Breaking The Block

2022-06-27XiaoXin

Xiao Xin

Throughout April as China was involvedin an all-out effort to contain Omicronin the financial hub of Shanghai, oneof the area’s greatest advantages—asmooth and fast transportation andlogistics network—partially devolvedinto a pain point hindering economicactivity.

The Chinese saying“ wherever there’spain, there’s a blockage”certainlyapplies to the numerous road transportblockages, most notably in the YangtzeRiver Delta region centered aroundShanghai.

The government’s swift move totroubleshoot the malfunctioninglogistics network coincided with thenational push for building a unifieddomestic market, and such sharp acutepain likely serves to warn of morefundamental economic problems thatmore people should be concernedabout.

Road Travails

With the nation poised to fightOmicron spread in Shanghai, sporadicroadblocks seemed to toss cold wateron zealous efforts to deliver food,medical, and other key supplies to thevirus-ravaged city.

When the caseload surged inShanghai in April, many localgovernments introduced independentviral prevention and containmentmeasures including the suspension ofintercity highway services seeking tocurb Omicron spread.

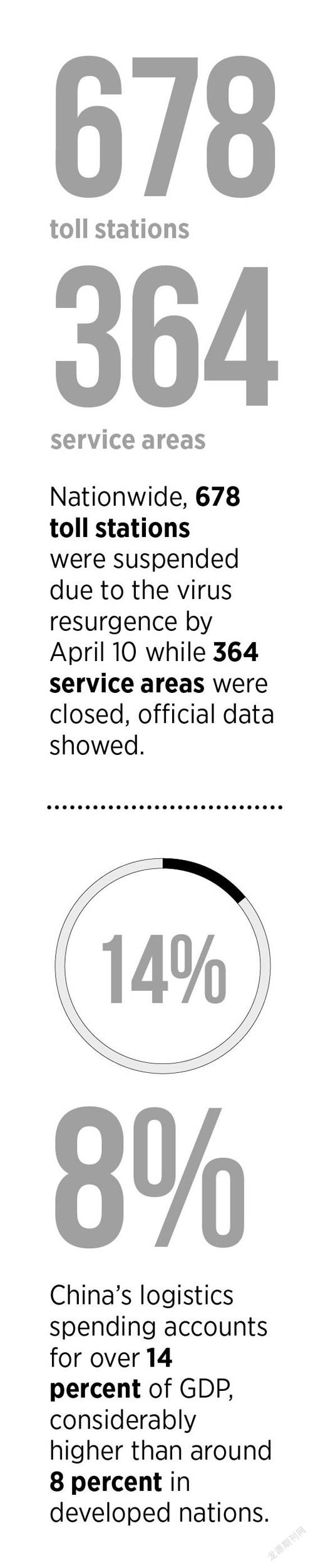

Nationwide, 678 toll stations weresuspended due to the virus resurgenceby April 10 while 364 service areas wereclosed, official data showed.

The blockage appeared to becompounded by tighter restrictions that were at local government discretion,eroding the country’s road transportcapacity, a foundation of the economy.

“In 2020, all 17.28 million truckdrivers in the country handled 74percent of freight traffic, a significantcontribution for economic andsocial development that ensured andimproved people’s livelihoods,”saidWang Yang, then vice minister oftransport, at a Beijing press conference in November 2021.

Multiple reports emerged of truckdrivers bewildered by varied regionally specific passes and quarantinerequirements that varied significantly based on each route.

A truck driver named Gao Chen from east China’s Anhui Province came torepresent the arduous physical andpsychological journey cargo freightmakes to support economic operations amid wide-ranging virus containmentefforts. The triangle-shaped regionwith Shanghai at its heart covers theprovinces of Anhui, Jiangsu, andZhejiang.

Gao and his wife are a typical duo employed as long-haul truckers, asdepicted in an article from Southern Metropolis Daily in mid-April.

With a purchased truck, the couplespends about 12 hours a day travelingbetween the Yangtze River Delta andthe Pearl River Delta. They usually makefour round trips every month.

The recent outbreak ofOmicron prompted manyregions to respond with an arrayof preparedness and preventionmeasures. Expressways thatnormally provided unhinderedflow of traffic slowed into a mazeof checkpoints.

On April 6, Gao picked up ashipment from Nantong in eastChina’s Jiangsu Province boundfor Zhuhai in south China’sGuangdong Province, whichnecessitated a special pass fromlocal authorities at townshiplevel in Nantong.

The next day, Gao took antigenand nucleic acid tests at anexpressway rest area entranceand waited around for nearlythree hours before passing. Hewas not allowed to leave thecabin until the cargo was fullyloaded onto his truck.

When Gao approached thedestination in Zhuhai, thoseinspectors refused to recognizethe nucleic acid test he took the night before in Jiangxi Province. Because proof of a local negative COVID-19 test within 24 hoursis mandatory, he had no choicebut to park the truck near thedestination and spend anothernight seeking local results.

And in certain cities, cargothat wasn’t categorized as keyanti-virus supplies was delayed, resulting in truck driverswaiting up to eight days on theexpressways, according to media reports.

The worst-case scenario fortruck drivers is a travel codemarked with an asterisk, whichmeans that the cities they havevisited in the past 14 days aremedium or high-risk areas,blocking their access to mostplaces. They are either persuaded to return to where they camefrom or pay for quarantine at adesignated place.

Such travails seem like atotally different virus variant.But a sober assessment showsmore fundamental concerns:a rather fragmented roadtransport network that could beproblematic in urgent emergency situations.

Incompatibility

Disrupted logistics has beenin essence attributed to closed-loop quarantine standardswidely accepted in the logisticsindustry that are not compatible with region-varying closed-loopquarantine policies, accordingto Lu Chengyun at the NationalDevelopment and ReformCommission (NDRC)’s Institute of Comprehensive Transportation,as quoted by the BeijingNews inmid-April.

Such incompatibility points to a broader issue with the country’s transportation and logistics.

The predicament in the logistics industry duringthe epidemic highlightsthat excessive costs ofcommunication andcoordination between differentregions and various government bodies are an importantimpeding factor, reported theChina News Service in mid-April, citing Cai Zhibing, associateprofessor at the Party School ofthe Central Committee of theCommunist Party of China (CPC).

The logistics industry isessentially about economicbonds between different partsof the country. The closer theregional economic relationship, the cheaper the flows betweenthe regions should be, and themore prosperous the logisticsector can become, Cai said.

China’s logistics spendingaccounts for over 14 percent ofGDP, considerably higher thanaround 8 percent in developednations, he noted, anticipatingthat a unified domestic marketwould effectively lower logistics costs.

A survey of the country’sexpressway enormity,nonetheless, offers some clues as to why discrepancy often prevails over consistency.

With a total length of around 160,000 kilometers, China’sexpressway network is theworld’s largest. This feat couldbe easily taken for granted, given the size of the economy and itsstrong infrastructure push overthe decades.

But the feat was accomplished through incremental prowess,with local governments primarily relied on to fund the expressway network.

Under the country’s fiscaland tax system, a gap remainsbetween local governments’autonomy in carrying outtheir fiscal functions and theirresponsibility to accelerate local economic development.

To enable transportconnectivity, local governments’financing vehicles and large centrally administered stateowned construction firms are known as the mainstay of fundraising for highways.

Strengthening highway maintenance and management means continued commitment after highways open to traffic, which seems to have only expanded local governments’ role in highway-related policymaking

Currently, more than 20highway-related listed firms arein the Chinese mainland stockmarket, and most are actuallycontrolled by local governmentswhose core assets are their rightto collect tolls for travel acrosspremium highways and bridgesand to operate expressways andbridges.

As the country’s highwaynetwork matures, with addedlineage stabilizing, some of theearliest completed highwayshave reached or are set to hitexpiration for toll payments.

This suggests expresswayoperators ought to diversifyinto other sectors to continueexpanding. Accordingly, multiple service areas in Jiangsu havebeen remodeled as shoppingcenters and tourist attractions as part of an industry-wide push to carve out a path toward highway profitability.

The regionally segmentedlandscape of highway building and maintenance and theresulting highway-relateddecision-making demonstrate the need for a top-downapproach to dissolve clotsimpeding transport arteries.

Fundamental Cure?

Coincidently, the guidelinesfor accelerating the buildingof a unified domestic marketwere unveiled by the CPCCentral Committee and the State Council on April 10. The top-level strategy intending to break local protection and marketfragmentation also coveredlogistics concerns.

Specifically, the strategy urged construction of an emergencylogistics system and cross-regional integration of transport infrastructure.

Soon thereafter on April 11,the State Council, the country’scabinet, issued a noticerequesting local governments to “make every effort” to addressroad network blockages andcongestion and ensure smoothmain arterial roads.

Any blockages orshutdowns of highways,roads and waterways, without authorization, would bestrictly prohibited, read thenotice. Unauthorized closures of highway rest areas, portterminals, railway stations,and airports and unapprovedbans on crew shift changes for international shipping services were not allowed as well.

A suspension in case ofconfirmed infections or closecontacts will need to be reported to the provincial-level jointepidemic prevention and control mechanism for approval. Ashutdown of airports thatinvolves cross-provincial orinternational flights will have to be filed with the State Councilor departments under thecabinet for approval, the noticestipulates.

Showing commitment to aproblem-oriented approach, the State Council notice mapped out targeted traffic management that wouldn’t restrict flow of freightvehicles or passengers. Vehicleregistration and householdregistration were prohibited asrestraints to limit traffic. Andtruck drivers, passengers, andcrews with a green health codecannot be stopped just for anasterisk.

Shortly after the notice, theState Council’s joint epidemicprevention and controlmechanism released the national standardized pass. With the pass, freight vehicles passing throughvirus-hit regions across provinces would gain priority access.Eligible regions were requiredto create fast lanes dedicated tovehicles holding the pass.

The timely notice and a slewof efforts in its wake, primarily headed by the Ministry ofTransport (MOT) and NDRC,quickly dissolved the transport clots.

By April 26, only eight tollstations remained out of service, accounting for 0.07 percent ofthe nation’s total. Meanwhile,27 service areas, or 0.41 percentof the country’s total, were stillsuspended, as per transportministry statistics.

At a May 11 media briefing,a month after the worst ofthe roadblock predicament,Li Guoping, security directorat MOT, announced that“thenumber of out-of-service tollstations and service areas hasbasically been reduced to zero.”

As the toll stations and service areas get back up and running,logistics are improving.

On May 10, national roadshit a traffic volume of 21.88million vehicles, an increaseof 26.39 percent from April 10.Truck traffic totaled 7.21 millionvehicles, up 25.65 percent fromthe April 10 reading, according to Li.

The quick removal ofroadblocks, representative of the change-as-you-go tougheningof restrictions in the domesticmarket, evidently offeredclues on dealing with market fragmentation.

As Cai put it, availability of unified industry regulationsshould be a prerequisitefor reducing the costsof communication andcoordination across different parts of the country to foster a stable and healthy logistics industry.

The remaining questionis whether current policy ismerely a stopgap band-aid ora fundamental cure that couldbe referenced to diagnose andtreat other pain points haunting China’s huge market.