CSSC HK Shipping Industry and Finance Integration Records Counter-Cyclical Growth

2022-11-03HeBaoxin

He Baoxin

CSSC (Hong Kong) Shipping Co Ltd, a subsidiary of China State Shipbuilding Corporation (CSSC), recently released its 2022 interim performance report. The report showed that the company's revenue and profit, two important operating indicators, both hit record highs. In the first half of 2022, the total revenue of CSSC HK Shipping chartering business reached HKD 1.505 billion, up 43.3% year on year. Of this amount, operating chartering revenue was HKD 984 million, up 60.26% YOY, and financial chartering revenue was HKD 333 million, up 44.7% YOY. Net profit was HKD 906 million, up 36.9% YOY, and the H1 2022 net profit outnumbered the annual net profit of 2019 when it was listed in the Hong Kong Exchanges and Clearing Limited. This stellar report card is a great gift to the 10th anniversary of CSSC (Hong Kong) Shipping and the third anniversary of its listing on HKEX.

Ship proficiency guarantees countercyclical adjustment

From 2017 to 2021, the compound growth rate of CSSC HK Shipping chartering operating revenue reached 19.25%, and the compound growth rate of net profit reached 25.52%. How does the company maintain high growth in a long-term and stable fashion? The gene of ship proficiency has played an important role therein.

Ship chartering is essentially a leasing industry. Ship chartering companies provide chartering services to ship owners to earn spreads and rents. However, unlike the traditional chartering industry, ship chartering is not only affected by the leasing industry, but also bears the dual influence from the shipbuilding industry and the shipping industry. CSSC-backed HK Shipping is a strong performer of manufacturer-side ship chartering companies. It has the most direct and rapid information access channel for important information about shiprelated enterprise dynamics, the supply and demand relationship of the shipping market and the demand of major global customers, and hence it is able to make a more accurate analysis of the industry trend.

For example, when the global shipping industry was on the downturn in 2019, CSSC HK Shipping signed a package of orders up to 10 billion yuan with a number of upstream and downstream companies, set a record in the Chinese shipbuilding market for signing the highest vale, covering the most widely ship types and most shipowners and shipyards, establishing itself as one of the biggest beneficiaries of the shipping industry recovery in the past two years.

In 2021, the company grabbed the time window before the price rise of trunk container ships, ordered two 24,000TEU container ships and six 16,000TEU container ships at low prices, and reached a long-term chartering arrangement with the leading liner company. It validated two 174,000 m3 LNG carriers, established strategic partnerships with PetroChina and COSCO Shipping, and locked the high price chartering party in advance. The ships will be put on hire for operation in succession from May 2023 to 2024, providing a strong guarantee for the medium-term and long-term development.

After several rounds of countercyclical layout, CSSC HK Shipping fleet is growing stronger. By the end of June, the company had operated 132 ships, up 15.8% YOY, with 25 more ships under construction, creating a growing scale advantage.

It is worth mentioning that the expansion of CSSC HK Shipping has been progressing in a planned and step-by-step way. Of the 132 chartering parties under execution, 104 are long-term ones, with an average chartering term of 7.34 years, ensuring the long-term and stable cash flow, and ensuring the use efficiency of assets while expanding the asset scale. At present, all the ships of CSSC HK Shipping are in operation, and the lease cash collection rate hits 100%.

Broaden the profile, write a new chapter of combining industry and finance

Overlaying advantage highlights the leading effect. Global seaborne trade has maintained growth in the past 40 years, and the demand side has been extremely resilient. After nearly 10 years of overcapacity addressing, the proportion of handheld order transport capacity of all ship types in the shipping industry stands at a historical low, and the growth rate of the supply side is continuing to decline. In the wane and wax, the shipping industry is in a watershed moment of a new upward cycle.

The trend of the shipping industry boom has gradually become clear, which will bring a new round of development opportunities to the whole industrial chain. At the same time, the high-capital-intensive and longreturn cycle attribute of ship chartering has laid a very high industry barrier, so the head chartering companies in the industry will be the biggest beneficiaries of the industry cycle.

As the only listed shipyardbased chartering company in Greater China region, CSSC HK Shipping has a wider financing channel. Meanwhile, the company has also received Fitch A and S&P A-global credit rating for three consecutive years, and the financing cost is low in the industry. In addition, the company has long been focusing on the ship business, and has the advantages of an experienced management team, so it is easier to grapple with all kinds of emergencies in the long-term operation.

Innovate the development model of integrating industry and finance. CSSC HK Shipping has fully grasped the general trend of long-term positive development of the shipping industry, and blazed a trail of a differentiated development path of industry and finance integration.

Different from the traditional mode relying mainly on financial chartering in the industry, CSSC HK Shipping has attached great importance to the operational chartering mode, shared risks with partners, and even established joint ventures or fully invested in the shipping track independently.

Such an innovative business model of combining industry and finance has continued since the establishment of the company. In 2013, CSSC HK Shipping and Parakou Shipping established a CP Worldwide joint venture, marking the company's commitment to being a ship chartering company providing integrated services.

We learned that in H1 2022, the company's joint venture oil tanker fleet investment income increased significantly, the investment income attributable to CSSC HK Shipping was HKD 92 million, a YOY increase of HKD 102 million. In addition, the selfoperated bulk carrier fleet has also achieved bright results. The company owned six 64,000 DWT bulk carriers and two 82,000 DWT bulk carriers, with operating revenue of HKD 288 million and net profit of HKD 171 million, up 95% YOY.

It is worth mentioning that in May this year, the company also established a CA Shipping joint venture with Asian Seas Line, and invested in ordering 2+2 1100TEU feeder container ships, unveiling the new company's entry into the container ship domain.

Predictably, CSSC HK Shipping will enter more segments in the future, and further fully improve the role orientation of shipowner while playing the role orientation of charteree.

Focus on the “dual-carbon” and deploy clean energy. The “dualcarbon” goal is the guidance for the future development of various industries, and the energy transition of the shipbuilding industry is also on the agenda. Yet the new energy conversion of ships is very complicated, and leading enterprises need to take the initiative to speed up the process. As the first chartering company in the industry to lay out the whole clean energy industry chain, CSSC HK Shipping entered clean energy and green shipbuilding in 2015, and has been increasing investment since.

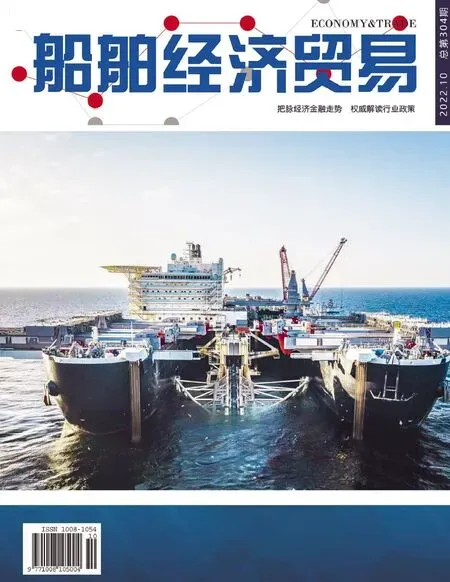

As of June 30, 2022, CSSC HK Shipping had owned 20 LNG carriers, FLNG units, large LNG-FSRUs and VLGCs, accounting for 35.7% of the contract value. The H1 business contributed HKD 746 million in revenue, up 84% YOY.

To sum up, CSSC HK Shipping, which was born in the freezing point period of the shipping industry, has ranked among the forefront of the world ship chartering industry in only 10 years.

In 2022, CSSC HK Shipping has entered the second 10-year new stage of development. Relying on the strong industrial background and technological advantages of CSSC, the company will continue to give full play to the professional advantages and differentiated competitive advantages of ship proficiency, constantly broaden the profile, break through the growth ceiling, write a new chapter of the combination of industry and finance, and continue to lead the diversified and healthy development of China's shipbuilding industry.