Surging Chinese Investment in the U.S. Benefits Both Countries

2016-09-26

OPINION

Surging Chinese Investment in the U.S. Benefits Both Countries

During the first seven months of this year,Chinese companies’ investment in the United States continued its rapid growth by increasing 210 percent year on year, according to China’s Ministry of Commerce. The growth rate not only exceeded the average rate of global investment by Chinese companies,but far outpaced their investment in other developed economies. If the speed continues,Chinese companies’ investment in the United States is bound to set a record this year.

In the first seven months of the year,Chinese companies made non-financial direct investments in 5,465 companies, across 156 countries and regions, totaling 673.24 billion yuan ($102.75 billion), up 61.8 percent from the same period last year. As China becomes the most active investor in the world, the United States has become its biggest investment destination.

Several factors contribute to the galloping growth.

Against the backdrop of a slowing economy and depreciating yuan, partly caused by an appreciating U.S. dollar, more Chinese companies, privately owned ones in particular, are increasing the proportion of their overseas assets, especially dollardenominated assets.

On the other side of the equation, China has stepped up its efforts in cutting excess capacity amid economic restructuring. In this context, Chinese firms intend to offset excess capacity via overseas acquisition.

Moreover, Chinese companies seeking to upgrade no longer depend on the expansion of production scale to achieve more profit. Instead, they are eyeing more profitable exploits such as design, distribution and retail as well as branding and management. The United States,undoubtedly home to many such companies, is therefore a top choice for the overseas expansion of Chinese firms.

Lastly, trade protectionism has increased in recent years in a climate of sluggish global trade. Many Chinese companies smartly circumnavigate mounting trade barriers and disputes by investing hefty sums of money building factories in the United States.

Despite the rapid growth, Chinese investment only accounts for a tiny part of total foreign investment in the United States. According to Washington-based think tank American Enterprise Institute for Public Policy Research, Chinese companies investing in the United States face extra-contractual interventions, which will exist for a long period of time and are likely to intensify.

First, trust between the two countries is fragile and is frequently undermined, owing to major differences in the economic systems and ideologies of the two nations as well as sustained trade disputes. Suspicion and estrangement between the two countries have created an invisible barrier to Chinese companies wishing to invest in the United States.

Secondly, strict criteria on “national security” grounds are another hurdle faced by Chinese firms eyeing the U.S. market. The Committee on Foreign Investment in the United States (CFIUS) is responsible for reviewing the impact of foreign investment on U.S. companies and national security. Despite their review being in line with international conventions and its operations being reasonably transparent, it has maintained a highly cautious attitude toward Chinese companies in many fields, especially in the hi-tech sector, making China its most targeted country for three years in a row.

As a matter of fact, the investment surge benefits both China and the United States,helping the latter create jobs and alleviate trade deficit pressure.

Official data shows that Chinese companies have invested in 42 U.S. states. If they make $30 billion worth of investment in the United States this year, at least 14,000 jobs can be created there, bringing the total number of created jobs to over 100,000.

Besides, China’s trade surplus with the United States totaled a record-high 877.91 billion yuan ($131.5 billion) by the end of July. If Chinese companies expand American investment, they can help boost U.S. exports and alleviate pressure on the nation’s trade deficit. Therefore, both sides should strive to maintain the rapid growth of Chinese investment in the United States.

Then, what should be done to further increase the volume and scope of investment?

Undoubtedly, eliminating the political divide and enhancing mutual trust should be the top priority of the two sides.

For China, investment is never a one-way road. The Chinese Government should create more opportunities for U.S. firms to access the market by further opening up its energy, telecommunications, transportation and finance sectors as quickly as possible. Also, it should clarify the relationship between the ownership and corporate governance structures at state-owned enterprises and reveal related information to U.S. firms in a more transparent manner.

As for the United States, it should correct its tendency of politicalizing reviews of Chinese investment. Instead, more attention should be paid to the economic aspects of Chinese companies’ investment and investment constraints should be appropriately loosened.

Chinese companies have to fulfill their responsibilities too. On the one hand, they should avoid industries that the CFIUS is extremely vigilant on, such as telecommunications, ports, oil and gas, and power supply, and choose reviewfree and government-supported industries as much as possible. On the other hand, they should increase their operational transparency and win over public support.

More importantly, the two sides should speed up negotiations over their bilateral investment treaty (BIT), which has seen 26 rounds of negotiations held over the past eight years. Once the BIT is signed, hurdles in two-way capital flows between the countries will be officially removed.

Moreover, a China-U.S. Trade and Investment Agreement (CHUSTIA) is likely to be signed following the BIT. According to a report from the Peterson Institute for International Economics, the CHUSTIA would expand U.S. exports by almost $400 billion and U.S. national income by over $100 billion annually. The agreement will increase Chinese exports to the United States by 41 percent and U.S. exports to China by 109 percent, therefore decreasing the U.S. trade deficit. If the two sides have more balanced current accounts, Chinese companies will have clearer expectations in the capital account, and their U.S. investment journey will be more solid and steady. ■

This is an edited excerpt from an article originally

published in Securities Times

Copyedited by Dominic James Madar

Comments to yushujun@bjreview.com

NUMBERS

($1=6.6 yuan)

244 bln yuan

Combined net profits of the 1,787 companies listed on the Shenzhen Stock Exchange in the first half of 2016, rising 5.8 percent year on year

1.14 tln yuan

Combined net profits of the 1,124 companies listed on the Shanghai Stock Exchange in the first half of 2016, shrinking 5.7 percent year on year

3.63 bln tons

China’s national freight volume in July, as an indicator of economic activity, up 4 percent year on year, but 0.7 percentage points lower than in June

31.97 mln tons

China’s national oil reserves at the start of 2016

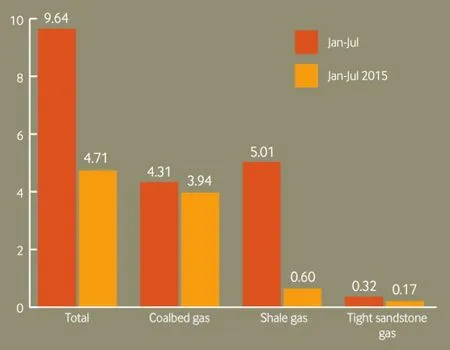

Output of Unconventional Natural Gas(bln cubic meters)

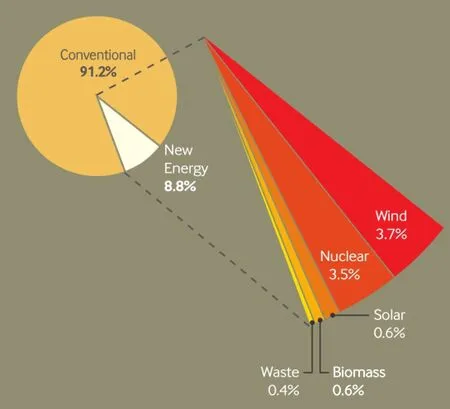

Proportion of Industrial Power Generation Jan-Jul

(Source: National Bureau of Statistics)

40

Number of manufacturing innovation centers China plans to build by 2025

160 million

Number of passengers that China Southern Airlines, the country’s largest air carrier by fleet size, plans to carry annually by 2020

54,496 units

Total sales volume of Volvo Cars in China in the first eight months of the year

2 bln yuan

Money that China’s online video site Youku Tudou Inc. plans to invest in live video programs over the next three years