What Do Middle-Class ASEAN Consumers Buy?

2018-06-07ByWangJiping

By Wang Jiping

With a population of about 640 million,ASEAN member states are now nurturing a consumer market with huge potential. The market research firm Nielsen estimates that by 2020, the middle-class population in Southeast Asia—people with an average disposable income of US$16 to US$100 per day—will number 400 million.

The median age of the ASEAN population is 29, much younger than that of other emerging Asian economies and developed markets in the rest of the world. Last year, the Hong Kong Trade Development Council Research (HKTDC Research) conducted a survey on the consumer behavior of middle-class ASEAN consumers through face-to-face interviews.

Researchers interviewed over 1,400 people with a minimum household income of US$1,000 per month from seven cities in five ASEAN countries:Bangkok, Thailand, Kuala Lumpur, Malaysia,Manila, the Philippines, Jakarta, Indonesia,Surabaya, Indonesia, Ho Chi Minh City, Vietnam and Hanoi, Vietnam. All respondents were between 18 and 61 years old, and 80 percent were under 41. The investigation found that a growing middle class in ASEAN member states has contributed to sales growth in areas such as travel and recreation, health and fashion in the region.At the same time, other factors were taken into consideration when these customers make their buying decisions. Eco-friendly products, other users’ experiences and social media all played a part in the decision-making process.

Travel and Recreation Cost Most

In recent years, the development of online travel agencies and low-cost airfares has rendered traveling more affordable for the ASEAN middle class. Many young people often visit nearby countries on weekends. Respondents from six of the seven cities in the investigation spent most on travel and recreation over the past two years, while interviewees from Hanoi spent more on fashion, evidencing their limited purchasing power compared to respondents from the other six cities. As a newly industrialized country, Vietnam is the lowest among thefive surveyed countries in terms of national income. Domestically, the average income in Hanoi is still lower than that in Ho Chi Minh City.

In terms of expenditures on travel and recreation,respondents spent most on fees for package tours(36 percent), followed by accommodations (32 percent), air tickets (28 percent) and park tickets(4 percent). The second largest purchasing sector of interviewees over the past two years was beauty and health. In this category, they spent most on health products (28 percent), which barely edged out cosmetics (27 percent). In addition, with personal training gaining popularity in recent years, spending on fitness products and services like high-intensity training and yoga was also on the rise. According to the survey, fashion and digital products ranked third and fourth respectively in terms of respondent’s expenditures over the last two years.

Spending on fashion mainly consisted of business clothing, casual wear and shoes, while consumption of non-apparel products such as accessories and travel goods accounted for a relatively small portion. Nowadays, smart phones have become an irreplaceable device with many functions beyond making calls such as providing mobile internet access, taking pictures and playing music and video. It was no surprise that phones were the most costly item among all digital products listed in the survey.

Factors in Decision Making

Middle-class ASEAN consumers take many factors into consideration when making a purchasing decision.

The survey showed that product function is the principal in fluencing factor. Respondents paid greatest attention to matching their needs or requirements with the functions of a product. Due to the relatively high cost of electricity in ASEAN countries, consumers usually preferred energysaving products.

At the same time, some factors not directly related to the features or functions of the products also in fluence the decision-making process of ASEAN consumers. For example, they are increasingly concerned about environmental protection, so they are more likely to buy ecofriendly products. About 56 percent of the respondents said products with green labels could in fluence their purchasing decisions,47 percent prefer to buy organic, and 42 percent purchase products produced with good manufacturing practices.

With smart phones more affordable and network coverage expanding, many middle-class ASEAN consumers shop online and consider other buyers’ opinions in the decision-making process.

The investigation found that ASEAN consumers search for product information through various channels. Product reviews,friend recommendations and video descriptions are the primary sources of information. About 62 percent of the interviewees consider other users’opinions as a major reference. Meanwhile, more than half of respondents said that social media,such as Facebook and Instagram, have a great in fluence on their buying decisions.

Traditional promotional methods still play an important role. However, as factors in fluencing customer purchasing evolve rapidly, oneway promotion will only have a limited effect.According to the survey, only 20 percent and 18 percent of the interviewees think direct mail and celebrity endorsements, respectively, in fluence their decision-making process.

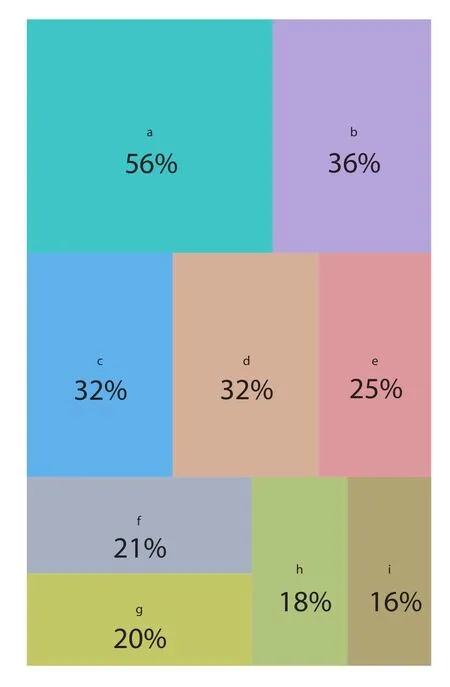

Top three expenditures on products/ services a travel and recreation (number of respondents: 790)b beauty and health (number of respondents: 507)c fashion (number of respondents: 447)d electronics (number of respondents: 444)e daily use items (number of respondents: 348)f entertainment (number of respondents: 298)g financial services (number of respondents: 287)h food (number of respondents: 246)i education (number of respondents: 219)

Note: Each respondent can choose three

Source: Hong Kong Trade Development Council Research