Reform of Teaching Mode for College Students’ Financial Literacy Training under General Education: Taking Yangtze University as an Example

2021-06-30XiaofangZOUXiaotianZHOUChenZHANGRuiKE

Xiaofang ZOU, Xiaotian ZHOU, Chen ZHANG, Rui KE

Economics and Management School, Yangtze University, Jingzhou 434023, China

Abstract The development of Internet finance has made the financial environment faced by college students more complicated. The level of financial literacy best reflects a person’s sensitivity to the financial environment and flexibility to respond to financial events. Therefore, to improve the financial literacy of college students, popularizing financial knowledge is bound to become the key content of general education and teaching work in contemporary colleges and universities. In this article, taking 400 undergraduates from Yangtze University as the research object, the participation in online lending and the mastery of financial knowledge were investigated and analyzed, then the current teaching situation of financial literacy courses was introduced, and finally, a number of suggestions to improve the teaching reform of financial literacy were put forward.

Key words College students, General education, Financial literacy, Teaching mode

1 Introduction

With the rapid development of technology, the rise of the Internet economy has made the financial environment more sensitive and complex. Financial frauds, usury and other incidents of unhealthy consumption with college students as the audience have emerged one after another. As a new force in the consumer group, college students are facing the chaos of online loans due to their immature consumption concepts and extremely lack of financial literacy. Some students have difficulty distinguishing the pros and cons of online lending. Driven by the impulse to consume, college students usually choose online lending, which provides convenience for college students, and at the same time, also adds a lot of financial risks. Therefore, it is of great practical significance to carry out financial risk prevention and financial literacy training for college students. Improving the financial literacy of college students and popularizing financial knowledge is bound to become a key issue in the development of general education teaching in contemporary college education. In this article, 400 students from Yangtze University who had taken the general course of Financial Literacy of Contemporary College Students were taken as the survey object, the situation of participating in online lending was investigated, the mastery of the students on financial knowledge was analyzed, and targeted reform suggestions were put forward for the improvement of the curriculum system.

2 Research sample and target selection

The object of this research is 400 students from Yangtze University who took the general course of Financial Literacy of Contemporary College Students in the 6 semesters from 2018 to 2020. They were fresh to senior students, among which juniors and seniors accounted for 76%.

The questionnaires were distributed through the teaching platforms of Chaoxing and Rain Classroom, and 400 valid questionnaires were obtained. The first half of the questionnaire involved the participation of college students in online loans, the main uses of online loans and the repayment of online loans, to investigate the safety of online loan consumption. The second half involved analyzing the financial literacy of the respondents from basic financial knowledge and financial management behaviors, as well as their feedback on the effects of course teaching. The consumer safety awareness and financial literacy of college students was analyzed comprehensively. At the same time, new ideas were put forward for the reform of the curriculum teaching.

3 Analysis of college students’ online loan consumption

3.1 Participation of college students in online lending

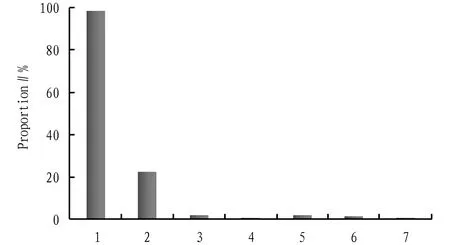

With the rapid development of Internet technology, online payment is becoming more and more popular. It has become a common phenomenon for people to use Internet finance to borrow money. The advantages of Internet financial lending are convenience, fast speed and easiness to operate. More and more people choose online lending. For most college students who only need small loans and don’t have much capital, online loans that do not require mortgages or third-party guarantees naturally become a good choice. The survey results show that 72% of the students had experience in online loans. Secondly, as many as 98.5% of the students with online lending experience chose to use Ant Cash Now (Jiebei) and Ant Credit Pay (Huabei), and 22.5% of them chose to use Jingdong Baitiao. These two online loan platforms are related to Taobao and Jingdong Mall, respectively. It reflects that the online lending platform used by the students may have a greater relationship with meeting consumer demand on the e-commerce platform (Fig.1).

Note: 1. Huabei and Jiebei; 2. Jingdong Baitiao; 3. Fenqile; 4. Youqianhua (Baidu); 5. Online banks; 6. 360 Jietiao; 7. Other lending platforms.

3.2 Main purposes of college students’ online loans

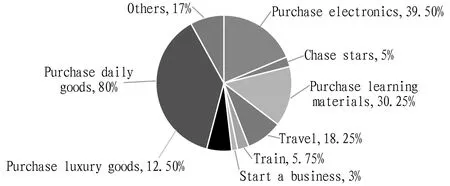

Survey data shows that up to 80% of the students’ online loans were used to meet daily consumption needs, 39.5% were used to purchase electronic products, 30.25% were used to pay for the purchase of study materials such as postgraduate entrance examination certificates, and 12.5% were used to buy luxury goods such as brand-name cosmetics, bags, and sneakers. There were also other uses, but the proportion was relatively small and individual differentiation was obvious (Fig.2). On the one hand, this is closely related to the rapid and convenient electronic payment methods and the prosperity of the online shopping industry to guide young people to impulsive consumption. On the other hand, these phenomena reflect that contemporary college students are young, pursue fashion, have a strong desire to consume, but lack mature financial management concepts or reasonable planning ability, leading to pre-consumption, over-consumption, and even blind consumption. This reflects that many college students have a very serious comparison psychology, and their consumption concepts are incorrect, increasing financial risks. Therefore, colleges and universities must strengthen financial education for college students, and guide students to establish correct values and consumption concepts and consume rationally, thereby preventing financial risks.

Fig.2 Main uses of college students’ online loans

3.3 Repayment situation of college students’ online loans

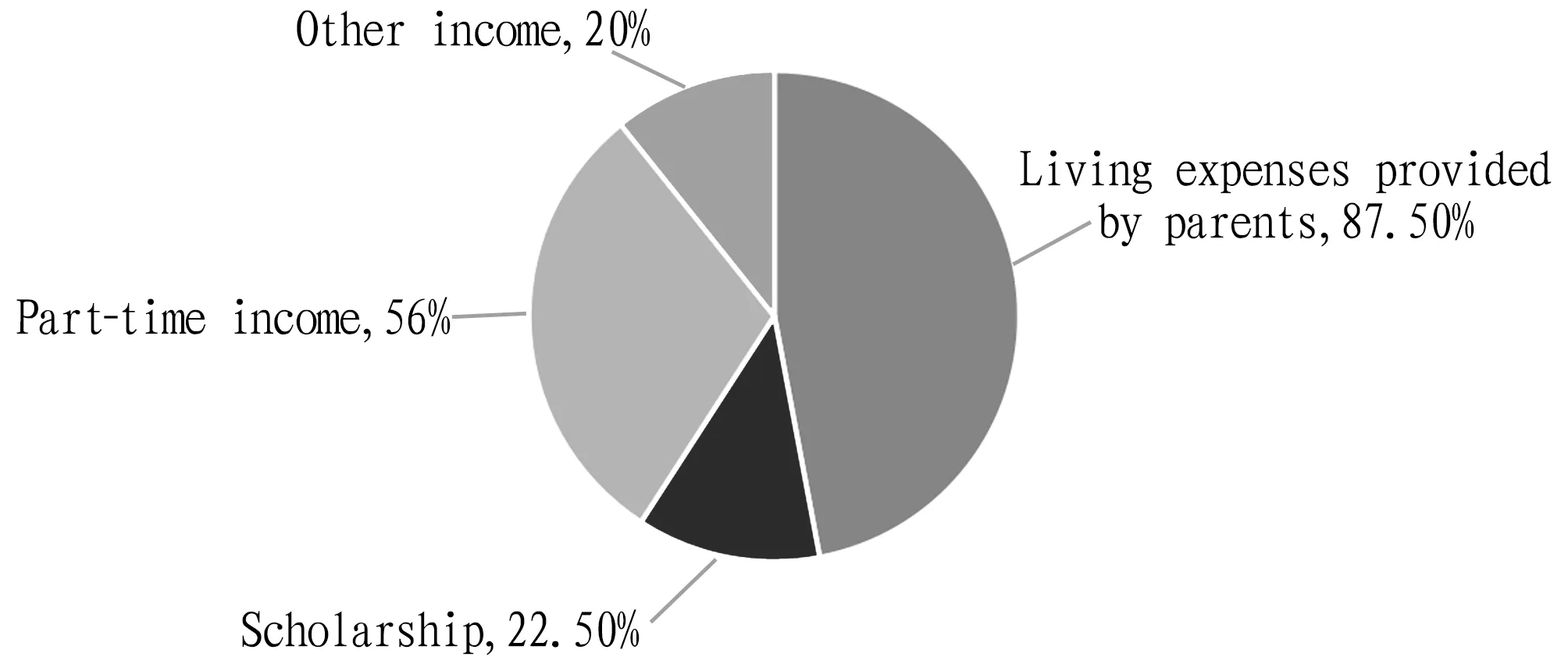

As shown in Fig.3, 87.5% of the students repaid their loans with their living expenses that were from their parents, and 56% of the students repaid their loans by looking for part-time jobs. According to the above data, college students mainly relied on the living expenses given by their parents to repay the loans, and hardly had the ability to repay the loan by themselves. Although some students will supplement their living expenses with part-time income, the stability of part-time income was not guaranteed. According to the investigation on whether the repayment can be made on time, 83.5% of the college students paid on time every time, 15.5% of the college students paid on time in most cases, occasionally defaulted, and a few people failed to pay on time many times because of the financial situation (Fig.4). In general, more than 80% of the college students were optimistic about their repayment, but there were still nearly 20% of the students who borrowed online but could not repay in time. This shows that students could realize the importance of normal repayment. At present, students’ credit repayment risk is controllable. However, we still need to pay attention to the excessive consumption and high interest loans of college students. The phenomenon of "robbing Peter to pay Paul" should be curbed, because once college students have complicated credit relations, it is bound to trigger new repayment risks.

Fig.3 Sources of funds for college students to repay online loans

Fig.4 Repayment situation of college students’ online loans

4 Analysis on the current situation of college students’ financial literacy training

4.1 College Students’ understanding of basic financial knowledge

In the questionnaire, there were questions about basic financial knowledge. The college students had a better understanding of the problems of keeping bank cards, credit reports, and the factors that affect the interest calculation. It can be found that most college students had the most basic risk awareness. However, the knowledge of finance was not comprehensive, especially the knowledge of loan. In the face of various online lending platforms, it is easier to make bad online lending behavior due to the lack of risk judgment ability. In addition, the risk degree of various financial products was not well understood. More than half of the students did not accurately judge the risks of financial products. In daily investment, it may lead to losses due to insufficient understanding of financial products and incomplete risk assessment.4.2 Sources of financial knowledge

According to the survey, nearly 80% of the students began to get into financial knowledge only after high school, 75.76% independently searched and learned about finance through the news media, and 53% obtained relevant financial knowledge mainly from the school curriculum. The students had the interest and willingness to actively understand financial knowledge. However, the time for the school to cultivate students’ financial literacy is relatively late, and the training resources are insufficient. In addition, the limitations of textbooks and news media also add obstacles for students to acquire professional financial knowledge.4.3 Feedback of course

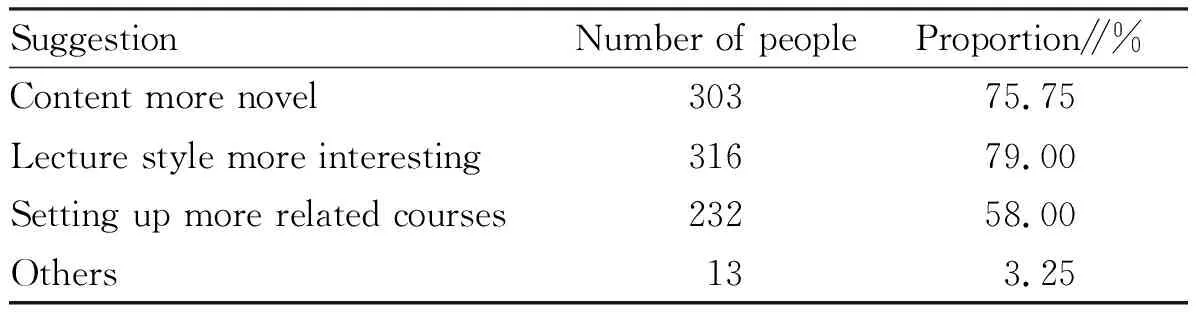

According to the results of the survey (Fig.5), for the course of Financial Literacy of Contemporary College Students offered by the University, 77.89% of the students thought it was useful, 18% thought it was very useful, and the vast majority of the students thought that the content of financial literacy course was quite beneficial to themselves. Therefore, it is necessary for schools to continue to offer financial general courses, and relevant compulsory courses or elective courses should be added, to improve the financial literacy of college students. In addition, college students’ feedback on the needs of financial courses was mainly reflected in the more novel course content and humorous lecture style (Table 1). Thus, it can be seen the popularity of the financial literacy course in colleges and universities is not high, the practicality of the course content is not strong, and teaching methods should strengthen the connection between common sense and practice of financial literacy.

Fig.5 Feedback on the course of Financial Literacy of Contemporary College Students

Table 1 Students’ suggestions on course content

5 Suggestions on the reform of teaching mode of college students’ financial literacy training

In view of the feedback of the research on the teaching effect of the course of Financial Literacy of Contemporary College Students, combined with the teaching characteristics of financial literacy education, the following suggestions on the reform of the teaching mode of college students’ financial training are put forward.

5.1 Popularizing the basic knowledge of finance as the teaching goal

Different from financial education, financial literacy requires students to have the basic cognitive ability of financial knowledge and practice. Financial literacy education should emphasize the popularization of basic financial knowledge for students and their ability to reasonably use financial knowledge in life, such as savings and investment, lending, consumption and expenditure, wealth management and pension planning. Therefore, the education goal of college students’ financial literacy should be based on cultivating their ability to analyze and solve problems in real life.5.2 Constructing teaching situation to design teaching mode

According to the principle of practicality and the teaching goal of popularizing basic knowledge, we choose a financial professional knowledge, construct a problem-based teaching model, focus on analyzing the behavior of different economic individuals, guide students to observe the economic phenomena in real life, provide scenes close to daily life, design real tasks, analyze problems in real situations, and learn to solve complex problems. For example, according to the teaching goal of "loan issue", problem design is performed for the course, including what’s the interest rate for borrowing? How to calculate the interest? How to compare the interest rates of different institutions or platforms? What is the process for banks and Ant Credit Pay to issue loans? How much pressure do you have to pay back? Around these problems, specific scenarios are designed to simulate the behavior of borrowers, banks, financial platforms and other participants, so as to find problems in the process of role experience, and drive students to actively explore the corresponding financial principles and absorb practical knowledge from them. This teaching mode encourages students to learn independently and learn cooperatively, thereby solving problems in specific situations and promoting the formation of financial literacy and the realization of economic socialization teaching objectives.

5.3 Using financial documentary teaching strategy flexibly

According to the selection and design of specific questions, documentary videos on related subjects are collected on the Internet and integrated as an effective tool to show students specific situations, thus enhancing the interest and science of the course. For example, in terms of currency issue, the large-scale documentary Currency and Currency War of CCTV can be used as teaching aids to broaden students’ knowledge and enable them to master basic financial knowledge and develop the ability to use financial knowledge.

5.4 Implementing teaching organization by group role design

In the process of teaching organization of financial literacygeneral course, teachers should change from the traditional "lecturer" to "guider" and "organizer", breaking the original teaching method of "cramming". They should give full play to students’ subjective initiative and emphasize individual students’ autonomous learning and interactive communication. Teachers can organize students to work in groups, and each group can choose a small topic, such as buying bank financial products. The participants of the business (investors, banks, issuers and regulators) were involved in the role design, and students are organized to collect data, construct concepts, and conduct role play and group discussion, and finally form the classroom report. In the group report, students will comment on the speeches of other groups. This way of communication can enhance students’ sense of participation in class, cultivate students’ divergent thinking, and develop students’ ability to use financial knowledge to solve problems.