A Look at Offshore Bond Offerings by Chinese Enterprises

2019-04-09ByNianJiawen

By Nian Jiawen

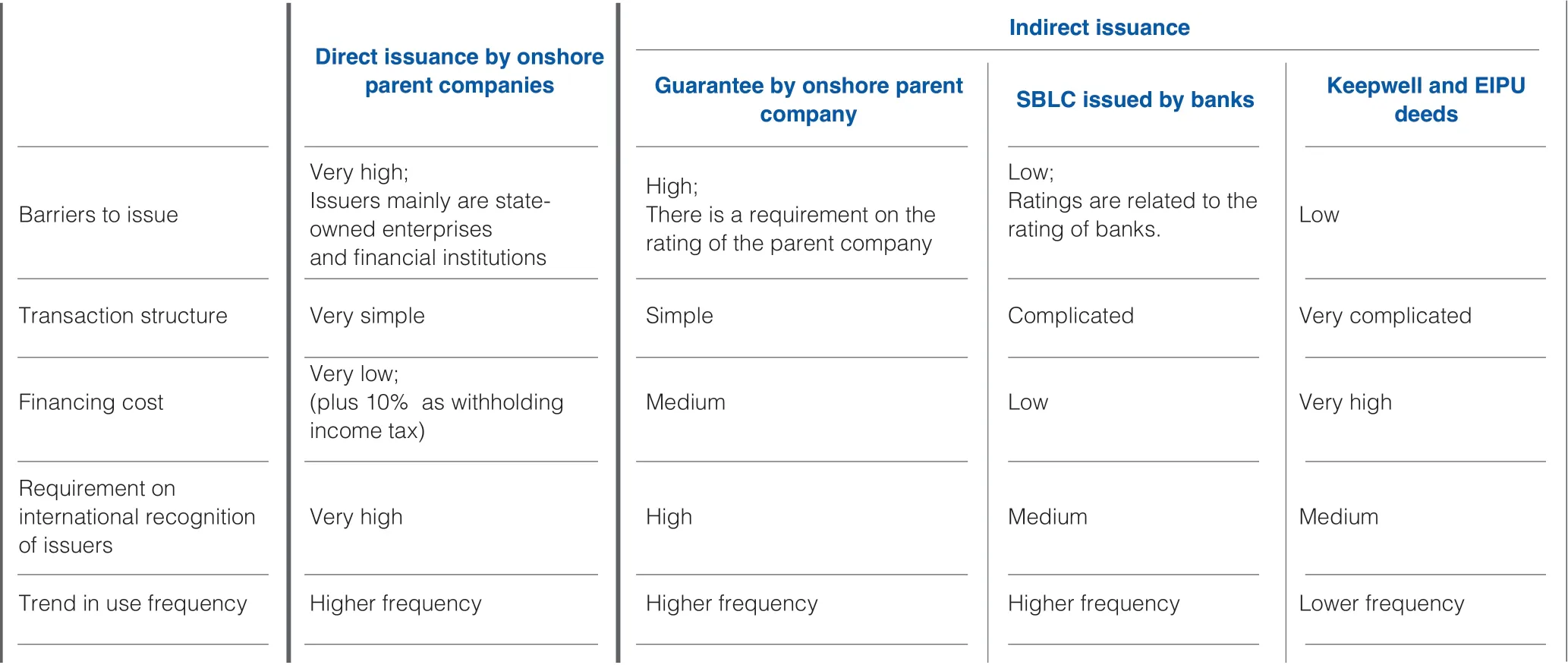

C hinese enterprises have a number of tools to issue bonds offshore. These include offerings by onshore parent companies or through overseas subsidiaries with support from credit enhancement tools. This article looks at the major differences of these types of transactions in an effort to make investment decisions easier.

China’s National Development and Reform Commission defines offshore debt securities as debt instruments with a term of more than one year. They can be denominated in renminbi or other currencies and issued directly by Chinese domestic enterprises as well as their offshore subsidiaries or branches, according to the commission’s Circular on Administrative Reform for the Filing and Registration of Offshore Debt Securities Issued by Enterprises(NDRC Document No. 2044 [2015] ). At present, most offshore debt securities issued by Chinese enterprises are denominated in US dollars, euros or renminbi, and US dollar bonds account for the largest portion.Usually they are offered privately in accordance with Regulation S (Reg S) and Rule 144A directly to qualified institutional investors without the need for registration with the US Securities and Exchange Commission(SEC). They also may be offered publicly with an SEC registration,though the requirements for this kind of offer are much stricter.

In recent years, China has eased its curbs on offshore corporate bond issues, shifting from overall quotas to qualification reviews and post–issuance filings. At the same time,there are more flexible regulations related to the use and repatriation of proceeds from debt offers, and this is one of the key reasons for the rapid growth in overseas bond issues by Chinese enterprises. According to data compiled by Bloomberg,overseas issues of US dollar bonds by Chinese enterprises reached a peak of US$215.9 billion in 2017 after several years of rapid growth.But in 2018, the total fell 23.12% to US $179.3 billion.Most of the bonds issued were at fixed rates in offers under Reg S, and aimed at Asian institutional investors.The following article analyzes the main structures chosen by issuers for these offerings.

According to Document No. 2044,an offshore bond offering, whether direct or indirect, must be registered and comply with the regulations of China’s State Administration of Foreign Exchange (SAFE).

All enterprises registered in China which control their core business and assets directly are eligible to issue bonds overseas.

As an example, a company we’ll call Company A issued US$2.25 billion of 10-year fixed rate senior unsecured bonds. They were issued in the US in accordance with 144A,which has modified the requirement on privately placed securities of more than US$500 million and with a maturity of 10 or more years.This kind of debt security is aimed principally at qualified institutional investors in the US. In this case,rating agencies gave the company – a Chinese e-commerce giant – a high rating on is debt as a result of its solid financial performance and strong management. Its bonds carried a coupon rate of 3.6% and ratings of A1, A+ and A+ from Moody's,Standard & Poor's and Fitch Ratings,respectively. Company A’s bond offer received US$57 billion worth of subscriptions, making it seven times oversubscribed. The relatively stricter standards on information disclosure under 144A and the high ratings from international rating agencies ensured the issue’s success at a relatively low coupon rate.

Companies with a strong business performance and good reputation often choose to make a direct offer,thereby avoiding the need for a cross-border guarantee and enjoying fewer restrictions on the repatriation of funds. The simple transaction structure makes this type of bonds popular with investors. However, the issuer is required to pay withholding tax – 10% of the interest obtained by the foreign investors. This will add to financing costs for the bond issuers.

Indirect Issuance

Some Chinese enterprises choose to issue offshore bonds through their overseas subsidiaries. The parent companies generally are responsible for the main business and hold the core assets. They also guarantee the obligations and provide enhanced credit support for the bond issuance.The bond issuers or their subsidiaries have set up special purpose vehicles(SPVs), raising debt overseas by means of cross-border guarantees,keepwell or equity interest purchase undertakings (EIPU) or standby letters of credit.

By means of a cross-border guarantee, a Chinese enterprise,as the actual offshore bond issuer,provides guaranty services to its overseas subsidiary (often an SPV) which makes the offer. This is a weaker position in terms of repayment as the issuing entity often has limited assets. Cross-border guarantees are a good way to attract investors to bonds issued in this manner.

A company we’ll call Company G intended to issue senior unsecured bonds in an offshore market.It issued US$1 billion in fixed-rate bonds with a 10-year maturity in a private offer under Reg S. This had less stringent requirements on information disclosure but did not include qualified institutional investors within the US. The company offered the bonds via its subsidiary, providing unconditional and irrevocable guarantees. As a Chinese energy giant with electric grid construction and operation as its core business,Company G’s bonds won ratings of Aa3, AA-, and A+from Moody’s,Standard & Poor's and Fitch Ratings, respectively.The offering, at a coupon rate as low as 3.125%, was more than four times oversubscribed. It can be concluded that the more credit enhancement the parent company can provide in a cross-border guarantee, the simpler the transaction structure.

This will lead to cheaper financing costs. Nevertheless, this type of bond offering needs to comply with China’s foreign exchange regulations on cross-border guarantees.

Another form of overseas bond offering is through keepwell or EIPU deeds. In this way the overseas subsidiary of a parent company or an SPV set up by the subsidiary acts as the bond issuer. Its creditworthiness is strengthened by the use of a deed with the parent company.

Keepwell deeds are a contract between a parent company and its subsidiary in which the parent company provides a written guarantee to keep the subsidiary solvent and in good financial health by maintaining certain financial ratios or equity levels. These deeds differ from a bond guarantee as they only allow creditors to force the credit enhancement provider to supplement the liquidity of the issuer for bond repayment,instead of paying the debt directly.EIPU deeds supplement keepwells.Under this kind of arrangement, the parent company will purchase the assets of the offshore issuer and its onshore subsidiary to cover any debt obligations of the offshore issuer in face of a default risk.

For instance, Company B, through its wholly-owned offshore subsidiary,issued non-mortgage, secured bonds in Hong Kong under Reg S. The US$500 million worth of five-year bonds had a fixed rate and were offered with a complicated credit enhancement strategy. The bonds were issued by an SPV, a subsidiary of Company H. The offering was aided by a guarantee from the overseas subsidiary, as well as the keepwell and the EIPU deeds with Company B, which had the highest ratingin the domestic real estate sector.Furthermore, Company B and its offshore subsidiary had their credit enhanced through keepwell deeds with Company B’s corporate parent.The bonds, carrying a coupon of 4.5%,were rated Baa2, BBB+ and BBB+ by Moody’s, Standard & Poor's and Fitch Ratings, respectively. Company B later issued another US$500 million worth of offshore bonds using the same strategy.

Transaction Structures for Offshore Bonds

The keepwell and EIPU structures have been widely used by onshore Chinese enterprises since 2012,mainly because of flexibility in the repatriation of funds. However, there has been less enthusiasm for this type of structure since 2017 because of new regulations by SAFE that year.The Circular on Further Advancing Foreign Exchange Administrative Reform to Enhance Authenticity and Compliance Reviews (SAFE Document No. 3 [2017]) relaxed restrictions on the domestic use of funds raised overseas and backed by a domestic guarantee. This removed the advantage of flexible capital use under the keepwell and EIPU structure. Additionally, the structure has its own disadvantages, including complexity, as well as lower ratings and higher costs compared with credit enhancement by guarantee.

China’s onshore enterprises can also offer overseas bonds backed by a standby letter of credit (SBLC) issued by a bank. Under this structure, if the issuer, usually an SPV, cannot repay the bonds, repayment will be made by the bank that issued the standby letter of credit. This is a kind of cross-border guarantee, and the participating bank should report related information to SAFE through the regulator’s information system.The advantage of this structure is that the issuer can enjoy credit support from a commercial bank. With its bonds rated at the same quality as the provider of the standby letter of credit, the bond issuer can reduce its costs even though it pays a fee for the bank guarantee. As a result, this transaction structure is highly suited to onshore enterprises that have strong relations with domestic banks.

As an example, Company Y intended to issue US$1 billion worth of senior bonds in Hong Kong under Reg S. Its offshore SPV acted as an issuer of the non-mortgage, secured bonds which had a maturity of 10 years. The SPV reached a keepwell deed agreement with Company Y.The bond issue was also backed by an irrevocable SBLC issued by the Hong Kong branch of a mainland bank. The bonds were rated as A1 by Moody’s,with a coupon rate of 4.0%, thanks to the high ratings of the mainland bank by Moody’s and Standard &Poor’s: A1 and A, respectively. In this way Company Y reduced its financing costs through the good credit of onshore financial institutions.

In summary, there are four transaction structures for Chinese enterprises to issue bonds overseas.The following chart lists and compares these structures.