Firm review revelation policy considering social ties among consumers

2021-04-24LiuXueyuMeiShuZhongWeijun

Liu Xueyu Mei Shu’e Zhong Weijun

(School of Economics and Management, Southeast University, Nanjing 211189, China)

Abstract:An optimization model is proposed to analyze the optimal review revelation policies and consumer online social network management strategies of e-commerce firms. The results show that displaying friend reviews to consumers does not necessarily increase firms’ profits. Only when positive reviews account for a large proportion of all the reviews and when the cost of showing friend reviews is not high, can showing friend reviews be more profitable than not showing such information. The distribution of social ties among consumers can affect firms’ profits. Even in the case that showing friend reviews to consumers is more profitable, an increase in the proportion of strong ties is not necessarily beneficial to firms. Only when the proportion of positive reviews is large enough, can firms’ profits increase with the increase in the proportion of strong ties among consumers. Moreover, the degree of consumer distrust in the average quality rating can also affect firms’ strategies for managing consumer online social networks. As the degree of consumer distrust in the average quality rating rises, firms are more likely to obtain higher profits by taking measures to increase the proportion of strong ties among consumers on their websites.

Key words:online product review; social tie; review revelation policy; social commerce

In recent years, online product reviews have become an important source of information for consumers to learn about product quality in the e-commerce environment. Since many e-commerce websites have added social capabilities to encourage consumers to establish social connections with each other, current e-commerce websites can not only show consumers crowd reviews, but also show them reviews posted on the websites by their friends. For example, Dianping allows users to follow their WeChat friends as well as other unknown users and then shows users the reviews posted by the people they follow. Taobao has also established a review sharing community called “Yangtao” where users can read product reviews from their friends. The above examples indicate that the sociality of online product reviews is gradually increasing, and it has been a trend for e-commerce websites to display friend reviews to consumers. However, there are still numerous e-commerce websites that do not provide consumers with friend reviews, such as Jingdong and UNIQLO. Why do some websites display friend reviews and others do not? Which of these two review revelation strategies is more profitable?

This paper is related to the literature that investigates the effects of online product reviews on consumers and firms. Chevalier et al.[1-3]argued that online reviews are important for consumers to learn about the product quality. Weinburger et al.[4-6]found that negative reviews have stronger effects on consumers than positive reviews. Numerous studies have examined firm information revelation policies on the displaying of product reviews. Yi et al.[7]investigated how firms can strategically manage product reviews by highlighting authentic reviews selected by themselves. Li et al.[8]examined the conditions in which showing average star ratings on the product list is more profitable than not showing this information. Chen and Xie[9]proposed a normative model to study when the seller can benefit from allowing consumers to post product reviews on its website. Liu et al.[10]found that although more informative reviews can reduce price competition, such information can still hurt firms.

Another stream of relevant literature concerns friend reviews. Sun et al.[11]pointed out that product reviews have become increasingly social, consumers can get product reviews not only from the general community but also from their own online social connections. Zhang and Godes[12]investigated the impact of the review source on the quality of consumer decisions. Brown and Reingen[13]analyzed word-of-mouth referral behavior in a natural environment and found that strong ties are perceived as more influential than weak ties by recipients. Bitter et al.[14-15]also obtained similar results in their experiments which show that the product information from strong ties is perceived to be more diagnostic.

Research on online product reviews has gradually expanded from crowd reviews to friend reviews. While prior research on friend reviews has mostly focused on analyzing how the reviews from friends with different tie strengths affect consumer decisions, few of them have explored the impact of the emergence of friend reviews on firm decisions. To fill this gap, we study firms’ optimal review display strategies by considering the social ties between consumers and review publishers. More specifically, under which conditions can showing friend reviews be more profitable than not showing this information? When a firm decides to show friend reviews, does the distribution of tie strength among consumers affect its profit?

1 Assumptions

Assume that a firm sells products on its website at pricep. A product has two possible states: It either has quality defects or does not. The marginal production cost for each product is assumed to be 0. The total mass of consumers is normalized to 1. Consumers are all risk neutral. Each consumer has at most a unit demand. We assume that each early buyer submits a quality rating. If a buyer thinks that the product has no quality defects, she rates the product “1” (i.e., contributes a positive review), or “0” otherwise (i.e., contributes a negative review). The firm calculates the average product quality ratingRbased on all consumer ratings and displays it to consumers. The firm can also show consumers the reviews from their friends based on consumer social connections on the website. Therefore, the firm has two optional review revelation strategies:providing consumers with the average quality rating or providing consumers with both the average quality rating and ratings from their friends. We then make the following assumptions to describe our research problem.

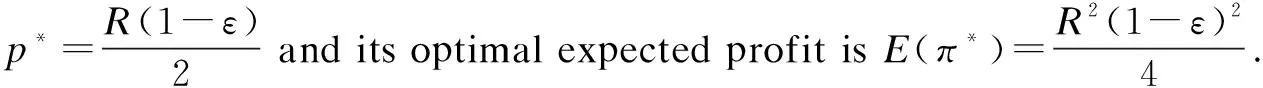

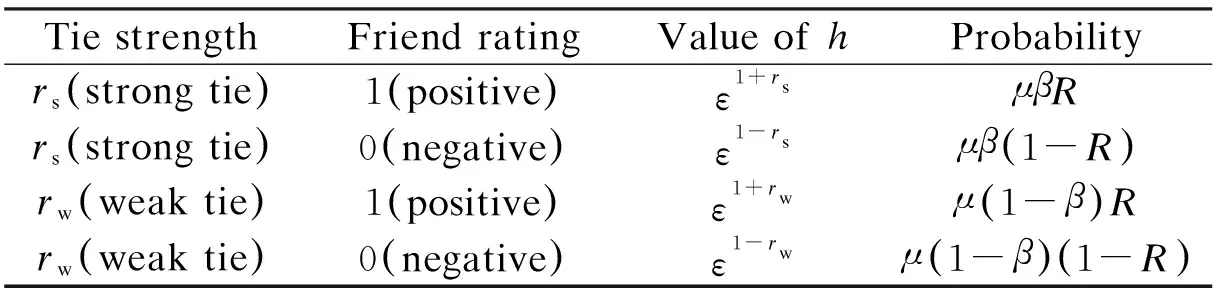

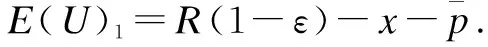

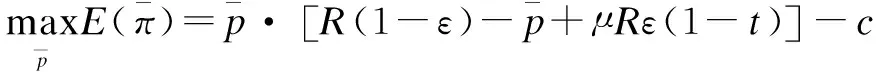

Letvbe the value that a consumer can obtain from the product.vis ex ante unknown and is the realization of a binary random variable,v∈{0,1} with Pr(v=1)=q∈(0,1). Specifically, the probability that a product has no quality defects isq, and the utility that a consumer can obtain from the product is 1; the probability that a product has quality defects is 1-q, and the utility that a consumer can obtain from the product is 0.qessentially measures the true quality of the product, similar to the assumptions in Refs.[16-17].qis known to the firm but not to consumers. Consumers form their expectationE(q) of the product quality based on the average quality ratingR. Assume thatR=q+m, 0≤R≤1.qis the true quality of the product andm(0≤m≤1-q) represents the positive bias in the average rating caused by the self-selection bias by early buyers and the firm’s manipulation of online reviews. Moreover,Ractually also represents the probability that a buyer posts a positive review. According to Hu et al.[18], consumers can be aware of the existence of the positive bias in the average rating and attempt to make corrections. Leth(0 If consumers purchase online, they have to wait for the delivery and may be worried about the security of online payments. Thus, purchasing online requires a hassle costx. For simplicity, we assume that the hassle costs are different across consumers and thatxis distributed uniformly in [0,1]. Based on the above assumptions, consumeri’s expected utility from the product isE(U)i=R(1-h)-x-p. Consumeriwill buy the product only whenE(U)i≥0. We modelras the tie strength between two consumers that have social connections with each other. Drawing on Kornish and Li[19], we use a two-point model of the distribution onrin the population, representing strong(rs) and weak(rw) ties, 0 Suppose that when the firm does not display friend reviews, all consumers’ corrections of the average quality rating are the same, expressed byε(0<ε<1), i.e.,h=ε. Consumeri’s expected utility from the product then can be expressed asE(U)i=R(1-ε)-x-p. Consumeriwill buy the product only ifE(U)i≥0. Therefore, we can formulate the expected demand for the product asE(D)=R(1-ε)-p. The firm maximizes its expected profit by choosing the optimal price, (1) By solving the above optimization problem, the following proposition is obtained. We assume that the market scale remains 1 when the firm shows friend reviews to consumers. To distinguish from the case where friend reviews are not available, in the case where friend reviews are available, the mark “-” is added above the corresponding symbols. For analytical tractability, we suppose that each consumer can see at most one review from one of her friends when the firm displays friend reviews, which is consistent with most actual situations. Furthermore, considering that, in reality, some consumers may not establish social connections with others on e-commerce websites or choose to submit anonymous reviews in order to protect their privacy, there may be some consumers for whom friend reviews are unavailable and so they will not be affected by friend reviews. We suppose that onlyμ(0<μ<1) of the consumers can see reviews posted by their friends, and for each of them, the probability of seeing a positive friend review isR, and the probability of seeing a negative friend review is 1-R. The expected value of the percentage of positive reviews in all the friend reviews displayed by the firm is alsoR. Considering the fact that consumers rarely see friend reviews when shopping online, we assume that even if friend reviews are available, consumers will still use the average rating to infer the product quality. Friend reviews affect consumer purchase decisions by influencingh, i.e., consumers’ corrections of the average quality rating. The value ofhfor a certain consumer is affected by the review posted by her friend, as well as by the tie strengthrbetween them. Specifically, when the friend rates “1” (i.e., contributes a positive review), the consumer’s correction of the average rating will decline on the basis ofε, and the greater the tie strength between the consumer and her friend, the smaller the correction will be. While when the friend rates “0” (i.e., contributes a negative review), the consumer’s correction of the average rating will increase on the basis ofε, and the greater the tie strength between the consumer and her friend, the larger the correction will be. In addition, according to a widely accepted view in the field of word-of-mouth communication that negative product information has a greater impact on consumers than positive product information, the impact of negative friend reviews on consumers should be greater than that of positive friend reviews. Based on the above analysis, we assume thathandrsatisfyhp(r)=ε1+rwhen the friend posts a positive review,hn(r)=ε1-rwhen the friend posts a negative review. The corrections of consumers for whom friend reviews are available include the four possible situations shown in Tab.1, while the corrections of consumers for whom friend reviews are unavailable remainε. The firm will face five possible types of consumers if it displays friend reviews: 1) Type 1—Have no friend review; 2) Type 2—A friend with strong tie posts a positive review; 3) Type 3—A friend with strong tie posts a negative review; 4) Type 4—A friend with weak tie posts a positive review; 5) Type 5—A friend with weak tie posts a negative review. Tab.1 Possible values of h when the firm shows friend reviews to consumers (2) wheret=βRεrs+β(1-R)ε-rs+(1-β)Rεrw+(1-β)(1-R)ε-rw. The firm chooses its price to optimize its profit, that is (3) wherecdenotes the cost of displaying friend reviews. By solving the above optimization problem, Proposition 2 is obtained. A formal comparison of the optimal results in Proposition 1 and Proposition 2 leads to Proposition 3, which states the conditions under which each review revelation strategy dominates the other. Proposition 3If and only if the proportion of positive reviews in friend reviewsRand the cost of displaying friend reviewscsatisfyR>R1,c Proposition 3 shows that displaying friend reviews to consumers does not necessarily increase firms’ profits. Displaying friend reviews is more profitable than not displaying such information when two conditions hold: 1) Positive reviews account for a high proportion of friend reviews; 2) The cost of showing friend reviews is not very high. It can be easily proved that, whenR>R1, the optimal price and expected demand of the product will both increase after the firm displays friend reviews to consumers. This means that when positive reviews account for a high proportion, the positive impact of displaying friend reviews exceeds the negative, the firm can charge a higher price and sell more products by showing friend reviews to consumers. However, if the cost of displaying friend reviews is too high, the increased sales still cannot make up for the above cost. Therefore, firms may consider showing friend reviews to consumers only when the cost is within an acceptable range. The above analysis indicates that if an e-commerce firm wants to jump on the bandwagon of showing friend reviews, it should either have a high development efficiency or take measures to improve its development efficiency so as to reduce the cost of developing social modules in review systems. Moreover, since the proportion of positive reviews is related to the true quality of the product and the positive deviation of reviews, Proposition 3 shows that when the cost of displaying friend reviews is not too high, firms with different qualities should also adopt different review display strategies. For firms selling high quality products, regardless of the deviation of quality information in the reviews, the proportion of positive reviews must be at a high level, so high-quality firms should always show friend reviews to consumers. However, low-quality firms should dynamically adjust their review display strategies according to changes in the proportion of positive reviews. For example, when a product just enters the market, if the early quality ratings show a large positive deviation due to either early buyers’ self-selection bias or other reasons, so that positive reviews account for a relatively high proportion, the firm should then show friend reviews to consumers. As the market gradually matures, the positive deviation of quality ratings decreases. When the proportion of positive reviews drops to a certain low level, the firm should change its review display strategy and stop showing friend reviews. If the proportion of positive reviews is large enough, the positive impact of displaying friend reviews exceeds the negative one, displaying friend reviews will ultimately have a positive impact on firms’ profits. Furthermore, as the proportion of consumers affected by friend reviews increases, the above positive impact will be enhanced, so that the increase in profits from showing friend reviews can still exceed the cost, even if the cost is high. Corollary 1 suggests that when the proportion of positive reviews and the proportion of consumers affected by friend reviews are both large, firms are more likely to increase their profits by displaying friend reviews. It means that if high-quality firms want to benefit from showing friend reviews to consumers, they should take effective measures to encourage consumers to establish and expand their social circles on the websites as well as encourage buyers to publish real-name reviews, so that more potential consumers can see reviews from their friends. The social ties between reviewers and potential consumers can affect the latter’s purchase decisions by influencing their corrections of the average quality rating. Thus, the distribution of social ties among consumers will ultimately affect firms’ profits. When a firm decides to show friend reviews to consumers, by analyzing the impact of the increase in the proportion of strong ties within the crowd on the firm’s profit, we obtain the following proposition. Since the impact of reviews from strong ties on consumers is stronger than that from weak ties, an increase in the proportion of strong ties among consumers has two opposite effects on firms’ profits when the total number of friend reviews is fixed: 1) The positive impact of favorable reviews posted by friends will be enhanced; 2) The negative impact of unfavorable reviews posted by friends will also be enhanced. This paper analyzes the situation that the reviews have reached a stable state, so the total number of friend reviews will not change. The changing trend of firms’ profits with the proportion of strong ties thus depends on the proportion of positive reviews in all the reviews that will be shown as friend reviews. Since the effect of negative reviews is stronger than that of positive ones, when the proportion of positive reviews from friends is not large enough (i.e.R≤R2), the enhancement of negative impact exceeds the enhancement of positive impact, so that an increase in the proportion of strong ties will weaken the profitability of firms. When the proportion of positive reviews from friends is large enough (i.e.R>R2), the positive impact supercedes the negative impact, so that an increase in the proportion of strong ties will enhance the profitability of firms. Based on the above analysis, Corollary 2 is obtained. Corollary 2Even in the case that showing friend reviews to consumers can increase firms’ profits, a large proportion of strong ties among consumers is not necessarily beneficial to the firm. Proposition 4 and Corollary 2 reveal that, though it has been a major trend for traditional e-commerce websites to add social capabilities to make use of the power of social networks, firms should strategically manage consumer online social networks rather than blindly promote social connections and interactions among consumers. Specifically, when the proportion of positive friend reviews is large enough, i.e.,R>R2, firms should take measures to increase the proportion of strong ties among consumers on their websites, such as promoting social interactions among consumers or providing a social login with social platforms characterized by strong ties (e.g. WeChat) and then recommending friends with a high interaction intensity for consumers. WhenR≤R2, firms should adopt opposite strategies to restrain the increase in the proportion of strong ties among consumers. Corollary 3 suggests that the degree of consumer distrust in the average quality rating will also affect firms’ strategies for managing consumer online social networks. Interestingly, as the degree of consumer distrust in the average quality rating rises, firms are more likely to obtain higher profits by taking measures to increase the proportion of strong social ties among consumers. This means that when consumers are skeptical of the average quality rating, more firms can benefit from promoting social connections among consumers. However, when consumers trust the average quality rating very much, firms can hardly benefit from the increase in the proportion of strong social ties among consumers. 1) With the increase in the sociality of online product reviews, how to choose an optimal review display strategy has become one of the important issues for e-commerce firms. Moreover, when firms choose to display friend reviews to consumers, they should also decide how to strategically manage consumer online social networks to increase their profits. In this paper, an optimization model is proposed to address the problems mentioned above. 2) Results show that though it has been a trend for e-commerce websites to display friend reviews to consumers, revealing such information does not necessarily increase firms’ profits. Only when positive reviews account for a large proportion of all the reviews and the cost of showing friend reviews is not high, can showing friend reviews be more profitable than not showing such information. In addition, the distribution of social ties among consumers can also affect firms’ profits. An increase in the proportion of strong ties is not necessarily beneficial to firms, even in the case that showing friend reviews to consumers is more profitable. Specifically, the expected profits of firms will increase with the increase in the proportion of strong ties among consumers only when the proportion of positive reviews is large enough, which indicates that e-commerce firms should be cautious about managing consumer social networks instead of promoting social interactions among consumers blindly. Additionally, the degree of consumer distrust in the average quality rating will also affect firms’ strategies for managing consumer online social networks. 3) Our analysis still has limitations. For instance, we assume that each consumer has at most one friend who has posted a review of the product, that is, each consumer will at most be influenced by one friend when making a purchase decision. But actually, it is possible that a consumer may have multiple friends with different tie strengths who have purchased the same product and have posted different reviews. Therefore, future research will focus on analyzing how multiple friend reviews jointly affect consumer purchase decisions.2 Model and Analysis

2.1 Providing consumers only with the average rating

2.2 Providing consumers with both the average rating and friend reviews

2.3 Comparison of different review revelation strategies

2.4 Impact of the distribution of social ties

3 Conclusions

杂志排行

Journal of Southeast University(English Edition)的其它文章

- Coupling dimensions of human resource archetypes and organizational learning modes

- Min-max fuzzy model predictive tracking control of boiler-turbine system for ultra-supercritical units

- Fundamentals of quasigroup Hopf group-coalgebras

- Expansion performance and self-stressing behavior of CFST columns considering concrete creep and shrinkage effect

- A fault feature extraction method of gearbox based on compounddictionary noise reduction and optimized Fourier decomposition

- Effect of carbonation-drying-wetting on durability of coral aggregate seawater concrete