Realization Path for Inclusive Finance to Support Rural Revitalization in Poverty-stricken Areas

2021-08-24QiHUANG

Qi HUANG

Zhengzhou Central Sub-branch, the People’s Bank of China, Zhengzhou 450040, China

Abstract Based on the quarterly economic, social and financial development data of 39 poverty-stricken counties in Henan Province during 2016-2018, this paper utilized the entropy-based TOPSIS method to objectively measure the rural revitalization index, and then built the quantile regression model to study the effects of various elements of inclusive finance on different stages of rural revitalization.Research results show that industrial development, agricultural modernization, targeted poverty alleviation, endogenous demand, and rural governance are the main points of inclusive finance in poverty-stricken areas to support rural revitalization; the rural revitalization index indicates that compared with the Dabie Mountain area and the non-contiguous poverty-stricken areas, the rural revitalization of the Qinba Mountain area is slower; for inclusive finance supporting rural revitalization, it is necessary to bring into play the role of monetary policy tools in re-lending, functions of credit in supporting industrial development, and role of insurance in risk protection; furthermore, inclusive finance solves problems such as the diminishing marginal effect of physical machinery investment in rural revitalization support, financial support for the coordinated development of small farmers and new agricultural business entities, financial support for the development of the entire industry chain, and the "siphon effect" of capital.

Key words Inclusive finance, Rural revitalization, Poverty-stricken areas, Entropy-based TOPSIS, Quantile regression analysis method

1 Introduction

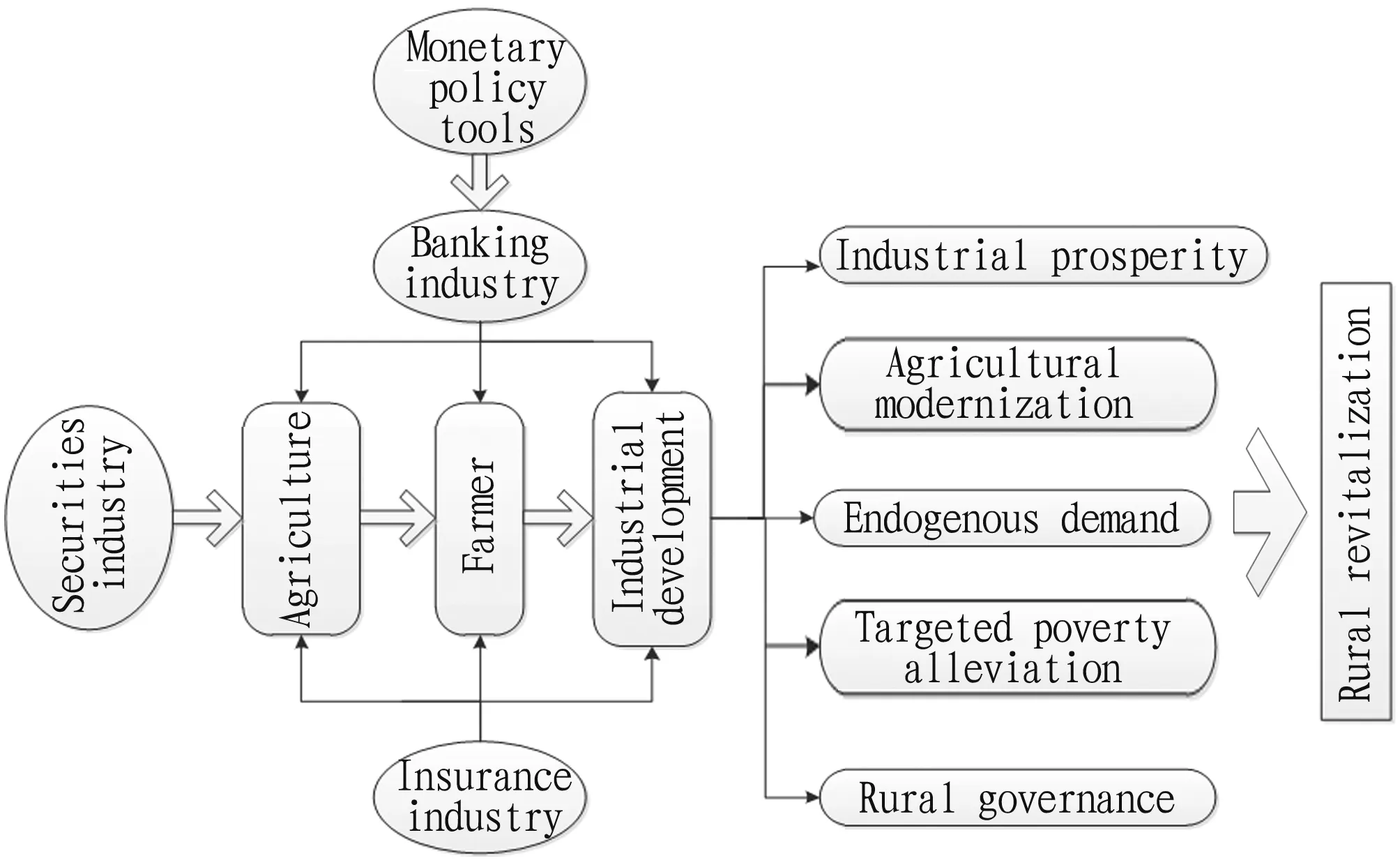

The rural revitalization strategy is a general strategy for promoting China’s agricultural modernization and rural areas.Besides, it is also a major measure for resolving the imbalance between urban and rural areas and the insufficient development of rural areas in the new era.At the present stage, the entire macroeconomic development is still under pressure of downturn.However, rural development outshines others in China’s economic development, reflecting that rural development is a power for the sound and sustained development of China’s economic and social development.For inclusive finance supporting rural revitalization in poverty-stricken areas, it, in essence, is that the banking, securities, and insurance industries directly or indirectly provide convenient and effective financial support for agriculture, farmers, and industrial development, so as to promote industrial prosperity, agricultural modernization, and stimulate endogenous demands to achieve targeted poverty alleviation, and improve rural governance, accordingly realizing the rural revitalization.

2 Mechanism of inclusive finance in supporting rural revitalization in poverty-stricken areas

The mechanism of financial support for rural revitalization is specifically manifested in the following four aspects.(i)the re-lending of monetary policy tool is intended to issue loans to financial institutions at a lower cost, and guide financial institutions to summon up their enthusiasm for credit support for rural revitalization.(ii)The banking industry provides financial services such as deposits and loans for the county economy and urban and rural residents.Deposit can help the masses accumulate wealth and obtain appropriate deposit income, while loan can alleviate the shortage of funds for the masses to develop production, thereby realizing the income increase brought by production.(iii)The securities industry helps many enterprises in poverty-stricken areas issue bonds, the New Third Board, and IPOs to expand and strengthen local enterprises and promote local economic development.(iv)The insurance industry provides certain compensation for economic losses incurred from natural disasters and accidents in the process of agricultural production and operation.Among these, the banking industry plays a leading role in supporting the rural revitalization by inclusive finance(Fig.1).

Fig.1 Mechanism of inclusive finance in supporting rural revitalization in poverty-stricken areas

3 Research methods

3.1 Entropy-based TOPSIS method

The entropy-based TOPSIS method is a method of comprehensive evaluation indicators.First, it adopts entropy method to determine the indicator weight coefficients, and then substitutes the weight into the TOPSIS model for comprehensive evaluation.3.1.1

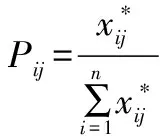

Entropy method.(i)Calculate the indicator value proportionP

of thei

-th evaluated object under thej

evaluation indicator, and get the standardized matrix of the dataP

={P

}:

j

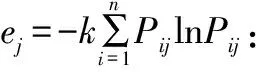

-th indicator.For thej

-th indicator, if the information utility value of the indicator is larger, it means that the evaluation effect of the indicator is greater, and the corresponding entropy value will be smaller.Define the importance valued

=1-e

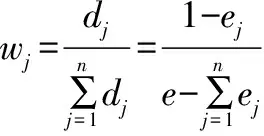

.(iv)Determine the entropy weight of thej

-th indicator:

w

, the entropy weight of thej

-th indicator is determined by the importance of the indicator.If the information utility value of the indicator is greater, the importance of the relevant evaluation is greater, and the weight is also greater.3.1.2

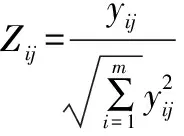

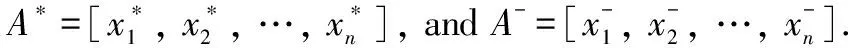

TOPSIS model.(i)In the process of multi-objective decision-making, the dimensions of each indicator are different, and the variation range is different, it impossible to reflect the actual situation of the indicators when making decisions.Therefore, it is necessary to standardize the decision matrix, that is making dimensionless and centralization treatment.Get the normal matrixZ

=(z

)×, where

X

=(x

)×=[w

·z

]×.

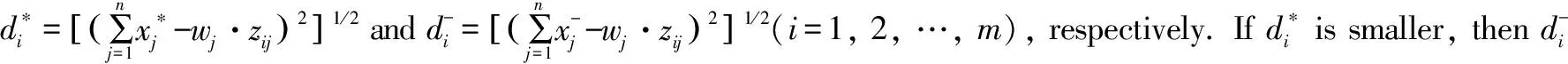

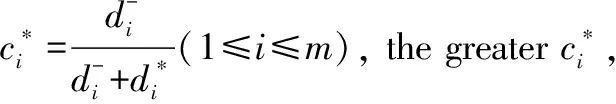

(iv)Calculation of Euclidean distance

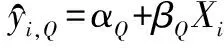

3.2 Quantile regression method

Quantile regression analysis is used to analyze the nonlinear relationship of variables, theψ

quantile functionQ

(ψ

)of the explained variabley

is expressed as:Q

(ψ

)=inf{y

∶F

(y

)≥Ψ

}.

First, it is necessary to define the probability functionρ

(μ

):

y

in theΨ

quantile, namely:

4 Measurement of rural revitalization in poverty-stricken areas

4.1 Selection of multi-dimensional indicators for rural revitalization measurement

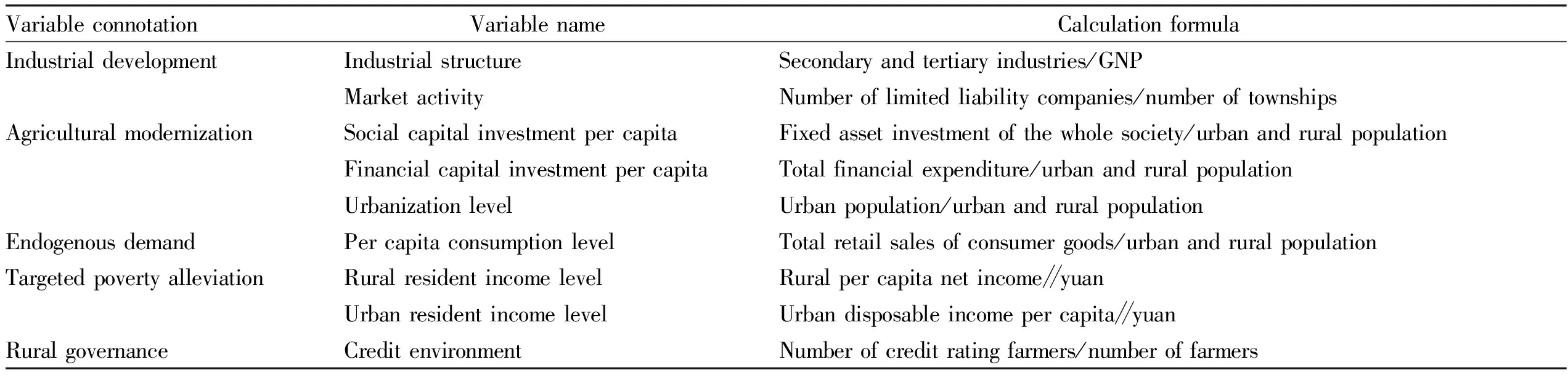

Rural revitalization has rich connotations.With reference to research opinions of scholars, we established a multi-dimensional indicator of rural revitalization comprehensively considering the key factors for rural revitalization: industrial prosperity, agricultural modernization, poverty alleviation, endogenous demand, and credit construction.Using the entropy-based TOPSIS method, we measured the rural revitalization(Table 1).

Table 1 Selection of multi-dimensional indicators for rural revitalization measurement

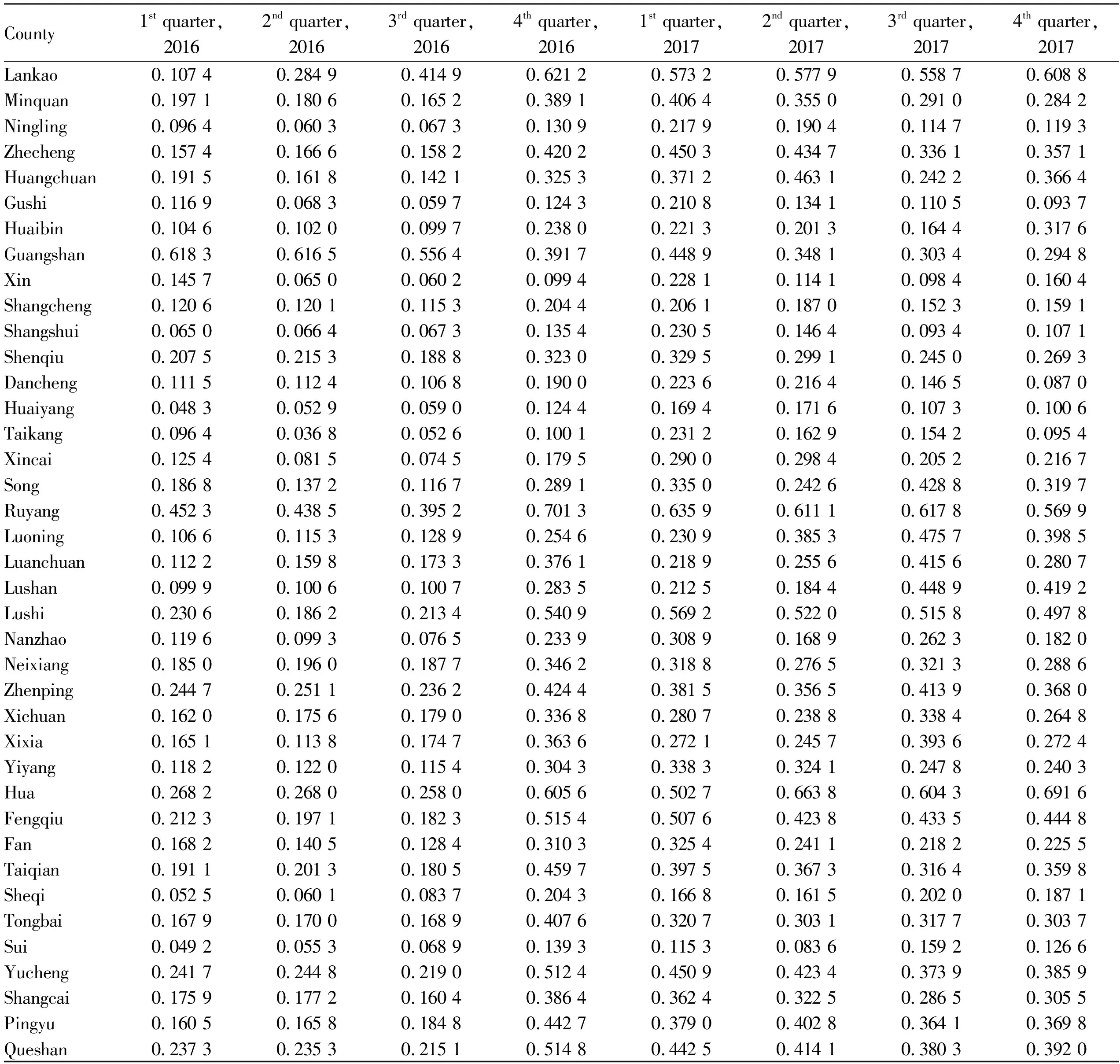

4.2 Multi-dimensional measurement of rural revitalization in poverty-stricken areas

Using the entropy-based TOPSIS method, we measured the level of rural revitalization in poverty-stricken areas.Firstly, For the dimensionless treated data, we determined the entropy weight of each indicator, and then substituted the indicator weight into the TOPSIS model to obtain the Euclidean distance between the positive ideal value D+ and the negative ideal value D-for each quarter from the first quarter of 2016 to the first quarter of 2018, thereby calculate the rural revitalization index for each year(Table 2).

Table 2 Rural revitalization index of 39 poverty-stricken counties in Henan Province during 2016 and 2018

From the perspective of time dimension, from the fourth quarter of 2016 to the first quarter of 2018, rural areas in 39 poverty-stricken counties in Henan Province gradually started to develop(Table 2).The the fourth quarter of 2016 was the start of the rural development.However, from that on, due to the weak sustainable force, rural development slowed down.Specifically, the rural revitalization index of the concentrated contiguous deeply poverty-stricken areas and non-contiguous poverty-stricken areas of Dabie Mountain was higher than the average of 39 poverty-stricken counties.The rural revitalization index of the concentrated contiguous deeply poverty-stricken areas of Qinba Mountain was lower than the average of 39 poverty-stricken counties.These indicate that rural revitalization should promptly solve the problem of weak sustainable development force in rural areas, and also should focus on the relatively slow development of the concentrated contiguous deeply poverty-stricken areas of Qinba Mountain.

From a regional perspective, Hua County, Lankao County, and Lushi County developed rapidly in 2016-2018 and had a good foundation for rural revitalization.The rural revitalization index of Hua County increased rapidly from 0.268 2 in the first quarter of 2016 to 0.642 9 in the first quarter of 2018; the rural revitalization index of Lankao County increased rapidly from 0.107 4 in the first quarter of 2016 to 0.623 6 in the first quarter of 2018; the rural revitalization index of Lushi County increased rapidly from 0.230 6 in the first quarter of 2016 to 0.488 3 in the first quarter of 2018.From 2016 to 2018, the rural development of Guangshan County and Ruyang County showed the trend of slowdown.The rural revitalization index of Guangshan County declined from 0.618 3 in the first quarter of 2016 to 0.364 0 in the first quarter of 2018; the rural revitalization index of Ruyang County declined from 0.452 3 in the first quarter of 2016 to 0.218 7 in the first quarter of 2018.These indicate that the pace of rural revitalization in different poverty-stricken counties is different, and regions with faster development have the advantage to support their development.In this study, we will further explore the key factors that determine rural revitalization in poverty-stricken areas from the perspective of inclusive finance.

5 Empirical analysis of inclusive finance supporting rural revitalization in poverty-stricken areas

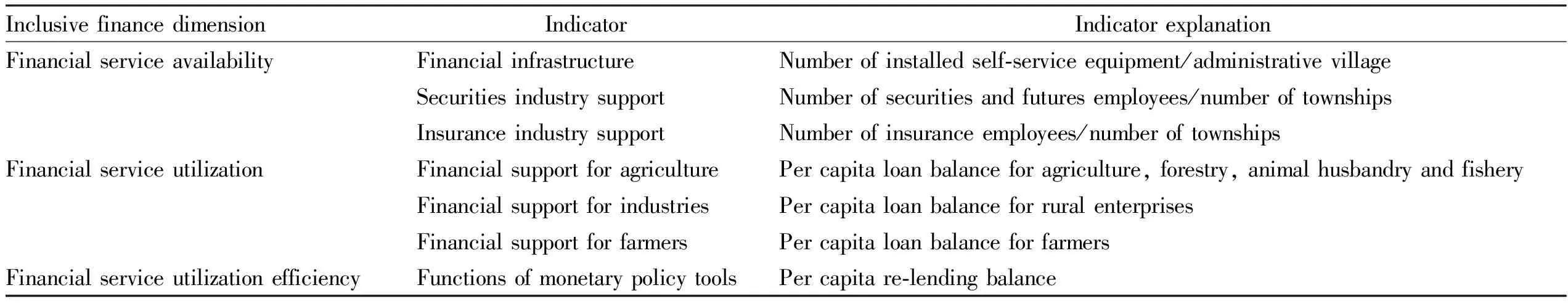

5.1 Indicator selection

(i)Explained variable: rural revitalization index, which reflects the degree of rural revitalization in multiple dimensions.(ii)Explanatory variables: financial service availability, financial service utilization and financial service utilization efficiency(Table 3).

Table 3 Indicator system of inclusive finance supporting rural revitalization

5.2 Quantile regression analysis of inclusive finance supporting rural revitalization

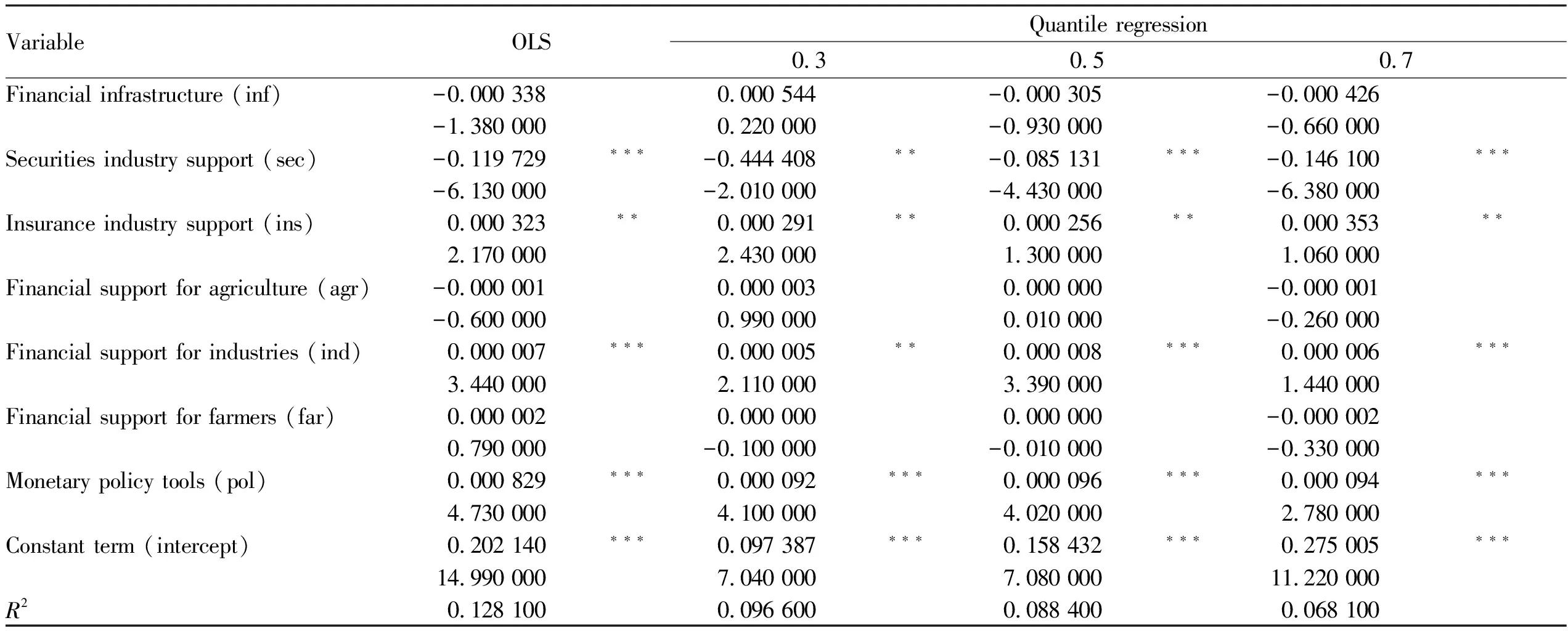

In this paper, we used the ordinary least squares(OLS)regression analysis and quantile regression analysis to study the effect of inclusive finance on supporting rural revitalization in 39 poverty-stricken counties in Henan Province.The results of OLS regression analysis show that the role of finance in industry support, insurance industry support, and monetary policy tools has a significant positive effect on rural revitalization, and the effect of financial support for farmers on rural revitalization is positive but not significant.It indicates that, generally, the inclusive financial development is the core path to support rural revitalization.The support of securities industry for rural revitalization is significantly negative, and the effect of financial infrastructure and financial support for agricultural development is not significant for rural revitalization.The results of quantile regression analysis show that with the increase of quantile, the effect of financial infrastructure on rural revitalization is 0.000 544 at the 0.3 quantile,-0.000 305 at the 0.5 quantile, and-0.000 426 at the 0.7 quantile, all of which are not significant at 90% confidence.These reflect that physical equipment and tools such as ATM, POS, and other self-service terminals provided by financial institutions in counties have little effect on rural revitalization.The effect of financial support for rural households on rural revitalization is 0.000 000 at the 0.3 quantile, 0.000 000 at the 0.5 quantile, and-0.000 002 at the 0.7 quantile, all of which are not significant at the 90% confidence level.The credit support of inclusive finance for farmers has achieved remarkable results in poverty alleviation, but rural revitalization is a more macro and long-term strategy, and the credit support of inclusive finance for farmers is relatively small.The effect of financial support for industrial development on rural revitalization is 0.000 005 at the 0.3 quantile, 0.000 008 at the 0.5 quantile, and 0.000 006 at the 0.7 quantile, all of which are significant at the 90% confidence level, showing that the support of inclusive finance for industrial development will effectively promote rural revitalization.The effect of financial support for agricultural development on rural revitalization is 0.000 003 at the 0.3 quantile, 0.000 000 at the 0.5 quantile, and-0.000 001 at the 0.7 quantile, all of which are not significant at the 90% confidence level, showing that further increase in support for agriculture in inclusive finance has no significant effect on rural revitalization.The development of the entire industry chain may be the future trend of rural revitalization.Particularly, for areas with a high level of rural revitalization, investing too much financial resources into agriculture may cause a waste of financial resources and reduce the efficiency of financial support for rural revitalization.The support of securities industry for rural revitalization is-0.444 408 at the 0.3 quantile,-0.085 131 at the 0.5 quantile, and-0.146 100 at the 0.7 quantile, all of which are significant at the 90% confidence level.These indicate that financial policies have opened green channels for IPOs in poverty-stricken areas, aiming to attract investment to promote the development of local industries, but there may actually be a risk of capital flight, which will hinder the implementation of the rural revitalization strategy.The support of insurance industry for rural revitalization is 0.000 291 at the 0.3 quantile, 0.000 256 at the 0.5 quantile, and 0.000 256 at the 0.7 quantile, all of which are significant at the 90% confidence level, showing that the support of insurance’ for rural revitalization can not only diversify agricultural production and operation risks, but also provide credit enhancement for credit financing, which can promote the expansion of credit scale and introduce more funds to support rural revitalization.The effect of monetary policy tools on rural revitalization is 0.000 092 at the 0.3 quantile, 0.000 096 at the 0.5 quantile, and 0.000 094 at the 0.7 quantile, all of which are significant at the 90% confidence level, showing that in the process of implementing the rural revitalization strategy, supporting agriculture and small businesses and poverty alleviation re-lending play a role in guiding financial institutions to accurately support weak links in the real economy(Table 4).

Table 4 Quantile regression of inclusive finance supporting rural revitalization in 39 poverty-stricken counties of Henan Province

6 Conclusions and policy recommendations

6.2 Conclusions

Rural revitalization is a comprehensive concept with rich connotations.Through comprehensive consideration of the key factors for rural revitalization, we used entropy-based TOPSIS method to measure the rural revitalization index, and explore the rules of rural development in 39 poverty-stricken counties in Henan Province.From the fourth quarter of 2016 to the first quarter of 2018, 39 poverty-stricken counties and rural areas in Henan Province gradually began to develop, but the pace of rural revitalization in different counties was different.To implement the rural revitalization strategy, it is necessary to promptly solve the problem of weak sustainable development force in rural areas, and focus on the relatively slow-developing concentrated contiguous areas of Qinba Mountain, and take effective measures to promote the steady implementation and balanced development of the rural revitalization strategy.Rural revitalization is a long-term strategy, and all-round and balanced development requires more precise financial support measures.(i)Financial institutions have further increased their investment in physical equipment and tools such as ATM, POS, and other self-service terminals in counties, and the marginal effect of supporting rural revitalization is diminishing.(ii)At the current stage, the way that finance supports the development of small farmers does not meet the goal of integrating small farmers and new agricultural business entities.It is necessary to promote the coordinated development of small farmers and new agricultural business entities.(iii)The development of the whole industry chain is the future trend of rural revitalization.Excessive investment of financial resources into agriculture may cause a waste of financial resources and reduce the efficiency of financial support for rural revitalization.(iv)Financial policies have opened green channels for IPOs in poverty-stricken areas, aiming to attract investment to promote the development of local industries, but there may actually be a risk of capital flight, which will hinder the implementation of the rural revitalization strategy.It is necessary to be highly vigilant against the "siphon effect" of capital.(v)It is necessary to bring into play the role of monetary policy tool re-lending in credit support and guidance for rural revitalization, the supporting role of credit for industrial development, and the risk compensation role of insurance for rural revitalization, which is an effective way for inclusive finance supporting rural revitalization.

6.2 Policy recommendations

Finance is a core of the modern economic system and provides important financial support for rural revitalization.At present, the development of the financial system in rural areas lags behind, and the problem of difficulty in financing and expensive financing still exists.The availability, convenience, and satisfaction of finance for farmers are much lower than that of urban residents.Due to the characteristics of high risks, low and slow returns, agriculture-related financial services are developing slowly and still need support of many policies.With the promotion of the rural revitalization strategy, the development of inclusive finance is ushering in new opportunities.Under the new strategic requirements, it is urgent to establish a comprehensive, sustainable, competitive and risk-controllable rural inclusive financial system.Therefore, all financial institutions should strengthen agricultural financial innovation, provide and develop agricultural characteristic financial services for rural areas, and properly guide funds to support the smooth progress of the rural revitalization strategy.杂志排行

Asian Agricultural Research的其它文章

- Prevalence Characteristics of Rice Black-streaked Dwarf Virus Disease and Continuous Control Strategies

- Advances in Integrated Control Techniques of Rice Blast

- Experience in Remediation of Contaminated Sites at Home and Abroad

- Impact of COVID-19 on Agriculture, Countryside and Farmers and Countermeasures

- Research on the Revitalization of Rural Talents under the Strategy of Rural Revitalization

- Effects of Biological Flocs on Growth Performance of Cyprinus carpio var.Furui No.2 and Aquaculture Water Quality