How Can Cosmetics Brands Deal With New Generation Becoming the Mainstream?

2019-03-27ChenShiXiaJintao

Chen Shi, Xia Jintao

Hola Kora, China

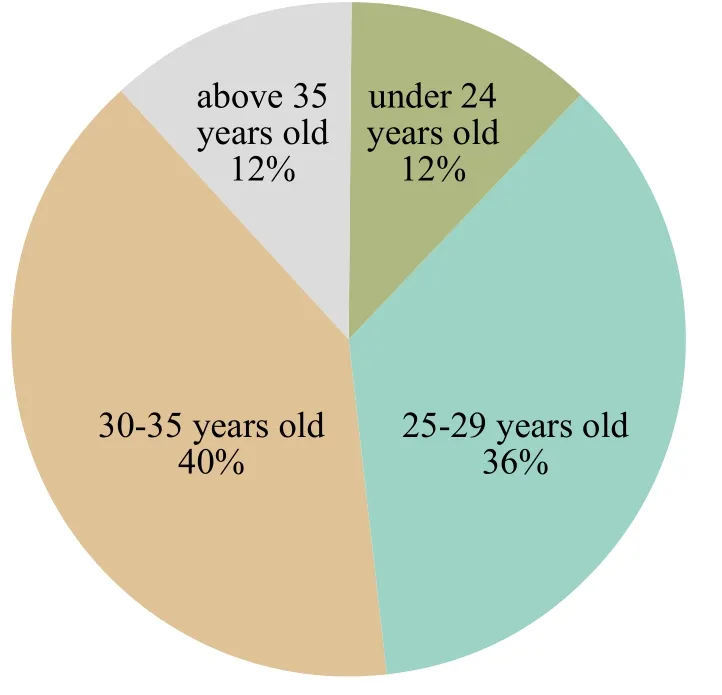

Through the deep data analysis of the cosmetics industry, it can be found that the changes in population structure, differences of consumption habits, and income factors which have led to the intergenerational replacement of Chinese consumers.Middle-aged crowd in China, their consumption concept tend to be relatively conservative, while for young generations, their income level is becoming higher. The purchasing power and consumption tendency of such young consumer groups are significantly higher than that of middle-aged and elderly people. Relevant data show that the consumption intention and consumer confidence index of the new generation (born in 1995 and beyond) are significantly higher than the overall level of ditferent age groups, and the growth rate are accelerating. In the urban residents'consumption in 2012, the contribution of the new generation is 15%, and it is expected to reach 35%by 2020, which fully shows that the new generation of consumers has begun to become the mainstream of new generation consumption.

Figure 1. The domestic cosmetics consumption market in China

At the same time, taking the Tmall Double 11 in the past three years as an example (Figure 1), we can clearly find out the following points:

Having been declining in China for five years in a row, OLAY turned against the wind in 2017 and achieved big success in 2018; Lancôme walked down the altar, becoming NO.1 for its reputation and reasonable price, and win the favor of consumers in the small sized cities by a toner called TONIQUE CONFORT; In addition, the new brand represented by HFP officially debuted. In addition, 2018 is also a year for global fashion brands to change their logos.Luxurious brands including GUCCI, Balenciaga,and LV quickly moved closer to the fashion brand,making them popular instantly.

They all have one thing in common, which is trying to attract the new generation of consumer groups. This phenomenon also proves indirectly that the new generation has become the trend of the current mainstream of China's consumption in the cosmetics market.

The new generation of consumer groups has become the core consumer of all categories. The cosmetics brands must make a priority of the new generation, and take them as the center for branddriven development strategies.

New generations of consumers have grown up with the Internet era, and as a result, they are deeply influenced by it. Their acquisition of skin care and beauty knowledge are increasingly widespread. Becauseof the popularization of KOL on social media platforms such as Weibo, WeChat and Xiao Hong Shu, the marketing promotion of brand owners, and the in fluence of this groups' own good educational background factors, the cosmetics consumption concept of the new generation consumer is becoming mature. They no longer blindly believe in brands, and their choice of brands begins to depend on their own tastes.

Table 1. Ranking list of well-know cosmetics brands of Tmall Double 11 during 2016 to 2018

Challenges and opportunities coexist. The new generation of consumers is affected by the environment and their consumption concept of not blindly believing brands have not only promoted the innovation of the cosmetics brand ecology but also created more new opportunities. In the future,cosmetics brands must grasp the characteristics of the new generation of consumers, creating the core competitiveness from four dimensions including brand, channel, marketing, and R&D.

Creating a multi-brand matrix

Referring to the overseas cosmetics giant,the Estée Lauder was positioned as a high-end at the beginning of its establishment. The company enhanced its brand image and brand recognition by selling in a limited channel such as highend department stores and specialty stores. After establishing the brand recognition, it continued to acquire market segments by independent R&D to expand different market segments, cover different consumer groups, and enjoy the dividends brought by the new generation becoming the mainstream,thereby enhancing core competitiveness.

Estée Lauder

At the beginning of the establishment, Estée Lauder launched the classic basic categories. In the growth stage, it gradually developed brands independently created such as Aramis and Clinique. After being listed into the market, it also vigorously developed outsourcing and expanded the brand lineup. In recent years, it has increased the acquisition of trendy makeup brands to enhance brand rejuvenation. These, in fact, are key measures for Estée Lauder to build a multi-brand matrix to create core competitiveness. According to relevant data, Estée Lauder has formed a multi-brand matrix covering top brands, first-line brands, and other brand series. Its business network covers the whole world. In 2017, the operating revenue reached 11.824 billion USD, accounting for 13.7% of the global high-end cosmetics market.

In fact, cosmetic brands such as Estée Lauder,CHANDO, Carslan, KANS, UNIFON, and Hola Kora are all multi-brand matrices based on the implementation of the multi-brand strategy and cultivation of single star brands. After they have established a certain market position by the main brand, it begins its development path to independently cultivate or extend M&A to build a multi-brand matrix and continue to expand the brand series. A single brand has a growing ceiling. After establishing a certain market position for the main brand, domestic-funded enterprises will continue to expand their product lines and expand their market segments to help long-term development.

Accelerate omnichannel operations

So far, for the cosmetics market, a single channel operation has been outdated, and omnichannel operations have become a trend. According to data from Euromonitor, in the past three years, in the distribution of cosmetics channels in China, shopping center, e-commerce, department stores and cosmetics franchise (CS) are the main channels, accounting for about 26%, 23%, 19%, and 18% respectively.

Since the rapid rise of e-commerce channels in 2009, the proportion of channels has risen rapidly,this has also triggered the paradox of the physical store's extinction. However, in fact, the proportion of channels has become stable, like department stores positioning as medium and high-end, large-scale shopping center focusing on mass products, as well as CS channels with channel management, brand agency, and member management advantages only experienced a slight slowdown in the growth rate of e-commerce.

It is understood that the channel layout of most well-known cosmetics companies in China is relatively simple, such as Proya, Marubi which rely on CS, and Yujiahui which relies on e-commerce to achieve rapid growth. However, with the new generation becoming the mainstream of consumption today, consumer demand experiences rapid changes and market trends is increasingly diversified. If companies only rely on single channel development, it is likely to restrict the brand's control of changes in consumer demand,resulting in weakening customer's loyalty.

Many cosmetic foreign brands are just on the contrary. They often have the characteristics of wide brand coverage and omnichannel operation.Through different sales channels focusing on product characteristics, price grades, target customers orientation, etc., top brands mainly rely on highend department stores, independent concept stores,etc., while second-tier brands rely on e-commerce,department store counters, etc., and popular brands are mainly based on CS channels.

Proya

Taking the multi-brand matrix as the cornerstone and carrying out omnichannel development is actually more conducive to comprehensively reaching customers and helping to build the core competitiveness of enterprises. Taking e-commerce channels as an example, it can get customer feedback in a timely manner, so as to more accurately analyze customer images and customer behaviors, accelerate brand influence and reach customers. At the same time, the development of physical stores such as department store counters and CS channels will not only promote the construction of the brand image but also significantly enhance the customer experience and help to increase consumer loyalty. It is of great benefit to comprehensively understand the overall characteristics of the new generation of consumer groups, as well as consumer behavior and is an important measure for cosmetics brands to maintain their core competitiveness during this period.

Explore digital marketing

The research above discusses that the new generation of consumers is affected by the environment and forms consumption values that do not blindly believe in brands. This phenomenon has also promoted the current cosmetic market to change from the traditional channel of the past to the current user orientation. For the new generation of consumers who are more mature and knowledgeable, they are better at seeking consumer reference on the Internet in a time when Internet is booming. Therefore, to build the core competitiveness of the brand, we must start from digital marketing and comprehensively explore user needs.

The focus of the user-oriented cosmetics market will be more biased towards the marketing of end consumers, namely, through the advertising and marketing of traditional media, and digital marketing,etc. to expand brand in fluence and enhance consumer perception. For the new generation of consumers,they are more inclined to the “I-oriented” digital marketing than the “others-orientated” mandatory traditional media advertising marketing.

Digital marketing refers to targeted marketing activities based on clear objects, using digital media channels such as telephone, SMS, email,fax, and web platform to achieve precise marketing and realize quantifiable and digitalized marketing effects. With the rapid development of social media platforms, the new generation of consumer mainstream, personalized consumer demand, KOL marketing, celebrity endorsement, cross-border marketing, and other digital marketing methods have gradually occupied a key position in the cosmetics market.

At the same time, the transformation of marketing methods brought by digital marketing has also promoted the rapid development of new brands.According to Tmall Beauty data, there were a large number of new brands emerging in 2018. They have diversified digital marketing and deeply analyzed new generation users' psychology, achieving very good results in terms of user satisfaction, sales, and brand recognition etc. Taking the domestically recognized children's care brand, Hola Kora, as an example, it created a brand new brand around the needs of the new generation, pioneering the brand concept of“good habits, self-cultivation”, creatively integrating children's care with early childhood education.It brings educating into life, letting the baby find happiness and growth in daily care. It establishes a three-dimensional product form centered on the amino acid safety care, supplemented by the colorful moonlight city preschool education section, and joins the cutting-edge design OIB to enter the world stage in one fell swoop. It won the German IF Award and has formed a brand IP that helps children develop a good habit of hygiene, responsibility, and good character, thereby giving the brand product its own content and setting the carrier of the communication as content, thus realizing the self-generation of the new-generation users and rapid increase of brand recognition.

From the perspective of the audience, it appears in the way and form that the audience likes to watch.This is a marketing method that the new generation loves to see, and it can reach the user more efficiently and accurately. In the consumer's purchase process,it contains knowledge, interest, purchase actions and user loyalty, of which interest will be one hundred times more important than knowledge and purchase actions; and with the rise of new media, and other media platforms, the pulverization of user media will more make the mandatory notification a failure. The TV station and the billion-dollar endorsement era will end, and the content communication behavior that stimulates user interest is bound to become the key to brand marketing. It will also become the key to the brand's core competitiveness and the establishment of a “moat”.

Hola Kora

L'Oreal

invest in innovative R&D

R&D investment is the source of innovation.The new product iteration is always the foundation for the growth of cosmetics brands. To build core competitiveness, it is indispensable to invest in innovative research and development of products.For cosmetic brands, research and development,including basic research and development, formula development, product testing, product packaging design, etc., are fundamental to drive the cosmetics group's product updates.

Taking L'Oreal, for example, L'Oreal has 22 R&D centers in Europe, the United States, Japan, China,India, and Brazil as of 2018. The R&D expenditures reached USD 990 million in 17 years. And the proportion of R&D expenditures from 2004 to 2017 was around 3%-3.4% or so. A large amount of R&D investment has brought about the rapid iteration of the company's products, the number of products updated every year accounting for 15%-20%. This data also fully demonstrates the degree of recognition attached to the R&D investment of international cosmetics leading brands.

At present, the trend of the new generation becoming the mainstream of consumption has shown an irreversible attitude, and the consumption patterns and consumer psychology of the new generation have determined the professionalism of their purchase of products.In a sense, they are more “professional” than the brand itself. Large and comprehensive products have obviously been eliminated by the mainstream of consumption, and small and beautiful products with more professional and more subdivided products have begun to be welcome by them. Supporting product segmentation and specialized product arrays are based on the brand's continuous investment in innovative R&D.

Opportunities and challenges coexist, and the new generation becoming the mainstream will lead to turmoil and change in the cosmetics market. The competition between domestic and foreign players will inevitably lead to a user-oriented tendency. All these cosmetic brands have expectations for the future, but all these are established on how the core competitiveness is realized by each brand. Only when the brand, channel, marketing, and research and development keep pace with each other, can they enjoy the big dividend and win the future.

杂志排行

China Detergent & Cosmetics的其它文章

- YUNNAN BAIYAO's Absorption and Merger of YUNNAN BAIYAO Holdings Passed Audit

- The Methodology of Cosmetics Efficacy Evaluation to Provide Scientific Support for Soothing Skin Efficacy Claims

- JD Worldwide Added Three More Korean Beauty Brands

- Editorial Board of CDC

- Wish a Perseveringly and Fantastic 2019

- National Medical Products Administration:The Product Claiming Using “Cosmeceuticals” or “EGF” Was Illegal