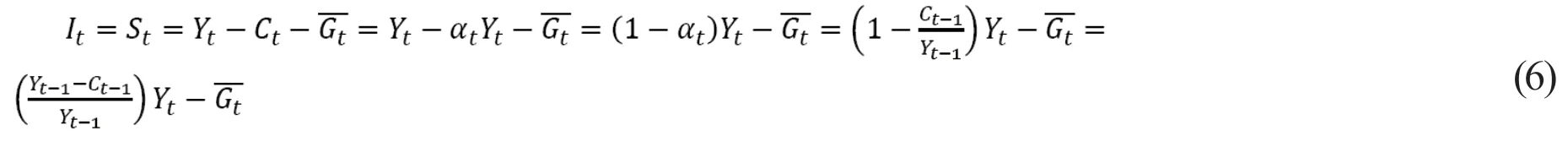

Marginal propensity to consume for each periodαtdepends on the previous period revenueYt-1and consumptionCt-1. Then, (1 -αt)is the marginal propensity to save. Since saving equals investment,we get equation (6):

The amount of investment in periodtis equal to the national income in periodtmultiplied by the savings rate in periodtminus government purchases. The saving rate in periodtis determined by the marginal propensity to save in the previous period (t-1). After the current savingSttransform into investment intperiod, there will be an equal proportion of primary change in national output. Since this is the construction stage of rural road infrastructure, and there is no depreciation in capital stockK,the increment of capital stock in periodtis equal to the investment in periodt, and the investment in periodtis equal to the savings in periodt, that is ΔKt=It=St.

The investment will generate an initial ΔYt1in national income, and the increase in income will promote a series of secondary consumption expenditures and increased employment, ΔYt2, ΔYt3,…,ΔYtn, namely the multiplier effect. Changes in national income caused by investments can be written as:. Then we get equation (7):

The first item on the right of equation (7) can be rewritten as equation (8):

Equation (8) is the investment multiplier for periodt. The change of investment in periodtwill increase or decrease the change of income ΔYtthrough the multiplier effect.

Now, we prove the research hypothesis H1:

From this inequality, it can be concluded that if the investment is not excessive, the multiplier effect will make each unit of input produce greater output than the input. The research hypothesis H1is supported.

The capital stock of rural roads before the start of the second stage is equation (9):The economic volume caused by investments (i.e., the total income in the first stage) is equation (10):

In addition to the multiplier effect, there is a positive externality of location space in the supply of rural highway transportation infrastructure because the convenience of transportation makes the production factors in the region produce an agglomeration effect. This agglomeration effect will make some production factors form at a certain scale and produce economies of scale that will produce products and corresponding industries with competitive advantages. Only after the characteristic industries with regional comparative advantages are truly developed can these industries bring predictable and stable income flows to the region and realize the support and driving effect on the economy.

Usage Stage

The main stimulating effects of rural road infrastructure on the economy in the usage stage include depreciation and maintenance and support for the development of other industries.

Depreciation and maintenance.

Rural road infrastructure has not been put to use in the investment and construction stage, so capital depreciation has not been added to the investment model. The capital stock at the beginning of the second stage can be expressed as. However, wear and depreciation will occur during the usage stage, and depreciation items need to be added to the model in the second stage. Letδrepresent the capital depreciation rate, (0 <δ < 1) ;K(t) is the capital stock;Itis the net investment in yeart. That is capital flow;Igis the total investment.

The expression of total investment is:

In the usage stage, rural roads are a kind of capital. This capital will be continuously reduced due to depreciation, and new capital will be formed due to continuous investments.

The relationship between capital stockK(t) and investmentItis:

From equation (12), we can get equation (13):

Obviously, the capital stock is integral to the net investment. From formula (12)we can deduce, the increment ofKis based on the flowItand timedt. Thus, we can get equation (14):

This definite integral represents capital accumulation from investmentItin the time interval [0,t].Formula (15) can thus be deduced from formula (14):

Formula (15) represents the time during the usage stage of rural roads. The capital amount in thetyear is equal to the initial capital amountK(0) and the accumulation of the annual investment amountIt, that is. The capita l stock is depreciated annually at a rate ofδ, (0 <δ < 1), the depreciation rate in the second year isδ2,…, the depreciation rate in the nth year isδn, (0 <δ < 1).

Assuming no additional investments, the initial capital of rural roads when they are put into use isK(0), and the capital stock after the first year’s usage will be:K(1) =K(0) -δK(0) =K(0)(1-δ).

The capital stock after usage in the second year will be:

K(2) =K(1) -δK(1) =K(1)(1-δ) =K(0)(1-δ)2. …

The capital stock after usage in the nth year will be:K(n) =K(0)(1-δ)n.

If there is no additional investment, the capital stock will decrease at an equal proportion.

Next, we calculate the total depreciation. The depreciation amount in the first year is:

Δ1=K(0)δ, (0 <δ < 1).

The depreciation in the second year is: Δ2= (K(0)-δK(0))δ=K(0)δ-K(0)δ2, (0 <δ < 1).

The depreciation in the third year is: Δ3= (K(0)-δK(0) +K(0)δ2)δ=K(0)δ-K(0)δ2+K(0)δ3, (0 <δ< 1).…

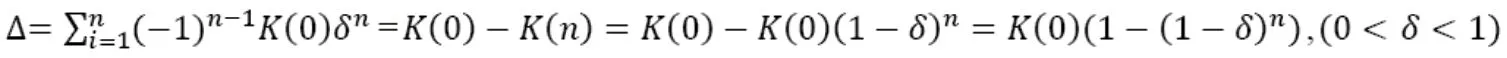

The depreciation in the nth year is: Δn=K(0)δ-K(0)δ2+…+ (-1)n-1K(0)δn, (0 <δ < 1).

The expression of total depreciation can be written as:

Formula (16) represents the mathematical expression of total depreciation once the rural road transportation infrastructure is put to use but without additional investments. To simplify equation (16),make the total depreciation equal to the initial capital quantity minus the capital stock after n years.The capital stock after n years is:K(n) =K(0)(1-δ)n.

The expression of total depreciation can be rewritten from equation (16) to equation (17):

Next, we will prove the research for hypothesis H2:

FromK(0) =K(0)(1-(1-δ)n), we know that (1-δ)nis an exponential function, which decreases at a higher rate. The higher rate (1-δ)nis, the faster depreciation. If we want to keep the capital at the original level, more investment is required, especially for the one-time overhaul. Thus, our research hypothesis H2is supported.

The research hypothesis H2has been supported, which shows if the rural roads cannot be maintained after they are put to use, the depreciation rate is quite high, and road conditions will soon reach a level of deterioration that prevents continued use. The practice of “paying attention to construction and neglecting maintenance” needs to be modified.

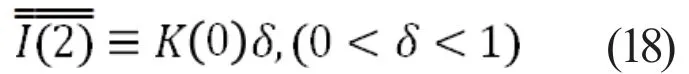

Now consider the investment and depreciation of annual maintenance and management of rural roads without discount. To keep the capital at the initial level during the use of the capital, it is sufficient to make the investment in the first year precisely equal to the depreciation in the first year,that is:I(2)t=1= Δ1=K(0)δ,(0 <δ < 1).

The investment in the second year should also be exactly equal to the depreciation in the second year. The depreciation amount in the second year is the same as that in the first year:I(2)t=2= Δ2=K(1)δ=K(0)δ,(0 <δ < 1).

The reason isI(2)t=1= Δ1=K(0)δ,(0 <δ < 1). The investment will make up for the depreciation completely so that the capital stock at the end of the first year and the beginning of the second year will reach the initial level, so the depreciation volume will be Δ2= … = Δn=K(0)δ= Δ1,(0 <δ < 1).The annual investment amount is constant, written as equation (18):

The simplified treatment made here does not consider the discount rate. If the discount rate is considered, the investment in the first yearI(2)t=1and investment in the nth yearI(2)t=nwill not be equal.

Next, consider the investment and depreciation at a discount.I(2)t=n=I(2)t=1(1+i)-n,(0 <i < 1),(0 <δ < 1),iis the natural interest rate (discount rate).

By combining the investments above, we get equation (19):

From equation (19), we know the discount value of all costs to fully maintain the existing road infrastructure in each phase to reach the initial level.

Next, let us prove research hypothesis H3:

We confirmed above that depreciation is in the form of an exponential function, and that discount is also in the form of an exponential function. To compare the speeds of depreciation and discount, the comparison process is:

Total depreciation of rural roads capital for overhaul:

The total investment in the annual maintenance of rural roads capital is:

Set (1-δ)ndeformation as (1-δ)n= (1/(1-δ))-n, and then compare the exponential function (1/(1-δ))-nande-in.

If we setδ <(1-1/e), the comparison between depreciation and investment becomes the comparison betweene-nande-in. Since (0 <δ < 1),e-nis faster, that is, depreciation is faster, we can conclude that when other conditions are the same, it is more economical to adopt the form of annual maintenance, and the research hypothesis H3has now been supported.

Research hypothesis H3being supported shows that the cost of maintenance of rural roads every year is smaller than that of an overhaul after many years, and the practice of paying attention to maintenance is economical. The same should be done for other types of infrastructure.

Supporting other industries.

After the rural road transportation infrastructure has been completed, its economic value depends on the development of other industries. The transportation sector assists the development of other industries and reflects its own value in the process of assisting other industries except for transportation itself (hereinafter referred to as “other industries”). Suppose that the output value of other industries in rural areas isRO, and the initial capital of rural road traffic isK(0). Before the rural roads are put to use, the output value of other industries in the countryside isROB. After the rural roads have been put to use, the output value isROA. Then (ROA-ROB) represents the change in the output value of other rural industries after the provision of rural road facilities.

Next, we calculate the change in output of other industries caused by the supply of a unit of rural transportation infrastructure. For convenience, let us assume that there is no depreciation in the transportation capital. The change in the output value of other industries caused by a unit of traffic capital is obtained by dividing (ROA-ROB) by the initial capitalK(0), which is called the traffic-induced growth rate, set asJ, and the expression in equation (20):

However, capital will be depreciated. To maintain the initial traffic capital stockK(0), the annual maintenance cost is the same as the depreciation capital. Therefore, the induced growth rate of traffic capital should be modified to equation (21):

It is not difficult to see that the only difference between formula (21) and formula (20) lies in the molecular difference. The depreciation of traffic capital is caused by the use of traffic infrastructure by other industries. Therefore, the net economic volume generated by the supply of unit traffic capital equals the output growth of other industries deducing the depreciation of traffic capital.

The assets are discounted according to the market interest rate, and then the growth rate caused by traffic capital is explained in algebraic form. Let the discount rate bei, (0 <i < 1).ROBis used as the base point and will not be discounted.ROAis a series of income streams. We can write the discrete form of its income stream by year:

Without assuming whether the future income stream is the same every year, the sum of the above discrete values is equal toROA. However, it cannot be given by integral and can only be added item by item to getROA. The sum of the discounted value of the investment to make up for the depreciation of the transportation capital is:

Whether the future revenue streams are the same or not does not affect the description of depreciation but will affect the complexity of algebraic operations. Therefore, it may be assumed that after the supply of transportation infrastructure, the income flow of other industries will not change,and equation (23) can be obtained:

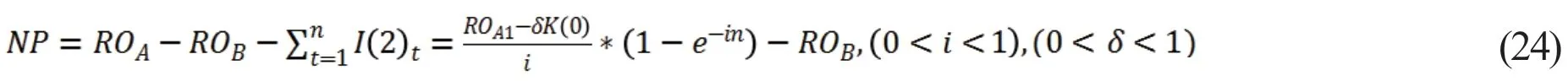

The net income brought by the transportation infrastructure in the usage stage is equation (24):

The net incomeNPis greater than 0, indicating that the investment in rural road infrastructure is economical. In the usage stage of rural road infrastructure,NP= 0 indicates that the growth rate caused by traffic capital is 0,J= 0, and the initial capital of infrastructure is excessive. The worst situation is thatNP< 0, the more infrastructure investment, the less economy.

The growth path of the traffic-induced economy.

Generally, after the rural road traffic infrastructure is put into operation, the growth rate caused by traffic capital will show the following path: first, it will experience an acceleration period, then a deceleration period, and finally, it will reach a relatively stable period. Whent= 0, capital will grow from nothing, and other industries will gradually adapt to the transportation infrastructure. This adaptation process will make the slope ofJ(t) increasingly steep. This period is the acceleration period ofJ(t). As the adaptability of other industries to traffic becomes better and better, the growth rate will gradually slow, soJ(t)) enters the deceleration period and gradually reaches its peak in deceleration.That is, rural road infrastructure will fully integrate with other industries. This period is a stationary period whenJ(t) has reached the optimal level, calledJ(t)gold. This time should be extended as much as possible becauseJ(t)goldshows that the growth rate caused by rural road traffic has reached a peak,and the role of traffic in other departments has been fully played. At this point, the traffic load on rural roads also reaches its maximum.

The induced growth rate will gradually decline. The only option forJ(t)goldto be extended is to carefully maintain the rural road traffic facilities and maintain good rural road conditions. However,J(t) will also decline in the future. In addition to the decline in transport capacity caused by the depreciation of rural roads infrastructure, the gradual improvement of the economic development level results in the existing rural road infrastructure becoming unable to meet the traffic demands,resulting in the traffic-induced growth rate gradually dropping after exceedingJ(t)gold. In another case, due to the loss of comparative advantage and competitive advantage, the level and development quality of other industries gradually decline due to the loss of market share, resulting in a relative surplus of rural road infrastructure; thusJ(t) shows a gradual downward trend afterJ(t) passesJ(t)gold.

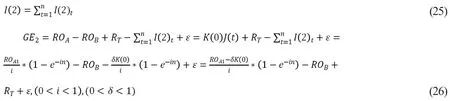

The second stage analyzes the stimulating effect of rural road infrastructure on economic growth in the usage stage. During the second stage, investmentI(2) and incomeGE2are equations (25) and (26),respectively:

(ROA-ROB) is the development income of other industries;is the depreciation in the second stage;ROBis the economic volume of other industries before the use of transportation capital;is the economic volume of other industries after the use of transportation capital calculated by discount;δis the depreciation rate of transportation capital; 0 <δ < 1;iis the discount rate, and 0 <i < 1;nis the number of periods. In addition to these economic quantities that can be calculated, there are many stimulating effects on the economy that cannot be measured, such as employment promotion, location spillover effects, radiation functions,networking functions, and others. These stimulating effects on the economy are all classified as disturbance itemsε.

The Stage for Upgrade or Discard

However, the infrastructure of rural roads will be depreciated continuously with the wear and tear of the usage process, and will finally enter the third stage: upgrading or abandonment.

Upgrading brings new investment.

China has invested a large number of subsidy funds in upgrading rural roads, bridges, and other infrastructure. This process is included in the investment, recorded asI(3), to distinguish it from the investmentIin the first stage.I(3) is different fromI.I(3) is the reinvestment and construction of those parts inIthat did not meet the quality standards. The upgraded part has thus reduced the original part.Therefore,I(3) is less than the total amount ofI, andI(3) does not change the total value of the rural road capital but changes the structural proportion of capital. The proportion of low-grade rural roads will gradually decrease due toI(3). The economic growth rate fromI(3) is recorded asJI(3), which is caused by the upgrading of the original capital.

Abandonment of rural roads.

After the second stage of usage and maintenance of rural road infrastructure, in addition to the options of upgrading and reconstruction, rural roads can also be abandoned. After the disposal of rural roads, some abandoned roads close to farmlands can be demolished and reclaimed, but not necessarily reclaimed into farmland. For example, some areas have reclaimed these abandoned rural roads into shelterbelts, from one kind of public goods to another. The investment incurred in the abandonment process is set asI(4) to distinguishIandI(3). AfterI(4) occurs, the capital stock of these rural roads no longer exists and becomes other resources: arable land, farmland shelter, forests, green belts, etc., which are recorded asOR(other resources). The investment in the third stage isI(3) +I(4),and the income isI(3)JI(3)+OR. The induced growth rate of abandoned roads is included inJI(3).

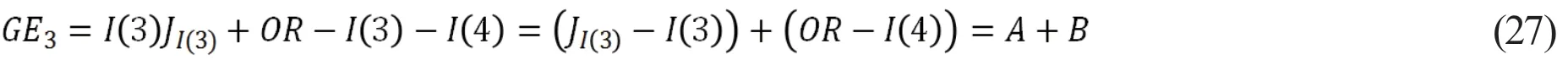

The total income of the third stage is equation (27):

Wherein, A refers to the economic benefits brought by upgrading, transformation, and reconstruction; and B refers to the economic benefits brought by demolition and reclamation.JI(3)refers to the economic growth of other industries caused by rural road reconstruction;I(3) refers to reconstruction investments, andI(4) refers to demolition and reclamation investments.

Conclusions and Policy Implications

There is a close relationship between rural road infrastructure and rural economies. We constructed a three-stage model of investment in rural road transport infrastructure. Specifically,the stimulating effect of rural road infrastructure on the economy can be divided into three stages:investment stage, use stage, and upgrading (or abandonment) stage. Different factors stimulate economic growth in different stages. In the first stage, the multiplier effect makes investment stimulate economic growth; in the second stage, the growth rate induced by traffic stimulates economic growth; in the third stage, the growth rate is caused by the upgrading of transportation infrastructure, or the income from reclamation which can also stimulate economic growth.

The net present value (NPV) of rural road investments can be obtained by subtracting the sum of the cost of these three stages from the sum of the benefits of these three stages. After discounting the findings, we can obtain the results. According to the discount results, if the net present value is greater than zero, it indicates that the rural road investment is effective; if the net present value is less than zero, the rural road investment is invalid; if the net present value is equal to zero, it means that the rural road investment is equal to the benefit from the investment. In addition, if the process of investments in rural roads has the first and third stages, but the second stage exists for only a short time, it indicates that there is a serious oversupply of rural road transportation infrastructure or there has been a mistake in predicting the future traffic flow. The ideal outcome is that the second stage is relatively long. The longer the second stages are, the more reasonable the supply of rural road transportation infrastructure is.

The research draws the following three conclusions: first, under the premise of no excessive investments, investments in rural road transport infrastructure can stimulate economic growth.Second, if rural roads cannot be maintained all the time, they will undergo a major overhaul or reconstruction in the nth year of operation. Third, the annual maintenance cost of infrastructure is smaller than the one-time overhaul or reconstruction after n years of use.

We also identified two policy implications: first, rural roads are low-flow roads. In addition to their good public attributes, the construction of rural road transportation infrastructure also needs to consider its economies of scale because huge investments may result in tax burdens and fiscal deficits. Therefore, road transportation should also be supplied according to demand as this will make the investments more efficient. Second, on the premise that the investment is not excessive, it is economical to revise the practice of “paying attention to construction and neglect maintenance.”

There are also some inadequacies in this paper. This paper uses a three-stage model to study a series of economic effects caused by the public good of investments in rural roads. However, there are the following problems in the analysis and modeling process of this paper. First, in macroeconomics,investments have a multiplier effect, so investments have the effect of stimulating economic growth,but we did not estimate how great this effect might be. Second, rural roads have driving effects on the economy, but we did not provide quantitative support for this point; rural roads will depreciate in the usage process, and we did not provide quantitative support for this either. Third, there are a series of economic effects in the process of maintenance, upgrading, and abandonment of rural roads,and again we did not quantify them. These are the shortcomings of this paper. We believe that more attention should be paid to quantitative support in future research.

杂志排行

Contemporary Social Sciences的其它文章

- Research on the Influence Degree and Effect of Support on Innovation Incentives for R&D Personnel in Micro and Small Enterprises: An Empirical Study based on the China Micro and Small Enterprise Survey (CMES)

- Research on the Development of Rural Tourism in the Context of Comprehensively Promoting Rural Revitalization: A Social-System-Based Approach

- On the Development of Modern Tourism in Liangshan Yi Autonomous Prefecture, Sichuan Province

- A Study of Sanxingdui Museum’s Building of International Communication Capacity

- Enlightenment from Development Experience of World-Class Universities in Foreign Inland Regions

- Erasable/Inerasable L1 Transfer in Interlanguage Phonology: An Optimality Theory Analysis of /aʊn/and Sentence Stress in Chinese Learners of English