Bigger, But Better?

2016-09-26WangJun

BUSINESS

Bigger, But Better?

China’s largest firms need to build competitiveness and profitability By Wang Jun

State Grid Corp. of China ranks second on the Fortune Global 500 list in 2016, with business revenue of $329.6 billion

The Fortune Global 500, an annual list of the globe’s top 500 companies by revenue, now includes 110 Chinese firms,an increase for the 10th consecutive year,according to the Fortune Global 500’s 2016 edition released late July. However, the Top 500 Enterprises of China 2016 list, unveiled by the China Enterprise Confederation (CEC)on August 27, shows that the combined revenue of China’s top 500 companies fell for the first time in 15 years.

“Among the world’s top 500, companies from China and the United States account for nearly half, reflecting the change in the world economic structure,” said Miao Rong, chief researcher of the CEC’s research department. “But for Chinese enterprises, most of which are in construction, iron, coal and non-ferrous metals industries, there is still much to be done in reducing ‘puffiness’ and becoming both bigger and stronger.”

Bigger presence, heavier loss

Since 2011, the global business expansion of multinational companies has slowed. Business revenue growth has dropped off in lists of the world’s top 500, the U.S. top 500, and China’s top 500, though growth in China’s top 500 remains higher than that in the other lists. Business revenues and assets of Chinese top 500 companies have grown 1.7 and 2.7 times respectively compared to 2008, while those of the global 500 grew by only 17 and 12.9 percent, respectively.

China’s highest entry on the Fortune Global 500, State Grid Corp. of China, with business revenue of $329.6 billion, ranks second only behind Wal-Mart. Just behind, in third and fourth place respectively, are China National Petroleum Corp. and China Petrochemical Corp.

Among the 110 Chinese firms on the global list, 13 are debutants, and 73 have seen their rankings move ahead by 43.1 places on average.

However, debutant JD.com, the e-commerce giant, has also suffered the second largest loss among the Chinese companies on the global list, losing $1.49 billion in 2015.

This reflects the Achilles heel of the Top 500 Enterprises of China: They are greater in size, but their losses are also mounting. In the 2016 edition, 72 firms (14.4 percent) reported losses, compared to 57 last year, with companies in iron, non-ferrous metals and coal accounting for much of the losses. In comparison, seven fewer firms in the Fortune Global 500 and 17 fewer firms in the U.S. top 500 reported losses.

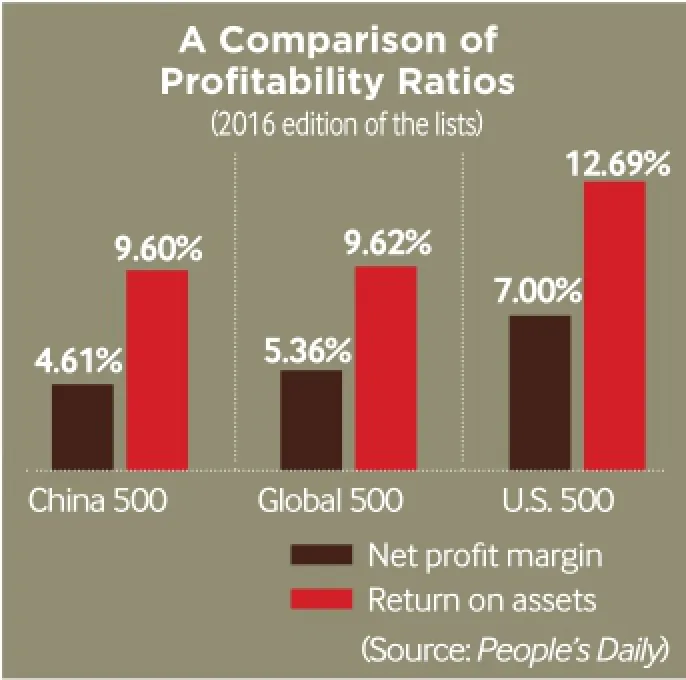

The average profit of firms in the Top 500 Enterprises of China is also lower than that in the U.S. equivalent. “Revenues generated by China’s top 500 are 78.9 percent of those in the U.S. top 500, while net profit gained is a mere 52.63 percent of the U.S. figure,” said Miao. “This indicates that Chinese firms are big, but not strong enough. Without a strong competitive core, Chinese companies will find their profitability limited.

China’s Top 10 Companies By 2015 Revenue

(Source: China Enterprise Confederation/ China Enterprise Directors Association)

Causes and prescription

What has curbed the profitability of the Top 500 Enterprises of China?

Structural problems are still outstanding. On the Fortune Global 500, the 134 U.S. firms come from 46 industries, most of which are high value-added, such as finance, insurance,healthcare, pharmacy, food production and sales and high-end manufacturing. The 99 Chinese mainland firms hail from 30 industries,however most of these are traditional, such as banking, mining, crude oil, engineering, car components, and metals. Of the top Chinese 500, almost one third (154) are from the real estate, construction, iron and steel, coal and nonferrous metals industries, which are suffering severe overcapacity and price declines.

“Most big Chinese firms are in traditional industries that face heavy pressure to reduce overcapacity, and these industries are a major target of the supply-side reform,” said Wang Zhongyu, Chairman of the CEC.

Per-capita revenue from Chinese mainland firms in the Fortune Global 500 is only 76 percent of the average. Likewise, per-capita profits lag, with the average of $17,300 for Chinese firms trailing the overall average of $22,400.

“To improve the profitability of Chinese firms, the country must accelerate supply-side reform. Chinese companies, especially stateowned enterprises, are facing the outstanding challenge of reducing staff to increase productivity,” said Miao.

He also explained the monopoly factor in Chinese firms: “Compared with the Fortune Global 500, profits gained in the China top 500 mainly come from industries of monopoly with low business costs, however they lack core competitiveness in competitive sectors.” He added, “This indicates that China’s top 500 firms still have to improve innovation to drive their growth.”

Huawei Technologies Co. Ltd., the world leader in patent applications in 2014, was ranked 27th in the latest Top 500 Enterprises of China list. The company invested 59.6 billion yuan ($8.91 billion) in research and development, accounting for 15.1 percent of its total revenue and putting Huawei 15th among all companies of the world in this regard. Benefiting from such high input in research and development, Huawei has jumped 268 places to number 129 in this year’s rankings of the Fortune Global 500 since it first made the cut in 2010.

“Innovation is the life of a company. In an era when intelligent technology develops rapidly, every entrepreneur must have crisis awareness and bear in mind that not to advance is to retreat and to advance slowly is also to retreat, in order to gain the initiative through innovation. Otherwise we might lose a golden opportunity for development,” said Cui Genliang, President of Hengtong Group Co. Ltd.,a China top 500 company.

For further growth, Chinese firms also need the government to create a better business environment. Miao said about 40 percent of Chinese top 500 are private companies, who have benefited a lot from reform and openingup policies, yet they are now facing great uncertainties.

“Establishing proper relations between the government and businesses, and ensuring their performance under a legal framework will be sure to profoundly shape the growth of big private companies,” Miao said. ■

Copyedited by Dominic James Madar

Comments to wangjun@bjreview.com