Plight and Countermeasures of Petty Credit Loan in Rural Financial Institutions in the Context of Rural Revitalization Strategy

2020-08-31XiaofangZOU

Xiaofang ZOU

Economics and Management School of Yangtze University, Jingzhou 434023, China

Abstract The implementation of China’s rural revitalization strategy will surely release a huge financial demand in rural areas. How to use the petty credit loan in rural financial institutions to develop rural economy is an effective way to implement the rural revitalization strategy. This paper first analyzes the significance of petty credit loan in rural financial institutions for rural revitalization strategy, then introduces the remarkable contribution of petty credit loan in China’s rural financial institutions to actively solving the problems of farmers about difficult financing and expensive financing and elaborates on the main problems of petty credit loan business in rural financial institutions that still exist in the process of supporting rural revitalization, and finally gives several suggestions on solving the problems about the financing of farmers and the development of petty credit loan business in rural financial institutions.

Key words Rural revitalization strategy, Rural financial institutions, Petty credit loan, Financial support

1 Introduction

In the report of the 19th National Congress of the Communist Party of China in October 2017, China proposed the rural revitalization strategy, pointing out that rural revitalization strategy was an overall grasp of the work of "agriculture, rural areas and farmers" in the new period, an inevitable requirement for solving the contradiction between the people’s growing needs for a better life and the unbalanced and insufficient development, and even more an important measure for comprehensively winning the moderately prosperous life and realizing the Chinese dream. The implementation of rural revitalization strategy is mainly completed through economic construction, and the promotion of rural economic construction requires a large amount of financial support to arouse farmers’ enthusiasm for innovation and entrepreneurship and stimulate farmers’ consumption and investment demands, thereby increasing farmers’ income levels and then achieving the goal of industrial prosperity and prosperous life. In 2018, the Central Document No.1,OpinionsontheImplementationofRuralRevitalizationStrategy, was issued, which particularly emphasized that it was necessary to improve the level of financial services and strengthen the support for rural financial credit system with the aim of better meeting the demand for funds in the process of rural revitalization. The economic development in rural areas is very backward, and the social environment is relatively isolated. Farmers encounter the difficulties in making indirect financing through the financial market and also face the difficulties in obtaining large mortgage loans because of unclear rural property rights and the low values of farmers’ assets. In view of this, petty credit loan has almost become the main source for farmers to obtain loans. Therefore, in a logical sense, the benign development of petty credit loan can promote the realization of the goal of rural revitalization strategy. From the perspective of economic benefits, the development of petty credit loan can promote the industrial structure adjustment and industrial prosperity in rural areas, increase the incomes of farmers and realize the goal of common prosperity; from the perspective of social benefits, the development of petty credit loan can realize the goal of farmer’s prosperous life, which help the people live and work in peace and contentment and thus maintain the stability of rural order.

2 Analysis for the current situation of the development of petty credit loan in China’s rural financial institutions

Petty credit loan is the small-value, continuous credit services provided for low-income groups and micro-enterprises. It mainly has 4 basic characteristics: small value, unsecured guarantee, convenient and fast handling, and service for the poor people. Petty credit loan is one of the effective ways to solve farmers’ difficult financing and expensive financing and one of the main credit businesses of rural financial institutions at present.

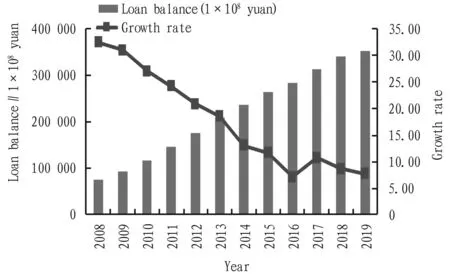

2.1 Steady growth in the scale of petty credit loan in rural financial institutionsThe scale of petty credit loan in rural financial institutions has shown a steady growth trend in the past decade. As shown in Fig.1, in 2009, the scale of petty credit loan in rural financial institutions was only 92 600 yuan; after 10 years, at the end of 2019, the balance of local and foreign currency agricultural loans in financial institutions reached 35 190 billion yuan, with a growth of nearly 4 times. As the scale of loans grew larger and larger, the base for calculating the growth rate also became larger, so the growth rate showed a trend of reduction year by year instead, which demonstrated that there would be a quite large space for improvement on the scale of petty credit loan in rural financial institutions in the future.

Data source: GTA database, website of National Bureau of Statistics.

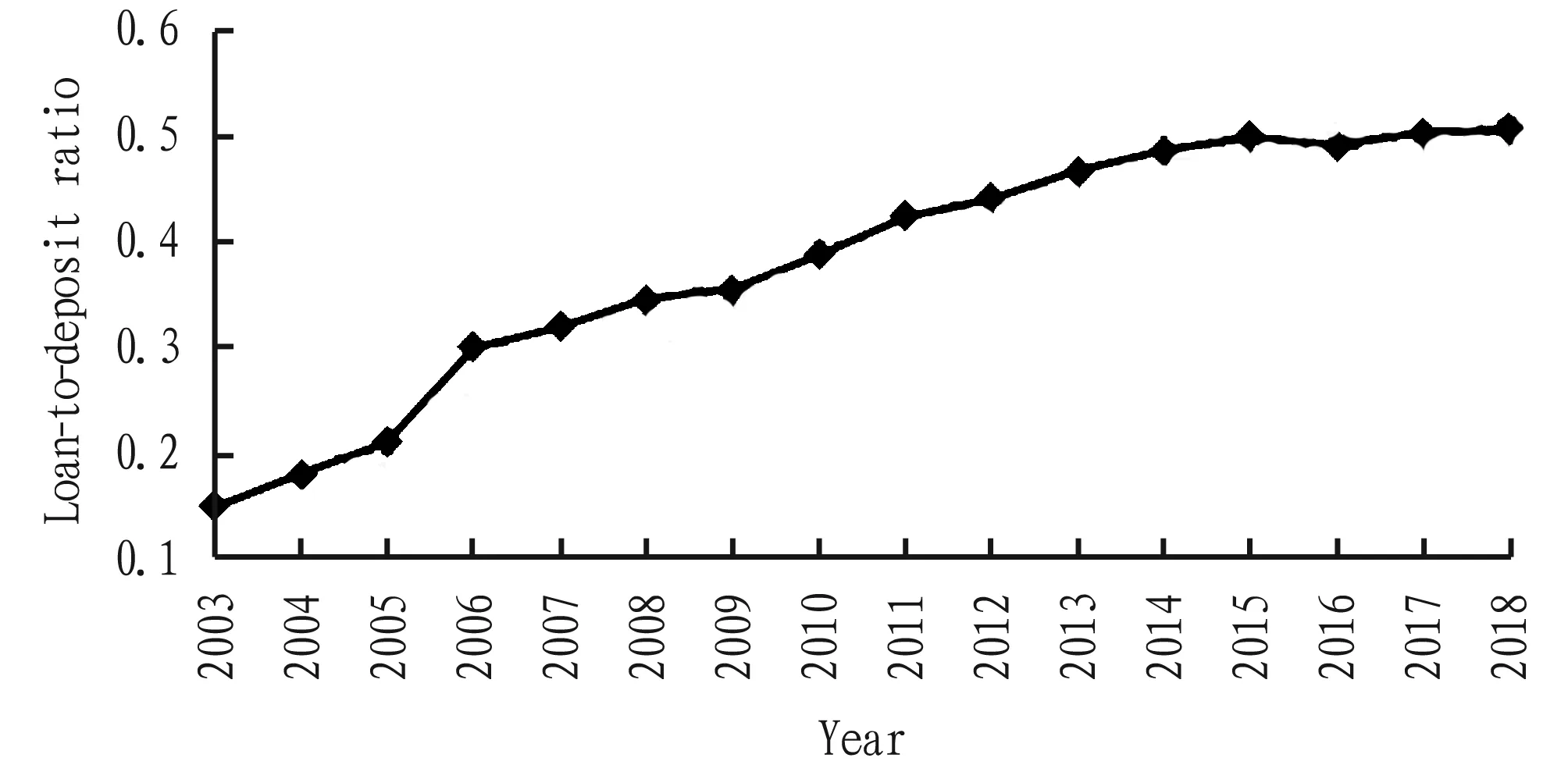

2.2 Continuous expansion in the loan-to-deposit ratio of rural financial institutionsAs shown in Fig.2, the rural loan-to-deposit ratio in 2003 was only 0.15, but by 2018 the rural loan-to-deposit ratio reached 0.51. The rural loan-to-deposit ratio increased year by year, with a relatively large growth rate, which demonstrated that rural financial credit had gradually been recognized by everyone. More and more people were willing to participate in the new loan models continuously introduced by financial institutions, which had greatly promoted the development of regional economy in China’s rural areas.

Data source: GTA database.

2.3 Continuous increase in the coverage of service outlets for petty credit loan in rural financial institutionsThe service outlets for petty credit loan in rural financial institutions show an increase in their quantity and a continuous expansion in their coverage. By the end of 2015, the quantity of county-level banking outlets in China reached 110 000, and all townships in 24 provinces (regions) across China achieved a full coverage of basic financial services. As of the end of December 2017, the coverage rate of banking financial institutions in China’s townships was 95.99%, and the coverage rate of basic financial services in administrative villages was 96.44%. More than 80% of these financial institutions serve agriculture, rural areas and farmers as well as small and micro enterprises and provide them with special petty credit loan services. It can be seen that rural small and medium-sized financial institutions continue to play a major role in supporting agriculture services, which has laid a financial foundation for ensuring the solution to farmers’ financing difficulties.

3 Problems confronted by the petty credit loan in China’s rural financial institutions in the process of supporting rural revitalization strategy

3.1 Urgent demand for strengthening the investment of petty credit loan in rural financial institutions in the process of supporting rural revitalizationThe petty credit loan in rural financial institutions shows an inadequate investment in the process of supporting rural revitalization, which is mainly reflected in the lack of enthusiasm for promoting petty credit loan business. (i) The petty credit loan business in rural areas has little profit. The number of customers of rural petty credit loan is relatively large, but the amount of each loan is not large. It is difficult for financial institutions that provide loans to track the purpose of each loan and complete the post-loan supervision work in a timely manner, which will greatly increase the management costs of financial Institutions. Moreover, some rural financial institutions have little or even no profit in granting credit loans to farmers, which has led to rural financial institutions’ lack of enthusiasm for expanding petty credit loan business. (ii) The issuing entities of credit loans bear large risks. Agriculture is a high-risk and low-income industry, which is easily affected by various factors such as natural weather and disasters,etc. In China, the popularity rate of agricultural insurance is low and the scope of business areas of rural financial institutions is narrow. This makes it difficult for rural financial institutions to disperse the risks of petty loans, and these risks may be borne solely by the issuing institutions of loans. Therefore, from the perspective of risks and benefits, rural financial institutions lack the enthusiasm for promoting and developing rural petty credit loan business.

3.2 Urgent demand for updating the development model of petty credit loan in rural financial institutions in the process of supporting rural revitalization(i) The outflow of rural deposits has restricted the supply of funds for petty credit loan. China’s rural financial institutions have been plagued with insufficient funding sources, causing a large number of rural financial institutions to carry out commercial transformation, such as the transformation of public welfare petty credit loan institutions to companies and the reorganization of rural credit cooperatives into rural commercial banks. Under the profit-driven guidance, the business model of these commercialized rural financial institutions shifted to absorbing farmers’ deposits, but most of the funds from absorbing deposits was used for more profitable urban real estate loans and interbank business investments, resulting in the serious outflow of rural deposits and aggravating the imbalance between supply and demand in the rural petty credit loan market. (ii) The petty credit loan products of rural financial institutions lack diversity. The rural financial institutions in China provide exclusive financial services for rural areas, showing a lack of horizontal competition and leading to insufficient incentives to financial service innovation and relatively unitary credit loan products. For example, there are only 4 types of rural credit loan products. The pledged collateral of farmers is scattered, with low values and severe conditions for applicable objects. These greatly restrict the choice of credit loan products by rural residents. Moreover, the development of financial institutions is limited, and the supporting business of related financial products is still very imperfect, which can not meet the diversified financial demands released by rural areas in the process of rural revitalization strategy.

3.3 Urgent demand for improving the system guarantee of petty credit loan in rural financial institutions in the process of supporting rural revitalizationA main reason for the difficulty of financing for farmers and agricultural business entities lies in credit and guarantee issues. It is an iron law of financial institutions to assess credit and guarantee loans, but the existing rural financial system in China is not perfect. (i) The rural credit environment is poor. The construction of credit systems in most rural areas lags behind, and rural banks in some areas have not yet entered the national credit reporting system. This has led to the inability of rural financial institutions to effectively assess the credit ratings of rural households when making loans. Besides, farmers in some regions generally have weak credit awareness and malicious arrears, which has led to serious fear of loans of rural financial institutions, which indirectly raises the cost of rural financial institutions. (ii) Lack of rural property rights trading market and intermediary organizations. Restricted by factors such as poor rural economic conditions, small transaction scale, and small property liquidity, rural areas lack credible property rights trading centers and intermediary organizations with strong comprehensive business capabilities, which have caused the property transfer in rural areas to remain in the system, and it is difficult for rural and agricultural management organizations to provide qualified collateral when applying for loans. In this situation, the credit risk of rural loans is high and the guarantee is difficult, which has become a shackle that hinders the development of rural finance.

3.4 Urgent demand for strengthening the talent reserve of petty credit loan in rural financial institutions in the process of supporting rural revitalizationIn China, rural financial institutions extremely lack comprehensive financial talents who understand both finance and agriculture. (i) At present, the promotion personnel of the petty credit loan business of rural financial institutions are mainly local villagers. Although they are familiar with the agricultural production process, they lack the necessary financial basic knowledge. At the same time, college students newly recruited by rural financial institutions to improve the talent structure as talent reserves lack the experience of agricultural production activities and lack understanding of agricultural production. (ii) The petty credit loan business has strong policy attributes, and the low level of performance incentives has led to a lack of motivation among business personnel. (iii) Since most rural financial institutions are located in relatively remote areas, the salary level is unattractive, which makes the problem of brain drain more serious.

4 Recommendations for China’s rural financial institutions supporting the rural revitalization strategy through the petty credit loan

4.1 Providing preferential policies and system guarantees, and establishing a financial service system for rural revitalizationWith the promotion of the rural revitalization strategy, the government should strengthen financial support and solidly promote rural inclusive financial services. (i) Taking farmers and agricultural enterprises as the main body, it is required to adhere to the core concepts of government guidance, market operation, and government support, to guide funds to flow to the rural economy. (ii) Rural financial institutions should continue to go deep into towns and townships, establish more township banks, solidly promote inclusive financial services, and continue to increase credit in rural markets. (iii) It is recommended to accelerate the construction of rural property rights trading centers, accelerate the implementation of the rural land transfer system, enhance the mobility of rural properties, increase the value of collateral when farmers apply for loans, and increase the availability of credit for farmers and agricultural business entities, reduce the cost of financing and strengthen the inclusive financial protection for rural revitalization.

4.2 Providing diversified financial products and services to improve rural financial servicesIn order to solve the problems of difficulty in guarantee and financing for farmers and agricultural business entities, rural financial institutions should make innovation upon rural financial products and provide diversified financial services. For example, rural financial institutions can actively explore new financing models such as agricultural facilities, production orders, and rural e-commerce database loans to increase the amount and extend the loan term, to meet the circulation of rural land management rights, and service-driven funding needs for various forms of operation. For farmers who want to develop, work diligently, and have a good credit record, rural financial institutions should appropriately relax loan tolerance, increase credit support, and expand the coverage of petty credit loan. With the promotion and deepening of the rural revitalization strategy, the scale of the rural economy and the industrialization cooperation will be strengthened, and financial institutions can vigorously explore "land management rights + joint insurance of farmers", "land management rights +", "company + farmers", "company +..."models guaranteed by the industrial chain or industrial ecosystem, so as to effectively revitalize rural economic resources and meet the diverse financial needs of rural revitalization.

4.3 Strengthening the cultivation of talents in rural financial institutions and improving the level of rural financial services

It is recommended to strengthen professional training for employees and improve the level of financial services on the basis of the actual situation of the development of petty credit loan business. (i) It is recommended to strengthen agricultural knowledge training for staff of rural financial institutions. Through cooperation between financial institutions and agricultural organizations, and opening of relevant courses, it is necessary to strengthen the communication between financial institutions and grass-roots agricultural organiza-tions and farmers. Through regular on-site training courses, on-site production and other means, it is expected to strengthen agricultural knowledge learning and understand agricultural production. (ii) It is recommended to improve the professional competence of the staff through building the transfer exchange channels with personnel from external agencies. (iii) In terms of the internal risk control, rural financial institutions should pay special attention to the education and training of client managers, ensure that client managers do pre-loan investigation, mid-loan review and post-loan inspection for each loan, so that they can always pay attention to customer operations and always pay attention to capital risks, and formulate corresponding level allocation standards, strengthen assessment, form a long-term assessment mechanism, and improve the working ability and professionalism of financial service personnel in rural financial institutions.

4.4 Improving rural financial infrastructure and optimizing the financial service environment for rural revitalization(i) It is recommended to constantly promote the construction of a rural credit system, promote the establishment of a new type of agricultural business credit evaluation platform, determine rural credit evaluation standards, promptly update the rural personal credit record system, weaken credit risks caused by information asymmetry, and provide a high-quality rural credit environment for financial support for rural revitalization. (ii) It is recommended to vigorously improve the rural payment environment, encourage rural financial institutions or third-party payment institutions to penetrate into remote villages and towns, and strive to realize that rural people can handle financial services such as transfers, remittances, loans,etc. at any time and any place, and promote bank cards to help agricultural withdrawal services achieve sustainable development, and promote the application of mobile payment and other new payment methods, to provide a good payment environment for financial support for rural revitalization.

杂志排行

Asian Agricultural Research的其它文章

- Return of Rural Migrants in Southwest China: An Empirical Study Based on 2010 Copies of Questionnaires

- Construction Approaches of Enterprise Innovation Network from the Perspective of Social Network

- Study on the Present Situation and Strategies of Rural Waste Classification Treatment in Northeast China

- Research on the Mixed Teaching Model in Colleges and Universities in the Context of "Internet+"