Current Situation of Suncare Market

2018-10-22DengJing

Deng Jing

JALA Group Co., China

Abstract Reviewing the current situation of global and China’s sun care market, the market scale of China in sun care products has ranked second in the world, but the consumption per capita is still far lower than that of developed countries in Europe and America. Chinese consumers show their varieties of preferences in categories, and sales channels in China develop unbalanced. These will drive China’s market bigger and bigger. Finally, it forecasts the trend of China’s sun care market.

Key words sun care; global market; China’s market; current situation; trend

Sun care products

Definition

According to article 56 inImplementation rules of Regulation on Supervision and Management of Cosmetics, sun care products are cosmetics with the function of absorbing ultraviolet rays and lightening the skin damage caused by sunlight.

Sun care products are classified as special use cosmetics in China.

Classification based on functions

According to different functions, suncare products can be divided into three categories.

Sun protection products: products specially designed for skin exposure to ultraviolet rays. Ultraviolet light can come from natural sunlight or solar bath equipment.

Daily used make-up cosmetics and skin care products which are declared with sun protection effect are not included in this category. Although all cosmetics with sun protection declarations should be put on record as special use cosmetics in China according to the regulations,but we don’t count above mentioned products in our statistical scope in this article.

After-sun products: specially designed products for the sun-exposed skin. It can moisturize or repair the sunexposed skin.

Self tanning products: the products are claimed that it can artificially colour the skin and make the skin appear bronze / wheat color. However, daily used moisturizing cream which can make skin darker and washable bronzed cosmetics are not included in this category.

Market status of sun care worldwide

According to Mintel’s statistics, the global sales amount of sun care products are expected to RMB 49.83 billion in 2017, which is increasing about 6.55% from RMB 46.77 billion in 2016.[1]

Worldwide market scale

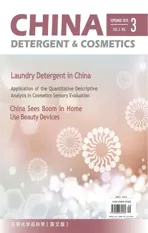

The European market has maintained a dominant position in the consumption of sun care products. it accounts for more than 35% of the world. With the rapid development of Asia Pacific market, the consumption of the Asia Pacific market in 2016 has rapidly increased to 32% of the total global consumption. It almost reaches the market share of European market. Moreover, the estimated consumption amount of the Asia Pacific market in 2017 will be slightly more than the European market. The North American market ranks the third, and its consumption accounts for stable in 21%~22% (Figure 1).

Figure 1. Market share of sun care by region

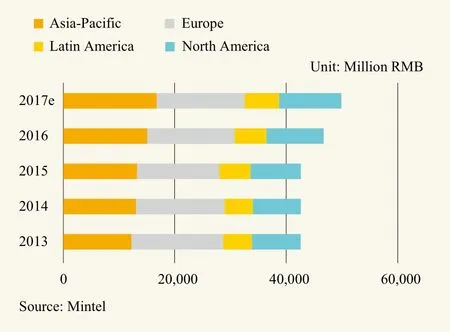

In the European market, Italy, Spain, Britain, Germany and France are the top 5 markets in the scale of sales, and their total consumption of sun care products accounted for more than 70% in 2016. Referring to market growth rate, the compound annual growth rate in past five years(2012~2016) is 3.5% in Europe. The growth rate of top 5 countries was lower than the average. However, in some emerging markets, such as Turkey, Russia, Portugal and Norway, it has grown rapidly over the past five years(Figure 2).

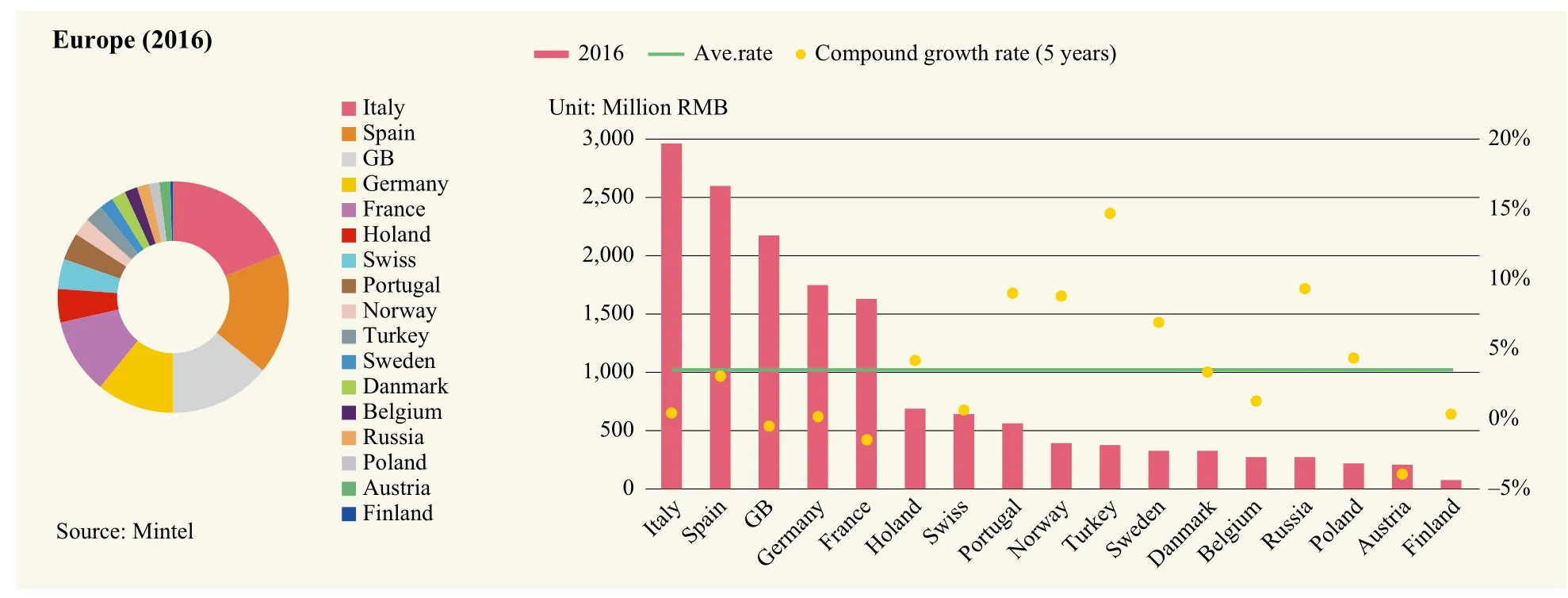

In the Asia Pacific market, China, Japan and South Korea are the top 3 markets in the scale of sales. In 2016,their total consumption of sun care products accounted for 86.5%. Among them, the Chinese market accounts for over 50% of the Asia Pacific market. Referring to the growth rate, the compound growth rate of the Asia Pacific market in past five years (2012~2016) is 10.19%. The growth rate of Vietnam market is 24.9% and the growth rate of China market is 12.6%. Other countries in the Asia Pacific market has also grown in a relatively high speed(Figure 3).

Figure 2. Sun care market in European, 2016

Figure 3. Sun care market in Asia-Pacific, 2016

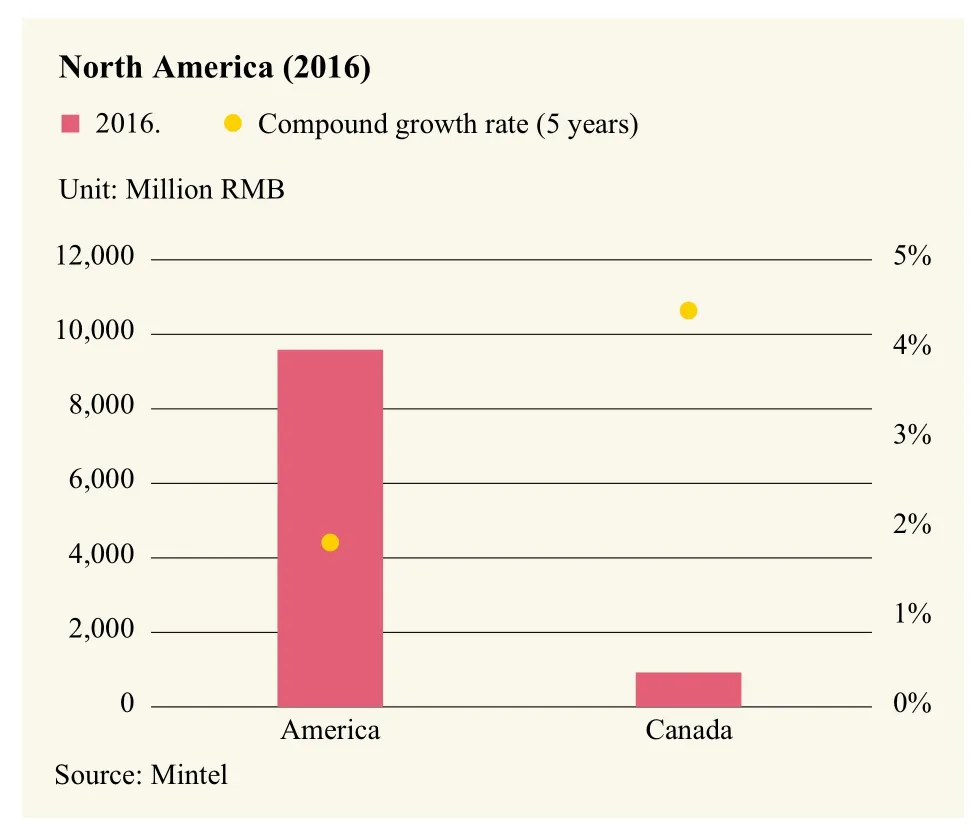

In the North American market, the United States dominates the sun care market with a large scale and slow growth. In the past five years, the compound growth rate was 1.8%. Although the Canada market is small, compared with the United States, its market develops faster, and the compound growth rate of five years is 4.4% (Figure 4).

Figure 4. Sun care market in North American, 2016

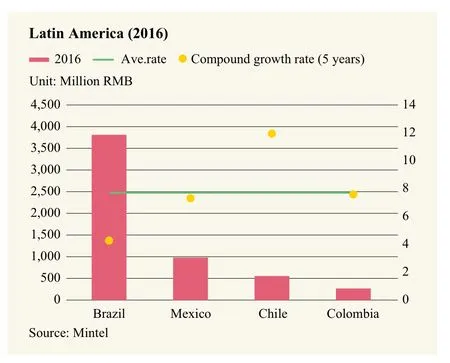

In the Latin American market, Brazil and Mexico are top 2 markets in the sales scale. The compound annual growth rate of the Latin American market in past five years (2012~2016)is 7.725%. Chile market grows fast with 11.9% (Figure 5).

Figure 5. Sun care market in Latin American, 2016

Per capita consumption value in the world

We can draw a general outline of the global market for sun care products according to the scale of global market.We also need to add another axis to discover the market deeply. That is demographic factors, which can be shown by the per capita consumption value. Then, we can further discover the market’s opportunities and trends.

From the point of view of per capita consumption value, we can gain some new insights about the global market for sun care products:

The European’s sun care market is a mature market. The per capita consumption value in Europe is much higher than that in other markets. In the European countries, Norway’s per capita consumption value is the highest, which reaches RMB 76.70, and Swiss market is just behind Norway with RMB 76.57. Although the Norwegian and Swiss markets’ scales are not large, their per capita consumption values are indeed the top 2 in the world. The average per capita consumption value in European market is around RMB 54.29.

The per capita consumption value in North America is slightly higher than the global average, and there is no significant difference between the United States and Canada. The per capita consumption value of US market is RMB 29.59, and the per capita consumption value of Canada market is RMB 26.15.

Not like North America market, there is significant difference among countries in the Asia Pacific market. The per capita consumption value in the South Korea market is RMB 38.49, and that in the Japan market is RMB 25.66,which is higher than that in the North American market.However, China’s per capita consumption value is only RMB 5.73, which is only one seventh of the South Korean market per capita, and 22% of the Japan market per capita.

The market of suncare products in Chile and Brazil is mature, even if the overall market size is not large. The per capita consumption value is RMB 23.12 in Chile, and RMB 16.9 in Brazil.

There are some special cases. Even Russia and Turkey are European countries, but their suncare markets are very immature. Their consumption of suncare products is very small. The per capita consumption value in the Russia market is RMB 1.87, and the per capita consumption value in the Turkey market is RMB 4.76.

By comparing the overall scale and per capita consumption value of sun care products in various countries of the world,we can find that, although the size of China market is already the largest in the world, the per capita consumption value in China is still at a very low level. More than this, there is a large gap, comparing to the South Korea and Japan markets in Asia Pacific region. Compared with the mature European market,there is great potential for development. This development potential is also the kinetic energy to support its two digit growth in China market.

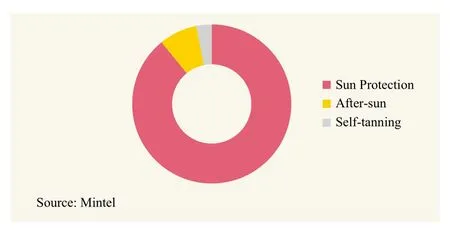

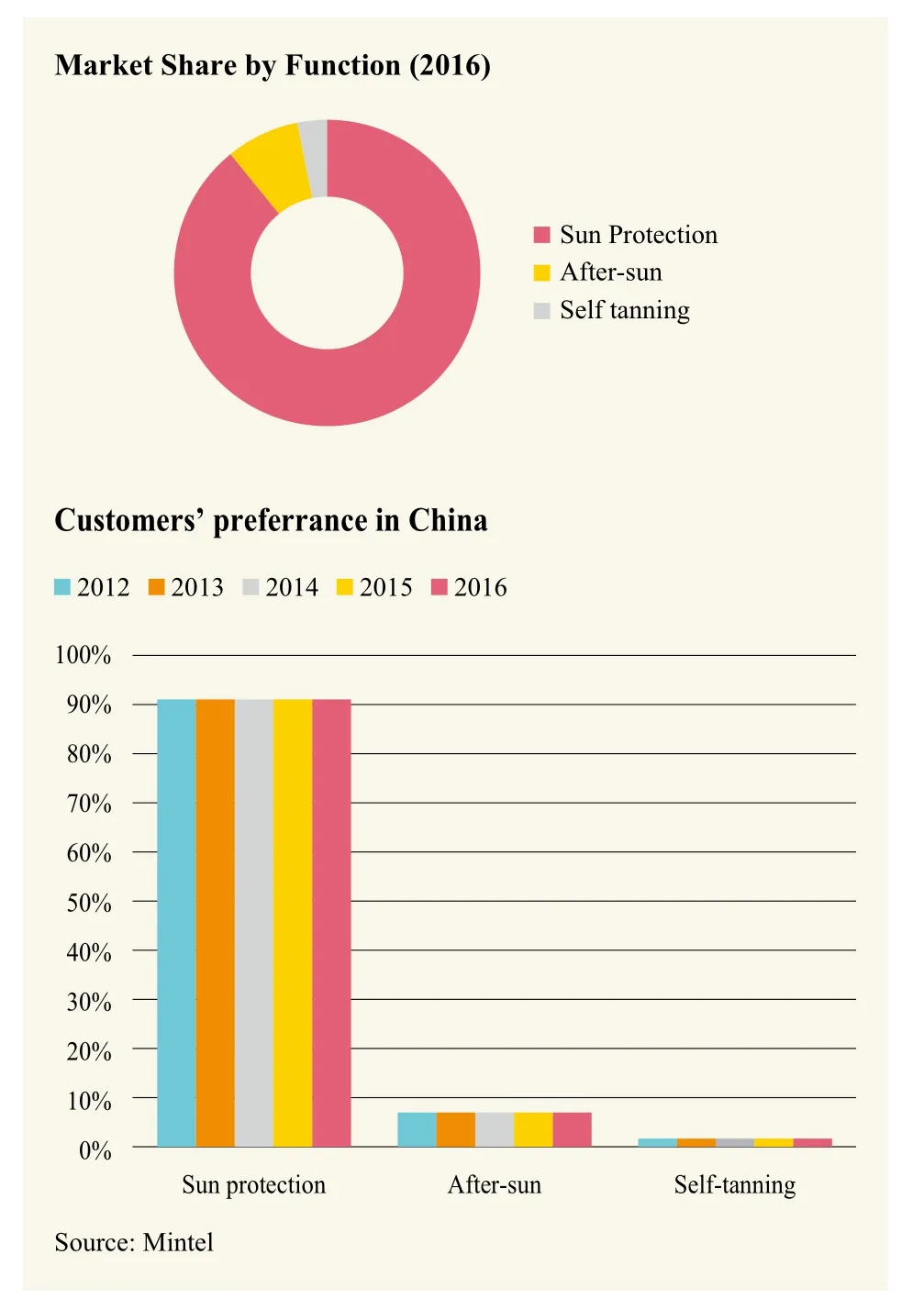

Customer preference

Sun care products can be divided into sun protection,after-sun and self-tanning by their different functions.Consumers in different markets have their distinctive preferences for products. Throughout the global market,sun protection products are the major products. In 2016,89.17% of consumption is sun protection products. Aftersun and self-tanning products account for 7.91% and 2.92%respectively (Figure 6).

Figure 6. Global market share of sun care products by function

Comparing the sales of three functional products in the European market, the Asia-Pacific market, the North American market and the Latin American market respectively, we can see that:

(1) The sales proportion of sun protection products decreased as the market matured. In Europe, the average sales of sun protection products are 81.2%. In the UK market,the sales of sun protection products accounted for only 63.72%. However, sun protection products account for more than 90% in the Asia Pacific market and the North American market, and more than 95% in the Latin American market.

(2) After-sun products are an important supplement to sun protection products. In the European market, the average sales value of after-sun products is 13.6%. In the UK market, the sales of after-sun products are as high as 28.01%.In the Asia Pacific market, 7.09% of the China market is after-sun products, and that is only 3.92% in Japan. In the North American market, 5.33% of the US market is after-sun products, and only 0.79% in Brazil.

(3) Self-tanning products are personalized products. The average market share in the European market is 5.2%, and the maximum share is 10.31% in Belgium. Germany follows it with 9.53%. Consumers in the Asia Pacific market rarely buy self-tanning products. There is no self-tanning products sold in Japan. The market share of self-tanning products in the China market and South Korea market accounted for 1.98% and 1.02%, respectively.

By analyzing the consumption of suncare products with different functions, we can find that:

(1) The consumer demand in the European market is more diversified. The consumers not only pay attention to sun protection products, but also pay much attention to after-sun products.

(2) The culture has an impact on the selection of products. For example, the consumers in the Asia Pacific market are more admired for the concept of “white skin is beautiful skin”, so there is not much higher demand on self-tanning products.

(3) There is a higher consumption demand for personalized products in Europe, and self-tanning products are more popular.

Sun care market in China

China market is big in the consumption of suncare products.In terms of market scale, China market is the second largest market in the world, with sales of RMB 7.829 billion in 2016,just after the US market, which reaches RMB 9.585 billion.

Market scale

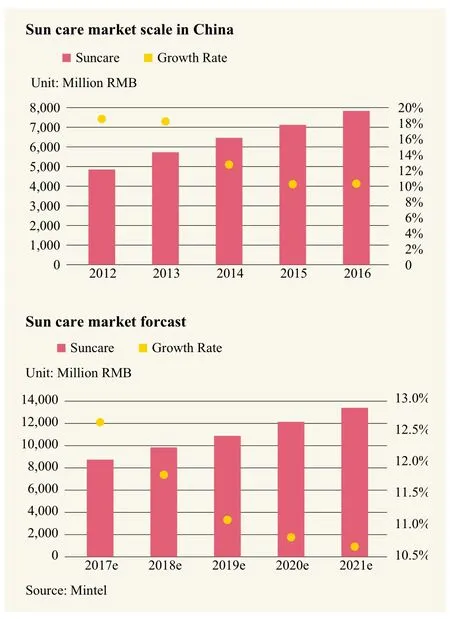

In the past, consumers only weared sun care products on their beach vacations and weared sun care products only in summer. With the improvement of Chinese consumers awareness of sun care, the use of sun care products has become a daily necessity for many Chinese consumers. Benefiting from this, the sun care market scale of China has increased year by year. In 2012, the sales of sun care products were RMB 4.87 billion, and by 2016, the sales amount reached RMB 7.83 billion. The compound growth rate was 12.15%.

At present, the sun care market size of China has jumped to the second in the world. Based on the huge population size, the sun care market in China will continue to rise at a rate of 10%,according to Mintel (Figure 7).

Figure 7. The scale and forcast of sun care market in China

Catagory

The Chinese consumers’ preference on sun care products is basically similar to that of global consumers. Sun protection products have leadingship positions, with the 90%market share. Referring to the data of past five years, this consumption structure has hardly changed (Figure 8).[2]

Chinese consumers believe that sun protection products are the foundation of sun care, and the foundation is the key. Therefore, only when the sun protection products fail to protect the skin very well, and then, after-sun products will be considered for further repairing. Most Chinese are still think that white skin is beautiful and having a white skin is an old Chinese beauty standard. Few Chinese consumers would purchase self tanning products unless they need a personalized skin color.

Figure 8. Market share by functions in China

Figure 9. Distribution channels of sun care products in China, 2016

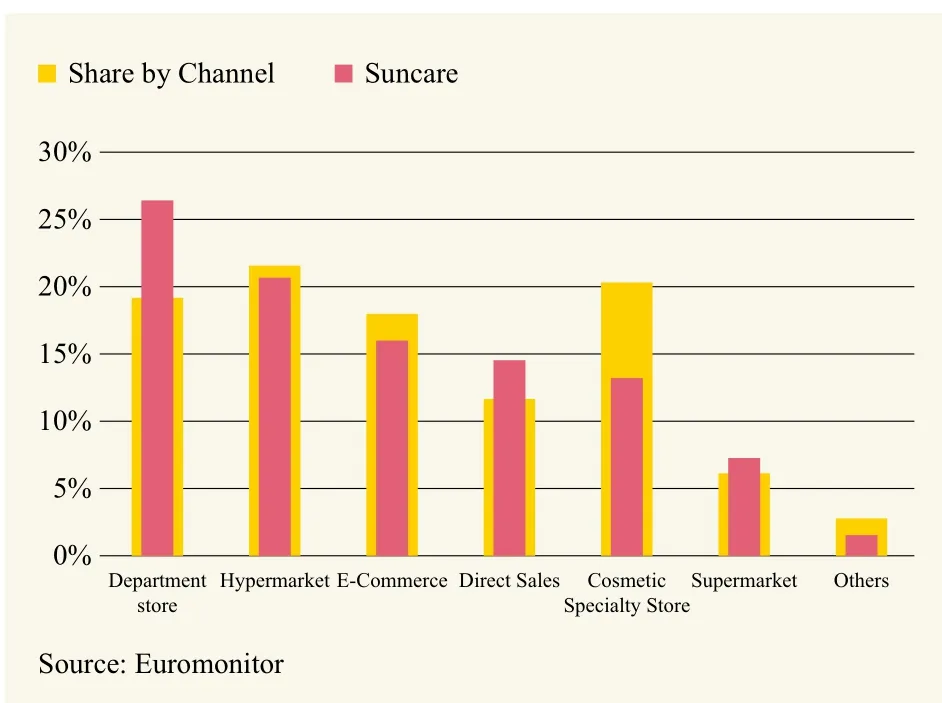

Sales channels

The main sales channels in China are department stores,cosmetics specialty stores, hypermarkets and supermarkets,e-commerce and direct sales channels. According to Euromonitor International’s survey data in 2016, the preferred channel for Chinese consumers to buy sun care products is department stores, and the market share is 26.40%. The second is hypermarkets and supermarkets, and the market share is 20.7%. The third channel is e-commerce channel, which is commonly known as online shopping, and the market share is 16.10%.

We can find that the channel structure of sun care market in China is slightly different from the channel structure of cosmetics market in China. The cosmetics specialty store, which is one of the most popular channels of cosmetics market, are not the most important sales channels of sun care market in China (Figure 9).

Brands

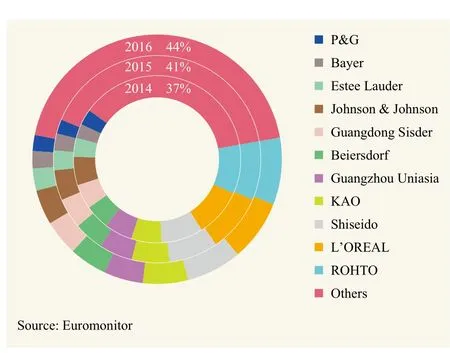

There is fierce competition in the Chinese sun care market, and there is no dominant leader brand. According to Euromonitor International, we can find the competition pattern of China’s suncare market (Figure 10) as follows:

Figure 10. China sun care products market competition by manufacturers (2014~2016)

(1) Chinese companies are rather vulnerable in sun care market in China. Among the top 11 brands of the market share, 2 are Chinese enterprises and 9 are foreign enterprises.The proportion of these two Chinese enterprises is 5.2% of Guangzhou Uniasia and 4.7% of Guangdong Sisder and the total market share is less than 10%. This situation of market structure is quite different from the market structure of China’s cosmetics markets.

(2) There are too much players in sun care market, and there is no player has the leading advantages. In 2016, the biggest player was ROHTO, with market share of 8.6%, follows by L’OREAL, accounting for 8%. In addition, the total market share of the top 11 enterprises accounted for 56%. That shows that the market concentration was really dispersed.

(3) Chinese companies are growing up. From 2014 to 2016, the market share of other enterprises has risen from 37% to 44%, most of which are Chinese enterprises.

Market trends of Sun care

On 27 October, 2017, The Outline of the National Beauty Industry Development Strategic Plan, led by Institute of Industrial and Technological Economics of National Development and Reform Commission, predicted that by 2020, the annual output value of the beauty industry in China will exceed RMB 1 trillion, and the employment population will reach 30 million.[3]

Compared to other products, sun care market is just getting started in China. The per capita consumption value of sun care products in European and American is much higher than that in China. China’s per capita consumption value is still far behind neighbors, such as South Korea and Japan. Therefore, with the sustained and rapid development of the whole industry, China’s sun care market has a large growth capacity.

Market scale in China will increase

First of all, more and more consumers would like to try it.

Secondly, more and more consumers realize that our skin should to be protected everyday by sun care products.

Thirdly, the consumption strength of Chinese consumers is increasing with the rapid development of the economy. The consumer’s pursuit of beauty is also an expression of the pursuit of a better life. More consumers are willing to invest in their beauty and use cosmetics.

Therefore, there is a positive environment which is good to suncare market’s growth.

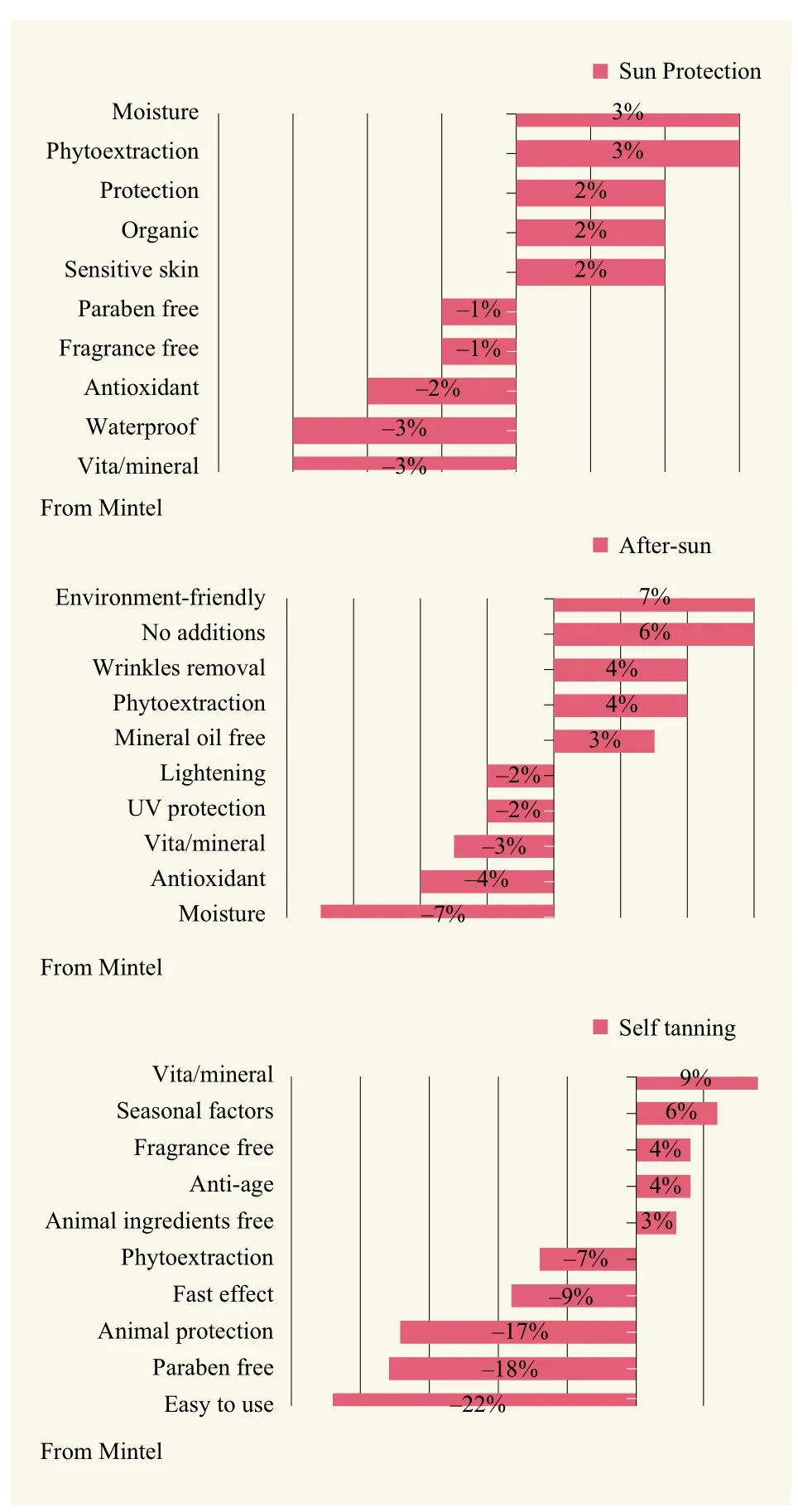

Products will be gradually specialized by functions

By investigating the global demands of sun care products,Mintel’s report shows that consumers’ preferred functions on products are different by categories, and this causes that products will be gradually specialized by functions. From 2016 to 2017, the data showed that more consumers want the sun protection products moisture function, and higher protective ability. Meanwhile, consumers expect products aimed at sensitive skin. Referring to after-sun products,consumers are more concerned on the raw materials. They prefer the products, which are made with plants’ extracts.Mineral oil free product is also preferred. In addition,consumers prefer the after-sun products with the function of anti-aging. Self-tanning products often have been added ingredints such as vitamins and minerals, which can increase skin care effect (Figure 11).

Figure 11. Change in functions demands for sun care product

Price is a key factor

There is no doubt that the performance and price are the most important factors that influence conseme’s purching decision. According to the market survey by Mintel, 46%of American consumers believe that price is an important factor which affects their consumption of sun care products.55% American consumer thought the performance is the most important factor. Referring to current price of sun care products, 20% of consumers think that the price is too expensive.

Right channel will help the rapid growth of the market scale

Compared with the global market, China’s market has its unique characteristics.

First, the coverage area of cosmetics specialty stores in China is very wide, especially in tire-2 and tire-3 cities.But it is not the main sales channel for sun care products.Therefore, cosmetics specialty stores will be the most important growth point for sun care products in China.

Secondly, e-commerce is particularly developed in China. As the most modern and convenient shopping channel, e-commerce channel has become one of the important channels for Chinese consumers. In the past few years, many cosmetic brands grew up through e-commerce. Therefore, e-commerce channels are also an important channel for sun care brands.

Summary

Different functions of sun care products can meet consumer’s needs professionally. Sun protection cream can help consumers to block ultraviolet, blue light and other lights. After-sun products can treat sun burnt skin.Self tanning products can help consumers safely and effectively get a natural-looking glow. With the rising of consumer’s sun protection awareness and knowledge, the innovation of sun care products in China’s market will become more mature.

杂志排行

China Detergent & Cosmetics的其它文章

- Tmall Global Encourages Italian Beauty Brands to Enter the Chinese Market

- China Acid-based Surfactant Forum 2018 Held in Changsha

- JD.Com Will Admit Unilever into Its Warehousing, Logistics Networks

- BASF to Establish $10b Site in Guangdong

- Major Industry Events

- China’s makeup supplier Beukay Cosmetics Sets Its Sights on International Markets