Religious atmosphere and the cost of equity capital:Evidence from China

2018-07-04NingHuHongChenMuhuaLiu

Ning Hu ,Hong Chen ,Muhua Liu

a School of Accountancy,Shanghai University of Finance and Economics,China

b Auditing Bureau of Bao’an District,China

c College of Economics,Shenzhen University,China

1.Introduction

The impact of formal legal and governmental institutions on the accounting and auditing behavior of listed firms has been a central concern of capital market accounting research.Recently,more and more researchers have begun to emphasize the importance of informal institutional arrangements and their effect on economic growth(North,1990;Williamson,2000;Allen et al.,2005).Informal institutional arrangements are the norms or unconsciously accepted standards that are rooted in a culture;they include,but are not restricted to,ethics,values,religions and customs(Helmke and Levitsky,2004).Relevant literatures have made various elaborations in this fields.Lacker(2013)and Chen(2015)find that social networks can relieve financial constraints and increase investment and management efficiency.Bunkanwanicha et al.(2013)and Xu et al.(2015)note that marriages and divorces have a great impact on the stock prices and returns of family firms.Gul et al.(2011)and Liand Liu(2012)find that gender diversified boards of directors can drive up investment efficiency and the informativeness of stock prices and reduce the risk of stock price crashes.As an important part of human culture,religion has also attracted researchers’attention.With the development of religious economic theory and research paradigms,the study of religious culture has become an emerging field in corporate governance at home and abroad(Hilary and Hui,2009;Dyreng et al.,2012;McGuire et al.,2012;Chen et al.,2013;Du,2013;Du et al.,2014a,2014b).

The geographical proximity of religious structures is usually used to measure the strength of religious influence(Malloy,2005;Betler,2008;Chen,2013;Du,2013).Chen et al.(2013)and Du(2013)use the number of Buddhist and Taoist temples within a given radius of a Chinese listed firm as a proxy for the intensity of the religious atmosphere.Using this proxy and quasi-firm-level religious data of Chinese firms from the2007–2014 period,we focus on the impact of religious atmosphere on a firm’s cost of equity capital.We find that listed firms located in areas with stronger religious atmosphere enjoy a lower cost of equity capital.In order to further clarify the channel how religious atmosphere reduces the cost of equity capital,based on mediation effect method(Wen,2004),we prove that religious atmosphere reduces the cost of listed firms’equity capital by improving the quality of accounting information and investment efficiency and by increasing the performance of corporate social responsibility.Moreover,the negative impact of religious atmosphere on listed firms’cost of equity capital is more pronounced in firms with more stringent external legal environments and higher auditing quality,which suggests that there is a complementary relationship between the internal and external formal institutional arrangements of a firm(referred to as formal institutions)and religious tradition(referred to informal institutions).

Our study makes several contributions to the literature.First,we emphasize and expand the understanding of the economic consequences of religious atmosphere.Prior studies have focused on how religion affects a wide range of corporate governance mechanisms,investment decisions,principal-agent problems and stock price collapse risk(Callen et al.,2011,Dyreng et al.,2012;McGuire et al.,2012;Chen et al.,2013;Du et al.,2014a,2014b;Callen and Fang,2015),but little attention has been paid to the economic consequences,especially the effect on the cost of equity capital.Our study enriches the literature on the economic consequences of religious atmosphere.Second,we expand the literature on religious economics in emerging markets.Previous studies of the consequences of religious atmosphere have been conducted in developed countries such as the USA,and the religion has been Christian;this study is conducted in a developing country,China,where Buddhism is the largest religion,closely followed by Taoism.Buddhism and Christianity,as Chinese and Western religions,have different ideas about God,the nature of good and evil,repentance,the ultimate goal of life,precepts and artistic traditions(Yao,2004;Zhu,2010;Shiand Chen,2014;Chen and Fei,2015).The Chinese capital market is undergoing a key stage in its economic transformation;it currently lacks fully established formal institutions and efficient law enforcement,which makes it very important to investigate how the informal institutions such as religious culture affects firms’behaviors and what are the economic consequences of this process.Our study provides a more comprehensive understanding of the role of religion in China.Third,we supplement the literature on the relationship between informal institutional arrangements(religious atmosphere)and formal institutional arrangements.Our research shows that there is a complementary effect rather than a substitution effect between these informal and formal institutional arrangements,which further supports the arguments of Chen et al.(2013)on the economic consequences of religion.Fourth,we enrich and expand the application of geographical proximity as a proxy for religious influence in the context of China.Most previous studies of religious economics have been conducted in developed markets and they usually measure religious atmosphere at the state(county)levels.In this study,we measure religious atmosphere at the corporate level,which means that we not only more accurately catch the religious atmosphere of a listed firm,we also alleviate the possible cross-sectional self-correlation problem(Malloy,2005;Butler,2008;Du,2013).

The remainder of this paper is organized as follows.Section 2 reviews the literature and describes the theoretical analysis and research hypothesis.Section 3 details the research design.Section 4 summarizes the statistics and the empirical results.Section 5 concludes the paper.

2.Literature review and hypothesis development

2.1.Literature review and theoretical analysis

Today,many people believe that religion does not play an important role in Chinese social life for two reasons:first,atheism is taken for granted in China,because the country is governed by the Chinese Communist Party,and second,different from the western religions,Chinese religions(including Buddhism and Taoism)are diffuse,and most believers do not pay regular homage.As religious sites are also served as tourist attractions,it is difficult to separate pilgrims from other visitors(Yang,2007).Accordingly,it is necessary to first review Chinese religious traditions,the status quo and recent trends.China has a long history of religious pluralism.Buddhism was introduced to China during the Western Han Dynasty(206BCE–A.D.24),and Taoism is more than 1900 year sold.Thus,there can be no doubt that religion has had a far-reaching influence on various aspects of Chinese culture such as aesthetics,politics,literature,philosophy and medicine.Although political struggles during the 1949–1976 period caused a significant decrease in religious activities,long repressed religious beliefs have been liberated since the reform and opening up policy,and the influence of religion has gradually expanded.

In recent years,Chinese leaders have realized that religion can rectify the moral deficiencies caused by rapid economic growth,and they have affirmed the importance of religion in various forms.For example,President Xi Jinping met with the Grand Master Hsing Yun(Abbot of Foguangshan Temple)in February 2014 and highly praised his book Bai Nian Fo Yuan.In 2015,Premier Li Keqiang made a splendid statement on religious culture in his report on the government work during the NPC and CPPCC sessions and advocated the comprehensive implementation of ‘‘respecting the freedom of religious belief and giving full play to religious believers’positive role.” In fact,religious activity throughout China has grown beyond expectations in the past four decades.According to Chen(2003),there are about 16,000 Buddhist temples and 10,000 Taoist temples in China.Another statistics made by the World Value Survey(WVS)shows that around 11%of Chinese people are religious believers.In addition,according to the 2011 annual official report Religion Blue Book:Report on Religions in China,approximately 185 million Chinese hold Buddhist beliefs.Yang(2010)argues that these figures might significantly underestimate religious beliefs for several reasons.First,thousands of Buddhists,known as secular disciples,pray at home in a conservative tradition.Second,giving the persecution during the Cultural Revolution,many believers are still reluctant to openly acknowledge their religious beliefs.Moreover,the poor are more likely to seek the spiritual comfort of religious belief because of the unacceptable disparity between the rich and the poor.Clearly,religion plays a vital role in China,and it is important to study the influence of religion on the Chinese capital market.

What role does religion play in human behaviors?Previous studies have provided abundant evidence that religion exerts a non-negligible impact on the behavior of individuals.First,the overwhelming majority of religions stress restraint over personal selfish desires(Conroy and Emerson,2004).Unlike the frictions and conflicts between foreign religions,Taoism and Buddhism,as indigenous religions,influence each other and have become integrated.The basic ideas of Taoism,such as‘‘Recognize the Essence and Resist Private Desires” and Buddhism’s ‘‘Past and Present,Causal Reincarnation” and ‘‘Four Noble Truths(the Truth of Suffering,the Origin of Suffering,the Distinction of Suffering,the Path of Liberation)” strengthen believers’self-restraint and stress the importance of ethics and morals.Second,religion has a significant impact on individuals’attitudes toward risk.According to Miller and Hoffmann(1995),Ferguson(2009),religious believers possess a strong aversion to uncertainty.Using micro-data on Chinese residents,Pan and Zhong(2016)find that Chinese families with Buddhist beliefs have higher rates of saving and lower debt levels than non-Buddhists.Although the term ‘‘risk” is not directly expressed in religious ideology,Taoism’s ideas of ‘‘avoiding all harm and keeping out of trouble throughout one’s whole life” and Buddhism’s idea of‘‘loss of one’s life makes one beyond redemption” both indicate a risk-adverse perspective.Moreover,religion can stimulate an individual’s altruism(e.g.,donations).For instance,Buddhist doctrines encourage ‘‘delivering all living creatures from torment,” ‘‘the cultivation of love” and ‘‘benefiting oneself and others.” These quotations illustrate that religion promotes a social trust mechanism based on mutual assistance(Liet al.,2008;Ruan and Liu,2011).Hence,it is no exaggeration to say that religious beliefs shape individuals’values.In real social interactions,it is difficult to directly observe whether an individual possesses religious beliefs,as religious beliefs are not exactly equal to religious practices or behaviors.Specifically,those who have religious beliefs do not necessarily publicly perform religious behaviors,and performing some religious practices and behaviors does not necessarily mean that one has religious beliefs.However,according to the theory of social norms,local ethics and morality exert a subtle influence on all of the individuals who live in a community.Therefore,in areas where the religious atmosphere is relatively strong,religious doctrines will become an important part of local ethics.Religious believers in areas with stronger religious atmosphere are affected by religious ethics when they are immersed in local morals.This gradually results in the formation of regional ethical codes based on religion.The above effect influences not only individuals’behavior but also organizations’decisions.In this study,we are interested in whether the influence of religion is reflected in the cost of equity capital.

2.2.Hypothesis development

2.2.1.Religious atmosphere and cost of equity capital

As an alternative to the market,a firm can be seen as a group of contracts.Due to bounded rationality,speculation and asset specificity,a firm’s internal contracts cannot be as complete as those in the market.If different subjects do not have the same resources and information,the powerful party(parties)will exploit the less powerful.Due to the high risk of agency problems caused by moral hazard and adverse selection in this environment,investors will claim a higher risk premium.

According to the theory of social norms(Cornwall et al.,1986;Sunstein,1996),every individual in an organization,whether he or she is a religious believer or not,will inevitably be affected by the religious norms in the surrounding environment.Therefore,religion has a direct influence on individuals and an indirect influence on organizations’attitudes and behaviors(Hilary and Hui,2009;Chen et al.,2013;Du,2013).Religious culture plays a role in shaping an organization’s ‘‘cognitive map” and provides the values and codes of conduct that are followed by individuals.The basic principles of Taoism, ‘‘Recognize the Essence and Resist Private Desires,” and of Buddhism, ‘‘Past and Present,Causal Reincarnation,” strengthen individuals’restraint and ethical behavior,which in a business environment helps prevent and rectify damage to others’interests,improve the quality of earnings information and guarantee the accuracy of the measurement of all of the subjects’input and income.Ample evidence shows that earnings quality has a direct impact on the cost of equity capital(Botosan and Plumlee,2002;Jong-Hag and Woo-Jong,2014;Romilda and Stefania,2014;Kima et al.,2015;Hao and Wang,2015).Religious culture also exerts a kind of social control over individuals’behavior in an organization.Principles of Buddhism such as the doctrines of the Three Universal Characteristics(all sensations are suffering,all phenomena are impermanent and all Dharma are not self)and Four Unlimited Hearts(kindness,compassion,happiness,willingness)advocates the resisting of individual’s opportunistic behavior and overconfidence,which helps strengthen risk management and increase investment efficiency,thus reducing potential risks and reducing ICC.In addition,Buddhism’s emphasis on ‘‘delivering all living creatures from torment” and ‘‘benefiting oneself and others” and Taoism’s emphasis on ‘‘saving individuals from suffering,emergency and poverty”encourage mutual assistance and an environment of benign trust,thus enhancing investors’confidence in a firm shaped by a higher religious atmosphere and consequently reducing its cost of equity financing.Based on this discussion,we propose the following hypothesis.

Hypothesis 1.The ICC tends to be lower when stronger religious atmosphere is created at the registered location of a listed firm.

2.2.2.Paths through which religious atmosphere reduces a firm’s ICC

According to the hierarchical theory of social institutions proposed by Williamson(2000),informal institutions such as religion and culture which is redeemed as basic rules of social operation,can exert a deep and thorough influence on society.In this study,the effect of religious atmosphere on the cost of equity capital is shown to operate through the following three channels,although it is not limited to them.

The first channel is effectively improving a firm’s earnings quality.As an informal institutional arrangement,religious culture helps to shape a firm’s internal governance mechanisms,enhancing the constraints on management opportunism.As a result,the firm’s performance meets investors’expectations and increases their confidence,thus reducing the firm’s cost of equity capital.Existing literatures show that firms headquar-tered in areas with strong religious social norms generally demonstrate a much higher quality of accreditation,greater voluntary information disclosure and a lower probability of restatement or violation of accounting standards(Callen et al.,2011;Dyreng et al.,2012;McGuire et al.,2012;Chen et al.,2013;Du et al.,2014b).A large number of studies have shown that higher earnings quality helps to reduce the cost of equity financing(Botosan and Plumlee,2002;Jong-Hag and Woo-Jong,2014;Kima et al.,2015).Thus,religious atmosphere improves oversight of financial information and decreases the risk of intentional or unintentional financial reporting misstatements.Accordingly,a firm can increase the authenticity and accuracy of earnings,reduce investors’misestimates of cash flows due to information asymmetry and reduce the covariance in investors’estimates of cash flows between the firm and others,which can lower the cost of equity capital.

The second channel works by strengthening a firm’s risk management procedures and improving the effi-ciency of its decision making.A growing body of research on how religious atmosphere affects firms’attitudes toward risk suggests that individuals with religious beliefs or firms in environments with a stronger religious atmosphere possess a higher level of risk aversion.Miller and Hoffman(1995)find that religion is negatively correlated with attitude toward risk for individuals,as those with religious beliefs generally are exhibited disgust with uncertainty.Using individual-level data,Osoba(2003)further finds that risk-averse individuals go to church more frequently than risk-seeking individuals.Shu et al.(2012),Bernile et al.(2017),as well as Sunder et al.(2017)argue that it is more likely for risk-seeking individuals to take risks at organization level.If religious atmosphere has a negative impact on individuals’willingness to take risks,there should be evidence for a corresponding pattern in organizational behavior.The above prediction has been supported by a number of studies.Hillary and Hui(2009)argue that firms located in counties with higher levels of religiosity display lower levels of risk exposure and associated lower investment rates and less growth.Omer et al.(2016)claim that auditors in areas with stronger religious atmosphere are more likely to issue non-standard audit opinions when dealing with uncertainty arising from legal proceedings.Callen and Fang(2015)state that firms headquartered in areas with stronger religious atmosphere might be reluctant to adopt aggressive accounting policies and more likely to execute a stable investment strategy,which helps reduce the risk of a stock price crash.Therefore,by enhancing a firm’s stringency,religious atmosphere generates a more positive investor response toward investment and financing decisions,thus reducing the cost of equity capital.

The third channel through which religious atmosphere affects the cost of equity capital is by encouraging social responsibility.You et al.(2011)and Stephen et al.(2017)find that the accumulation of social capital is of great significance to the growth of a firm. The more sufficient social capital entrepreneurs possess, the higher price investors are willing to pay for their firms. Religion promotes the accumulation of social capital and individuals can access abundant social capital by participating in activities organized by religious groups.Higher religious atmosphere gives firms easier access to abundant social capital and beneficial social resources(El Ghoul et al.,2012).Guiso et al.(2003),Renneboog and Spaenjers(2012)and Ruan(2011)argue that religion supports the accumulation of social capital,especially by encouraging the taking of social responsibility.To some extent,increasing trust can increase market participation,arouse an active response in the capital market and drive up stock liquidity,all of which help to reduce the cost of equity capital(Yakov et al.,2015).In addition,religious atmosphere can promote social capital accumulation through its institutional attributes,which may indirectly affect the cost of equity capital.According to Brammer(2007),Li et al.(2013)and Zhou and Hu(2014),religion increases the frequency and intensity of firms’donations and their fulfillment of other social responsibilities.Thus,stock liquidity can be further increased and the cost of equity capital decreased.Based on these above channels,three hypotheses are proposed.

H2a.Earnings quality partially plays an intermediary role in the effect of religious atmosphere on the reduction of the cost of equity capital.

H2b.Efficiency of decision making partially plays an intermediary role in the effect of religious atmosphere on the reduction of the cost of equity capital.

H2c.Corporate social responsibility partially plays an intermediary role in the effect of religious atmosphere on the reduction of the cost of equity capital.

3.Research design

3.1.Model construction

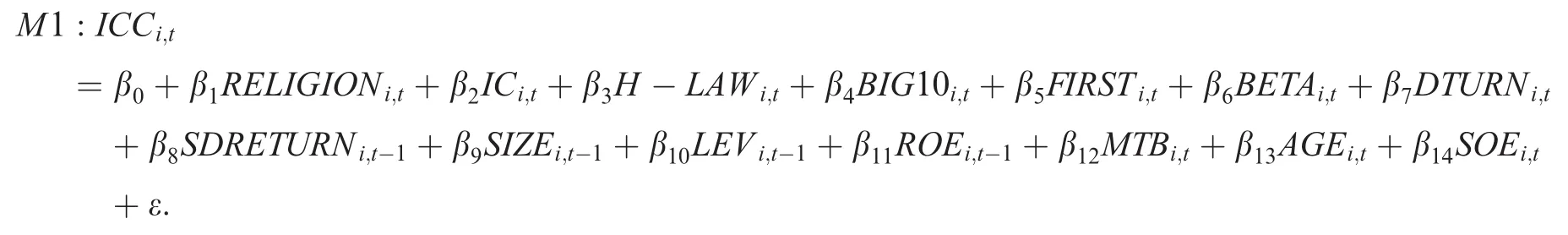

To test Hypothesis 1,we construct the following model:

The dependent variable is the cost of equity capital(ICC),and the main independent variable is the religious atmosphere,RELIGION.The measures of the two variables are described in Section 3.2.The coefficient β1 of the variable RELIGION indicates the influence of religious atmosphere on the cost of equity capital.According to the above analysis,we predict a negative correlation between RELIGION and ICC.

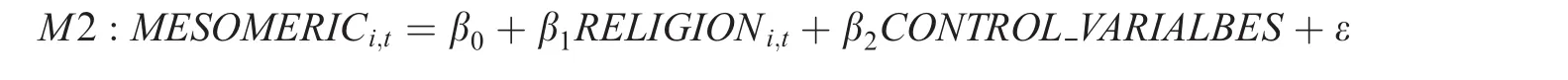

To further clarify the specific path through which religious atmosphere reduces the cost of equity capital,we use Wen’s(2004)method for testing the intermediary effect.We combine the following models M 2 and M 3 with model M 1 to test the intermediary effect:

and

In M 2 and M 3,MESOMERIC is the mediating variable.Based on Hypotheses 2a,2b and 2c,accounting information quality(DA),corporate social responsibility(CSR)and investment efficiency(OVERINV)are selected as the intermediary variables.We select the modified Jones model(Dechow et al.,1995)and take the residual DA as the proxy for accounting information quality.We use Richardson’s(2006)model of investment efficiency to calculate the residual OVERINV as a proxy for investment efficiency.Finally,we use a firm’s voluntarily disclosure of a corporate social responsibility report(CSR)as a proxy for corporate social responsibility.

3.2.Variable measurement

3.2.1.Cost of equity capital

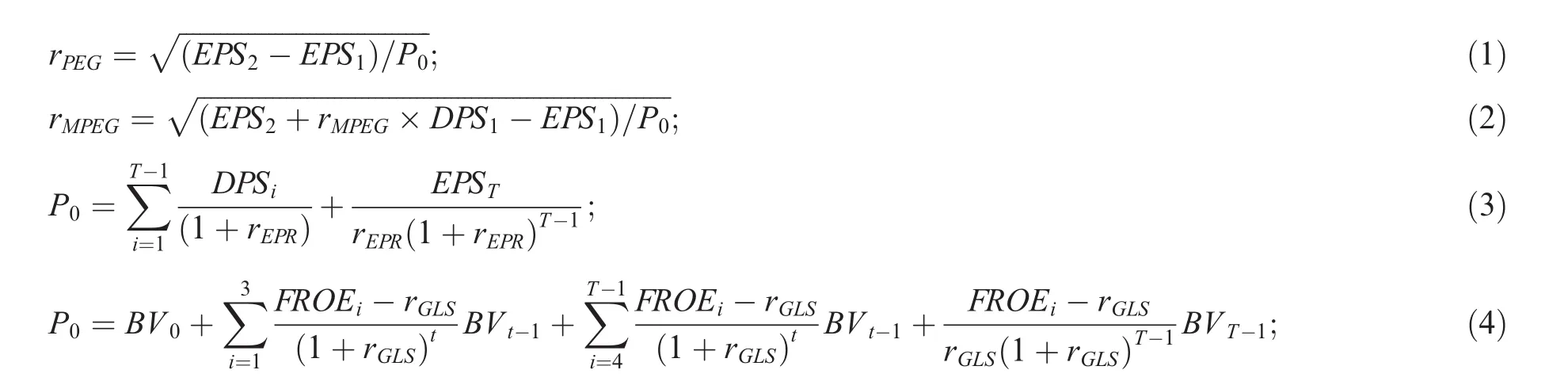

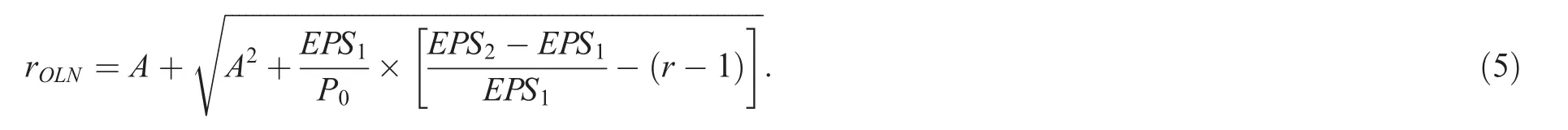

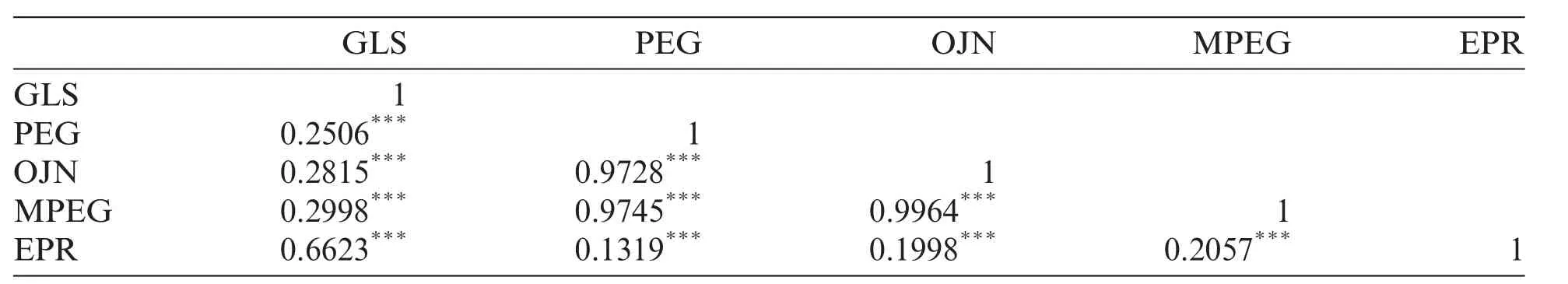

The cost of equity capital is one of the core concepts of corporate financial management.It is not only used to determine the source of funding and in financial planning,but also as the main standard for evaluating investment projects,business performance and company value.However,the difficulty in measuring the cost of equity capital and the complexity of the influencing factors make it a tricky problem.The measurement of the cost of equity capital is divided into ex-ante measurements of ICC and ex-post measurements of ICC.Numerous studies have shown that the ex-post measurements of ICC are often inaccurate(Gebhardt,Lee and Swaminathan;2001;Easton,2004;Hou et al.,2012;Mao and Ye,2012;Hao and Wang,2015).The common ex-ante methods of measuring ICC are the Gordon growth model,the residual income model and the abnormal earnings growth model.As they are based on different theoretical foundations,the measurement results of each method are different.To reduce the estimation error caused by using one single model,we follow Hail and Leuz(2006)and Hou et al.(2012)in using the following five ex-ante methods for measuring ICC(all of them have a significant positive correlation at the 1%level;see Appendix B),and we take the mean of the five indicators as an alternative indicator of the cost of equity capital:

and

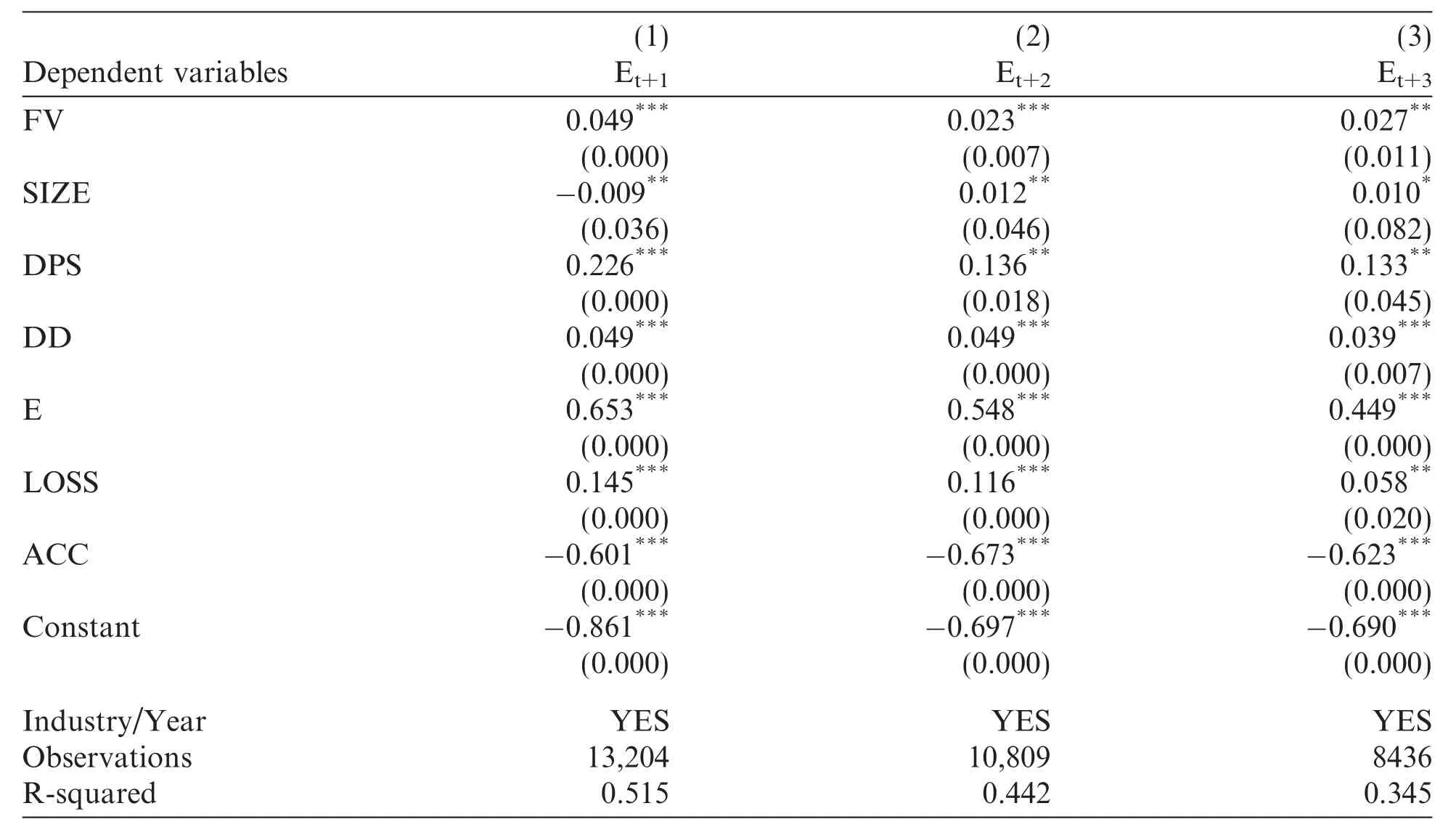

Model(1)is the PEG model,where EPS is the earnings per share and P0is the initial stock price.Model(2)is the MPEG model,where DPS is the dividend per share with the consideration of the cash dividend.Model(3)is the EPR model,and T takes a value of 1,which means the cost of equity capital is calculated based on the forecast data of one year and the current stock price.Model(4)is the GLS model,where BV is the book value of net assets per share and FROE is the expected return rate on net assets.T takes 12;that is,from the fourth year,the company’s expected return on net assets(FROE)is equal to the industry average returns on net assets(ROE),and from the12th year,the return on the net assets of the company is equal to the cost of the equity capital.Model(5)is the OJN model,where A ≡ (γ-1+DPSi/P0)/2 and γ-1=gp,indicating the longterm growth rate of earnings per share,which takes2%.Dueto the insufficient coverage of domestic analysts’earnings forecasts and the subjective nature of forecasts,we use the method given in Hou et al.(2012)to estimate a mixed cross-section regression model,M 0,and use the estimated coefficients and the actual value of the firm to obtain the forecast earnings.

E is earnings before the deduction of additional items.FV is the company’s value;given the liquidity of domestic stock,it is equal to Negotiable shares×Market value+Non-negotiable shares×Book value+Book value of the debt.SIZE is the total assets;DIV is the dividend payment;DD is a dummy variable that equals 1 for dividend payers,and 0 otherwise;LOSS is a dummy variable that equals1 for firms with negative earnings,and 0 otherwise;and ACC refers to the total accruals,which is equal to the operation’s net profit– net cash flow.All the independent variables are measured as of year t.

Given the potential overweighting of firms with extreme earnings in the estimation of Eq.M 0,we winsorize earnings and other continuous variables each year at the 1st and 99th percentile.For each firm i and each year t in our sample,we compute the earnings forecasts for up to five years into the future by multiplying the independent variables at year t by the coefficients of the pooled regression estimated using the previous10 years of data.In addition,to estimate a firm’s earnings forecasts,we only require the firm to have non-missing values for the independent variables in year t.As a result,the survivorship bias is kept to a minimum.The regression results of model M 0,given in Appendix A,show that the coefficients of the independent variables are in line with prior research(Hou et al.,2012;Hao and Wang,2015),and all of them are highly significant.The R2is also very high,which suggests that it is reasonable to use M 0 to forecast the earnings.

3.2.2.Measurement of religious atmosphere

There are four methods to empirically measure the influence of religion:(a)the number of religious believers divided by the total population in a county(Hilary and Hui,2009;Dyreng et al.,2012);(b)the ratio of residents’who participate in religious practices(e.g.,praying in church)in a county(McGuire et al.,2012);(c)the number of religious sites in a county(Dyreng et al.,2012);and(d)the number of religious sites within a certain distance of a firm(Chen et al.,2013;Du,2013).To meet acceptable standards of objectivity,reliability and availability and to alleviate the endogeneity problem,we follow previous studies(Chen et al.,2013;Du,2013)and use the number of monasteries(temples)within a certain radius of a firm as a proxy for the influence of religion in that area.We manually collect all of the longitude and latitude data for the 161 national major Buddhist monasteries and Taoist temples(140 Buddhist monasteries and 21 Taoist temples)listed in the Report of Identification of Major Temples of Buddhism and Taoism in the Han Region,which was released by the Religious Affairs Bureau of the State Council on 9 April 1983.We then define religious atmosphere at the corporate level as follows.First,we manually collect the registered address of each firm’s headquarters and of each religious monastery(temple),and determine its latitude and longitude using Google Earth maps.Second,we calculate the distance between each firm and the religious temples in four steps.

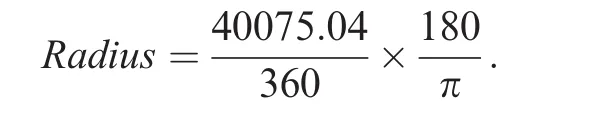

a.We confirm the longitude and latitude of the firm’s headquarters(religious temple),λFand ΦF(λRand ΦR),where the angle between the firm’s headquarters and the temple through the center of the earth and the earth’s surface is θ.Then,

b.The radius formula is as follows:

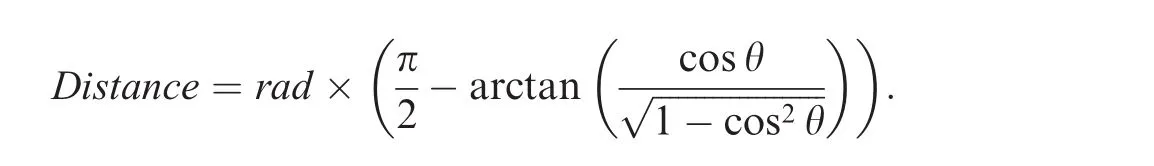

c.The distance between the firm’s headquarters and the religious temple is

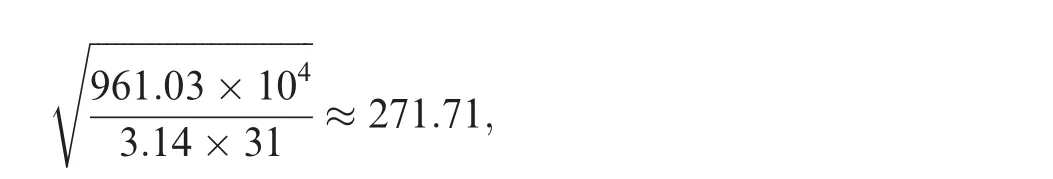

d.We then calculate the distance using only the area of mainland China(thus,the three special administrative regions,Hong Kong,Macau and Taiwan are excluded):

where 961.03×104denotes the area of mainland China(unit:km2),3.14 denotes the circumference ratio and 31 denotes the number of provinces,municipalities and autonomous regions in mainland China.

Based on the above calculation,we first use 200 km as the benchmark for defining the religious influence variable,RELIGION.As a robustness test,we extend the distance to 300 km(RELIGION2).

A firm-level measure of religious atmosphere has an advantage over country-level and region-level measures(Wines and Napier,1992;Du,2013).If a monastery(temple)is located at the junction of two or more provinces,its influence it not restricted to the province it is located in.Province-level proxies fail to capture this characteristic,whereas firm-level proxies are not limited by administrative boundaries,as they are measured as the distance between a firm and a monastery(temple).

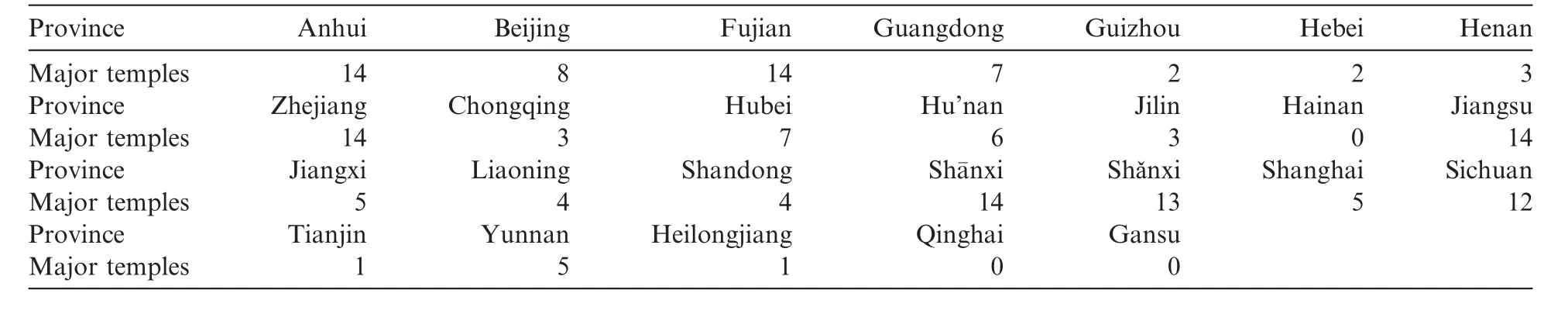

Table 1 reports the distribution of major monasteries(temples)in various provinces and municipalities in the Han area.The table shows the number of Buddhist monasteries and Taoist temples in each province.The highest numbers of major temples are found in Anhui,Fujian,Sh¯anxi,Shǎnxi,Zhejiang and Jiangsu;moderate numbers of temples are found in Beijing,Hebei and Guangdong,and only a few temples are found in Shanghai,Tianjin,Qinghai,Gansu and Hainan.Combined with the provinces’marketization ranking,it is clear that the provincial religious influence variable and the level of provincial marketization share low multi-collinearity.

Table 1 Distribution of major temples by province.

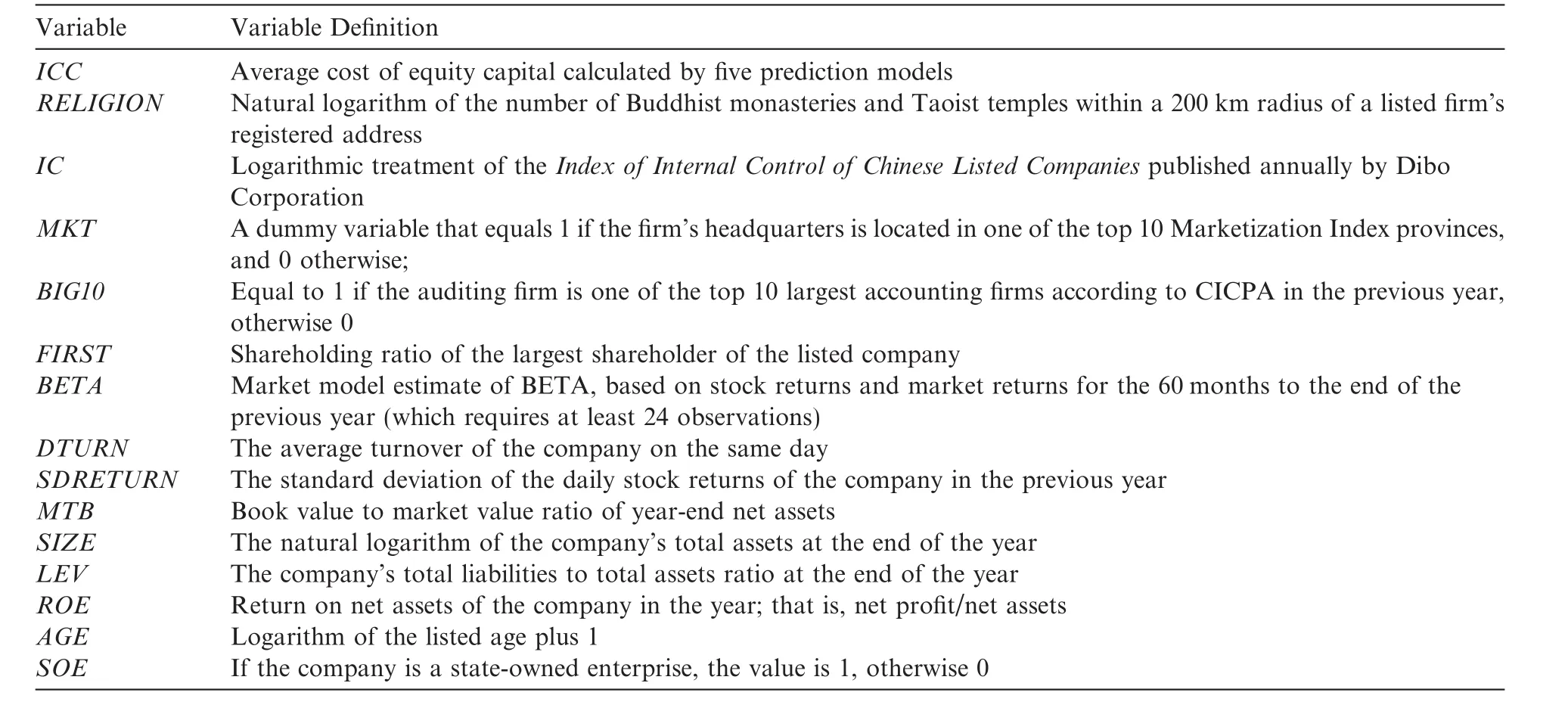

In addition,following Romilda and Stefania(2014),Kima et al.(2015)and Hao and Wang(2015),we further control for governance in the internal and external environments,including internal control effectiveness(IC),external legal environment(MKT),auditor reputation(BIG10)and the largest shareholder holding ratio(FIRST).We also control for corporate related risks,including the market risk(BETA),stock liquidity(DTURN)and stock return volatility(SDRETURN),and company fundamentals indicators,including stock price level(MTB),company size(SIZE),solvency(LEV),profitability(ROE)and age(AGE).The variables definitions are given in Table 2.

3.3.Data sources and sample selection

Our study takes A-share listed companies from the 2007–2014 period as the initial sample.In the sample selecting process,we exclude the following observations:(1)firms in the banking,insurance and other financial industries;(2)firms whose latitude and longitude cannot be determined or those with missing variables;(3)firms registered in five minority ethnic areas including Ningxia,Guangxi,Inner Mongolia,Tibet and Xinjiang(The Report on Determining the Nationally Important Temples of Buddhism and Taoism in Han Nationality Region only lists Buddhist temples in the Han nationality region);and(4)firms with less than three estimated results from Eqs.(1)–(5).After the above observations are removed,we obtain 6014 valid samples.All of the continuous independent variables are winsorized at the 1%and 99%levels.The financial data are from the CSMAR(China Stock Market and Accounting Research)database.The religious atmosphere(RELIGION)data are hand-collected.The data for BIG10 are taken from the official website of the Chinese Institute of Certified Public Accountants(www.cicpa.org.cn),which publicly issues accounting firms’annual rankings.The internal control(IC)data are from the Index of Internal Control of Listed Companies in China published annually by the Di Bo Company,and the corporate social responsibility(CSR)data are from the Corporate Social Responsibility Report by Running&Loving Global Consulting Co.Ltd.The economic and demographic data at the provincial level are obtained from the China Statistical Yearbooks.

Table 2 Variable definitions.

4.Empirical results and analysis

4.1.Descriptive statistics

Table 3 reports the descriptive statistics of the variables after the winsorizing process. The variables are generally in accordance with a normal distribution and show some certain variation over the sample period.The mean ICC of the sample firms is0.077,with a standard deviation of 0.04.The25%and 75%quantile are0.047 and 0.099,respectively,which suggests that there is a significant difference in the cost of equity capital for different firms.The mean of RELIGION at the corporate level is 2.077,with standard deviation 0.922.The 25%and 75%quantiles suggest there is a big variation in the influence of religious atmosphere.The average level of the internal control index is 6.47,with a small standard deviation.Nearly 60%of the sample firms are headquartered in areas with a good legal environment,65%are state-owned enterprises and 37.1%use one of the top 10 audit firms.Moreover,the average shareholding of the largest shareholder is 34.8%;the 25%and 75%quantiles of this variable are 22.6%and 46.3%,respectively,which suggests that the percentage of shares held by the biggest shareholder varies across firms.The standard deviations of the other indicators are small,indicating that there might be no significant differences.

4.2.Religious atmosphere and cost of equity capital

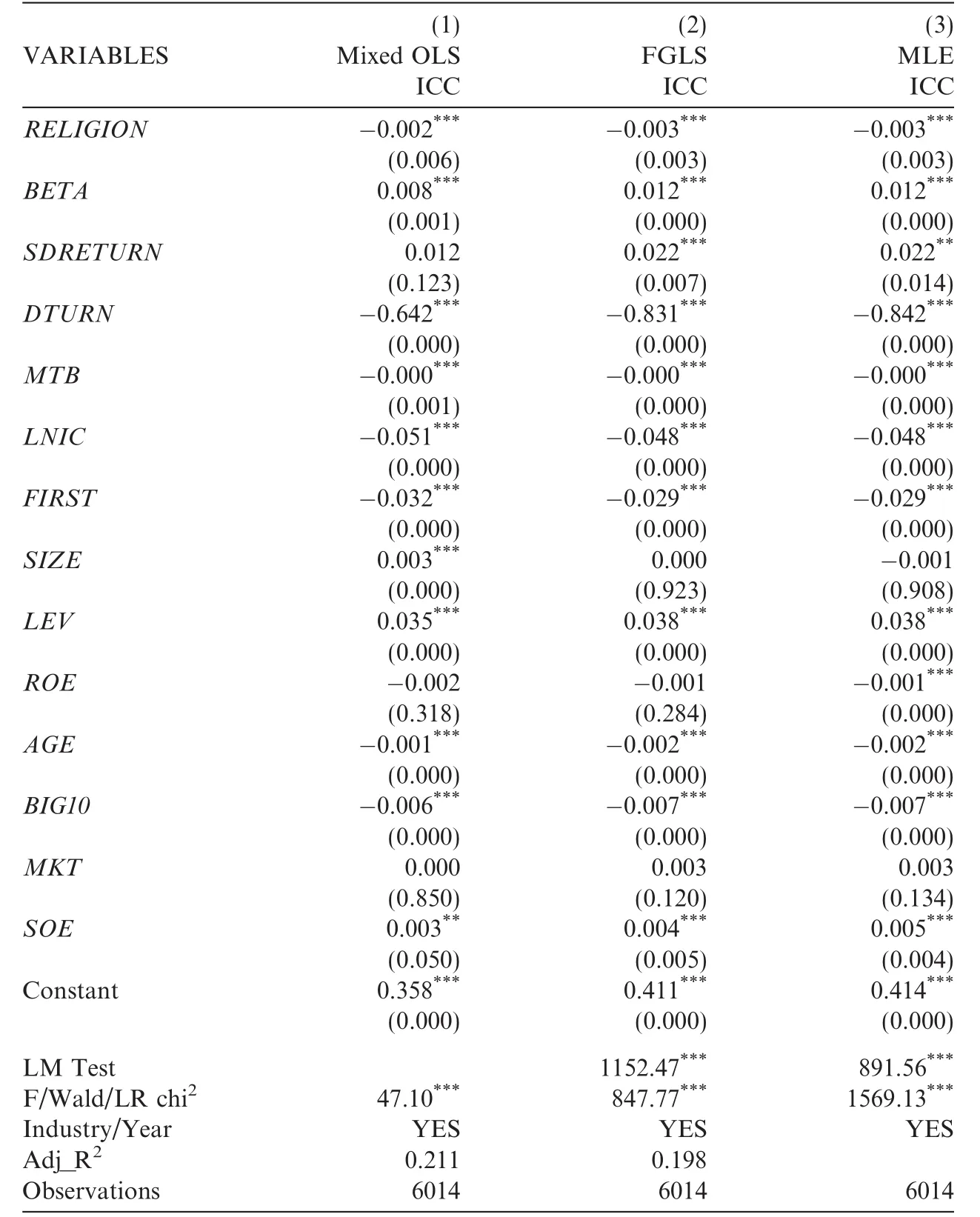

Hypotheses 1 predicts that the religious atmosphere will be negatively correlated with ICC.Table 4 shows the regression results of M 1 with industry fixed effects,year fixed effects and the clustering effect at the firm level.In columns 1–3,the results of the mixed OLS model,FGLS random effects model and MLE random effects model all show a significant negative correlation between religious atmosphere(RELIGION)and the cost of equity capital(ICC)at the 1%level,indicating that religious atmosphere helps a company reduce the cost of equity capital.Thus,Hypothesis1 is supported.For the control variables,the effectiveness of internal control(IC),the auditor reputation(BIG10)as well as the holding of the largest shareholder FIRST are all negatively correlated with the cost of equity capital at the 1%level,which confirms the role of internal andexternal corporate governance mechanisms in reducing the cost of the firm’s equity capital(Romilda and Stefania,2014;Kima et al.,2015;Hao and Wang,2015).Other control variables,such as market risk(BETA),stock liquidity(DTURN),stock return volatility(SDRETURN),market to book ratio(MTB),solvency(LEV),profitability(ROE)and age(AGE),all pass the significance test and the results are consistent with our expectations.SIZE is significantly positive in the mixed OLS model,which is contrary to our expectation.We further test the individual effects.The results of the LM test(Breusch and Pagan,1979)show that the mixed OLS model is rejected.Due to space limitations,the following tables report only the regression results of the MLE random effects model.

Table 4 Religious atmosphere and the cost of equity capital.

Table 5 How religious atmosphere reduces ICC:Intermediary effect analysis.

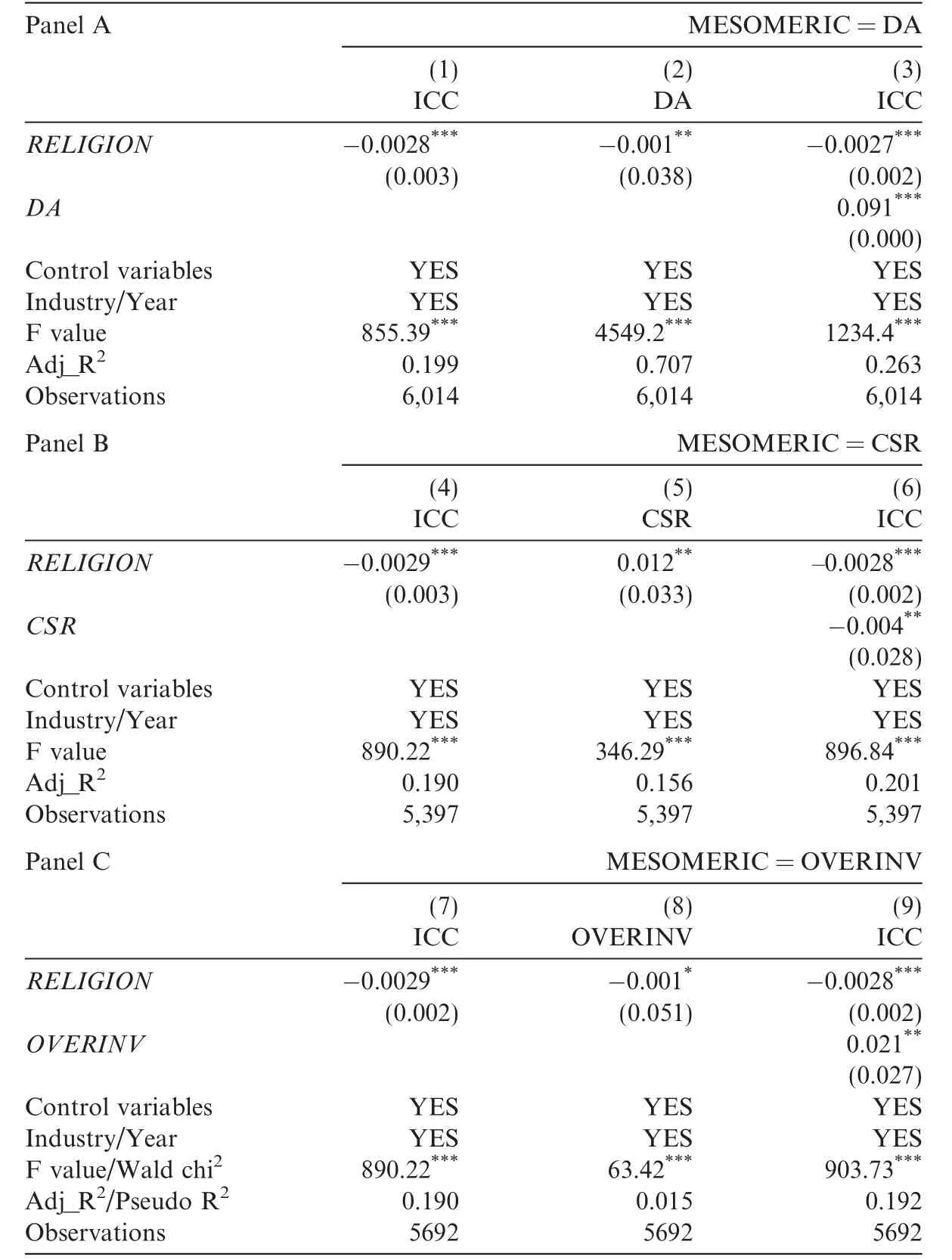

4.3.Channel analysis:How religious atmosphere reduces ICC

Tables 5 reports the results on the analysis of the channels through which religious atmosphere reduces ICC.The analyses are based on the intermediary effect method(Wen,2004).In columns(1),(4)and(7),the values for religious atmosphere(RELIGION)are all negatively correlated with the cost of equity capital at the 1%level;in columns(2),(5)and(8),religious atmosphere is shown to significantly reduce discretionary accruals(DA),increase the probability of corporate social responsibility disclosure(CSR)and restrain over investment behavior(OVERINV).These results show that it is necessary to further test the mediating effect of accounting quality(DA),corporate social responsibility(CSR)and investment efficiency(OVERINV)on the relationship between religious atmosphere and the cost of equity capital.In columns(3),(6)and(9),discre-tionary accruals(DA),over investment(OVERINV)and the disclosure of social responsibility reports(CSR)are all significantly and positively correlated with the cost of equity capital at the 1%,5%and 5%levels,respectively.Religious atmosphere(RELIGION)is still negatively correlated with the cost of equity capital at the 1%level,but the coefficient of RELIGION is reduced to a certain extent when the above intermediary variables are added to the model,showing that the quality of accounting information(DA),corporate social responsibility(CSR)and investment efficiency(OVERINV)mediate the effect of religious atmosphere on the cost of equity capital.Religious atmosphere may also influence the behavior of listed companies through other channels(e.g.,by affecting the choice of accounting firms)that affect the cost of equity capital.This remains to be further researched.

4.4.Religion and formal institutional arrangements:Alternatives or complements?

An institution is defined by a series of rules that are followed by its members.These rules include not only formal institutional arrangements such as laws,government regulations and economic contract arrangements,but also informal institutional arrangements such as religious culture,ethics,values and ideologies(North,1990).Williamson(2000)argues that an institution can be divided into four levels.The first level consists of informal institutions such as religion,culture and custom,which form the basis of the institutional structure.The second level includes formal political and legal institutional arrangements.The third level is composed of contracts and governance structures,which are also formal institutional arrangements.The fourth level is market-oriented institutional arrangements such as resource allocation and employment,prices and quantities.According to the hierarchical theory of social institutions,the higher the level of the institution,the more stable the institution.In general,participant-sseek institutional protection from the highest functioning level.When the function of one institution is weak and normal operations cannot be guaranteed,for sustainability,market participants will seek protection at a lower-level of institutional arrangement.When formal institutional arrangements fail,high-level informal institutional arrangements can effectively substitute for formal institutions.If formal governance mechanisms are weak and their social function cannot be guaranteed,religion,as an informal institution,will make up for the deficiency in the formal institution(McGuire et al.,2012;Du,2013).

Of course,there might also be a complementary relationship between religious and formal governing mechanisms.That is,the role of religion might be enhanced when the formal governing mechanism functions effectively.For example,if formal institutional arrangements are visualized as a circle and informal institutional arrangements are visualized as a square drawn around the circle,the scope of informal institutional arrangement may decrease as the radius of the circle(formal institutional arrangement)increases,but it will never disappear.In other words,due to institutional friction and transaction costs,the formal institutional arrangements always leave a role for informal institutional arrangements.According to the flight attendant theory(Davis et al.,1997),managers as ‘‘flight attendants” are motivated to pursue their own self-interest.However,their religious tradition may prompt them to work harder and to strengthen corporate governance,improve the quality of corporate accounting information and reduce information asymmetry,thereby reducing financing costs and increasing the company’s value.

After verifying that the religious atmosphere of listed firms can significantly reduce the cost of equity capital,we further discuss the relationship between the informal institution(religion)and the formal institution(market level,audit quality).We examine whether these different governance mechanisms are complementary,mutually substitutable or irrelevant to the effect of religious atmosphere on the cost of equity capital.The role of religion in corporate governance may be weak in areas with a higher level of marketization(high-quality audit firms).In areas with low marketization(low-quality audit firms),the role of religion in corporate governance may both highlight and make up for deficiencies in the formal institutions(El Ghoul et al.,2012;Du,2013).In contrast,Chen et al.(2013)holds that in areas with higher levels of marketization,a religious atmosphere strengthens people’s internal ethics and morality and spurs them to enhance internal and external governance mechanisms and improve the quality of accounting information.Furthermore,in areas with high levels of marketization,the risk-adverse orientation of religious traditions may further strengthen management’s more conservative accounting and investment decisions.Furthermore,informal institutional arrange-ments and formal institutional arrangements may also have complementary effects on the cost of equity capital.

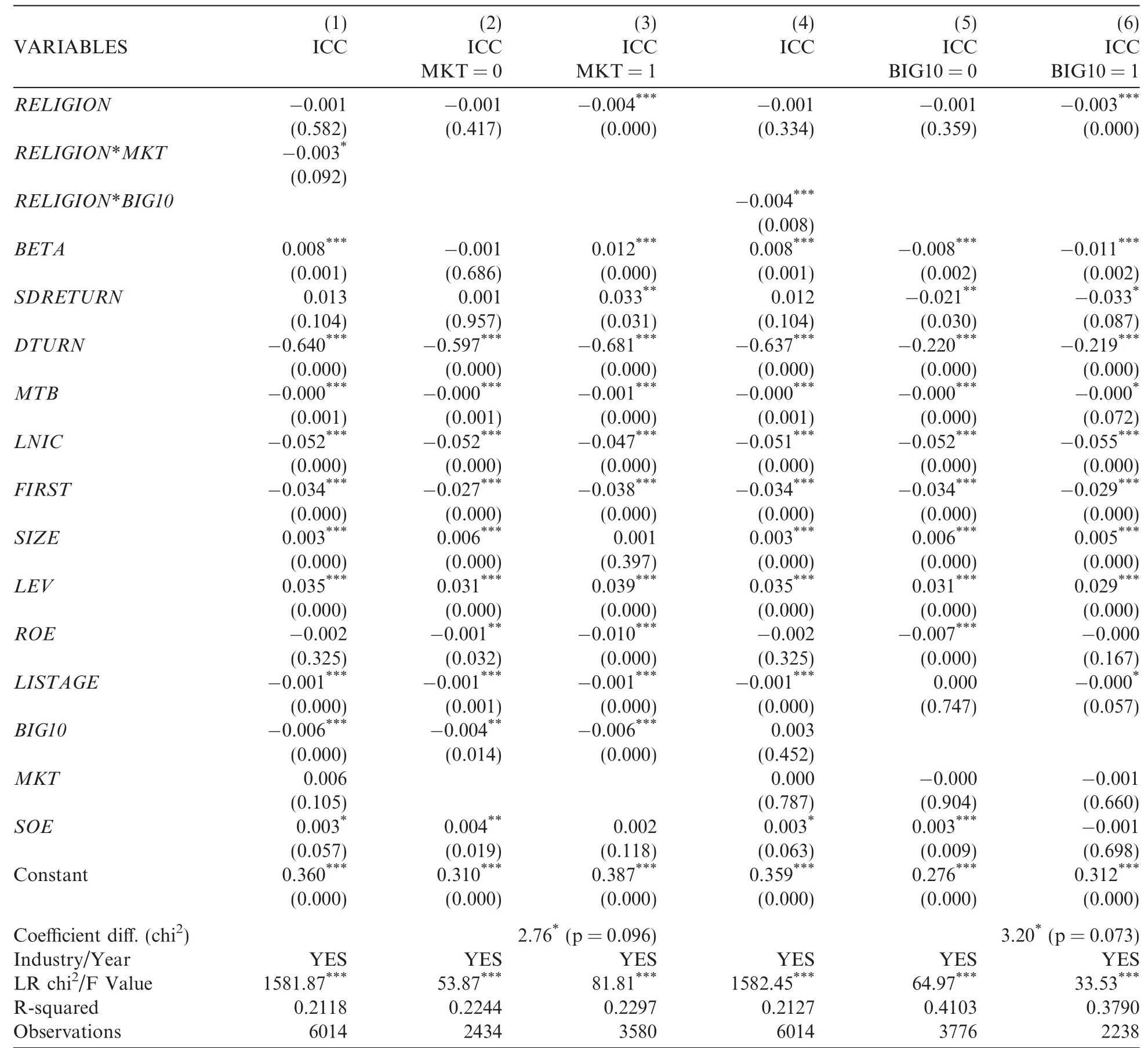

Table 6 Religious atmosphere,formal institutional arrangements and the cost of equity capital.

Table 6 provides the results of the analyses of the influence of religious atmosphere on the cost of equity capital under two formal institutional arrangements.In columns(1)and(4),RELIGION*MKT and RELIGION*-BIG10 are significantly negatively correlated at the10%and 1%levels,respectively,showing that when the formal institutions function effectively,the effect of religious atmosphere is not diminished,but rather enhanced.Columns(2)–(3)and columns(5)–(6)further provide the grouped regression results based on marketization and auditor reputation.The coefficient of religious atmosphere is much smaller in the sample with a stronger external legal environment and the sample with higher audit quality.The SUE(Seemly Unrelated Estimation)test shows that the chi2between columns(2)and(3)is2.76 and the chi2between columns(5)and(6)is3.2,suggesting that there are statistically significant differences between different formal institutions.Based on the above findings,religious atmosphere,as an informal institution,complements rather than substitutes for formal institutional arrangements in the determination of the cost of equity capital of listed firms in China.

4.5.Robustness test

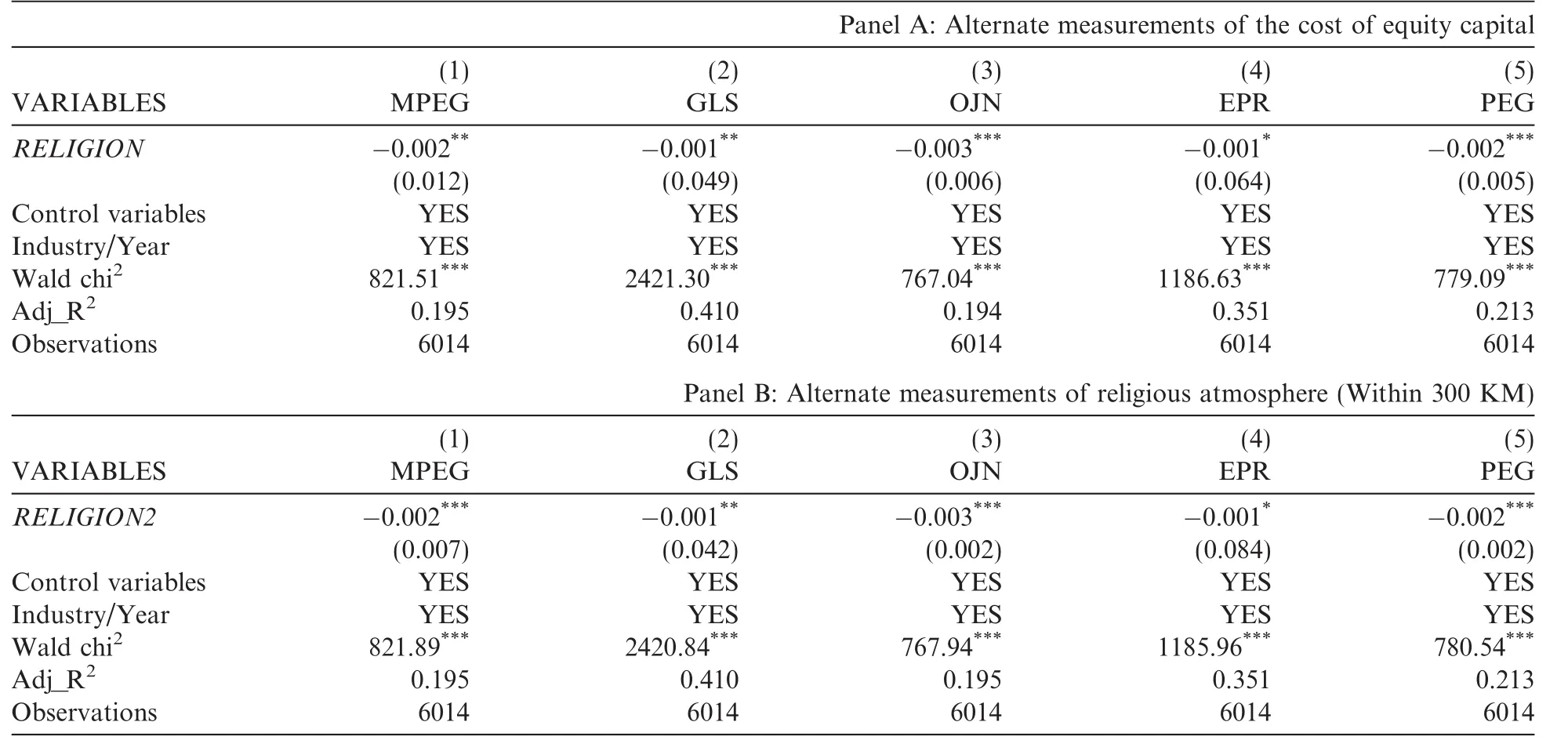

To ensure the reliability of our conclusions,we conduct the following robustness tests:(a)we use the original value of the cost of cost of equity capital in models(1)–(5)as the dependent variable,and rerun the regression;and(b)we set 300 km as the radius for religious atmosphere(RELIGION2)at the firm level,and rerun the regression.As shown in Panels A and B in Table 7,the coefficient of RELIGION(RELIGION2)is still negatively related to the cost of equity capital.Overall,the results of the robustness tests are statistically indistinguishable from those in the main tests.Therefore,the findings in Table 7 support the hypothesis that religion is negatively associated with the cost of equity capital.

4.6.Endogeneity

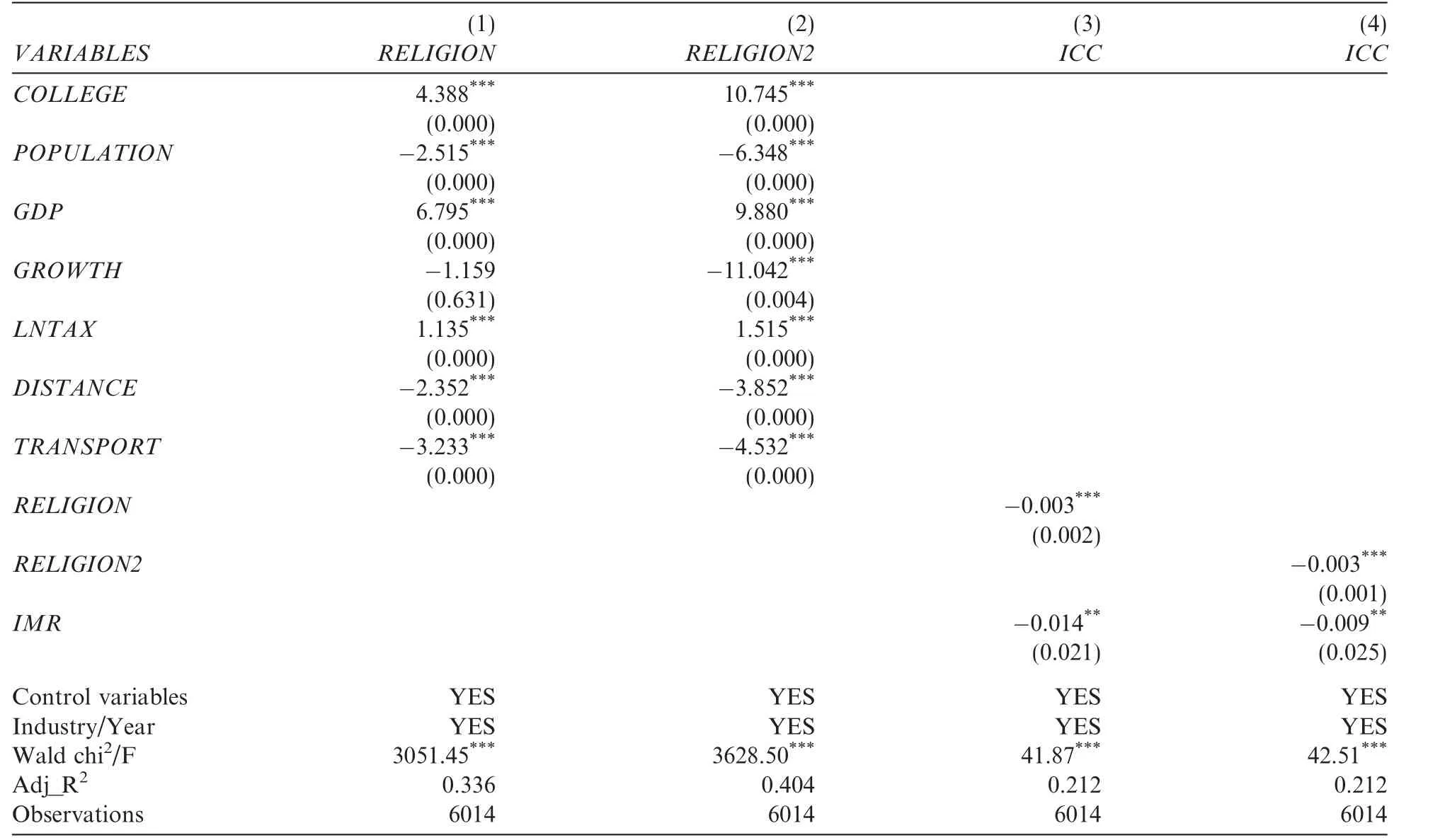

The implicit assumption of our model is that the decision to locate a listed company’s headquarters at its registered address is exogenous;in fact,there may be endogenous factors.Hilary and Hui(2009)and El Ghoul et al.(2012)find that decisions about a company’s location are influenced by factors such as taxation,labor costs,raw materials,suppliers and customers.Similarly,the choice of a listed company’s registered address should be exogenous,and therefore not affected by the cost of equity capital.Nevertheless,following El Ghoul et al.(2012)and Du et al.(2014a),we use Heckman’s two-stage regression method to control for possible endogeneity problems.In the first stage,we control for COLLEGE,represented by the natural logarithms of the number of universities in the firm’s province;TAX,represented by the natural logarithm of tax revenue at the provincial level;POP,represented by the natural logarithm of the province’s population;GDP,repre-sented by the natural logarithm of provincial per capita;GROWTH,represented by the growth rate of provincial GDP per capita;TRANSPORT,represented by the natural logarithm of the provincial railway mileage;and DISTANCE,represented by the natural logarithm of the distance(in kilometers)between a listed firm and the nearest financial center(e.g.,Beijing,Shanghai or Shenzhen in China).In the second stage,we control for all of the variables.Table 8 reports the regression results of Heckman’s two-stage treatment.After controlling for the potential factors,the religious atmosphere RELIGION(RELIGION2)is still significantly negative at the 1%level.Thus,our conclusions are robust.

Table 7 Robustness test.

Table 8 Heckman’s two-stage regression.

5.Conclusions

According to Allen et al.(2005),it is difficult to explain the rapid growth of China’s economy given the relatively weak formal institutions.We construct quasi-firm-level religious variables using a digital map and explore the impact of religious atmosphere on the cost of equity capital for listed companies.Our research expands the study of religious economies in emerging markets.The empirical results show that firms registered in areas with stronger religious atmosphere enjoy a lower cost of equity capital.Moreover,this relationship is more pronounced in subsamples with stronger external legal environments and higher auditing quality,indicating that formal institutional arrangements and religious traditions are to some degree complementary.In addition,to further clarify the specific path through which religious atmosphere reduces the cost of equity capital,we use Wen’s(2004)method of intermediary effect to verify that religious atmosphere reduces the cost of equity capital by influencing the quality of accounting information,investment decisions and the disclosure of social responsibility.Our study helps market practitioners to understand the role of religion in emerging markets and provides new micro-empirical evidence from China that may affect religious policy.

Our study,of course,has limitations,which may indicate future research directions.First,methods for effectively and reasonably measuring religious traditions need further development.Although this study uses quasi-firm-level religious variables based on geographic proximity,these variables have some limitations.For example,in some areas that have a strong religious atmosphere(such as Guangdong Province),only a small number of temples have been rated as ‘‘major temples,” indicating that the religious atmosphere variable does not fully reflect the actual religious beliefs in that area.Furthermore,field surveys need high inputs and are characterized by weak data replicability,which creates enormous challenges for accurate measurements of religious atmosphere.Second,we find that our selected mediation variables only partially explain the channels through which religion affects the cost of equity capital of listed companies,indicating that religion may also affect the behavior of listed firms through other channels(such as the choice of accounting firms)and thus affect the cost of equity capital indirectly.Finally,we only explore the influence of local religions on the cost of equity capital;we do not study the influence of other religions in China such as Islam,Christianity or Catholicism on the cost of equity capital.More detailed studies of the comparative influence of different religions on the cost of equity capital are needed.

Acknowledgments

We acknowledge financial support from the National Natural Science Foundation of China(No.71502115)and the Graduate Innovation Fund of Shanghai University of Finance and Economics(No.CXJJ-2016-306).All of the remaining errors and omissions are our own.

Appendix A:Estimation of expected earnings

Appendix B:Pearson correlations among five ex-ante measures of ICC

Allen,F.,Qian,J.,Qian,M.,2005.Law,finance and economic growth in China.J.Financ.Econ.77(1),57–116.

Bernile,G.,Bhagwat,V.,Rau,P.R.,2017.What doesn’t kill you will only make you more risk-loving:Early-life disasters and CEO behavior.J.Financ.72,167–206.

Botoson,C.,Plumlee,M.,2002.A re-examination of disclosure level and expected cost of equity capital.Account.Rev.40(1),21–53.

Brammer,S.,Williams,G.,Zinkin,J.,2007.Religion and attitudes to corporate social responsibility in a large cross-country sample.J.Business Ethics 71(3),229–243.

Breusch,T.S.,Pagan,A.R.,1979.A simple test for heteroskedasticity and random coefficient variation.Econometrica 47(5),1287–1294.

Bunkanwanicha,P.,Fan,J.P.H.,Wiwattanakantang,Y.,2013.The value of marriage to family firms.J.Financ.Quant.Anal.48(2),611–636.

Butler,A.W.,2008.Distance still matters:Evidence from municipal bond underwriting.Rev.Financ.Stud.21,763–784.

Callen,J.L.,Fang,X.,2015.Religion and stock price crash risk.J.Financ.Quant.Anal.50(1–2),169–195.

Callen,J.L.,Morel,M.,Richardson,G.,2011.Do culture and religion mitigate earnings management?Evidence from a cross-country analysis.Inter.J.Disc.Gov.8(2),103–121.

Chen,D.,Hu,X.,Liang,S.,Xin,F.,2013.Religion tradition and corporate governance.Econ.Res.J.9,71–84(in Chinese).

Chen,H.,2003.A brief overview of law and religion in the People’s Republic of China.Brigham Young Uni.Law Rev.29(2),465–474.

Chen,J.,Fei,X.,2015.The comparative study of confession thought between Buddhism and Christianity.J.Buddhism Res.3,146–151(in Chinese).

Chen,Y.,2015.Social networks and enterprise efficiency:Evidence based on the position of structure hole.Account.Res.1,48–55(in Chinese).

Conroy,S.J.,Emerson,L.N.,2004.Business ethics and religion:Religiosity as a predictor of ethical awareness among students.J.Business Ethics 50(4),383–396.

Cornwall,M.,Albrecht,S.L.,Cunningham,P.H.,Pitcher,B.L.,1986.The dimensions of religiosity:A conceptual model with an empirical test.Rev.Relig.Res.27(3),226–244.

Davis,J.H.,Schoorman,F.David,Donaldson,Lex,1997.Toward a stewardship theory of management.Academy of Manage.Rev.22,20–47.

Dechow,P.M.,Sloan,R.G.,Sweeney,A.P.,1995.Detecting earnings management.Account.Rev.70(2),193–225.

Du,X.,2013.Does religion matter to owner-manager agency costs?Evidence from China.J.Business Ethics 118(2),319–347.

Du,X.,Jian,W.,Du,Y.,Feng,W.,Zeng,Q.,2014a.Religion,the nature of ultimateowner,and corpora tephilanthropic giving:Evidence from China.J.Business Ethics 123(2),235–256.

Du,X.,Jian,W.,Lai,S.,Du,Y.,Pei,H.,2014b.Does religion mitigate earnings management?Evidence from China.J.Business Ethics 124(3),485–507.

Dyreng,S.D.,Mayew,W.J.,Williams,C.D.,2012.Religious social norms and corporate financial reporting.J.Business.Financ.Accoun.39(7–8),845–875.

Easton,P.,2004.PE ratios,PEG ratios and estimating the implied expected rate of return on equity capital.Account.Rev.79(1),73–95.

El Ghoul,S.,Guedhami,O.,Ni,Y.,Pittman,J.,Saadi,S.,2012.Does religion matter to equity pricing?J.Business Ethics 111(4),491–518.

Ferguson,M.A.,2009.Communicating with risk takers:A public relations perspective.Public Relations Res.Annual.3,195–224.

Gebhardt,W.,Lee,C.,Swamina than,B.,2001.Towards an implied cost of capital.J.Account.Res.39(1),135–176.

Guiso,L.,Sapienza,P.,Zingales,L.,2003.People’s opium?Religion and economic attitudes.J.Mone.Econ.50(1),225–282.

Gul,F.,Srinidhi,B.,Ng,A.C.,2011.Does Board Gender Diversity Improve the Informativess of Stock Prices.J.Account.Econ.51,314–338.

Hail,L.,Leuz,C.,2006.International differences in the cost of equity capital:Do legal institutions and securities regulation matter?J.Account.Res.44(3),485–531.

Helmke,G.,Levitsky,S.,2004.Informal institutions and comparative politics:A research agenda.Perspect.Politics 2(4),725–740.

Hao,D.,Wang,J.,2015.Does auditor’s industry specialty reduce the company’s cost of equity capital?Based on the analysis of legal environment and property nature.J.Financ.Econ.Res.3,132–144(in Chinese).

Hilary,G.,Hui,K.W.,2009.Does religion matter in corporate decision making in America?J.Financ.Econ.93(3),455–473.

Hou,K.,van Dijk,M.A.,Zhang,Y.,2012.The implied cost of capital:A new approach.J.Account Econ.53,504–526.

Jong-Hag,C.,Woo-Jong,L.,2014.Association between Big 4 auditor choice and cost of equity capital for multiple-segment firms.Account.Financ.54(1),135–163.

Kima,J.,Mary,L.Z.M.,Wang,H.,2015.Financial development and the cost of equity capital:Evidence from China.China J.Account.Res.8(4),243–277.

Larcker,D.F.,So,E.C.,Wang,C.Y.,2013.Boardroom centrality and firm performance.J.Account.Econ.55(2–3),225–250.

Li,S.,Zhao,Y.,Tong,J.,2013.Does a social responsibility report reduce the cost of equity capital?Accout.Res.9,64–70(in Chinese).

Li,T.,Huang,C.,He,X.,Zhou,K.,2008.What influences the social trust level of the residents?Econ.Res.J.1,137–152(in Chinese).

Li,X.,Liu,X.,2012.CEO vs CFO:Gender and stock price crash risk.World Econ.12,102–129(in Chinese).

Malloy,C.J.,2005.The geography of equity analysis.J.Financ.60(2),719–755.

Mao,X.,Ye,K.,2012.Measurement and evaluation of company’s cost of equity capital-based on the empirical inspection in Chinese security market.Accout.Res.11,12–22(in Chinese).

McGuire,S.T.,Omer,T.C.,Sharp,N.Y.,2012.The impact of religion on financial reporting irregularities.Account.Rev.87(2),645–673.

Miller,A.S.,Hoffmann,J.P.,1995.Risk and religion:An explanation of gender differences in religiosity.J.Scien.Stud.Relig.34(1),63–75.

North,D.C.,1990.Institutions,Institutional Change and Economic Performance.Cambridge University Press,Cambridge.

Omer,T.C.,Sharp,N.Y.,Wang,D.D.,2016.Do local religious norms affect auditorsgoing concern decisions?J.Business Ethics132(1),1–21.

Osoba,B.,2003.Risk preferences and the practice of religion:Evidence from panel data.Working Paper,West Virginia University.

Pan,L.,Zhong,C.,2016.Go to church or go for bank loan?–Micro-empirical evidence of interconnectedness between religion and financial behavior.China Econ.Quart.1,125–148(in Chinese).

Renneboog,L.,Spaenjers,C.,2012.Religion,economic attitudes,and household finance.Oxford Econ.Papers 64,1–103.

Richardson,S.,2006.Over-investment of free cash flow.Rev.Account.Stud.11(2),159–189.

Romilda,M.,Stefania,V.,2014.The relationship between corporate governance and the cost of equity capital.Evidence from the Italian stock exchange.J.Manage.Govern.18(2),419–448.

Ruan,R.,Liu,L.,2011.China’s rural informal social security supply research.Manage.World 4,46–57(in Chinese).

Shi,R.,Chen,D.,2014.Flowers of intent and the entity of the lotus–Art comparative study of Buddhism and Christianity.J.Art Res.3,172–173(in Chinese).

Shu,T.,Sulaeman,J.,Yeung,P.E.,2012.Local religious beliefs and mutual fund risk-taking behaviors.Manage.Sci.58(10),1779–1796.

Stephen,P.F.,Javakhadzeb,D.,Rajkovicc,T.,2017.The international effect of managerial social capital on the cost of equity.J.Banking Financ.64,69–84.

Sunder,J.,Sunder,S.V.,Zhang,J.,2017.Pilot CEOs and corporate innovation.J.Financ.Econ.123,209–224.

Sunstein,C.R.,1996.Social norms and social rules.Columbia Law Rev.96(4),903–968.

Wen,Z.,Zhang,L.,Hou,J.,Liu,H.,2004.Intermediary effect inspection procedures and its application.J.Psych.5,614–621(in Chinese).

Wines,W.A.,Napier,N.K.,1992.Toward an understanding of cross-cultural ethics:A tentative model.J.Business Ethics 11,831–841.

Williamson,O.E.,2000.The new institutional economics:Taking stock,looking ahead.J.Econ.Literature 38(3),595–613.

Xu,L.,Lai,D.,Xin,Y.,2015.Unsustainable burden:The research of economic consequences of executives’marriage crisis.Manage.World 5,117–133(in Chinese).

Yakov,A.,Allaudeen,H.,Kang,W.,Zhang,H.,2015.Stock liquidity and the cost of equity capital in global markets.J.Appl.Corp.Financ.27(4),68–74.

Yang,F.G.,2010.Religion in China under communism:A shortage economy explanation.J.Church State 52(1),3–33.

Yang,Q.,2007.Religion in Chinese Society.Shanghai People Press,Shanghai.

Yao,W.,2004.Comparison of the ‘‘god” concept in Buddhism and Christianity.J.Shaanxi Normal Uni.3,31–36(in Chinese).

You,J.,Liu,C.,2011.Embeddedness perspective of entrepreneurs’social capital and cost of equity capital:The empirical evidence from China’s private listed companies.Chinese Ind.Econ.6,109–119(in Chinese).

Zhou,Y.,Hu,A.,2014.Capital with Faith:A study on the charitable giving behavior of Wenzhou private entrepreneurs.J.Social Sci.Res.1,57–81(in Chinese).

Zhu,B.,2010.When Buddha meets Christ:Buddhism and Christian sociology comparison.Sci.Tribune 8,186–187(in Chinese).

杂志排行

China Journal of Accounting Research的其它文章

- Executive turnover in China’s state-owned enterprises:Government-oriented or market-oriented?

- Does independent directors’monitoring affect reputation?Evidence from the stock and labor markets☆

- Can material asset reorganizations affect acquirers’debt financing costs?–Evidence from the Chinese Merger and Acquisition Market☆