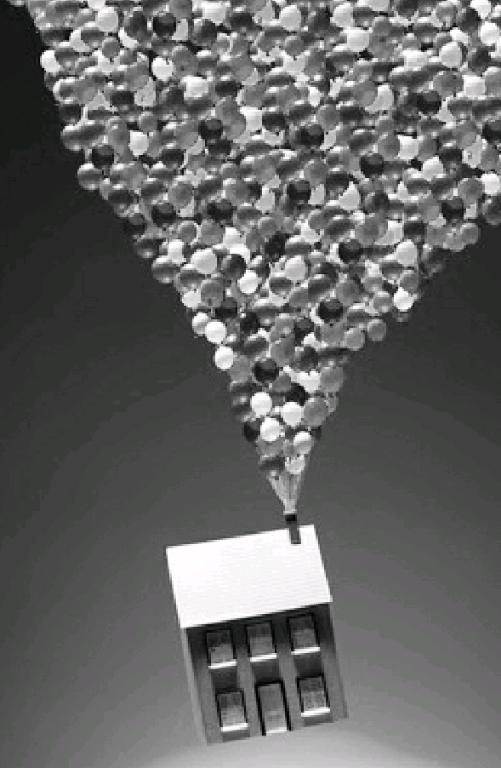

China Launches Crackdown on an Overheated Property Market

2017-01-10

Tightens Home-Purchasing Rules

Shanghai Again Tightens Home-Purchasing Rules, Targeting Divorce, in Bid to Cool Market Commercial lenders required to examine sources of funds used for down payments

Shanghai has further tightened home-purchasing rules by demanding lenders scrutinize the sources of funds used for down payments — a move that will likely curb the surge of divorce filings among couples seeking to purchase second homes.

A document laid out by the local market interest-ratepricing self-discipline mechanism, a group of banks under the guidance of the central bank, highlighted the need to inspect the authenticity of a residents proof of income in relation to home purchases, requiring commercial lenders to step up efforts to check the income of both the borrower and their spouse.

The document also placed emphasis on the principal source of mortgage repayments, strictly prohibiting adult children, parents or parents-in-law, former spouses or any other third party from jointly fulfilling repayment obligations, in a bid to circumvent housing-loan policies.

Despite seeing a number of home-purchasing restrictions being introduced, including a mandatory down payment of at least 50% of the property price for second-time homebuyers, Shanghai residents have still found ways to get around policy curbs. Filing for divorce and transferring a house to a spouse in return for a 30% down payment and zero property tax —benefits of first-time homebuyers — is a common way around recent restrictions.

Since mid-October, mortgage managers of several banks in Shanghai, including China Mingsheng Bank and Industrial Bank, have told property agents that they will not grant loans to people who divorced within the past year.

Hits Developers over Unauthorized Home-Price Hikes

Crackdown on builders is latest move in Chinese cities ongoing fight to cool overheated property market.

The Shanghai government has punished eight property developers for increasing home prices without notifying authorities — the citys latest move to cool the overheated property market.

The property developers were suspended from signing contracts with home buyers after regulators found that the companies had increased prices "without authorization," the Shanghai government said on its official WeChat account.

In China, real estate developers are required to register home prices with the local price bureau before a sales launch. If property companies want to change the prices later, they have to notify the authorities, and the change must be within a certain range, depending on the city. But the policy has not been strictly enforced.

Now, as home sales and prices soar in first- and secondtier cities, the Shanghai government has turned to the policy, along with other measures, in a bid to rein in the housing market.

Seven real estate agencies also were punished, for forging records of home sales and misleading customers, the government said.

The latest data from the National Bureau of Statistics showed that home prices in Shanghai rose 5.2% in August compared with the previous month, the second-highest growth among 70 cities.

Rumors that further home-purchase restrictions would soon be imposed in the city had couples flocking to marriage registration offices to file for divorce in late August, believing that as unmarried people, they would remain eligible to buy a second home.

Shanghai has some of the toughest restrictions on home buyers in China. Under rules that city authorities released in March, residents who do not have a Shanghai hukou — a household registration permit — have to show they have had a pension and medical insurance plan in the city for at least the past five years before they can buy a home there. Also required is a down payment of at least 70% for second homes larger than 140 square meters or worth more than 4.5 million yuan($668,000).

Its Harder to Buy Multiple Homes

Governments tighten requirements, including raising minimum down payments, to dampen exploding market.

Reacting to surging housing prices in the past few months, about 20 Chinese cities have tightened home purchase requirements since late September in efforts to cool an overheated market.

Some cities are prohibiting property developers from selling homes to residents who dont have local hukou, or residency registration, and to those who already own more than one home. Other cities are raising the required minimum amount of money necessary for a down payment.

"There is a common reason for the restrictions — the property market has been too hot, especially regarding the surging prices" said expert.

The average price of a new home in 70 major Chinese cities jumped 7.5 percent in August compared with a year earlier. This was on top of a 6.1 percent increase in July. Sixtytwo cities saw home prices rise in August from a year earlier, up from 52 cities in July, according to the National Bureau of Statistics.

New Property Curbs are in Southeastern and Southern China

The cities that have restricted home purchases are those that have seen recent price hikes and want to crack down on an overheated property market that could collapse, said expert. The majority of cities with new property curbs are in southeastern and southern China.

Xiamen, a tourist city in southeastern Fujian province, registered the largest increase in property prices, with a 44.3 percent jump in August compared with a year earlier — far higher than the gains of 25.8 percent in Beijing and the 37.8 percent in Shanghai.

In early September, the Xiamen government banned the sale of homes at the low end of the market — those of 144 square meters or less — to local residents who already owned two units, residents without local hukou who owned at least one unit, and residents without local hukou who hadnt worked continuously in the city for at least one year.

Xiamens initial restrictions in September worked, as the month saw only 140,000 square meters of home space sold in the city, down 48 percent from the monthly average in the first eight months of the year, according to CRIC, a data provider owned by E-house.

Ingenious Ways of Circumventing the Rules

But sometimes the policies failed to stop the home-buying frenzy as many people found ingenious ways of circumventing the rules, including divorce.

On Sept. 25, Nanjing, capital of the southeastern province of Jiangsu, banned property developers from selling new homes to local families who already owned two apartments and to families without local hukou who owned one unit.

The following day, at least 320 couples in Nanjing filed for divorce. Thats three times the normal number, according to local media Yangtse Evening News. Since the rules apply to families, as divorced individuals, these people could qualify to buy a home under the new rules, while they would not have qualified if they had stayed married.

The citys government tightened the rules, saying that single and divorced locals are allowed to buy only one unit.

Tightening Down-payment Requirements

Besides controlling the number of qualified homebuyers, some cities are attempting to cool the market by tightening down-payment requirements.

On Sept. 30, Beijing increased the amount that first-time home buyers must submit for a down payment, from 30 percent of the homes price to 35 percent. For families that already own a unit, the down payment of a second home is at least 50 percent.

Some cities conducted restrictions out of fear that property bubbles could be contagious.

Shenzhen, the manufacturing hub of southern China, rolled out home purchase restrictions on Tuesday. Two days later, Dongguan, a city 80 kilometers from Shenzhen, prohibited home purchases by local residents who already owned two apartments. It also banned residents without local hukou from buying a second house unless they could prove they had worked in the city for one year during the past two years.

The Dongguan governments new rule seeks to crack down on speculators who were rejected due by Shenzhens property market restrictions, said expert. There might not be many more cities following the"tightening spree" because almost all those that have seen property price surges have already taken action.

杂志排行

中国经贸聚焦·英文版的其它文章

- Wal-Mart is Forming a Closer Relationship with Chinese E-commerce Giant JD.com.

- Green Light Turns Yellow for China’s Ride-Hailing Industry

- Migrant Workers in Beijing Feel Pinch of Ride-Hailing Shake-Up

- The Sorrow of Middle Class in China:No Other Choice than Buying Houses

- Apple’s Limited Battery Replacement Fails to Satisfy

- Alibaba and JD.com Compete Against Supermarkets, Corner Stores