An analysis on Sino-Russian cooperation in the Arctic in the BRI era

2018-12-20OlgaALEXEEVAFredericLASSERRE

Olga ALEXEEVA & Frederic LASSERRE

1 Universite du Quebec a Montreal, Case postale 8888, Succursale Centre-Ville, Montreal, Quebec H3C 3P8, Canada;

2 Laval University,2405 Terrasse, Quebec City, Quebec G1V 0A6, Canada

Abstract Over the past decade Sino-Russian cooperation in the Arctic has emerged as one of the major topics of the Russia-China negotiations on how to expand their comprehensive strategic partnership and to bring it to a new level. China considers the Arctic region important for its economic interests and desires to be included in the development of the region and its economic potential. For Russia, the Arctic is afuture strategic resource base that would replace the old depleting fields and assure Russia’s status as a major worldwide energy supplier. Despite many joint statements on deepening of the Sino-Russian cooperation in the development of the Arctic energy resources, the concrete results of these ambitious plans are few. Some joint projects were dropped, as China and Russia could not agree on the conditions of the deal, others are progressing very slowly and have an uncertain future. In 2017, China has expanded its “Belt and Road Initiative” (BRI) to the Arctic thus elevating the Sino-Russian cooperation in the Artcic to a higher level. How did the relationship between Russia and China evolve in the Arctic and how do Russia and China view and respond to the new Arctic dimension of the BRI? What factors limit the strategic rapprochement between China and Russia in the Arctic?

Keywords Arctic, China-Russia cooperation, Belt and Road Initiative, Yamal LNG, Northern Sea Route

1 Introduction*

In January 2018, China released its first Arctic White Paper that outlines the major points of Beijing’s Arctic strategy.The document has attracted a lot of media attention both in the West and in Asia, and renewed concerns raised by some academic and many media commentators about a Chinese takeover of the Arctic. Although the Paper does not provide any detailed policy guidelines, mostly confirming the well-known Chinese interest for the economic development of various Arctic resources, one theme stands out in this otherwise very generic presentation―China’s ambition to tie the Arctic to its Belt and Road Initiative (BRI) by using a“Polar Silk Road” to connect China to Europe through the Arctic Ocean (State Council Information Office of the PRC,2018).

The idea to extend the BRI to the Arctic reflects not only China’s recent shift to a more confident approach in pursuing its economic and geopolitical interests worldwide,but also Beijing’s desire to further strengthen and promote the Sino-Russian economic ties in the polar region.Currently, Russia is the only BRI partner among the eight Arctic states and the largest recipient of Chinese Arctic investment. Since 2014, Moscow has been increasingly open to the idea of China’s greater involvement in extraction and mining activities in the Russian Arctic and has officially committed to further cooperate with China on Arctic BRI projects of various nature and different scale.

At the same time, Beijing has showed a growing enthusiasm for the use of the Northern Sea Route (NSR)(Huang et al., 2015). The Chinese are not only actively testing the feasibility of the Arctic shipping routes by sending commercial ships along the NSR but are also working on the design and construction of ice-classed vessels, capable of operating in Arctic waters. These Chinese activities found energetic official support in Moscow which confirmed on several occasion its intention to develop the cooperation with China on the NSR,conveniently re-christened as “Ice Silk road” or “Silk Road on Ice” to fit the BRI’s official vocabulary.

The emerging Sino-Russian cooperation in the Arctic and its economic and geopolitical potential has recently became the focus of some scholarly attention. The majority of Western scholars tends to analyse the Sino-Russian cooperation in the Arctic from Moscow’s perspective by focusing on the Russian aims of pursuing the partnership towards China in the Arctic (Lanteigne, 2015; Røseth,2014). In 2017, the Stockholm International Peace Research Institute (SIPRI) published a detailed and rather balanced report on the recent developments of the Sino-Russian economic cooperation in the Arctic. After examining the evolving interests and activities of China and Russia in the Arctic, the report concluded that the existing divergence in goals and approaches greatly undermines the future of Sino-Russian cooperation in the Arctic (Sørensen and Klimenko, 2017), apparently confirming views already exposed by Lee and Lukin (2016).

Russian experts, while noting that Russia and China have differing priorities in relation to the Arctic, emphasise the economic benefits of the joint development of the Arctic resources and shipping routes for both countries (Konyshev and Sergunin, 2012). Although acknowledging the potential strategic and military risks of the growing Chinese presence in the Arctic (Khramtchikhin, 2015) and the existing differences in Russian and Chinese interpretation of Arctic law and governance (Morozov, 2016; Zagorsky, 2016),most Russian scholars see the future of the Sino-Russian cooperation in the Arctic in a more optimistic light then their Western colleagues.

Chinese scholars also highlight the positive drivers for Sino-Russian cooperation in the Arctic (Wang et al., 2015;Song and Wang, 2014) and study the possibilities of connecting the Russian Arctic to the BRI project (Li et al.,2016; Lu, 2016). In the majority of the publications, China is described as “a natural partner” for Russia as it has the ability to supply technologies and investments to back up Moscow’s endeavour to develop Arctic resources and shipping routes.

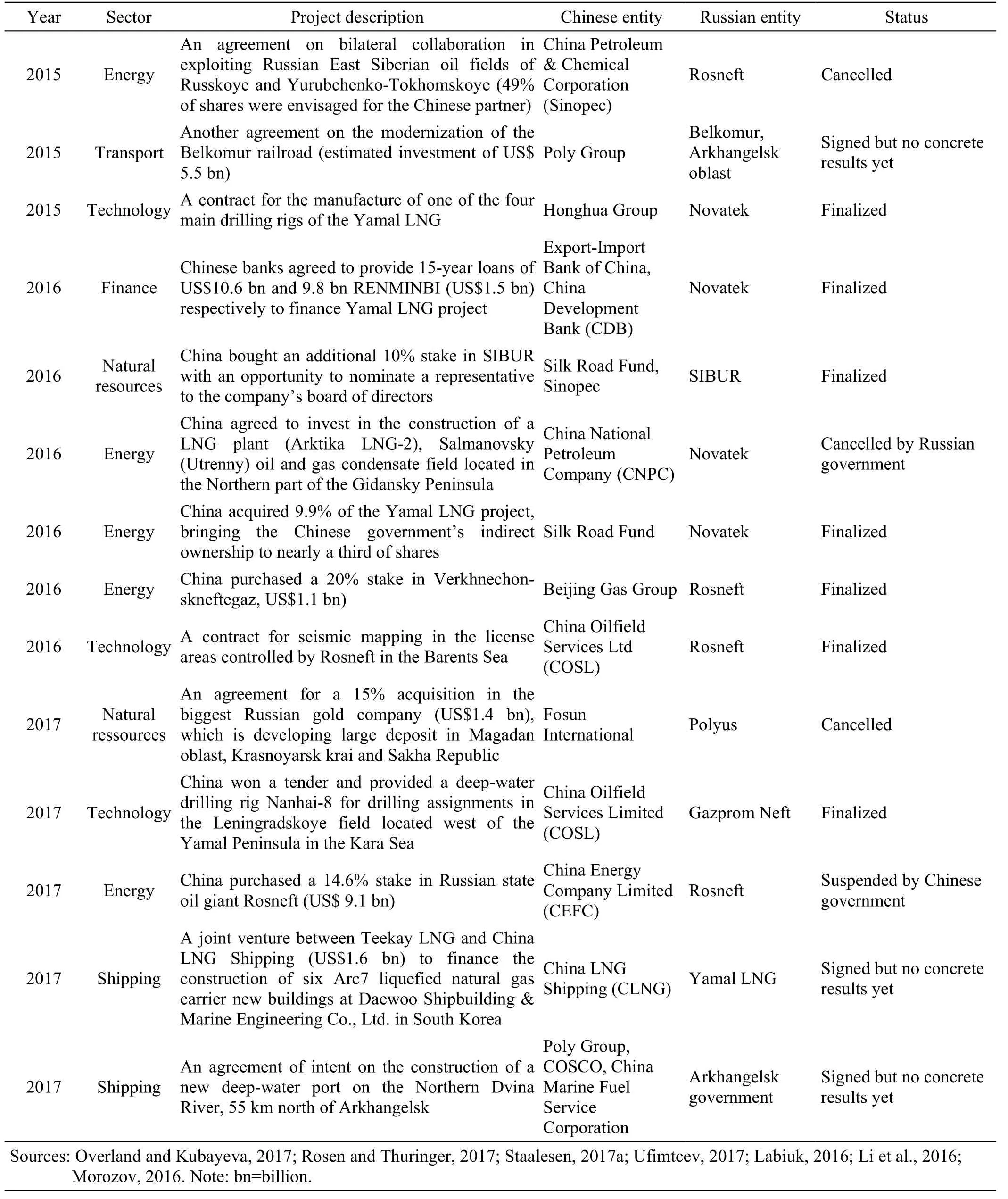

To identify the scope and scale of the Sino-Russian cooperation in the Arctic, we have assembled data from different Russian and Chinese sources in an attempt to quantify the Chinese participation in the development of the Russian Arctic since 2012 (Table 1). Governmental agencies in both Russia and China give very few details about the terms and conditions of the signed deals and their official statistics are often at odds with each other, so most of the data is sourced from periodicals and academic publications. The comprehensive analysis of these sources revealed that Sino-Russian projects in the Arctic―their expense, scope, and anticipated value―are frequently misrepresented for many different motives, including geopolitical concerns. How do Russia and China view and respond to the new Arctic dimension of the BRI? What are the potential implications for further Chinese-Russian cooperation on the NSR in the Arctic? Is the ongoing Russia-China cooperation in the Arctic the result of short-term pragmatic choices for both parties, or is it the beginning of a nascent strategic partnership? Are there discrepancies in the views of each partner regarding their cooperation in the Arctic? This paper examines whether this recent boost in Sino-Russian relations in the Arctic is a pragmatic choice for both parties or whether it is borne out of political and strategic partnership.

This paper aims to contribute to the literature on the development of the China-Russia partnership in the Arctic by providing a comprehensive and up-to-date analysis of recent Sino-Russian cooperation in the Arctic, through a review of commercial negotiations and economic activities related to the exploration of the energy and shipping potential of the Russian Arctic, as well as an assessment of the current state of the cooperation between the two countries. A thorough review of the Russian scientific literature was notably used to document the cooperation between Russia and China in the Arctic and how it is perceived in Russian sources. This was analyzed in the frame of the constructivist approach of international relations and political geography, theories that emphasize that States may cooperate in the political and economic field,to the difference of the realist approach (Lasserre et al.,2016). The paper will first explore Russian objectives in the Arctic; then the first steps of the Russia-China cooperation in the region; and will then analyse the achievements of this cooperation.

2 Russian ambitions and Chinese interests in the Arctic

Russia has many national interests in the Arctic.Geographically speaking, Russia is the largest of the five states bordering the Arctic Ocean and its northern shores encompass half of the total Arctic coastline. From the Soviet period, the Russian Arctic has inherited an important industrial base with various industries (mining, oil and gas,electric and nuclear power stations) and transport infrastructure (railroads, airfields, river and sea ports, and an Arctic fleet equipped with nuclear ice-breakers). The Russian Arctic zone has the largest endowment of natural resources with an anticipated 287 billion barrels of oil-equivalent (BBOE) in conventional oil and gas, as well as vast deposits of cobalt, copper, diamonds, gold, iron,nickel, platinum, high-value rare earth elements, titanium,vanadium and zirconium (Rosen and Thuringer, 2017).

Moscow fully acknowledges the potential of its Arctic areas and has adopted several official strategy papers which designate the Russian Arctic as “a strategic resource base for the Russian Federation in order to secure the socio-economic development of the country” (Russian Security Council 2009). Moscow’s official Arctic policy has multiple facets, including energy and mineral extraction,opening and use of the shipping routes, military and security concerns, climate change and preservation of indigenous people’s traditional economy and culture(Laruelle, 2014). The main emphasis, however, is on the development of natural resources, oil and gas in particular,which has led Moscow to repeatedly express a need for foreign investments and technology for its extraction sector.According to the Russian estimates, the Arctic zone of the Russian Federation contains approximately 12.5% of the Russia’s total gas resources, and 5% to 9% of its liquid hydrocarbon resources. By 2050, the deposits in the Arctic shelf are expected to provide between 20% and 30% of Russia’s total oil production, thus becoming the country’s most important source for hydrocarbons (Labiuk, 2016).However, one should keep in mind that these are estimates of mostly undiscovered resources. Indeed, to access the hydrocarbon deposits in the Arctic and to transport gas and oil to the potential consumers, Russia needs to build new infrastructure and restore the already existing one, as well as to organize technologically challenging drilling activities.Facing high investment costs, Russia wanted to attract and encourage foreign investors, but at the same time tried to keep foreign interference away from the most strategically important projects. Although Russia was seemingly opening the door for foreign investment and participation, there was no transparent and consistent policy regulating this process and there were also frequent changes in the regulations(Hedlund, 2014), which partly explains the limited scale of foreign involvement in the development of the Russian Arctic.

Another major obstacle for the exploitation of the Arctic energy resources is the lack of modern infrastructure along the NSR. Although the NSR has been actively used since the Soviet era for domestic purposes, its transformation into an international shipping route open to the intense commercial ship traffic will require a substantial investment. Russia needs not only to modernize its old ports along the NSR, but also to construct supply stations,guarantee safe navigation and build up a larger ice-breaker fleet capable of operating along the whole length of the NSR. For instance, although Russia has 20 river and sea ports in the Arctic, only 4 of them are connected to the national railway network and can be used to effectively access and manage the commercial traffic on a greater scale(Veretennikov et al., 2016; Zershikova, 2015). The cost of realization of these ambitious plans is extremely high and many experts consider that the effective use of the NSR poses a number of important challenges, both from the economic and political point of view (Heininen et al.,2014).

Since 2008, Russia has also increased its military and strategic presence in the Arctic. Military installations have been rebuilt on several islands, naval exercises and regular patrols have been organized, and military equipment and doctrines have been upgraded. In 2013, Russia reactivated the old Arctic cold war era air base, “Temp”, on Kotelny Island in the High North. Russia has built several new facilities and upgraded the airfield so it can receive Russian transport aircraft AN-26, AN-72, AN-74 and eventually IL-76, notwithstanding the bad weather conditions(Vertennikov et al., 2016). These developments are considered by some analysts as a clear sign of Russia’s growing expansionism, while others view them as a way for Russia to assert its sovereignty and to protect its economic interests in the Russian part of the Arctic (Konyshev and Sergunin, 2014; Laruelle, 2014; Lasserre et al., 2012). Most Western media started to perceive Russian intentions in the Arctic as aggressive, when, in 2007, a team of Russian scientists descended to the ocean bottom of the North Pole and planted a Russian flag on the seabed. This action, seen as a symbolic claim of the North Pole as Russian territory,was widely criticized by Western media and sparkled a new debate on the Arctic security (Devyatkin, 2018). Indeed,Russian security concerns in the Arctic seem to be closely related to the debates on the issue of Arctic territorial delimitation and legal status of straits. These debates attracted a lot of media attention, but in reality, all coastal states have claims of various nature within the UNCLOS framework and none of them is involved in violent confrontation over disputed territories and rights.

Despite the existing geopolitical motives, Russia’s attention in the Arctic appear to be mostly focused on the economic issues (Sørensen and Klimenko, 2017; Lee and Lukin, 2016). The development of the energy resources of the Russian Arctic and the opening of an ice-free shipping route between Europe and Asia have always been key objectives of Moscow’s Arctic policy, as they are believed to play an important role in Russia’s future economic development. But, in order to achieve these goals, Russia needs to solve a number of serious internal problems related to the degradation of Soviet-era infrastructure in the region,the overall weakness of the Russian economy, and the lack of funds and lack of technological capacity and know-how to extract oil and gas under the harsh Arctic conditions.

In contrast to Russia, China is a latecomer to the Arctic.Over the past thirty years, China has been increasingly active first in scientific research in the Arctic, then more recently in promoting its interests in the economic development and governing arrangements of the region.This is reflected in Chinese publications: China’s scientific production significantly expanded over the past 30 years,with a significant expansion of papers on social and political issues since about 2005 (Alexeeva and Lasserre,2012; Lasserre et al., 2017), a point confirmed by Brady who talks about a significant leap in Arctic activity, not merely research, after 2005 (Brady, 2017). However, as a non-Arctic state, China had to tread carefully and emphasise the peaceful character of its Arctic diplomacy, while working on finding ways to strengthen its role and influence in the region. Since 1999, Beijing has launched nine Arctic expeditions by 2018; established its own research station in the Arctic in 2004, and realized many research projects in climatology, glaciology, oceanography and marine biology in partnership with several Arctic countries, including Russia.Thus, in 2016, Chinese and Russian scientists organized the first joint expedition in the Chukchi sea and worked together on research projects in marine biology, chemistry and oceanography (V.I.Il’ichev Pacific Oceanological Institute,2016). As for economic and political interests, China’s presence has been much more assertive since 2013, notably with China gaining observer status at the Arctic Council, and COSCO’s (China Ocean Shipping Company) first comercial trial via the NSR.

Although China insisted on the purely scientific nature of its interest in the Arctic, Chinese activities in the region soon encompassed various economic partnerships with circumpolar states. While presented as a mere natural extension of China’s research activities, these new economic developments rather reflected Beijing’s raising concerns about securing energy supplies and exploring new shipping routes to sustain its growing economy. Using scientific diplomacy, Beijing successfully managed not only to legitimate its growing presence in the region but also to back up its desire to seek a greater role in Arctic governance(Sørensen and Klimenko, 2017). The newly established and self-proclaimed scientific expertise in polar research allowed Beijing to support its application for observer status at the Arctic Council, a request that was granted in May 2013 after China recognized the Arctic States’ sovereign rights in the region.

In 2012, in an effort to further justify the expansion of its national interests in the polar region, China introduced into the scientific and political discourse a new term to describe its geographical position towards the Arctic―“a near-Arctic state”. The term “near-Arctic state” seems to have been publicly used for the first time at the First Sino-Russian Arctic Cooperation Forum in Qingdao, China,organized in September 2012 (Yagia et al., 2015). Although geographically questionable, this term has been widely promoted by Chinese scholars and media. It is based on the arguments given by the director of Polar Strategic Studies Division at the Polar Research Institute of China, Zhang Xia,who stated in 2010, that China has a rightful claim to participate more actively in Arctic affairs because of geographical rationale and out of environmental concern.Zhang Xia gave three geographical reasons why China should look North: China is situated in the northern hemisphere; The Irtysh river, one of the major tributaries of the Ob river that flows into the Arctic ocean, has its origins in the Altay mountains in Xinjiang, China; Cold atmospheric fronts from the Arctic ocean stop at the northern slope of the Taishan mountain in China. These circumstances push China to take a greater interest in the climatic and environmental changes in the Arctic, as they will have a profound effect on China, and directly relate to Chinese industry, agriculture and people’s living(Kharlamp′eva, 2014). This argument led to the creation of other new concepts and terms, such as “Central Arctic state”,“sub-Arctic country”, “traditional Arctic states” and “Major Arctic stakeholder”. Thus, the Chinese scholar Li Zhenfu has recently introduced a rather radical concept of the“Greater Arctic”, an area which includes not only the 8 Arctic states but 45 other countries connected to the polar region by different economic and logistical ties (Li, 2016).However, this concept has been since disputed by other Chinese scholars and was never a part of the official Chinese statements.

So far, China is refraining from any territorial claims in the Arctic based on this self-description as some kind of new “periphery” Arctic state. On the contrary, Beijing has repeatedly stressed its respect for the sovereignty, sovereign rights and jurisdiction of Arctic countries. But by declaring itself “a near-Arctic state” in the various international conferences as well as in its recently (2018) published official Arctic White Paper, China increases the use of the term by the international media and academics, thus normalizing if not legalizing its existence and further use.This ultimately helps Beijing to assert further its right to play a greater role in the Arctic. The Chinese government’s interest is driven both by economic views(economic opportunities for Chinese companies) and the strengthening of long-term political presence in the region(Brady, 2017; Huang et al., 2015).

In 2015, Beijing subtly changed the official rhetoric regarding China’s interests in the Arctic. While still insisting on the importance of the environmental and climatic research, Beijing also named the development of multilevel and mutually beneficial economic cooperation with circumpolar states as one of its priorities in the Arctic.After emphasising its respect for the international rules and regulations, inherent rights of the Arctic states and the indigenous people, China has also argued that all non-Arctic states have a legal right to participate in exploration in the Arctic high seas and international sea-bed areas (Zhang,2015). At the same time, with the growing development of the BRI under President Xi Jinping, Beijing made an official connection between the BRI and China’s Arctic economic interests, later confirmed by the Chinese White paper on Arctic policy which outlined Chinese plans to use the NSR as the backbone of the BRI process in the Arctic(State Council Information Office of the PRC, 2018).

China and Russia are both interested in developing different economic projects in the Arctic and are increasingly active in promoting their national interests in the region. Although the Sino-Russian economic and geopolitical cooperation has intensified over the past two decades, the Arctic stayed mostly excluded from the dynamics of this bilateral cooperation. The Sino-Russian economic cooperation has been slowly gaining momentum since Vladimir Putin came to power and its major drive was the energy factor. Plans to build oil and gas pipelines from Siberia and the Russian Far East to China have been in process for over a decade, but the two sides failed to reach an agreement till 2008. The economic crisis, the growing dependence of Russian economy on energy exports, and rapidly changing international context have intensified Russia’s “pivot to the East” and have greatly increased China’s overall importance for Russia, both diplomatically and economically. As a result, several mega contracts have been signed and projects finalized, such as the completion of the East Siberia―Pacific Ocean oil pipeline. The agreement on the gas pipeline “Power of Siberia” was reached in 2014, and it will be completed in 2019 or 2020.Cooperation has also intensified in other areas. For example,in 2013 the Chinese built a whole residential district in Saint-Petersburg, “Baltic Pearl”, and they participate in several other infrastructure projects in different parts of Russia.

3 Sino-Russian partnership in the Arctic

At first glance, the close Sino-Russian cooperation on developing energy resources and sea routes in the Russian Arctic seems to have a great potential. The availability of energy resources and minerals in Russia, the growing consumer market of China and Beijing’s need to secure and diversify its energy supply, as well as the lengthy land border seem to be natural conditions driving both countries to find ways to complement each other and build mutually beneficial collaboration. The idea that there is a natural economic complementarity between China and Russia has been promoted by Beijing since the late 1990s in an attempt to support China’s view that a bilateral commercial relationship based on energy and natural resources was bound to emerge and to flourish (Wang, 2013; Diao and Liu,2009).

Moscow didn’t see the potential of the Sino-Russian sustainable rapprochement in the same light. For many years, the economic benefits of the closer commercial cooperation between Russia and China were seen by the Kremlin as ambiguous at best, often overshadowed by the issues of inter-dependency, reliance and security. The intensification of Russia-China economic cooperation gained momentum with Putin’s shift in Russian external policy whose main aim became the quest for a counter balance to the dominant economic ties with Europe and the United States (Sørensen and Klimenko, 2017; Lee and Lukin, 2016; Morozov, 2016). As part of this process,Russia decided to integrate China, considered as the main future consumer of Russian energy resources in the East, in Moscow’s plans for the development of the economy,energy industry and infrastructure in the Arctic.Nevertheless, in practical terms, the Sino-Russian cooperation in the Arctic was slow to develop and until recently, China and Russia had different views on how exactly they could cooperate with each other in the polar zone and what their respective roles could be in the use and exploration of the resources and shipping routes of the Russian Arctic. The actual convergence of their interests is,in fact, a recent phenomenon accentuated by the increasingly troubled relationship between Russia and the Western countries.

Although the Sino-Russian strategic rapprochement has been slowly gaing momentum for over a decade, in 2014, the prospects of the deepening and broadening of the economic and political partnership between Moscow and Beijing suddenly became more encouraging. Russia’s increasing turn to the East started in late 2000, partly in an effort to reduce Russian dependence on energy exports to Europe and take advantage of growing demand in Asia in general and China in particular. The Ukrainian crisis and rapid deterioration of Russia’s relations with the United States and the European Union have reinforced this strategic turn (Wishnick, 2017). On one hand, the fall in oil prices put pressure on the Russian economy, which made it more difficult for Moscow to finance new energy and infrastructure projects, especially in the Arctic where exploration needs a long-term substantial investment and has no immediate returns. Thus, Gazprom had to abandon the shelf development of the Shtokman field, located in the Barents Sea, following the major changes in the global gas markets and the collapse of the joint venture with Total and Statoil (Staalesen, 2017b). On the other hand, the Ukrainian crisis, followed by Western sanctions, limited Russia’s access to Western capital and technology, notably for deep-sea drilling on the Arctic continental shelf and forced major Russian oil and gas companies, Rosneft and Gazprom,to temporarily halt their offshore expansion in the Arctic zone.In the light of these developments, Moscow decided to search for partners elsewhere, particularly in Asia (Lukin, 2018;Ufimtsev, 2017; Lee and Lukin, 2016; Marangé, 2015;Røseth, 2014). Chinese companies and banks were thus invited not only to invest in several Arctic projects but also to export Chinese technology to Russia in order to explore the shelf of the Kara and Barents seas and jointly develop the NSR infrastructure. Russian official declarations have also confirmed that there is a real shift in Moscow’s perception of how extensive China’s involvement in the Russian Arctic could be in the future (Kravchuk, 2016).

By contrast, China has adopted a very cautious attitude towards Russia’s “pivot to the East”. The analysis of the public discourse of Xi Jinping in 2014–2015 reflects this attitude. While giving a broad summary on initiatives and priorities relating to China’s foreign and defense policy,the Chinese President rarely mentioned Russia specifically or spoke about Sino-Russian partnership outside of the mutual cooperation within BRIC (Brazil, Russia, India and China) and other international organizations (Gabuev, 2015).Being aware of Moscow’s previous long hesitations about China’s greater participation in the economic development of the Russian Arctic, Beijing had its own doubts on the prospects of a stronger and enduring Sino-Russian partnership in the Arctic.

Despite these initial uncertainties, Russia’s “pivot to the East” resulted in the apparent increase of the Sino-Russian technological and commercial cooperation in the oil and gas sectors in the Arctic (Table 1). The official Russian and Chinese media have reported on many occasions that Chinese and Russian companies are discussing promising new deals, signing memorandums and agreements that would take the Sino-Russian cooperation to a new level. However, it soon became clear that moving beyond political declarations is very difficult. Many announced “deals of the century” on gas and oil delivery as well as on the development of the offshore Arctic projects remained on paper owing to disagreements over price and management. For example, Russia failed to sell a share of the Vankorneft to Chinese companies or to persuade them to participate in Rosneft privatization, although both deals were discussed on the highest level and agreed on paper.

The acquisition of 10% of the shares in Rosneft’s subsidiary Vankorneft by China National Petroleum Corporation (CNPC) was announced in November 2014,when the USA and EU introduced sanctions against Russia which included a ban on the supply of equipment for the development of shelf and shale oil and gas, as well as financial restrictions on loan funds for the major Russian banks and corporations. Vankorneft operates the Vankor field,a major Russian deposit discovered in 1988 in Eastern Siberia, whose recoverable reserves are estimated at 361 ×106 t of oil and gas condensate and 138 billion m3of gas(Overland and Kubayeva, 2017). Although the deal was signed in presence of Vladimir Putin and Xi Jinping, it never went through and after long unsuccessful negotiations with Chinese partners, the state-owned Rosneft has ceded the intended Chinese shares to India’s Oil and Natural Gas Corporation Limited (ONGC). Apparently, CNPC failed to offer a fair price for the asset and asked for other conditions that Rosneft was not prepared to accept. CNPC wanted to have more seats on the Board of Directors of Vankorneft and actively participate in the drilling and extraction activities in the field, while Rosneft intended to retain the full control of infrastructure of the Vankor cluster and was expecting CNPC to be only a silent partner (Nikolaev, 2017).

Table 1 Sino-Russian projects in the Arctic, 2012–2017

Continued

As Table 1 shows, despite many bilateral agreements signed during high-level meetings and the official commitment to work together on Arctic projects, the cooperation between China and Russia in the Arctic is highly dynamic, with new deals regularly being formed and old ones being cancelled, changed or suspended. This dynamic is determined by many factors. On one hand,although Russians are now more open to a greater Chinese involvement in economic projects in the Arctic, the Chinese are prepared to participate in these projects only at a reasonable price and have proved to be difficult and intractable as partners. Many deals have been cancelled or suspended because Russians and Chinese did not have the same understanding on the value of deals and were reluctant to make mutual concessions (Table 1). In June 2018, yet another big Sino-Russian project was put on ice, namely the idea of building a high-speed railway between China and Germany via Russia and Kazakhstan (project “Eurasia”)(Marinin, 2018),

On the other hand, the Chinese are reluctant to invest in very expensive and risky projects, unless they can secure a role in the management and have a voice and voting rights.The Chinese government is less willing to sink capital into projects where Chinese companies have no possibility to be associated with actual engineering, design and drilling activities in the Arctic. The Chinese government is interested in becoming a partner in resource activity from start to finish and thus build its own technological expertise of operating in the Arctic and its industrial capabilities to ensure a cost-efficient extraction of oil and gas on the Arctic shelf. However, Russian companies, who mostly relied on Western drilling equipment and technology for the exploration and development of Arctic gas and oil, also aspire to catch up and eliminate the technology gap and are reluctant to share their experience and know-how with Chinese companies (Sorensen and Klimenko, 2017; Lukin,2016).

4 China’s Belt and Road Initiative in the Russian Arctic

As a way of trying to overcome these difficulties, Xi Jinping and Vladimir Putin have recently agreed on integrating the development of the Russian Arctic to China’s Belt and Road Initiative . The BRI is the development strategy proposed by the Chinese government since 2013 that focuses on connectivity and cooperation between Eurasian countries; initially it did not include the Arctic. Although the possibility to expand the BRI into the Arctic has been mentioned several times during high-level Sino-Russian meetings, official statements on the matter remained vague and dismissive. Chinese and Russians were both very cautious while discussing the potential benefits and implications of this idea for their strategic partnership.Since 2013, while promoting the BRI, Beijing has stressed the importance of this project for the Asian states and their national development, and the inclusion of the Arctic into the initiative would outline further the global character of the BRI. This inclusion provoked a new wave of media predictions about China’s expansion in the Arctic and imperial ambitions worldwide (Global Times, 2018; Haenle,2018; Huang et al., 2018;). China’s decision to officially link its Arctic ambitions to the BRI, despite these reservations, reflects China’s new confidence in pursuing its national interests inaugurated by Xi Jinping which gradually led Beijing to adopt a more risk-taking approach in its diplomacy. Xi Jinping has introduced several new doctrines into the Chinese political discourse that became central themes in the Chinese Communist Party’s slogans,and the “Three Confidences” doctrine is one of them. It refers to “confidence in our chosen socialist path,confidence in our political system, and confidence in our guiding theories” (Xu and Tan, 2015). In Moscow, the BRI was initially perceived not as an opportunity, but as a challenge, as an attempt to threaten Russian interests and influence in Central Asia (Gabuev, 2016). Russia was very reluctant to embrace the Chinese idea of Eurasian integration under Beijing’s leadership, so the decision to officially link the Russian Arctic to the Chinese global infrastructure initiative marks an important change in Moscow’s perception of the BRI and of the necessity to deepen Sino-Russian cooperation in the Arctic.

While presenting the potential of the Sino-Russian cooperation in the Arctic within the BRI, China and Russia are both placing the emphasis on opening trade routes and exploiting natural resources. The Yamal LNG megaproject is often cited as a perfect example of successful Sino-Russian collaboration in the development of the Arctic.Yamal LNG is a liquefied natural gas plant located in the northeastern part of the Yamal peninsula in the northwestern Siberia. The plant will be supplied from the Yuzhno-Tambeyskoe natural gas field which has a production potential of 27 billion m3of natural gas per annum (Bros and Mitrova, 2016). In December 2017,Vladimir Putin launched the loading of the first gas tanker at the Yamal LNG plant officially starting LNG exports from Yamal (Putin, 2017). The successful implementation and profitable functioning of the project heavily depended on the construction and development of important infrastructure in the Russian Arctic, including the Sabetta seaport and airport, roads and railways, fuel storages, an icebreaker and a LNG tanker fleet, vessel traffic management systems, navigation support aids and marine service buildings (Negreeva and Abarkina, 2016).Although the discussions about Yamal LNG started in the early 2000s, the project took a long time to gain momentum,because of its technological challenges and high realization cost estimated at USD 27 billion. To overcome these difficulties, the main owner, Novatek, brought the French company Total into the project in 2011, while China’s CNPC joined the consortium two years later by purchasing a 20% share in Yamal LNG (Overland and Kubayeva,2017).

Novatek was planning to raise more capital by borrowing from the US and EU banks but after the introduction of the Western sanctions Russia had to turn to Chinese banks instead. Although negotiations with the Export-Import Bank of China and the China Development Bank started in 2014, the agreement on two 15-year loans worth USD 12 billion was reached only in 2016, when the Russian government agreed to bring additional financial support into the project. Indeed, the Russia National Wealth Fund provided USD 2.6 billion and two Russian banks,Sberbank and Gazprombank, will provide a 15-year credit line facility for a total amount of USD 4.4 billion, thus somewhat reducing the financial risks (Filimonova and Krivokhizh, 2018).

In addition, the Chinese Silk Road Fund has purchased a 9.9% share of Yamal LNG thus changing the shareholder structure. Although Novatek has retained a majority stake with 50.1%, China has become the second-most important stakeholder with 29.9% share, thus outlining the Sino-Russian dimension of the project and reducing the influence of Total within the project (Bros and Mitrova, 2016).Chinese companies were also invited to participate in manufacturing of the key drilling equipment, which allowed Russia to overcome technological and industrial challenges that Novatek and by extension Yamal LNG faced as a result of Western sanctions. Thus, China Offshore Engineering Company have manufactured 36 core modules for liquefying the gas, while CNPC Offshore Engineering Company got the contract for designing and producing 20 engineering packages, including the pipe rack from the LNG plant to the docks and ships (China Internet Information Center, 2017; CNPC, 2016). It was the very first time that a key LNG work package was ever built in China. Other Chinese companies are supplying materials and overseeing project production and processing. Penglai Jutal Offshore Engineering Heavy Industries will manufacture pipe rack modules for 3 LNG trains, while BOMESC offshore Engineering Company Limited will fabricate modules for 10 auxiliary systems and 11 production lines of Yamal LNG (Li et al., 2016). In practical terms, China’s participation in Yamal LNG has grown exponentially and within only a few years, it became essential to the project’s successful realization and efficient functioning. This situation was, however, presented differently in Russia and in China.

For Russians, Yamal LNG is a national flagship project with both economic and political dimensions which has important implications not only for Moscow’s foreign policy but also for domestic strategy. When talking about the Yamal’s objectives, Vladimir Putin always emphasises the benefits that this project will bring to the economically depressed regions of the Russian Arctic in terms of new jobs opportunities, industrial and urban development and technological modernization (Putin, 2017). The project is also meant to confirm Russia’s “pivot to the East” as the Yamal’s liquefied natural gas will be mostly shipped to Asian markets via the NSR, thus underlining once again the strategic importance of the NSR and Russia’s intention to actively develop navigation along this route. But essentially, Yamal LNG is perceived and presented as an exclusively Russian project that will help “secure Russia’s future, and the future of its economy” (President of Russia, 2017).

The Chinese, on the contrary, stress their own contribution to the project and present Yamal LNG as an example of the successful Chinese strategy in the Arctic and as one of the essential pieces of China’s global infrastructure strategy, the Belt and Road Initiative (CCTV,2017; People’s Daily, 2017; Xinhua, 2017). According to some Chinese scholars, the active participation of Chinese companies in the project clearly demonstrates that China is able to compete with international companies not only in designing and manufacturing sophisticated drilling equipment and offshore drilling rigs but also in implementing and managing large-scale projects in the Arctic (Li et al., 2016; Weidacher Hsiung, 2016). Yamal LNG becomes therefore a showcase for China’s skills and competence in the development of the Arctic resources that,in turn, will strengthen the Chinese presence in the region.It also provides Beijing with an opportunity to further promote the BRI and the advertised benefits of its extension to the Arctic while at the same time emphasizing China’s role in global affairs.

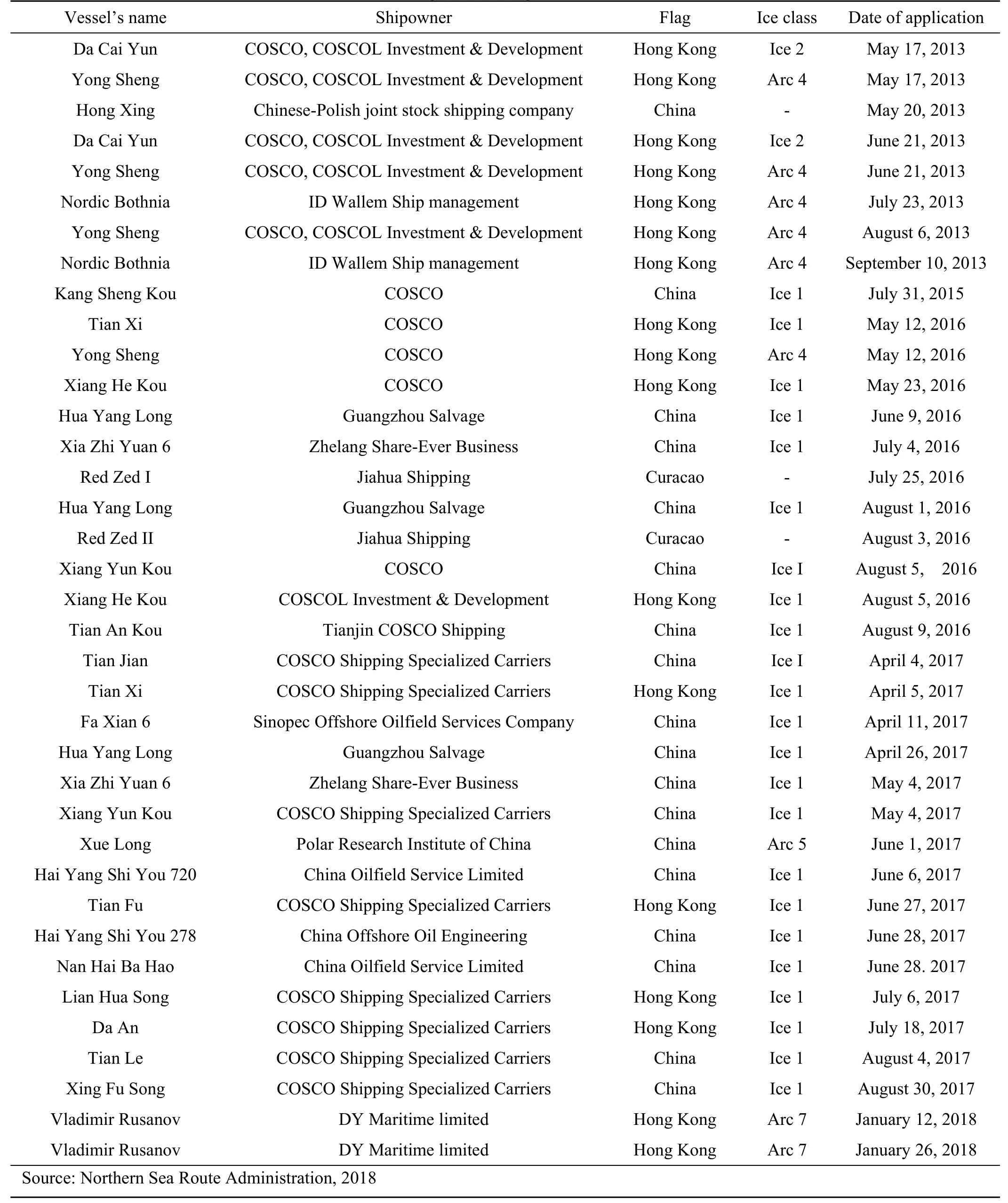

Sino-Russian cooperation in the realization of energy projects in the Arctic was accompanied by the development of commercial traffic along the NSR and by the growing Russian and Chinese enthusiasm about the use of this shipping route which connects Asian and European markets by significantly cutting the distance between Western Europe and China. China’s interest in the use of the NSR is not new, as the first Chinese cargo vessel, the multipurpose vessel Yongsheng operated by COSCO successfully navigated the NSR as early as 2013. Since then, the number of cargo vessels under the Chinese flag applying for navigation in the water area of the NSR has kept growing(Table 2) from 8 in 2013, 1 in 2015, 11 in 2016 to 15 in 2017. Since the opening of the NSR for foreign vessels,China has shipped via the NSR nearly 1 million tons of cargo and according to the Chinese projections, by 2020,1% of Chinese total freight could transit by this sea route,although how many tons it actually represents remain unknown (Erokhin, 2018).

Indeed, between 2011 and 2016, the cargo volume transported along the NSR increased from 1.96 to 7.27×106t (Gao, 2018). In the 1980s, yearly traffic reached 7 ×106t but after the collapse of the USSR, it has dropped dramatically to around 2 million tons in the 1990s as the Russian government decentralized the management of the NSR and stopped subsidizing Arctic infrastructure(Laruelle, 2014). However, this revival of shipping along the NSR, is a result of an increase in domestic traffic, on account of oil and gas related activities in the Russian Arctic. Although the NSR is actively used by such companies as Norilsk Nickel, Gazprom, Rosneft and Novatek to ship products and supplies to and from their respective exploration sites in the Russian Arctic, the number of international transits has actually decreased,from 41 in 2011 to 19 in 2016 and most of these voyages have been experimental trials meant to assess the potential and challenges of the new shipping corridor (Sørensen and Klimenko, 2017). These figures are from the Center for High North Logistics Information Office and are debatable because of the definition used for transit.

Table 2 Permission for navigation through the NSR issued to Chinese vessels

Despite the optimistic expectations expressed by both Russian and Chinese officials, the effective use of the NSR is linked to the modernization of the infrastructure along the Russian Arctic coastline, including the construction of deep-water ports connected to major gas and oil fields in the region and national transportation hubs by a network of roads and railways, building of ice-class vessels and ice-breakers and the creation of the operational rescue and communication systems. Aware of these challenges,Vladimir Putin and Xi Jinping have identified the joint development of the NSR infrastructure as a key area of Sino-Russian cooperation and discussed several possibilities for China’s participation in major infrastructure projects in the Russian Arctic, such as the construction of the Belkomur railway and of the deep-water harbor in Arkhangelsk (Sørensen and Klimenko, 2017). In this context, the embedding of the NSR into the BRI seems to be a logical and somewhat inevitable extension of the development of the Sino-Russian cooperation in the Arctic.However, the scale of China’s involvement in the use and development of the NSR is one again seen differently in Moscow and Beijing.

From Moscow’s point of view, the NSR is a historically existing national transport route which lies between the Kara Strait and Providence Bay in the Bering Sea with a total length of 5600 km and regularly used for commercial navigation by Russia since the 1930s (Heininen et al., 2014). Although the NSR passes through internal,territorial and adjacent waters, Russian exclusive economic zone and the open sea, Moscow considers it to be under its exclusive jurisdiction and regulates the conditions of the transit and insurance requirements. Russia collects fees for the right to transit and for the access to weather and ice reports, and demands that foreign vessels use Russian ice-breakers for escort and contract Russian pilots to pass through the straits (Laruelle, 2014). These fees are only collected if the vessel is escorted by an icebreaker which is not always the case. These requirements are disputed by a number of international and domestic actors, because the acceptance of these binding rules not only formally confirms Russia’s sovereignty over the NSR but also significantly increases the transit costs. For example, in 2017, the diesel-electric ship Vasiliy Golovnin delivering freight from Archangelsk to Sabetta, had to wait for 8 days for an ice-breaker escort, which has increased the operational costs of the transit by 30% (Severny, 2018).

For Moscow, the NSR has a great domestic importance,from both commercial and political point of view, so connecting the BRI with shipping routes in the Russian Arctic is seen only as one of the ways to support the development of commercial traffic along the NSR. In this perspective, China could be an investor financing the rehabilitation, modernization and construction of new infrastructure, and also a major user of the NSR, entitled to economic profits, but not an effective partner with Russia,sharing rights and responsibilities over the administration and control of the transportation network and facilities along the Russian Arctic coast.

The Chinese media and scholars present the inclusion of the NSR into the BRI as an important part of the Chinese strategy of diversifying China’s maritime trade routes and underlines not only the competitive advantages of the NSR(reduction of sailing time and transportation costs) but also its major weaknesses, that they believe are too challenging for Russia to face alone (Filimonova and Krivokhizh, 2018;Li et al., 2016; Lu, 2016). The Chinese participation in the development of commercial traffic along the NSR is thus presented as the only way for Russia to revive the NSR and to overcome the related technological and economic difficulties. Implementation of the BRI in the Arctic will enhance this trend. Chinese official discourse also reflects this vision with the introduction of a new term to define the NSR—“Silk Road on Ice” or “Polar Silk Road”. Although the concept became part of the official Chinese vocabulary in 2017, it can be traced back to a sentence in a joint Sino-Russian statement at the 2015 regular meeting of Chinese and Russian heads of government, calling for cooperation in Arctic navigation (Ministry of Foreign Affairs of the PRC, 2017). Despite the attempt to present the “Polar Silk Road” as a joint, or even Russian, idea, in Russian media and political discourse, this term is only used to refer to the Chinese concept and does not replace the Russian phrase “Северный морской путь” (NSR). This new Chinese terminology has fueled already existing concerns about China’s greater involvement in the development of shipping routes and energy projects in the Arctic.

Although Russia is seemingly open to accept the extension of the BRI further north, Moscow is not entirely comfortable allowing China, nor any other country, to gain some means of control over the economic development of the Russian Arctic. Thus, in December 2017, Vladimir Putin signed a law stipulating that only vessels under the Russian state flag can transport hydrocarbons and coal extracted in Russian territory and loaded on vessels along the NSR,provide ice-breaker assistance and carry out sanitary, rescue and environmental activities in the waters of the NSR(Fedoseev, 2017). What will be the real impact of this protectionist measure on the development of the international commercial traffic along the NSR remains to be seen, but it has already sent a clear signal that Russia won’t share control over the NSR with any country,including China, despite its formal inclusion into the BRI.

5 Conclusion

The Ukrainian/Crimean crisis and Western sanctions, which took away Russian access to key financial markets and technological know-how, have brought Russia closer to China and seem to elevate their strategic and economic partnership to a higher level. The Russian “pivot to the East” has resulted in the signing of a number of important agreements related to the joint economic development of the various resources of the Russian Arctic. This rapprochement has been recently confirmed by Beijing’s decision to expand the spatial scope of the BRI to the Russian Arctic and thus further promote Sino-Russian economic cooperation in the region. Thus, this paper has tackled the issue of how Russia and China can cooperate in the Arctic so as to foster their respective interests.

However, despite the apparent deepening of the bilateral relations, concrete results of these ambitious plans are limited. Some joint projects were dropped, as China and Russia could not agree on the conditions of the deal, others are progressing very slowly and have an uncertain future. Mutual strategic mistrust and different understanding of the mechanics and final goals of the Sino-Russian partnership in Beijing and Moscow seem to undermine the scale and the rhythms of their cooperation in the Russian Arctic. Yamal LNG is the only successful Sino-Russian joint venture in the Arctic where both sides seem to find their own interests, although Moscow and Beijing interpret differently their respective contribution to the implementation of the project.

The connection of the Arctic to the BRI might provide a new momentum for Sino-Russian cooperation in the Arctic by stimulating Chinese companies to participate more actively in the energy and infrastructure projects on the Russian territory. The realization of projects under the BRI umbrella will improve their opportunities for financial support from the Silk Road Fund and other official Chinese institutions thus reducing their exposure to various risks associated with many Russian projects in the Arctic. Greater involvement with the BRI might also motivate Russia to formulate a more coherent and pragmatic vision of its partnership with China and thus increase the scale of Chinese involvement in the development of the Russian Arctic. For now, the Sino-Russian relationship remains a marriage of convenience where both sides try to balance their vulnerabilities at the expense of the other. Closer cooperation within the BRI might change the situation and lead to a renegotiation of terms of Sino-Russian cooperation in the Arctic, even though the prospects for a mutually beneficial relationship remains tributary to a number of international and domestic factors.

杂志排行

Advances in Polar Science的其它文章

- Advances in Polar Science CONTENTS (Volume 29, 2018)

- Towards truly integrated modeling and observing of marine ice sheets

- Inviting Contributions to Special Issues in 2019

- Research on governance of HFO use and carriage on ships in accordance with the Polar Code

- Meteorological observations and weather forecasting services of the CHINARE

- Marine protected areas in the Southern Ocean: status and future