The Development of Countering Monopolization in the Electric Energy Industry

2021-01-19VitalyKorolev

Vitaly G.Korolev

1 Basic Department of FAS of Russia,Plekhanov Russian University of Economics 115093,36 Stremiannyy Lane,Moscow,Russian Federation

2 Federal Antimonopoly Service of the Russian Federation 125993,11 Sadovaya-Kudrinskaya Str.,Moscow,Russian Federation

Keywords Antimonopoly regulation Competition protection Electric energy industry Antimonopoly legislation

Abstract The relevance of the topic is that countering monopolization in the economy and protecting competition is one of the important tasks of the state.The purpose of the paper is the analysis and determination of the directions of development of antimonopoly regulation in the electric energy industry in Russia. It was determined that the market is still monopolized,with rather strict regulation and significant barriers for new entrants. It is proposed to reduce these barriers for access to retail and wholesale markets for new participants,the development of digital energy for the development of competition.

1 Introduction

Electric energy industry is one of the most important sectors for the economy,since the generation,transmission and distribution of energy provides both public and industrial and transportation needs of the state. At the same time,the development of generating capacities,network and distribution infrastructure involves significant investments in these facilities, their interconnection within the network. This is a prerequisite for the work of only large companies in this market and the monopolization of the energy market.

However, the need to develop small energy, energy industry using renewable energy sources (RES), the formation of reasonable tariffs for the availability of energy, primarily for the producer – all these are urgent and modern tasks of the state that need to be addressed (Formalev et al., 2018; Kuznetsova and Makarenko,2018; Kuznetsova and Makarenko, 2019; Makarenko and Kuznetsova, 2019; Rabinskii and Tushavina, 2019).Currently, the Unified Energy System of Russia operates, it includes seven integrated energy systems (OES):Centre, Middle Volga, Urals, North-West, South and Siberia, including geographically isolated systems: three in Chukotka Autonomous Okrug, several in Kamchatka Krai and Sakhalin Oblast, in the Magadan Oblast, the Norilsk-Taimyr and Nikolayev energy districts, decentralized energy supply zones of the Nenets Autonomous Okrug and in the northern part of Yakutia and the Yamalo-Nenets Autonomous Okrug.

The Central Operations and Dispatch Department in the UES of Russia is engaged in JSC System Operator of the Unified Energy System. As part of the UES of Russia,3.2 million km of power lines with a voltage of 0.4-750 kV are being operated,600 thousand substations(capacity 1.1 million MVA),main power transmission lines with a voltage of 330-750 kV-65 thous. km. The largest Russian electric grid company is PJSC Rosseti(operates 90% of distribution networks and over 70% of main power transmission lines) (Indicator of the technical...,2018). This clearly suggests that the electricity market in Russia is quite monopolized, hence the significant need for government regulation in this area,including tariff and antimonopoly regulation.

Countering unreasonable monopolization and developing competition in the energy sector as important tasks of the state are described in the new doctrine of energy security of Russia,which was adopted on May 13,2019 by Decree of the President of the Russian Federation No. 216 (On Approving the Doctrine..., 2019). It is a focus on the development of competition, “including the development of organized (exchange) trade in products of organizations of the fuel and energy complex”, which applies to electricity, set as the direction for the development of energy security in Russia. Similarly,the Strategy for the Development of Competition and Antimonopoly Regulation in the Russian Federation for the period until 2030(Report on the state of competition...,2019;The Strategy for the Development...,2019)reflects the task of“reducing the scope of activities of natural monopolies only by areas of activity of economic entities that have“network assets”.

The need to improve “state price (tariff) regulation in the field of natural monopolies, factoring in the objective increase in the costs of extraction, production and transportation of energy resources on the domestic market, the need for investment resources for the development of infrastructure facilities, including implying increased control over the efficiency of costs in this field”was also reflected both in the current energy strategy of the Russian Federation, adopted by Order of the Government of the Russian Federation of November 13,2009 No. 1715-p and in the draft of the new energy strategy until 2035, which has not yet been approved (On the Energy Strategy...,2009). It also states that“long-term, transparent and balanced tariff regulation of natural monopoly and regulated activities of the energy sector”, “development of competition and methods of state(including antimonopoly) regulation of tariffs in the electric energy industry”, “improvement of antimonopoly control mechanisms in domestic energy markets should be ensured”. That is,all these issues are quite relevant at the present stage.

The purpose of the paper is to analyze and determine the directions of development of antimonopoly regulation in the Russian electric energy industry so as to ensure the availability of energy for other sectors of the economy. Accordingly, the object of research is the energy sector (electric energy industry, production, transportation and distribution of electric energy) in the Russian Federation. Subject matter – practical aspects of antimonopoly state regulation in the electric energy industry.

1.1 Literature review

The sources of literature have been distinguished, which,in general cover the issues of antimonopoly regulation of the economy by the state, and specifically related to the issues of antimonopoly regulation in the electric energy industry. The first group of sources used within the framework of the paper includes publications by such authors as A.V. Komarov and M.V. Labusov (2014), G. Becker (2015), I. Artemyev and A. Sushkevich(2007),Yu.Kuznetsov and V.Novikov(2008),F.Scott Morton(2019). The second group of sources used in the paper includes publications by such authors as E.S.Titov(2015),A.Eklund,M.Angland,E.Woolbank(2019),R.Pierce Jr(2019),J.Monast(2018).

First of all,it is necessary to elaborate the meaning of antimonopoly regulation in the subject literature,what are the existing types of antimonopoly regulation. A.V.Komarov and M.V.Labusov(2014)define antimonopoly regulation in the broad meaning as measures to protect competition, which are related to the restriction of monopoly power of companies,control over the activities of such companies.

The history of antimonopoly regulation is described, in particular, by G.Becker(2015). According to this description, antimonopoly policy itself first appeared in the United States as far back as the 19th century. Then it was billed as“antitrust legislation”. Trusts were understood as a form of monopolistic associations,within the framework of which participants lose their industrial, commercial,and often legal independence. The abolition of restrictions on the maximum capital sizes of companies in the 19th century in the United States resulted in the growth of trusts that have a fashionable effect on the market, on competitors who increase prices for products and services. The first law aimed at counteracting trusts was adopted in 1887, it established the procedure for state regulation of the activities of railways, according to which transportation between states was organized,and it was impossible to arrange collusion on the conditions of transportation, to unexpectedly increase tariffs without prior(no less than 10 days)warning and coordination with the federal government.

However, it was precisely the Sherman’s Law, adopted on July 2, 1890, that became the first universal US federal law that was directed against monopolization in all sectors of the economy. Within the framework of this law,“monopolization”was generally regarded as a negative phenomenon against free competition. The law established that“any contract,agreement in the form of a trust or another, or a conspiracy to restrict commerce or trade between states or with a foreign state is declared illegal”(Article 1).

The actions of companies directed against competition became the basis for criminal prosecution of their management, were punished with high fines. Adopted on October 15, 1914, Clayton’s Law divided monopolization into “harmful” and “socially acceptable”; large companies received more specific restrictions: price discrimination became unlawful, which aimed at establishing monopoly dominance, binding contracts (not allowing the counterparty to conclude contracts with third parties), and restrictions were also introduced on the mergers of competing companies. Further,the regulation of the economy within the framework of counteracting monopolies in the USA developed only in the 1930s, which was conditioned upon the crisis of the Great Depression in 1929-1933. (Phillips Sawyer,2019). Nevertheless, already in the 1960s,the United States departed from strict antimonopoly regulation,and only price conspiracies,monopolization of markets became illegal,and many of the previously established restrictions were lifted(Phillips Sawyer,2019,20).

F.Scott Morton(2019),upon considering modern antimonopoly regulation in the United States,argues that antimonopoly legislation has decayed, thereby leading to increased monopolization of the market and reduced competition,indicating that“it is not necessary to assume that antimonopoly enforcement of the 1960s and 1970s’s was optimal to be concerned about the state of antimonopoly legislation today” (Scott Morton, 2019). With that,the antimonopoly policy of the state is to this day criticized by many researchers,it is not always considered a constructive and efficient form of public government intervention in private business. Antimonopoly regulation has been criticised by such famous representatives of economic and legal thought.

In particular, such authors as I.Artemyev and A.Sushkevich (2007) write with specific regard to this criticism of antimonopoly regulation and antimonopoly legislation. Yu. Kuznetsov and V. Novikov (2008) write about the same issues connected with the destructive consequences for the economy of the application of strict antimonopoly regulation in Western countries.

That is,there are two opposing points of view. One assumes that antimonopoly regulation is necessary because it restricts the power of monopolies,their pressure on the markets(on the markets for goods and services wherein they operate, as well as on the labour market), rising prices for products and services of monopolies(which increases the costs of enterprises). Another point of view proceeds from the fact that excessive government intervention in the affairs of large business, a ban on the growth of large companies and their integration,not only does not positively affect the economy and consumer welfare,but also often worsens this welfare. The second point of view is also substantiated by the fact that a large company often has the ability to minimize its own costs by building vertical integration, and also allows large-scale investments with horizontal company integration.

The same discussions arise with regard to the problems of antimonopoly regulation in the electric energy industry. Indeed, the electric energy industry is an area that requires the creation of large generation facilities (although the role of small energy in our time is increasing, including energy based on renewable energy sources),but the main thing is the formation of a transmission and distribution network,which is not necessary and economically expedient to build by each company independently, which is why such a network infrastructure in itself is a natural monopoly (Titov,2015; Skvortsov et al.,2019). Pierce R.Jr(2019)also indicates that network infrastructure is a fairly capital-intensive area, which involves significant investments in transmission and transportation. Significant investments are needed in this area, and, therefore, there are significant costs associated with depreciation of capacities.

Without consolidation, it is difficult to make large-scale investments in this area, therefore the state should not oppose the consolidation of network companies. J.Monast(2018)also points out that critics of antimonopoly regulation and counteracting the enlargement of companies in the energy sector cite the fact that this “control over the transmission and generation of electricity has become not only unnecessary for achieving the goals of accessibility and reliability, but also created barriers to economic and environmental benefits associated with natural gas,renewable energy and energy efficiency”(Monast,2018).

However,the results of this reform are evaluated rather ambiguously. In terms of antimonopoly regulation,its inefficiency is highlighted, since the formation of 23 independent companies did not lead to free pricing in the market: large companies PA Gazprom and PJSC Inter RAO Unified Energy Systems increased their own market shares by acquiring energy companies,started dictating small competitors their own conditions, and the monopolistic market of RAO“UES of Russia” was transformed into an oligopolistic one, where several major players operate. Although, at the same time,the process of pricing for electricity has come under state control.Currently,the share of electricity, the price of which is determined by the free market,can only be estimated at 40%,and electricity prices again have a tendency for increase(Komarov and Labusov,2014).

Prospects for the development of competition in the electricity market are now seen in the decentralization of this market. Technical solutions related to the sale of electricity through special digital platforms are already in place, which is indicated, in particular, by S.Kloppenburg and M.Boekelo (2019), A.Booth, P.Peters, and E. de Jong (2018). According to such scheme, upon using a digital platform, in fact, a company with such a platform can buy energy from different suppliers, can sell surplus of its own energy if it generates it. Here it is necessary to clarify that in world practice this is how the generation of solar and wind energy is supported,when network companies are undertaken to buy energy from households, small power plants from renewable energy sources,including at definitely high tariffs(Malikova and Zlatnikova,2019).

On the one hand,this is also state intervention in business. But on the other,it is a way of actively introducing new players to the market and developing the competition, the emergence of new energy offers on the market,as well as a way to competitively protect energy generation from renewable energy sources, factoring in the national policy in the field of increasing energy security, environmental protection, and reducing atmospheric emissions of greenhouse gases.

2 Materials and methods

One of the main purposes of the analysis of the development of competition in the electric energy industry is to establish the dominant position of energy retail companies(including suppliers of last resort)in the regions. For this,market concentration indicators are calculated:

1)Herfindahl–Hirschman index(HHI);

2)Concentration Ratio(CR).

The methodology for calculating these indices is associated with determining the influence of the largest suppliers on the market,their participation in the market.

The Herfindahl–Hirschman Index(HHI)is calculated as follows:

Where HHI is the Herfindahl–Hirschman index;

Siis each company’s market share in sales.

Accordingly, the highest value of the indicator is 10,000 (absolute concentration). It can be outlined a few more values for the concentration level:

Type I – high concentration: 1,800 <HHI <10,000 (can also be divided into more detailed levels, for example,up to 5,000,up to 10,000 and actually 10,000 as absolute);

Type II–moderate concentration: 1,000 <HHI <1,800;

Type III–low concentration: HHI <1,000

The concentration ration is the share of the largest market players;it is calculated as follows:

Where CR is the concentration ratio;

Siis the share of each large company.

Its maximum value is 100%. With that,as well as with the HHI,the following levels can be distinguished:up to 30%;up to 50%;up to 60;up to 80%,up to 99.9%(the higher the level,the higher the concentration).

To study the development of competition in the electric energy industry, the levels of concentration of electricity suppliers in retail markets will be presented as quantitative indicators. To study the issues of antimonopoly regulation,market development,it was also used qualitative data related to the structuring of the electricity market in Russia, the levels of regulation in this market, the geographical structure of the market, etc. Research materials–reports of the FAS Russia,materials of the consulting company Ernst&Young on the development of the electric energy industry,materials of the Russian Federal State Statistics Service.

3 Results and discussion

Currently, the Russian electric energy industry operates in the following segments: generation, transmission and distribution, distribution and consumption of electricity. With that, generation is a competitive segment,transmission and distribution are regulated,sales are a competitively regulated segment(see Figure 1).

Generating companies sell energy directly to customers, or online. Network companies carry out energy transfer and technological connection of new consumers, being natural monopolies. Sales companies sell energy to end consumers, buying it from network companies (who act as intermediaries). The supplier of last resort warrants that the consumer will receive electricity, even if no energy supply company has concluded an agreement with it(Report on the state...,2019). The relations between the supplier of last resort and consumers are public in nature and subject to state regulation(Energy strategy of Russia...,2014). Electric energy industry market regulators in Russia:

–The Ministry of Energy of the Russian Federation (control and regulation of the electric energy industry,including compliance with legislation and the implementation of investment programs);

–FAS Russia(antimonopoly and tariff regulation of the industry);

–Rostekhnadzor (control and supervision of the technical condition, safety of electric energy facilities, and the dispatch system).

Apart from the government agencies, there is a commercial and technological infrastructure. The commercial infrastructure of the market includes:

–JSC“Administrator of the Trade System”(purchase and sale of energy in the wholesale market);

–Association “NP Market Council” (interaction between the subjects of the wholesale and retail electricity markets);

–JSC Centre for Financial Settlements(ensuring the repayment of mutual claims and obligations of wholesale market participants).

The technological infrastructure entities include JSC “System Operator of the Unified Energy System”,which provides real-time dispatch control in the wholesale and retail electricity markets.

The market itself is divided as follows:

–wholesale (sellers – generating companies, buyers – network companies, large industrial consumers and last resort energy suppliers);

Fig.1 Electric energy industry segments of Russia.

–retail(sellers–sales companies guaranteeing a supplier and small-scale renewable energy generation companies(up to 25 MW of installed capacity),the buyers are the population and legal entities(small enterprises)).

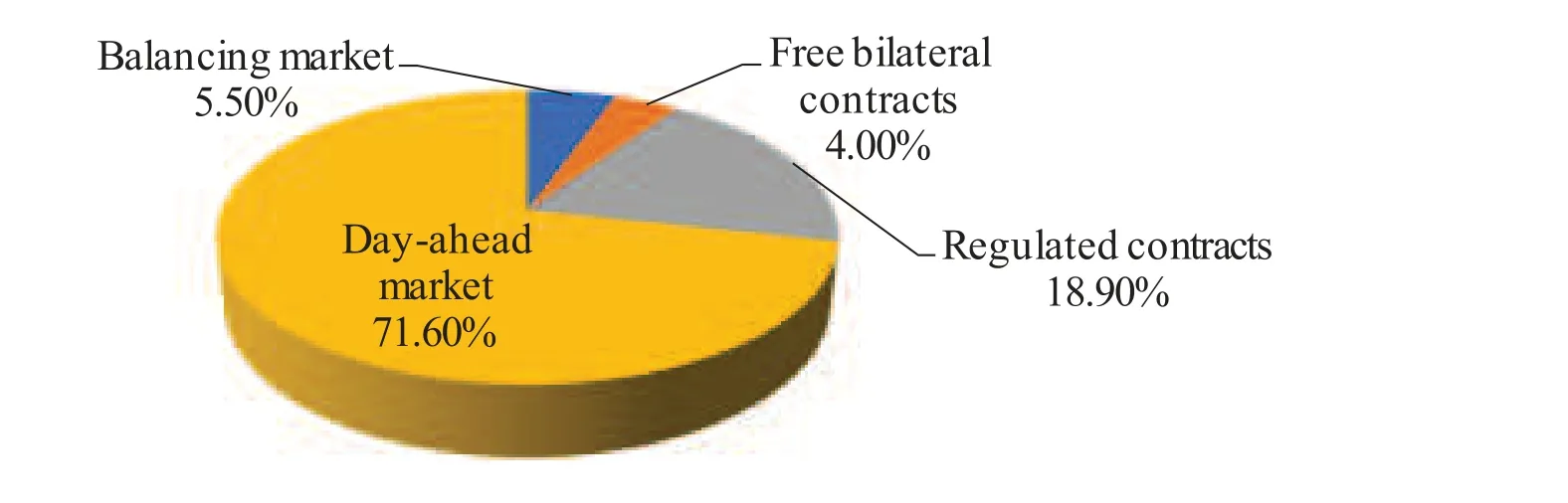

With that, the actual electricity and capacity are two separate goods. Capacity is the right of the buyer to demand from a supplier a certain capacity to keep equipment ready to generate certain amounts of energy that are necessary to meet the needs of a given consumer. For suppliers with a capacity of over 25 MW,sales are carried out only in the wholesale market. With a capacity of up to 25 MW,energy plants can operate both in the wholesale and retail markets. Accordingly, either a power supply contract(sale of energy plus the provision of its transmission through a grid company)or purchase and sale of electricity and capacity contract is concluded with consumers (in this case, the buyer enters into a separate transmission contract with the grid company).About 72%of energy is sold on the day-ahead wholesale market(Figure 2).

If the actual volume of electricity consumption turned out to be higher than planned(within the framework of applications on the day-ahead market), then the consumer purchases energy in the amount of deviation in balancing markets. Free contracts suggest that market participants individually determine the counterparties,prices and volumes of electricity supply,but the share of such contracts shall be only 4%.The territory of Russia is divided into several zones related to the pricing of electric energy(Figure 3).

Fig.2 Electricity sales structure in wholesale markets in 2018.

Fig.3 Price zones of electric energy industry in Russia.

As is evident from Figure 2, in the first price zone there are territories in the European part of Russia up to the Urals. In the second zone is the southern part of Siberia. Non-price zones are in the north of Russia, in the Far East,and in the Kaliningrad region –there is no possibility of organizing market relations in this area,energy and capacity are sold at regulated tariffs based on special rules. Moreover,in price zones,energy is sold pursuant to various principles: for the population and equivalent categories–at regulated tariffs,for others–at market prices. For energy producers, there is a limit on the share in energy sales in price zones–not more than 35%,but in non-price and isolated zones there are no such restrictions.

It should be noted that in December 2018, the Government of the Russian Federation decided to join the Western and Central energy regions of the Republic of Sakha (Yakutia) to the zone of the wholesale electric energy(capacity) market from the beginning of 2019. In accordance with the Decree of the Government of the Russian Federation No. 1496 dated December 08, 2018, these areas were excluded from the isolated zone and included in the non-price zone of the wholesale electric energy(capacity)market. As a result,the boundaries of the wholesale electric energy and capacity market expanded, and this contributed to the improvement of the investment climate in the region and created additional conditions associated with the development of competition in this area of the wholesale electric energy and capacity market.

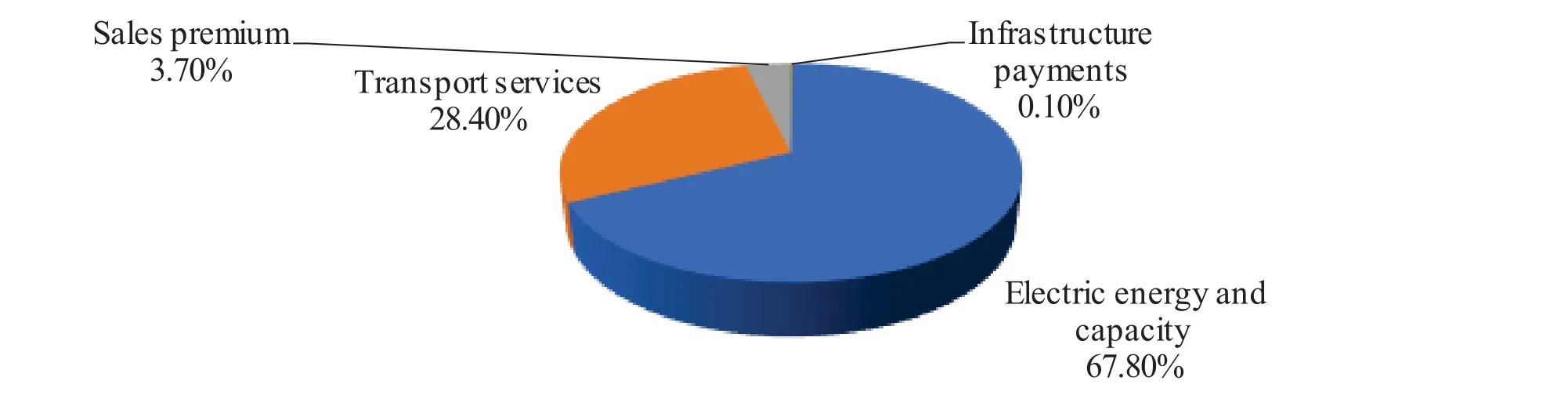

A regulated component of the price is the sales allowance (payment for the services of the energy sales company), which cannot be higher than those established for certain groups of consumers (the population and equivalent organizations, network companies to compensate for energy losses,some other types of consumers).Premiums are established by the authorities of the constituent entities of the Russian Federation proceeding from the economically justified costs of the supplier of last resort. Accordingly,for the consumer,the tariff is formed by factoring in several components(Figure 4).

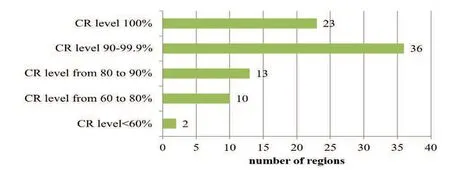

That is, most of the tariff is still the cost of energy and capacity itself, as well as energy transfer through network companies. Currently, in Russia, the electricity market is quite monopolized. According to the results of the analysis of the state of competition in the wholesale electric energy market for 2017,conducted in 2018,the concentration ratio (CR) within the boundaries of the First price zone is moderate, within the boundaries of the Second price zone is high. The concentration ratio (CR)in the wholesale market of electric energy and capacity in terms of electricity production and installed capacity in the geographical boundaries of the free flow zones is also high. Figure 5 demonstrates the distribution of the concentration ratio by region:

Fig.4 Tariff structure in the retail market for consumers Source:Rosseti Annual Report(2018).

Fig.5 Concentration ratio(CR)by region in the wholesale electric energy markets(2017 survey data).

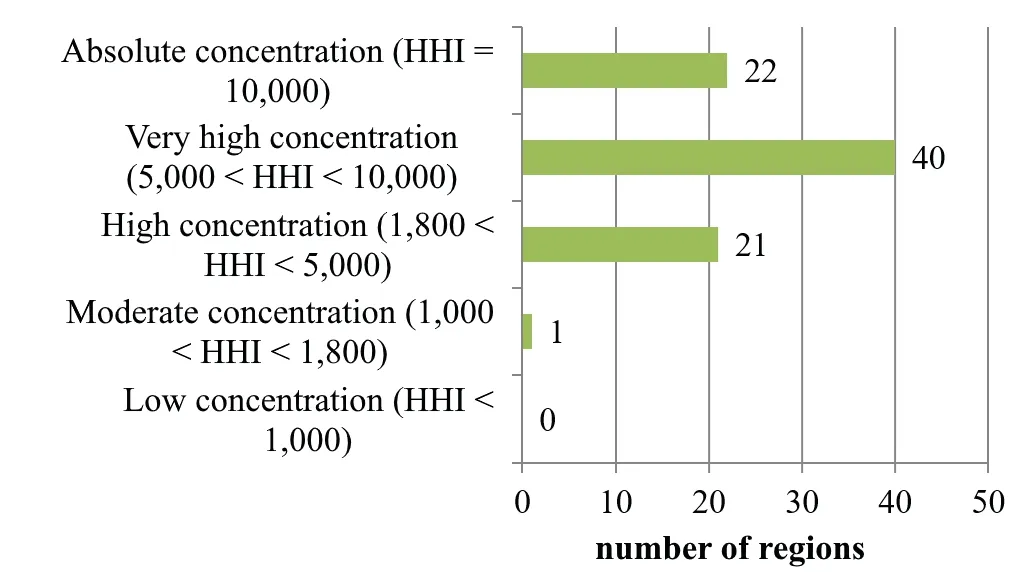

That is, only in 2 regions the concentration level is relatively low – these are the Tula and Ryazan regions(central Russia). A slightly higher level, but up to 80% – in another 10 regions, and these are the regions of the Volga,Urals, Central Russia,Altai. In another 13 regions, the concentration level is from 80 to 90%–this is also mainly the Volga region, the Urals, and Central Russia. There are already 36 regions with a level of 90-99.9%, and Moscow and St. Petersburg are therein. The level of 100% is in 23 regions, and this is mainly Eastern Siberia, Crimea, a number of regions of the North Caucasus. The value of the Herfindahl-Hirschman Index (HHI) of market concentration for Russian energy also corresponds to a high level of concentration of commodity markets (The main characteristics..., 2019). The distribution of regions by value is presented in Figure 6.

The lowest concentration level (HHI=1,426.1) is in Altai Krai. A relatively moderate concentration level for installed capacity in 2017 was established only within the geographical borders of the Urals and Central Russia. This is conditioned upon the fact that in most regions the share of suppliers of last resort exceeds 75%for the territory of the subject of the federation, or even approaches and equates to 100%. In most regions,it is the supplier of last resort that is the subject of the wholesale electric energy market, and energy retail companies purchase electricity from it for subsequent retail resale. In a number of regions, including Moscow and St. Petersburg, market concentration is high due to an increase in the share of suppliers of last resort based on the results of acquisitions and mergers in the market. Indeed, currently most of Russia’s generating assets are owned by heat generating companies of the wholesale electric energy market (WGC), the federal hydrogenerating company of the wholesale market(PJSC RusHydro),14 territorial generating companies(TGK)and Rosenergoatom. However, in a number of regions, according to the FAS Russia, the share of suppliers of last resort decreased while the share of other energy retail organizations increased.

Fig.6 Market concentration level(HHI)by region in the wholesale electric energy markets(2017 survey data).

In 2017, the number of wholesale market participants in the wholesale market increased by 24 compared to 2016, there are 92 generating companies, but there are not enough manufacturers within the boundaries of free flow zones and a high probability of using their market power. Nevertheless, the FAS Russia estimates that as a result of the reform of the energy sector, the number of independent participants in the wholesale market has increased, and concentration in this market has decreased. In 2018, in the regions of the Russian Federation, territorial authorities noted the presence of 691 energy retail organizations (including branches of large companies operating in several regions),of which 310 had the status of a supplier of last resort.

FAS Russia also outlines the main barriers for entry to and exit from the electric energy and capacity market,primarily economic restrictions,among which are:

–the need for significant capital investments with long payback periods(including not only for generation,but also for connection to the network infrastructure object);

–non-recoverability of investments upon exit from the market;

–impossibility without permission to exit the market;

– the need to have a certain (large enough, justifying the cost) production volume so as to achieve the“economy of scale”;

–the presence of technical restrictions–at least 5 MW for each point of supply of the manufacturer.

In general,one can state the high monopolization of the electric energy and capacity market in Russia,which is especially compounded by the underdeveloped networks, generation and sales in the eastern and northern regions of the country, and the processes associated with mergers and acquisitions of companies in the western part of the country. Currently,the FAS offers a number of activities that would contribute to the development of competition in the electricity market. The following is required:

– expansion of the use of bilateral energy purchase and sale agreements, which should be actively applied not only in the wholesale market,but also in retail markets;

–reduction of free flow zones(i.e. zones in the wholesale market of electric energy(capacity), where basic conditions contain no significant systemic restrictions during 30%of the time per month);

–development of competition between energy producers in the Far East(increasing access to this market for different energy producers,stimulation of this access);

–development of energy based on renewable energy sources,primarily in isolated areas of the Far East;

–provision for compliance with the ban on combining natural monopoly and competitive activities(generation and network transmission and distribution of energy).

It will also be necessary to increase the participation of consumers and energy retail companies in the wholesale market by simplifying the scheme for a single group of supply points, since this will expand the membership,reduce the monopoly power of suppliers of last resort in the regions, increase competition for consumers,develop a distribution system for electric energy,increase competition between sales companies.

The author also believes that the development of a new energy industry is required, which is based on digitalization, namely the introduction and development of:

–open modular digital platforms to organize cyberphysical systems and environments in the electric energy industry on their basis;

–intelligent multi-agent control systems;

–development of electric energy storage systems(both batteries for the domestic sector, and high-capacity electric energy storage systems,including in the hydrogen cycle).

The state already has an understanding of the need for the development of digital energy,there is a“Digital Economy of the Russian Federation”program(approved by order of the Government of the Russian Federation No. 1632-p dated July 28,2017), several projects are being implemented starting in 2014. The EnergyNet National Technology Initiative also involves the development of“reliable and flexible networks” and the creation of competitive technological solutions by 2035(Efimov et al.,2016;Filimonova et al.,2016;Shevgunov,2019;Shevgunov et al.,2019;Grigoryev,2019). Development in this direction should contribute to increased competition not only in the wholesale electric energy market,but also in the retail market: diversification of electricity purchases by energy retail companies and end consumers. Since only tariff regulation and price restrictions and company dominance are clearly insufficient for the development of competition in the electric energy industry.

4 Conclusions

The conducted study suggests the following points. The electric energy industry itself is partly an object of natural monopolies. And while generation can be concentrated in the hands of various economic entities, it is advisable to transfer and distribute energy to a single company. In this regard, of matter is the high cost of creating and maintaining transmission and distribution networks and systems, the need to ensure their stable operation and security. Currently in Russia, despite the disaggregation of the natural monopoly of RAO“UES of Russia” and the creation of several generating companies, including grid companies, the energy market has actually been re-consolidated, transformed into an oligopolistic one,with the need for state regulation and tariff control.

In modern Russia, it is better for the state not to impede the development of large network companies, but to control their tariffs so as to prevent their negative impact on the development of the economy (including in Russia through a special body – FAS Russia). In terms of generation, the state, on the contrary, should strive for increase of competition and limitation of monopolies so that a greater number of generating companies have free access to the sale of energy in the wholesale and retail markets. This access and sales is facilitated by the development of energy digitalization, digital platforms for consumers, metering systems, free flow of energy,including optimization of price regulation, including decrease in the regulatory role of the FAS Russia in this field,as strict standards do not allow fully developing small generation and the retail electric energy market.

In the Russian Federation, the electric energy market is heavily regulated. Energy industry in the regions is divided into two price zones,a non-price zone and a zone of isolated energy systems. In each of the zones,tariff regulation is built differently, and in the non-price zone and in the zone of isolated energy systems there is still no possibility of a complete market circulation of electricity. At the same time, in Russia there is a wholesale market that allows large energy generating companies to sell to end suppliers or energy supply companies, as well as a retail market where suppliers of last resort and energy companies sell energy to end consumers as intermediaries.

The sale involves the sale of energy and capacity (readiness to meet the needs), the tariff includes delivery and distribution fees,infrastructure premiums on the market,and in the retail market,the price premium for the energy sales company(upon selling to the public,to some other customers,upon selling to non-price zone,it is regulated by the authorities of the Federation). In Russia, despite the reform of the energy sector, a high level of market concentration in the retail market remains,and this is conditioned both upon the underdevelopment of competition in a number of territories (except Central Russia),and upon the enlargement of energy companies,including in the central part of the country. In addition, there are many barriers that impede the access of new participants to the market, both wholesale and retail. To develop the market, it is proposed to reduce these barriers, and the active development of digital energy is proposed to increase competition in the retail electric energy market.

杂志排行

Journal of Environmental Accounting and Management的其它文章

- The Influence of Alternative Fuels on the Development of Large-Scale Production

- A Retrospective Comparison on Europe and China Ecological Wisdom of Pre-Industrial Urban Communities of under the Lens of Sustainability Pillars

- Green Lifestyle among Indonesian Millennials: A Comparative Study between Asia and Europe

- Legislative Regulation of Criminal Liability for Environmental Crimes

- Regional Diversif cation of Rural Territories with Limited Spatial Location of Green Tourism Objects

- Influence of Intensity of Rain Strains and Slopes on the Development of Soil Erosion under the Forest