Fueling the Clean Energy Transition

2022-06-27TaoZihui

Tao Zihui

Climate change is a long-term battle for the internationalcommunity; what the world needs now more than ever is a new“green” agenda.

Like many a multilateralgathering over the past fewyears, the 2022 Annual Conferenceof the Boao Forum for Asia (BFA),a platform that promotes regionaleconomic integration, placed specialemphasis on low-carbon development. The event, running from April 20 to22 in Boao, Hainan Province, homedin on green and sustainable growth asthe world is reeling from the COVID-19pandemic and global climate change.

China received much attention.Among all the ambitious commitments on the global stage, the country’s“30-60” decarbonization goals, namely topeak carbon emissions before 2030 and achieve carbon neutrality before 2060,stand out.

For China, carbon neutrality—requiring technological revolution—isnot only a goal, but also a desired resultcombining the right policies and thenecessary capital, including individuals reducing their carbon footprint,according to Li Lei, vice president andregional head of North Asia of SABIC.The Saudi Arabia-headquartereddiversified chemical company is amember of the BFA.

A Clean Break

“To address sustainable development challenges, innovation is the mostfundamental logic and must becomethe strong competitive advantage onwhich companies can lean,” Li said.

Hydrogen energy development,certainly, is an essential component of this kind of innovation.

Depending on the source from which it is produced, hydrogen can be gray, blue or green; green hydrogen is the only typeproduced in a climate-neutral mannerthat can reduce emissions.

Green hydrogen is produced by using clean energy from renewable energysources, such as solar or wind power,to split water into two hydrogen atomsand one oxygen atom through a process called electrolysis. As it is considereda superior clean energy source forthe future, China is accelerating itsdeployment nationwide.

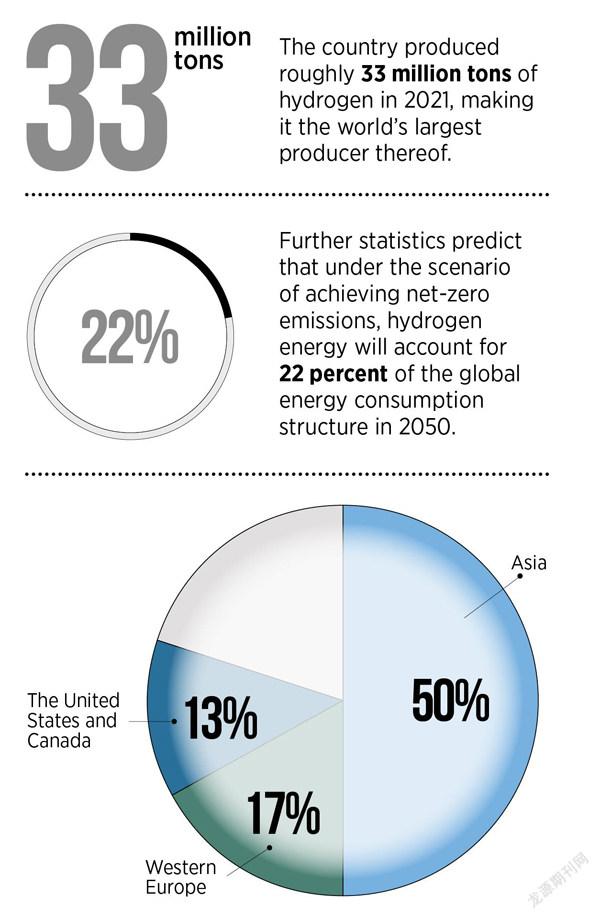

The country produced roughly 33million tons of hydrogen in 2021, making it the world’s largest producer thereof.By 2035, the proportion of hydrogenproduced from renewable energy sources will increase significantly, according toa plan on the development of hydrogenfor the 2021-35 period. The documentwas jointly released by the NationalDevelopment and Reform Commissionand the National Energy Administration on March 23.

By 2025, China intends to haveall related core technologies andmanufacturing processes in place, it added.

Nevertheless, the development ofhydrogen energy as of yet has a longand winding road ahead. Many worryabout its costs and whether it will prove competitive in the market. Easy access to investment and financing opportunities are essential to the sound demand andsupply of green hydrogen energy,participants said at a BFA sub-forum on the issue on April 20.

Wang Naixiang, chairman of China Beijing Green Exchange, pointed outthat the development of hydrogenmust break through the bottlenecksin investment and financing. It isestimated that in 2030, hydrogenenergy will require US$700 billion indirect investment; the future holds atrillion-level market. Further statistics predict that under the scenarioof achieving net-zero emissions,hydrogen energy will account for22 percent of the global energyconsumption structure in 2050, he added.

Deng Jianling, general managerof China Huaneng Group Co. Ltd.,believes that with technologicaladvancements, the market will surely become more open to the energy.

“I remain very optimistic about its prospects,” Deng said.

Continued innovation is crucial to industrial progress and global economies should therefore intensify collaboration, Martina Merz, CEO of German conglomerate ThyssenKrupp, told the subforum. “Green transition relates to the success of a country and even that of the world. We must exert every effort we possibly can to change the gloomy status quo,” she said.

Progress and Prospects

Despite the COVID-19 pandemic, Asian countrieshave continued their mobilization of financialresources for green and sustainable initiatives asclimate financing across Asia in 2020 accounted for some 50 percent of the global total, compared with 17 percent for Western Europe and 13 percent forthe United States and Canada, according to a report citing the latest estimates from the Climate PolicyInitiative released by the BFA on April 20.

Aiming to enhance green governance, Asian authorities have set up high-level collectives and committees overseeing the formulation and implementation of national net-zero strategies, defining decarbonization goals and drafting roadmaps to meet these targets, as well as establishing carbon emission tradingsystems, the report read.

The Green Finance Committee ofthe China Society for Finance andBanking in late 2021 issued a reportpredicting China will need 487 trillionyuan (US$75.53 trillion) in green andlow-carbon investment over the next 30 years.“In the international market, this amount will be even larger, and it mayrequire hundreds of trillions of dollarsin green and low-carbon investment,”committee chairman Ma Jun said at the subforum.

China, while maintaining aneffective policy mix to spur greeninvestment, is working toward amechanism that supports financingactivities with a market-based approach. It also helps other developing countries cope with climate change and promote global green transition.

In 2016, the People’s Bank of China, the country’s central bank, led cross-department coordination to introduce a guideline on the creation of a greenfinancial system, marking the world’sfirst policy framework of this kindapproved and established by centralgovernment departments.

“China’s carbon neutralitycommitment to the world, which isnow being followed by the introduction of a series of supportive policies andinitiatives, shows its unequivocalresolution in this brand-new field,”SABIC’s Li said.

Zhou Xiaochuan, vice chairman ofthe BFA and China’s chief representative to the organization, said thegovernment should guide businesses,investors and financial institutions totake a rational and realistic approach to investing in carbon mitigation projects and achieve the established targetsaccording to well-conceived roadmapsand timetables.

“It’s not just about emissionreductions or carbon neutraltechnology,” Zhu Min, former deputymanaging director of the International Monetary Fund, told the subforum. “It’s about a change in the socialmindset, from production to lifestyle. Only education can cultivate a newgeneration. It’s all about society.”