Can material asset reorganizations affect acquirers’debt financing costs?–Evidence from the Chinese Merger and Acquisition Market☆

2018-07-04QingquanTangHongwenHan

Qingquan Tang,Hongwen Han

Sun Yat-sen Business School,Sun Yat-sen University,China

Center for Accounting,Finance and Institutions,Sun Yat-sen University,China

1.Introduction

Merger and acquisition(M&A)transactions are a widely discussed issue in research on capital markets.Earlier academic research mainly focuses on the motivation for conducting M&As,including obtaining business synergies,consolidating market position,and building a ‘‘commercial empire” (Jensen and Ruback,1983;Mullin,1995;Martynova and Renneboog,2006).The recent literature focuses on whether M&A transactions create wealth value in stock markets,and explore the determinants of this value-creation(Zhang,2003;Martynova and Renneboog,2011;Cai and Sevilir,2012;Tian et al.,2013;Chen et al.,2013a;Kravet,2014;Mateev,2017).However,there is little research on the economic consequences of M&As in debt markets.In thispaper,we investigate whether and how material asset reorganizations(MARs),1According to the management regulation of material asset reorganizations(MARs)of listed companies issued by the China Securities Regulatory Commission(CSRC),a M&A transaction is identified as a MAR if it meets one of the following standards.(1)The total assets purchased by the acquirer account for over 50%of its year-end total assets of the audited consolidated financial statement in the latest fiscal year.(2)The sale in come from the assets purchased by the acquirer in the latest fiscal year accounts for over 50%of its sale in come of the audited consolidated financial statement in the same period.(3)The net assets purchased by the acquirer account for over 50%of its year-end net assets of the audited consolidated financial statement in the latest fiscal year,and the value of purchased net assets is more than 50 million RMB.a special form of M&A transactions,can affect acquirers’ex post debt financing costs.

The theoretical and empirical literature(e.g.,Wang et al.,2014)shows that the cost of debt financing is directly related to borrowing firms’credit risk.Research also finds that creditors rely on the collateral and the quality of accounting information to reduce credit risk and manage loan protection(Chen et al.,2013b;Wang et al.,2014;Pan and Tian,2016).The MAR is a special form of M&A and has a much higher magnitude than conventional M&A transactions.Thus,MAR implementation could mean that a large amount of assets flow to the acquirer from the target firm,enabling the acquirer to possess considerably greater asset collateral.This would reducedebt financing frictions,lowering the ex post cost of debt.In capital markets,accounting information serves as a crucial‘‘bridge” between a corporation and its investors,because it reflects the firm’s financial status,operating results and changes in cash flow.When the accounting information is of high quality,it indicates that the firm’s true financial information is reflected to a large extent,so external investors can rely on financial statement numbers and use them to reduce information risk and make rational investment decisions.As a result,the firm’s accounting information quality is negatively associated with its debt financing cost(Francis et al.,2005;Spiceland et al.,2016).In addition,when the acquiring firm’s accounting information quality is higher,MAR implementation can more effectively reduce debt financing costs,because detailed acquisition information must be disclosed to meet China Securities Regulatory Commission(CSRC)requirements,and newly added asset collateral in the MAR transaction is incremental in perfect information environments.

In this paper,we focus on China’s capital market because it provides an excellent setting for our research questions.First,the use of collateral to mitigate agency conflicts is more critical and widespread in emerging markets because the information environment is relatively opaque,and liquidation payoffs and competition between capital suppliers are lower than in developed markets(Chen et al.,2013b;Pan and Tian,2016).Lu et al.(2008)and Chen et al.(2013b)argue that borrowing firms’accounting information quality can be another effective tool to alleviate debt agency problems in emerging markets,where laws,institutions,and enforcement efforts are generally weak.Collectively,the asset collateral and accounting information quality of borrowing firms are key factors that affect their debt financing cost in emerging markets(Wang et al.,2014).China has the largest emerging capital market.Unlike developed capital markets such as the United States and Europe,it still suffers from poor legal enforcement and weaker information circumstance,although it has grown tremendously,and the invest or protection system is gradually being standardized(Li et al.,2013).Therefore,studying the debt-cost effect of asset collateral and accounting information quality in China’s capital market is highly relevant and meaningful.Second,under pressure to transform and upgrade China’s macro industrial structure,the Chinese government has enacted many policies to promote M&A activities in enterprises.Therefore,M&A transactions are increasing rapidly in the capital market,both in terms of the number of transactions and the size of each transaction(Han and Tang,2017).These large-scale M&A activities involve a substantial influx of assets and information disclosure,providing an appropriate scenario and sample to investigate the effect of asset collateral and accounting information quality on debt financing cost.

We use a sample of 2213 M&A transactions by listed companies in the Chinese A-share market from 2008 to 2014.We find that MARs have a significant negative effect on acquiring firms’ex post debt financing costs.The results are robust when various proxies for debt cost are used.Furthermore,we show that this association is driven by newly added assets and collateral,suggesting that MARs can improve acquiring firms’asset collateral,and subsequently reduce the cost of debt.Moreover,we provide direct evidence that acquiring firms’accounting information quality is negatively associated with their debt financing cost,which supports findings in the literature on the M&A lieu.In addition,we show that the effect of MARs on the cost of debt is more pronounced when acquiring firms’accounting information quality is higher,indicating that accounting information quality has a spillover effect on the debt-cost impact of MARs.

Our study makes several contributions to the literature.First,we contribute to the M&A literature by examining whether MAR transactions affect acquiring firms’ex post debt costs.Studies have explored the motivation for M&As and proposed several theories(e.g.,business synergy,transaction costs,market power,agency problem).A growing body of recent literature discusses whether M&As can create value in stock markets,and the factors that determine this value-creation.However,there is little evidence on the consequences of M&A transactions in debt markets.In this paper,we investigate the association between MARs and acquirers’debt costs,and provide new insights into the economic outcomes of M&As.

Second,our paper adds to the literature on debt financing.Debt financing is an important and flexible channel for external corporate financing(Norden and van Kampen,2013;Li et al.,2013).From a practical perspective,debt financing constitutes a large fraction of a firm’s external financing,and bank loans are particularly important.Chinese researchers have focused more on the scale and maturity of debt financing,but have not paid as much attention to the cost of debt financing(Wei et al.,2012).The cost of debt is directly related to the firm’s interest expense and net profit,and it affects the firm’s business operations,investment activities and financing ability(Weiet al.,2012;Chen and Wang,2016).It is thus important to study the cost of corporate debt financing.We focus on the Chinese M&A market,a typical emerging market,and analyze the effect of MARs on acquirers’debt financing costs.The conclusions of this paper enrich both the debt financing literature and M&A theory in emerging markets.

Finally,our study contributes to the corporate disclosure literature by examining the economic consequences of financial reporting quality,specifically the direct and indirect effects of financial accounting quality on debt costs.This question is important and relevant to both finance and accounting research because it addresses the functions that accounting serves in financial markets.In their literature review on corporate disclosure,Leuz and Wysocki(2016)point out that the economic consequences of financial reporting require further investigation.In this paper,we study the effect of accounting information quality on debt cost in China’s M&A market,and show that acquirers’accounting information quality has a direct effect on debt cost and an indirect effect on the association between the MARs and debt costs.These conclusions will stimulate related research on the economic outcomes of financial accounting.

The remainder of this paper is organized as follows.Section 2 provides a literature review.Section 3 develops the hypotheses.Section 4 discusses our research design.Section 5 presents the results of our empirical tests,and Section 6 concludes the paper.

2.Literature review

This paper investigates how MARs and accounting information quality affect the debt financing costs of acquiring firms.In the following discussion we review two streams of literature pertinent to our research questions.

2.1.The motivation and value-creation of M&A transactions

Literature from the last few decades related to M&As mostly focuses on the motivation for M&As,exploring whether these transactions create value and the factors that determine this value-creation.Earlier studies focus on examining the motivation for M&As and introduce theories such as efficiency theory(Jensen and Ruback,1983),agency theory(Jensen and Mecking,1976)and market power theory(Mullin,1995).Efficiency theory states that M&A transactions are used to obtain synergies in areas such as management,marketing,operation and finance.From the perspective of agency conflicts,firm managers might conduct M&A transactions to earn private interests such as on-the-job consumption and promotion opportunities.Market power theory argues that firms can use M&As to weaken industrial competition and enhance the market power of their products to obtain monopoly profits.Yu and Wang(2015)show that the main motivations behind Chinese capital market firms’M&As are to eliminate losses,and allow for back door listing and delisting avoidance.

The more recent literature focuses on whether M&A transactions can create value in stock markets,and the factors that drive this value-creation.Empirical results show that M&A transactions can create positive abnormal returns for target firms.However,there is still uncertainty about value-creation for the acquirers’shareholders in developed markets(e.g.,Sirower,1997,Campa and Hernando,2006;Martynova and Renneboog,2011;Intrisano and Rossi,2012;Mateev,2017).Findings in the Chinese market indicate that M&As fail to createvalue for acquirers(Zhang,2003;Liand Zhu,2006).In recent years,a burgeoning literature has begun to explore the factors affecting this value-creation(or lack thereof),including the internal characteristics and external environment of the acquirers.Internal characteristics include ownership structure(Bhaumik and Selarka,2012),board governance(Cai and Sevilir,2012;Chen et al.,2013a;Wang and Hu,2014),political associations(Liu et al.,2016),managers’characteristics(Chikh and Filbien,2011;Wang,2016;De Desar et al.,2016)and internal control(Zhao and Zhang,2013).External environmental factors include government intervention(Wang and Gao,2012),market-oriented systems(Wang and Nie,2016),and industrial clusters(Li et al.,2016).

2.2.The determinants of debt financing costs

Debt financing is a vital part of a firm’s external financing.It enables the firm to meet the capital demands of its business operation and to invest,but also facilitates and optimizes its corporate governance mechanisms,for instance by constraining the incentive for over-investment(Watts,2003).However,the high cost of debt financing can aggravate the firm’s interest burden,lower its profitability and exacerbate financing constraints,which consequently influence the firm’sbusiness operations and investment activities.Studies(e.g.Jiang,2009;Chen et al.,2016;Chui et al.,2016)argue that the cost of debt financing is determined by firms’internal features(for instance financial reality,corporate governance,accounting information,internal control and audit opinion)and external environment(for instance government intervention,financial ecological condition and public pressure).

In this paper,we are particularly interested in the role of accounting information quality in lowering the cost of debt.Francis et al.(2005)find that when faced with borrowing firms’relatively poor accruals quality,which increases information risk and is detrimental for mapping accounting earnings into cash flows,creditors demand a higher capital risk premium.Their empirical result shows that firms with bad accruals quality are prone to paying higher debt costs than firms with good accruals quality,consistent with their prediction that accounting quality is priced by the debt market.Li and Wang(2011)find that the higher the quality of accounting information,the lower the information asymmetry and the cost of debt financing.Spicel and et al.(2016)show that firms’financial reporting quality is more important than strict debt covenants in lowering debt cost,although debt covenant design can help mitigate adverse information risk.In addition,Zhang(2008)finds that creditors provide capital with lower interest rates to more conservative borrowers, supporting the argument by Watts(2003)that accounting conservatism can enhance efficiency in the debt contracting process.Wang and Li(2016)also show that accounting conservatism can mitigate the agency problems between borrowing firms and creditors,and reduce creditors’monitoring costs,and thus has a negative effect on debt cost.

Based on the literature review,we identify several questions that require further examination.First,the literature on M&As has concentrated heavily on the motivations for M&A transactions,whether M&A transactions create value in the stock market and the factors that affect this value-creation.However,few studies have explored the economic outcomes of M&As in the debt market.Second,as Wei et al.(2012)point out,alongside the scale and maturity of debt financing,the cost of debt financing is a key dimension in debt contracting.However,researchers have long overlooked this topic.There is also little evidence to date on the association between the cost of debt financing and MARs.Third,because accounting information serves as a critical channel for communication between the firm and its external decision makers,the quality of accounting information can bean important tool to mitigate information asymmetry and lower the cost of debt.In the Chinese market context,the CSRC requires the acquiring firm to disclose detailed acquisition information when conducting a MAR transaction.If the firm produces high-quality accounting information,the disclosed information should have a higher degree of credibility,which can strengthen the negative effect of an MAR transaction on the cost of debt.Accordingly,our paper addresses these previously unexplored questions by examining how MARs and accounting information quality affect acquirers’debt financing costs.

3.Hypothesis development

Debt financing is the predominate source of external funding for firms with capital demands.Because creditors are not involved in the day-to-day business operations of borrowing firms,the situation generates asymmetric information that results in a trade-off between creditors and debtors.For creditors,the concern is whether the borrowing firms can make repayments on the interest and principal in time.However,in the presence of information asymmetry,two primary imperfections arise:adverse selection(the borrowers’tendency to withhold value-relevant unfavorable information)and moral hazard(the borrowers have risk-shifting incentives and change the use of funds from creditors or the promised direction of corporate investment in debt contracting).Such conflicts will mean risk for creditors(Li and Wang,2011).

To reduce this credit risk triggered by asymmetric information,the collateral has been extensively used in debt markets around the world.Bonfim(2005)demonstrates the key role of collateral in risk management.It can serve as a screening device to cope with adverse selection, or provides an incentive to reduce moral hazard.The argument about adverse selection focuses on ex ante private information.Studies show that because it is private information and not fully accessible to creditors,high-quality borrowing firms tend to voluntarily provide collateral to signal their low risk in the hope that they can obtain debt with lower interest rates(Jiménez et al.,2006).In terms of the moral hazard problem,studies find that observably riskier borrowers are more likely to be required to provide collateral(Boot et al.,1991;Han et al.,2009).Berger et al.(2011)provide empirical support for these arguments by showing that the ex post theory of collateral is relatively dominant,although both exist.Duarte et al.(2016)use data from Portugal and find that compared to borrowers with a high default risk,good borrowers are more likely to provide collateral as a signal to obtain lower interest rates.Furthermore,creditors require greater collateral and higher interest rates for riskier borrowers to safeguard their capital.

Debt agency problems in the Chinese capital market might be more severe due to the opaque information environment,lower liquidation payoffs and lower competition between capital suppliers(Chen et al.,2013b;Li and Wang,2013;Pan and Tian,2016).As a result,the use of collateral becomes more critical for obtaining debt financing with favor able interest rates.In recent years,several researchers in China have analyzed the role of collateral in firms’debt financing.Empirical results indicate that high-quality borrowers are more inclined to provide collateral to demonstrate their creditworthiness.In doing so,the adverse selection problem can be mitigated and firms can obtain lower interest rates.Alternatively,creditors require borrowing firms with low credit ratings to provide greater collateral and pay higher risk premiums to reduce moral hazard and protect their interests in case of a breach of the debt contract(Ping and Yang,2009;Yin and Gan,2011).Wang et al.(2014)show that the credit risk in China’s debt market can be dispersed using asset collateral and accounting information quality.

MARs are usually regarded as a denotative extended pattern for firms to realize rapid expansion, because in MARs the magnitude of asset transaction is significantly larger than in conventional M&A activities.As a result,the successful implementation of a MAR is always likely to trigger the adjustment of business boundaries(Chang et al.,2014),and it generates tremendous asset flows from the target firm to the acquiring firm.More importantly, this flow enables the acquirer to possess greater asset collateral,and even more than if they had undertaken a conventional M&A transaction.As widely discussed in other studies(e.g.,Han et al.,2009;Duarte et al.,2016)collateral is an important external mechanism to ensure creditors’benefits.It can restrain the borrowing firms’moral hazard and thus reduce the risk premium demanded by creditors.At the same time,the collateral addresses adverse selection problems arising from the information gap between creditors and borrowers.Therefore,borrowing firms are more likely to pledge asset collateral as a signal of their low risk type to achieve lower debt financing cost.Overall,we suggest that acquiring firms conducting MARs are more likely to achieve lower cost debt financing.This leads to the following hypothesis:H1a.MAR transactions are negatively associated with acquirers’debt financing costs.

In MAR transactions it is difficult for acquiring firms to use their own cash to implement these activities,because the transaction amounts are extremely large.To address this problem,the acquiring firms adopt many methods(for in stance they might is sue stock publicly or privately,and absorb direct investment)to realize the acquisitions of target assets.To support enterprises to achieve industry transformation through MARs,the Chinese government has established many policies,such as MAR Supervision Regulation of Listed Companies,the Applicable Suggestions on Articles 14 and 44 in MAR Supervision Regulation of Listed Companies–No.12 Applicable Law to Securities and Futures,Revision of the Regulation Relating to MAR and Supporting Funds of Listed Companies,The Regulation of Issuing Shares to Purchase Assets in MAR.2When carrying out an MAR transaction,the listed acquiring firm could issue stocks to purchase target assets and at the same time raise part supporting funds to improve the integration performance of the acquisition project.If the proportion of these supporting funds does not exceed 100%of the total transaction amount,the MAR transaction should be approved by the M&A audit committee,and if it is more than 100%,it should be approved by issuance examination committee.Furthermore,the CSRC stipulates that to promote business or industrial integration and enhance synergy effects,the listed acquirer firm can issue stocks to purchase target assets for special objects excluding the controlling shareholder,the actual controller,or its related-party under the limited condition of no change in control right,but the number of issued stocks must be more than 5%of the total capital stock of the listed acquirer firm after stock issuance.If it is less than 5%,the total purchasing asset amount of the listed acquiring firms on the main board and small and medium-sized boards of the China capital market must be not less than 100 million RMB,and 50 million RMB on growth enterprises market board.These policies and regulations have greatly encouraged enterprise participation in MAR transactions.Between 2007 and 2013,76%of listed companies in China used stocks to complete their MARs,and funds raised through these stock issuances reached 887.426 billion RMB,accounting for 72%of the total MAR market asset transaction amount(Chang and Hou,2015).Xu et al.(2016)show that 84%of acquiring firms in MAR transactions choose the private placement approach to raisefunds,and the raised funds are more than the total transaction amount of the MARs.These studies indicate that acquirers undertaking MAR transactions obtain target assets but also acquire a sizeable quantity of assets through supporting funds.These newly added assets can be helpful in improving the acquirers’collateral size,which can mitigate the credit risk from information asymmetry and thus result in lower debt costs.

More specifically,because creditors do not have the same information as borrowers,the selection of credit worthy candidates could be difficult(Karapetyan et al.,2014).Nevertheless,creditors have recognized the risk-mitigation effect of collateral:it can help reduce their potential loss from defaults.Consequently,creditors provide a range of contracting terms so that high(low)quality borrowing firms choose secured(unsecured)debt at lower(higher)risk premiums(Chen et al.,2013b).At the same time,high-quality borrowers are more inclined to provide asset collateral and signal their creditworthiness,which is usually private information and imperfectly provided to creditors(Han et al.,2009;Duarte et al.,2016).Overall,the use of collateral is helpful to mitigate ex ante and ex post informational problems.The empirical literature has shown an inverse association between collateral and the cost of debt(Berger et al.,2011;Cerqueiro et al.,2016).Based on these studies,we predict that as a result of MAR implementation,a large amount of assets flow into acquiring firms.This enables the acquirers to gain greater collateral and reduce the cost of debt financing.Accordingly,we propose the following hypotheses:

H1b.The newly added assets from MAR transactions are negatively associated with acquirers’debt financing costs.

H1c.The newly added collateral from MAR transactions is negatively associated with acquirers’debt financing costs.

In debt financing,creditors lend capital to borrowing firms in return for promised principal and interest payments,and leave the control of operations to borrowing firms’shareholders and managers as long as the execution of debt contracting is satisfactory(Spiceland et al.,2016).The information asymmetry between creditors and borrowers is prevalent in debt markets because creditors lack reliable information about borrowers.As a result,creditors face informational problems such as adverse selection and moral hazard,which make it difficult to assess borrowers’investment projects and monitor opportunistic behaviors(García-Teruel et al.,2014).Thus,when creditors lend capital to borrowers they tend to rely on all available information to assess the borrowers’income-generating ability,the ability to fulfill interest and principal payment obligations in the future(Spicel and et al.,2016).

Accounting information is a primary source of information for creditors(Sengupta,1998).High quality accounting information can more accurately reflect a firm’s operational performance and financial status.Consequently,it allows creditors to evaluate the potential return of investment opportunities and monitor the use of their capital once committed in the debt market(Beyer et al.,2010).

Studies have shown that the quality of borrowers’accounting information can affect creditors’estimates of future cash flows,and debt repayments are serviced from these flows(Bharath et al.,2008).Creditors use this accounting information to estimate borrowers’expected future cash flows and assess their repayment ability.Reliable financial reporting is thus essential for borrowers to reduce the level of information asymmetry and mitigate adverse selection problems.Empirical studies have found that poorer borrowing firm accounting quality hinders the ability to map accounting earnings into cash flows and increases creditors’information risk,leading to a higher risk premium(e.g.,Francis et al.,2005;Li and Wang,2011).Because accounting earnings are a main source of cash flow and the control rights are shifted from borrowers to creditors when accounting-based debt covenants are violated,borrowing firms have incentives to conduct earnings management.Ma et al.(2015)document that creditors(especially banks)can discern borrowing firms’earnings quality using their accounting information.When the quality of accounting earnings is high,the possibility that borrowers have manipulated their earnings is low.The accounting earnings are thus reliable and the information risk faced by creditors is low.As a result,the higher the quality of accounting information provided by borrowers,the lower the debt cost demanded by creditors(Spicel and et al.,2016).

At the same time,high quality accounting information is positively associated with creditors’ability to monitor management activities,and can thus reduce managerial incentives to engage in value-destroying activities such as empire building.Accounting information is an important source of firm-specific information for external investors and is thus widely used by creditors to monitor borrowers(Costello et al.,2011).In summary,high quality accounting information is an important mechanism to communicate borrowers’information to creditors and to facilitate debt monitoring.

Building on the literature,our study focuses on the M&A setting and investigates the effects of accounting information quality on debt costs.We measure accounting quality using the magnitude of adverse operating accruals.Larger abnormal operating accruals suggest unexpected deviations between earnings and operating cash flows,which makes it harder for creditors to estimate future operating cash flows.Accordingly,we argue that high-quality accounting information about acquiring firms could mitigate debt agency problems by reducing information asymmetry(information risk).Asa result,we assume that the higher the acquiring firms’accounting information quality,the lower the debt cost required by creditors.

H2.The accounting information quality of acquirers is negatively associated with their debt financing cost.

According to the limited attention theory of the capital market,investors tend to screen firms when making investment decisions about a large body of companies due to limited time and personal stamina.They select investment portfolios from these screened firms.A MAR transaction involves a larger scale of asset acquisition than a conventional M&A,and thus has a significant influence on the acquiring firm’s main business operations.In general,MAR transactions signal investment opportunities and thus attract investors’attention in capital markets.

Furthermore,the CSRC has stringent requirements for information disclosure by acquiring firms in MAR transactions.When announcing an MAR,the acquiring firm must provide an overview of the acquisition,which includes background and incentive,transaction content,target value estimate and whether the transaction is a related-party transaction or a backdoor listing.Moreover,the acquirer must provide information about the target firm such as operating status,property control relationship,main business development,financial condition and target asset details.The acquirer must also reveal the potential influence of the MAR on its business operations,profitability,ownership structure and peer competition.Finally,the acquirer must mention risk factors that could exist in this transaction,and present the opinions of independent directors and audit opinions of independent financial consultants about the transaction.

If the acquisition disclosure in the MAR announcement is reliable,it saves external investors’information acquisition costs and reduces information asymmetry.As noted above,firms with high accounting quality tend to have a reputation for faithful and accurate disclosures.Creditors find it less likely that these firms will withhold adverse private information,and are more likely to consider them creditworthy candidates.In summary,we suggest that when acquiring firms’accounting information quality is high,it is helpful to strengthen creditors’confidence about the reliability of the acquisition information and newly added assets disclosed in the MAR transactions.This will further reduce the information asymmetry between acquirers and creditors,and enable creditors to more accurately analyze future investment returns,resulting in lower interest rates.We thus predict that acquiring firms’accounting information quality can reinforce the association between MARs and debt costs.

H3.The negative association between MARs and debt costs is stronger for acquiring firms with higher accounting information quality.

4.Research design

4.1.Sample selection and date sources

Our paper uses the M&A transactions of listed companies in the Chinese A-share market between 2008 and 2014 as the initial research sample.Following other studies(e.g.,Chen et al.,2013a;Kravet,2014;Han and Tang,2017),we use the following filter rules to select our sample.(1)Listed companies affiliated to the finance and insurance industry or labeled as ST and*ST are excluded.(2)Observations with missing variables or negative net assets are omitted.(3)In consideration of date availability,we only select the buyer in M&A transactions and the buyer is a listed company.(4)Given that M&As can affect the acquiring firm’s business activities,we exclude transaction amounts lower than 10 million RMB.(5)Debt restructuring,corporate divestiture or asset replacement M&As are omitted.(6)If the acquiring firm conducts many M&A transactions in a single year,the amounts involved in each M&A transaction are added together to create an annual acquisition amount of the acquiring firm and are included as one observation.

The M&A data are sourced from the CSMAR Database,and the MAR data are obtained from the CSRC website and then manually checked and processed.In addition,financial indexes and information data of listed companies are sourced from the CSMAR and WIND databases.We collect 2213 sample observations involving 1188 listed companies in the A-share market.The sample distribution is shown in Table 1.To mitigate the effect of outliers on our research results,all continuous variables are winsorized at the extreme 1%of their distributions,a widely adopted approach in the empirical corporate finance and accounting literature.

Table 1 Sample distribution.

4.2.Variable measurement

4.2.1.Material asset reorganization

4.2.1.1.MMA.we view a M&A as a MAR transaction when it meets any one of the three conditions in the MAR Supervision Regulation of Listed Companies issued by the CSRC(see Section 1).Using the information announcement in the CSRC website,the MMA index is manually selected,which equals one when the M&A conforms to the MAR standard,and zero otherwise.

4.2.2.Newly added asset and collateral

4.2.2.1.ADDASSET.We use the change in total assets before and after M&A to estimate the added assets(ADDASSET).More specifically,ADDASSET index is calculated as the difference between the assets of the acquiring firm one year after and one year before M&A transaction,divided by the assets of the acquiring firm one year before M&A transaction.

4.2.2.2.ACOLLATER.With reference to previous literature(Hall,2012;Norden and van Kampen,2013),we use the change in net fixed assets before and after M&A to measure the added collateral(ACOLLATER).Specifically,ACOLLATER index is estimated as the difference between the net fixed assets of the acquiring firm one year after and one year before M&A transaction,divided by the net fixed assets of the acquiring firm one year before M&A transaction.

4.2.3.Cost of debt financing

4.2.3.1.DCOST.In the literature,credit ratings of borrowing firms and the average yield to debt maturity are always used to measure the cost of debt financing.However,it is difficult to obtain authoritative credit ratings and yield to maturity information for China’s debt market.We therefore use interest expense as a proxy index DCOST to estimate borrowing companies’debt costs,consistent with previous studies(e.g.,Jiang,2009;Li and Liu,2009).Specifically,DCOST is calculated as the interest expense divided by the total debt of the acquiring firm one year after M&A transaction.

4.2.4.Accounting information quality

Following Francis et al.(2005)and Huang et al.(2014),we use discretionary accruals calculated using the modified DD model developed by Dechow and Dichev in 2002(hereafter DD)to measure the accounting information quality of listed companies,as follows:

where DAtis the ratio of total current accruals to the total assets of listed companies in year t,and the total current accruals is equal to net profit plus non-operating income less non-operating expense minus net operating cash flow.CFOt–1,CFOtand CFOt+1are cash flow from operations in year t–1,t and t+1 respectively,scaled by average total assets in year t.DCFO equals one if CFOtis less than CFOt–1,and zero otherwise.

4.2.4.1.ACCQ1.In other studies,the absolute residual value ABS_DA obtained from regression of model(1)is taken as the proxy variable for accounting information quality.If the ABS_DA value is greater,it indicates that the higher the unexpected deviations between earnings and operating cash flows,the lower the accounting information quality of listed companies.To simplify,we multiply ABS_DA by–1 to obtain a new continuous variable ACCQ1,so that the larger the ACCQ1,the higher the accounting information quality.

4.2.4.2.ACCQ2.To avoid the possible effects of ABS_DA’s outliers and measurement errors on our research results,with reference to the previous literature(e.g.,Pittman and Fortin,2004)we generate an indicator variable ACCQ2 that is set to one if ABS_DA is less than the median of full sample observations,indicating that the accounting information quality is high,and zero otherwise.

4.2.5.Control variables

Following previous studies(Bhojraj et al.,2003;Anderson et al.,2004;Jiang,2009),we select listed companies’financial characteristics including SIZE,LEV,ROA,GROWTH,INTANG,RECEIVE and corporategovernance structure including DUAL,FIRST and SOE as control variables to exclude the effect on debt cost.In addition,we control year and industry fixed effects.All of the variable definitions in this paper are summarized in Table 2.

Table 2 Variable definitions.

4.3.Empirical models

To avoid potential endogeneity problems between independent variables(e.g.,MMA,ACCQ1 and ACCQ2)and debt cost,and considering the hysteresis effect of the MAR,we follow other studies(e.g.,Han and Tang,2017)and choose the lagged debt cost DCOSTt+1as the dependent variable in our model design.

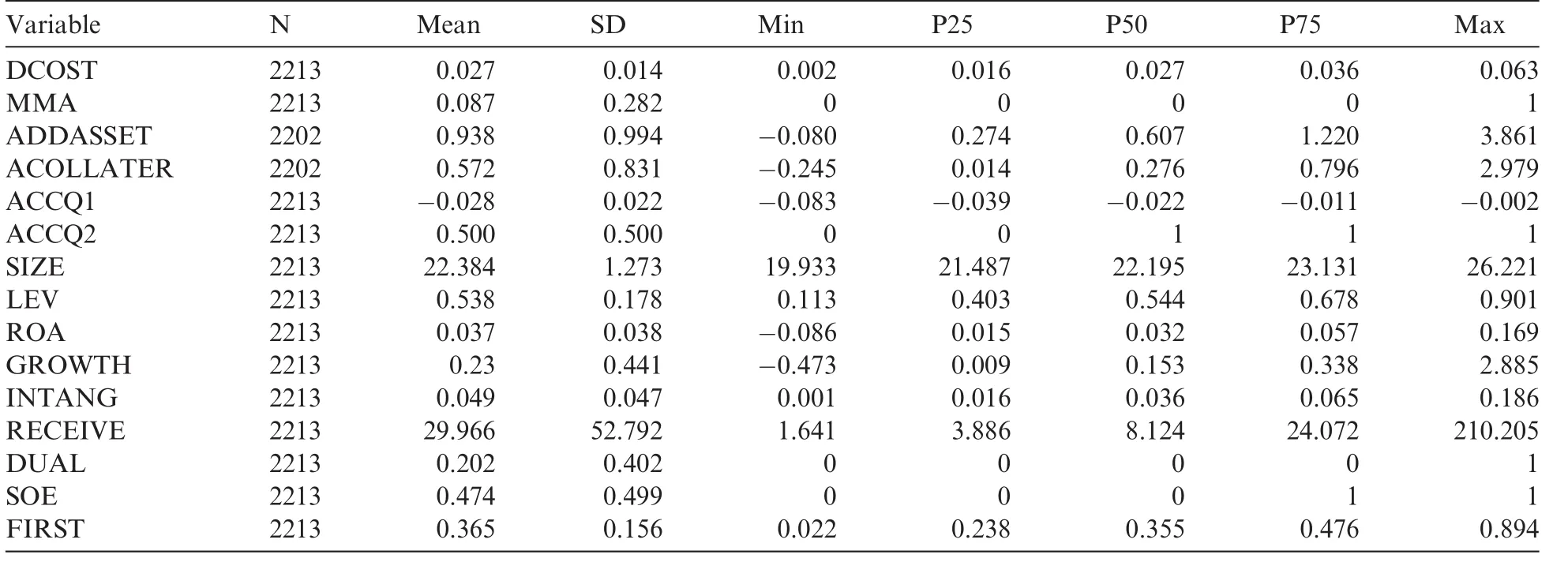

Table 3 Descriptive statistics.

To test our hypotheses,we estimate the following regressions:

where the dependent variable is the lagged debt cost DCOST,and CONTROL represents a vector of control variables(e.g.,SIZE,LEV,ROA,GROWTH,INTANG,RECEIVE,DUAL,FIRST and SOE),c is a constant,β′is estimated coefficient matrix of CONTROL and θ is regression residual.In model(2),α1is the estimated coefficient of independent variable MMA,and we expect α1to be significantly negative if H1ais true.In model(3),α2is the estimated coefficient of independent variable ADDASSET.We expectα2to be significantly negative if H1bis true.In model(4),α3is the estimated coefficient of independent variable ACOLLATER.We expectα3to be significantly negative if H1cis true.In model(5),α4is the estimated coefficient of independent variable ACCQ measured by two proxy variables ACCQ1 and ACCQ2.We expectα4to be significantly negative if H2is true.In model(5),we are interested in the estimated coefficient of interaction variable MMA*ACCQ and expect this coefficient α53to be significantly negative if H3is true.All of the variable definitions are shown in Table 2.

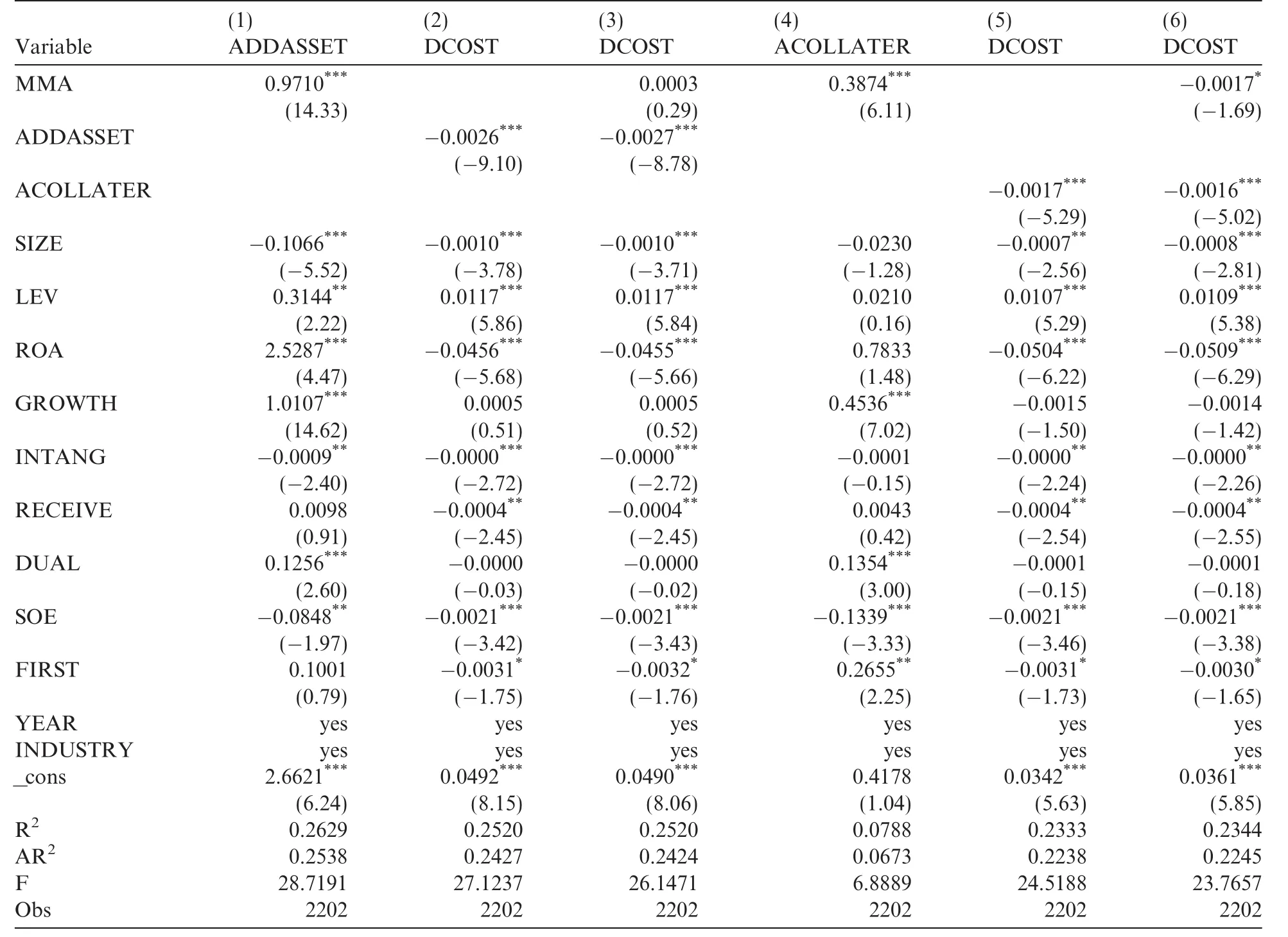

Table 4 Association between debt cost and MAR transactions based on model(2).

5.Empirical results

5.1.Descriptive statistics

Table 3 presents the descriptive statistics of our main variables.As in other studies(e.g.,Zou and Adams,2008;Jiang,2009),the mean and median values of DCOST are approximately 2.7%.However,there is an obvious difference between quantile values that could be related to MMA and AACQ.The mean value of MMA is 0.087,which indicates that 8.7%of sample firms engaged in MAR transactions between 2008 and 2014,consistent with the total result of sample distribution in Table 1.The mean value of SOE and DUAL is 0.474 and 0.202 respectively,which shows that 47.4%of sample firms are state-owned enterprises and firms in which the chairman and CEO positions are held by on person account for 20.2%of the total sample.Descriptive results for other variables are similar to previous studies(e.g.,Zou and Adams,2008;Huang et al.,2014).

Table 5 Effects of the added asset and collateral on debt cost based on model(3)and(4).

5.2.Mars and debt cost:The test results of H 1a,H 1b and H 1c

Table 4 presents the OLS regression results from model(2)above.In Column 1,we only consider the influence of control variables(e.g.,SIZE,LEV,ROA)on the debt costs of acquiring firms.We observe a negative association between acquirer size and debt cost.Acquirers with greater financial leverage have higher debt costs,and profit ability is negatively associated with debt cost.Acquirers with a higher proportion of intangible assets have higher debt costs,and the faster the turnover of accounts receivable,the lower the debt costs.These empirical results are in line with financial facts and consistent with other studies(e.g.,Zou and Adams,2008;Weiet al.,2012).In Column 2,we include the independent variable MMA on the basis of Column 1 and find that the estimated coefficient of MMA is–0.0026,which is significant at the 1%level.This result shows that MARshave a significant negative effect on the acquiring firms’ex post debt costsafter the effects of control variables are excluded and when year and industry fixed effects are controlled.This result indicates that MARs more effectively reduce acquirers’debt costs than conventional M&A transactions,so H1ais verified.

Table5 reports the OLS regression results from model(3)above.The estimated coefficient of MMA in Column 1 is 0.9710 and statistically significant at the 1%level,indicating that MARs have a positive effect on acquirers’newly added assets.The estimated coefficient of ADDASSET in Column 2 is –0.0026 and statistically significant at the 1%level,suggesting that the newly added assets have a negative effect on acquiring firms’debt costs.In Column 3,we include both MMA and ADDASSET for regression.The result shows thatthe estimated coefficient of MMA is statistically insignificant and the estimated coefficient of ADDASSET is statistically significant.Following the mediating effect test procedure proposed by Baron and Kenny(2002),we combine the results of Table 5 in Columns 1–3 with the proven hypothesis H1a,and thereby conclude that the acquirers conducting MARs have more newly added assets than conventional M&As and thus reduce their debt financing costs.That is,MARs negatively affect acquiring firms’ex post debt cost by positively affecting newly added assets,so H1bis verified.

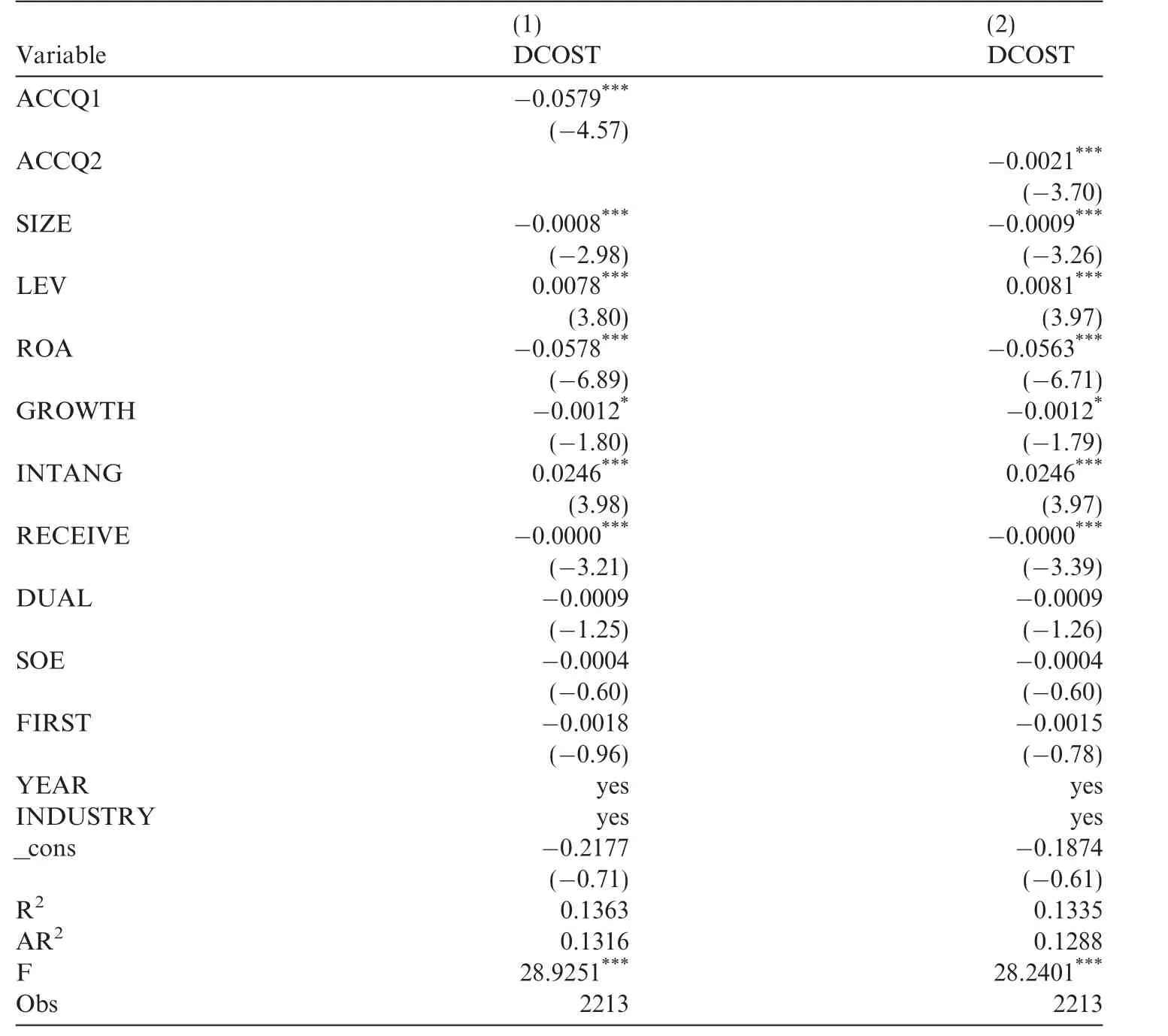

Table 6 Association between debt cost and accounting information quality based on model(5).

This paper also verifies whether the decline in acquiring firms’debt cost is caused by the increase in collateral from the MARs.The test results from model(4)are presented in Table 5.In Column 4 the estimated coefficient of MMA is0.3874 and significant at the 1%level.This result shows that the MARs have a positive effect on the acquirers’newly added collateral.The estimated coefficient of ACOLLATER in Column 5 is –0.0017 and significant at 1%,indicating that newly added collateral has a significant negative effect on the acquiring firms’debt costs.In addition,Column 6 shows that the estimated coefficients of MMA and ACOLLATER are statistically significant.Using the above test method of mediating effect,we can conclude that MAR transac-tions enable the acquirers to obtain greater newly added collateral than conventional M&As,and thus reduce debt financing costs.That is,MARs negatively affect acquiring firms’debt costs by partially affecting newly added collateral.This indicates that greater asset collateral from MARs is more likely to reduce the acquiring firms’debt costs,so H1bis verified.

Table 7 Moderating effect of the acquiring firms’accounting information quality based on model(6).

5.3.Acquiring firms’accounting information quality and debt costs:The test results of H 2

Table 6 shows the OLS regression results from model(5).In Column 1,the independent variable is ACCQ1,a continuous variable measuring the accounting information quality of acquiring firms.The estimated coefficient of ACCQ1 is–0.0579 and statistically significant at the 1%level.In Column 2,the independent variable is ACCQ2,an indicator variable adjusting absolute residuals of model(1)by the median of full sample observations.The estimated coefficient of ACCQ2 is–0.0021 and statistically significant at the 1%level.Overall,these results indicate that the accounting information quality of acquiring firms has a direct negative impact on the cost of debt after other determinants of debt cost and year and industry fixed effects are controlled.This finding indicates that acquiring firms with higher accounting information quality are more likely to obtain lower cost debt financing,so H2is verified.

Table 8 Robustness test:alternative measurement of debt cost following the practice of Zou and Adams(2008).

5.4.Moderating effect of accounting information quality:The test results of H 3

Table7 reports the OLS regression results from model(6).To test the robustness of H1aand H2,we simultaneously put MMA and ACCQ into the regression model.The results are presented in Columns 1 and 3 of Table 6.These results show that both MARs and accounting information quality have a statistically significant,negative effect on acquiring firms’debt costs,indicating that H1aand H2are correct.In Columns 2 and 4 of Table 6 we introduce the interaction variables MMA*ACCQ1 and MMA*ACCQ2.The results show that all of the estimated coefficients of these interaction variables are significantly negative.Specifically,the esti-mated coefficient of MMA*ACCQ1 in Column 2 is–0.0853,which is significant at the 5%level,and the estimated coefficient of MMA*ACCQ2 in Column 4 is–0.0060,which is significant at the1%level.These findings indicate that the quality of accounting information has an enhanced moderating effect in the relationship between MARs and debt cost.That is,when acquiring firms’accounting information quality is higher,the negative effect of MARs on ex post debt financing costs is stronger.Overall,we confirm that MAR transactions by acquiring firms with high accounting information quality have a stronger negative effect on the ex post cost of debt financing than MAR transactions by acquiring firms with low accounting information quality,so H3is verified.

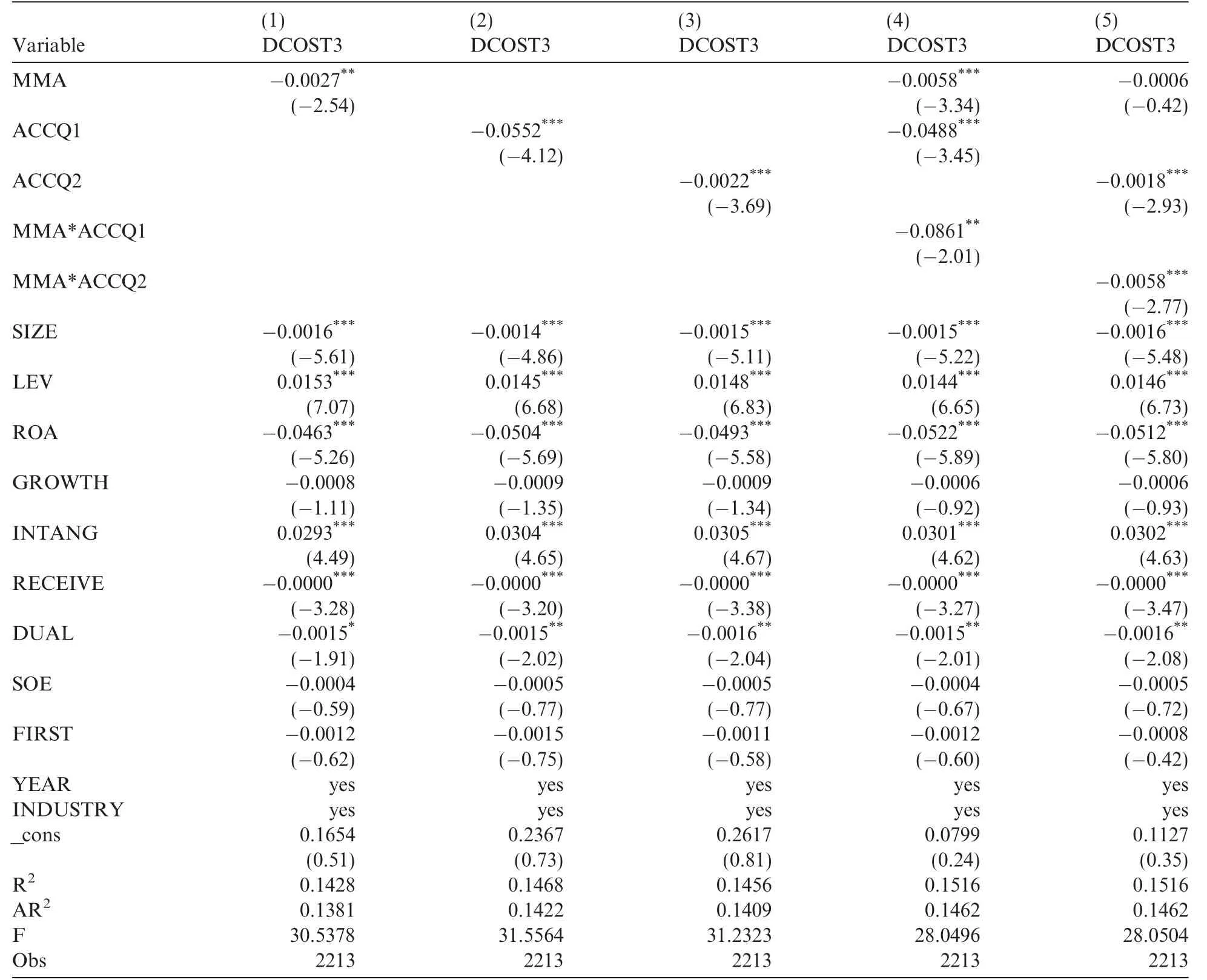

Table 9 Robustness test:alternative measurement of debt cost calculated by financial expense divided by total debt.

5.5.Robustness tests

To further validate our research results,we conduct various robustness tests as follows.First,we acknowledge that our proxy for debt cost could be noisy.This paper therefore selects alternative measurements for thecost of debt that result in modified dependent variables.Zou and Adams(2008)use the sum of interest expense and interest capitalized to total debt ratio as a proxy variable DCOST2 for debt cost.We choose this alternative measurement DCOST2 and rerun all hypothesis test models,and the results are reported in Table 8.Interest expenses are also an important component of firms’debt costs.However,debt costs also include debt financing fees and other financial expenses,which are all part of the firm’s financial expenses.We therefore use the ratio of financial expense to total debt as a wide proxy variable DCOST3 for debt cost,and the results are presented in Table9.From these results in Tables8 and 9,we find that our hypotheses are still supported,but not as strongly.

Table 10 Robustness test:alternative measurement of ACCQ calculated by modified Jones matching performance model.

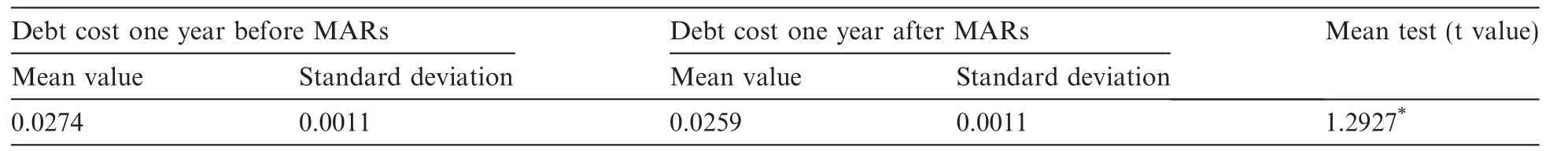

Table 11 Robustness test:longitudinal comparison in the debt cost effect of MARs.

Next,we examine whether our findings are robust when an alternative proxy for accounting information quality is used that results in modified independent variables of H2and H3.Other studies(e.g.,Kothari et al.,2005;Pan and Yu,2014)use a modified Jones matching performance model to calculate discretionary accruals and measure accounting information quality.Using this approach,we re-estimate the ACCQ of acquiring firms and set up two proxy indexes.These indexes are ACCQ3 and ACCQ4.Similar to ACCQ1 and ACCQ2,ACCQ3 is a continuous variable calculated as the opposite of absolute residuals in a modified Jones matching performance model,and ACCQ4 is an indicator variable adjusted by the median absolute residuals of the full sample.The test results are reported in Table 10.The conclusions drawn in this paper are not substantially affected,even though the significance of individual estimated coefficients are weaker.H2and H3are therefore robust.

Finally,we follow other studies(e.g.,Han and Tang,2017)and adopt the longitudinal comparison method to test our finding that MAR transactions can reduce acquiring firms’debt costs.The analysis result is displayed in Table 11.We find a significant downward trend in debt costs from one year before an acquiring firm’s MAR transaction to one year after the transaction.Together with the results of our horizontal comparison analysis,we conclude that MAR implementation decreases acquiring firms’debt costs.

6.Conclusion

In this paper,we investigate whether MARs(as a special form of M&A transaction)are related to acquiring firms’debt financing costs.Using a sample of listed companies’M&A transactions in the Chinese A-share market,we find that MAR implementation can enable the acquirers to obtain a massive in flow of assets from target firms and gain significant asset collateral,and this can decrease the acquirers’debt financing costs.Our results help to reveal the economic consequences of M&A transactions and enrich the current literature on debt financing.This paper also examines the role of accounting information quality in the M&A market.We show that acquiring firms’accounting information quality has a significant negative effect on their debt financing costs.This result builds on studies that find a negative relationship between accounting information quality and debt costs.In addition,we find that the effect of MARs on the ex post cost of debt financing is stronger for acquiring firms that have higher quality accounting information.This result indicates the spillover effect of accounting information quality in the M&A setting,and helps to reveal the reinforcing mechanism of the MARs on debt cost.

Our paper sheds light on the consequences of M&A transactions in the debt market by investigating the association between MARs and debt costs with horizontal and longitudinal comparisons.At the same time,we provide direct evidence for the usefulness of accounting information,which has been subject to considerable debate in recent decades,by confirming the importance of the quality of accounting information in lowering the cost of debt financing.The results of our study show that acquirers’accounting information quality directly affects debt financing costs,and also intensifies the negative relationship between MARs and debt cost.These findings provide valuable insights for managers in acquiring firms,because the results that by improving the quality of their accounting information,acquirers can lower the cost of debt financing.More specifically,to reduce debt financing costs,acquiring firms should actively improve their financial reporting quality rather than conduct earnings manipulation,and should decrease information risk and financial friction.Acquiring firms conducting MAR transactions also need to improve the quality of their accounting information and further decrease information asymmetry in capital markets if they desire lower-cost debt financing.

Anderson,R.C.,Mansi,S.A.,Reeb,D.M.,2004.Board characteristics,accounting report integrity,and the cost of debt.J.Account.Econ.37(3),315–342.

Berger,A.N.,Frame,W.S.,Ioannidou,V.,2011.Tests of ex ante versus ex post theories of collateral using private and public information.J.Financ.Econ.100(1),85–97.

Beyer,A.,Cohen,D.A.,Lys,T.Z.,Walther,B.R.,2010.The financial reporting environment:review of the recent literature.J.Account.Econ.50(2–3),296–343.

Bharath,S.T.,Sunder,J.,Sunder,S.V.,2008.Accounting quality and debt contracting.Account.Rev.83(1),1–28.

Bhaumik,S.K.,Selarka,E.,2012.Does ownership concentration improve M&A outcomes in emerging markets?Evidence from India.J.Corpor.Finance 18(4),717–726.

Bhojraj,S.,Sengupta,P.,2003.Effect of corporate governance on bond ratings and yields:the role of institutional investors and outside directors.J.Business 76(3),455–475.

Bomfim,A.N.,2005.Understanding credit derivatives and related instruments.Elsevier Academic Press,San Diego.

Boot,A.W.A.,1991.Secured lending and default risk:equilibrium analysis,policy implications and empirical results.Econ.J.101(406),458–472.

Cai,Y.,Sevilir,M.,2012.Board connections and M&A transactions.J.Financ.Econ.103(2),327–349.

Campa,J.M.,Hernando,I.,2006.M&As performance in the European financial industry.J.Bank.Finance 30(12),3367–3392.

Cerqueiro,G.,Ongena,S.,Roszbach,K.,2016.Collateralization,bank loan rates,and monitoring.J.Finance 71(3),1295–1322.

Chang,J.P.,Hou,X.H.,2015.A study on the features and enlightenment of Chinese listed companies’material asset reorganizations.Inner Mongolia Social Sci.36(3),105–109(in Chinese).

Chen,J.Z.,Lobo,G.J.,Wang,Y.,Yu,L.,2013a.Loan collateral and financial reporting conservatism:Chineseevidence.J.Bank.Finance 37(12),4989–5006.

Chen,P.F.,He,S.,Ma,Z.,Stice,D.,2016.The information role of audit opinions in debt contracting.J.Account.Econ.61(1),121–144.

Chen,S.H.,Jiang,G.S.,Lu,C.C.,2013b.The board ties,the selection of the Target Company,and acquisition performance:a study from the perspective based on the information asymmetry between the acquirer and the target.Manage.World 12,117–132(in Chinese).

Chikh,S.,Filbien,J.Y.,2011.Acquisitions and CEO power:evidence from French networks.J.Corpor.Finance 17(5),1221–1236.

Chui,A.C.,Kwok,C.C.,Zhou,G.S.,2016.National culture and the cost of debt.J.Bank.Finance 69,1–19.

Costello,A.M.,Wittenberg-Moerman,R.,2011.The impact of financial reporting quality on debt contracting:evidence from internal control weakness reports.J.Account.Res.49(1),97–136.

De Cesari,A.,Gonenc,H.,Ozkan,N.,2016.The effects of corporate acquisitions on CEO compensation and CEO turnover of family firms.J.Corpor.Finance 38,294–317.

Duarte,F.,Gama,M.,Paula,A.,Esperanc¸a,J.P.,2016.The role of collateral in the credit acquisition process:evidence from SME lending.J.Business Finance&Account.43(5–6),693–728.

Francis,J.,LaFond,R.,Olsson,P.,Schipper,K.,2005.The market pricing of accruals quality.J.Account.Econ.39(2),295–327.

García-Teruel,P.J.,Martínez-Solano,P.,Sánchez-Ballesta,J.P.,2014.The role of accruals quality in the access to bank debt.J.Bank.Finance 38,186–193.

Hall,T.W.,2012.The collateral channel:evidence on leverage and asset tangibility.J.Corpor.Finance 18(3),570–583.

Han,H.W.,Tang,Q.Q.,2017.Related–party M&As,nature of property rights and firm value.J.Account.Econ.31(2),78–90(in Chinese).

Han,L.,Fraser,S.,Storey,D.J.,2009.The role of collateral in entrepreneurial finance.J.Business Finance Account.36(3),424–455.

Huang,Q.Y.,Cheng,M.Y.,Ni,W.J.,Wei,M.H.,2014.Listing approach,political favors and earnings quality:evidence from Chinese family firms.Account.Res.(7),43 49+96(in Chinese)

Intrisano,C.,Rossi,F.,2012.Do M&As generate value for shareholders?An analysis of the Italian banking sector.Working paper.

Jensen,M.C.,Meckling,W.H.,1976.Theory of the firm:managerial behavior,agency costs and ownership structure.J.Financ.Econ.3(4),305–360.

Jensen,M.C.,Ruback,R.S.,1983.The market for corporate control:the scientific evidence.J.Financ.Econ.11(1–4),5–50.

Jiang,Y.,2009.Equity cost,debt cost and corporate governance:a study of the difference.Manage.World 11,144–155(in Chinese).

Jiménez,G.,Salas,V.,Saurina,J.,2006.Determinants of collateral.J.Financial Econ.81(2),255–281.

Karapetyan,A.,Stacescu,B.,2014.Does information sharing reduce the role of collateral as a screening device?J.Bank.Finance 43(1),48–57.

Kothari,S.P.,Leone,A.J.,Wasley,C.E.,2005.Performance matched discretionary accrual measures.J.Account.Econ.39(1),163–197.

Kravet,T.D.,2014.Accounting conservatism and managerial risk–taking:corporate acquisitions.J.Account.Econ.57(2–3),218–240.

Leuz,C.,Wysocki,P.D.,2016.The economics of disclosure and financial reporting regulation:evidence and suggestions for future research.J.Account.Res.54(2),525–622.

Li,G.Z.,Liu,L.,2009.The debt financing cost and the credit discrimination on private firms.J.Financ.Res.12,137–150(in Chinese).

Li,Q.Y.,Wang,H.J.,2013.Monetary policy,asset collateral–ability,cash flow and company investment:empirical evidence from Chinese manufacturing listed companies.J.Financ.Res.6,31–45(in Chinese).

Li,S.M.,Zhu,T.,2006.Can multiple M&A create value for shareholders?A study of the factors affecting the long–term performance of diversified M&A.Manage.World 3,129–137(in Chinese).

Li,Z.J.,Wang,S.P.,2011.Monetary policy,information disclosure quality and corporate debt financing.Account.Res.(10),56 62+97(in Chinese)

Li,W.F.,Guo,H.W.,Tang,Q.Q.,2016.Industry clusters,information transmission and valuein M&As.J.Finance Econ.42(1),123–133(in Chinese).

Liu,Q.,Luo,T.,Tian,G.,2016.Political connections with corrupt government bureaucrats and corporate M&A decisions:a natural experiment from the anti–corruption cases in China.Pacific-Basin Finance J.37,52–80.

Ma,R.J.,Jiang,C.,Tang,X.S.,2015.Earning quality of debtor firm and bank loan decision.Finance Econ.10,56–63(in Chinese).

Martynova,M.,Renneboog,L.,2006.Mergers and acquisitions in Europe.Social Sci.Electron.Publish.,1–79

Martynova,M.,Renneboog,L.,2011.The performance of the European market for corporate control:evidence from the fifth takeover wave.Eur.Financ.Manage.17(2),208–259.

Mateev,M.,2017.Is the M&A announcement effect different across Europe?More evidences from continental Europe and the UK.Res.Int.Business Finance 40,190–216.

Mullin,G.L.,Mullin,J.C.,Mullin,W.P.,1995.The competitive effects of mergers:stock market evidence from the USS teel dissolution suit.Rand J.Econ.,314–330

Norden,L.,van Kampen,S.,2013.Corporate leverage and the collateral channel.J.Bank.Finance 37(12),5062–5072.

Pan,H.B.,Yu,M.G.,2014.The accounting information quality of target firm,property and M&A performance.J.Financ.Res.7,140–153(in Chinese).

Pan,X.,Tian,G.G.,2016.Family control and loan collateral:evidence from China.J.Bank.Finance 67,53–68.

Ping,X.Q.,Yang,M.Y.,2009.An empirical study on information asymmetry in the lending market:evidence from China’sstate–owned commercial banks.J.Financ.Res.3,1–18(in Chinese).

Pittman,J.A.,Fortin,S.,2004.Auditor choice and the cost of debt capital for newly public firms.J.Account.Econ.37(1),113–136.

Sengupta,P.,1998.Corporate disclosure quality and the cost of debt.Account.Rev.73(4),459–474.

Sirower,M.L.,1997.The synergy trap:How companies lose the acquisition game.Simon and Schuster,New York.

Spiceland,C.P.,Yang,L.L.,Zhang,J.H.,2016.Accounting quality,debt covenant design,and thecost of debt.Rev.Quant.Financ.Acc.47(4),1271–1302.

Tian,G.L.,Han,J.,Li,L.C.,2013.Interlock directorates and merger performance:the evidence from Chinese A share listed companies.Nankai Business Review 6,112–122.

Wang,F.R.,Gao,F.,2012.Government intervention,corporate life cycle and performance of M&A-Evidence from Chinese listed companies.J.Finance 12,137–150(in Chinese).

Wang,Y.W.,Tang,J.X.,Kong,M.Q.,2016.Corporate M&A,earnings management and changes of executive compensation.Account.Res.(5),56 62+96(in Chinese)

Wang,Y.Y.,Yu,L.S.,Wang,X.K.,2014.Accounting conservatism,loan collateral and borrower/lender state ownership.Account.Res.(12),11 17+95(in Chinese)

Watts,R.L.,2003.Conservatism in accounting part I:Explanations and implications.Account.Horizons 17(3),207–221.

Wei,Z.H.,Wang,Z.J.,Wu,Y.H.,Li,C.Q.,2012.Financial ecological environment,audit opinion and the cost of debt financing.Audit.Res.3,98–105(in Chinese).

Xu,H.,Lin,Z.G.,Peng,Y.Y.,2016.Corporate M&A,private placement and earnings management.Commun.Finance Account.24,3–10(in Chinese).

Yin,Z.C.,Gan,L.,2011.Asymmetric Information,corporate heterogeneity and credit risk.Econ.Res.9,121–132(in Chinese).

Yu,Y.,Wang,J.Q.,2015.Comparative analysis of the motives,problems and prospects between Chinese and western merger.J.Southwest Jiaotong Uni.(social sciences)(1),107–111(in Chinese).

Zhang,J.,2008.The contracting benefits of accounting conservatism to lenders and borrowers.J.Account.Econ.45(1),27–54.

Zhang,X.,2003.Do mergers and acquisitions create value:evidence from Chinese listed companies?Econ.Res.(6),20 29+93(in Chinese)

Zhao,X.,Zhang,X.S.,2013.Internal control,managerial power and M&A performance:Evidence from the Chinese securities market.Nankai Bus.Rev.16(2),75–81(in Chinese).

Zou,H.,Adams,M.B.,2008.Debt capacity,cost of debt,and corporate insurance.J.Financ.Quantitat.Anal.43(2),433–466.